Japan Wood Products

Prices

Dollar Exchange Rates of

10th January 2014

Japan Yen 104.17

Reports From Japan

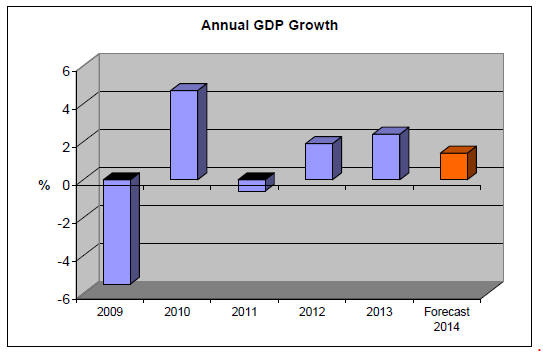

2014 GDP to slow

The Japanese government has forecast that GDP will grow

by 1.4% in the fiscal year beginning April 2014. This level

of growth is well below the 2.6% rate forecast for 2013

and reflects the anticipated impact of the consumption tax

increase set for April this year.

The government has also indicated it expects consumer

prices to rise in 2014, even discounting the impact of the

consumption tax increase.

In 2013 the Bank of Japan launched a massive monetary

stimulus programme to break the deflationary cycle in the

country. The aim is to achieve a 2% rate of inflation in two

years.

A recent press release after a meeting of the Bank of Japan

(BoJ) indicated that there was some concern that the pace

of economic growth was slowing.

This could mean the BoJ will maintain the monetary

easing policy to support the recovery and this seems more

likely as the US Federal Reserve reduces its debt

purchases.

Consumption tax increase to dampen consumer

demand

Short-term economic growth has been boosted through the

policies adopted by the Japanese government however;

sustaining growth remains a challenge given the very high

level of government debt to GDP and the declining

workforce, the result of the aging population in Japan.

The government has found itself very short of funds to

finance many of the reforms promised during the election

but is committed to raising the consumption tax from 5%

to 8% as of April this year.

The impact of the tax increase on the cost of living is sure

to dampen consumer demand.

The government is determined to break the deflationary

cycle which has plagued Japan for a decade and monetary

easing and well directed fiscal stimulus will be key to

maintaining economic expansion in 2014.

If Japan is successful with these measures then trade and

investment flows in the Asia-Pacific should improve

giving a boost to regional growth.

Yen weakens to 105 to the US dollar

The yen weakened to105 to the US during December

2013, the lowest it has been for several years. On a tradeweighted

basis, the yen dropped 15% in 2013 and is down

around 35% from its high in mid 2012.

The devaluation of the yen has strongly influenced the

Japanese stock market and has buoyed the prospects of

export companies whose stock performance was

remarkable in 2013.

In local currency terms, Japanese shares rose almost 50%

in 2013 far better than all other major developed markets.

However, in dollar terms Japanese stocks are up a little

over 24%, slightly below the improvement in the US

equity market

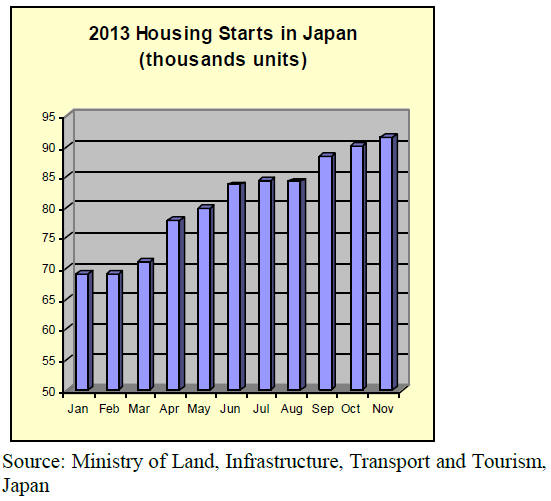

November housing starts beat expectations

Housing starts in November 2013 beat analysts

expectations and were higher than forecast according to

data from the Ministry of Land, Infrastructure, Transport

and Tourism.

See:www.mlit.go.jp/toukeijouhou/chojou/stat-e.htm

The November 2013 14% year-on-year rise in housing

starts comes after the 7% increase in October. Analysts

had expected a gain of just under 10%. As of November

2013 annualised housing starts were set to total 1.033

million, slightly down from 1.037 million anticipated in

October but still well ahead of the 990,000 figure which

was forecast at the beginning of 2013.

Order books for major construction companies are firm

but grew by only 2.2% in November 2013, a significant

decline from the 6% rise in orders reported in October.

The November expansion of new orders was the lowest in

seven months.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to extract and reproduce news on the Japanese

market.

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

LDP promotes wood use for public buildings

The Parliamentary Association of the Liberal Democratic

Party for promotion of wood use adopted resolution

regarding promotion of wood use for large buildings with

mitigation of limit of fire proof buildings and limit of

stories of school buildings, which needs revision of the

Building Standards Act.

It requires the Ministry of Land, Infrastructure and

Transport, Forestry Agency and the Ministry of Education,

Culture, Sports, Service and Technology building of three

stories wooden school buildings.

Establishment of Kitakami Plywood

Through four Seihoku group companies‟ investment,

Kitakami Plywood is established. Total capital is 100

million yen. Hokuyo Plywood is the main investor with

50% share. Akita Plywood and Seihoku put up 20% each

then Shin Akimoku joins with 10%.

The new plant locates in interior of Iwate prefecture so

that it will use locally produced domestic logs only.

Plan of first phase is to build a plant, which consumes

100-120 M cbms of logs a year to produce about thee

million sheets of plywood (12 mm thick/3x6). The items

of production are structural panel, coated concrete forming

panel and floor base panel.

President of Seihoku group, Mr. Inoue commented that

there is huge stock of domestic timber with ample growth

so that there are mushrooming number of biomass power

generation facilities recently but infrastructure of log

production is immature and incomplete so unless the gap

is solved, there is strong uneasiness of stable supply of

logs when looking at business for long term. In short, there

is plenty of timber and the demand is growing but the

system to harvest for stable supply is not there.

Oshika increases adhesive prices

Oshika Corporation (Tokyo), adhesive manufacturer,

decided to increase sales prices of phenol adhesive for

plywood manufacturing as of December 21 because of

higher cost of methanol and benzene.

According to the customs statistics made by the Ministry

of Finance, CIF prices of imported methanol in October

was 41.6 yen per kilogram, 10 yen higher than the prices

in October last year.

Further, Metax of Canada, the leading methanol

manufacturer and marketer revised the prices for Asian

market in November to $520 per ton, $30 higher than

October.

Major methanol plants in Indonesia and Saudi Arabia are

down by periodical repair and maintenance then the

supply from Iran is dropping while the demand of China

increased by about 10%. Domestic manufacturers like

Mitsubishi Gas Chemical and

Mitsui Chemical announced price hike.

By price increase of methanol, the main material to make

formalin, Oshika announced higher prices. The price

increase is 12% on phenol adhesive and 10% on urea

adhesive and 7% on melamine adhesive.

Price of benzene, raw material for phenol, is up due to

weak yen. The price shot up to over 130 yen per kilogram

in November, about 20% higher than November last year.

Plywood market trends

Brisk demand of domestic softwood plywood by house

builders and precutting plants continues.

October production and shipment were the all time high.

The production was 237,600 cbms, 11.1% higher than the

same month a year ago and the shipment was 245,700

cbms, 11.9% more then the inventories were 139,000

cbms, about 8,000 cbms less

than September. November would be the same as October.

The manufacturers think that the demand may further

expand through the peak in next February.

In November, the demand by wholesale channel also gets

busy so that orders to the manufacturers increased.

Shortage of truck is serious now and in December,

deliveries to the wholesalers take two weeks to one month.

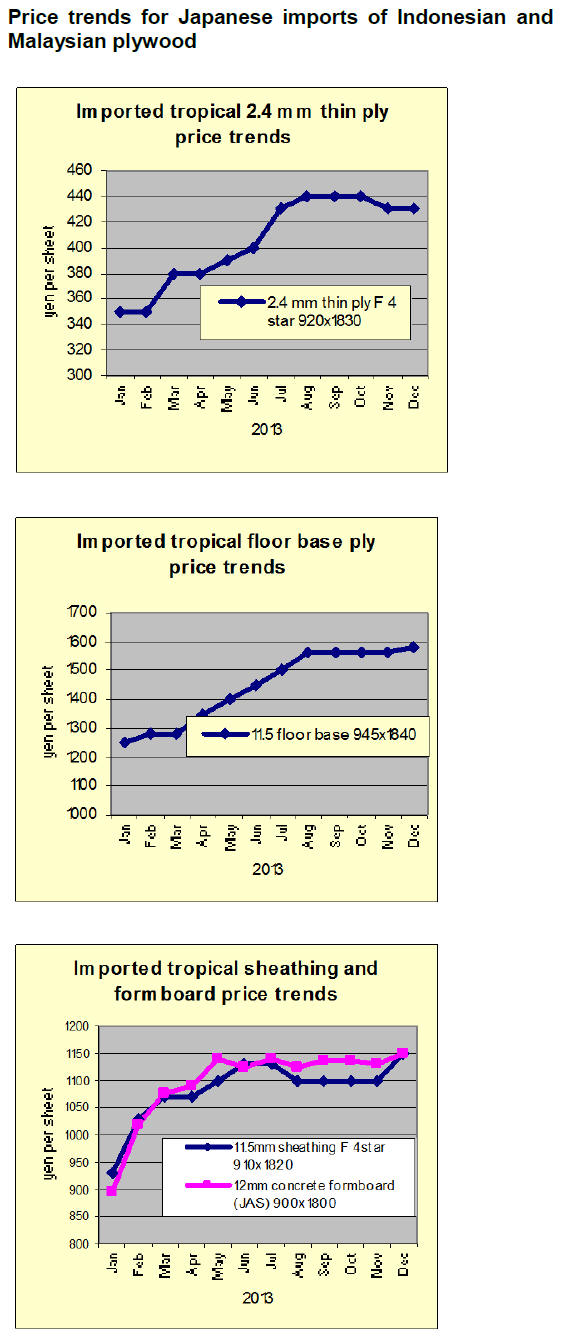

Import plywood prices in Tokyo market are soaring

rapidly. Export FOB prices by the suppliers hit the bottom

in late October then the prices have kept increasing. At the

same time, the yen has depreciated considerably by over

20 yen per dollar, which push the imported yen cost up.

Then the arrivals stayed low since last September and the

inventories in Japan have continued dropping. The

importers and wholesalers suffered a gap between high

imported cost and low market prices so they were not able

to purchase future cargoes. In late November, after the

inventories declined and the cost climbed, the importers

escalated the sales prices all at once to cover the gap.

Thus, the market prices inflated

rather sharply.

In Tokyo market, 3x6 concrete forming panel prices are

1,170 yen per sheet delivered, 70 yen up from November.

3x6 concrete forming for coating prices are about 1,280

yen, 50 yen up. 12 mm structural panel prices are 1,200

yen, 70 yen up.

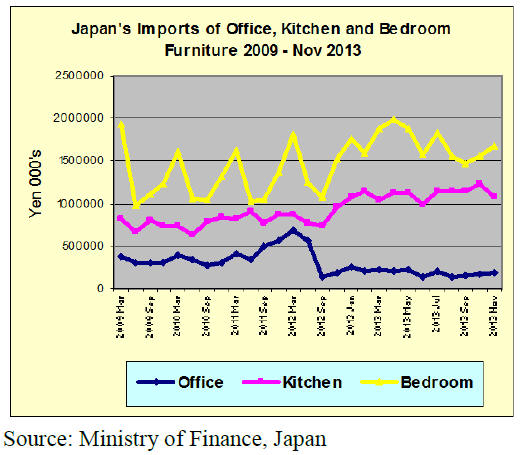

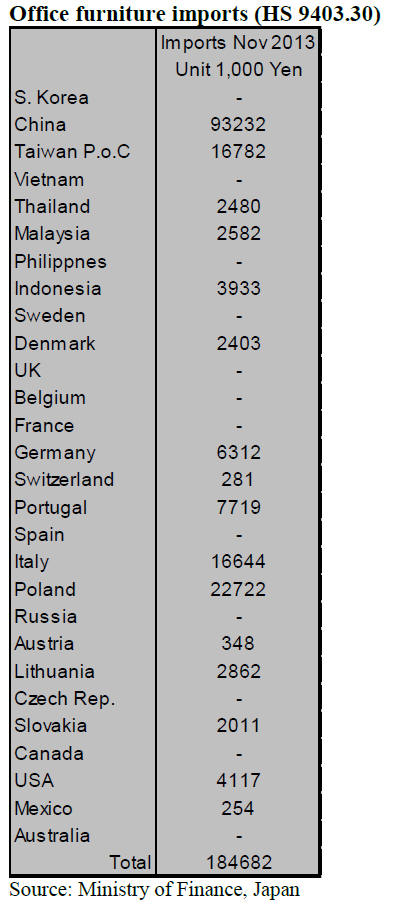

Office furniture imports (HS 9403.30)

In November 2013 Japan‟s imports of office furniture

increased by 9.5% marking the third consecutive increase

since September.

The top supplier remains China which provided 50.5% of

all November imports, marginally down from the 52%

supplied in October. The three main suppliers in

November were China, Poland and Taiwan P.o.C which,

together, accounted for 72% of all office furniture imports.

There were several winners in November including China,

Poland (for which imports doubled) Taiwan P.o.C, and

Italy. Suppliers in the US doubled exports in November as

did shippers in Poland. The main losers in November were

S. Korea, Malaysia, where exports halved, and Slovakia.

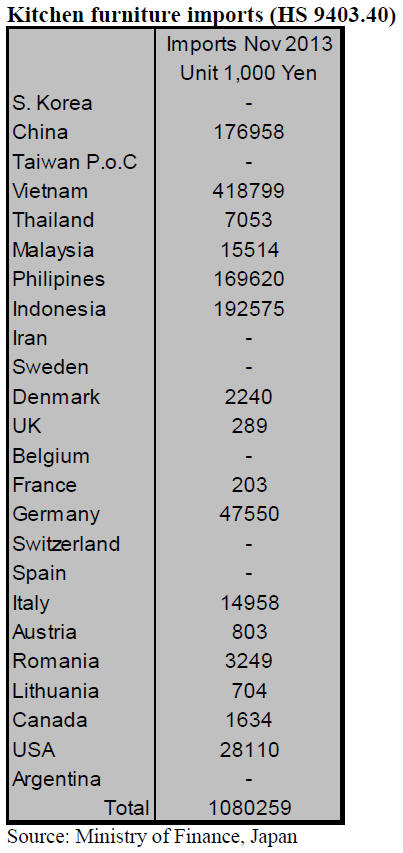

Kitchen furniture imports (HS 9403.40)

Asian suppliers notably Vietnam, Indonesia, China and

Philippines continue to provide the bulk of the kitchen

furniture imported by Japan according to figures from

Japan‟s Ministry of Finance. November kitchen furniture

imports, at yen 1,080,259 mil., were down by 12% on

levels in October. Overall, suppliers in Asia provided

88.7% of Japan‟s kitchen furniture imports in November.

Vietnam maintained its position as the number one

supplier of kitchen furniture by a significant margin

supplying 39% of Japan‟s kitchen furniture imports but the

November import figures show a slight decline in imports

from Vietnam.

The other main suppliers were Indonesian (17.8%), China

(16.4%) and Philippines (15.7%).

Japan‟s imports of Kitchen furniture from Indonesia fell

slightly but other SE Asian exports suffered significant

declines with imports from Thailand and Malaysia down

by half and imports from the Philippines down by around

25%

November imports from Italy jumped three fold but still

represent just a small part of Japan‟s overall imports of

kitchen furniture. The only significant EU supplier of

kitchen furniture in November was Germany where

imports doubled.

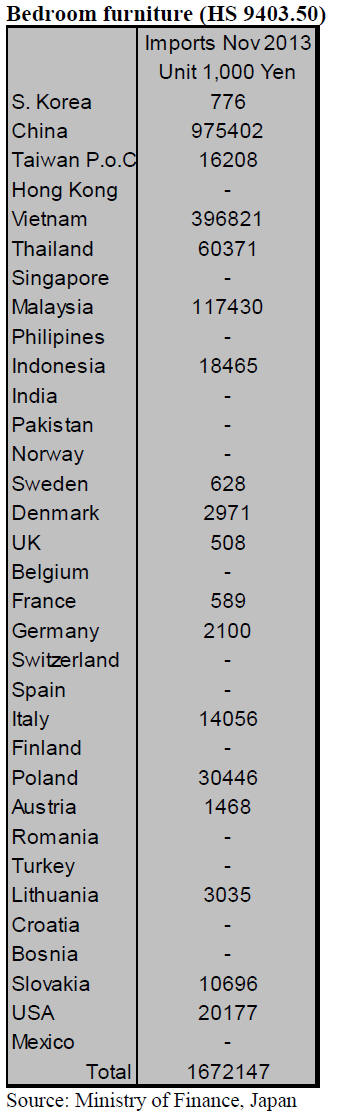

Bedroom furniture (HS 9403.50)

Japan‟s imports of bedroom furniture in November rose to

yen 1,672 mil. up by over 7% on levels a month earlier. in

October. The November increase marks the third

consecutive increase since mid 2013.

Once again China topped the table of bedroom furniture

suppliers to Japan, providing some 58% of all bedroom

furniture. Together China, Vietnam and Malaysia

accounted for most (89%) of all bedroom furniture

imports.

The rise in overall imports of this item was largely due to

increased supplies from China, Malaysia, Slovakia and the

US.

|