2. GHANA

Fuel prices reviewed upwards

Fuel prices were adjusted upwards in the first half of

March and petrol prices have been raised by 2-6%. The

increase in fuel costs is the result of the depreciation of the

cedi and the higher price of crude oil on the world market.

Luckily for the public, the current fuel price increases

have not yet translated into increases in transport fares

however, analysts point out that the price increase on

petrol and diesel will have an effect on timber companies.

VAT on financial services to generate much need

resources

A Value Added Tax (VAT) on financial services in

Ghana, will take effect as soon as on-going talks with the

banking community to identify the chargeable products

and reconfigure their systems are concluded, George

Blankson, Commissioner-General of the Ghana Revenue

Authority (GRA), has said.

The Finance Ministry expects this to boost VAT revenues

by GHS745 million this year and it has promised to spend

the extra money exclusively on infrastructure.

Cedi stabilises after BoG directive

Following directives on foreign exchange transactions

from the Bank of Ghana (BoG) the value of the Ghana

cedi is beginning to stabilise.

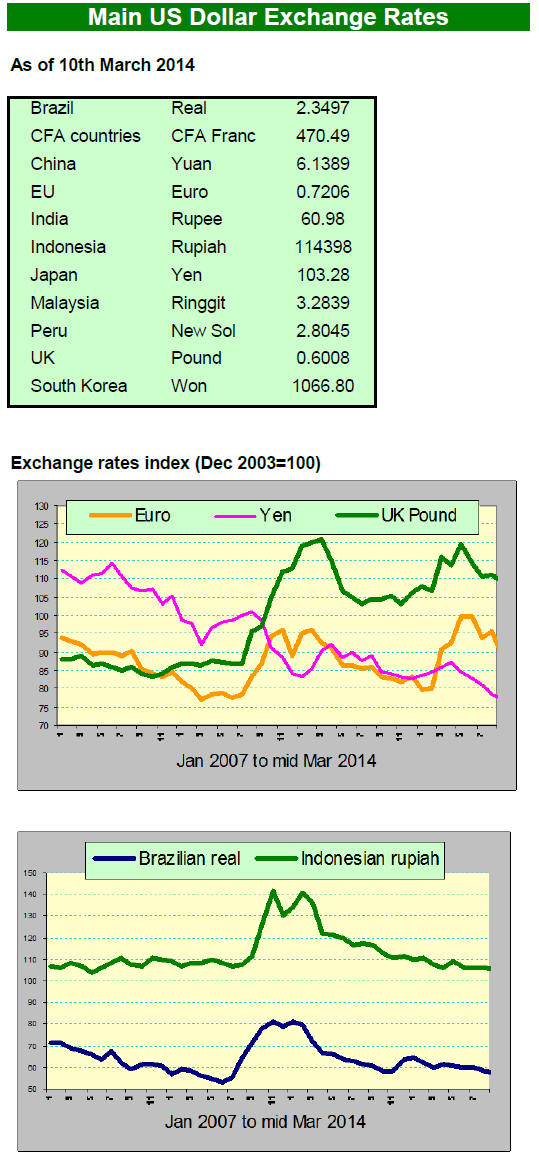

Before the BoG measures, the average exchange rate was

GHc 2.40 to the US dollar up from the GHc 2.23 to the

dollar in Jan.2014. The cedi depreciated 7.7% in the

month of January.

VPA conference hosted by GFC in London

The latest FLEGT newsletter has reported that ※Business

operators and NGOs from Europe attended a conference in

London in February to be briefed on Ghana's progress in

preparing for the VPA.

Officials from the Ghana Forestry Commission (GFC)

made presentations on the country‟s experiences and

lessons learnt from implementation of the VPA.

Participants also discussed challenges for small-scale

forest enterprises in meeting legality requirements and the

readiness of Ghana‟s timber industry to obtain FLEGT

licences. Another presentation updated participants on

Ghana‟s progress in developing its electronic timbertracking

system.

In their presentations, Raphael Yeboah and Chris Beeko of

the GFC reiterated the value of the VPA as a powerful tool

for strengthening domestic forest governance.

3. MALAYSIA

2013 furniture exports top US$2.2 billion

Furniture is very much in the news this month in Malaysia

as two annual furniture fairs were held in Kuala Lumpur.

The Malaysian furniture industry has come a long way

since its early days when it developed its trade in

rubberwood products.

International demand for Malaysian furniture is strong and

2013 exports were worth RM7.4 billion (approx. US$2.2

billion), the US, Japan, Australia, Singapore and UK were

the top buyers in 2013. Malaysia is the eighth ranked

global furniture exporter.

In recent years Malaysian exporters have been facing

growing competition from Chinese furniture exporters as

well as exporters in Vietnam where, in 2013, furniture

exports were worth US$4.5 billion.

The Malaysian International Furniture Fair (MIFF) was

held over five days and featured over 500 manufacturers

from 13 countries including China, Hong Kong, India,

Indonesia, Singapore, South Korea, Spain, Taiwan, United

Kingdom, the United States, Vietnam, Iran and the host

country.

Sales during the five days of MIFF 2013 have been

estimated at RM2.8 billion (approx. US$854 million), up

by about 5% on last year.

One of the highlights of the latest MIFF were the industry

seminars with topics such as „shaping of Malaysian

designs for the global market‟, „Intellectual property for

the furniture industry‟, and „Award-winning US-patented

high temperature drying technology for rubberwood‟, a

technology developed by the Forest Research Institute

Malaysia.

※MIFF provides a strategic platform for furniture

businesses, contract buyers, international chain stores,

hoteliers, architects and interior decorators to meet and

source for their requirements and establish business

networks,§ said Mohd Ridzal, Deputy Secretary-General

of the Ministry of International Trade and Industry.

An Export Furniture Exhibition (EFE) 2014 was also held

in Kuala Lumpur together with MIFF. The EFE fair had

110 exhibitors displaying a wide range of furniture from

Malaysia as well as overseas. The EFE 2014 is not

exclusively a trade only fair but also caters to consumers

with local visitors making purchases on the spot.

During the 2013 EFE, in-fair sales are said to have totalled

around RM2.2 billion (approx. US$ 680 million). EFE

exhibitors are that a 10 每 20% increase in sales was

achieved during the EFE 2014.

Industry analysts speculate that the furniture industry in

Malaysia will expand to meet growing demand and as

manufacturers in China face increasing production costs,

especially rising wages. Currently, Malaysian production

costs are about the same as those in China but are not

expected to increase significantly in the short term.

Analysts also point out the success of Malaysian producers

in meeting international quality and delivery requirements.

The Malaysian government is making a determined effort

to get manufacturers to move up the value chain and

become „brand manufacturers‟.

Demand changes in Japan and India have strong

impact on export performance

For exporters in Sarawak, India and Japan are the most

important markets for logs and plywood so developments

in these two markets are carefully assessed as they have a

huge impact on export manufacturers.

WTK Holdings Bhd, one of the top producers in Sarawak,

released its financial results for 2013 and these show how

demand in India and Japan drove the group‟s earnings last

year.

In the financial year ending 31 December 2013, WTK‟s

timber division reported a 6.7% growth in pre-tax profit to

RM41.6 million from RM39 million in 2012, this was

despite having sold lower volumes than in the previous

year.

The reduced log lower availability in 2013 pushed up

average selling prices on the back of the firm demand in

the main markets. Average log prices increased by 13.6%

in the final quarter of 2013 year on year while the sales

volume fell 8.7%. In addition to India and Japan the group

exported to Vietnam, Taiwan P.o.C and China.

WTK indicated the average selling price of plywood in the

final quarter jumped by almost 9% while sales volumes

dipped by 5.8% during the same period. Japan was the

group‟s key market, absorbing 88% of its total plywood

exports while Taiwan P.o.C and ASEAN countries

accounted for 10% and 2% respectively.

Log traders in Sarawak report current FOB log export

prices as follows:

meranti SQ US$270 每 290/cu.m

kapur SQ US$340 每 360/cu.m

keruing SQ US$310 每 335/cu.m

selangan batu regular US$515 每 535/cu.m

Plywood traders in Sarawak report current FOB export

prices as follows:

Floor base panels (11.5mm) US$690 每 695/cu.m.

Formboard US$555/cu.m

Middle East (9 每 18mm) US$470/cu.m

Taiwan (8.5 每 17.5mm) US$470 每 480/cu.m

Exports to South Korea (8.5 每 17.5mm) were reportedly at

US$490 每 510/cu.m. C&F.

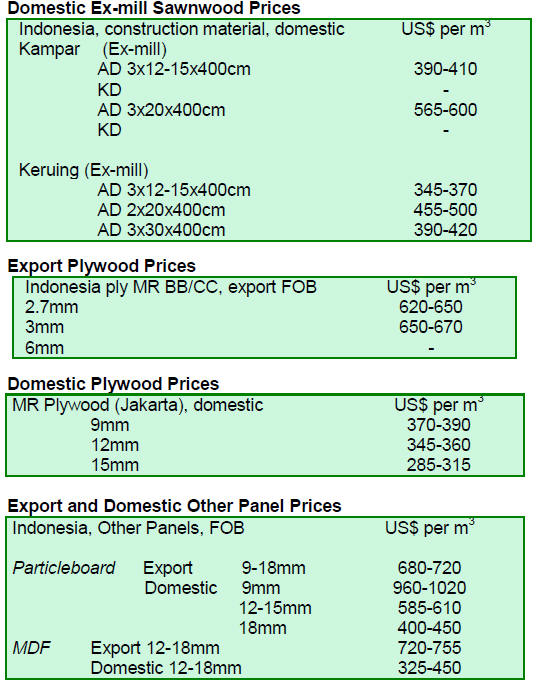

4. INDONESIA

Indonesia the first to secure VPA

ratification

On 27 February the European parliament ratified the EUIndonesia

Forest Law Enforcement, Governance and

Trade (FLEGT) Voluntary Partnership Agreement (VPA).

This agreement acknowledges that Indonesian timber and

wood products are being certified through the domestic

timber legality verification system (SVLK) as legally

harvested and processed, thus complying with the EU

Timber Regulation, which became effective in March last

year.

With this ratification by the EU, Indonesian timber

producers and exporters have gained a competitive edge in

the EU market said Bayu Krisnamurti, Indonesia‟s

Deputy Trade Minister.

Indonesia is one of the world‟s biggest timber producers

and is set to be the first country to have a VPA ratified by

the European Parliament.

The ratification of the VPA means Indonesian timber and

wood products exported the EU member states are exempt

from the mandatory due diligence requirements applied to

exports from countries which have not yet concluded VPA

negotiations.

Analysts suggest there will likely be a significant jump in

Indonesian wood product exports to the EU and Bayu

Krisnamurthi has said Indonesia expects to increase timber

and wood product shipments to the EU by 5-10 percent

this year.

Indonesia and EU hold first review of VPA

implementation plans

The FLEGT Newsletter has reported that ※representatives

of Indonesia, the EU Delegation to Indonesia and the EU

FLEGT Facility met in Jakarta at the end of January to

assess progress on VPA implementation. Indonesia‟s

representatives included officials from the ministries of

Forestry, Trade and Foreign Affairs and leaders from civil

society and the private sector.

Participants reviewed the joint Indonesia每EU action plan

on VPA implementation, an outcome of the 2013 joint

assessment of Indonesia‟s timber legality assurance

system, SVLK.

Indonesian officials reported progress on the critical issue

and released two new regulations on the SVLK and a third

on imports. Acknowledging the complexity of the

remaining issues in the action plan and the work needed to

maintain stakeholder participation, the two parties

extended the timeframes outlined in the action plan.

Indonesia and the EU also discussed the next joint SVLK

assessment, which they agreed to begin in the second half

of 2014, after the first meeting of the joint implementation

committee.

After the meeting, the Ministry of Forestry organised two

regional multi-stakeholder consultation workshops in

Makassar and Yogyakarta in February on the draft

regulations. A national consultation workshop is planned

for 19 March.§

5. MYANMAR

February export shipments the highest in

twelve

months

Log exports from April 2013 to the end of February 2014

are estimated to have been 476,000 cu.m of teak logs and

1,530,070 cu.m of other hardwoods. Some 556,300 cu.m

of teak logs and 1,567,900 cu.m of other hardwoods were

shipped during the 2012-13 financial year.

Teak and other hardwood log shipments in February were

the highest for the year to date at 123,875 cu.m of teak and

222,975 cu.m of other hardwoods. As 31 March is the last

date for log exports both sellers and buyers are anxious to

ship as much as possible before the deadline.

Directive on hewn teak, baulks and boule exports

On 26 February, following a directive from the Ministry of

Environment Conservation and Forestry, the Myanma

Timber Enterprise (MTE) announced that, from 1 April

this year all hewn (half squared or roughly squared handsawn)

teak and hardwoods must be further processed

domestically before export.

Similarly, baulks, and logs cut into boules must also be

further manufactured into processed wood products to

qualify for shipment.

FDI in wood processing tops US$51 mil. - India the

biggest investor

The Irrawaddy News Journal of 5 March has quoted

Directorate of Investment and Company Administration

sources saying that 8 timber processing licenses were

granted to foreign firms in the 2013-14 financial year.

Five companies from India were granted licenses

valued

US$26 million, two companies from Singapore received

licenses valued US$24 million and one Korean company

obtained a license valued at almost US$1 million.

3rd BIMSTEC Summit

The Third Bay of Bengal Initiative for Multi-Sectoral

Technical and Economic Cooperation (BIMSTEC)

summit, with participation from Bangladesh, Bhutan,

India, Myanmar, Nepal, Sri Lanka, and Thailand was held

at Naypyitaw on 4 March.

Member states signed two MOAs and one MOU including

the establishment of a Centre for Weather and Climate. A

Centre for Weather and Climate is to be set up near New

Dehli and India agreed to provide 35% of the budget.

The summit also laid out plans to enhance cooperation in

expanding skill and technology base of member states

through collaboration and partnerships in 14 sectors: trade

and investment, technology, energy, transport and

communications, tourism, fisheries, agriculture, cultural

cooperation, environment and disaster management, public

health, counter terrorism and transnational crime, and

climate change. A BIMSTEC secretariat will be

established in Dhaka, Bangladesh.

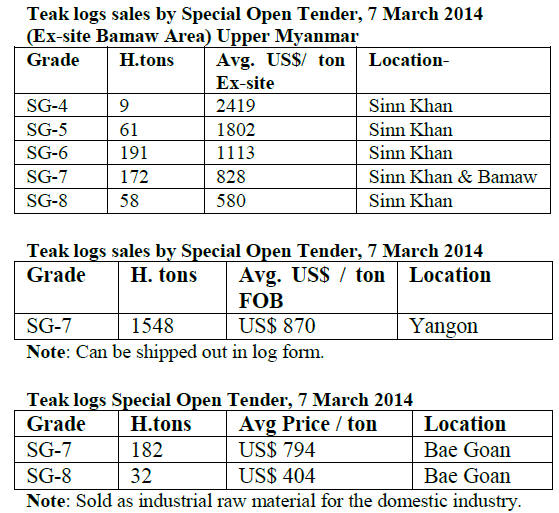

Teak open tender prices

The following regular items were sold by competitive

bidding on 7 March 2014 at the Myanma Timber

Enterprise (MTE) tender hall.

Analysts point out that the SG-7 and SG-8 teak logs

sold

in special open tenders were of lower quality than those

usually sold in the tender sales and because of this prices

were much lower than usual.

6.

INDIA

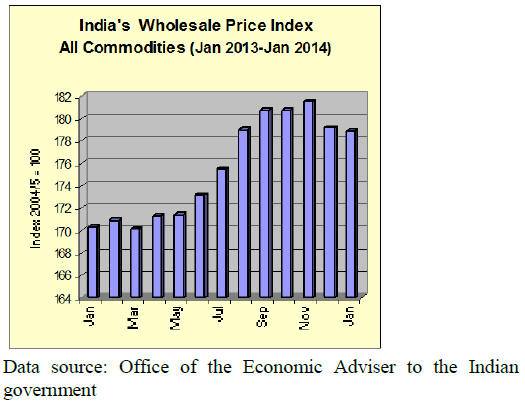

Wholesale price index down

The Office of the Economic Adviser to the Indian

government provides details of trend in the Wholesale

Price Index (WPI). The official Wholesale Price Index for

„All Commodities‟ (Base: 2004-05 = 100) for the month of

January 2014 declined to 178.9 from 179.2 in December

2013.

It has been estimated that February inflation was

up by

around 8 percent year on year, this compares to the almost

9% increase from December 2013 to January 2014.

Slightly lower food prices are suggested as one of the

main reasons for the decline in inflation. The decline

seems less to do with the actions of the Reserve Bank in

raising interest rates than changes in seasonal agricultural

output.

Weak February export data undermines optimism

Improved domestic consumption and increased exports

have been providing support to the economy and India‟s

PMI, for the manufacturing sector moved to a twelve

month high of 52.5 in February. The consumer goods

segment was again the best performing sub-sector, leading

to a rise in both output and new orders. However capital

investment remains stalled.

Export orders in the final quarter of 2013 rose 7.5%

compared to the previous quarter topping US$78.9 billion

and this generated optimism, boosted manufacturing

output and created more employment opportunities.

The last quarter 2103 export performance, coupled with

the slowing of gold imports, lowered India‟s current

account deficit to a four year low of US$4.2 billion or

0.9% of GDP at the end of 2013.

However, data from the ministry of trade has revealed that

exports fell in February, the first decline in eight months.

If this downward trend continues then expectations for an

export led recovery would fade.

The statistics show that February exports fell 3.7%

from a

year earlier to around US$26 billion and analysts blame

weakening demand in the US and EU.

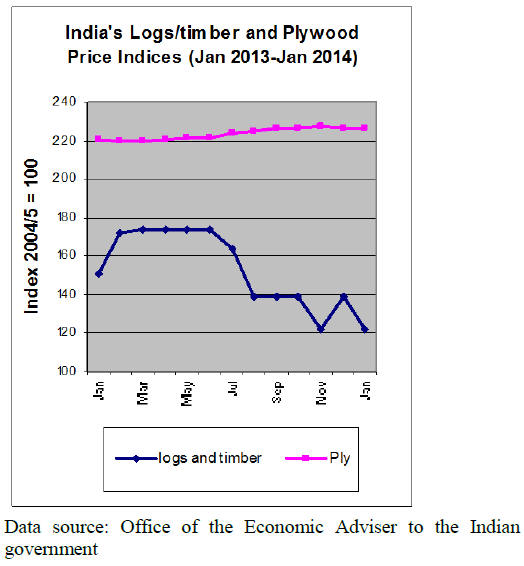

Timber and plywood wholesale price indices

In addition to data on the Wholesale Price Index for all

commodities, the Office of the Economic Adviser to the

Indian government also reports data on wholesale price

movements for a variety of wood products.

The Wholesale Price Indices for Logs/timber and plywood

are shown below. The logs/timber index continues to show

considerable volatility.

Rs 30 billion project to increase forest cover

The government of India has finally approved as a

"centrally sponsored scheme" a much awaited 'Green India

Mission' proposal of the Ministry of Environment and

Forests to increase forest cover in the country.

An official press release says: "Of the total expenditure of

Rs130 billion envisaged, the initial phase will require

some Rs 20 billion and that funding will come from the

Mahatma Gandhi National Rural Employment Guarantee

Act, the Compensatory Afforestation Fund Management

and Planning and the National Authority for Plantations ".

The objectives of the programme include increasing

forest/tree include improving the quality of this forest

cover, improving the ecosystem services including

biodiversity, hydrological services and increasing

opportunities for forest-based livelihood income

generation by households and sequestration of carbon.

A multidisciplinary team, from the government and NGOs

will be mandated to facilitate planning and implementation

at cluster/landscape unit level", said the official release.

Sweet smell of sandalwood prices drives interest

in

planting

The ever increasing prices for sandalwood and its oil is

stimulating investment in plantations by the government

and the private sectors.

Analysts point out that legislative amendments are

urgently required to allow private individuals and farmers

to take up sandalwood cultivation. Suitable growing

conditions exist in the four southern states and elsewhere

in the country and efforts are required to increase the area

under plantations.

Experts have pointed out that as against 3,000 tons of this

wood was produced annually in 1960s and 70s, but this

has now fallen to a mere 400 tons. Similarly sandalwood

oil production has also declined from 150 tons in 1970s to

just about 20 tons currently, necessitating imports of the

oil to meet the needs of local industries.

Currently the prices for sandalwood is around

US$1,25,000 per ton of wood and oil prices are about

US$2,200 per kg.

Plantation teak import prices

India‟s total imports of wood and wood products under HS

chapter 44 for the month of February 2014 were

US$207.51 million and exports under the same chapter

were US$23,04 million. Domestic demand continues to

be firm.

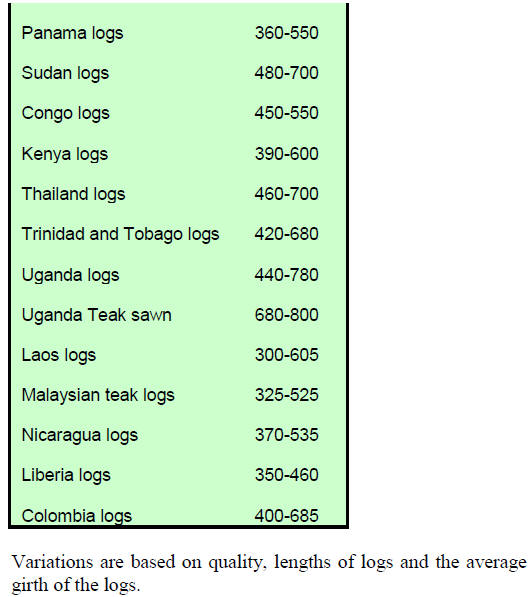

Current C & F prices for imported plantation teak, Indian

ports per cubic metre are shown below.

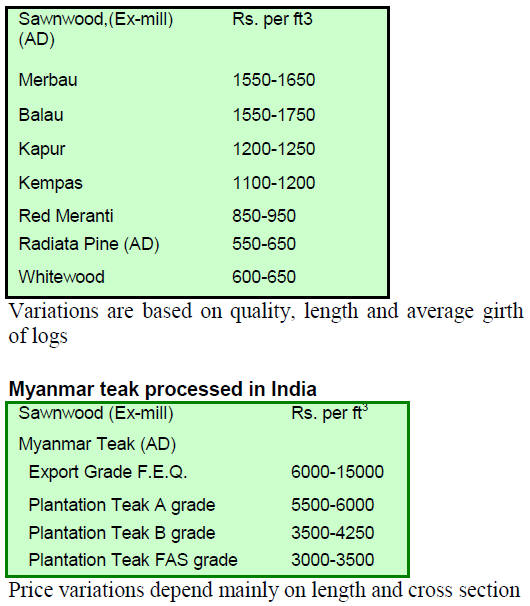

Prices for domestically sawn imported logs

Prices for air dry sawnwood per cubic Foot, ex-sawmill

are shown below.

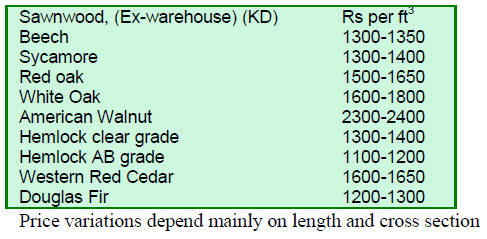

Imported sawnwood prices

Ex-warehouse prices for imported kiln dry (12% mc.)

sawnwood per cu.ft are shown below.

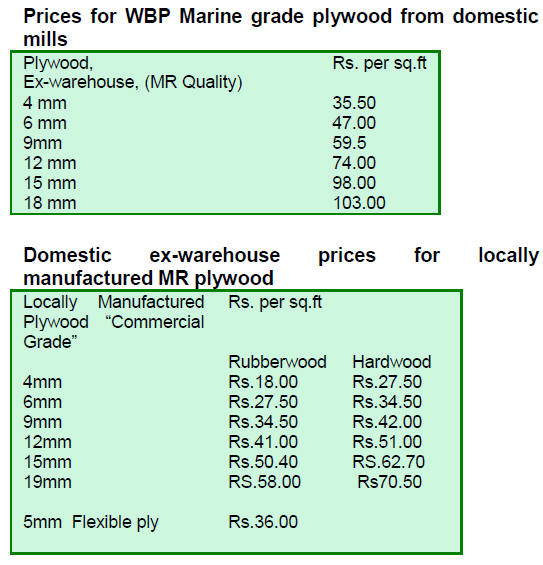

Plywood market slow to revive

Domestic manufacturers continue to report slow market

conditions and put this down to the subdued housing

sector. Prices remain unchanged.

7.

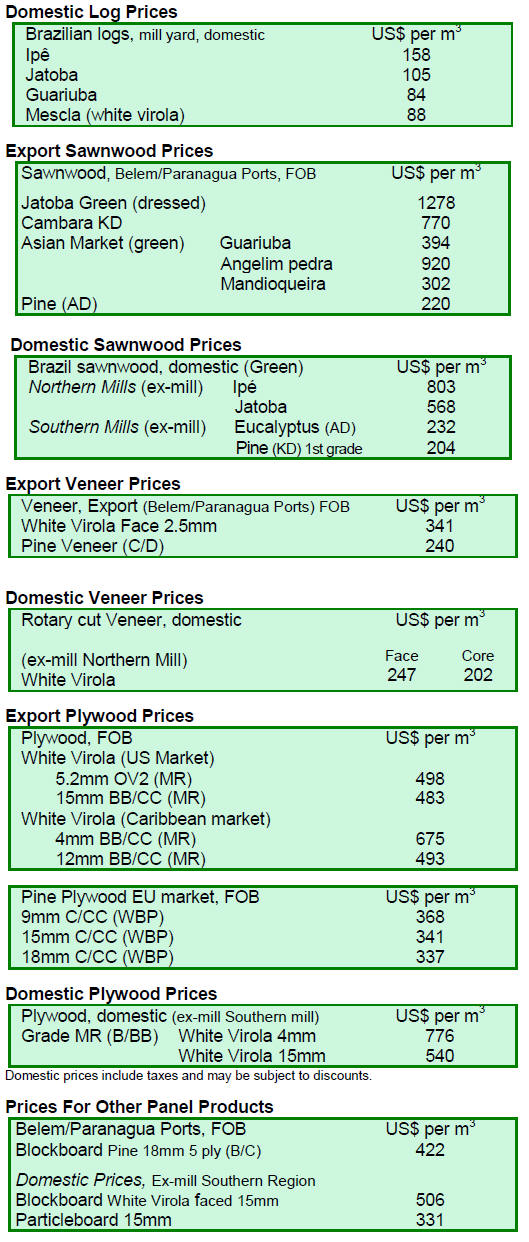

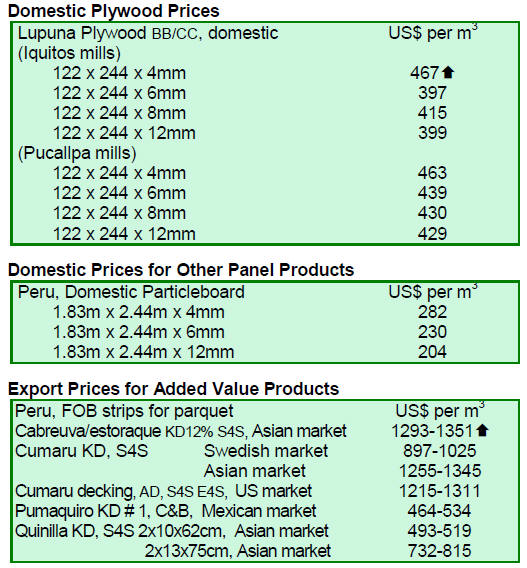

BRAZIL

Recovery of Brazilian pine plywood

exports

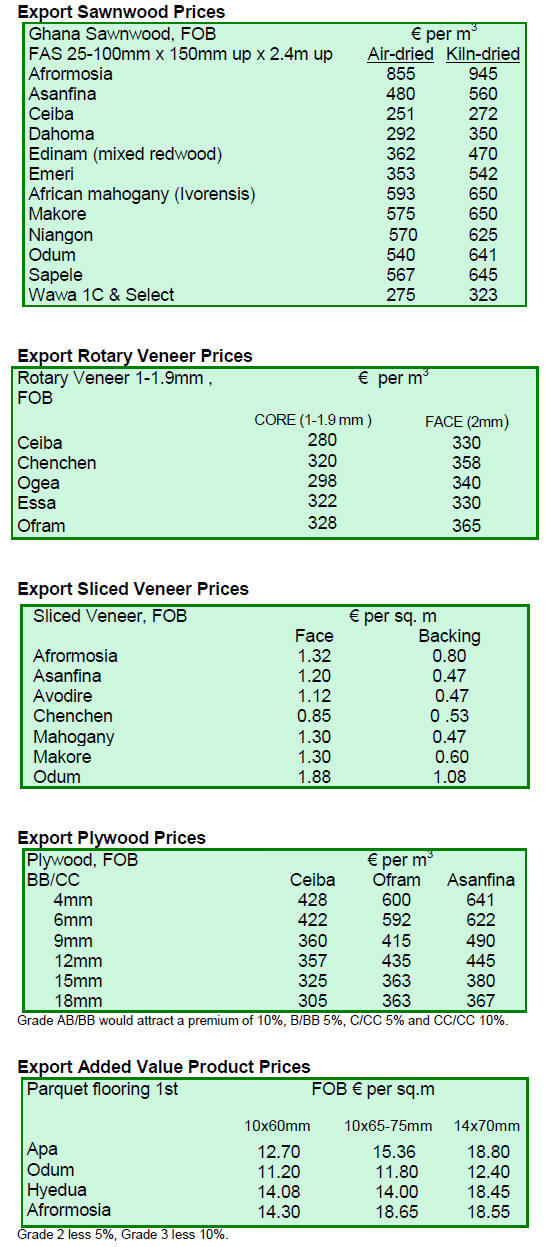

In 2013, there was a 24% increase in pine plywood

exports, the first increase in five years. The main markets

were Europe (71%) and North America (13%). Before the

2008/9 financial crisis the US was the main international

market for pine plywood.

According to the Brazilian Association of Mechanically

Processed Timber Industry (ABIMCI), the increase in

exports is the result of promotional efforts by the pine

plywood industry and the recent favorable exchange rate

which also helped the recovery.

However, ABIMCI warns it is necessary to continue with

the promotional efforts to secure better prices in

international markets.

In 2013, Brazilian pine plywood exports were 1.164

million cubic metres but in 2007, before the financial

crisis Brazil exported 1.536 million cubic metres.

Paran芍 state is the main pine plywood producer but

exports transaction costs are high because of taxes and

container handling fees at the Port of Paranagu芍. These

problems are compounded by the higher than average

minimum wage paid by companies in the state.

Earnings in the furniture industry drop

Despite an overall improvement in output and revenue in

the timber sector in 2013 the Brazilian wooden furniture

manufacturing sub-sector did not perform as well. In 2103

output from the furniture sector rose slightly but sector

revenues fell by approximately 2.5%.

According to the Brazilian Institute of Geography and

Statistics (IBGE) in 2013 furniture production increased

2.1% compared to 2012 but production by the whole

timber sector rose 4.6%,

The National Confederation of Industry has reported that

the utilisation of installed capacity in the furniture sector

increased 0.7% while that for the whole timber sector

increased by 2.3%.

Overall, the Brazilian wood processing industry achieved

a 3.8% growth in 2013, partially recovering the losses of

2012. Analysts say continued growth into 2014 could be

affected by a strengthening of the Brazilian currency and a

reigning in of credit as the central bank introduces further

monetary tightening.

Mato Grosso is the largest teak producer in Brazil

According to the Brazilian Association of Planted Forest

Producers (ABRAFLOR) the state of Mato Grosso is the

largest plantation teak producer in Brazil, with some

65,000 hectares of plantations. However, teak plantations

represent only 4% of the 5.1 mil. ha. of plantations in

Brazil, the majority being eucalyptus.

The Federation of Agriculture and Livestock in Mato

Grosso (FAMATO) has said the state has an opportunity

to expand the area of plantations but the lack of skilled

labour is a major constraint.

Teak is suited to the environmental conditions in Mato

Grosso but forestry companies in the state claim that, even

though there is a strong demand for teak in international

markets, the poor infrastructure in the state is holding back

development of the plantation sector.

São Paulo Furniture and Decoration Fair a success

The 17th Furniture and Decoration Accessories Fair, the

leading furniture and decoration accessories trade fair in

Latin America, was held in mid-February in São Paulo and

exceeded expectations.

The fair attracted 22,400 visitors including retailers and

professionals in the furniture and interior design industry

as well as importers from countries such as Bolivia, Chile,

Colombia, Dominican Republic, Ecuador, Guatemala,

Mexico, Panama, Paraguay, Peru, Puerto Rico, Uruguay

and Venezuela.

The fair generated business worth around R$200 mil. and

post-fair sales have been estimated at around R$300 mil.

The 18th Furniture and Decoration Accessories Fair will

take place in August, this year and will be held again in

São Paulo.

Price trends

Brazilian prices remain unchanged.

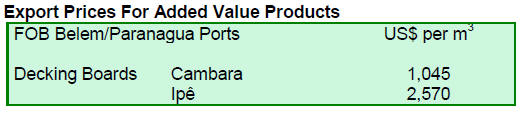

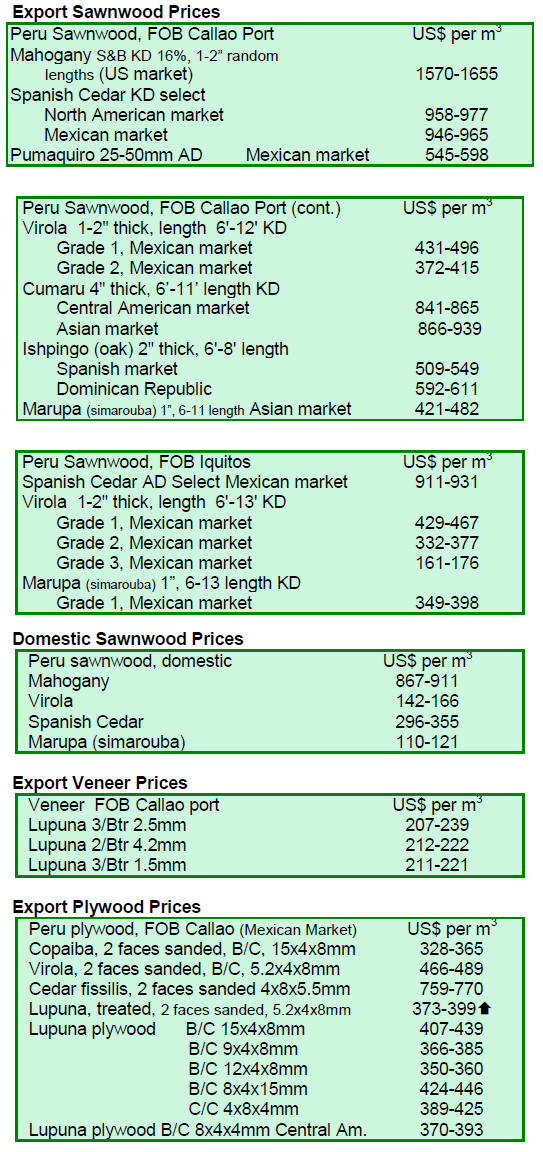

8. PERU

Disappointing export data from ADEX

According to statistics from the Exporters Association of

Peru (ADEX), 2013 exports of wood products were valued

at US$159.7 million FOB in contrast to the US$166.27

million in 2012, a decline of 3.9%.

In 2013 the three main markets for wood products from

Peru were China, United States and Mexico. Together

these three countries accounted for 74% of all wood

product exports.

The main items exported to China were strips and friezes

for flooring while the US market took mostly builders

woodwork and carpentry as well as blockboard. Demand

from China expanded 5% in 2013 while demand in the US

increased by 11%. In contrast, Mexican imports in 2013

fell 24%.

During 2013 exports of sawnwood were the second most

important category of exports accounting for around 36%

of all exports in value terms. 2013 exports of sawnwood

totalled US57.2 million FOB compared to the US66.4

million in 2012; a decline of almost 14%. The main

market for Peru‟s sawnwood in 2013 was China.

Exports of semi-manufactured products in 2013 were

valued at US$59.4 million FOB, up around 4% on levels

in 2012. China was the main buyer of semi-manufactured

products from Peru and accounted for 61% of all exports

of this category of product.

Encouragingly, demand for Peru‟s semi-manufactured

products from the US and Sweden expanded in 2013.

Exports of plywood and veneered panels in 2013 were

worth US$17.9 million FOB and Mexico was the main

market. However, 2013 exports of plywood and veneered

panels were down 19% compared to 2012.

Peru‟s 2013 exports of furniture and parts were valued at

US$7.9 million FOB, up 4.5% on 2012. The US market

accounted for over 60% of exports of furniture and parts

followed by Italy (13.5%).

Finland and IICA presented results forestry

innovations forum

At a Regional Forum in Lima from 5 to 7 March, progress

on the first phase some 24 projects promoting Sustainable

Forest Management Programe in the Andean Region was

assessed.

The Forum focused on highlighting innovations and

lessons learned from each of the four participating

countries Bolivia, Colombia, Ecuador and Peru. The

Forum provided the opportunity to validate innovations

and prepare strategies for replication and scaling of these

innovations such that they will be translated into expanded

investment and government policies.

A set of innovations, best practices and guidelines for

replication and scaling have been analyzed under the

umbrella of four themes related to sustainable forest

management in the region : the formation of multistakeholder

partnerships, compensation schemes for

environmental services, forest management Community

and diversification and value addition of forest products.

For more see:

http://forestalsostenibleandina.net/Noticias/noticiasforestales/

Finlandia-e-IICA-presentaron-innovacionesforestal.

aspx

9.

GUYANA

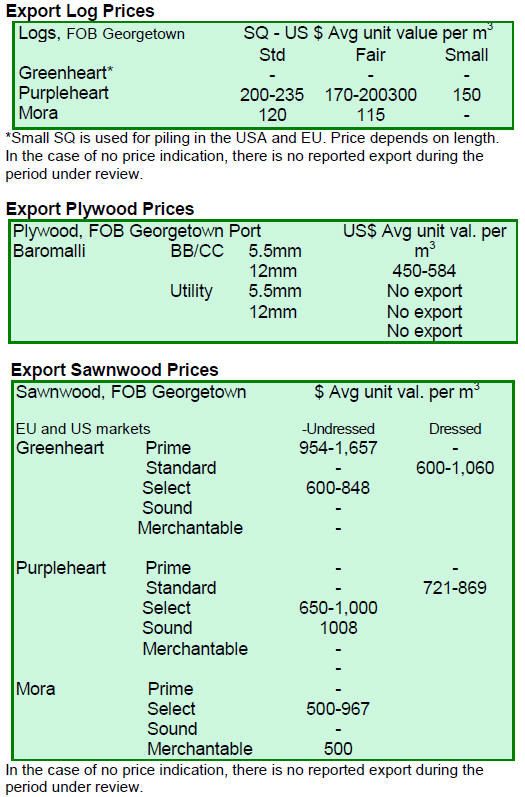

Mora log prices ease

In the period reviewed there were no exports of greenheart

logs. Purpleheart logs were exported however, but FOB

prices eased slightly.

For Standard sawmill quality purpleheart logs the top end

price fell from US$385 to US$235 per cubic metre FOB.

Similarly, there was a decline in price of Fair sawmill

quality purpleheart logs from US$300 to US$200 per

cubic metre FOB. However, for Small sawmill quality

purpleheart logs prices held firm at US$150 per cubic

metre FOB.

Mora log prices have also eased in recent weeks. Standard

sawmill quality mora FOB prices dipped from US$160 to

US$120 per cubic metre. Similarly for Fair sawmill

quality the price fell from US$140 to US$115 per cubic

metre FOB. Other logs, especially the lesser used but

commercial, species were exported.

Sawnwood prices remain firm

Despite the easing of log prices, sawnwood prices

remained firm. Undressed greenheart (Prime quality) saw

a significant increase in FOB prices from US$1,058 to

US$1,657 per cubic metre.

However, Select quality greenheart sawn prices fell from a

top end price of US$1,060 to US$848 per cubic metre

FOB. Sound quality greenheart sawnwood FOB prices

were fair at US$784 per cubic metre.

Undressed purpleheart sawnwood prices were largely

steady but Select quality sawnwood recorded a slight

increase in its top end price from US$1,000 to US$1,080

per cubic metre.

On the other hand, Undressed mora (Select quality) prices

surged from US$785 to US$976 per cubic metre FOB but

Merchantable quality mora sawnwood prices held firm at

US$500 per cubic metre FOB.

The main markets for sawn greenheart, purpleheart and

mora were the Caribbean, Europe, Middle East Oceanic

Region and North America.

Competition drives down dressed sawnwood prices

In contrast to the price movements of rough sawn timbers,

export prices for dressed sawnwood fell in the period

reviewed.

Dressed greenheart export prices fell from US$1,272 to

US$1,060 per cubic metre while Dressed purpleheart FOB

prices slipped from US$1,160 to US$869 per cubic metre.

The Caribbean and the Middle East market of U.A.E

absorbed most of these products.

Many of Guyana‟s lesser known species made their way

onto the international market at prices which were

attractive for producers. Guyana‟s washiba (ipe) continued

to rank high in terms of export market prices earning as

much as US$2,450 per cubic metre FOB in the US market.

Plywood prices remained firm at US$584 per cubic metre

FOB in the Caribbean and South American markets.

Greenheart pile prices were favourable. Select quality

piling earned as much as US$718 per cubic metre FOB

and Sound quality piling attracted prices as high as

US$388 per cubic metre. Europe and North America were

the top buyers of this durable timber product from

Guyana.

Similarly, wallaba poles of Select quality also attracted

favourable market prices as much as US$824 per cubic

metre FOB with the Caribbean being the foundation of this

market. During this period Splitwood (shingles)

maintained a strong presence in the Caribbean, Central

American and North American markets earning as much

as US$1,091 per cubic metre FOB.

Guyana‟s value added products made their way onto

export markets in the form of doors, indoor furniture,

crafts and wooden ornaments and utensils.

Increased demand in the domestic utilities sector

Guyana is currently experiencing a building boom and

this has resulted in increased domestic consumption of

sawnwood, plywood, joinery as well as poles and posts.

Recently, the Guyana Power and Light Inc. has been

expanding its electrification programme in areas not

served by the existing power grid such as in the new

housing schemes being established across Guyana. This

expansion of the power grid has created an extra demand

for transmission poles.

In addition, many large buildings are being

constructed

and this has led to increased demand for piles for

foundations purposes.

Wallaba is recognised both locally and internationally as a

leading highly durable tropical timber suitable for

transmission poles. Similarly Greenheart is also known

internationally as a leading species for construction piling.

Apart from the commonly know timbers there are many

species that can substitute for the establish species. For

instance suya (Pouteria speciosa) can be used for poles and

posts while black kakaralli (Eschweilera sagotiana) can be

utilised for piles. These timbers however, require some

form of preservative treatment.

The Forest Products Development and Marketing Council

of the Guyana forestry Commission, in an effort to educate

consumers on a wider range of timbers has embarked on a

campaign to publicise consumers of the characteristics and

properties of these lesser used species.

﹛