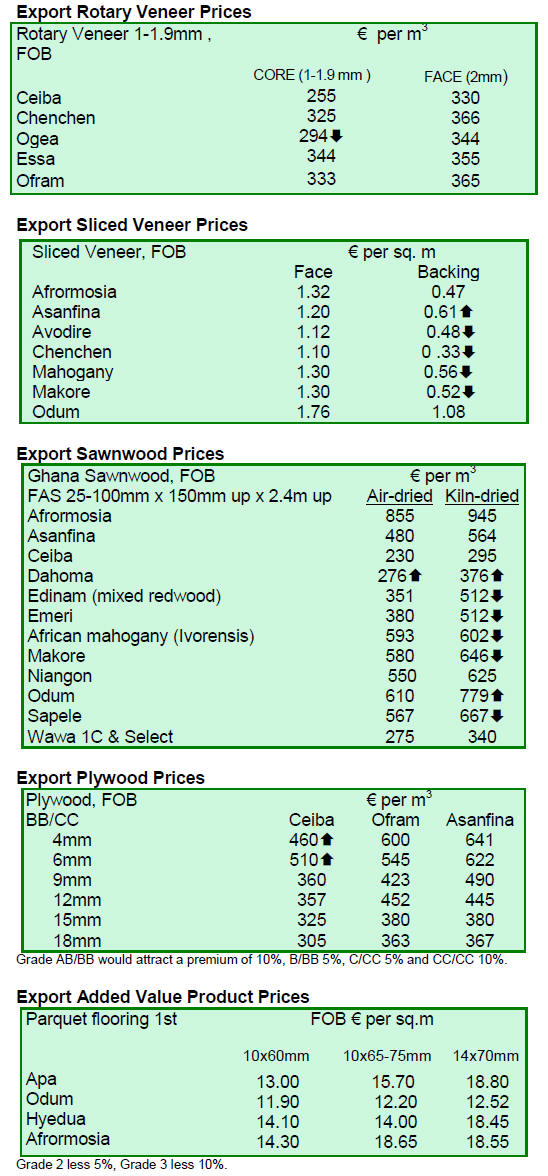

2. GHANA

EU markets absorbing more of Ghana¡¯s

exports

Ghana‟s exports of secondary wood products (SWPs), for

the first quarter of 2014 accounted for 90% of total export

revenues according to available statistics from the Timber

Industry Development Division (TIDD) of the Forestry

Commission (FC).

Exports in the first quarter 2014 totalled euro 22.49

million compared to euro 29.48 million in the first quarter

2013. The term SWP in Ghana includes sawnwood,

veneers, boules and plywood.

Wawa, mahogany, cedrella, koto, makore and teak were

the major timbers exported during the first three months of

the year.

Markets in the EU accounted for 42% of total in the first

quarter, significantly higher than the 22% in the same

quarter last year.

Shipments to African markets slipped to 33% of all

exports from last year‟s quarter figure of 36%.

The Asian, American and Middle Eastern markets

accounted for the balance.

Ghana to issue first timber validity license in

2014

The Deputy Minister of Lands and Natural Resources, Ms.

Barbara Serwah Asamoah, has hinted Ghana could start

the issuing Timber Validity Licenses (TVL) for timber

exports to the European Union markets by the end of the

year.

She said this during a tour of some timber companies in

the Western Region of Ghana with the EU Ambassador in

Ghana Mr. Claude Maerten. The purpose of the tour was

to assess the country‟s preparation towards compliance

with the EU Voluntary Partnership Agreement (VPA).

Also in the group making the tour was Dr Ben Donkor, the

Executive Director of the Timber Industry Development

Division (TIDD) and Mr. Chris Beeko, Director in-charge

of the Timber Validity Department of the Forestry

Commission.

Ms. Asamoah said Ghana had initiated several processes

towards full compliance with the VPA, to pave the way for

Ghanaian companies to export verified legally harvested

wood products to EU markets.

On his part Dr. Donkor said the Division had positioned

itself to ensure compliance with the Voluntary Partnership

Agreement, while Mr. Beeko said the FC had put in place

a Legality Assurance System (LAS) to help track timber as

it moves through the supply chain.

Regional shipping line mooted

The Ghana Chamber of Commerce and Industry (GCCI),

jointly with other Chambers in the region, plans to

establish a shipping line to serve the regional trade.

Funds for the project are to be raised in the capital market,

from private investors and interested institutional

investors.

If the investments are forthcoming the new line will help

ease challenges faced by those dealing with the regional

trade and should boost intra-regional trade.

¡¡

3. MALAYSIA

VPA could be signed in 2015

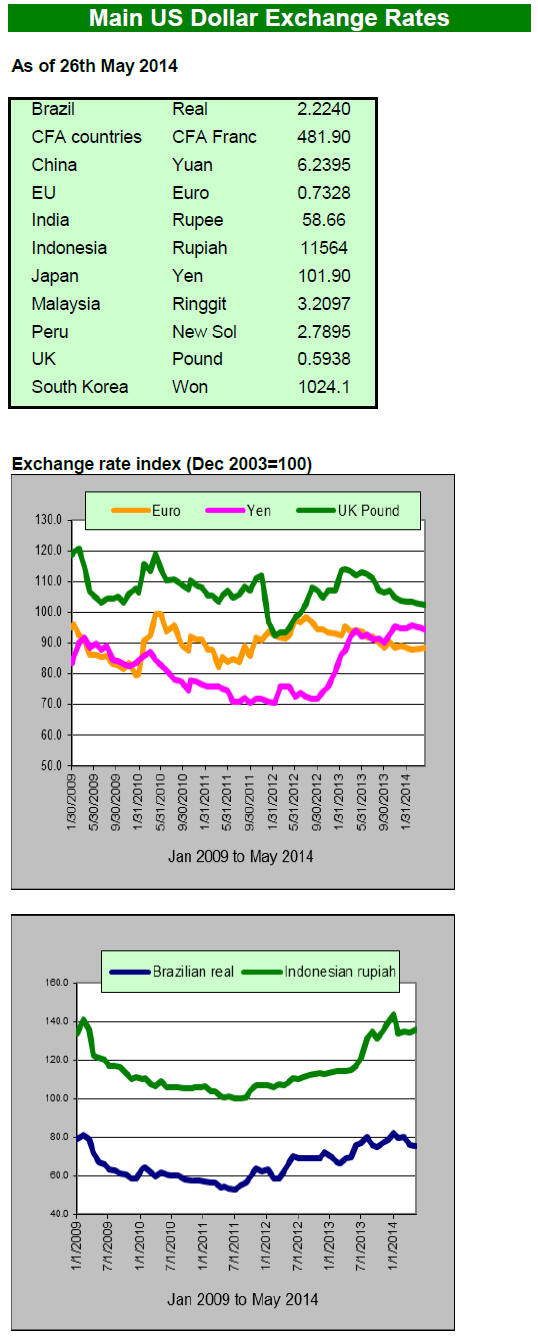

Malaysia started negotiating with the EU in 2006 on a

Voluntary Partnership Agreement (VPA) under the EU

Forest Law Enforcement, Governance and Trade (FLEGT)

initiative.

Eight years later the EU-Malaysia VPA is still elusive

however, some 60 experts recently gathered in Kuala

Lumpur for two meetings one of which was the Joint

Expert Meeting of stakeholders from EU and Malaysia to

finalise the Malaysian Timber Legality Assurance System

(TLAS).

This was followed by a meeting of the Technical

Working

Group which looked into the various outstanding issues of

the TLAS and VPA terms.

The experts felt that all outstanding issues could be settled

in time for the VPA to be signed by Peninsular Malaysia

and Sabah in early 2015.

EU has VPA timeline for Sarawak

The Malaysia Reserve, an e-newspaper, reported the EU

Chief Negotiator, Hugo Schally, as saying ¡°the EU has

clear time bound commitments for Sarawak to sign the

VPA after Peninsular Malaysia and Sabah¡±.

Though the timelines are still under negotiation the EU is

proposing a three-year period for Sarawak to sign once the

EU-Malaysia VPA takes effect.

Data released at the meetings showed that timber and

timber products exported by Malaysia in 2012 were worth

RM 20.2 billion (approximately US$ 6.2 billion).

Of the total exports, Japan accounted for RM 4.2 billion

(21%), United States RM 2.5 billion (12.4%) and the EU

RM 2.1 billion (10.4%).

The EU organised an information sharing meeting after

the two official meetings. Stakeholders, including

representatives of the timber trade and NGOs/Civil

Societies were invited to be briefed on the EU Timber

Regulations, Due Diligence, legality definition and the

state of negotiation of the EU-Malaysia VPA.

India main buyer of Sarawak logs

Statistics compiled by Sarawak Timber Association for the

first quarter of the year showed Sarawak exported 650,368

cubic metres of logs worth RM441,613,268

(approximately US$135.9 million). By way of

comparison, the first quarter of 2013 saw an export of

749,044 cubic metres worth RM422.4 million.

Merantis‟ formed the biggest species group in first quarter

exports at 312,938 cubic metres (48%). The next main

species group was Mixed Light Hardwood (MLH) at

100,773 cubic metres (15.5%).

India was the biggest buyer of Sarawak logs at 419,822

cubic metres in the first quarter 2014 (64.6%) followed by

Taiwan (76,601 cubic metres or 11.8%). Japan is now the

fourth ranked importer from Sarawak at 31,488 cubic

metres or 4.8%.

Regional markets support sawnwood exports

Sawntimber exports from Sarawk for the first quarter of

2014 totalled 143,354 cubic metres worth RM132,130,730

(approximately US$40.7 million) with the biggest buyer

being the Philippines at 39,204 cubic metres (27.3%)

followed by Thailand at 30,071 cubic metres (20.9%) and

Yemen, 18,973 cubic metres or 13.2%.

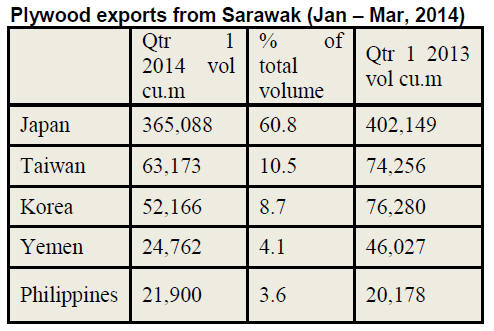

The changes in the structure of the timber industry in

Japan are reflected in the pattern of imports. Previously

Japan was a major log importer and manufacturer of

tropical plywood.

This has changed, Japan imports less logs but more

tropical plywood, mainly from Sarawak. The table below

shows the main export markets for Sarawak plywood in

the first quarter of 2013 and 2104.

4. INDONESIA

Indonesia to issue new SVLK regulations

The Government of Indonesia will issue revised SVLK

regulations in June this year as it has just completed an

assessment and revision process. SVLK stands for ¡°Sistem

Verifikasi Legalitas Kayu¡±, Indonesia's timber legality

assurance system.

The revisions draw upon the results of the 2013

independent SVLK evaluation jointly conducted by

Indonesia and the EU, the subsequent Indonesia-EU action

plan to advance VPA implementation and multistakeholder

consultations held in February and March

2014.

See: http://capacity4dev.ec.europa.eu/publicflegt/

blog/indonesia-posts-draft-regulations-timberlegality-

assurance-comments#sthash.qjf8s4Uv

and

http://eyesontheforest.or.id/attach/Anti%20Forest%20Mafi

a%20Coalition%20%2818Mar14%29%20SVLK%20Flaw

ed%20FINAL.pdf

Self declaration for community wood certification

Forestry Minister, Zulkifli Hasan has said the ministry is

committed to encourage the use of wood raw material

from community forests and to achieve this the regulations

will be simplified.

For example the sale of timbers such as sengon, jabon or

wood from fruit trees from community land only require a

bill of sale (receipt) to be deemed legal.

Association membership brings benefits to small

companies

Small sized furniture producers in Jepara, Central Java,

have found advantages in coming together as an

association as their negotiating power has increased and

they are seeing improved earnings.

"By joining an association, individual craftsmen

know that

they can work more effectively with governments and the

private sector," said Herry Purnomo, head of a research

project at the Center for International Forestry Research

(CIFOR).

Indonesian teak furniture for Taiwan P.o.C

ORDER Furniture Corporation of Germany has retail

outlets in Taiwan and since 2010 the company has been

buying teak furniture from 5 manufacturers in Jepara and

Solo.

In 2013, the company purchased 84 containers of teak

furniture and plans to increase purchases this year. At the

end of May representatives from the company will be in

Indonesia to try and find more suppliers in order to meet

increasing market demand.

¡¡

5. MYANMAR

MTE¡¯s sales policy for 2014

The Myanmar Timber Enterprise (MTE) has released

details of its sales policy which came into effect on 1 April

this year.

The following is a non-legal translation provided by the

ITTO analyst in Myanmar. Interested parties are advised

to contact MTE for full details.

(a) Direct Sales Contracts

(1) No further selection and transportation of logs

will be allowed against direct sales contracts, as

export in log form is no longer permitted from 1st

April 2014.

(2) Whatever logs selected prior to 1st April 2014

and were left unshipped will be sold at contracted

prices if payments are made latest by 30

September 2014. The selected logs will return to

MTE if payment is not made by 30 September

2014.

(3) Payments will NOT be accepted from 1

October 2014 and all contracts will cease to be

operative.

(b) Contracts for supply of Industrial Raw (IR)

logs

(1) Payment for logs selected prior to 1 April

2014 will be accepted only up to 30 September

2014. Cargo will be delivered against Delivery

Order issued after payment has been made.

(2) No more supplies will be made against these

contracts. From 1st October 2014 industrial raw

material needs by the private sector will be met

by open tender sales.

(c) General

(1) All other teak and hardwood logs that are

depot balances that are not covered by the

above two types of sales will be sold by open

tender.

(2) Starting 1st October, all logs that unshipped

and unpaid will be taken back and MTE will

re-sell them in open tenders.

(3) Industrial raw logs sold by MTE can be

transported to the private mills and factories

only after full payment has been made.

(4) Earnest money will be confiscated if

payment for successful lots in the open

tender sales is not made within 60 days from

the date of sales. The lots will then be resold

in coming open tender sales.

Products manufactured from logs purchased in

Myanmar Kyats can exported

It has also been learnt that logs and sawn timber purchased

with the domestic currency from the local marketing and

milling branch of MTE can be exported if they meet the

following criteria.

The timber raw material must have been

purchased through the open tender system.

Export item shall not be in log form.

The timber must be further processed and then

inspected by the Forest Department (FD) and

MTE.

After this joint inspection the Forest Department will issue

a certificate.

To avoid misunderstanding in the interpretation of the new

rules interested parties are advised to seek clarification

from the FD and MTE.

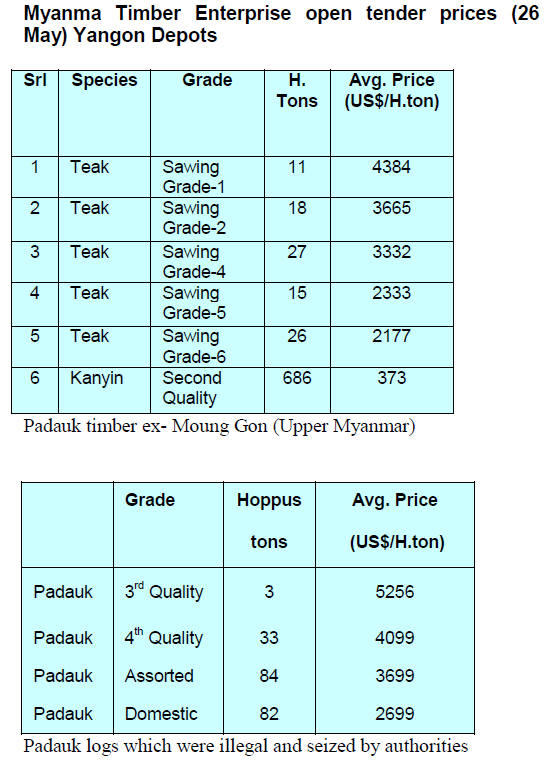

In addition 85 tons of various sizes of teak rough

sawnwood (including hand sawn timber) seized by

authorities were old by MTE on 23 May 2014. Total

revenue from this sale amounted to US$205,330.

Teak harvest reduced

It was reported in the Daily Eleven of 14 May that,

according to officials from MTE, only 60,000 tons of teak

will be harvested during this financial year.

Some will be utilised by the MTE mills and factories

which means there will be a reduction in the volumes

offered in the open tender sales.

6.

INDIA

Business sector says prospects look good

The election victory of India's opposition party has been

welcomed by the business community as the new central

government is expected to be more pro-business. Of

special interest is whether the new administration will

eliminate the controversial 2012 legislation that allowed

for retroactive corporate taxes.

The Bharatiya Janata Party (BJP) and its allies won more

than the 272 seats needed for a majority in Parliament and

has replaced the Congress Party.

India's business community is very happy say analysts as

the country will now have a stable government with a

business-friendly leader which could herald unprecedented

industrial growth.

Housing sector businesses, just as the rest of the business

community, have reacted positively to the BJP election

success and anticipate determined action to tackle inflation.

Wholesale Price Index rises stocking fears of further

inflation

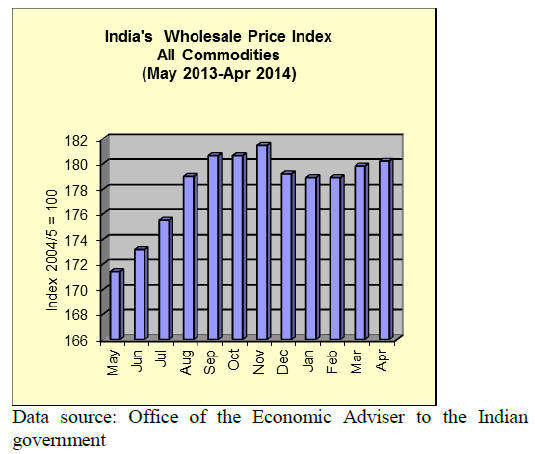

The Office of the Economic Adviser (OEA) to the Indian

government provides trends in the Wholesale Price Index

(WPI). The official Wholesale Price Index for All

Commodities (Base: 2004-05 = 100) for the month of

April, 2014 rose by 0.2 percent to 180.2 (provisional) from

179.8 (provisional) for the previous month.

On inflation a press release from the OEA says ¡°The

annual rate of inflation, based on monthly WPI, stood at

5.20% (provisional) for the month of April, 2014 (over

April, 2013) as compared to 5.70% (provisional) for the

previous month and 4.77% during the corresponding

month of the previous year.

The build-up inflation rate in the financial year so far was

0.22% compared to a build-up rate of 0.71% in the same

period of the previous financial year.

For more see: http://www.eaindustry.nic.in/

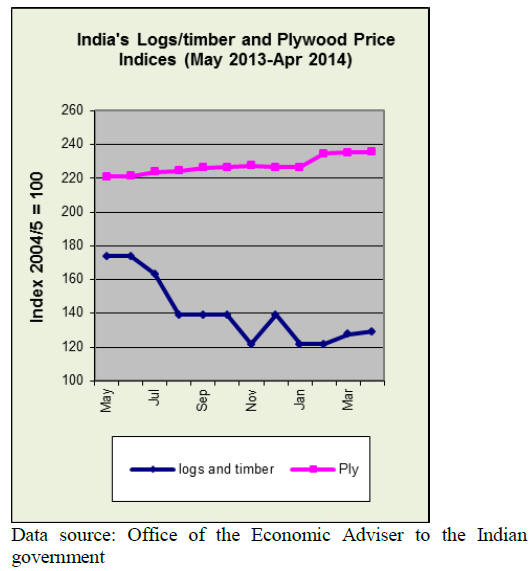

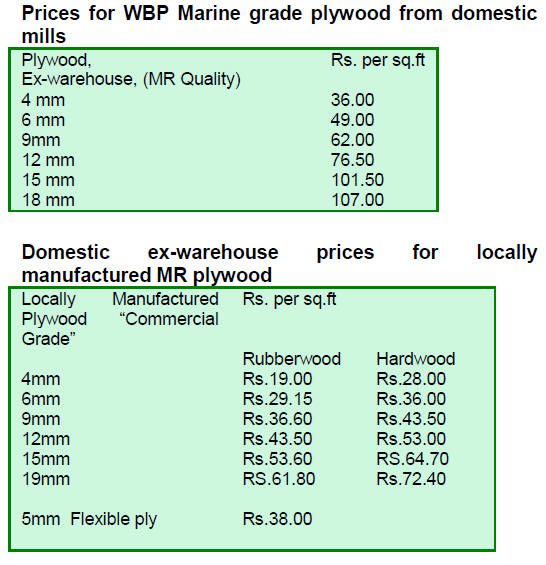

Timber and plywood wholesale price indices

In addition to data on the Wholesale Price Index for all

commodities, the OEA reports Wholesale Price Indices for

a variety of wood products.

The Wholesale Price Indices for Logs/timber and Plywood

are shown below. The April 2014 logs/timber index

increased from levels in March but the plywood index

remained flat.

The plywood price index for May is expected to be

significantly higher as the impact of the Myanmar log

export ban on veneer prices filters through to the market.

The Plywood Manufacturers Associations in Punjab,

Haryana, Gujarat, Kerala, Gandhidham have reported that

their members are facing sky rocketing prices of gurjan

face veneers.

The price of face veneers cut from gurjan logs

imported

from Myanmar before the log export ban has risen by 25%

to 50%. In the face of rising costs for gurjan face veneers

it would be expected that manufacturers would switch to

other species but that is not so easy in India.

Indian plywood users have been led to believe that red

coloured wood is stronger than other colour timbers. As

pointed out by analysts, ¡°the consumer needs to be more

rational, does the very thin face veneer of gurjan add to the

strength characteristics of the plywood? Not at all, it is

just a wrong notion that red coloured woods are stronger¡±.

However, in terms of marketing it will require a major

effort on the part of plywood manufacturers to convince

consumers that plywood with a pale timber face veneer is

just as strong as a red coloured veneer.

Those who have been in the plywood industry for years

recall that around 50 years ago no-one had heard of gurjan.

When it was first used for plywood the high resin content

was a serious problem in gluing veneers.

In the days when imported timbers were used for veneer,

pali (Pallanquium spp.), red cedar (Cedrela toona), white

cedar (Dysoxylum malabaricum), pandapine (Canarium

strictum), and mango (Mangifera indica) were the

favorites for plywood manufacture and none of these

timbers are dark red.

Indian importers feel the Myanmar log export ban should

have been phased which would have avoided the present

confused state of in the Indian plywood sector.

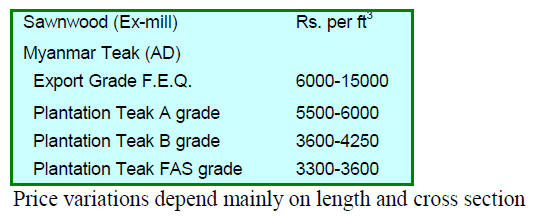

Imported plantation teak prices

Prices for plantation teak remained unchanged over the

past weeks and the flow of imports has been steady but the

impact of the log export ban in Myanmar will eventually

have a pronounced effect on the plantation teak market.

Over time the industry will be more dependent on

domestic teak resources and will slowly have to introduce

other tropical timbers as substitutes for Myanmar teak.

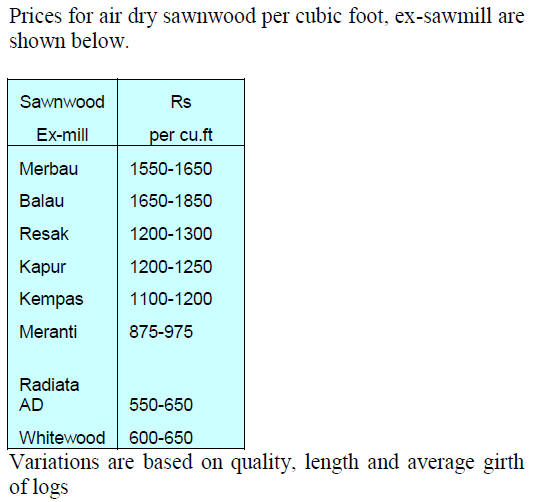

Imported sawnwood

Interest in non-teak tropical hardwoods is increasing as

Myanmar teak is becoming very expensive in the domestic

market as millers stocks of sawnwood cut form teak logs

imported before the log export ban in Myanmar run down.

Balau, Kapur and Red Meranti are becoming more

popular

and demand for these timbers is strengthening.

Myanmar teak processed in India

Export demand for teak products processed in India is

steady and millers still have reasonable stocks according

to analysts. However, teak prices will continue to climb as

log stocks fall.

During May and June there are usually a series of

auctions

of domestic logs but, due to the elections, all auctions

were postponed. The auction programme for June is yet to

be announced.

Analysts report that the transport of logs from the forests

to the depots has been maintained so millers should be

able to secure adequate stocks when auctions resume to

see them through the monsoon season when logging stops.

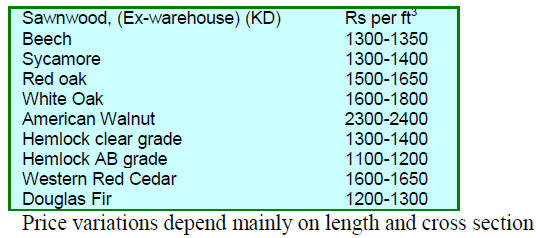

Imported sawnwood prices

Ex-warehouse prices for imported kiln dry (12% mc.)

sawnwood per cu.ft are shown below.

In the current market situation, and if promotional

activities are conducted to reach out to endusers and

consumers, the demand for imported sawnwood should

expand to make up for the volumes previously produced

from Myanmar logs.

Plywood prices rise as gurjan veneer stocks fall

Almost all Indian plywood mills have been compelled to

increase prices. While demand in the main cities remains

subdued, housing and infrastructure developments in

second and third tier towns are keeping plywood makers

busy.

The new central government has plans to further expand

these new towns to ease the pressure in the housing market

in the main cities.

¡¡

7.

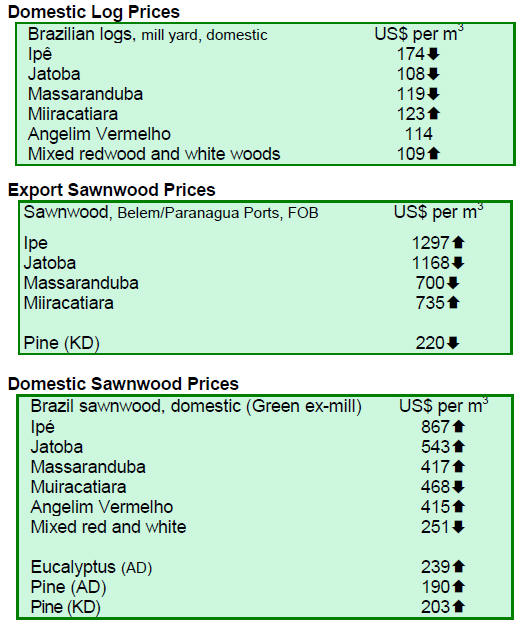

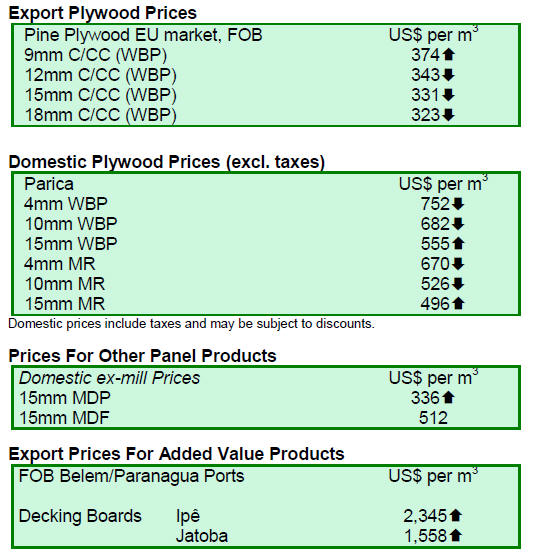

BRAZIL

Welcoming slowing of inflation

Brazil´s Consumer Price Index (IPCA) in April 2014 was

0.67% signalling a slowing of inflation compared to

March when the monthly rate of inflation was 0.92%. In

the first four months of this year the IPCA increased

2.86% compared to 2.5% in the same period last year.

In April 2014, the Monetary Policy Committee of the

Central Bank (COPOM) decided to increase the Selic rate

to a high of 11%.

Logging cycle can be reduced from 35 to 25 years

Brazilian forest regulations state that the logging cycle

shall be no less than 35 years and this applies to all natural

forest types.

Observers note that this cycle may be too long for some

regions and too short for others and that research is needed

to provide a sound basis for determining the logging cycle.

The Brazilian Agricultural Research Corporation

(EMBRAPA) has just published a study on the issue of

logging cycles "Strategies for Achieving Sustainable

Logging Rate in the Brazilian Amazon Forest" based on

assessment of forest management areas in Mato Grosso.

The study suggests that a 25-year cycle for timber

extraction of 30 cu.m/ha/year is appropriate for some

forest types rather than the current 35 years.

According to the Timber Industry Union of Northern Mato

Grosso State (SINDUSMAD), six native Amazon tree

species were studied and the ideal logging cycle is

different for each one. This study will provide a basis to

review the current 35 year cycle defined in the forest

regulations which also have a minimum diameter rule of

30 cm for all species.

Further work will be conducted to recommend different

diameter classes for various species.

Increased exports of tropical sawnwood

In April 2014, wood product exports (except pulp and

paper) increased 1.4% in terms of value compared to April

2013, from US$217 million to US$220 million.

Pine sawnwood exports increased 35% in value in April

2014 compared to April 2013, from US$14 million to

US$18.9 million. In terms of volume, exports rose 27.8%,

from 64,400 cu.m to 82,300 cu.m over the same period.

Tropical sawnwood exports increased 6.9% in volume,

from 26,200 cu.m in April 2013 to 28,000 cu.m in April

2014. In value, exports increased 3.6% from US$14

million to US$14.5 million over the same period.

Pine plywood exports expanded 4.4% in value in April

2014 compared to April 2013, from US$36.4 million to

US$ 38 million. The volume of exports increased 6.6%,

from 95,900 cu.m to 102,200 cu.m, during the same

period.

On the other hand, tropical plywood exports fell 17% from

4,100 cu.m in April 2013 to 3,400 cu.m in April 2014. In

terms of value, tropical plywood exports fell 16%, from

US$2.5 million in April 2013 to US$2.1 million in April

2014.

Wooden furniture exports fell marginally in April from

US$ 38.8 million in April 2013 to US$38.2 million in

April 2014.

Amazon Fund invests in sustainable practices

The Amazon Fund plans to fund activities to strengthen

environmental initiatives in Acre state. Specifically the

Fund will support a project ¡°Valuation of Environmental

Forest Assets¡± which will include work on integrated land

management, measures to promote forestry and

agroforestry production chains and technical and financial

incentives for environmental services.

Acre state policies are considered a model in terms

of

sustainable development. According to the Secretariat of

Agroforestry Extension and Family Production

(SEAPROF), the support for the project by the Amazon

Fund will boost the contribution to the economy in Acre

from sustainable forest production and will also help

reduce deforestation and environmental degradation.

This project seeks to introduce sustainable practices to

small family producers to generate economic alternatives,

food security and increased income.

Brazilian exports via Pacific coast to become a reality

The state government of Mato Grosso do Sul has invested

US$13.7 million in the construction of two bridges that

will connect Porto Murtinho and Caracol municipalities

(Mato Grosso State in Brazil) to Vallemy and São Carlos

municipalities (in Paraguay).

Completion of these bridges will facilitate transport of

agricultural, forestry and steel products from Brazil to

ports of Chile.

The shortest way for Brazilian products to reach Chilean

ports for shipment to Asia, the main importer of grains and

pulp from Mato Grosso, is Porto Murtinho (Brazil),

Mariscal Estigarribia (Paraguay) Tupiza (Bolivia) and

Iquique (Chile).

The new route will be some 900 km shorter than the 2,700

km. route that crosses Bolivia. The bridge (180 metres)

between Porto Murtinho and Vallemy will cost R$8.2

million and the bridge (120 metres) between Caracol and

San Carlos will cost about R$ 5.5 million. Construction

will begin in July and the bridges should be completed by

year end.

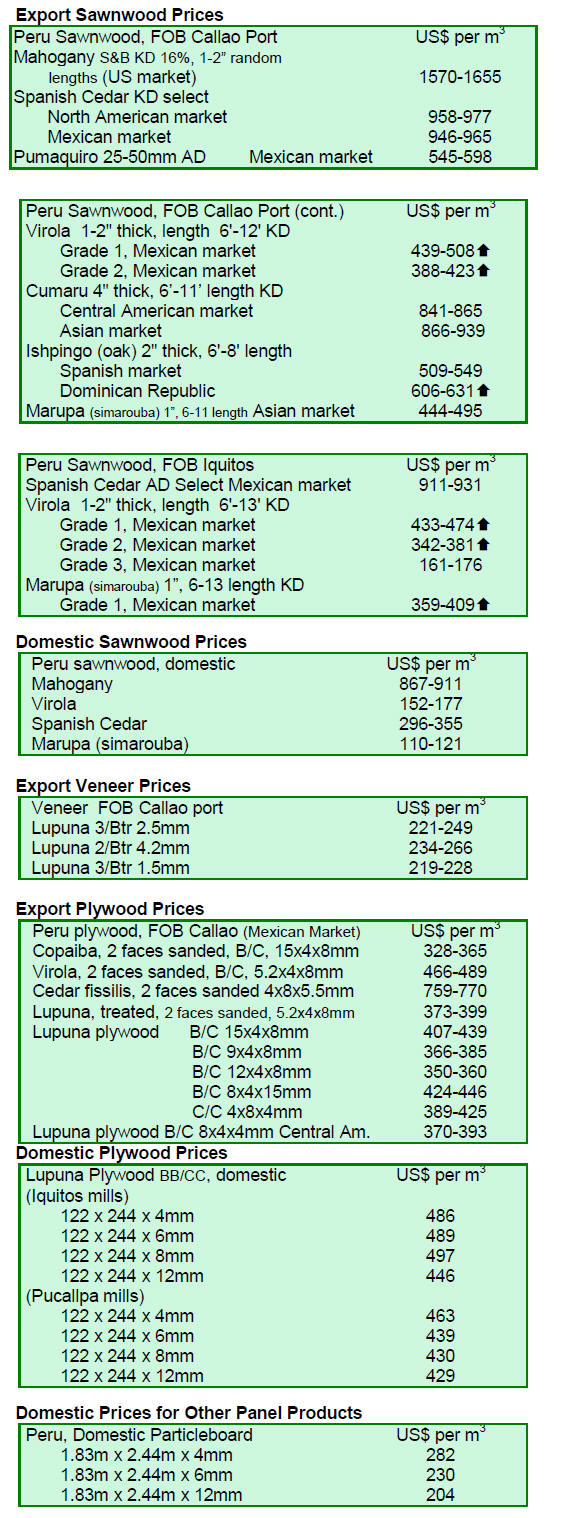

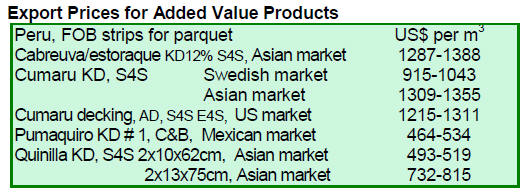

8. PERU

Forest products certification

The College of Engineers of Peru, Ucayali, SCS Global

Services and the Forest Products Association of Ucayali

(Aprofu) recently concluded a workshop on certification

of wood products in an effort to promote forest

certification amongst entrepreneurs, professionals,

technical advisors as well as indigenous communities in

the Peruvian Amazon.

The Workshop aimed to promote and strengthen the

technical capacity of forest management and chain of

custody in the context of forest certification.

SMEs to produce school furniture

In the framework of the "Purchases Myper¨²", established

by the local Fund for Social Development (Foncodes),

twenty micro and small enterprises in the Ucayali region

will receive orders for the production of 5,000 folding

chairs to be used in public schools.

Seeking a recovery of the forestry sector

The Forest Products Association of Ucayali (Aprofu), the

Roundtable for Sustainable Forestry Development Ucayali

(MCDFSRU) region, the National Forestry and the Forest

Department and Wildlife (DGFFS) conducted a series of

meetings during the first four months of this year to

contribute to the recovery of the forest sector.

Breaking the poverty trap

Cesar Peñaranda, an official from the Lima Chamber of

Commerce has said „¡±around one million people will

escape from poverty in Peru if the country‟s economy

posts a growth rate of over 5.5 percent¡±.

Currently around 25 percent of the population in Peru live

below the line of poverty according to a recent report from

the National Statistics Institute.

¡¡

9.

GUYANA

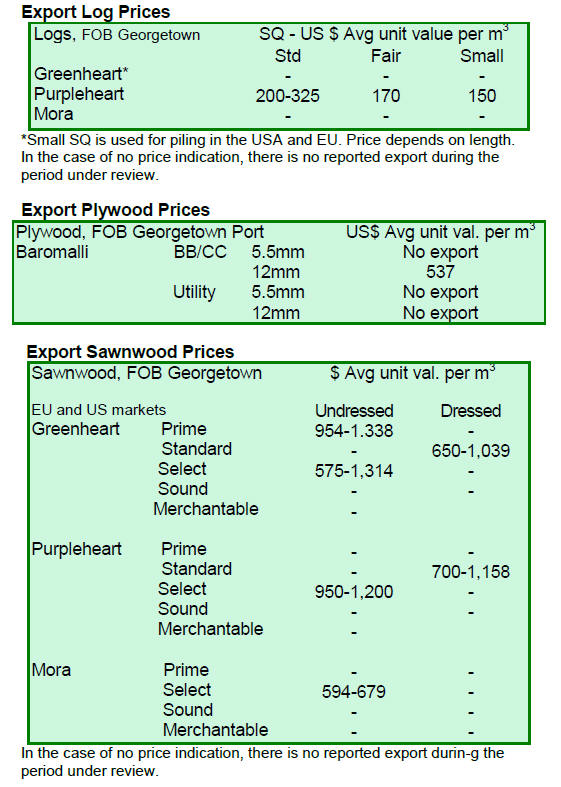

Wamara logs proving popular

There were no exports of greenheart logs in the period

reviewed however, purpleheart Standard Sawmill quality

logs attracted a favourable top end FOB price of US$325

per cubic metre.

Fair Sawmill quality purpleheart log FOB prices remained

at US$170 per cubic metre while Small Sawmill quality

logs were traded at US$150 per cubic metre FOB. Mora

log prices were unchanged, except for Standard Sawmill

Quality logs which earned US$120 per cubic metre FOB.

Wamara (Swartzia leiocalycina) logs are becoming more

popular and prices have moved up for all categories.

Standard Sawmill quality wamara logs were traded at

US$210 to US$215 per cubic metre FOB, Fair Sawmill

quality logs attraced a price of US$125 to US$210 per

cubic metre FOB while Small Sawmill quality log FOB

prices moved up to US$120 to US$200 per cubic metre.

Weaker Caribbean market for dressed greenheart

Sawnwood exports were active and attractive prices were

earned on the export market. Undressed greenheart (Prime

quality) commanded a price as high as US$1,338 per cubic

metre FOB and was shipped to buyers in the Middle East

and Oceania.

Undressed greenheart (Select quality) was sold at a

significantly higher price than recently earning as much as

US$1,314 per cubic metre FOB in Caribbean, European

and North American markets.

Undressed purpleheart sawnwood prices remained stable

at US$1,200 per cubic FOB while, in contrast, Undressed

Mora Select category earned a favourable price as high as

US$679 per cubic metre FOB in Caribbean markets.

Despite the overall positive price movements Dressed

greenheart prices in Caribbean markets declined

marginally from US$1,158 to US$1,039 per cubic metre

FOB. Dressed purpleheart sawnwood FOB prices held

firm at US$1,158 per cubic metre FOB.

Guyana made plywood was traded at a fair price earning

as much as US$537 per cubic metre FOB in the North

American market.

Splitwood (shingles) attracted a significant FOB price

earning as much as US$1,341 per cubic metre in

Caribbean and North American markets.

Select quality greenheart piles continue to earn

attract

favourable market prices ranging from US$350 to

US$1,043 per cubic metre FOB. Sound category

greenheart piles were traded at prices ranging from

US$298 to US$438 per cubic metre FOB in North

American and European markets.

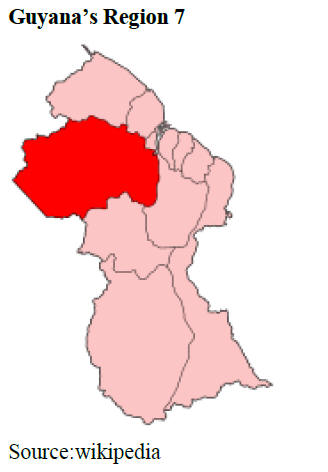

Community harvesting plan supported by GEF

Kaburi, with a population of 275 people, primarily

Akawaio and Patomona descendants, occupy an area of

41.57 square miles. Kaburi Village, located along the

Bartica-Potaro Road in Region 7 (Cuyuni/Mazaruni)

received a grant of US $3.4m from the Global

Environment Facility (GEF) to ensure the sustainable

management of the forest.

The capital of Region 7 is Bartica, with other major towns

including Issano, Isseneru, Kartuni, Peters Mine, Arimu

Mine, Kamarang, Keweigek, Imbaimaidai, Tumereng and

Kamikusa.

The funding will support development of a timber

harvesting plan for the village and has been provided by

the Global Environmental Facility (GEF) Small Grants

Programme (SGP) that provides financing directly to civil

society, community-based and non-governmental

organizations to design and implement projects that will

bring environmental and livelihood benefits to

communities.

The SGP is implemented by the United Nations

Development Programme (UNDP) and executed by the

United Nations Office for Project Services (UNOPS).

The village of Kaburi was established in 1935 and recently

received land title from the Government of Guyana. Some

residents are involved in small scale timber harvesting and

the Kaburi Village Council had requested assistance to

implement a forest management project they can sustain in

the village.