Japan Wood Products

Prices

Dollar Exchange Rates of

27th October 2014

Japan Yen 108.16

Reports From Japan

Better than expected industrial production and retail

sales

September‟s industrial output expanded at the fastest pace

in eight months. Production in September was up 2.7%

from the previous month, an increase for the first time in

two months.

The sectors contributing most to the expansion of output

were transport equipment, electronic parts and devices and

electrical machinery. But the Ministry of Trade and

Industry is forecasting that production could decline 0.1%

in October but tip up again in November. Inventories held

by companies fell in September compared to August the

first fall for five months.

The better than expected news on output and the rise in

September retail sales, the third monthly increase in a row,

is boosting opinions that the economy may have turned the

corner after the collapse after the sales tax increase earlier

in the year.

For more see:

http://www.meti.go.jp/english/statistics/tyo/iip/index.html

But, doubts raised on pace of economic recovery

The latest data show that Japan's September exports

clocked the fastest growth in seven months boosted by

improved sales into Asian markets. However, renewed

signs of slowing global growth may undermine future

growth which would add more doubts to whether Japan‟s

economy is really recovering. Already the IMF has halved

its forecasts for growth in the Japanese economy for 2014.

The good news on exports was undermined as government

data shows the September trade deficit widening which if

not reversed would mean Japan ends 2014 with yet

another record deficit.

In its mid-October assessment of the outlook for the

economy the Japanese government maintained its

pessimistic forecast which is fuelling fears of a recession

and certainly raises doubts that the country could

withstand the second consumption tax increase scheduled

for next year.

Etsuro Honda, a University of Shizuoka professor and

economic adviser to Japan‟s Prime Minister has said in

public that the sales tax increase should be delayed as an

increase now would pose a huge threat to the fragile

economy.

Good and bad sides of weaker yen

At a recent parliamentary meeting the governor of the

Bank of Japan said that the weaker yen had the twin and

opposite effects of driving exports but undermining the

profitability of small and medium manufacturers which

rely on imported raw materials.

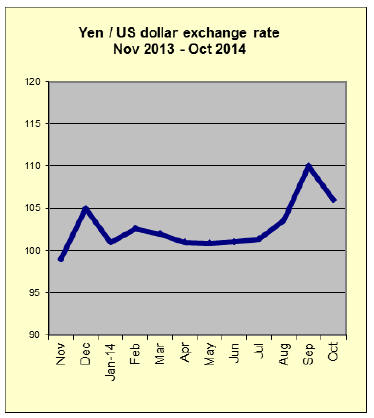

From a high of yen 106 to the US dollar in early October

there has be a steady decline in the exchange rate as

investors in Japan moved funds to US and European

bonds.

The dollar strengthened in anticipation of a rise in US

interest rates next year but a statement from the Federal

Reserve that a change may come later than expected

slowed the upward trend.

Year on year September housing down sharply

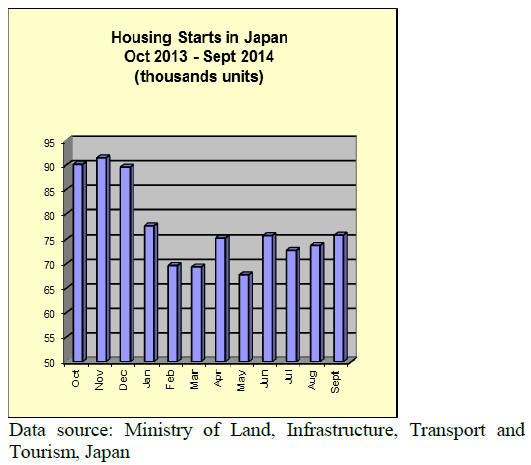

Data from the Ministry of Land, Infrastructure, Transport

and Tourism show that housing starts rose slightly on

levels a month earlier but were down just over 41% year

on year. August starts were down around 12% year on

year.

On an annualised basis 2015 housing starts, after including

the September data, will total 880,000. Annual starts were

841,000 in 2011, 893,002 in 2012 and 987,254 in 2013.

The survey conducted by the ministry reveals that

September orders received by the 50 largest building

contractors fell a massive 40% year on year.

For the full data see: http://www.estat.

go.jp/SG1/estat/ListE.do?lid=000001127843

Trends in office, kitchen and bedroom furniture

imports

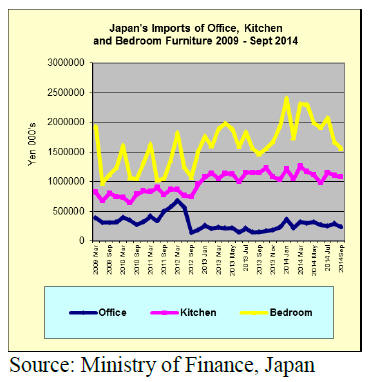

Japan‟s office, kitchen and bedroom furniture imports

from 2009 to the end of September 2014 are shown below.

Japan‟s imports of bedroom furniture continued to fall in

September and imports of kitchen and office furniture

followed suit. The weakening of furniture imports

reinforces the view that consumer sentiment is negative

and that the economy is yet to recover from the

consumption tax increase in April.

Office furniture imports (HS 9403.30)

Office furniture imports were 18% down in September

compared to August levels and aprt for the slight rise in

August, imports have been falling since May this year.

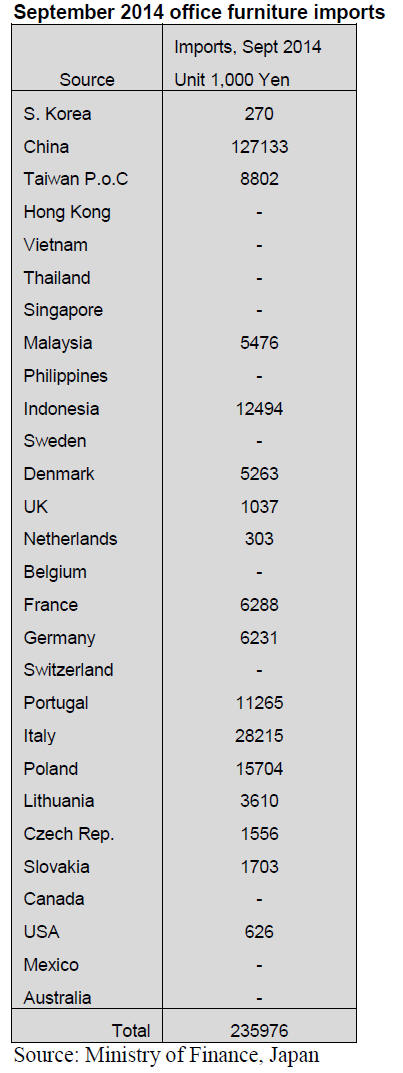

The number one supplier of office furniture to Japan in

September was China (54%) followed by Italy (12%) and

Poland (6%). These three suppliers accounted for around

72% of all September office furniture imports.

China is the main supplier but saw its market share drop

by around 11%. The other main suppliers, Italy and Poland

also saw a decline in imports by Japan.

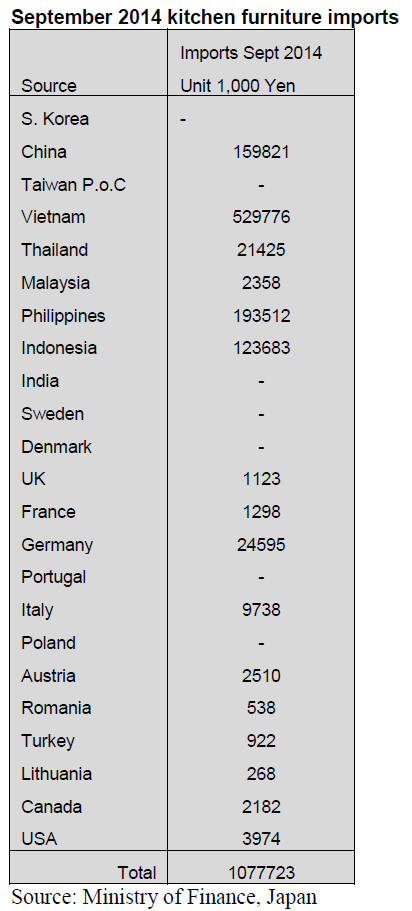

Kitchen furniture imports (HS 9403.40)

Overall, kitchen furniture imports by Japan fell by 3% in

September but the main supplier, Vietnam, saw trade rise

by around 6%. The other winner in September was

Indonesia which saw exports to Japan rise by almost 25%.

Other SE Asian suppliers of kitchen furniture to Japan,

such as Thailand and Malaysia, saw imports fall in

September.

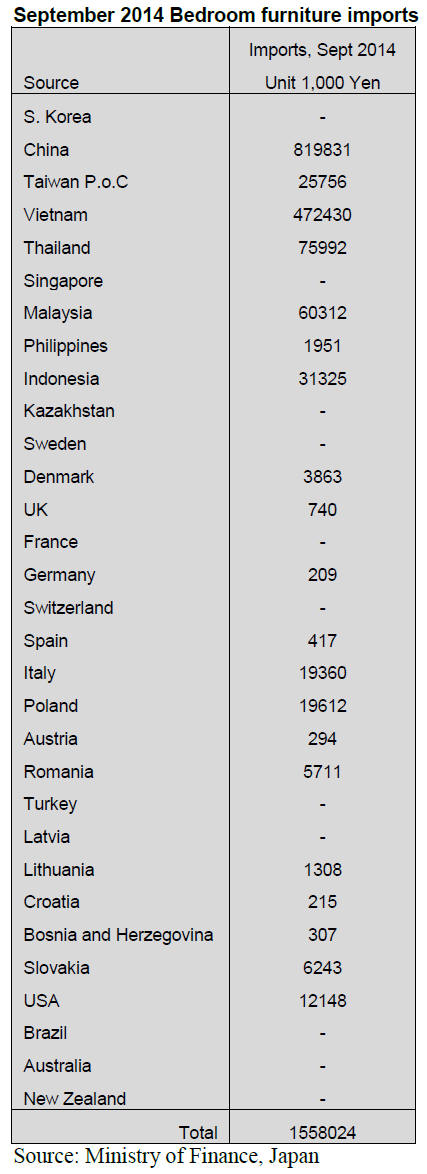

Bedroom furniture imports (HS 9403.50)

Japan‟s September imports of bedroom furniture fell 6.6%

compared to August with China seeing its share of

bedroom furniture imports slide almost 13%.

The top three suppliers China, Vietnam and Thailand

accounted for the bulk (88%) of the bedroom furniture

imports but both China and Thailand saw their share of

imports fall. In contrast, Japan‟s September imports of

bedroom furniture from Vietnam rose 12%.

Suppliers in the EU and US account for just a small part of

Japan‟s bedroom furniture import and the value of these

countries monthly exports of bedroom furniture remains

fairly consistent.

Trade news from the Japan Lumber Reports (JLR)

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

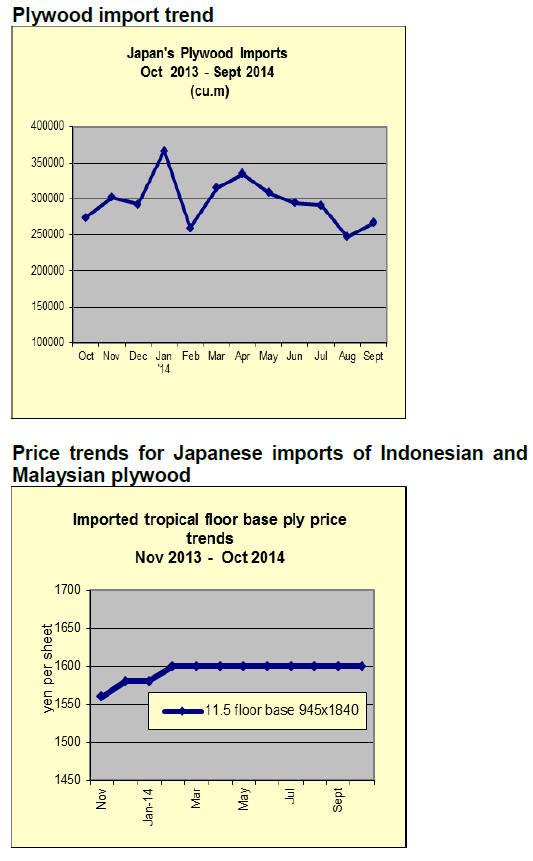

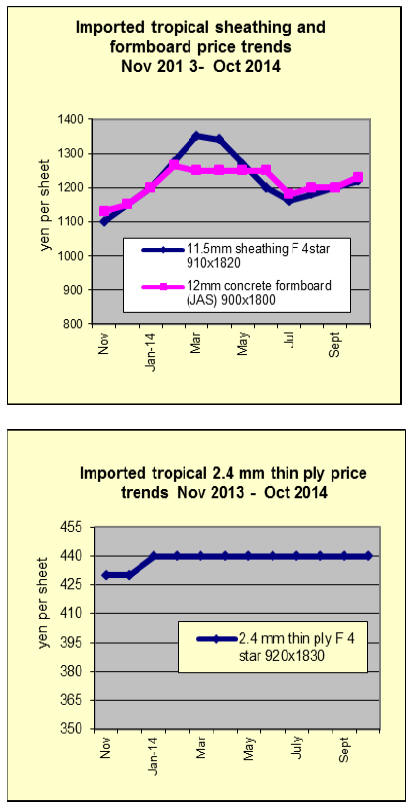

Imported south sea (tropical) hardwood plywood

Future cost of imported South Sea hardwood plywood has

been climbing sharply by recent steep depreciation of the

yen.

The supply side maintains bullish attitude and increases

the export prices before rainy season starts in October as

log cost would be going up by tight supply. The market in

Japan is rapidly firming under this situation.

The largest supplier in Malaysia has been raising the

export prices since last July by about USUS$10 per cbm

every month. Since last May, purchase by Japan decreased

because of depressed demand so the market prices have

been inching up gradually, pushed by higher import cost.

Up until early August, future cost was over market prices.

For instance, cost of JAS 3x6 concrete forming panel for

costing was 40-50 yen per sheet higher than the purchase

cost then the yen has started weakening rapidly since late

August and the cost of future purchase soared so the

difference between the cost and going market prices

widened. Thus, the market started tightening since the

third week of September.

Plywood export to Taiwan P.o.C

Seihoku Corporation (Tokyo) and Japan Kenzai Co., Ltd

(Tokyo) jointly plan to export 100% domestic softwood

plywood to Taiwan P.o.C. They plan to expand the export

market to other Asian countries in future. The first

container will sail to Taiwan P.o.C sometime in October

from Yokohama. This is trial shipment of about 1,200

sheets of 12 mm thick 3x6.

They plan to continue the shipment regularly every month

to develop market of items like floor base. Japan Kenzai‟s

subsidiary in Taiwan P.o.C will market in Taiwan P.o.C.

Seihoku has been seeking a chance to develop overseas

market then Japan Kenzai has overseas marketing base so

both interest fit the start of this business. Recent sharp

drop of the yen also helps promote this business.

In Taiwan P.o.C, majority of housing is condominiums so

that plywood is used for floor base. Normally floor is

placed directly on top of floor sheathing plywood.

Housing starts in Taiwan P.o.C in 2012 were about

100,000 units. Domestic plywood production is about

81,000 cbms while the imports are 639,200 cbms so share

of imports is high. Major source of plywood is 45.3%

from Malaysia, 41.8% from China, 11% from Indonesia.

Taiwan P.o.C uses plywood size of both 3x6 and 4x8.

Japan Kenzai estimates that size of plywood market in

Taiwan P.o.C is about 10% of Japan.

Plywood conference

Three countries regular plywood conference was held in

Jakarta, Indonesia in September. Indonesia, Malaysia and

Japan discussed and exchanged information on plywood

and relating materials. Supplying countries of Indonesia

and Malaysia reported various factors to push

manufacturing cost.

Indonesia reported that despite steady growth of domestic

demand, cost push factors like weak currency of Rupiah

and imported energy like oil will be burden for the

manufacturers.

Malaysia reported that minimum wage of workers is

significantly increased to 800 Ringgit a month since last

January then value added tax of 6% is introduced so the

manufacturing cost is up.

On new timber harvest right, allowable period is extended

to 60 years, which gives a chance to program long term

forest management but acquisition of forest certificate on

both natural and plantation timber by 2017, which is

another cost push factor.

Therefore, both countries hope to have a new price level

but Japan reported that the demand has been dwindling

after the consumption tax hike since last April and slump

seems to continue for some time.

Both supplying countries regard Japan as important market

but are concerned to declining export volume in shrinking

market and increase use of domestic softwood plywood

for base board and concrete forming panel.

Japan explained market condition of different kind of

plywood and the supply side asked many questions for use

of domestic species to which Japan replied that the supply

is not enough.

South Sea (tropical) logs

Log export prices are firming in Sarawak before rainy

season. In Sarawak, rain started since middle of August

and unstable weather continues before beginning of rainy

season in October and November.

Production of quality yellow meranti regular, which Japan

market looks for, is down and majority of supply is low

grade MLH and small diameter logs.

The Japanese buyers struggle to buy necessary logs. Some

say that up until 2012, two shipments a month were

regular pace but now because of lack of supply, even with

three ships in two months are hard to fill up ships.

In Sabah, log supply seems rather stable but it is necessary

to apply for export permit prior to two weeks of ship‟s

arrival so any extra volume is not allowed to load.

India keeps buying MLH and small logs. In India,

monsoon season is July through September so it will buy

more after Monsoon season is over.

Prices of low grade meranti logs for India are USUS$265

per cbm FOB, unchanged from September. Meranti

regular prices for Japan are USUS$280-295.Small

meranti is USUS$255-260 and super small is about

USUS$230.They are unchanged from September. |