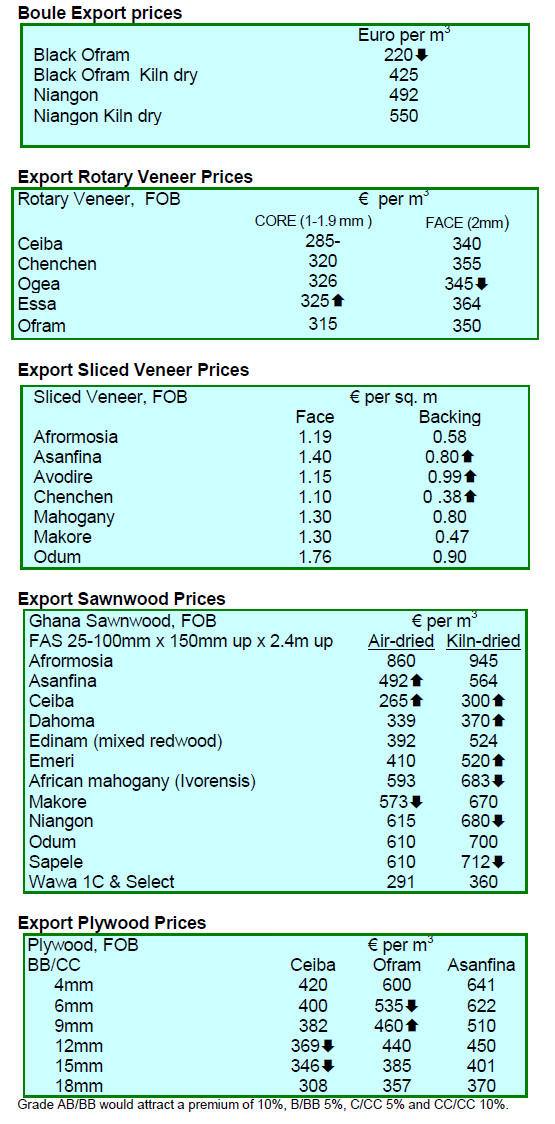

2. GHANA

AGI urges for structural change in

manufacturing

The Association of Ghana Industries (AGI) has urged the

government to focus more on helping Ghana industries

manufacture products to replace imports.

The president of the AGI, Mr. James Asare-Adjei, made

this known at the third AGI Awards ceremony to honour

companies that had achieved outstanding success in

industry and innovation. The theme for the event was

ˇ°Rewarding industry to Promote Made-in-Ghana -

Productsˇ±

Mr. Adjei welcomed plans metioned in the government‟s

2015 budget statement to establish an EXIM Bank, which

he thinks would lead in the strategic positioning of the

country as an export-led economy. He further expressed

optimism that the bank would be pro-industry offering

credit facilities targeting the manufacturing sector.

According to the president of AGI, until the structure of

the economy is changed from import-led to export-driven,

the country‟s balance of trade will continue to be in the

negative.

New power ministry created

Ghana has created a new ministry in response to the long

running energy crisis in the country that has seen the

timber industry having to turn to costly diesel power

generators.

National power generation was previously the

responsibility of the Energy Ministry which was also

responsible for managing the oil and gas industry.

Kwabena Donkor will head the new ministr

ˇˇ

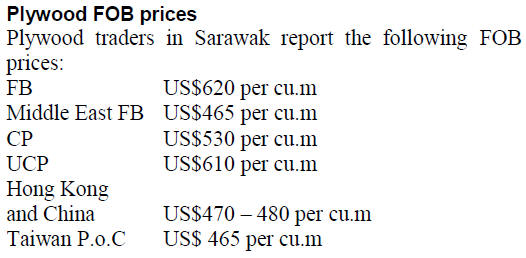

3. MALAYSIA

Middle East marketing mission nets RM6

million

A recent marketing mission from Malaysia to Qatar, Oman

and Kuwait has secured about RM6 million in export

orders says Malaysian Timber Council (MTC).

MTC‟s Director for Trade Promotion and Development,

Dr. Eric Ng, who led the delegation of Malaysian timber

companies, said in a press release that the marketing

mission was successful and able to highlight positive

demand for Malaysian timber products and build strong

bilateral trade relations with key market leaders in the

Middle East. He further said, ˇ°The Middle East has

become an increasingly important trading partner for the

Malaysian timber sector.

Last year, exports of Malaysian timber products to

emerging markets, particularly Middle East countries,

showed positive growth as mega-projects in these

countries favour Malaysian timber products, especially

sawn timber, medium-density fibreboard and wooden

furniture.

Tropical hardwood timbers such as meranti are also

among the top choices for home owners in the Middle East

who expect high quality and well-finished hardwoods for

doors, door frames, flooring, decking as well as trimmings

and decorative features.ˇ±

The MTC reports there are good prospects for Malaysian

hardwood sawnwood in particular, red meranti, MDF and

HDF laminated flooring.

Aquilaria products centrepiece at domestic show

The Malaysian Timber Industry Board (MTIB) and

Terengganu Timber Industry Training Centre (TTITC)

organised an international timber exhibition in the east

coast state of Terengganu in mid-November.

The event showcased some of the finest timber products

from carvings to commercial wood products such as

flooring, decking and timber frame houses. Other forest

products from specialised plantations of Aquilaria,

popularly known as agarwood or gaharu (the resin from

the heartwood is prized for its aromatic properties), also

took centre stage at this inaugural event.

The highlight of the exhibition was the signing of

memorandum of understanding (MOU) between the

Terengganu state government and two private companies:

Golden Pharos Berhad and Ta Ann Plywood.

The MOU signifies the commitment of the Terengganu

state government to promote the use of certified timber

(PEFC and FSC) in the domestic building and construction

industry under the domestic Certified Timber and Credible

Suppliers (CTCS) programme.

The CTCS programme continues to evolve and

collaboration between MTIB and TTITC will result in the

training of aspiring young entrepreneurs to become

professional installers for products that the CTCS

programme is promoting.

This would expand the small and medium sized industry

economic base as well as enlarging the timber sector. It is

envisaged that with the successful implementation of the

CTCS programme Malaysia would have professionally

trained timber product installers by 2015.

Innovative landscape management project for Sabah

Sabah State Government and UNDP Malaysia recently

signed a Memorandum of Understanding (MOU) in

preparation for the development phase of the Government

of Malaysia-United Nations Development Programme-

Global Environment Facility (GoM-UNDP-GEF) Project,

as well as, reaffirming commitment of the Sabah Forestry

Department (as the Implementing Partner) and UNDP to

implement and to achieve the project‟s key objective:

ˇ°To institutionalise a multiple-use forest landscape

planning and management model which brings the

management of critical protected areas and connecting

landscapes under a common management umbrella,

implementation of which is sustainably funded by revenues

generated within the areaˇ±.

The 261,264 ha GoM-UNDP-GEF Project area will be an

innovative landscape management model project that will

transform the management of the area which is home to

some of the most important remaining biodiversity in

Borneo. The area is located within Yayasan Sabah‟s

Sustainable Forest Management Licence Agreement Area

(SFMLA) in Kalabakan-Gunung Rara Forest Reserves.

This initiative should provide a highly relevant case study

that reflects many of the major production, mitigation and

conservation challenges facing policy makers and land

management agencies throughout SE Asia.

4. INDONESIA

SMEs to benefit from changes to SVLK

Following a multi-stakeholder internal discussion the

government has agreed to simplify the procedures for the

mandatory local timber legality verification system

(SVLK) for small and medium industries (SMEs).

The Trade Ministry‟s Director of Agriculture and Forest

Product Exports, Nurlaila, said the decision was made

because SMEs could not afford to pay high certification

costs, which could reach Rp 30 million (US$2,457).

Trade Minister Rachmat, the Minister of Industry, Saleh

Husin and the Minister of Forestry and Environment, Siti

Nurbaya, as well as representatives of the Association of

Indonesian Furniture and Handicraft (AMKRI), agreed the

new system will come into force 1 January 2015.

The new system requires SMEs to provide „supplyconformity

self-declarations‟ (DKP) for overseas

shipments. There is no charge for the issuance of such

documentation according to Nurlaila.

The DKP declarations normally include information such

as the four-digit commodity identification code, volume of

timber products, type of timber and the source of timber

raw materials to confirm their legality.

Application of DNA wood tracking

Dr. Ir. AYPBC Widyatmoko, a researcher at the Research

Institute for Biotechnology and Tree Improvement, has

developed an application for DNA tracking of wood. He

said by applying bio-forensics a solution may be at hand to

allow authorities to determine the origin of timber and thus

verify its legality.

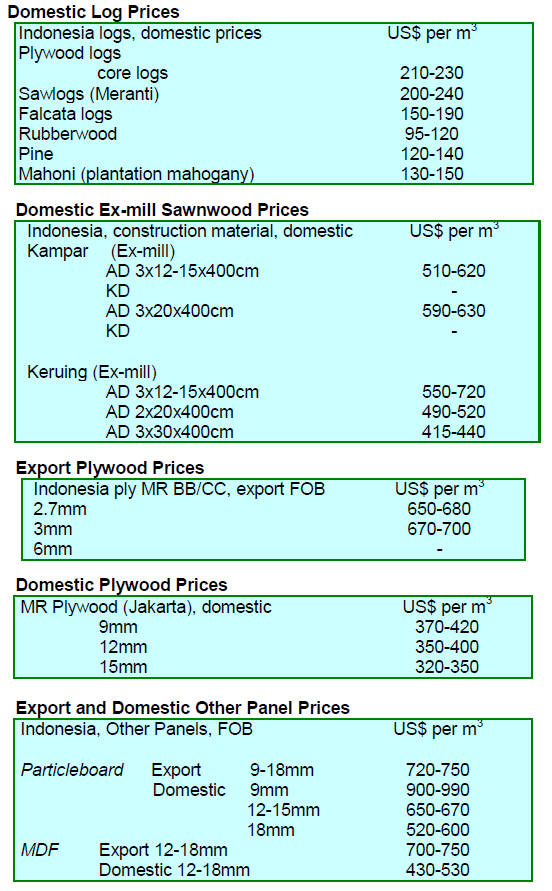

Economy snapshot

The pace of inflation in Indonesia accelerated to over 6%

year-on-year in November as higher fuel costs, the result

of the cut in fuel subsidies, kicked in. In related news,

international trade levels declined with both exports and

imports falling in October.

Exports fell 2% in October much more than expected and

analysts say much of the decline is the result of slower

growth in China, Indonesia‟s main trading partner. On the

other hand, Indonesia‟s trade balance is expected to

improve if oil prices remain low.

Indonesia‟s Institute for Development of Economics and

Finance (Indef) has forecast 2015 growth somewhat lower

than the government estimates citing the prospect of

weaker than expected exports. The government is

expected to expand public spending next year but, as

pointed out by Indef, the impact of this will not be felt

immediately.

For more see:

See http://indef.or.id/en/publication/8/detail/51/proyeksiekonomi-

indonesia-2015

5. MYANMAR

Suspicions of timber laundering

The domestic newspaper (Eleven Daily quoting an official

from the Forest Department) reported that during the

seven months of this fiscal year over 40,000 tons of

illegally harvested timber was seized.

Over 7,200 tons of teak and 34,000 tons of other

hardwoods were confiscated along with 1,091 logging

trucks, 106 items of logging and loading equipment such

as cranes, tractors and vehicles. In total almost 4,000

Myanmar nationals and109 foreigners were arrested in

anti-smuggling operations.

Timber seized timber during the seven months from April

to October included a large quantity of teak as well as

Tamalan (Dalbergia oliveri) which commands a very high

price in foreign markets.

In the most recent operation the Forestry Department

seized timber near Tachileik on the Myanmar Thai border.

The species seized were Tamalan, Padauk and Yindaik

(Dalbergia cultrata) worth an estimated MMK76.5 million.

Analysts say that these seizures represent just a fraction of

the volumes being smuggled across Myanmar‟s borders.

The seized timber is resold locally but some analysts fear

there is a „timber laundering‟ scheme in play but demand

from international buyers for verification of legality could

undermine such illegal activities.

US$ 80 million timber exports

According to Mr. Barber Cho of the Myanmar Timber

Merchants Association, export earnings from the export of

processed timber so far this fiscal year amounted to about

US$60 million. It is estimated that the figure for the year

could be over US$80 million, around US20-30 million

more than before the log export ban.

However, analysts point out that the annual revenue from

exports of wood products (logs and sawnwood) used to be

over US$700 million annually in the years before the log

export ban. If Myanmar is to achieve this level of exports

in the future considerable investment in modern

processing plant and in training of mill operatives is

required.

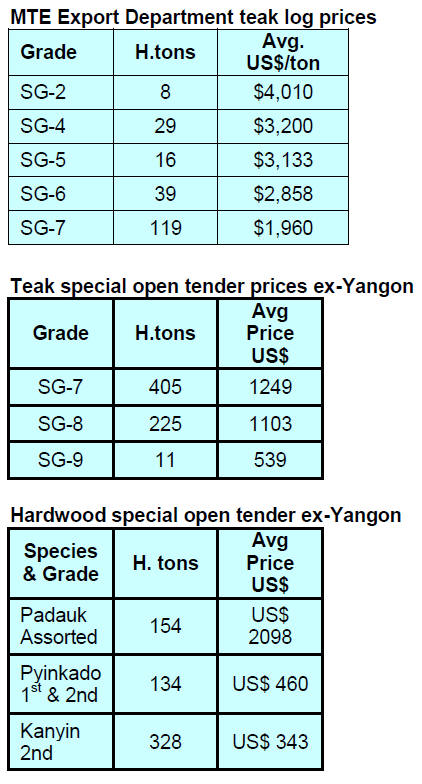

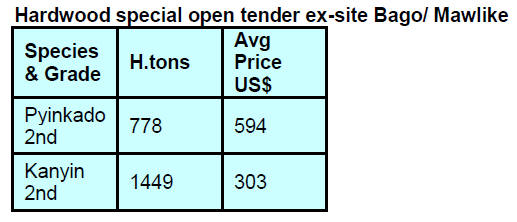

Sale of teak and hardwoods

The Myanma Timber Enterprise (MTE) sold the following

teak logs, teak conversions and hardwood logs by special

open tender during the 12 December Yangon sale. For

logs the quantity is expressed in h.tons (hoppus measure)

and for sawn timber it is expressed in tons of 50 cubic feet

or c.tons.

6.

INDIA

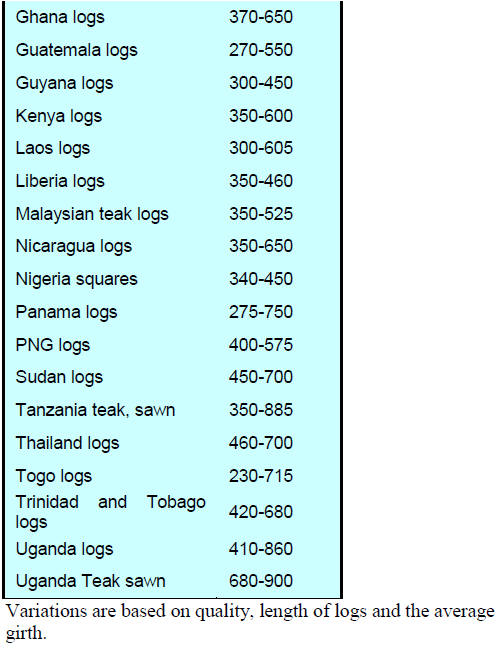

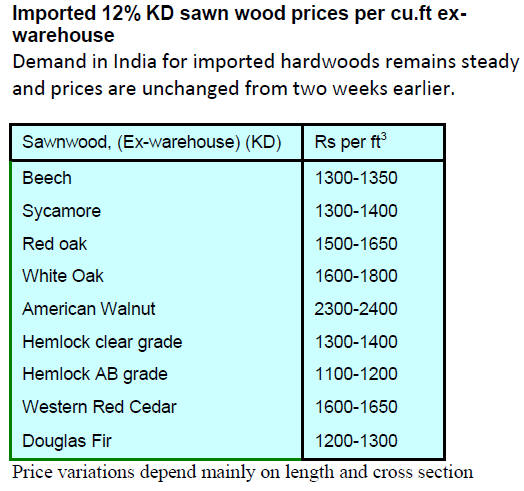

Flow of imports affected by Ebola

Fear of the Ebola virus is affecting the loading of vessels

carrying timber to India from West African countries as

Indian timber inspectors in the supply countries fear

contacting the disease. Many traders with staff in West

Africa have recalled these people until the risk subsides.

Out of the 16 countries shipping timber to India from West

Africa, three, Guinea, Liberia and Sierra Leone are badly

affected by Ebola. Ghana, another supplier, has not

reported any cases of Ebola but still some companies have

recalled their representatives.

Import duty on logs a burden to industry

Indian wood product manufacturers have, once again,

pleaded with the central government to remove import

duties on timber raw materials and to deliver incentives to

exporters such as a reduction or complete waiver of the

value added tax. The current import duty on logs is 9.4 %.

Manufacturers say the FOB price of imported logs has

risen over 50% in a short time and comes at a time when

the rupee remains weak which adds to the landed cost of

imported logs.

Red sanders auction delivers higher than expected

income

The Andhra Pradesh government has earned almost Rs10

billion from the sale and export of 3,615 metric tonnes of

confiscated red sanders logs.

The e-auction attracted a huge response from international

buyers and the average price exceeded the expected Rs.25

lakh per tonne. Forestry officials were expecting Rs.10

billion from sale of over 4,000 tonnes so are pleased with

the result.

The state government decided to offer only 4,160 tonnes

for sale and export in the first phase. The remaining

volume of red sander must before April 2015.

The state plans to use 30% of the proceeds from this sale

for protection of the natural red sanders forest. The

remaining money may be used to finance the government's

proposal to waive farm loans.

The state government conducted „road-shows‟ and pre-bid

meetings in China and Japan, where red sanders is in

demand.

As a result of this effort over 400 prospective buyers

including 140 from China, Japan, Singapore and other

countries visited the red sanders depots to inspect the logs.

In Andhra Pradesh, red sanders grows mainly in the

Seshachalam hill ranges spread across Kadapa, Chittoor

and Kurnool districts in the Rayalaseema region and parts

of Nellore district. The forest area home to red sanders is

estimated to be 47,000 hectares.

This resource attracts illegal loggers and there have been

bloody clashes between smugglers and the police. Two

forestry officials were killed and three were injured in an

attack by smugglers in December last year. Over 3,000

smugglers have been arrested and 2,025 tonnes of red

sanders was seized during 2013.

Krishnapatnam container terminal promoted in Côte

d'Ivoire

One of India‟s largest and fastest growing seaports,

Krishnapatnam Port, is emerging as a world-class port and

fast becoming a port of choice for international cargo.

According to Krishnapatnam Port Container Terminal

(KPCT) officials, India‟s trade with West Africa increased

15 times since 2003. Rice being India‟s main export to

West Africa followed by pharmaceutical products,

machinery, metals, chemicals, plastics, rubber and

vehicles.

KPCT recently organised a meeting for traders in Abidjan

to discuss bilateral trade developments. Indian importers

of teak wood and Indian exporters of pharmaceuticals,

transport equipment, engineering goods visited Abidjan.

The traderswere familiarised with the infrastructure and

operational advantages of KPCT and the ease of shipping

containerised cargos of cashew and timber throughout

India.

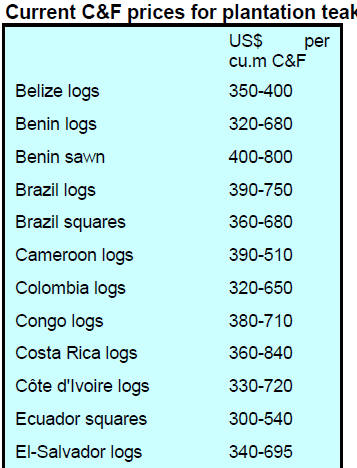

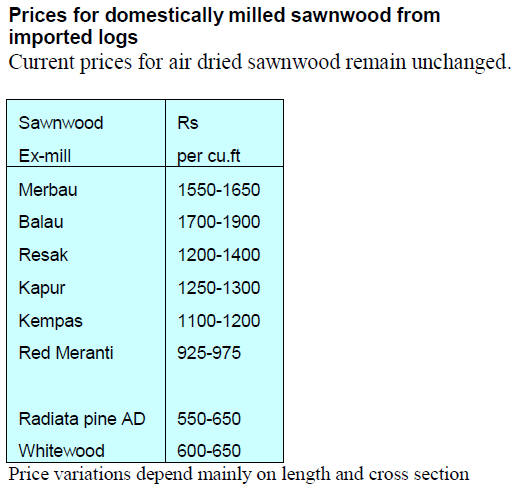

Imported plantation teak

Prices for imported plantation teak are unchanged from

two weeks earlier.

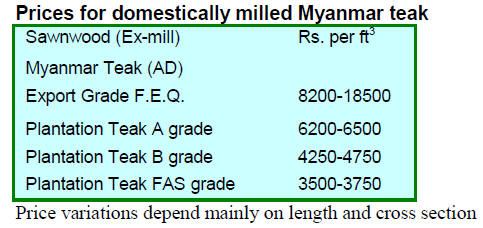

Domestically milled Myanmar teak

In the domestic market end-users continue to

resist the attempts by millers of imported teak

logs to raise prices.

Severe price competition in plywood market

Prices in the plywood market are extremely competitive as

the small and medium sized companies are able to produce

more cheaply than the larger mills. The only advantage the

larger mills have is on quality but in a price conscious

market the SMEs have the upper hand.

7.

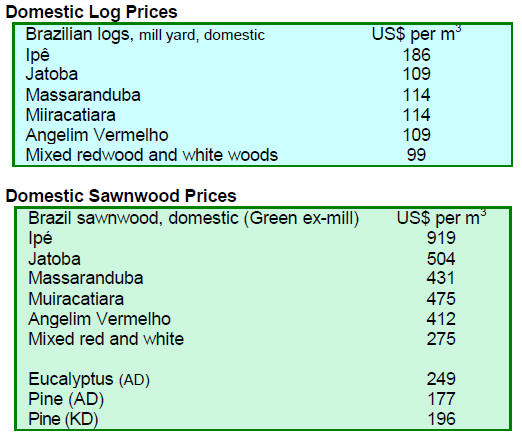

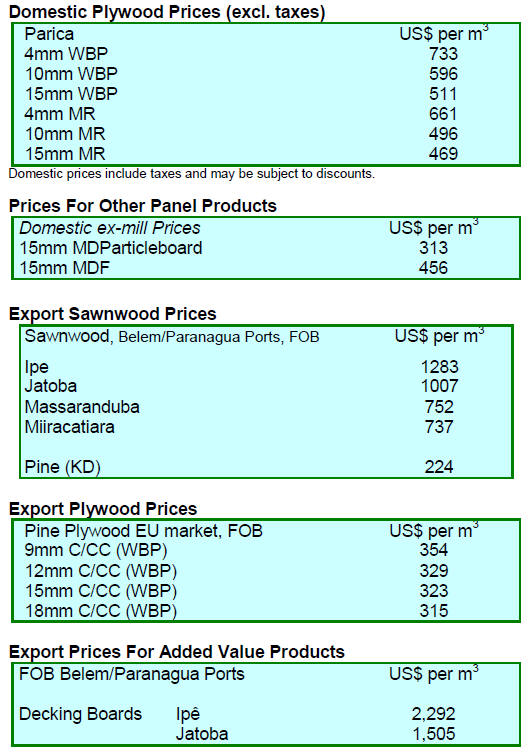

BRAZIL

Timber sector to contribute 20% to Mato

Grosso GDP

Mato Grosso, one of the major timber producing states in

the Amazon region, will undertake a Sustainable Forestry

Development Programme, details of which were made

available in early November. The aim is to have the timber

sector contribute 20% to Mato Grosso GDP growth over

the next 20 years.

According to the Center for Wood Producers and

Exporters of Mato Grosso (CIPEM), the programme will

be groundbreaking in the Mato Grosso‟s forest sector and

will result in increased production to meet domestic and

international demand.

The State Secretariat for Industry, Commerce, Mines and

Energy (SICME) is responsible for coordinating the

programme that will increase the area of forest under

sustainable forest management, optimise natural forests

management operations, promote the use of secondary

species through product development and added value

output.

The new programme includes the following strategic

actions: review of legal and institutional tools to provide

for simplification of licensing procedures; regularising

land ownership; decentralisation; timber out-grower

schemes; technological development and capacity

building; attracting investments; securing market

intelligence; creation and adjustments of tax and fiscal

incentives and improvement of infrastructure and logistics

in the forestry sector.

Hardwood values appreciated 250% in ten years

The Brazilian timber sector accounts for around 3%

(approx. US$290 billion) of global production and planted

forests in Brazil extends over some 8 million hectares. The

area of timber plantations is increasing and over the past

10 years the price of decorative hardwoods from

plantations has increased by around 250% which is

attracting considerable interest from investors.

However, the plantation story is not all success, there are

issues to be addressed such as the lack of government

support for credit lines to encourage plantations,

inadequate research funding, a shortage of professionals

and a shortages of companies specialising in providing

consulting services for the plantation sector.

It has been estimated that there are some 50,000 hectares

of abandoned forest plantations which undermines the

credibility of the sector. Generally, investment in forest

plantations in Brazil involves two species, eucalyptus and

high value hardwoods at a ratio of 75% and 25%.

Targeting increased exports to Europe

According to ABIMCI (Brazilian Association of

Mechanically-Processed Timber Industry) Brazilian wood

products now have enhanced credibility in the European

market and this is creating opportunities to expand trade.

Between January and October this year 20% of Brazil‟s

pine plywood was exported to the UK and ABIMCI

expects that the UK market will consume even more of the

country‟s plywood output in 2015.

Brazilian exporters have also had success in the German

market partly due to Germany‟s Global Connect initiative

which has stimulated „internationalisation‟ in German

companies and has strengthened trade relations with Brazil

as well as other exporting countries.

Demand for Brazilian wood products is forecast to grow

2% in 2015. European imports of Brazilian wood products

during the time when demand in the US was weak helped

ensure the viability of the Brazilian timber industry.

As pointed out by ABIMCI buyers in the UK and

Germany require quality and verification of the origin of

the product. Companies in Brazil that can meet these

requirements have an opportunity to expand sales in the

EU market.

Despite the optimism there challenges for Brazilian

producers such as the logistics of raw materials flows, lack

of manpower and poor infrastructure. Since the claims of

illegal logging in Par¨˘ state Brazilain exporters have faced

a tough time convincing buyers in the EU that this was an

isolated case.

Representatives from the Center for Timber Producers and

Exporters of Mato Grosso (CIPEM) attended the Annual

Meeting of Timber Trade Federation to discuss how the

timber industry in Mato Grosso state ensures all exports

are of legally harvested raw materials.

CIPEM has proposed the creation of procedures for

importers of Brazilian timber to identify timber companies

that guarantee the legal origin of the timber used in

manufacturing.

ˇˇ

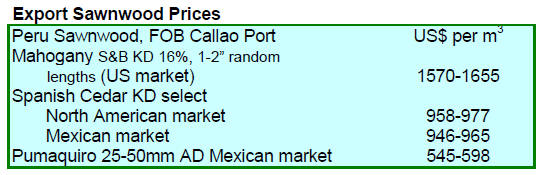

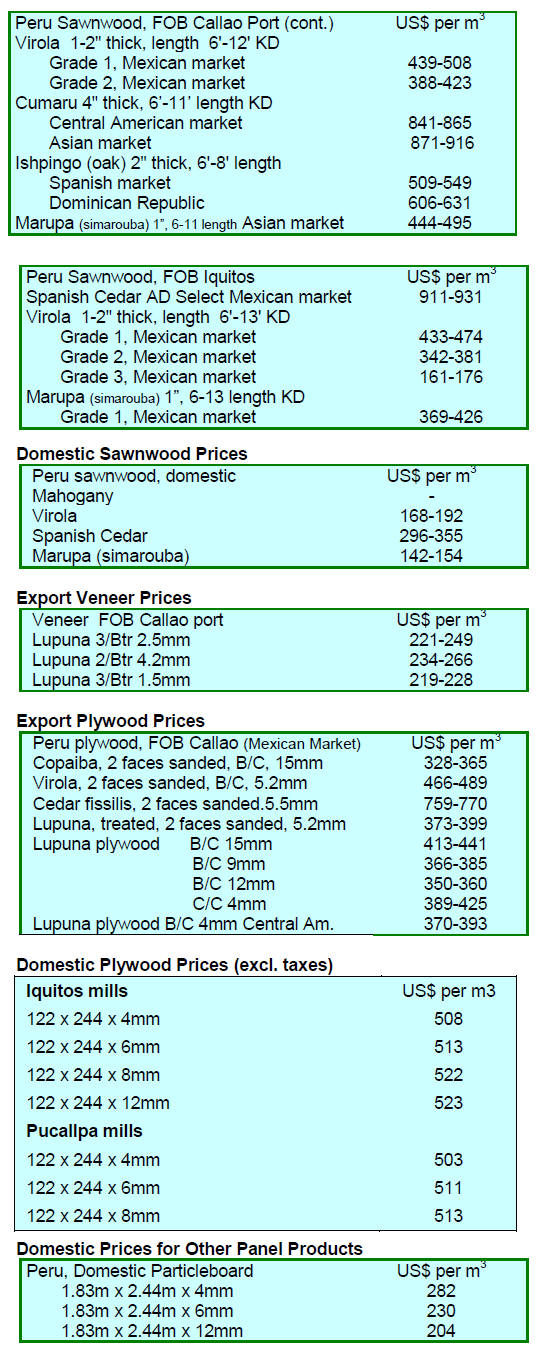

8. PERU

Tax adjustment to boost economy

The finance minister, Alonso Segura reported that the

government would be announcing some changes to the tax

system before year end along with a new policy package

to jumpstart the economy.

Although a lowering of the sales tax and a reduction in

corporate taxes have not been mentioned, such measures

are widely expected. Despite the tough economic

conditions Peru is set to achieve a 3% growth this year.

Exports down in first 10 months

The Foreign Trade Centre of the Lima Chamber of

Commerce has reported that October exports fell 14% year

on year. For the year to October exports were valued at

US$31.673 mil. a decline of 10% over the same period last

year In the first ten months of this year exports of socalled

traditional products (minerals, oil and gas) fell 16%.

„Traditional‟ exports account for 70% of total exports.

9.

GUYANA

LUS in public procurement

The Forest Products Development and Marketing Council,

in collaboration with the Ministry of Natural Resources

and Environment, coordinated a seminar aimed at

increasing the awareness and benefits of using lesser used

timber species.

The seminar specifically targeted government advisors and

engineers in the construction industrysince Government

projects utilise a significant amount of sawnwood.

In a presentation at the seminar the Commissioner of

Forest highlighted the availability of LUS and compared

the properties of some of these timbers with current

commercial species stressing that more must be done to

expand the use of LUS in government projects.

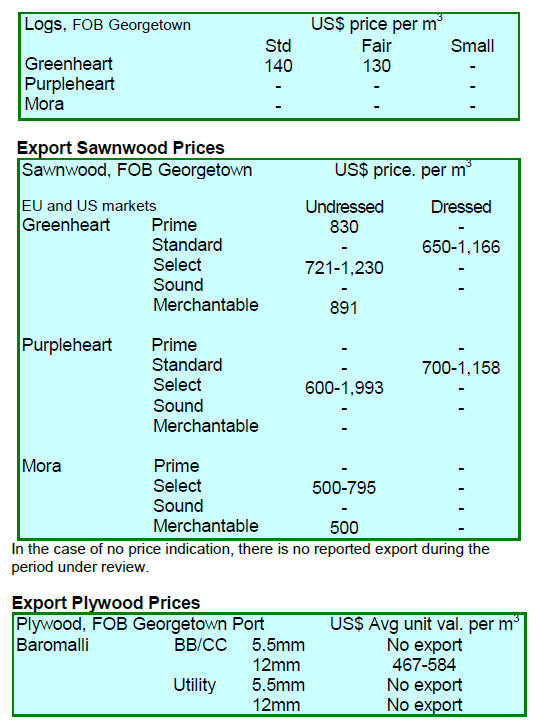

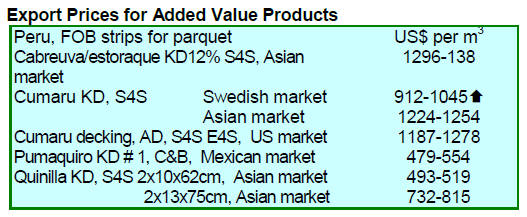

Export Prices

There were no exports of purpleheart and mora logs in the

period reviewed.