Japan Wood Products

Prices

Dollar Exchange Rates of

27th January 2015

Japan Yen 117.53

Reports From Japan

Postponing additional tax rise boosts consumer

confidence

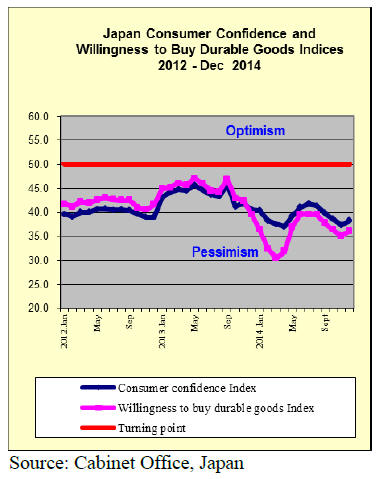

The results of the December 2014 consumer sentiment

survey were released on 19 January and showed that

consumer confidence improved for the first time in five

months. Consumers are apparently happy to see

postponement of the planned increase in consumption tax.

The overall seasonally adjusted index of sentiment among

households rose to 38.8, but it should be remembered that

readings below 50 signal pessimism.

All of the indices four components rose in December.

Consumer‟s assessment of employment conditions

improved, as did their assessment of income growth

potential. The index on readiness to buy new durable

goods also improved but only to 36.3, still stuck well

within the pessimistic range.

See

http://www.esri.cao.go.jp/en/stat/shouhi/shouhi-e.html

Industrial out rises in December

Data released 30 January from Japan‟s Ministry of

Economy, Trade and Industry (METI) shows that

industrial production rose in December month on month

which is being interpreted as a sign that the economy may

be on track to shed the deflation that has crippled the

country for years.

The numbers from METI show that manufacturing output

increased 0.3% in December year on year and was 1% up

from November. However the consumer price index

(excluding food) was down 0.2% from November.

For more see:

http://www.meti.go.jp/english/statistics/tyo/iip/index.html

At the same time Japan's unemployment rate fell to 3.4%

(down 1% from November) but stagnant wages meant

household spending fell from a year earlier and was 0.3%

down on November, the third consecutive monthly

decline.

With the Japanese economy so dependent on domestic

consumption all eyes are now on the wage negotiations

between businesses and the unions which will set wages

for the next fiscal year. If the unions are successful in their

wage negotiations then domestic consumption could get a

boost.

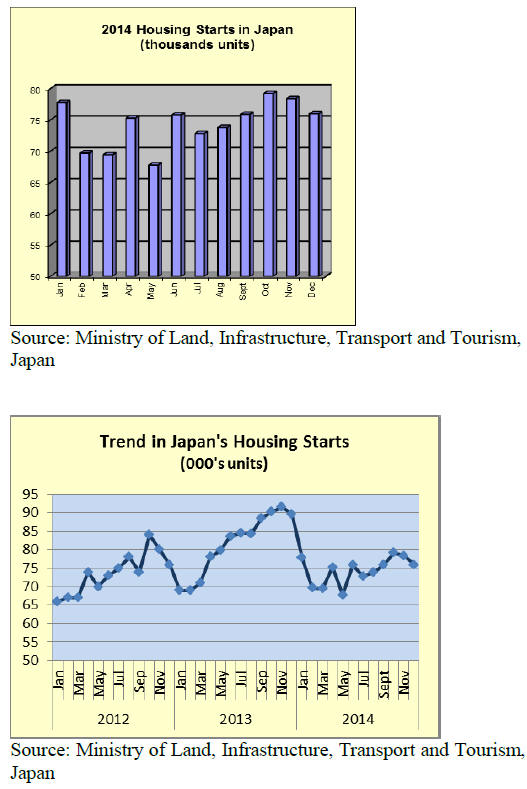

Housing starts miss target

December housing starts totalled 892,000 according to the

latest figures from the Ministry of Land, Infrastructure,

Transport and Tourism.

This figure represents an almost 15% decline on

December 2013 levels and comes after starts declined in

November. Forecasters expected 2014 housing starts to be

around 900,000. For 2014, housing starts fell 8.9% after

the 11% growth in 2013.

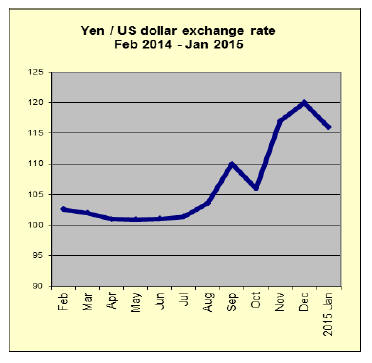

Yen up euro down

Over the past two weeks the yen has strengthened against

the US dollar, driven particularly by the sharp fall in the

euro after the results of the Greek election was announced

and partly because the Bank of Japan (BOJ) did not add

any new initiatives to its stimulus plan that toppled the

yen:dollar rate in October.

The euro fell to an 11-year in the second half of January in

response to the new Greek governments‟ plan to adjust the

austerity measures implemented by the previous

government.

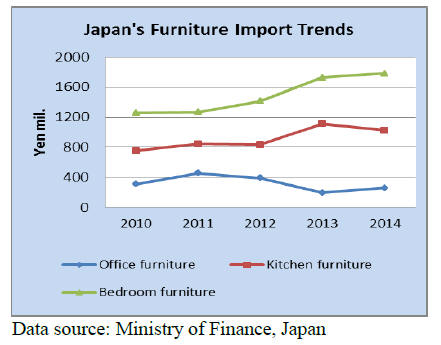

Japan’s furniture imports

Household and office furniture imports by Japan from

2010 to 2014 are shown below. Bedroom and kitchen

furniture imports have held up well over the past 3 years

despite a moribund housing market.

However, some of the apparent increase from 2012 is a

reflection of exchange rates as the yen weakened against

the US dollar, the currency of trade for the major

suppliers.

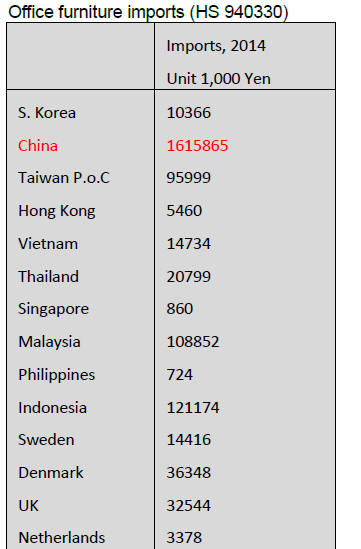

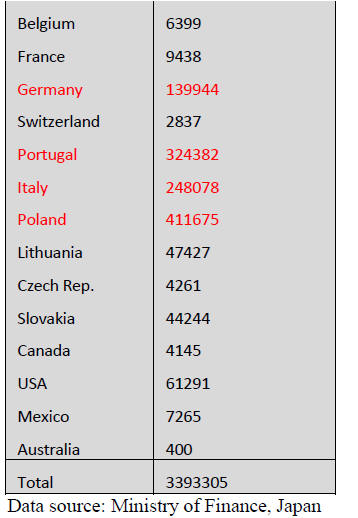

2014 office furniture imports

Cummulative 2014 imports of office furniture by source

are shown below. It can be seen that China dominate

Japan‟s imports of office furniture but manufacturers in

the EU such as Poland Portugal, Italy and Germany

feature in the top five suppliers.

Imports of office furniture from China (48%) and the four

EU suppliers mentioned above account for 80% of all

office furniture imports. Suppliers in tropical countries

(Vietnam, Thailand, Singapore, Malaysia, Philippines and

Indonesia) supplied just 8% of Japan‟s 2014 imports of

office furniture. The top five source countries are

indicated in red.

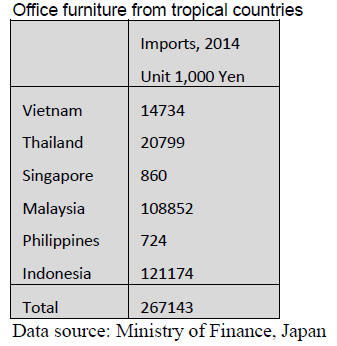

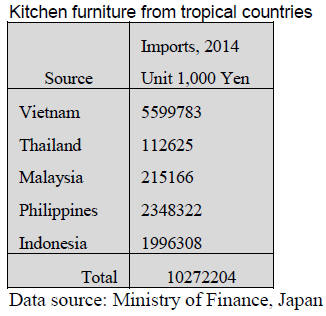

2014 kitchen furniture imports

In contrast to the trade in office furniture, in 2014

suppliers in tropical countries accounted for just over three

quarters (76%) of Japan‟s kitchen furniture imports.

Vietnam was the main supplier of kitchen furniture to

Japan followed by China, Philippines, Indonesia and

Germany. In addition, the list of tropical suppliers

included Thailand and Malaysia. The top five source

countries are indicated in red.

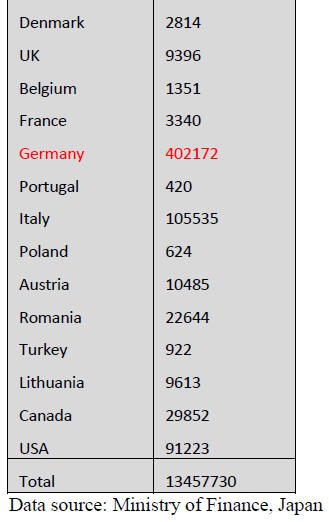

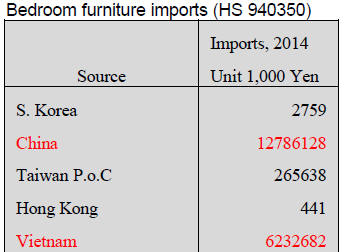

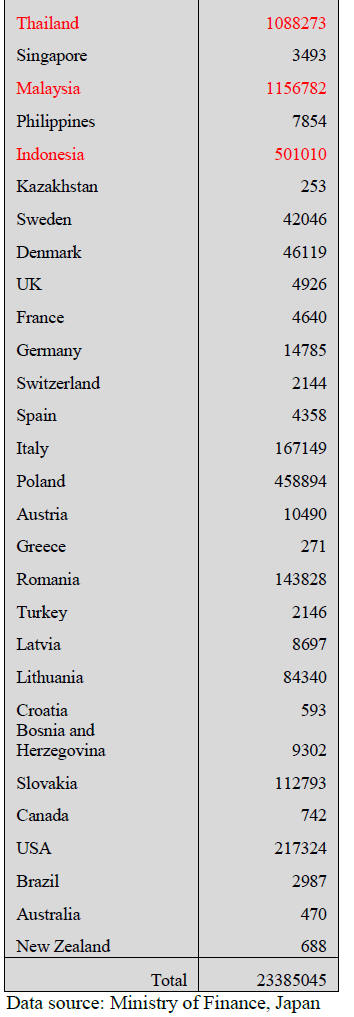

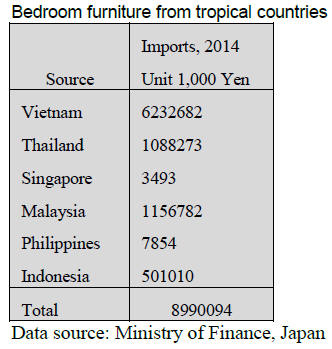

2014 Bedroom furniture imports

Since 2011 the yen value of Japan‟s bedroom furniture has

increased despite the slow housing market and weak

consumer sentiment in terms of buying durable goods.

2014 imports of bedroom furniture by source are shown

below.

The top five suppliers: China, Vietnam, Malaysia,

Thailand and Indonesia (in order of rank) accounted for a

massive 93% of Japan‟s entire imports of bedroom

furniture.

Asian suppliers dominate this trade with Singapore and

Philippines being other major Asian suppliers but not big

enough to make into the top five group. The top five

source countries are indicated in red.

Trade news from the Japan Lumber Reports (JLR)

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

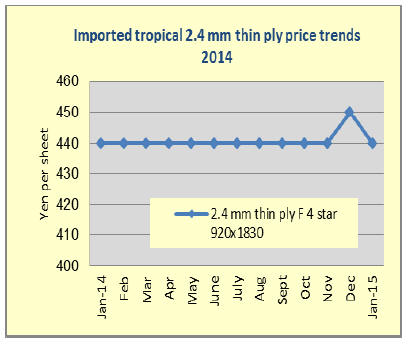

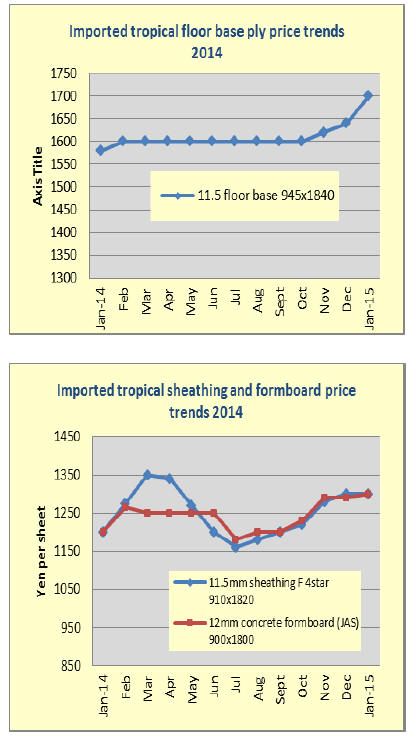

Widening gap between costs and market prices for

imported plywood

By progressing depreciation of the yen, future cost of

imported South Sea hardwood plywood is far higher than

the market prices in Japan. Cost of 3x6 concrete forming

panel is 120 yen per sheet higher than October market

prices. The suppliers hold firm stand by high log cost so

future orders continue declining, which will reduce future

arrivals considerably.

Yen‟s rate to the dollar plunged to 120 yen per dollar, 11%

drop compared to late October so even with unchanged

export dollar prices, cost gap jumped up by about 180 yen

per sheet.

Since last May, the demand slowed down after the tax

increase and the future cost has been always far head of

the market prices so that the importers have been reducing

future purchases.

Consequently, monthly arrived volume dropped to

258,890 cbm during August and October from 308,900

cbm during March and July, about 50 M cbms decrease.

Despite three positive factors of high suppliers‟ prices,

weakening yen and dropping inventories, the market

prices remain weak.

Orders to the suppliers in November seem to be down to

60-70% of normal months so the future arrivals will be

considerably reduced. Normal monthly arrivals are over

300 M cbms then they are down to 250 M cbms now and

they may be down close to 200 M cbms in the first quarter.

Supply region is in rainy season now and the suppliers are

worried about higher log prices in coming months so

reduction of future orders may be a good news to the

suppliers. Current market prices of JAS 3x6 concrete

forming for coating in Tokyo region are 1,400 yen per

sheet delivered, 40 yen higher than November.

Plywood market developments

Domestic softwood plywood production in October was

219,100 cbms, 4.4% more than September with the

shipment of 221,600 cbms, 1.2% more so the inventories

were 213,000 cbms, which were the almost same as one

month production.

The softwood plywood market started collapsing after

October and the prices have been dropping then the

inventories started shrinking so that the manufacturers

decided to set a new prices since December to restructure

the market, which stopped downward move of the prices.

Dealers had been doing business with very little

inventories but now they have to secure a certain volume

as surplus volume is decreasing.

In Tokyo market, 12 mm 3x6 panel (special grade/F☆☆

☆☆) prices are 860 yen, 40 yen lower than October.

Import plywood market is firming by sudden depreciation

of the yen with declining arrivals. Actually price increase

in Japan market has been way behind the soaring cost so

the importers are worried about if the market prices would

go up to catch up spiraling cost.

October arrivals were 259,500 cbms, 5.2% less than the

same month a year earlier and 10,000 cbms less than

September arrivals. In particular, Malaysian volume was

the lowest this year at 95,100 cbms, 20,000 cbms less than

September.

LVL Association roadmap for development

Japan LVL Association held the regular directors meeting

and the chairman commented that the members have been

struggling to sell LVL after the tax hike in last April

because the demand drop is much more than expected.

The Association has been developing LVL products for

residential use and non-residential use. Since new housing

starts are hard to increase, it is necessary to develop more

non-residential use of LVL.

At the meeting, it showed road map for development of

important factors of materials, structure and fire proof. In

materials, veneer strength simulation will be done for

efficient LVL production like laminated lumber for next

revision of JAS.

For fire proof, fire proof wall, floor and roof will be

developed with performance tests to get the Minister‟s

certificate so that LVL can be used for fire proof

buildings. Also by recent revision of JAS rules, for large

sized beam, producible width, height and length of

laminated lumber, solid wood lumber and LVL are shown

so that designers can select the most suitable material.

Next target is to use LVL for wall like European use since

use of LVL has been mainly for structural post and sill in

Japan.

|