|

Report

from

Europe

Stasis in EU tropical hardwood imports in 2014

The latest Eurostat trade data to end October 2014 shows

that tropical hardwood imports into the EU last year were

only marginally better than the historically low levels

recorded in the previous two years.

Various factors account for this lack of import growth

including lacklustre performance of the construction and

joinery sectors in much of Europe during 2014, supply

constraints and logistical problems (particularly for

shipments out of Douala port in Cameroon), and the EU

Timber Regulation which has encouraged buyers to focus

on a more limited range of tropical suppliers in order to

meet the VPA due diligence requirements.

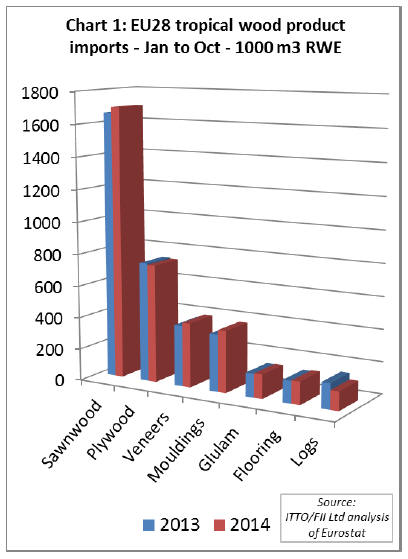

Total EU28 imports of all the main timber products from

tropical countries were 3.63 million cu.m in roundwood

equivalent (RWE) terms in the first 10 months of 2014,

1.3% greater than the same period in 2013.

In value terms, EU tropical timber imports in the first ten

months of 2014 were euro1.18 billion, only 0.7% greater

than the same period the previous year.

The volume of EU imports of tropical sawn wood,

veneers, mouldings, glulam and flooring all increased

slightly in the first 10 months of 2014. However there was

a decline in EU imports of tropical plywood and logs

(Chart 1).

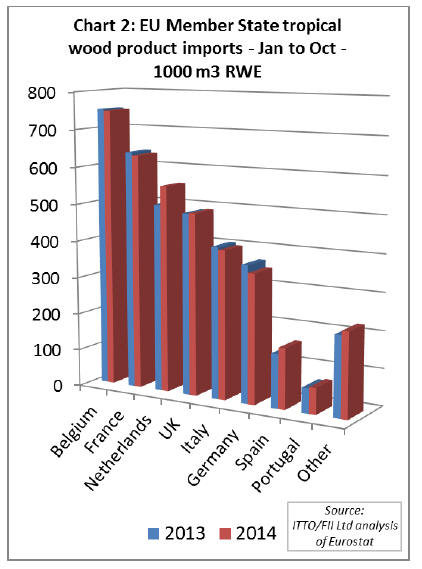

Total tropical hardwood imports into most EU countries

remained fairly static at low levels between 2013 and 2014

(Chart 2). There were slight gains in a few countries

including the Netherlands, Spain, Portugal and the UK, but

these were offset by declines in Germany and Italy.

Belgium an important transit country

In the first ten months of 2014, the volume of tropical

wood product imports into Belgium fell very slightly (-

0.5%) to 748,000 cu.m RWE.

Belgium‟s domestic market for tropical hardwood was

very slow last year, but any weakness at home was offset

by a rise in Belgium‟s re-exports of tropical hardwood

products to neighbouring countries.

Belgium‟s re-exports to other EU countries of all wood

products identified as containing tropical wood was

251,000 cu.m RWE in the first 10 months of 2014, 12%

more than the same period in 2013. Most of this volume

was destined for France, Netherlands and Germany.

Increased flows of tropical wood through Belgium

suggests a continuing trend towards concentration of trade

in a smaller number of larger importers close to the major

ports.

In part this reflects much tighter control of stock levels by

merchants and manufacturers who prefer to buy small but

regular volumes of mixed containers.

To some extent this trend is being reinforced by EUTR

which may be seen as another reason to avoid buying

direct and instead rely on timber placed on the EU market

by larger companies.

Weak construction depresses French imports

Direct imports of tropical wood into France were 632,000

cu.m RWE in the first ten months of 2014, 1.2% less than

previous year. The decline was partly due to the

continuing weakness in the French construction sector last

year.

Already slowing in the first half of 2014, output in

France's construction sector contracted a further 0.6% in

the three months to November according to the latest data

from INSEE.

Tropical hardwood plywood has also come under rising

competitive pressure in France from imported Chinese

plywood, European birch plywood, and other panel

products.

Imports of sawnwood into France from Cameroon fell

particularly dramatically last year. However there was a

rise in French veneer imports from Gabon, encouraged by

the EU‟s decision to suspend the GSP tariff on okoume

veneer from Gabon on 24 June 2014 and to backdate the

suspension to 1 January 2014.

Netherlands tropical wood imports rise 10%

In contrast to France, the volume of tropical hardwood

imports into the Netherlands increased 10% in the first ten

months of 2014.

Improving construction activity led to a particularly sharp

increase in Netherlands imports in the first two quarters of

2014. However the rate of growth slowed in the third

quarter of the year.

Demand for hardwoods in the Netherlands has benefitted

from the temporary VAT reduction on renovation

activities implemented since early 2013. This is now due

to remain in place until 30 June 2015 in an effort to offset

continuing challenges in the Netherlands housing sector.

Recognition of the Malaysian Timber Certification System

since October 2013 alongside other PEFC systems and

FSC for Dutch government procurement may well have

boosted imports of tropical hardwood into the Netherlands

last year.

In the first ten months of 2015, Netherlands imports of

Malaysian timber products were 246122 cu.m RWE, up

nearly 40% compared to the same period in 2013.

Slowing growth in UK tropical hardwood imports

After a sharp rise in the first six months of 2014, the rate

of growth in UK imports of tropical hardwood slowed in

the third quarter of the year.

Overall, UK imports of tropical hardwood products were

490,000 cu.m RWE in the first ten months of 2014, up

only 0.4% compared to the same period in 2013.

The slowing pace of UK tropical hardwood imports was

not due to any significant decline in the UK hardwood

market. UK hardwood distributors remained very busy in

the second half of 2014 driven by the on-going recovery in

construction.

However Chinese Mixed Light Hardwood plywood was

taking a rising share of the UK market during 2014,

largely at the expense of tropical hardwood plywood from

Malaysia.

UK tropical hardwood demand also remains very heavily

oriented towards sapele, with very little interest being

shown in lesser known or secondary species. As a result

the UK struggled to obtain adequate supplies, particularly

with the slow movement of goods through Douala port in

Cameroon during 2014. This encouraged some increased

interest in Malaysian meranti in the UK last year.

Sales of chemically and thermally modified wood products

have also been rising in the UK, taking share from tropical

hardwood.

Tropical wood regains some share in Italian market

Italian imports of tropical hardwood imports fell only

slightly in 2014 despite evidence of a continuing sharp

downturn in construction and other economic activity.

Overall Italy imported 400,000 cu.m RWE of tropical

hardwood products in the first ten months of 2014, only

1.7% less than the same period in 2013.

However this is hardly cause for celebration after seven

years of near continuous decline in Italian tropical

hardwood imports (from over 1.4 million cu.m RWE in

2007).

The relative stability in Italian imports in 2013 and 2014

despite continuing contraction in end-use sectors is partly

due to tropical hardwood reclaiming some of the share lost

to US hardwoods, particularly in the mouldings sector, as

prices of the latter have risen. This boosted Italian imports

of sawn wood from Gabon and Ivory Coast in 2014.

Italian timber merchants and manufacturers have also

increased sales into other parts of Europe. For example EU

internal trade data indicates that Italy‟s exports of tropical

hardwood plywood to other EU countries increased from

55,000 cu.m in the first ten months of 2013 to 63500 cu.m

in the same period in 2014, most destined for Germany,

Netherlands and France.

Indonesian wood products fare well in Germany

Imports of tropical hardwood products into Germany were

348,000 cu.m RWE in the first ten months of 2014, down

5.2% compared to the same period in 2013.

After two years of robust growth, Germany‟s construction

sector contracted during 2014. Germany‟s imports of

tropical sawn hardwood declined from all four the

country‟s largest suppliers ¨C Malaysia, Ghana, Cameroon

and Ivory Coast.

However, at least one tropical supply country fared well in

Germany last year. German imports of Indonesian

plywood, S4S sawn lumber, mouldings, veneers and

flooring components all increased in 2014.

This may be at least partly due to mandatory SVLK

certification of Indonesian products. Implementation of a

tough EUTR inspection regime in Germany and the

government‟s decision to confiscate a consignment of

African wenge logs due to an alleged breach of the law,

have sensitised importers to the need for legally verified

timber.

Pick up in Spanish and Portuguese imports

After several years of contracting demand, there was a

pick-up in demand for tropical hardwood products in

Spain and Portugal in the first 10 months of 2014.

In RWE terms, imports into Spain were nearly 12% higher

than the same period the previous year, while imports into

Portugal were 5% higher. This is an encouraging sign that

the painful structural reforms imposed by both countries in

the wake of financial crises are beginning to stimulate

more economic activity.

Although Spain‟s imports of tropical hardwood from

Cameroon fell last year, the country was importing more

from Ivory Coast, Brazil, Gabon and the Congo countries.

Portugal was importing more from Brazil in 2014.

Spain‟s tropical hardwood imports consist primarily of

sawn wood and veneers, whereas Portugal imports mainly

tropical sawn wood with a declining volume of logs.

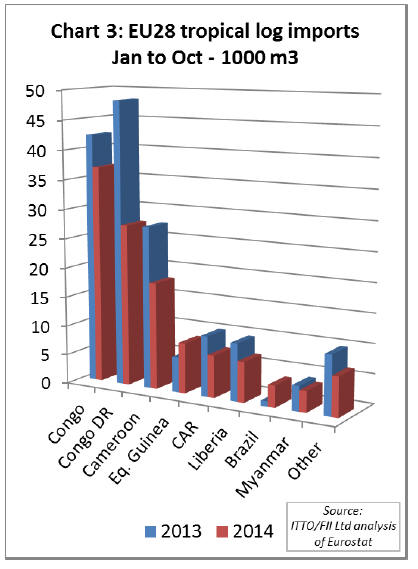

EU tropical hardwood log imports slide even further

EU imports of tropical hardwood logs were 119,000 cu.m

in the first ten months of 2014, 25% less than the same

period of 2013. Imports fell particularly dramatically from

the Democratic Republic of Congo, down 43% at 27,000

cu.m in the first 10 months of the year (Chart 3).

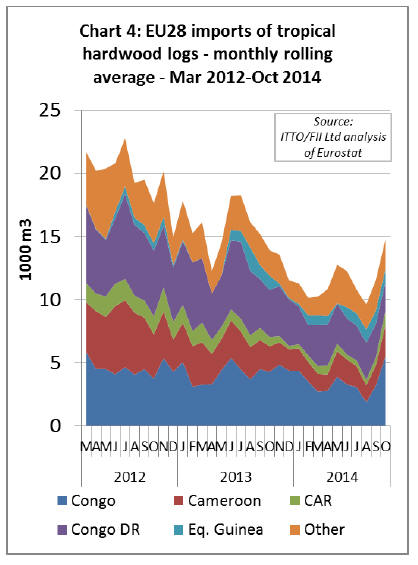

Analysis of monthly data indicates that while the general

trend in EU imports of tropical logs has been downwards

over the last 3 years, there was a sharp increase in imports

in September and October 2014.

Minor recovery in EU imports of sawn tropical

hardwood

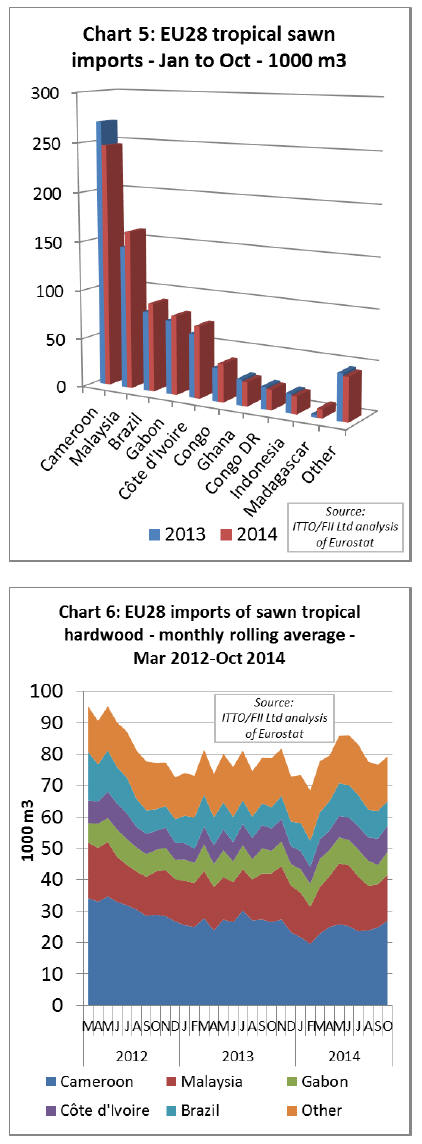

EU imports of sawn tropical hardwood were 806,000 cu.m

in the first 10 months of 2014, 2% more than the same

period in 2013. Imports from Cameroon fell 9% to

247,000 cu.m (Chart 5).

However, this decline was offset by rising imports from

Malaysia (+11% to 161,000 cu.m), Brazil (+11% to

90,000 cu.m), Gabon (+7% to 81,000 cu.m), Ivory Coast

(+13% to 73,000 cu.m) and the Republic of Congo (+14%

to 39,000 cu.m).

Monthly data indicates that after a slow start to 2014, EU

imports of sawn hardwood increased strongly between

March and June (Chart 6). Imports fell away again in third

quarter of 2014 as consumption had not kept pace with

imports and European stocks had begun to build.

However there was a slight uptick in EU imports in

October 2014, mainly because wood at last began to flow

more freely from Cameroon. This followed introduction of

emergency measures by the Cameroon authorities to

reduce serious congestion at the port. These measures

included commissioning of new cranes and the allocation

and redevelopment of more transit space for timber

shipments.

Looking forward, port congestion is widely expected to

become less of a problem in Cameroon following the

recent announcement by the Minister of the Economy,

Planning and Regional Development that the Limbe Deep

Seaport supported by South Korean investment should

become operational during 2015.

The Kribi Seaport in Cameroon, supported by US$567

million of Chinese investment, is also reported to be 60%

complete and is expected to provide a large new harbour

serving all of Central Africa.

Strongerr EU demand for Asian decking in 2014

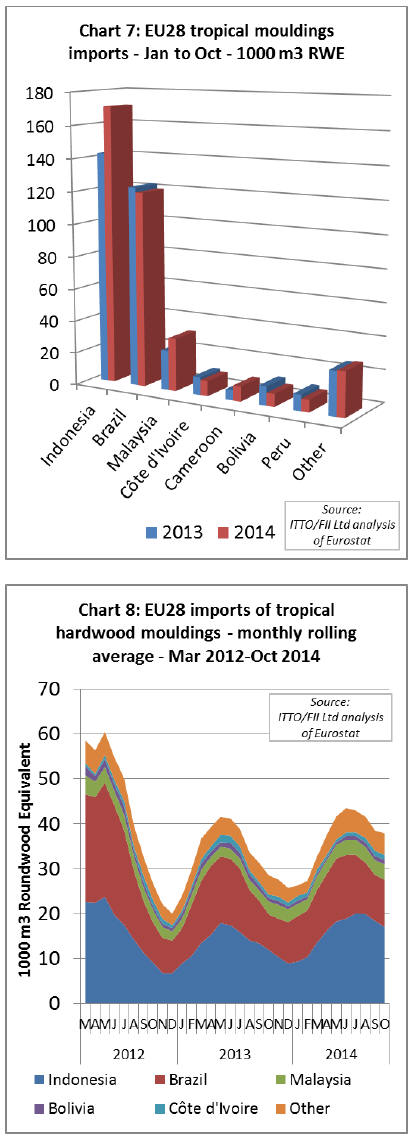

EU imports of tropical hardwood mouldings and decking

in the first 10 months of 2014 were 385,000 cu.m, 8%

more than the same period in 2014.

Imports from Indonesia during the period were 171,000

cu.m, a 20% gain on 2013 (Chart 6). Imports from

Malaysia also increased 34% to 33,000 cu.m. However

imports from Brazil declined 2% to 120,000 cu.m.

Brazilian decking products were the target of a

Greenpeace campaign in Europe in 2014. Several large

European retailers put their sales of ipe decking on hold

following Greenpeace allegations that legal documentation

provided by Brazilian exporters does not meet EUTR

requirements.

According to a recent report by the European Timber

Trade Federation, investigations by the Belgian EUTR

authorities and customs into six containers of ipe decking

imported into Belgium alleged by Greenpeace to derive

from an illegal source were still ongoing in December

2014. The Belgian authorities were awaiting „clarity‟ on

legality documentation from Brazil and the Belgian

importers.

Monthly data for 2014 reveals the usual steep rise in EU

imports of moulding and decking products during the

second quarter, levelling off in June/July and then

declining towards the end of the year (Chart 8).

Overall the European summer decking season in 2014 was

marginally better than in 2013 when imports were

seriously undermined by over-stocking from the previous

year.

Although European importers are quite optimistic about

demand for decking in the coming 2015 season, there are

concerns that higher prices for tropical hardwood decking

will lead to increased substitution by alternative products,

notably wood plastic composites.

Indonesian bangkirai exporters are quoting significantly

higher prices this year due to rising log and labour costs.

The relative weakness of the euro against the dollar is a

further disincentive for European importers. Supplies of

Brazilian decking are also expected to be limited as more

of this product is diverted to the U.S. market.

|