2. GHANA

Surge in air dry sawnwood exports as power

outages

limit kilning

Air dried sawnwood exports increased 35% between

January and November 2014 compared to the same period

in 2103. The increase in exports of air dry rather than kiln

dry sawnwood can be attributed to the unavailability of

power for manufacturers to operate kilns.

Ghana is currently experiencing extreme power shortages

and scheduled load-shedding began last year. The ongoing

power crisis is affecting the manufacturing sector

where some companies have lowered production rates and

cut staff numbers.

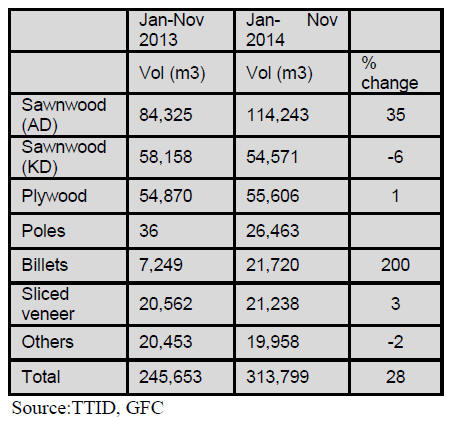

According to the most recent data from the Timber

Industry Development Division (TIDD) of the Forestry

Commission (FC), Ghana‟s January to November 2014

timber export of 313,799 cubic metres of wood products

earned Euro122.40 million.

Some 21 different products were exported and the

following table illustrates the growth in exports for the

main products.

Ghana‟s sliced veneer exports to neighbouring

countries

between January and November 2014 totalled 85 cubic

metres. The main markets were for veneers in Egypt, Italy,

China, Spain and Germany. The major species used for the

production of veneer were asanfina, ceiba and mahogany.

Plywood exports to neighbouring countries continue with

buyers in Nigeria accounting for over 60% of total

regional plywood sales. Nigeria is a major market in the

ECOWAS block and Ghana plans to double exports.

New bamboo craft village

Ghana now has a new centre in the nation‟s capital for

bamboo, cane and rattan artisans known as the Bamboo,

Cane and Rattan Village to serve as a permanent home for

artisans.

The facility was recently handed over by the Millennium

Development Authority (MiDa), to the Ministry of Lands

and Natural Resources.

The Minister for Lands and Natural Resources, Nii Osah

Mills, said the centre opened at an opportune time to

provide a secure work place for artisans. He said the

government was committed to promoting the trade and

development of bamboo and rattan products due to the

enormous economic advantages generated by the sector.

In Ghana, bamboo and rattan resources constitute the two

largest non-timber forest products available.

Trade growth requires upgraded port infrastructure

In a press release the Director-General of the Ghana Ports

and Harbours Authority (GPHA), Mr. Richard Anamoo

has called for a significant investment in infrastructure in

both ports and inland logistics capabilities to meet the

projected demands of some of the world‟s fastest-growing

economies.

The huge growth in trade throughout West Africa and the

projected future growth demanded an upgrade in

infrastructure at various ports in West Africa to handle

greater volumes and larger vessels.

Mr Anamoo, recently attended a three-day West African

Ports and Harbours meeting in Accra which underscored

the need for West African regional ports to collaborate to

boost trade.

The meeting organised by the International Quality and

Productivity Centre, (IQPC), in collaboration with the

Ghana Ports and Harbours Authority and examined

terminal handling efficiencies, how to ease port

congestion, dredging efficiencies, containerisation and

multimodal transport networks.

The meeting focused on operational and construction

challenges affecting port expansion, development and

efficiency for West African ports.

For more see: http://ghanaports.gov.gh/news/1101/IQ-IQPC%2c-

WEST-AFRICAN-PORTS-AND-HARBOURSCONFERENCE-

ENDS-WITH-A-CALL-FOR-PARTNERSHIPTakoradi

Port upgrade

The Port of Takoradi is one of Ghana‟s main commercial

ports handling 65% of the countries commodity exports

such as cocoa, timber, bauxite and manganese. However,

since the port was built in 1928 it had not until recently

benefitted from any major refurbishment.

In 2009 work began to dredge and upgrade Takoradi

harbour. Other work involved extending the breakwater,

the construction of new quays and construction of

additional storage. The Director of the Takoradi Port,

Capt. James Owusu Koranteng, has said work on the

breakwater was 95% complete.

3. MALAYSIA

Quiet trading during Lunar holiday period

Chinese New Year fell on 19 February and that heralded

the start of the Year of the Goat (sheep or ram in some

communities). This is a major festive period for the many

communities in Asia who follow the lunar calendar.

Apart from the official public holidays, the timber industry

in Malaysia usually takes a long break. Some logging

companies break for as long as the traditional 15 days.

However, some processing mills were back at work after

the two day official national holiday.

Both production and trade is very slow over the Chinese

New Year and there have been no market developments of

note.

Strong growth in final Qtr 2014

On the economic front industry watchers were pleasantly

surprised by some good news. Malaysia‟s GDP rose 5.8 %

year on year in the last quarter of 2014 after increasing 5.6

% in the third quarter.

Despite the fall in commodity prices GDP growth was

firm driven by private consumption and investment. The

sharp fall in crude oil prices, a major export from

Malaysia, has forced a revision of the budget and first

quarter 2015 growth may be weaker than initially

estimated. Petroleum income makes up about a third of the

Government‟s annual revenue.

Most economists remain cautious on the outlook for 2015

as they expect the slump in oil prices to have a bigger

impact on exports in the near future.

Bank Negara has said private consumption is likely to

moderate in 2015 especially as consumer sentiment will be

dampened when the new consumption tax rate of 6 % that

is introduced in April.

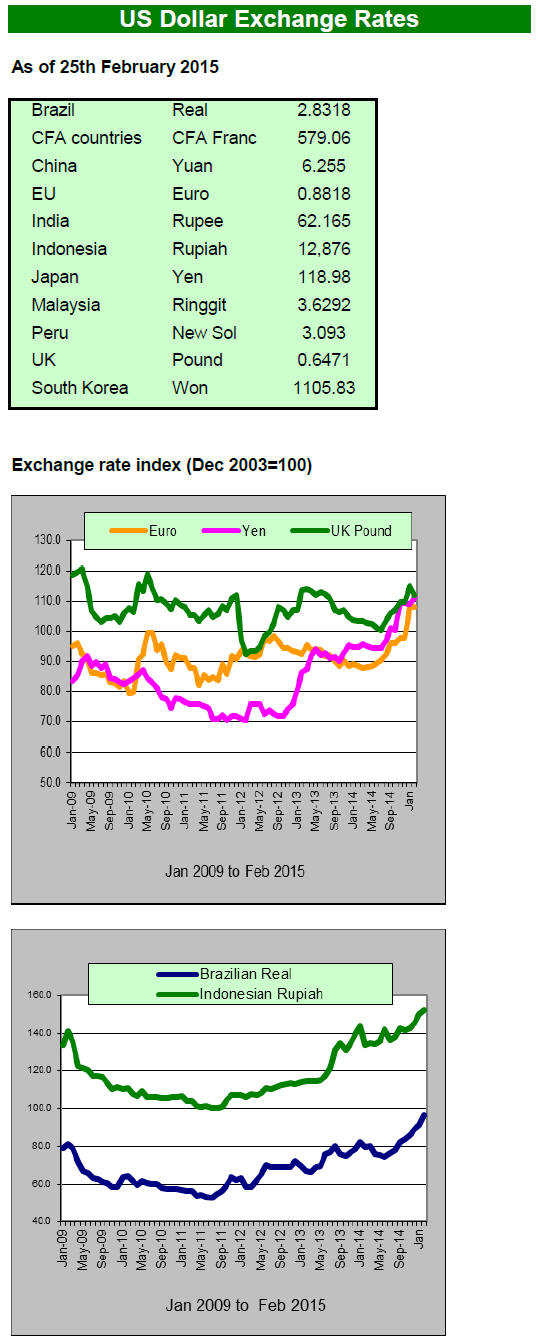

Exchange rate volatility across the region

All eyes are on the ringgit/US dollar exchange rate. The

Malaysian ringgit is currently at a five year low against the

US dollar but could weaken further. As the strength of the

ringgit is linked to oil prices more exchange rate volatility

can be expected.

Across the region currencies are slipping against the dollar

and many Central banks are cutting interest rates.

Indonesia was the most recent among Asian countries to

lower its domestic interest rate.

In January Singapore loosened its monetary policy to keep

its currency low. China and India have already lowered

their rates. Analysts anticipate Thailand will soon decide

to lower rates.

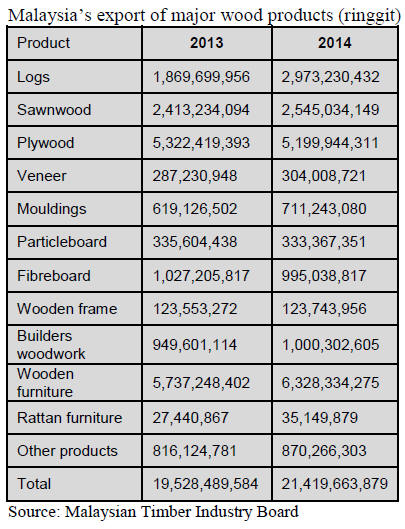

Healthy export growth in 2014

Malaysia‟s wood product exports grew 9.7% in 2014 year

on year. Wooden furniture and plywood exports accounted

for around 54% of total exports but plywood exports were

down marginally in 2014 compared to 2013 however,

wood furniture exports expanded 10% year on year.

Log exports were a massive 59% higher in 2014 compared

to 2013. The 2014 export statistics from the Malaysian

Timber Industry Board are shown below.

﹛

4. INDONESIA

Ministry of Industry 每 No to log exports

The Minister of Industry, Saleh Husin said the country has

no policy allowing log exports because many wood-based

industries, especially furniture makers, would be adversely

affected.

He said that his ministry fully supported the development

of the national furniture industry, especially the small and

medium-sized enterprises which need help in remaining

competitive in an era of free trade.

There have been suggestions that the Ministry of

Environment and Forestry was considering allowing the

export of specific species as prices for domestic sales by

growers were not competitive with international prices.

Minister Saleh has indicated he will coordinate with the

Minister of Environment and Forestry on this issue.

SMEs benefitting from EU recognition of SVLK

Indonesia‟s wood product exports to the EU are expected

to reach US$1 billion this year according to Indonesia‟s

Ambassador to the EU Arif Havas Oegroseno.

The Ambassador said that recognition of Indonesia‟s

legality verification scheme (SVLK) contributed to a sharp

increase in wood product exports to the EU in 2014 where

shipments rose 27% from a year earlier to US$690

million. In particular there was a sharp increase in exports

from SMEs in Jepara, Yogyakarta and Bali.

Investment in port modernisation

The Indonesian parliament approved and passed a revised

budget which cuts the deficit and increased spending on

infrastructure in what has been termed ※productive"

spending aimed at improving the country‟s infrastructure.

The impact of poor infrastructure on export competiveness

has often been highlighted. In particular, criticisms of the

current ports infrastructure in terms of size limitations,

especially for the second-tier ports and inconsistencies in

regulations have been identified as slowing vessel

turnaround times.

However, the government plans to modernise the

country‟s ports system from the national budget of

US$430 billion over five years for upgrading

infrastructure. Investments will be made to expand

capacity at second-tier ports as well as improvements in

Jakarta and Surabaya, the main international sea-ports.

﹛

5. MYANMAR

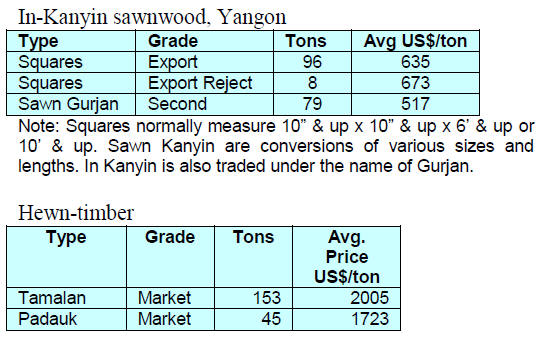

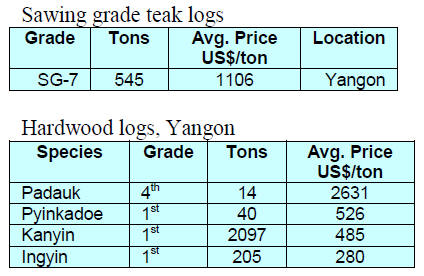

Average Prices of sawn timber

Prices for sawn teak in the Open Tender held on 20

February averaged US$4500 per cubic ton for boards and

ranged from US$1000 to US$2000 per cubic ton for

Second Class teak scantlings. Third Class (the lowest

grade) scantlings sold for between US$500 and US$1000

per cubic ton.

Average prices in other tender sales were reported to be

MMK 0.651 million per h.ton for teak and MMK 0.372

million for other sawn hardwoods in the Mandalay

Division and MMK 0.632 for teak and MMK 0.359 for

hardwoods in the Yangon Division.

The following timber was sold by Myanma Timber

Enterprise by special open tender on 20 February 2015.

Prices for logs are expressed in hoppus tons and prices for

hewn or sawn teak are expressed in cubic tons.

Forest loss along the Ayeyarwady River

The domestic press (Eleven Media) has reported a survey

conducted by ※Seine Yaung So§, a Mandalay-based

environmental group, on conditions along the upper

Ayeyarwady River where deforestation and water

pollution from gold mining sites is reportedly severe. The

group says deforestation can cause flooding, landslides

and soil erosion.

The survey of the Ayeyawady River will be presented to

the public as well as to experts and relevant authorities to

raise awareness of the need for greater protection efforts.

Trade deficit widens

The Myanmar Times of 18 February reported that the

trade deficit widened to MMK 2.3 trillion during the first

half of this fiscal year. Exports totalled K5.632 trillion

between April and September, far below the K8.018

trillion in imports.

The government‟s Planning and Financial Development

Joint Committee figures showed that the deficit for the

first half of FY 2013-14 was K394 billion, compared to

K2.386 trillion for the first half of the 2014-15.

Slower growth forecast by IMF

An International Monetary Fund (IMF) team led by

Yongzheng Yang visited Myanmar during January 28 to

February 5. The press release after the mission from the

IMF says: ※Real GDP growth is expected to decelerate

slightly to 7.8 percent in fiscal year (FY) 2014/15 (year

ending March) from 8.3 percent in FY2013/14 due to

slower growth in the agricultural sector.

Inflation is expected to pick up to around 6 percent year on

year (y/y) in FY2014/15 from 5.8 percent in FY2013/14.

The recent kyat depreciation is primary driven by the

global strengthening of the U.S. dollar and a widening

external current account deficit.

The trade deficit increased to 5.5 percent of GDP in

December 2014 as imports grew by 25 percent y/y for the

period April-December 2014 while exports growth

remained flat.§

For more see:

http://www.imf.org/external/np/sec/pr/2015/pr1548.htm

Correction: Timber exports to US to reach 300 cubic tons.

Volume 19 Number 3, 2015.

Barber Cho of the MTMA has advised that ※there was a

misinterpretation in the report on the IWPA trading with

Myanmar. It is NOT a waiver for ALL US companies to trade

with Myanmar. But it is a license for only IWPA members to

trade with Myanmar as long as we commit to a reform agenda."

6.

INDIA

US$4.5 billion investment in housing

The CREDAI newsletter of December last year reported

the real estate sector attracted US$4.5 billion in

investments between January and September last year with

Mumbai topping the list of recipients. Of the total

investment, land and development stage transactions

attracted nearly 60 per cent from domestic as well as

foreign entities.

See: http://www.credai.org/indian-realty-market-sees-45-

bn-investment-during-january-september-cbre-economictimes

Re-zoning Mumbai to boost housing development

In related news the VOX news site has an analysis of the

negative impact of restrictions on residential housing in

India and the initiative of the government to rezone parts

of Mumbai.

This rezoning says Matthew Yglesias in the VOX write-up

※is probably the most important urban-policy development

in the world today. It should fairly dramatically increase

living standards in one of the biggest cities on the planet

and possibly do a great deal to drive economic growth

forward throughout India.§

The VOX report says ※Greater Mumbai's governing

authority is proposing a sweeping change to the permitted

Floor Space Index (FSI, the ratio of a building's total floor

area to the size of the piece of land upon which it is built).

Under the plan, Mumbai is set to be divided into five

zones with an FSI of 8 allowed in the very densest areas

and FSIs in the 5-6 range in places well-served by mass

transit. Fifty-eight percent of the city's land area would

remain below 3.5, resulting in an increase in the amount of

building allowed in many areas.

Because Mumbai offers job opportunities people continue

to move into the city putting a massive strain on housing

development which is constrained by regulations which

have not keep pace with urbanisation. The VOX report

says in 2009 the Mumbai resident had an average

residential space only 12% of that of Shanghai residents.§

For more see: http:

www.vox.com/2015/2/20/8072575/mumbai-fsi-reform

Review of obsolete environmental legislation

planned

Government sponsored „brain-storming‟ on amendments

to laws on various aspects of environmental protection

will be conducted involving the Indian Forest Service

(IFS). The brain-storming sessions will be held in

Bengaluru, Bhopal and Guwahati.

Prakash Javadekar, the Environment Minister said a panel

had recently reviewed existing laws and suggested

amendments. The laws, which were reviewed by a fourmember

panel headed by former cabinet secretary T S R

Subramanian, are the Environment (Protection) Act, 1986,

the Forest (Conservation) Act, 1980, the Wildlife

(Protection) Act, 1972, the Water (Prevention and Control

of Pollution) Act, 1974 and the Air (Prevention and

Control of Pollution) Act, 1981.

The new government wants to review and remove

inappropriate or obsolete content from existing laws but

this is a huge task as there are over 2500 Acts on the

statute book of which the Prime Minister‟s office has

listed almost 2000 for repeal.

Canada promotes its wood products in India

Canada‟s largest softwood producers joined a governmentsponsored

trade mission to India to promote Canadian

wood products as sustainably sourced and environmentally

friendly.

Products made from Western Canadian species were

displayed at the DelhiWood trade show this January and

February, including doors, furniture and interior paneling.

Canadian wood products are also permanently displayed in

Mumbai and promoted by the government of British

Columbia/Canada to Indian manufacturers, importers,

interior designers and architects. Traditionally India uses

mainly hardwoods but is increasingly switching to more

use of softwoods.

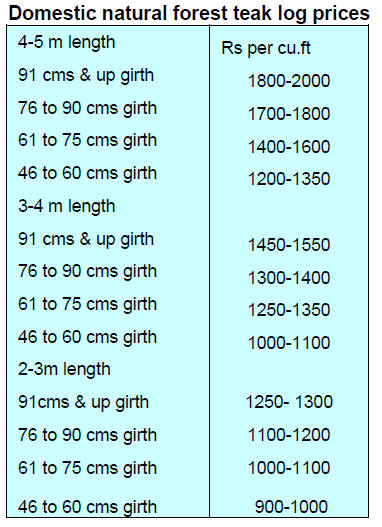

Auction sales at depots of Western India

Because many buyers refused to attend the most recent eauction

as the terms of trade and the transparency in

dealings were considered unacceptable the sales were

postponed.

Domestic natural forest teak logs are preferred over

imported plantation teak as logs from domestic forests are

of a greater diameter and thus the sap is proportionally

smaller which results in higher recovery rates.

Teak log buyers are hopeful that their concerns on the eauction

process can be address providing for a quick

resumption of sales to clear the backlog of timber in the

depots.

Teak sales at Central India forest depots

The series of auctions in Central India continued and

prices were firmer as buyers were active having refused to

participate in the sales in Gujarat.

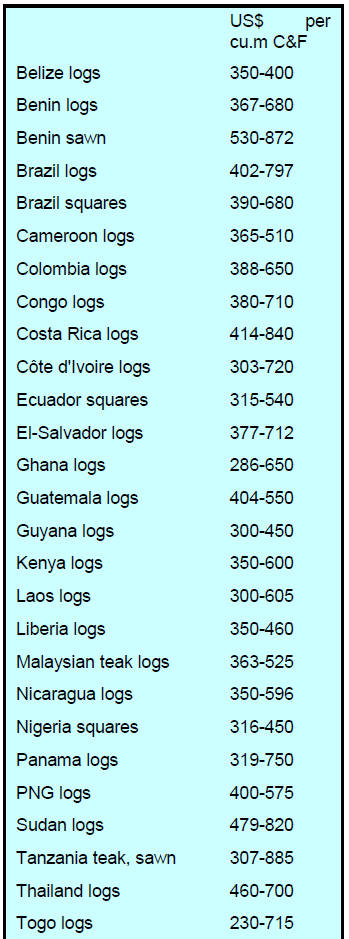

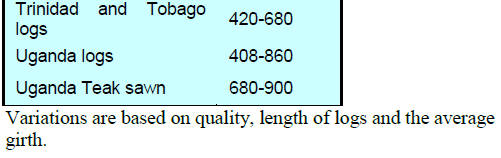

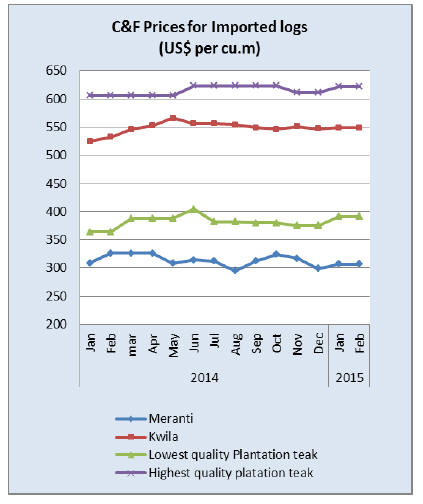

Current C&F prices for plantation teak

C&F prices have not changed over the past two weeks

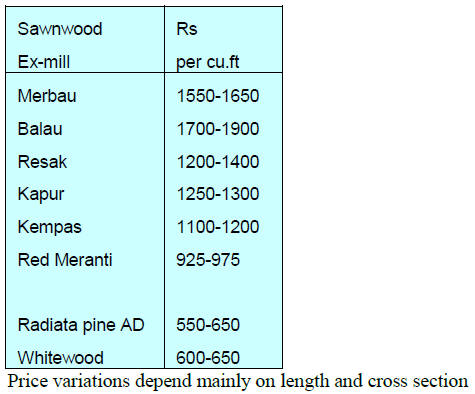

Prices for domestically milled sawnwood from

imported logs

Current exmill prices for air dried sawnwood are shown

below. Prices have not changed over the past two weeks.

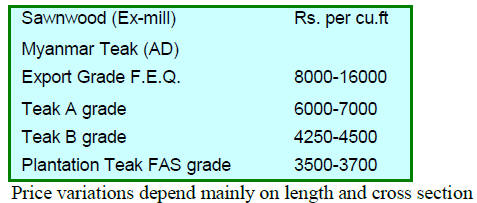

Prices for domestically milled Myanmar teak

Prices are generally stable but prices for decking have seen

a correction.

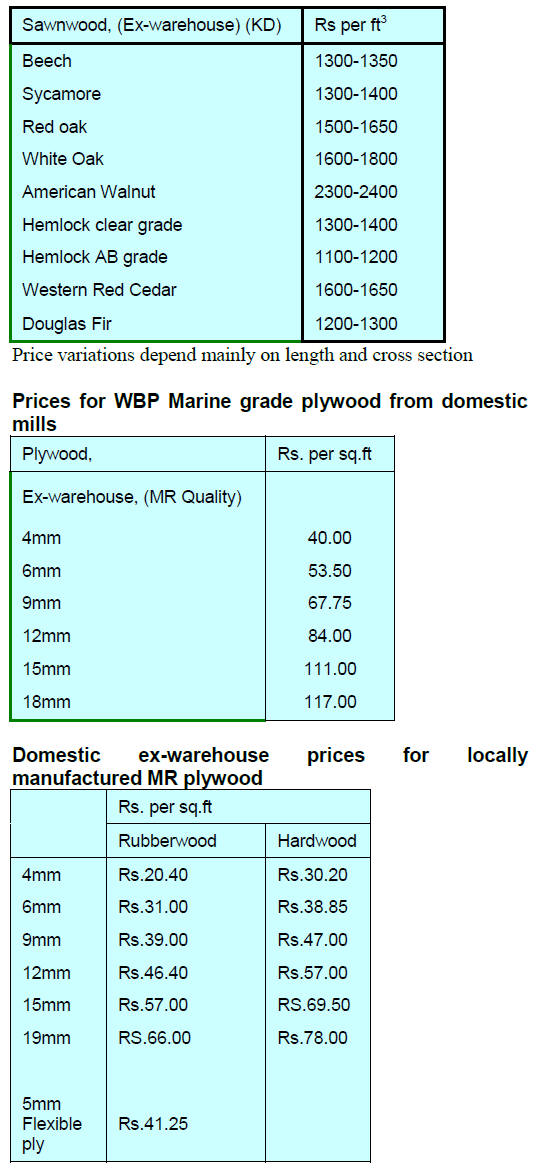

Imported 12% KD sawn wood prices per cu.ft

exwarehouse

No price changes have been reported

7.

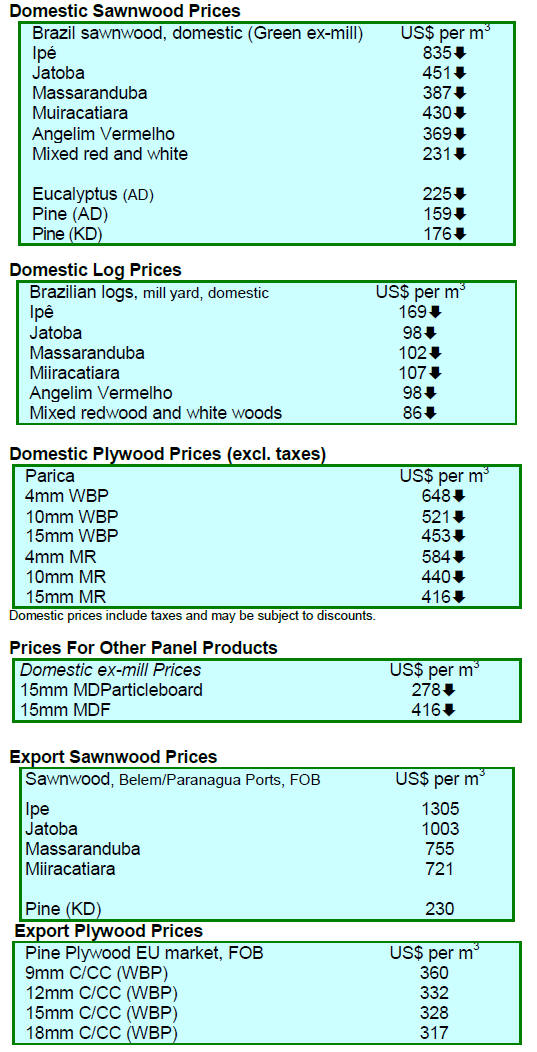

BRAZIL

Interest rates soar in the face of

stubborn inflation

Brazil‟s Central Bank pushed interest rates higher at its

latest meeting lifting the rate from 11.75% to 12.25%.

This is the highest rate since August last year.

The move on interest rates comes as the Consumer Price

Index (IPCA), jumped to 1.24% in January 2015, after the

0.78% increase in December 2014.

The January inflation figure is another record

being the

highest since February 2003 (1.57%).

The Central Bank, in its Boletin Focus, a weekly Central

Bank survey of analysts from about 100 private financial

institutions, says the economy is expected to contract 0.5%

this year and that inflation will be above the government's

projection.

However, those surveyed for the Boletin analysis still

expect GDP to grow 1.5 percent in 2016. The Boletin

Focus says Brazil‟s inflation is likely to finish 2015 at just

over 7%, slightly higher than previously estimated.

For more see:

http://www.bcb.gov.br/pec/gci/ingl/Readout/R20150220.p

df

ABIMAD fair promotes new styles and concepts

The 19th ABIMAD fair (Associação Brasileira das

Ind迆strias de M車veis - Brazilian Association of Furniture

Industries) ran from 3-6 February attracting round 22,000

visitors (retailers and industry professionals) and recorded

business deals worth an estimated R$500 million.

Attendance at this years‟ fair was a 10% increase

compared to 2014.

The theme of the 19th ABIMAD was „Immerse yourself in

high decoration‟. According to Rafael Magno, of the

ABIMAD marketing department, upon entering the

pavilion, visitors were greeted by many different styles

and concepts for interior decoration.

The highly decorative furniture sector in Brazil is growing

faster than other sectors of the economy and trading values

are in the region of R$7 billion per year.

According to ABIMAD, output from this sector is

increasing to meet growing domestic demand which has

been sustained even under the current tough economic

conditions in the country.

Reforestation project in Tocantins

The Bank of Amazonia (BASA) approved R$51.3 million

in funding for industrial scale forest plantation

development in the state of Tocantins.

The initial funding will be for the establishment of 10,000

hectares of eucalyptus plantations across 39 properties in

the municipalities of Wanderlândia, Darcin車polis, Nova

Olinda, Goiatins, Babaçulândia, Filad谷lfia and

Palmeirante. The purpose is to produce pulp logs, biomass

raw material and sawlogs.

The project aims to promote the economies in the

region

through job creation. The total investment in the

plantations is projected at R$64.2 million of which R$12.9

will be provided by the private sector and R$ 51.3 from

BASA.

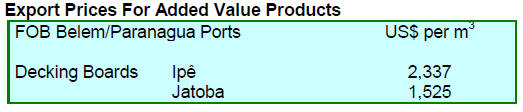

January export round-up

In January 2015, Brazilian exports of wood-based

products (except pulp and paper) increased 7.6% in value

compared to January 2014, from US$ 174.2 million to

US$ 187.5 million.

Pine sawnwood exports increased significantly (28%) in

value in January 2015 compared to January 2014, rising

from US$13.9 million to US$17.8 million. In volume,

exports rose 25%, from 61,000 cu.m to 76,400 cu.m over

the same period.

Tropical sawnwood exports were up 22.4% in volume,

from 22,800 cu.m in January 2014 to 27,900 cu.m in

January 2015. In terms of value, exports increased 12.5%

from US$13.6 million to US$15.3 million, over the same

period.

Pine plywood exports also increased ring almost 17% in

value in January 2015 in comparison with January 2014,

from US$27.2 million to US$31.8 million. The volume of

pine plywood exports increased 14%, from 74,900 cu.m to

85,300 cu.m, over the same period.

Surprisingly tropical plywood exports also increased in

January from 2,200 cu.m in January 2014 to 5,500 cu.m

this January. The value of tropical timber exports

increased 100% from US$1.4 million in January 2014 to

US$2.8 million in January 2015.

However, wooden furniture exports fell from US$29.9

million in January 2014 to US$26.4 million in January

2015, a 12% decline.

In previous issues it was reported that furniture

exports

from the Bento Gonçalves furniture cluster (one of the

main clusters of Rio Grande do Sul state) have fallen.

Especially badly affected was demand in Argentina (-

59%) and Venezuela (-52%).

Project &Orchestra Brazil* in 2015

The 2015 calendar for the project „Orchestra Brazil‟, a

partnership between Bento Gonçalves Furniture Industry

Union (SINDIMÓVEIS) and the Brazilian Agency for

Export and Investment Promotion (APEX-Brazil), has

been set out.

The project aims to enhance integration of furniture

industries in their approach to international markets. The

2015 calendar of events includes fairs, meet buyer projects

and missions in South Africa, Germany, Argentina,

Bolivia, Chile, Colombia, United States, Italy, Guatemala,

Mexico and Turkey.

The first activity of the year was a sponsored visit by four

companies to the Kitchen and Bath Industry Show (KBIS)

in Las Vegas. „Orchestra Brazil‟ will be one of the

supporters of the March Fimma Brazil Buyer Project

(International Fair of Machines, Raw Materials and

Accessories for the Furniture Industry) which will take

place in Bento Gonçalves (Rio Grande do Sul State).

In 2015, „Orchestra Brazil‟ introduced changes which now

segment participating industries by their export capacity so

that activities can be tailored to the various companies.

Companies are now classified as those new to exporting,

beginner exporters, regular exporters and experienced

international exporters. The categories are not related to

the size of the company but to their willingness and

experience in exporting.

The companies about to enter the export market will be

provided with information on foreign markets. Those

companies that are in the initial phase of exporting will get

support to diversify their markets; companies with solid

exports will focus on increasing competitiveness and

companies firmly established in international markets will

be supported to increase global market share.

Currently, the project has the participation of 73 industries

and 50 design studios.

The priority markets for 2015 are South Africa,

Guatemala, Mexico, United States, Argentina, Colombia,

Peru, Turkey, Bolivia and Chile.

For more see:

http://www.sindmoveis.com.br/portal/

Forest sector exports in 2014

Brazilian exports of pulp, paper and timber in 2014 were

valued at US$5.29 billion, US$ 1.93 billion and US$ 2.73

billion, respectively according to the Secretariat of

Agricultural Policy (SPA), the Ministry of Agriculture,

Livestock and Food Supply (MAPA). The value of

primary forest production exceeded R$13 billion and the

sector employed some 4.5 million people.

Planted forests in Brazil extend to 7.6 million hectares or

approximately 1% of production forest area of the country.

This sector accounts for 75% of all that is consumed by

forest-based industries in the country. The gross domestic

product of the sector was US$56 billion, representing

1.2% of all wealth generated in the country.

﹛

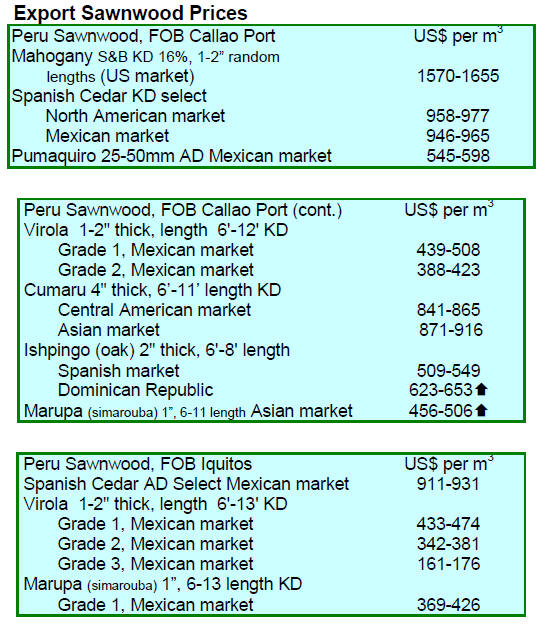

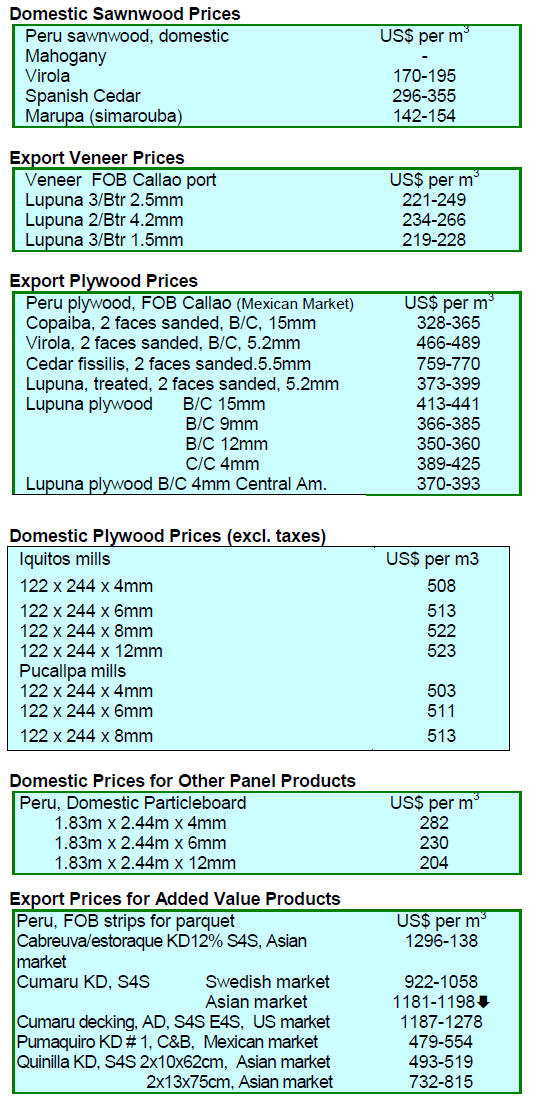

8. PERU

Private companies invest in plantations

ICCGSA Investments expects the first harvest of bolaina

(Guazuma crinita) to be made shortly from its plantations

in the province of Puerto Inca.

To-date the company has established just over 1,000

hectares in cooperation with Reforestadora Amazonica

S.A. This company is responsible for planting,

maintaining, harvesting and converting the timber wood.

CIFOR says ※Bolaina has traditionally been used in places

such as Contamana as a cheap wood for construction.

Demand for bolaina surged in 2007, after a strong

earthquake leveled the city of Pisco, on Peru‟s southern

coast and manufacturers bought large amounts of the

wood for prefabricated houses.§

Exporters expect recovery in 2015

Noting that 2014 was an unremarkable year for the timber

sector, Erik Fischer, chairman of the Wood and Wood

Industry Association of Exporters (ADEX), said that 2015

may be the year in which the industry could realise the

long-awaited recovery.

Currently, regional export markets are weakening.

Demand in the US is improving but buyers for the

Mexican market are quiet and in Europe there still

considerable volatility.

9.

GUYANA

Focus on value-added production

A sharper focus on value-added production and

dissemination of information on the implications of the

Guyana EU/FLEGT agreement that is now being

negotiated are among the priority areas in the forestry

sector identified in the new five year (2015-2019) strategic

plan formulated by Forest Products Development and

Marketing Council of Guyana (FPDMC).

It is envisaged that the EU/FLEGT agreement will open up

greater market opportunities for Guyana‟s timber products.

With this in mind, the FPDMC will be embarking on a

sensitisation drive which will be designed to inform

stakeholders on the conditions that would have to be met

in order for Guyana to be compliant with this agreement.

As such these would include methodology and

legality

with respect to harvesting of timber and chain of custody

of forest products. Additionally stakeholders will also be

informed of the need to maintain a high level of quality of

timber products.

The FPDMC is set up to work with stakeholders to

promote the sustainability of the country‟s forest products

by increasing value-added and competitiveness through

improved capability and enhanced trade opportunities and

market access.

In related news, leaders of Guyana‟s Amerindian

communities, while welcoming the efforts to strengthen

forest management, have called for Amerindian land rights

to be secured and more community involvement in the

negotiations on the VPA.

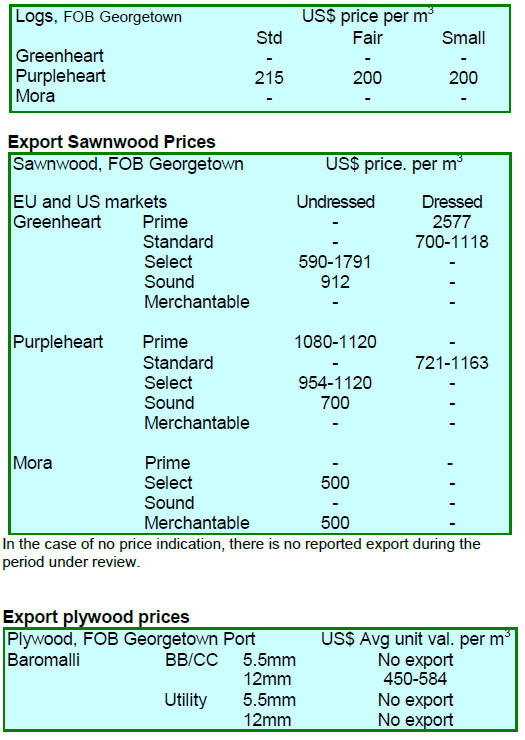

Export prices

There were no exports of greenheart or mora logs in the

period reported.

﹛