|

Report from

North America

US imports of almost all wood products increased

significantly in 2014 compared to the previous year. Only

hardwood plywood imports declined, despite an upswing

in US demand for cabinets.

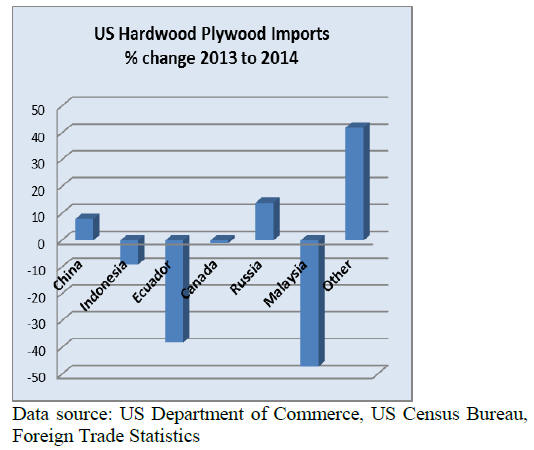

Decline in hardwood plywood imports but China¡¯s

import share up

2014 imports of hardwood plywood were slightly lower

than in 2013. The US imported a total of 2.91 million

cu.m. of hardwood plywood in 2014, 1% down from the

previous year.

Imports declined despite a stronger US economy in 2014

and the removal of antidumping duties on Chinese

plywood in November 2013.

Hardwood plywood imports from China grew by 8% from

2013, when the special import duties were in effect much

of the year. The US imported 1.52 million cu.m. of

hardwood plywood from China in 2014. China‟s share in

total imports grew from 48% in 2013 to 52% in 2014.

The second-largest source of imports was Indonesia at

448,180 cu.m. Imports from Indonesia were lower than in

2013, and its import share declined from 17% to 15%.

The strongest growth in hardwood plywood imports in

2014 was from Russia. Imports grew by 14% from the

previous year to 291,592 cu.m. Russia‟s import share

increased by one percentage point to 10% in 2014.

Hardwood plywood imports from other main sources of

supply went down in 2014. Canadian shipments declined

by 1% to 180,637 cu.m. Imports from Ecuador fell by

almost 40% from 2013 171,080 cu.m.

Plywood imports from Malaysia were almost half of 2013

volumes at 73,265 cu.m.

Imports from all other countries were 222,290 cu.m. in

2014, up 33% from the previous year.

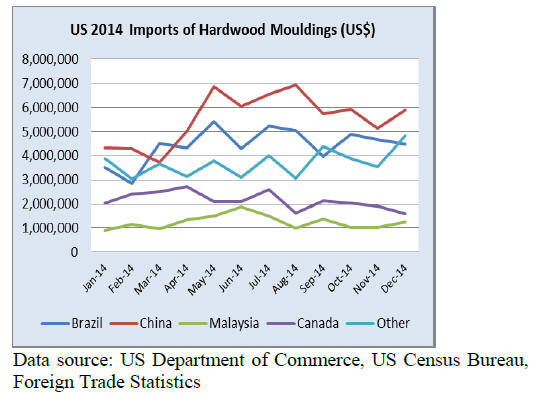

China surpasses Brazil as largest source of hardwood

mouldings

The total value of hardwood mouldings imports into the

US in 2014 increased by 11% from the previous year.

Hardwood moulding imports were worth $204.6 million in

2014.

China surpassed Brazil in 2013 to become the largest

import source of hardwood mouldings. China maintained

this position in 2014 with $66.5 million shipped to the US

market; imports from China increased by 2% from the

previous year.

Hardwood moulding imports from Brazil grew by 14% to

$53.2 million in 2014; imports from Malaysia increased by

20%.

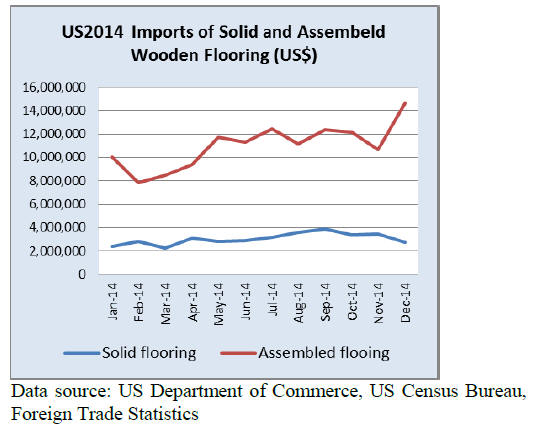

More hardwood flooring from China in 2014

US imports of wood flooring grew significantly in 2014.

Imports of assembled wood flooring panels were worth

$132.3 million, up 16% from 2013. Assembled wood

flooring imports from China were practically unchanged

from the previous year at $67.4 million.

US imports of hardwood flooring from Canada increased

by 20% to $29.0 million in 2014. Indonesia exported $7.6

million worth of assembled flooring panels to the US in

2014, up 72% from the previous year.

Total hardwood flooring imports were $36.5 million in

2014, up 12% from 2013. Indonesia was no longer the

largest supplier of hardwood flooring at $6.9 million,

down from $11.3 million in 2013.

Malaysia increased hardwood flooring shipments by 16%

to $8.1 million. China became the US‟ second-largest

supplier of hardwood flooring at $7.4 million (+37%).

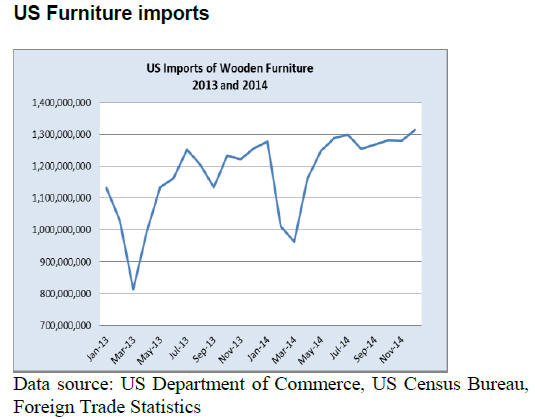

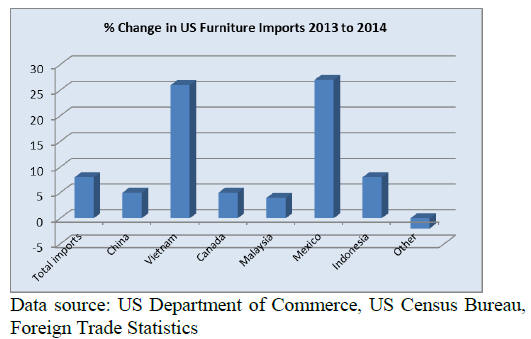

Vietnam and Mexico increase furniture import share

Following a 7% growth in 2013, US wooden furniture

imports increased by 8% in 2014. Wooden furniture

imports were worth $14.65 billion in 2014. Imports from

all major suppliers increased. The largest growth was in

imports from Vietnam and Mexico.

Furniture imports from China grew by 5% in 2014 to

$6.99 billion. China‟s share in total US furniture imports

fell by one percentage point to 48%.

Imports from Vietnam gained significantly in 2014. They

were worth $2.52 billion, up 26% from 2013. As a result,

Vietnam‟s import share grew from 15% in 2013 to 17% in

2014.

Canada‟s import share remained unchanged in 2014, with

imports at $1.20 billion (+5%). Wooden furniture imports

from Mexico were worth $0.66 billion (+27%). Mexico‟s

share in total furniture imports increased one percentage

point to 5%.

Malaysian furniture shipments were up 4% in 2014 ($0.56

billion). Imports from Indonesia increased by 8% to also

$0.56 billion. Both countries‟ imports share was

unchanged at 4%.

Wooden furniture imports from other countries were down

in 2014, despite higher shipments from Europe last

summer.

Uptick in December furniture retail sales

Furniture retail sales in the US increased by 1% between

November to December according to US Census Bureau

data. While the month-on-month growth is small, sales

were 11% higher than in December 2013.

Unemployment down, GDP growth up

The US economy grew by an estimated 2.6% (annual rate)

in the 4th quarter of 2014. GDP growth slowed from the

5% annual rate in the 3rd quarter. The slowdown was due

to higher imports, lower federal government spending,

lower exports and less investment in non-residential

buildings and assets than in the 3rd quarter.

Unemployment was practically unchanged at 5.7% in

January. The number of long-term unemployed and those

who work part-time involuntarily were also unchanged

from December. Employment increased in retailing,

construction and manufacturing.

Economic activity in the manufacturing sector expanded in

January. However, growth in new orders and production

slowed from December, according to the Institute for

Supply Management. Inventories of raw materials were

higher, while raw material prices declined from December.

Both wood products manufacturing and furniture

manufacturing reported increased production in January.

Demand is strong going into 2015, and production should

increase with the labour dispute at the West Coast ports

resolved.

Consumer spending forecast to increase 3.3% in 2015

In January consumer confidence in the US economy

improved by 5% from the previous month.

The latest consumer survey by Thomson

Reuters/University of Michigan recorded the highest

confidence level since January 2004. Compared to a year

ago confidence in the economy improved by 21%.

Consumers believe the outlook for the US economy is

better than any time in the last ten years. Income gains are

expected to be modest in 2015, but personal expenditures

will grow at 3.3% this year.

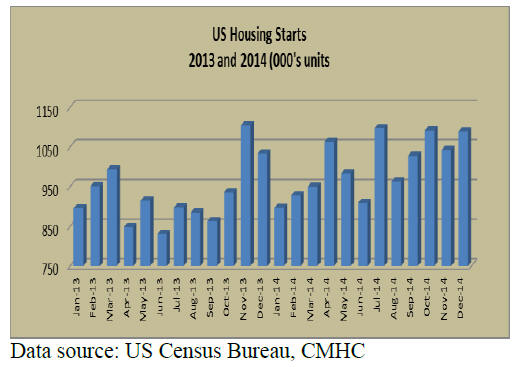

2014 housing starts surpass 1 million

For the first time since 2007 annual housing starts were

over 1 million. Housing starts increased by 4.4% in

December to an annual seasonally adjusted rate of 1.089

million units.

Single-family housing starts grew by 7.2% in December.

Multifamily construction declined by 1%. The Midwest

was the only region with lower housing starts in

December.

Economists at the International Builders‟ Show in Las

Vegas predict significant growth in the housing market in

2015. The National Association of Home Builders

forecasts housing starts to grow by 6.7% from 2014.

Construction of single-family homes is expected to

increase by 26% in 2015.

The number of building permits for single-family homes

increased in December, while multi-family permits

declined.

Oil prices affect Canadian economy

Canadian housing starts decreased by 7% to just under

180,000 in December at a seasonally adjusted annual rate.

Both multi-family and single-family home starts declined.

Home construction is expected to slow further in 2015.

The lower oil prices have a negative effect on housing

demand in oil-producing regions. However, regions with

manufacturing industries benefit from the lower Canadian

dollar, low interest rates and low oil prices. Especially

Ontario will likely see an upturn in economic activity and

construction.

Non-residential construction unchanged

Investment in non-residential construction was unchanged

in December from the previous month, at a seasonally

adjusted annual rate. Construction spending grew from

June to October but has not improved since then,

according to US Census Bureau data.

Trends in private and public construction differed only

slightly. The American Institute of Architects reported

improving business conditions for the end of 2014. The

strongest improvement was in institutional buildings. The

Northeast was the only region where business conditions

worsened.

Trans Pacific Partnership trade deal nears completion

US trade officials urged the US Congress to support the

government‟s plan for the Trans Pacific Partnership trade

deal. The 12-nation trade deal may be completed in

March, according to statements by trade officials.

Then the deal will be submitted to Congress for a yes-orno

vote. Some business groups, unions and other groups

are lobbying against the trade deal.

The trade agreement would cover 40% of the world

economy, including the US, Canada and Mexico in North

America, and Japan, Vietnam, Malaysia and Singapore.

|