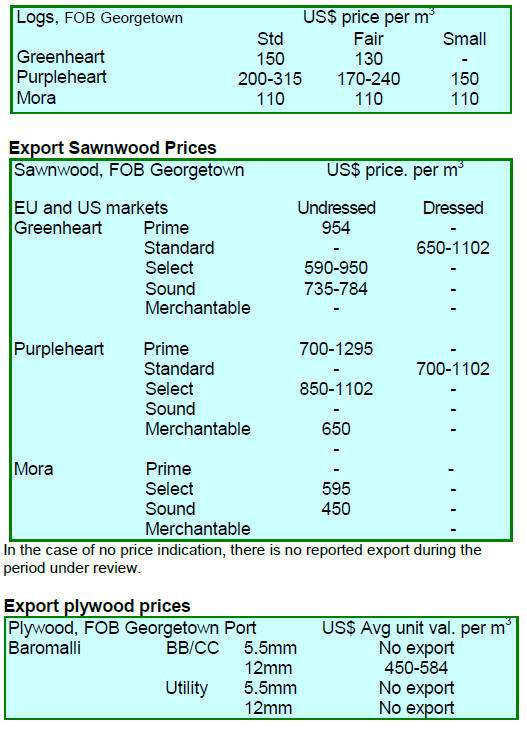

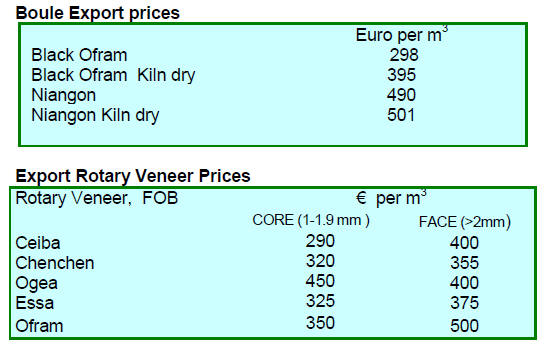

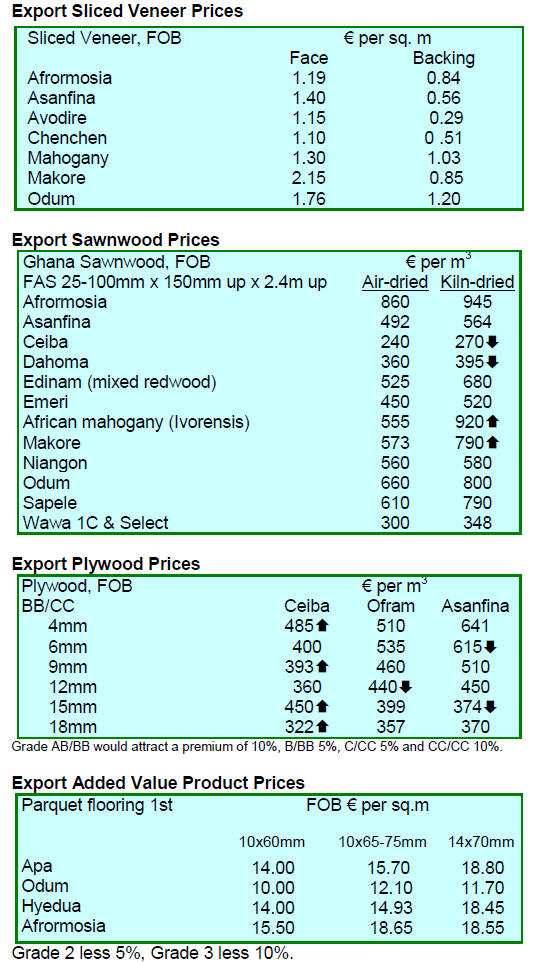

2. GHANA

Air dry sawnwood dominates January exports

The Timber Industry Development Division (TIDD) of the

Ghana Forestry Commission has just released the January

export data which reported wood product exports for the

month amounted to 25,720 cubic metres valued at Euro

12.61 million.

Some 14 products were prossed processed from 34

different species and were shipped by 99 exporters to 33

different countries.

Air and kiln dried sawnwood, poles, plywood (for the

regional market) and billets were the top 5 products

exported in January.

Compared to January 2014, the current export figures

registered increases of 55% and 79% in volume and value

respectively. But when compared to the previous month

(December 2014) both the volume and values fell.

African and Asian markets accounted for 67% of the total

volume exported in January and the TIDD says average

prices edged up in January.

Success in degraded forest recovery

The Minister of Lands and Natural Resources, Mr. Nii

Osah-Mills revealed that the Forestry Commission has

reclaimed a total of 21,665 hectares of degraded forest

land through the National Forest Plantation Development

Programme (NFPDP).

In his speech the Minister said the NFPDP was created to

restore the country‟s degraded forest landscape and that

this effort had created about 2,200 jobs.

Non-food inflation surges

Ghana's annual consumer price inflation rose marginally to

16.6% in March up from 16.5% in February. Government

data shows that the increase was mainly due to rising food

costs for which inflation for March jumped over 7%.

Inflation rates for non-food items (housing, water,

electricity, gas and other fuels) increased over 20% in

March.

As much of the inflationary pressure is due to the

weakened currency the news that Ghana has begun

implementing a three-year IMF programme which the

Ministry of Finance says will stabilise the Cedi exchange

rate and create a better commercial environment.

3. MALAYSIA

Authority to control timber trade

transferred to State

Governments

The Sabah State Legislative Assembly has enacted a new

law strengthening monitoring and regulation of the trade

in wood products set to come into force on 1 May this

year. The driving force behind this is the issue of legality

in the timber trade.

Ellron Angin, from the Chief Ministers office said this

new law was one of the first after the Federal government

transferred the authority to control timber imports and

exports to the State Government.

The new law gives the Director of Forestry the power

collect and maintain statistics on the timber trade, conduct

research and investigations as well as monitor and control

the trade.

The Director will have the power to issue licenses,

certificates and approvals in respect of the timber industry,

to impose fees and charges. Under the new law timber

exporters and importers must provide details of their trade

to the Director of Forests.

Sarawak replaces 1958 Forest law

The Sarawak State Assembly has also strengthened its

Forestry laws with the passing of the Forest Bill 2015.

This law aims to enhance forest protection and

incorporates tough penalties for illegal logging.

Awang Tengah Ali Hasan, Second Minister for Resource

Planning and Environment, called for cooperation from

the Forest Department, Sarawak Forestry Corporation,

police, Malaysian Anti-Corruption Commission (MACC),

Malaysian Maritime Enforcement Agency (MMEA) and

the Customs Department to enable the law to be

effectively enforced.

The Forests Bill, 2015 replaces the Forests Ordinance

(Cap. 126) of 1958 and its various amendments.

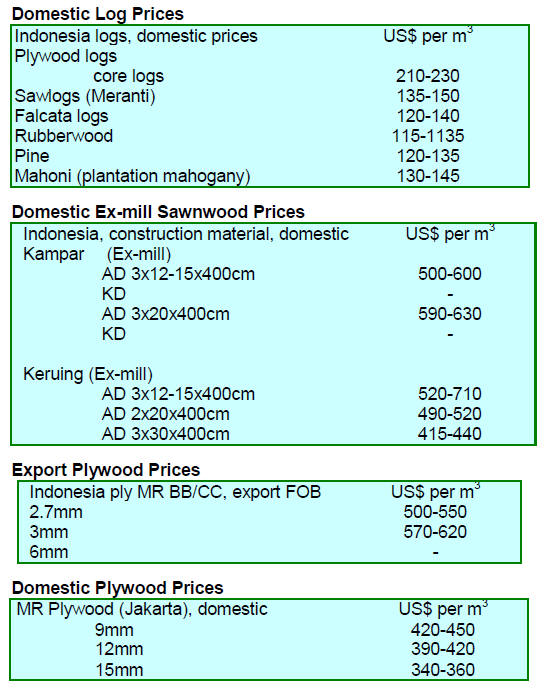

4. INDONESIA

Easing SVLK for small companies

criticised

Environmentalists have criticised the government‟s

decision to ease the SVLK/TLAS requirements for small

and medium furniture and craft manufacturers. But there is

some confussion on what the government intends.

The Chairman of the Indonesia Rattan Furniture and Craft

Association (AMKRI), Soenoto, said furniture and

handicraft SMEs will be exempted from the SVLK but on

the other hand, Widayati Soetrisno of the Indonesian

Furniture Entrepreneurs Association (Asmindo), said that

without the SVLK Indonesian furniture and craft exporters

would face major challenges in international markets.

For more see:

http://silk.dephut.go.id/index.php/article/vnews/129

http://silk.dephut.go.id/index.php/article/vnews/128

Cultural change needed to secure forest

The Indonesian President has assured Norway that his

government was as committed to improving

environmental protection as the previous administration.

Norway concluded an arrangement with the previous

government pledging around US$1 billion to help

Indonesia protect its forests.

Indonesia imposed a temporary moratorium on forest

clearing under the arrangement with Norway but progress

on halting deforestation and on reigning in forest clearing

has been slow.

The Norwegian and Indonesian governments have come to

realise realistic targets must be set and that to achieve real

progress ¡°a cultural change¡± is needed in Indonesia to

successfully curb deforestation.

Legal Timber Trade Centre proposed

Minister of Environment and Forestry, Siti Nurbaya

Bakar, has indicated that she was in discussions with the

Ministry of Commerce on the establishment of a trade

centre specifically for timber which meets the

requirements of the national timber legality assurance

scheme, SVLK.

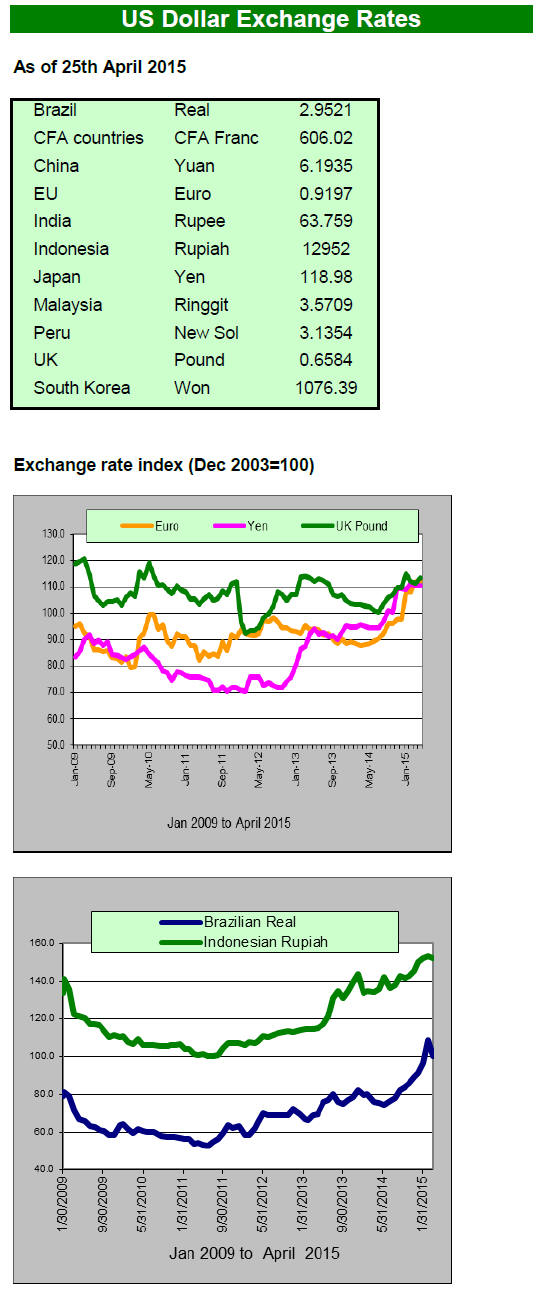

Rising production costs eat into exchange rate

advantage

The steady depreciation of the rupiah against the US dollar

and other major currencies is improving the international

competitiveness of Indonesian manufacturers but rising

labour costs, infrastructure weaknesses and inefficient

ports has generated a feeling that the advantages from a

weaker currency are being lost.

The chairman of the Wood and Rattan Furniture

Association in East Java gas said its members have lost

markets worth millions this year because European and

US buyers switched to buying furniture from China and

Vietnam.

He said the weak rupiah does not compensate for the

overall loss of competitiveness. Manufacturers say the

biggest problem is rising wages, the result of stronger

union activity.

According to JP Morgan, because Indonesia‟s inflation is

higher than in the countries with which it competes the

rupiah‟s real trade-weighted exchange rate is 9.8 percent

stronger than in mid-2014. Such a situation spells disaster

for exporters.

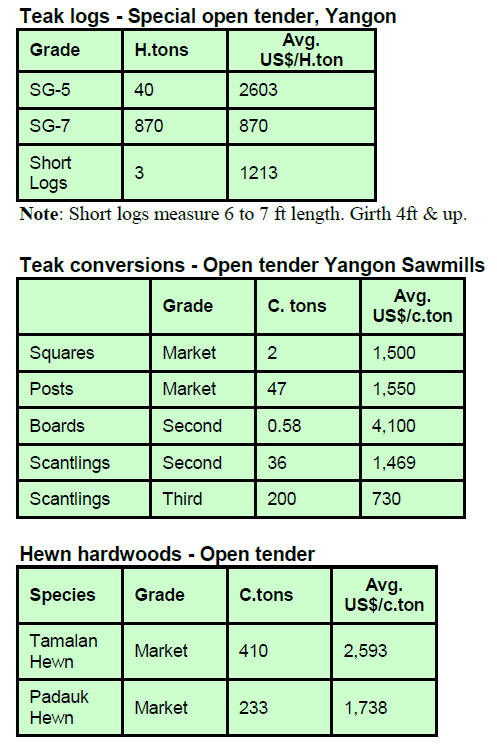

5. MYANMAR

Yunnan crackdown on illegal border trade

According to the Myanmar „Eleven Media Group‟ which

quoted private sector sources, the Yunnan provincial

government has alerted the government in Myanmar of its

operation targeting the illegal border trade. The effort will

focus on the boder areas in in Honghe, Dehong, Wenshan

and Xishuangbanna.

A Myanmar entrepreneur is quoted as saying ¡°Myanmar

will cooperate with the Yunnan government on the twomonth

crackdown in order to effectively control the region

where illegal trade is rife and ensure the stability and

sustainable development of the border region.¡± The Muse-

Namkham Border Trade Association has distributed a

letter to many organisations which it was said, came from

the Myanmar Consulate General in Kunming.

Analysts note strict action was taken against those

involved in illegal trade on the Chinese side of the border

and the tightening of inspections may impact legitimate

trade across the border.

It has been estimated by Myanmar‟s Department of

Commerce and Consumer Affairs that the China-Myanmar

border trade exceeded US$5 billion in the year to April

2015, up by nearly US$2 billion from the previous year.

For more see:www.elevenmyanmar.com/business/chinacrackdown-

illegal-border-trade

Foreign banks open for business in Yangon

Under economic reforms that began in 2011, Myanmar

granted nine foreign banks licenses to operate in the

country on a provisional basis.

Sumitomo Mitsui Banking Corporation, Bank of Tokyo-

Mitsubishi UFJ and Singapore‟s Overseas Chinese

Banking Corporation became the first to offer services in

Myanmar following the approval of license applications

last year.

The three banks are the first foreign banks to operate in the

country for more than 50 years. For more see:

www.irrawaddy.org

First tender of fiscal 2015/16

The Myanma Timber Enterprise concluded its first tender

of the new fiscal year on 24 April. This was the first tender

for the new fiscal year 2015-16.

Prices secured are shown below. Log prices are

expressed

in hoppus tons (H.tons) and prices for „conversions‟ and

sawn teak (including hewn timber) are shown in cubic tons

(C.tons). Average prices are in US Dollars. Bid prices for

Sawing Grade SG-7 ranged from US$510 to US$1218.

Tamalan and padauk seem to be out of favour at

present as

reflected in the lower than usual prices.But it is noted that

the grade offered was only „Market Quality‟.

The logs sold in the open tender for which prices

are

shown above were those remaining unshipped after the log

export ban entered into force on 1 April 2014.

6.

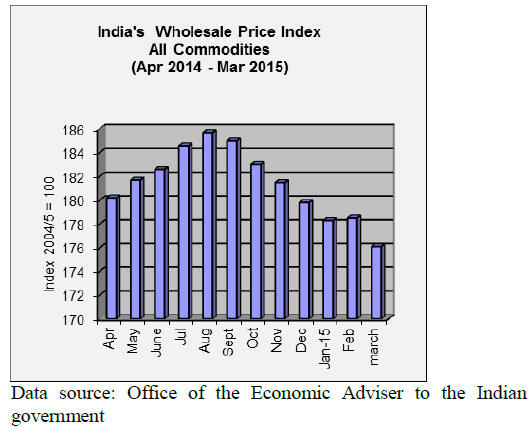

INDIA

Welcome decline in inflation

The Office of the Economic Adviser (OEA) to the Indian

government provides trends in the Wholesale Price Index

(WPI).

The official Wholesale Price Index for All Commodities

(Base: 2004-05 = 100) for March rose by 0.02% to 176.1

from 175.8 in February.

The year on year annual rate of inflation, based on

monthly WPI, stood at -2.33% (provisional) for March

2015 compared to -2.06 for February.

For more see:

http://eaindustry.nic.in/cmonthly.pdf

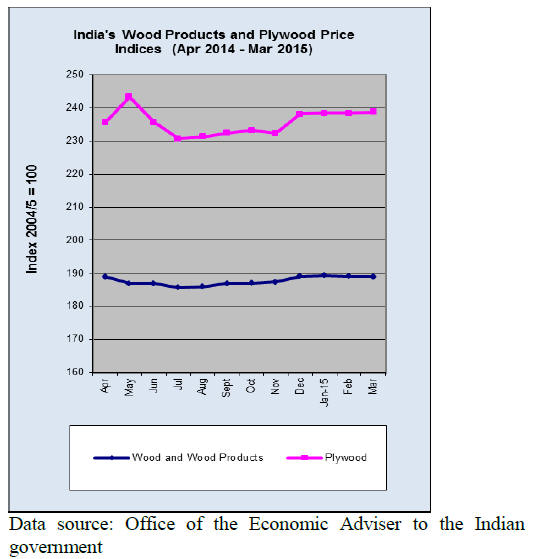

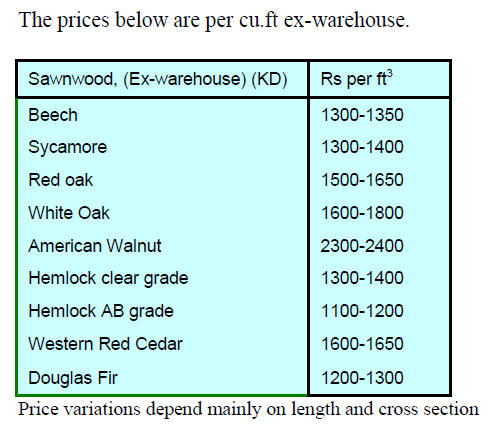

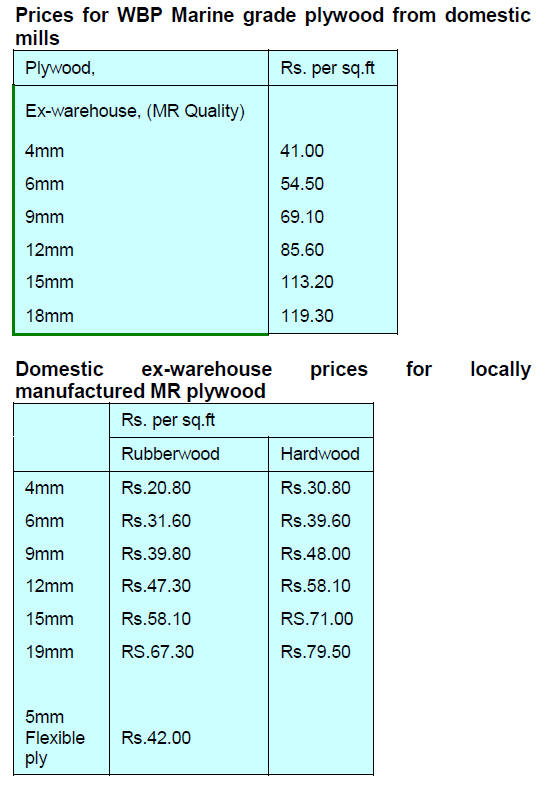

Timber and plywood wholesale price indices

The OEA also reports Wholesale Price Indices for a

variety of wood products. The Wholesale Price Indices for

Wood products and Plywood are shown below.

The March price index for wood and wood products

declined slightly while the March index for plywood rose.

See

http://eaindustry.nic.in/display_data.asp

Andhra Pradesh seeks removal of ban on red sanders

felling

The Andhra Pradesh state government has approached the

Ministry of Environment, Forests and Climate Change

(MoEFCC) requesting the lifting of the ban on felling red

sanders, a decision that has attracted strong criticism

across India.

The state government is in financial difficulties so is

proposing selling this rare and highly expensive wood in

the international market.

Red sanders was placed on the endangered list by the

Convention on International Trade in Endangered Species

(CITES) in 1995 with the support of the Andhra Pradesh

state government.

The state government says listing is no longer appropriate

because of the healthy state of red sanders resources and

as such there is no justification for its listing as an

endangered species.

The state government says the timber is available in the

Seshachalam forests in an area of about 5,500 sq km

where there is an estimated 14 million red sanders trees.

The state government has estimated that the international

market for red sanders is around 3,000 tonnes annually.

Some 3,500 tonnes of red sanders logs will be auctioned in

May this year. The state government has secured

exemption from CITES for the current round of auctions.

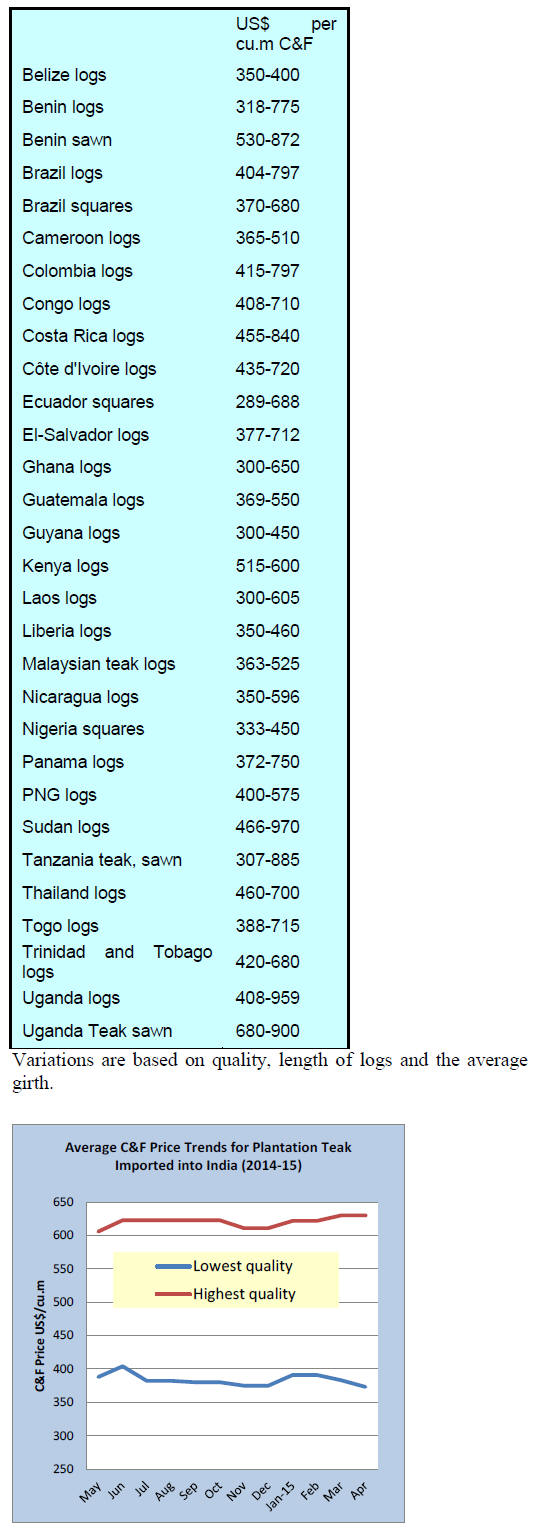

C&F prices for plantation teak

The flow of plantation teak imports is reported as

satisfactory and demand levels in the Indian market

remain unchanged.

Importers note an improvement in the volumes of larger

sized logs becoming available from shippers and this is

reflected in slightly higher top end prices.

A parcel of 445 cubic metres of plantation teak logs

arrived last month from Vietnam at US$515 per cubic

metre C&F. Traders report a steady flow of plantation

teak.

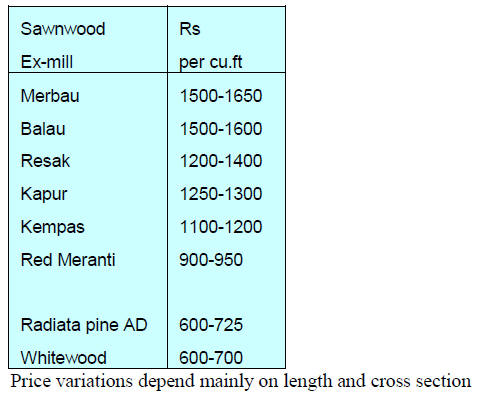

Prices for domestically milled sawnwood from

imported logs

Overall, prices remain firm despite a dip in merbau and

balau prices over the past weeks.

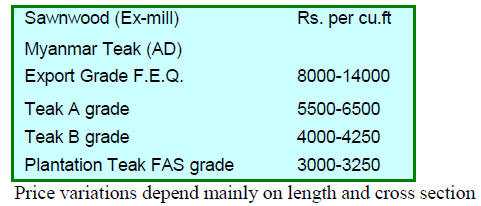

Myanmar teak arrivals

The volume of sawn teak imports from Myanmar is

increasing and some price movements have been reported.

Imported 12% KD sawnwood prices

The market for imported US sawnwood is small in India

but there is growing interest in US logs.

Data from the United States Department of Agriculture

(USDA ) show that US sawn hardwood and veneer exports

to India reached US$ 2.14 million in 2014.

Exports of US sawn hardwoods were valued at US$1.6

million in 2014 a fall of around 24% year on year.

However exports of US hardwood veneers to India rose

almost 20% to US$ 1.5 million in 2014 while US

hardwood log exports to India were valued at US$ 2.25

million in the same year.

The American Hardwood Export Council (AHEC) plans to

run grading and design seminars for Indian importers,

manufacturers and specifiers in the second half of 2015.

According to the USDA the main species of sawnwood

exported to India in 2014 were hickory, ash and white oak.

Beech veneer an alternative for gurjan

Plywood prices in India remain unchanged. The Indian

housing sector remains very quiet with buyers

complaining of high prices. The recent reduction of

interest rates on home loans has had little impact and it is

only in the new satellite cities where there are

opportunities for wood product manufacturers.

Plywood manufacturers have found that beech is a suitable

replacement for gurjan core, back and face veneer which is

opening up new opportunities for overseas suppliers of

beech.

7.

BRAZIL

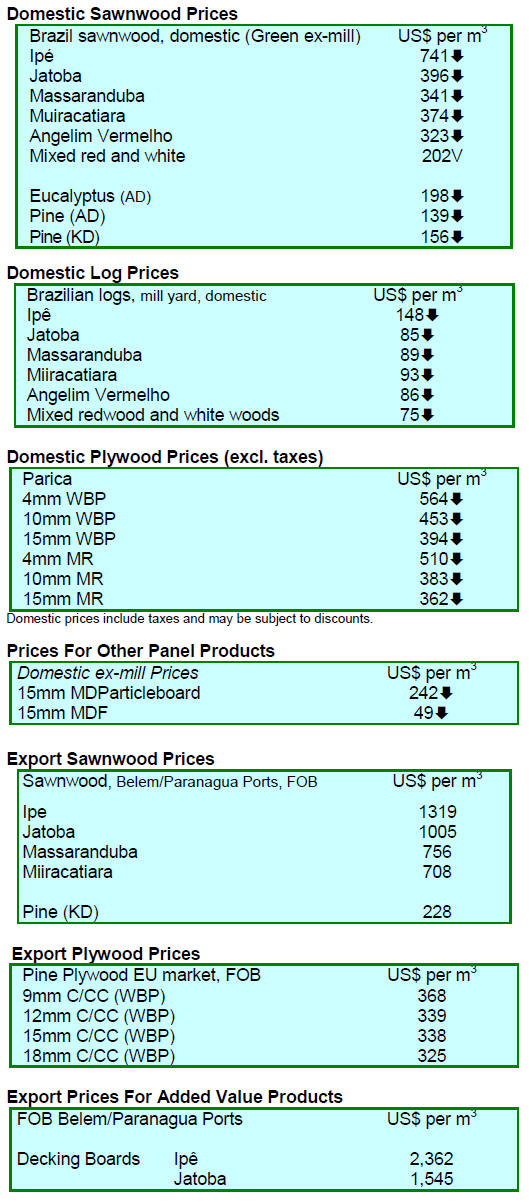

March export performance

In March 2015, Brazilian exports of wood-based products

(except pulp and paper) increased 29% in value compared

to March 2014, from US$218.6 million to US$282.3

million.

Pine sawnwood exports increased 45% in value in March

2015 compared to March 2014, from US$17.5 million to

US$25.4 million. In terms of volume, exports increased

43%, from 75,500 cu.m to 108,300 cu.m over the same

period.

Tropical sawnwood exports increased almost 38% in

volume, from 22,600 cu.m in March 2014 to 31,100 cu.m

in March 2015 while the value of exports increased 24%

from US$13.3 million to US$ 16.5 million, over the same

period.

Pine plywood exports jumped 26.5% in value in March

2015 in comparison with March 2014 from US$37.0

million to US$ 46.8 million. The volume increased 28.9%,

from 98,800 cu.m to 127,400 cu.m, during the same

period.

Reflecting the growing interest in international markets it

is no surprise that tropical plywood exports increased

almost 138% in volume, from 4,000 cu.m in March 2014

to 9,500 cu.m in March 2015 and the value increased from

US$2.3 million in March 2014 to US$4.7 million in March

this year.

Exports of wooden furniture have started to recover with

March exports totalling US$46 million up from US$41

million in March 2014.

Turning back to international markets

Brazil is currently facing economic difficulties, investment

rates have fallen and the construction and building sectors

are in decline which negatively impacts demand for wood

products. Because of this domestic millers and

manufacturers are directing efforts to international

markets.

Ten years ago a significant number of domestic timber

companies abandoned the international market as they

could not compete due high production costs and an

unfavourable exchange rate. During this period the timber

industry directed output to the domestic market which was

expanding, driven primarily by the construction sector.

Now the situation is different, domestic demand for wood

products is shrinking and the appreciation of US Dollar

against the Brazilian currency favors exports. As a result

many timber companies are turning back to international

markets.

However, Brazilian exporters face some challenges as in

many international market sectors competitors secured a

firm footing when Brazilian exporters withdrew.

The challenges facing Brazilian exporters include: pricing

as most commodity prices have fallen (ii) exchange rate

volatility (iii) the increase in number of shippers to

international market and (iv) domestic inflation which

continues to push up production costs.

Inflation close to record high

Brazil‟s Consumer Price Index (IPCA) recorded a 1.3%

increase in March 2015 after rising 1.22% in February

2015. This is the highest monthly rate since February 2003

when it topped 1.6%. Over the twelve months to March

the IPCA climbed over 8%.

The march figure is well above the government's target

ceiling and the government is striving to keep consumer

price growth at no more that 4.5% (+ - 2%) for the year.

The average exchange rate in March 2015 was BRL

3.14/US$ significantly down on the BRL 2.33/US$ twelve

months ago and the March figure represents a sharp

depreciation of the Brazilian currency against the US

Dollar.

At its last meeting the Monetary Policy Committee

(COPOM) of the Brazilian Central Bank (BCB), set

interest rates at 12.75% per year but analysts expect a

further hike at the next meeting.

2016 Forest concession plan open for public comment

The Brazilian Forest Service (SFB) has made available the

2016 Annual Plan for Forest Concessions (PAOF) for

public consultation. The PAOF is prepared annually in

order to plan allocations of forest concessions.

The PAOF 2016 covers ten concession areas totalling 2.6

million hectares. Entrepreneurs can secure access to public

forests for sustainable logging through these forest

concessions.

Comments and suggestions can be made any individual or

agency up until May 8th. Suggestions and comments

received will be evaluated before the final document is

published in late July, 2015.

Interventions in flood forests

Flood forests are some of the most vulnerable ecosystems

in the world and flood forests extend over a wide area in

the Amazon but here less than 2% of this ecosystem is

total protected.

In Brazil, the proximity of flood forests to navigable

waters and urban areas creates great pressure on this

ecosystem. The Bel¨¦m municipality (Par¨¢ state) has some

protected areas but it has been estimated that 70% of this

forest type has been disturbed due to illegal cutting and

clearing.

The Flood Forests Anthropization Index (FFAI) aims to

preserve these threatened areas through intervention but

lacks the resources to adequately tackle the problem.

¡¡

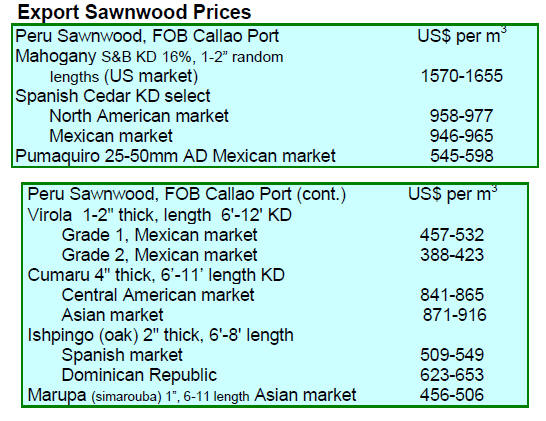

8. PERU

Spanish particleboard ¨C a strong presence

in the

Peruvian market

The consumption of Spanish particleboard in the Peruvian

market more than doubled in the first quarter of this year

due largely to the efforts of the Martin Peru Group.

The Spanish share of Peruvian particleboard imports grew

to around 20% in the first quarter, up 11% on first quarter

in 2014.

High preference wood products

According to a study by the Institute of Higher Education

Private Construction Technology (Capeco), 65% of home

owners in Lima chose wood products (floors, doors,

windows, furniture, etc.) over other materails for their

homes.

The executive director of the Center for Technological

Innovation Wood (CITEmadera), Jessica Moscoso, said

that the Lima housing market absorbed 29,000 new homes

in 2104.

Gustavo Delgado a specialist at CITEmadera, said the

market for wood products, whether domestic or imported,

will continue to grow if the housing market maintains its

upward growth.

He noted that imports of furniture and wood products were

worth more than US$865 million in 2014.

Tenth Annual MegaFlorestais

The Ministry of Agriculture and Irrigation (MINAGRI)

through the National Forest and Wildlife Service

(SERFOR) with participation of the US based Initiative

for the Rights and Resources

(http://www.rightsandresources.org/) hosted the Tenth

Annual MegaFlorestais in mid-April bringing leaders from

forestry agencies in countries with a large forest cover.

Participants were from Russia, Brazil, Cameroon, Canada,

China, United States, Democratic Republic of Congo,

Indonesia and Mexico.

The objective of the meeting was to promote an exchange

of skills in forest management and industry, promote the

role of public forest agencies and strengthen skills to

assume leadership in promoting the contribution of

forestry to social and economic development.

The topic of the meeting was "Combating Deforestation

and Promoting the Contribution of Forestry to the Green

Economy", with a focus on the importance of forest

resources, trade and government policies, among others.

9.

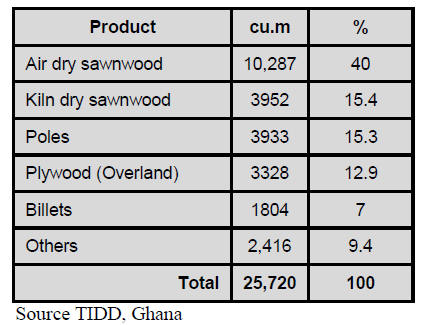

GUYANA

Wrapping up talks with EU on forest law

enforcement

mechanism

As part of its Forest Policy implementation the

Government of Guyana wrapped up talks with the

European Union on the Voluntary Partnership Agreement

(VPA). Guyana is committed to signing a VPA with the

EU in the latter part of 2016.

The VPA is a key element of the EU‟s Forest Law and

Enforcement Governance and Trade (FLEGT) Action Plan

and the Guyana government is convinced a VPA would

facilitate increased market access for Guyana‟s timber into

the lucrative EU market.

The FLEGT VPA process also provides an opportunity for

Guyana to further strengthen and mainstream its

consultation and engagement process to enhance forest

governance, improve legal compliance and build incountry

capacity for community engagement in forest

policy development and implementation.

The EU and Guyana successfully concluded the third

negotiation session on 16April. Guyana was represented

at this session by the National Technical Working Group

(NTWG) ¨C a multi-stakeholder group comprising

representatives of the Private Sector, indigenous bodies

and Government agencies selected through a participatory

process.

At this negotiation session, the parties committed to

maintaining the momentum to reach an agreement that

considers the views of all relevant stakeholders. The

parties also committed to further promoting the

identification of synergies amongst FLEGT; Reduction of

Emissions from Deforestation and Degradation (REDD+);

and the Low Carbon Development Strategy (LCDS)

processes.

Additionally, the parties agreed to continue examining the

framework under which these initiatives can be further

integrated and be mutually supportive.

Both parties acknowledged the progress that has been

made since the last negotiation session and during this

session, including the revision of the joint roadmap. The

next negotiation session would be held in Brussels in

November 2015

First quarter jump in export earnings

Earnings from wood product exports increase during the

first quarter of this year to US$12.3 million compared to

the US$8.2 million in the same period last year.

Sawnwood exports in the first quarter 2015 amounted to

US$ 4.9 million as compared to US$4.2 million in the first

quarter last year 2014, an which reflects an increase of

16%.

Exports of processed roundwood (piling, transmission

poles and posts) as well as charcoal contributed to the

overall increase in export earnings.

In contrast to the improvement in export earnings detailed

above, plywood exports fell in the first quarter, dropping

to US$200,000 compared to the US$400,000 in 2014.

Guyana‟s exports of roofing shingles contributed just

US$300,000 to first quarter 2015 earnings compared to the

US$400,000 sold in the same period in 2014.

The main export destinations during the first

quarter

include Europe, Middle East, North America, Oceania and

other South American countries. Guyana‟s Forest Products

Development and Marketing Council continues to

encourage downstream processing of high value wood

products.

Export prices

There were exports of greenheart, purpleheart and mora

logs in the period reported.