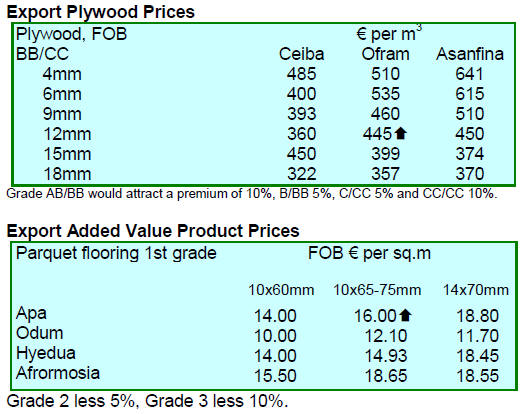

2. GHANA

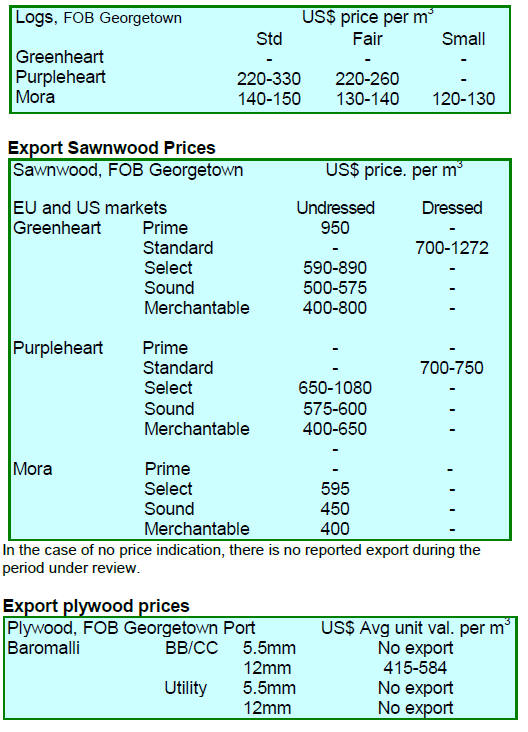

Exports 27% lower in third quarter 2014

Contracts covering export shipments of 120,588 cu.m

were approved by the Timber Industry Development

Division (TIDD) of the Forestry Commission during the

fourth quarter of 2014. This represented a decline of 27%

when compared to the volume approved for export in the

third quarter of the same year.

The main reason behind the decline in fourth quarter

exports was the sharp fall in teak logs/billet exports where

a 52% fall was recorded.

Exports of plywood to the neighbouring West African

countries and other international markets fell 9% and 20%

respectively compared to the third quarter.

An analysis of fourth quarter contracts showed that

exports of all categories of wood products (primary,

secondary and tertiary) fell from the previous quarter. The

table below shows the comparative analysis;

For 2014 exports of primary products accounted for

approximately 24% of all exports while secondary and

tertiary products accounted for 74% and 2% respectively.

Neighbouring countries the main market for plywood

West African markets continue to be the major

destinations for Ghana‟s plywood. Of the 12,058 cu.m

approved for export in 2014, 97% was destined for

countries in the West Africna sub region with Nigeria

being the major importer.

Almost all the tertiary products, sliced veneer and kiln

dried lumber were shipped to European markets.

The United States continued to be an important market

especially for mahogany and cedrella sawnwood and

rotary peeled veneer. The Middle East and Egyptian

markets emerged as major destinations for backing grade

veneer. Little interest has been generated for any product

other than teak sawnwood and logs and gmelina logs in

India.

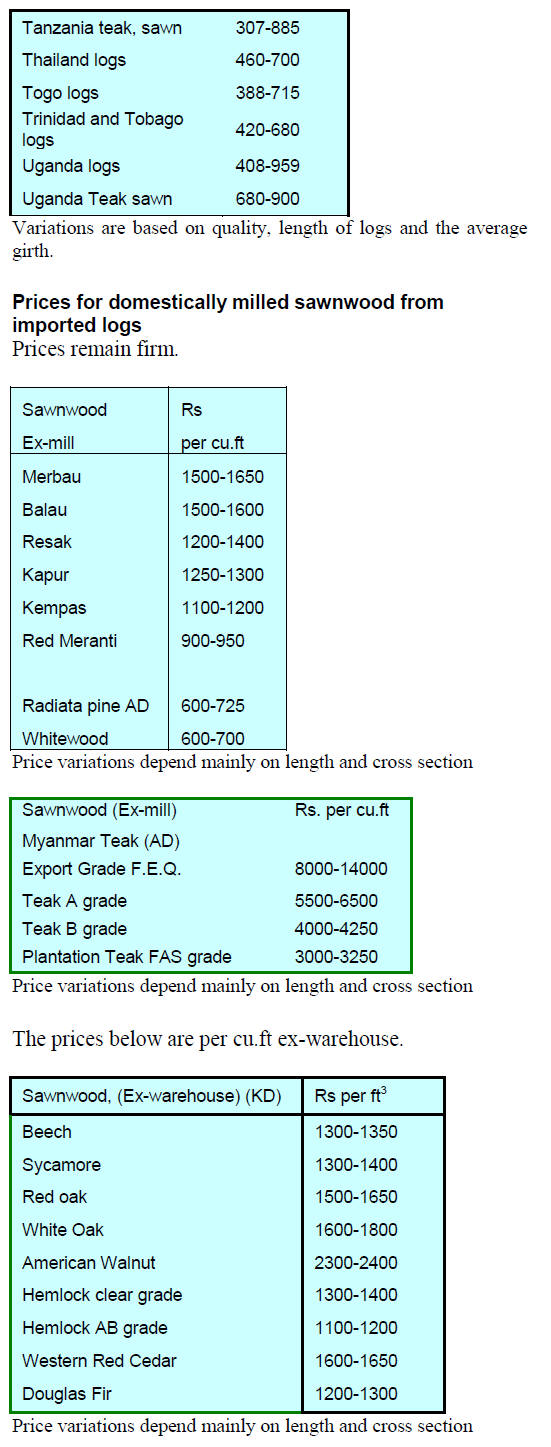

3. MALAYSIA

National ˇ®heritage treeˇ± scheme underway

The National Landscape Department (NLD) of Malaysia‟s

Ministry of Urban Wellbeing, Housing and Local

Government has published a list of national heritage trees

in order to draw attention to unique and ancient individual

trees in the country.

The concept of heritage trees emerged after a property

development company was fined RM 966,000 (approx.

US$270,000) for the unauthorised felling of trees on a

housing development site.

The NLD surveyed parks, roadsides, car parks and

riversides in 28 local authority urban areas to identify

heritage trees. To be classified as a heritage tree the tree

should have a special value in terms of natural beauty or

contribute to the landscape‟s aesthetics. Rare and

endangered tree species are also labelled heritage trees.

The listed trees have been assigned a price to deter felling

with the most expensive tree in the country, a Pokok Ara

(Ficus benjimina) in the state of Pahang, being valued at

over RM1.5 million (approx. US$400,000).

The NLD continues to work with local councils to educate

the public on the importance and value of heritage trees, as

well as developing an online map of the trees.

Unions fail to get minimum wage increased

Despite trade union Labour Day calls for an increase in the

minimum wage the prime Minister has said that for now

the minimum wage must as it is. The PM pointed out that

it was only a year and a half ago that the rate was

increased.

The minimum wage policy in Malaysia decided in 2013

was fully implemented in January last year and was set at

RM900 per month for workers in Peninsula Malaysia and

RM800 for those in Sabah and Sarawak. The minimum

wage must be reviewed once in two years under the

Minimum Wage Order 2012.

However the Malaysian PM proposed the country‟s

Social

Security Organisation‟s (Socso) protection scheme,

presently covering those with a monthly income of

RM3,000 (approx. US$ 835) and below, be extended to all

workers in the private sector regardless of their salaries.

If implemented this would increase the number of

employees protected under Socso by 500,000 from the

present six million.

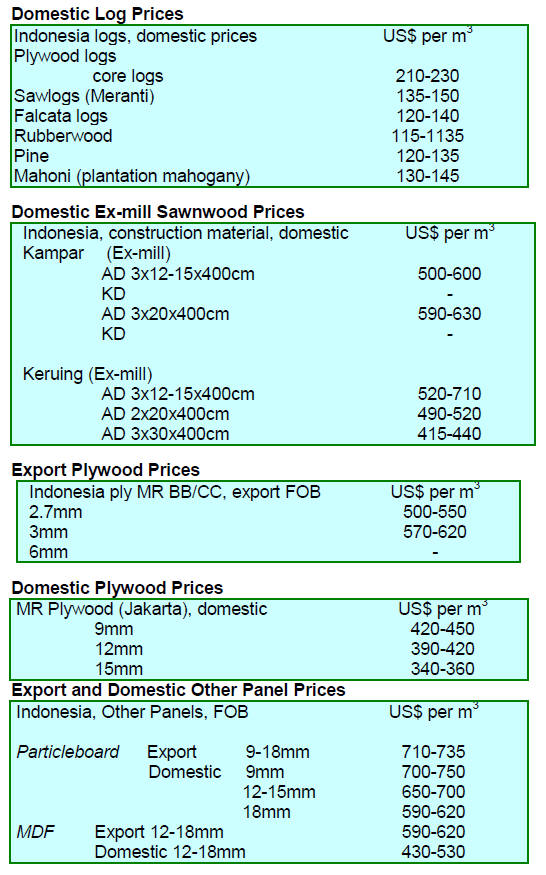

4. INDONESIA

Moratorium on forest clearing to be

extended and

strengthened

The current moratorium on new plantation concessions

involving the clearing of primary forests and peat land

expired on 13 May. However, prior to the expiration the

Environment and Forestry Ministry indicated not only

would it be extended but also strengthened.

Secretary-Genera,l Hadi Daryanto, in an interview

reported by the Jakarta Post, said the new regulations will

be more inclusive and target specific institutions such as

the Public Works and Housing Ministry, the Agriculture

Ministry and the National Land Agency.

In related news, the Executive Director of the Riau chapter

of the Indonesian Forum for the Environment (Walhi), has

called for more drastic action and demands the conduct of

an audit and evaluation of concessions granted before a

moratorium.

This call comes after it was discovered that forest clearing

permits in the forests of Riau have been over-issued since

2009.

Ministry criticised for no public disclosure of

documents

The Indonesian Environment and Forestry Ministry is

defending its decision not to release what it deems to be

confidential documents but which several civil society

organizations say are key to its mandated role to monitor

the performance of the forestry sector.

Forest Watch Indonesia (FWI) said it had been denied

access to four documents which they claim are essential if

FWI is to monitor the implementation of the domestic

timber legality verification system (SVLK).

The four types of documents requested by FWI are the

Timber Usage Working Plan (RKUPHHK), the Annual

Timber Usage Working Plan (RKTUPHHK), the

Industrial Material Fulfillment Plan (RPBBI) and the

Timber Exploitation Permits (IPK).

Q1 GDP growth target missed

Indonesia‟s year on year GDP growth in the first quarter

of this year was 4.7%, slightly worse than forecast. As a

result analysts have raised concerns about growth

prospects for the rest of the year.

The poor first quarter results were largely because of a

drop in export earnings, a reflection of a sluggish global

economy and low commodity prices.

On the domestic front, consumers are bearing the brunt of

high interest rates and businesses are holding back on

expansion plans. When slow government spending is

added to the mix, prospects for high growth begin to fade.

Going forward, there are further risks to growth from

weaker economic growth in China and Japan this year,

Indonesia‟s key trading partners. China and Japan account

for about 20% of Indonesia‟s non-oil and gas exports.

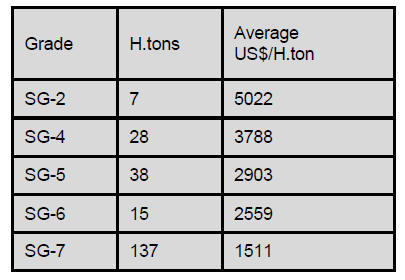

5. MYANMAR

New faces in Myanmar Timber Merchants

Association

The Myanmar Timber Merchants Association (MTMA)

has elected new executive committee members for 2015-

16.

The President is Dr. Sein Win, the Vice President is U Tin

Oo and the Secretary is U Kyaw Kyaw Win. Most of the

previous committee members are not included in the new

executive.

Timber industry circles keenly await news on

developments and hope that the FLEGT and certification

processes continue uninterrupted.

Timber export earnings decline

The domestic press, Eleven Media, quoting a Ministry of

Commerce source, says that Myanmar earned US$94

million from wood product exports in fiscal year 2014-15,

down significantly from the previous year.

Severe penalties for timber smuggling planned

Harsher penalties for timber smuggling are being

considered in a revised version of the Forest Law. The

changes are being made in response to the rise in illegal

felling and smuggling.

The indications are that penalties under the law will be

much harsher than in the current law such that the

previous one year jail term will be extended to five years.

The amendments to the law will cover jail sentences and

the level of fines.

April log sales

The following timber was sold by the Myanma Timber

Enterprise by tender on 27 April 2015. The volume of logs

is expressed in hoppus tons (H.tons) and the volume of

conversions or sawn teak including hewn timber are

shown in cubic tons (C.tons).

Myanmar Kyat weakens against the dollar

The US dollar strengthened against the Myanmar Kyat in

recent weeks. The Kyat was trading at MMK1020 per US

dollar during the first week of April but it ended the month

at MMK1098 and continued to weaken to around

MMK1100 in mid-May.

6.

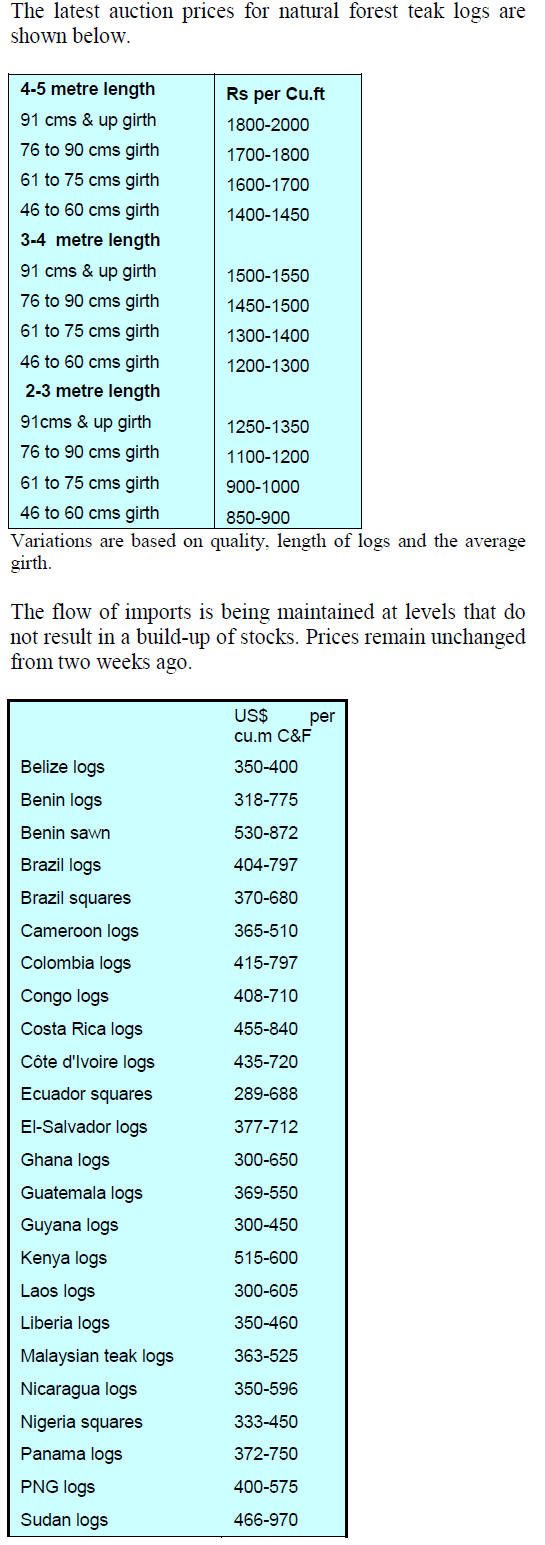

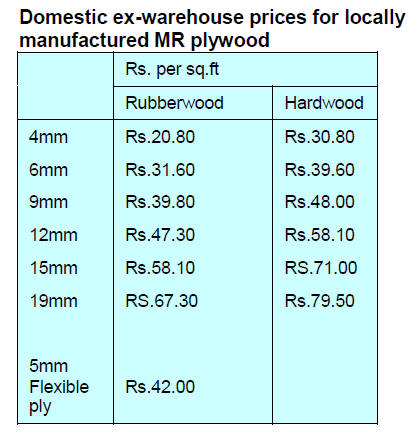

INDIA

Rising list prices disguise heavy

discounts on offer in

housing market

According to figures from the property research firm

Liases Foras, there was over 800 million sq ft of unsold

housing stock at the end of 2014 and that sales in the final

quarter of 2014 fell 8%.

While list prices for new homes rose in the final quarter of

2014 this hides the heavy discounts on offer from builders

who are anxious to generate cash flow in the dull market

conditions.

Yashwant Dalal, President of the Estate Agents

Association of India, says even with the higher incentives

being offered to brokers, the problem is the lack of buyers.

Analysts anticipate a rise in demand only when interest

rates on home loans come down.

It has been estimated that, given the completed stock of

new homes, even with a 1% fall in interest rates it will

take around 40 months for this stock to be cleared at

current rates of sales.

Property Fair in Abu Dhabi

In related news an India Property Fest will be held in Abu

Dhabi 29-30 May. Abu Dhabi has a large Indian expatriate

population. Builders from India will present their

selecetion of residential and commercial properties.

Representatives from financial institutions will also be

present to offer financing. In a press release the organisers

offer some insights into the Indian housing market:

• a dynamic and organised sector with a long-term

road map for growth

• the sector is the second largest employer after

agriculture

• the sector is set to grow at 30% over the next decade

• there is firm demand for office space in India‟s

leading urban and semi-urban centres

• the market is expected to grow to US$180 billion

by 2020

Bengaluru, Chennai, Hyderabad, Mangaluru, Mumbai,

New Delhi, Goa, Kerala and Pune are some of the most

favoured locations for investment.

For more see

http://www.daijiworld.com/news/news_disp.asp?n_id=317

372

Teak sales in Central India forest depots

Log auctions were held at Timarni, Khirakia, Narmada

Nagar, Ashapur and other depots in Central India and sales

were brisk as the quality of the logs was good and millers

were active in the market. Around 3,000 cubic metres of

logs were successfully auctioned.

Plywood and laminates market review

US based Research and Markets (R&M) recently

announced the release of a market report ˇ°Indian Plywood

and Laminates Market: Trends and Opportunities 2015-

2019ˇ±

See

http://www.researchandmarkets.com/research/g5lclq/indian_plywood

This report offers an insight into the plywood and

laminates market in India. The press release from R&M

says ˇ°The report assesses the market sizing and growth of

the Indian plywood and laminates and analyses various

market segments and major end users.

The report also discusses key factors driving growth in the

sector, major trends and challenges faced by

manufacturers of plywood and laminates.ˇ±

In introducing the report R&M state ˇ°the market for

plywood and laminates is mainly driven by increasing

demand from housing market. The demand has increased

due to growing significance of new construction industry.

Plywood and laminates have become an indispensable part

of big and evolving markets like real-estate market,

furniture market, modular kitchen market as well as the

flooring market. The increased demand in these markets

triggers the demand in the plywood and laminates market.

Apart from this, increasing urban population, rising per

capita income and a gradual shift towards non-food

industry are other key factors driving the growth of

plywood and laminates industry in India.

Further, the implementation of Goods and Services Tax

(GST) in the near future will provide an impetus to

plywood and laminate industry.ˇ±

7.

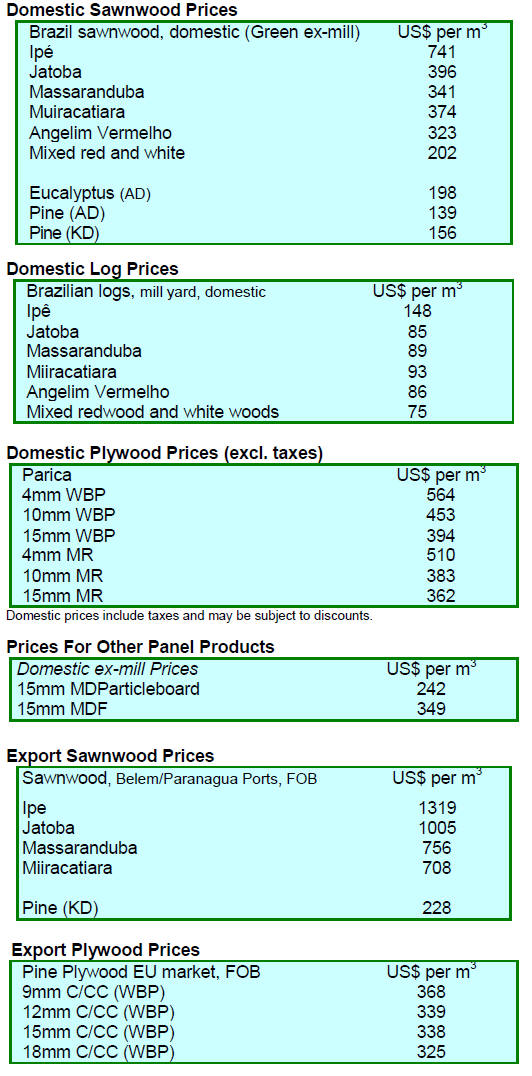

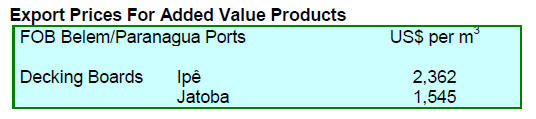

BRAZIL

Amazon forest concessions approved

40 year concessions have been approved in four

management units in the Altamira National Forest (Par¨˘

state). The concessions cover an area of approximately

362,000 hectares.

Altogether the Altamira National Forest extends over

725,000 hectares in the municipalities of Altamira, Itaituba

and Trairão.

The area currently under concession management in the

Altamira National Forest can produce around 200,000

cubic metres of logs annually. It is expected that the new

forest concessions will generate R$80 million in annual

revenues and create around 900 jobs.

According to the Ministry of Environment (MMA), forest

concessions are a socioeconomic solution that guarantees

the viability of conservation actions through slowing

deforestation. Additionally, concession management

impacts the behavior of local communities and consumers

who learn to appreciate legally harvested timber.

Furniture manufacturers struggle against weak

domestic demand

According to the Furniture Industry Association of Rio

Grande do Sul state (MOVERGS) and the Institute of

Studies and Industrial Marketing (IEMI) Brazilian

furniture production fell by almost 11% in February.

Amongst producers in Rio Grande do Sul State, one of the

leading furniture producer states, the decline was just over

19%.

This downturn in factory output reflects mainly a decline

in domestic demand. Also, in the first two months of this

year Brazilian furniture exports totalled only US$85

million, a 14% decline compared to the same period in

2014.

The latest figures also show that furniture prices have

increased by almost 4.5% over the past 12 months and the

authors of the study say this is mainly the result of higher

production costs driven up by rising energy costs.

While some 1,900 new jobs were created in the furniture

sector in January only 24 new posts were registered in

February. Overall employment in the Brazilian furniture

manufacturing sector as of February this year was 275,173

of which 39,308 posts were registered in Rio Grande do

Sul state.

African mahogany has great potential in Brazil

The 2nd International Workshop on African mahogany

was held in late April in São Paulo bringing together

exhibitors, investors and producers.

The event delivered new information and opportunities for

business and dealt with topics such as silviculture, enduses

and marketing.

According to African Mahogani Australia (AMA), one of

the largest private plantation managers of high value

African Mahogany (Khaya senegalensis), Khaya

senegalensis tolerates a variety of soil types and climate

making it a feasible proposition in Brazil. Two other

species, Khaya ivorensis and Khaya anthotheca were also

said likely to adapt well areas in Brazil.

According to the Brazilian Institute for Forestry

Development (IBDF), African mahogany cultivation has

several advantages including legislation that considers it

an exotic species which means there are limited logging

restrictions. And, says IBF, there will always be market

for hardwood plantation species as values tend to rise due

to restrictions of harvesting timber from natural forests.

The African mahogany market already generates R$500

million per year in Brazil and according to AMA the

market will expand in the future as China and European

countries begin to favour plantation wood.

Research is underway to determine which species are

suitable for the climatic regions in Brazil. The Brazilian

Association of African Mahogany Producers (ABPMA)

presented statistics indicating an increase in the African

mahogany plantation areas in Brazil.

IBÁ takes command of ICFPA

The president of the Brazilian Tree Industry (IBÁ) has

taken the helm at the International Council of Forest and

Paper Associations (ICFPA). The term of office is two

years and during this period Brazil will host the

headquarters of ICFPA. This is the first time that an

ICFPA member from Southern Hemisphere is chairing the

ICFPA.

ICFPA, created in 2002, brings together associations of

forest-based industry from 33 countries to discuss

common issues among members and promote cooperation

among them.

This entity represents the forest sector in international

forums such as the United Nations Food and Agriculture

Organization (FAO), the Forest Stewardship Council

(FSC) and the Programme for the Endorsement of Forest

Certification (PEFC).

The topics covered by ICFPA involve issues relevant to

the forest sector development, such as multiple forest use,

global trends in the timber industry, forest products trade,

new technologies, bio-economy, amongst others.

The IBA´s nomination to head ICFPA shows the

increasing presence of Brazil in the international forestry

community. In 2015 the focus of ICFPA will be

collaboration of forest based industries in mitigating the

effects of climate change in relation to the participation of

ICFPA in the United Nations Conference (COP21) to be

held in December 2015.

8. PERU

First export of plantation timber to US

Reforestadora Amaz¨®nica S.A.C. (RAMSA) recently

shipped to the US a consignment of plantation grown

bolaina (Guazuma crinita) and Capirona (Calycophyllum

sp.).

If this is a success the company aims to market these

species in Europe and Asia, according to Felipe Koechlin,

RAMSA General Manager.

He stressed that the company was encouraged to enter the

plantation business after the government recognised the

potential of the plantation sector and introduced Decree

No. 017 (Promotion System Forest Plantations on private

land).

The company, which is FSC certified, manages 14,000

hectares and has around 4,000 hectares of native bolaina

and capirona. RAMSA recently exported products

manufactured from eight year old plantation logs.

Satellites help fight deforestation

A geospatial system, linked to satellites will enable realtime

monitoring land use and relief of forests and help

three state agencies in efforts to combat illegal logging and

deforestation in the Ucayali region.

This is the first satellite monitoring unit to assess

deforestation and illegal logging in Pucallpa and was

possible through support from the US Agency for

International Development (USAID) through the Initiative

for Conservation in the Andean Amazon (ICAA).

Initial trials will focus on the Ucayali region as it has the

second largest forest area (more than nine million

hectares) and a high rate of deforestation.

Manufacturing output continues to slide

Cesar Peñaranda, Executive Director of the Institute of

Economics and Business Development (IEDEP) within the

Lima Chamber of Commerce expressed concern on the

1.4% projected decline in first quarter manufacturing

output. He noted that slowing domestic consumption and

weaker export demand is having a negative impact on

production.

This decline is of concern as manufacturing is the second

most important activity after services and contributes

around 16% to GDP. The current weaker manufacturing

output comes on top of the 10 consecutive monthly falls

since May 2014.

For more see:

http://www.camaralima.org.pe/principal/noticias/noticia/se

ctor-manufactura-caeria-1-4-en-primer-trimestre-delpresente-

ano/326

9.

GUYANA

Over the past two weeks the news from Guyana

has been

dominated by the general election. The results of the vote

have been released showing the opposition coalition has

won a majority.

The Partnership for National Unity and Alliance for

Change coalition led by David Granger won a majority

and will form the new government.

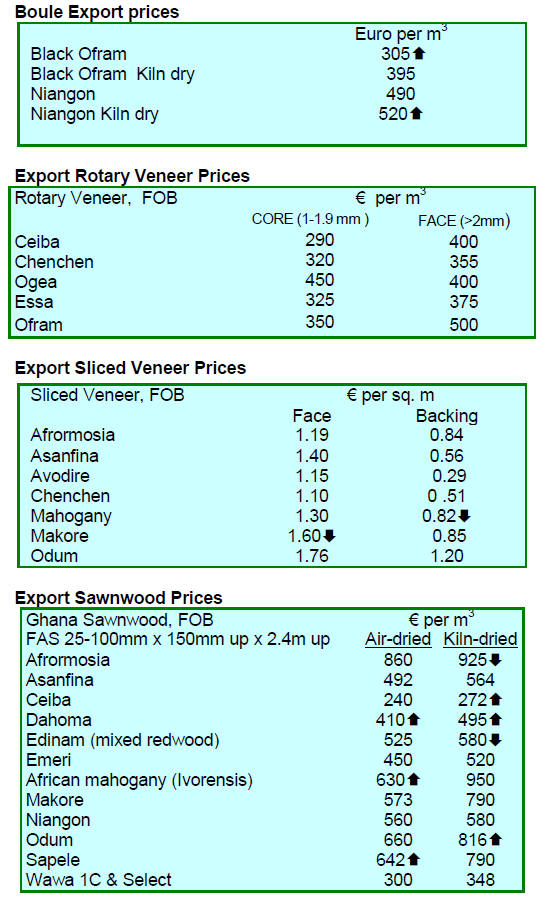

Export prices

There were no exports of greenheart logs but exports of

purpleheart and mora logs continued.