|

Report from

Europe

Innovation is key to success

The International Hardwood Conference (IHC) held in

Copenhagen from 16-18 September identified access to

raw materials, changes in global trade flow patterns and

growing purchasing competition with buyers from other

parts of the world as well as innovation in non-wood

materials as key challenges currently facing the European

hardwood industry.

At the same time, however, the conference also

highlighted European countries& common goals and

interests in their commitment to the sustainable use of

hardwoods and the promotion of an increased use of

wood.

The benefits of wood as an environmentally friendly,

sustainable building material were emphasised as a major

advantage in this context, as was Europe&s advanced

educational system in the fields of architecture and wood

engineering.

Innovation, creativity, new and high-end applications for

hardwood as well as tapping into new markets were

considered key to success.

Presentations held in the morning of the conference

primarily focused on trade flow trends in the global and

European markets as well as on the situation in major

hardwood exporting and importing markets in Europe, the

USA, Asia and Africa.

In the afternoon, the focus shifted to the sustainable and

creative use of wood in architecture, and furniture

production as well as on new market opportunities for

hardwoods.

China and Asia dominate the timber trade

Rupert Oliver, speaking on behalf of the EU-funded and

ITTO-hosted FLEGT Independent Market Monitoring

(IMM) project, opened the Conference with an overview

of global hardwood markets. He showed that the global

value of hardwood trade, adjusted for inflation, had

rebounded close to pre-crisis levels in 2014.

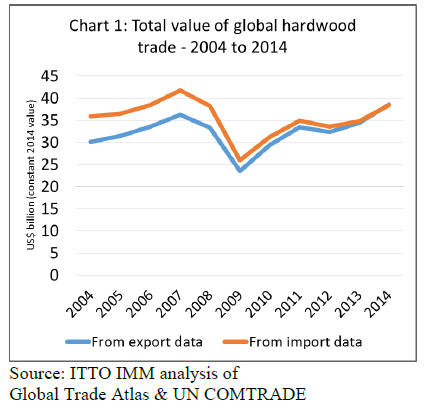

The total value of global trade in hardwood products

(including logs, sawn, mouldings/decking, veneer, and

plywood) was around US$38.5 billion in 2014, an increase

of 10% on the previous year (Chart 1).

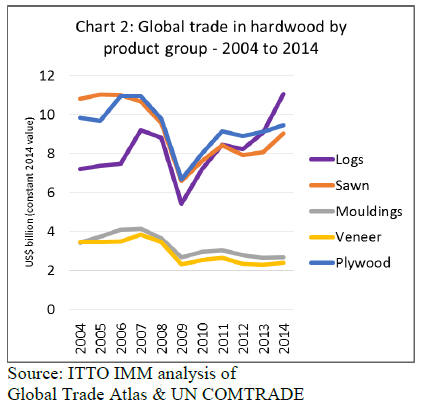

Analysis of the various product groups reveals that the

upward trend was heavily dependent on a sharp increase in

the global hardwood log trade.

In fact, the total value of global trade in hardwood logs, at

around US$11.1 billion in 2014, was significantly higher

than the previous peak in 2007 (when global hardwood log

trade was US$9.2 billion).

The value of global trade in all other hardwood materials 每

sawn wood, mouldings, veneer and plywood - still falls

short of the peak just prior to the financial crises that hit

western industrialised nations in 2008 (Chart 2).

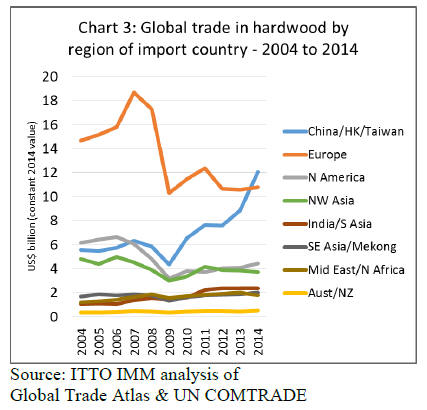

These trends are largely explained by the regional shift in

global hardwood trade since the financial crisis (Chart 3).

The value of China&s hardwood imports doubled between

2009 and 2014, to more than US$12bn.

Although China&s imports of sawn hardwood have been

rising, growth is still heavily concentrated in logs. The

value of China&s log imports increased from just over

US$2 billion in 2009 to close to US$7 billion in 2014.

Meanwhile the influence of Europe - traditionally a large

buyer of further processed products like sawn wood,

veneers or mouldings - has declined in global hardwood

trade flows.

The total value of hardwood imports by European

countries (including intra-EU trade), fell from more than

US$18bn in 2007 to just over US$10bn in 2009. The total

value of hardwood imports by European countries has

remained broadly flat since then.

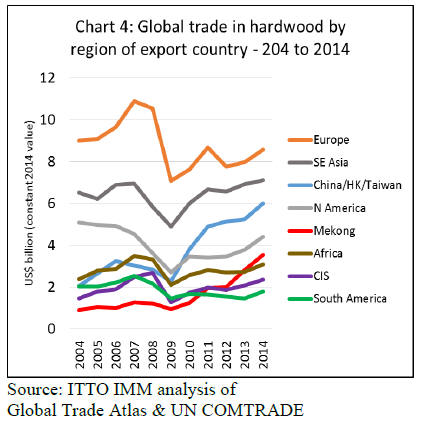

In terms of hardwood export value, the large volume of

intra-regional trade means that, in total, European

countries remain the largest source of internationally

traded hardwoods (Chart 4). In 2014, European countries

exported hardwoods with a total value of US$10.8 billion,

2% more than the previous year but well below the peak

level of US$18.7 billion recorded in 2007.

The increase in European country exports last year was

driven partly by improved consumption in the UK and

Spain and partly by rising sales of hardwood logs and

sawnwood to countries outside Europe, notably China and

Egypt.

However, the value of hardwood exports by countries in

other parts of the world has been rising more rapidly.

There&s been a particularly rapid rise in the value of

exports by China (dominated by plywood) and by

countries in the Mekong delta region (including both

rubber wood and hongmu species, both destined primarily

for China).

The value of exports by the USA has also been rising with

a significantly higher proportion now destined for China

and South East Asia and a lower proportion destined for

Canada, Mexico and Europe.

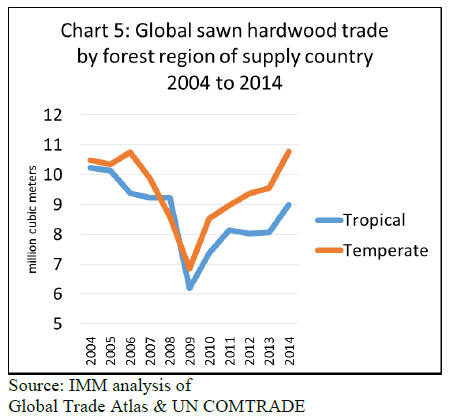

Considering just sawn wood, Mr. Oliver showed that

global trade in temperate hardwoods recovered much

faster than tropical wood following the financial crisis

(Chart 5).

In fact global trade in sawn temperate hardwood reached

10.77 million m3 in 2014, 13% higher than the previous

year and just exceeding the previous peak in global trade

of 10.75 million m3 in 2006.

Global trade in sawn tropical hardwood also increased

sharply in 2014, rising 12% to reach 8.99 million m3.

However, this level is still 12% down on peak levels in

excess of 10 million m3 prior to the crises.

As major 求barriers′ to expansion of hardwood markets in

Europe, Mr. Oliver identified the difficulties arising from

the global financial crisis, product innovations in nonwood

materials, the shift in global economic activity and

hardwood supply to emerging markets, freight and

transport issues, EU production of wood-based panels and

surfacing technologies and exchange rate movements,

among other things.

On the other hand, new opportunities for hardwood are

being created in Europe from increased use of wood in

green building, interest in hardwood in higher-value

structural applications, innovations such as thermal

modification which extend applications for less durable

species, rising awareness of carbon credentials,

certification and legality verification as well as architects&

and structural engineers& increased knowledge of timber.

European hardwood production stable at 6 million

cu.m

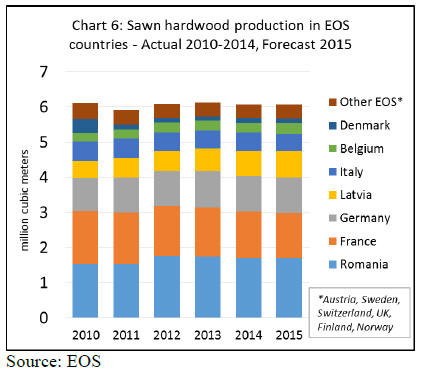

Jean-Francois Guilbert of French Timber assessed the

European market from the perspective of the European

hardwood sawmillers. Sawn hardwood production in

member countries of European Sawmillers Organisation

(EOS) was flat at around 6 million cubic meters per year

between 2010 and 2014. Production is expected to remain

at the same level in 2015 (Chart 6).

There have been minor shifts in European sawn hardwood

production in recent years. Production in Romania, the

largest supplier (mainly of beech) was rising between

2010 and 2013, but declined 3% to 1.70 million in 2014.

Production in France, which has been declining slowly

since 2010, fell a further 4% to 1.33 million m3 in 2014.

Production in Germany fell 3% to 1.0 million m3 in 2014.

However production in Latvia has been rising over the last

5 years and increased a further 9% to 717,000 m3 in 2014.

Mr. Guilbert noted that exports to non-European countries,

particularly China, were an increasingly important driver

of production trends in the European sawn hardwood

sector. Large quantities of European oak and beech logs

are now destined for China which is making roundwood

sourcing increasingly difficult for European sawmills.

However China is also an important market for European

sawn wood, particularly oak. Sales of European sawn oak

have remained relatively strong in China this year despite

the recent economic slowdown. This was partly attributed

to the weakness in the euro, which has given European

timber a competitive advantage over hardwood traded in

US dollars.

The weak euro has also helped sales in Egypt, Mexico and

the USA. Within Europe, Mr. Guilbert identified the UK

as a key market for sawn oak. For beech, Spain and Poland

are important markets within Europe while Egypt is

recovering strongly outside Europe.

Mr. Guilbert noted that, such is the strength of

international demand, European sawmills could sell

considerably more but production is now constrained by

limited log availability.

While this is partly due to high log exports to China, other

factors include increased fragmentation of private forest

estates and reduced focus on commercial timber

exploitation, the long-term lack of incentives for

plantation establishment throughout much of Europe, and

fierce competition for hardwood logs from the wine

industry (mainly oak) and energy sector.

No real recovery in hardwood consuming sectors

ETTF President Andreas von Möller spoke about recent

trends in the European sawn hardwood market from the

perspective of importers. He noted that at a European

level, key hardwood-consuming industries in Europe -

including construction, furniture, wood flooring and

windows - had shown little or no recovery since the

financial crises. He also stressed that developments

differed greatly from one European country to the next.

The furniture industry, for example, which EU-wide was

still below pre-crisis levels in 2014, was growing strongly

in Poland. Construction is good in Germany and the UK

and recovering in Spain and the Netherlands, while France

and Italy are still experiencing a downward trend.

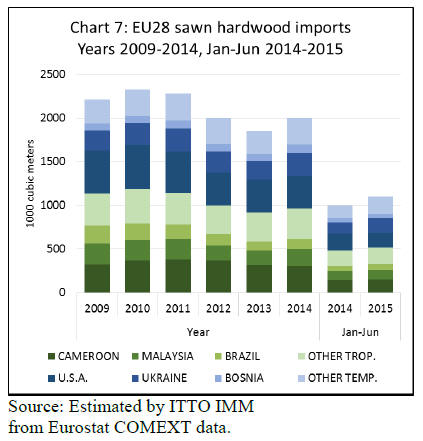

More positively, Mr. von Möller noted that total imports

of sawn hardwood into the EU28 were 1.97 million m3 in

2014, a rise of 9% compared to 2013. Imports have also

continued to rise in 2015, reaching 1.1 million m3 in the

first five months of the year, up 11% compared to the

same period in 2014.

However Mr. von Möller echoed Mr. Oliver&s assessment

that temperate hardwoods have generally performed better

than tropical hardwoods in the EU market in recent years.

EU imports of temperate sawn hardwood were 1.10

million m3 in 2014, 12% up on the previous year and 41%

down compared to before the financial crisis.

This compares to tropical sawn hardwood of which

960,000 m3 were imported in 2014, 5% up on the previous

year but still 63% down compared to before the financial

crisis. Much of the gain in EU imports of sawn hardwood

in 2015 is due to rising trade with Ukraine, Belarus and

Russia (Chart 7).

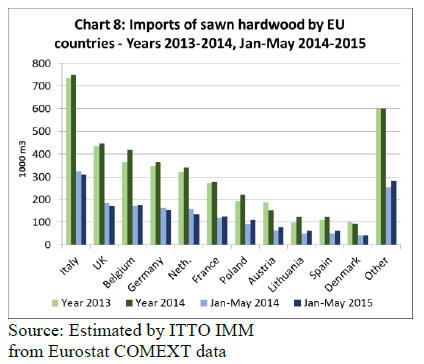

Mr. von Möller also reported that the latest sawn

hardwood import data indicates widely varying market

conditions between EU member states this year. Imports

declined in several large EU markets in the first five

months of 2015, including the UK, Germany, Italy and the

Netherlands. In fact amongst the five largest markets, only

Belgium has increased imports this year.

However imports into several smaller EU markets have

registered double-digit percentage growth this year

including Poland, Austria, Lithuania, Spain, Estonia,

Slovenia, Hungary, Romania, Ireland and Croatia (Chart

8).

Mr. von Möller went on to identify a number of key trends

in the European sawn hardwood sector. Darker woods are

currently favoured compared to light/reddish coloured

timbers. In flooring, there continues to be a fashion for

wider planks, particularly with 求rustic′ character. Narrow

planks with 求plastic′ appearance lacking character and

natural features are less favoured.

He noted that there is regular on-going substitution 每

driven by price fluctuations and exchange rates 每 between

American tulipwood and beech on the one hand, and a

range of tropical species on the other, including

wawa/ayous/obeche and limba.

Distribution networks for sawn hardwood in Europe have

also undergone profound change since the financial crises.

Generally there is now a strong preference for sourcing

internally from elsewhere in Europe rather than importing

from overseas.

There&s much less willingness on the part of many

European manufacturers and distributors to hold stock and

a strong preference for buying from other European

operators as and when products are needed. European

operators are now much more inclined than in the past to

spend time searching around a wide range of suppliers for

the lowest price rather than to depend on a few regular

suppliers.

There&s also a much greater tendency to buy mixed

container loads with smaller volumes of product in each

specification than to buy full container loads of a single

specification.

Timber-sector players worldwide are interdependent

Presenting to IHC on the Asian hardwood market

situation, Ms. Sheam Satkuru-Granzella, Director of the

Malaysian Timber Council&s European office, highlighted

the importance of global interlinkage and interdependence

in the timber trade.

She underlined the importance of China and India as wood

consuming and remanufacturing countries and observed

that current weakness in the Chinese market would

significantly impact developing countries, particularly in

Africa and Papua New Guinea.

Ms. Satkuru-Granzella noted the growing importance of

the Chinese domestic market as opposed to the re-export

business. She also observed that while there has been

recent strong growth in China&s imports of red 求hongmu′

timbers, China&s market for more modern furniture and

finishing in lighter shades is also growing rapidly.

In Europe, Ms. Satkuru-Granzella identified on-going

economic consolidation as well as weakness in the

European construction sector, with no major changes

expected in the short-term, as major challenges facing the

Asian hardwood business in Europe. She emphasised that

Asian hardwood producers are focusing elsewhere due to

subdued European demand.

She also mentioned implementation of the EUTR as

another challenge, noting problems associated with

inconsistent application of the regulation across the EU.

Structural changes in US hardwood production and

sales

Mike Snow, Executive Director of the American

Hardwood Export Council, spoke about structural changes

in the US hardwood industry that increased the sector&s

emphasis on exports in recent years. Total US hardwood

production peaked as long ago as 1999 and, after sliding

for a few years, fell sharply by 49.3% between 2005 and

2009.

US hardwood production started to recover from 2009 but

is still way below peak levels. It&s also well below

potential: as harvest has remained well below growth the

volume of hardwood standing in US forests has more than

doubled to over 11 billion cubic metres in the last 50

years.

Mr. Snow noted that while demand for hardwood in some

industrial sectors in the US has been rising, there has been

a long term decline in US domestic consumption of graded

lumber in the furniture and construction sectors.

US lumber production has shifted from around 60% grade

and 40% industrial lumber to 40% grade and 60%

industrial. The vast majority of the graded lumber

produced in the US is now exported.

In terms of US hardwood lumber exports, China and other

Asian markets like Vietnam and Thailand have

significantly gained in importance over the last ten years,

whereas volumes to Europe have declined. China, in

particular, saw disproportionate growth: between 1999 and

2006 US exports to China increased by 759% and between

2009 and 2015 by another 270%.

Mr. Snow also confirmed the increasing importance of the

Chinese domestic market as a wood consumer. He said

that whereas a decade ago, around 80% of the American

hardwood imported by China was further processed and

re-exported, the proportions have now reversed with only

around 20% re-exported and up to 80% destined for the

domestic market.

Purchasing competition for African timber

Mr. Ad Wesselink, Managing Director of Netherlandsbased

Wijma, identified purchasing competition from

Chinese companies 每 which do not have to verify the

legality of their purchases 每 and Chinese investments in

Africa as key challenges for European companies active in

African timber trade and manufacturing.

Furthermore, African timber still struggles with image

issues and certification is proceeding much too slowly.

Added to this are serious logistical and transport issues.

And of course the European market for tropical timber

remains subdued.

Mr. Wesselink noted that EU imports of African sawn

wood decreased from 1.12 million m3 in 2004 to just

530,000m3 in 2014. The sharpest falls were registered

between 2005 and 2009; since then imports have stabilised

with slight fluctuations.

African logs have fared even worse in the EU market,

declining around 80% in the last ten years, to just 102,000

cu.m in 2014. Europe&s share in African tropical timber

exports has therefore fallen from 78% in 2004 to 52% in

2014.

To turn the situation around, Mr. Wesselink said the

tropical timber sector must do more to raise awareness of

progress in forest management. Around 5.5 million ha of

forest in the Congo, Gabon and Cameroon is now FSC

certified and large areas are legally verified, for example.

These facts need to be communicated.

Due Diligence: costly and time-consuming

Armand Stockmans of Somex underlined the commitment

of the EU trade to meeting the legality requirements of the

EU Timber Regulation (EUTR) 每 even though Due

Diligence remained complex and costly in many instances:

Operators have to deal with different documents from each

country and to adapt their due diligence accordingly.

Green building is a key new market opportunity

The afternoon session of the IHC focussed more on new

market opportunities and the potential for increased use of

hardwood as a construction material. Matti Kuittinen from

Aalto University School of Arts, Design and Architecture

reported a recent revival in wood construction. Besides

single-family homes, several tall wooden buildings are

under construction all over the world.

As a main reason for the increased use of wood 每 besides

aesthetics 每 he noted the growing awareness of climate

change and other environmental issues, for example

reflected in Green Building initiatives at national level in a

several EU countries and the EU Directive for energy

performance of buildings that requires new buildings to be

nearly zero energy after 2020.

Zero energy buildings can be made from different

materials, according to Mr. Kuittinen, but wooden

buildings always seem to have lower carbon footprint than

others. He concluded that 求wood construction has been

and will always be a vital part of our bioeconomy′.

This view was shared by Peter Wilson, Director of the

Institute for Sustainable Construction at Napier University

in Edinburgh, UK. He emphasised the number and

importance of European architects as potential clients for

the wood industry and stated that the timber industry still

fails to reach out to enough architects.

Architects are of special importance to the hardwood

industry since they are often the key decision makers in

high-value building projects.

Mr. Wilson felt there is particular value in working with

European universities 每 which train some of the world&s

leading architects - to increase coverage of timber in the

architectural syllabus. He also stressed that the

development of engineered wood products has changed

the perception of timber among designers and architects.

China, in particular, should be encouraged to build its fast

growing cities in wood rather than concrete or steel.

AHEC&s European Director David Venables echoed this

call. He named architects, designers and specifiers as

potential clients and key to future growth in the hardwood

market.

In addition to more promotion and more education, he

emphasised the need to develop innovative tools to deliver

credible technical and performance data on hardwood

materials. It is necessary to scientifically prove the

advantageous performance of hardwoods compared with

other building materials.

Moreover, wood promotion should support the use of

wood through simple and understandable messages.

AHEC is showing how it&s possible to influence fashion

trends to favour of a wider range of hardwood timbers by

working with high-profile architects and designers.

Besides structural applications and a focus on

environmental advantages, Mr. Venables identified

exterior applications and a wider use of species and grades

as new opportunities for the hardwood sector. As an

example, he presented AHEC&s 求Endless Stair′ project,

made from cross-laminated Tulipwood produced from No

2 Common grade material.

Eyes opened for new market opportunities

Both organisers and participants seemed broadly satisfied

with this year&s IHC, which for the first time was jointly

organised by the European Timber Trade Federation

(ETTF) and the European Organisation of the Sawmill

Industry (EOS), with the Danish Sawmill Association and

Timber Trade Federation as national co-hosts. Martin

Nyrop-Larsen from the Danish Sawmill Association said

that both traders and sawmillers benefitted from 求useful

information about markets and the future′. He noted that

求eyes were opened for new market opportunities, for

example in India′. The conference attracted around 100

delegates from 19 countries.

|