|

Report from

Europe

EU economy yet to show any signs of acceleration

Europe‟s economy has regained a certain level of stability

since the height of the financial crisis, but growth remains

slow and there is no sign of acceleration.

The EU28 group of nations recorded only 0.4% GDP

growth in the second quarter of 2015, down from 0.5% in

the first quarter and falling short of most forecasts.

The pace of growth is particularly slow in the euro-zone

currency area which has yet to recoup output lost in the

aftermath of the financial crisis.

A particular concern is that growth remains stagnant at a

time when the region is benefiting from massive stimulus

on three fronts: a weaker euro exchange rate that typically

boosts exports, lower oil prices that raise disposable

incomes, and a bond-buying programme of more than €1

trillion (US$1.12 trillion) launched by the European

Central Bank in March this year.

The second quarter slowdown in EU growth is largely due

to France which recorded zero growth during the three

month period after 0.7% growth in the first quarter.

Although French exports are rising these have been

insufficient to offset a continuing fall in domestic

household consumption.

The French government is stepping up efforts to boost

private sector demand, having just announced an

additional €11bn in tax cuts for companies and households

over the next three years on top of €30bn in tax breaks

already promised through the government‟s so-called

responsibility pact with business. However the

government will have to cut public spending by €50

billion between 2015 and 2017 to fund the tax breaks.

Germany‟s quarterly growth rate quickened to 0.4% in the

second quarter from 0.3% in the first quarter of 2015. The

main driver of growth in Germany this year has been a rise

in exports as foreign trade received a boost from the

weaker euro. Elsewhere in the euro-zone, the Italian,

Dutch and Austrian economies all grew in the second

quarter of 2015, but just barely.

Once again there was better news from Spain where the

recovery has continued to gather pace with 1% growth in

GDP in the second quarter of 2015 following 0.9% in the

first.

Outside the euro-zone, the UK economy continues to

perform relatively well with GDP growth of 0.7% in the

second quarter of 2015, up from 0.4% in the first quarter

of the year.

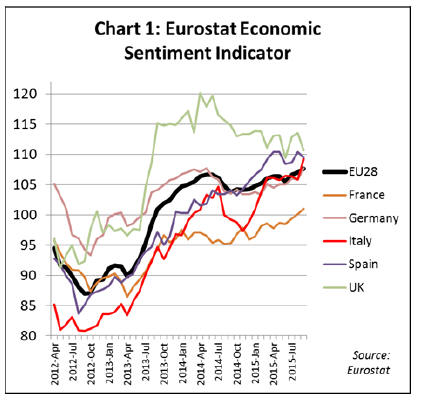

Trends in GDP growth are mirrored in Eurostat‟s

Economic Confidence Indicator (ECI), a forward-looking

index that measures perceptions and expectations in five

surveyed sectors (industry, services, retail trade,

construction and consumers) in all EU Member States

(Chart 1).

After a period of strong recovery in economic sentiment in

2013 and the first half of 2014, the ECI for the EU as a

whole dipped during winter 2014/2015 and has recovered

only slowly since then.

The dip was mainly due to a sharp fall in sentiment in Italy

at a time when the UK and Germany were also sliding

from the heights achieved in mid-2014. Sentiment has

been recovering slowly in France and rapidly in Spain

over the same period.

The good news is that overall EU-wide sentiment has

remained above 100 throughout this period ¨C indicating

above average economic sentiment. This is despite widely

publicised financial problems in Greece leading to some

renewed concern about the long-term stability of the euro.

European construction activity stalls

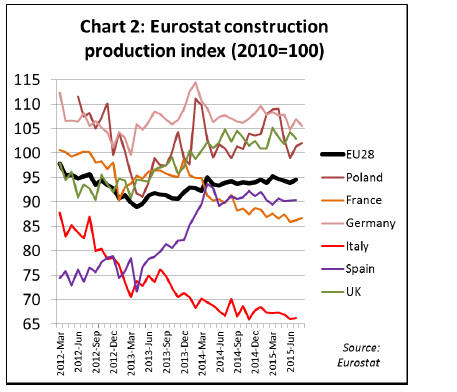

Europe-wide, the construction industry continues to

disappoint. Although overall European construction

activity hit bottom in March 2013, it increased only slowly

until April 2014 and has been static at 5% below the 2010

level since then.

Construction activity in France has been sliding in recent

months, while Italy still remains extremely depressed.

More positively, the gains made in UK and Spanish

construction activity in 2014 have been maintained in

2015 while activity in Germany remains stable at a high

level (Chart 2).

¡¡

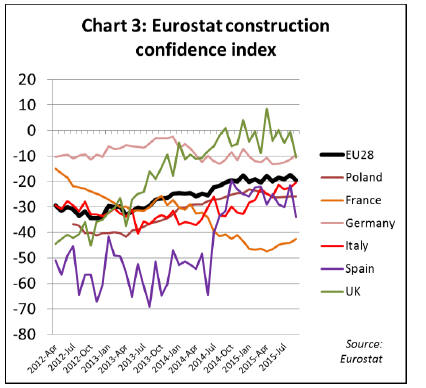

The Eurostat Construction Confidence Index in the EU

remains stagnant and deep in negative territory, indicating

that many in the industry still expect market conditions to

deteriorate rather than to improve in the next three months.

Confidence in France dipped sharply during the summer

this year.

However confidence is higher in the UK and Germany

than elsewhere in Europe. Confidence in Italy, while still

low, has been improving this year (Chart 3).

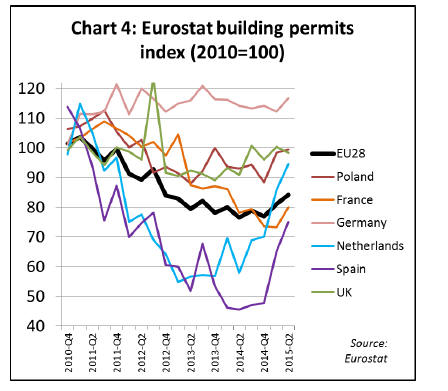

More positively, the latest EU-wide data for building

permits shows that across Europe these recorded two

consecutive quarters of growth in the first half of 2015, the

first time this has occurred for at least 5 years.

Building permits have increased this year in most main EU

markets, growing particularly rapidly in Spain and the

Netherlands (Chart 4).

The growth in building permits, a forward looking

indicator, is reflected in forecasts which generally remain

optimistic about the prospects for sustained recovery in

European construction over the medium to long term.

A report by Building Radar, an independent research

agency, forecasts that EU-wide construction activity will

increase by 2% per annum between 2015 and 2017, and

then by around 3% per annum between 2018 and 2020.

New build growth is expected to rise to around 7.6% in

2020 while growth in renovation and maintenance will rise

more slowly to around 4.5% by 2020.

At these growth rates, the total value of EU construction

would increase from €1305 billion in 2014 to €1502

billion in 2020.

Although the value of EU construction in 2020 would still

be below the peak level just prior to the financial crises (in

excess €1600 billion in 2007 at constant prices), the sector

remains vast and generates a huge level of activity.

European wood joinery production stabilised in 2014

According to newly-published Eurostat data, the total

value of EU production of wooden doors and windows

increased slightly in 2014 after a period of decline. EU

imports of both commodities also rebounded from the low

levels recorded the previous year. However domestic

producers maintained their hugely dominant position in

these market segments.

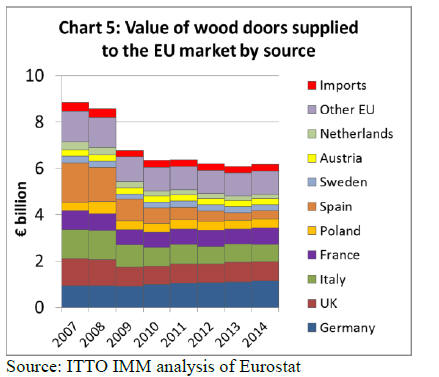

EU wooden door production was €6.18 billion in 2014, up

1.6% compared to the previous year (Chart 5). Wooden

door production increased in Germany (+2.6% to €1370

mil.), France (+9.2% to €698 mil.), Poland (+5.4% to €398

mil.) and Spain (+6.7% to €349 mil.).

However this was offset by a fall in production in Italy (-

4.3% to €750 mil.) and in Sweden (-2.8% to €267 mil.).

Production in the UK remained stable at €844 mil.

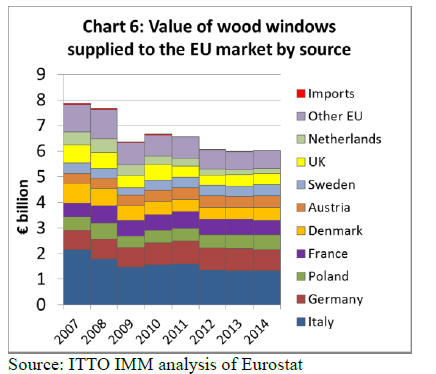

EU wood window production increased 0.5% from €6.00

billion in 2013 to €6.03 billion in 2014 (Chart 6). During

2014 production remained stable at €1.32 billion in Italy,

the largest wood window manufacturing country.

Production fell during 2014 in Germany (-3.1% to

€840m), France (-10.7% to €546m), and the UK (-6.1% to

€425m).

However these losses were offset by rising production in

Poland (+4.9% to €574m), Denmark (+14.1% to €505m),

Austria (+4.2% to €469m), Sweden (+13.1 to €437m) and

the Netherlands (+10.7% to €206m).

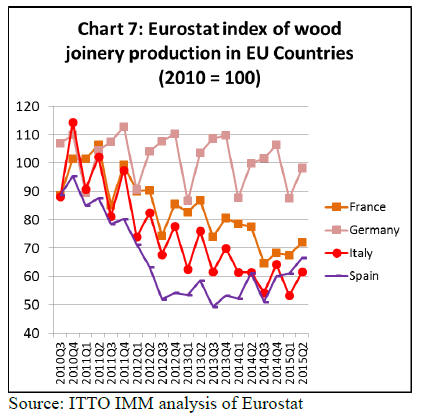

The Eurostat index of joinery production in EU countries

(which excludes flooring but includes doors, windows and

glulam and covers only a few countries) shows that

production stabilised at a low level in Italy and France in

the first half of 2015 after 5 years of continuous decline.

Production in Spain has recovered slightly this year but is

still 30% down on the 2010 level. Production in Germany,

while varying on a seasonal basis, has been relatively

stable overall during the last 5 years (Chart 7).

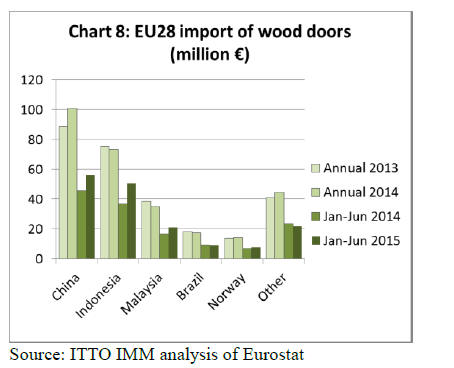

EU wood door imports rise 20% in 2015

Imports of wood doors into the EU were valued at €168m

in the first 6 months of 2015, 20% more than the same

period last year (Chart 8). Imports from China increased

24% to €56.4m, while imports from Indonesia increased

37% to €50.5m and imports from Malaysia were up 26%

at €21.1m.

Imports of wood doors from Brazil remained stable at

€9.3m during the period. Imports accounted for around

4.6% of the total supply of EU wooden door consumption

in 2015, up slightly from 4.5% in 2013 but down from 5%

in 2010.

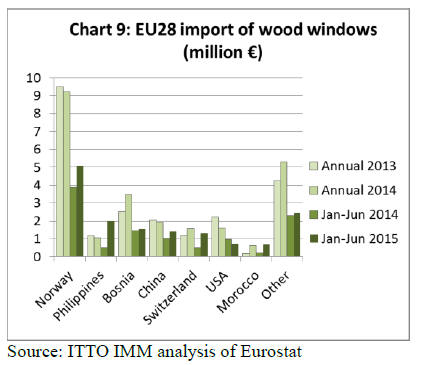

Negligible EU imports of wood windows

The EU market for wood windows is very heavily

dominated by domestic producers. In 2014, imports

accounted for only 0.4% of the total value of EU wooden

window consumption, the same as the previous year but

down from 0.8% in 2007. EU imports of wood windows in

the first six months of 2015 were valued at €15.3m, 42%

more than the same period in 2014.

Most wood windows imported into the EU derive from

other European countries, including Norway, Bosnia and

Switzerland. Imports from all these countries increased in

the first half of 2015.

However, the largest increase in imports was from the

Philippines which surged to €2m in the first half of 2015,

more than three times the value of the same period in 2014

(Chart 9).

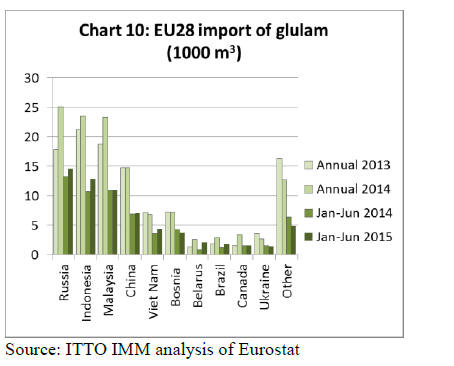

EU glulam imports continue to rise in 2015

The EU imported 65,300m3 of glulam products in the first

half of 2015, 6% more than the same period in 2014.

Imports from Russia increased 10% to 14,600 m3 during

the period (Chart 10). There was also a 20% increase in

imports from Indonesia to 12,900 m3.

Imports from Malaysia and China were stable in the first

six months of 2015, at 11,000 m3 and 7000 m3

respectively.

Imports of glulam account for around 5% of total EU

consumption of this commodity. Much of the imported

glulam consists of laminated veneer lumber for window

manufacturing. Glulam imports from Russia and China are

primarily pine and larch. Imports from Malaysia and

Indonesia consist of meranti.

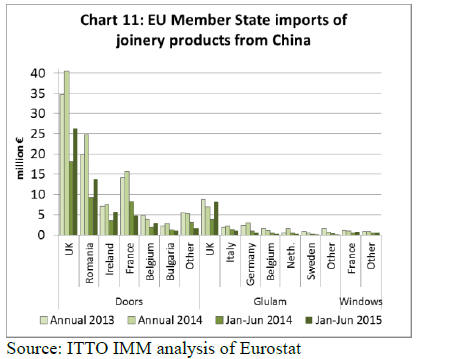

EU imports of joinery products from China rise 26%

EU28 imports of joinery products (excluding flooring)

from China had a value of €68.5 million in the first 6

months of 2015, 26% more than the same period the

previous year. Chart 14 summarises EU imports of joinery

products from China by product group and EU Member

State.

Doors make up the bulk of EU joinery trade with China,

with total value of €100.7 million in 2014. The UK and

Romania are the main European markets for China‟s

wooden doors and imports by both countries have been

rising in the last three years.

Imports of wood doors from China are also rising in

Ireland and Belgium this year. However imports by France

have declined this year after rising in 2014.

EU imports of glulam products from China were €10.7m

in the first 6 months of 2015, 36% more than the same

period in 2015. The UK is the only EU country importing

significant quantities of glulam products from China.

UK imports of Chinese glulam fell 18% last year but have

rebounded strongly in 2015, reaching €8.2 million in the

first 6 months, more than during the whole of 2014.

EU imports of finished wood windows from China

increased 35% in the first 6 months of 2015, but were still

negligible with a value of only €1.4m, mainly destined for

France.

CLT development creates new opportunities for

hardwoods

The latest UNECE Forest Products Annual Market Review

highlights the rapid growth in the market for crosslaminated

lumber (CLT) and the new opportunities the

product creates for wood, including hardwood, to compete

in high-end structural applications.

Although the first CLT production facilities were

constructed in the DACH countries (Germany, Austria and

Switzerland) in 1994, the full potential is only now being

realised following a long period of technical and market

development.

CLT first entered the building market during the 2005 to

2010 period, transforming from a small-scale niche

product into large-scale industrial production.

CLT panels consist of several layers of structural lumber

boards stacked crosswise (typically at 90 degrees) and

glued together on their wide faces and, sometimes, on the

narrow faces as well.

In special configurations, consecutive layers may be

placed in the same direction to obtain specific structural

characteristics. CLT products are usually fabricated with

three to seven layers, but with additional layers in some

cases.

Thickness of individual lumber pieces typically varies

from 16 mm to 51 mm and width varies from 60 mm to

240 mm. Boards are finger-jointed using structural

adhesive. Lumber is visually-graded or machine stressrated

and is kiln dried. Panel sizes vary by manufacturer;

typical widths are 0.6m, 1.2m, and3 m, while length can

be up to 18m and thickness up to 508 mm.

The dimensions and lay-up of CLT production are now

internationally standardized and recognised, and

production techniques are optimized in modern

manufacturing facilities. CLT is designed to maximise

yield, utilise lower grades of lumber, and it can be made in

a high volume of very large sections.

The result is a light but very strong panel product that can

be made off-site and erected quickly to form structural

walls, floors and ceilings. CLT is used in a wide range of

applications in single-family houses, multi-storey towers,

public buildings and specialty construction.

CLT offers new opportunities for wood to compete in

large-scale structural applications dominated for many

years by concrete and steel. In addition to delivering

comparable technical performance, CLT panels can

readily out-perform these alternatives on environmental

issues. Wood‟s renewability, low embodied energy, and

potential as a carbon store during use are all considerable

benefits.

Global production of CLT was about 625000 cu.m in

2014, and this figure is forecast to increase to about

700000 m3 in 2015. About 90% (560,000 cu.m) of global

cross-laminated timber (CLT) was produced in Europe in

2014, and this is forecast to increase to 630,000 cu.m in

2015. The DACH countries have continued to be the

driving force in CLT development, not only as the

originators of CLT products but also as the leading CLT

producers. Austria has seven CLT production facilities,

Germany three and Switzerland two.

Minor production sites exist in Finland, Italy, Norway,

Spain and Sweden, and more CLT factories are under

construction in Finland, France, Sweden and the UK. The

central European CLT industry is strongly export oriented,

supplying other parts of Europe as well as overseas

markets.

The use of CLT is making possible the construction of tall

wooden buildings. The current record-holder is a 14-storey

residential high-rise in Bergen, Norway, and an 18-storey

wooden building is planned in Vancouver, Canada.

Earthquake-prone countries such as Japan have shown

keen interest in increasing the use of CLT, and Japan has

published a roadmap to pave the way for CLT in the

Japanese building market.

To date commercial production of CLT has been

dominated by softwood, notably Norway spruce and Sitka

spruce, for reasons of price and wood consistency.

However the American Hardwood Export Council

(AHEC) is also now promoting development of hardwood

CLT, noting that some hardwood species are underutilised

and readily available at competitive prices while

also offering up to twice the inherent strength of

softwoods.

This last factor presents an opportunity to significantly

reduce the amount of fibre, or mass, required to achieve

the same strength performance. Hardwood species also

provide opportunities to improve the appearance of CLT

panels.

AHEC is particularly promoting the potential for CLT in

tulipwood (Liriodendron tulipifera), an abundant U.S.

hardwood species. Other temperate hardwood species with

potential include poplar and birch.

The potential for tropical hardwood CLT has yet to be

seriously explored, but there may be specific opportunities

for some faster growing plantation species or the pioneer

species found in large quantities in secondary tropical

forests.

Eucalyptus is generally considered too difficult to machine

to be a viable option for CLT, but recently progress is

being made in Australia to develop a related product under

the brand name ¡°Cross Laminated Strand Timber¡± by

Melbourne-based Lignor.

The international CLT product and design standards, and

open-source software packages such as the CLTdesigner

have supported the international trade of CLT.

Standardization in Europe comprises product standard EN

16351 (currently a draft version, with legal validity

envisaged by the end of 2015) and design standard EN

1995-1-1 (currently in revision).

For a review of the CLT market see UNECE Forest

Products Annual Market Review 2014-15:

http://www.unece.org/fileadmin/DAM/timber/publications

/2015-FPAMR.pdf

¡¡

|