Japan Wood Products

Prices

Dollar Exchange Rates of 25th

October 2015

Japan Yen 121.10

Reports From Japan

Manufacturing capacity exceeds output by an

increasing margin

In a mid-month report the Bank of Japan (BoJ) said that manufacturing

capacity exceeded output in the second quarter. The BoJ figures show that

the difference between available resources in the economy and their degree

of utilisation worsened in the second quarter.

The poor figures are expected to be repeated in the third quarter which

would pull Japan into a technical recession. The Bank’s own assessment of

the economy is that it has been weakening since May this year.

The fundamental problem, say analysts, is the economy will just not expand.

Japan’s economy is no bigger than it was in the mid-1990s mainly because of

a shrinking workforce.

More monetary easing? – not just yet

At its end of October policy meeting the Bank of Japan (BoJ), despite

being under pressure to introduce further stimulus measures, decided to wait

anticipating the negative sentiment created by the slowdown in growth in

China’s economy will dissipate. But many are calling for action by the Bank

as exports falter and housing growth slows.

September retail sales were weaker than expected, falling 0.2% from a year

earlier after five months of gains. This, along with the recent fall in

Consumer prices in the year to September and a decline in household

spending, is putting pressure on the BoJ to come with more stimulus

measures.

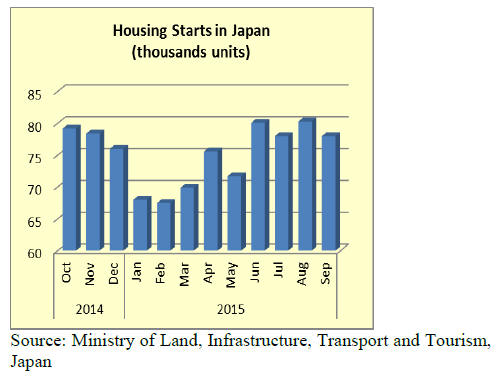

Poor September housing results

Japan's Ministry of Land, Infrastructure, Transport and Tourism has

released September housing start data showing a sharp, almost 2.5%, month on

month decline. Compared to levels in September 2014 the current data

reflects an 11% year on year fall. The current data is particularly worrying

as analysts had forecast a 6% increase in September.

The impact of the September starts drives down forecast annual 2015 starts

to below 930,000

The Ministry has also reported that orders placed with the large

construction companies in Japan continued the downward trend that saw August

orders fall by over 15%.

For more see:

http://www.e-stat.go.jp/SG1/estat/NewListE.do?tid=000001016966

More fixed rate home loans

There is now a trend amongst Japanese home buyers towards fixed rate loans

as they expect the BoJ monetary easing will eventually result in and

interest rate rise despite inflation being well below the BoJ’s 2% target.

Data from the Japan Housing Finance Agency show that 61% of recent new home

loans were with a fixed interest rate for at least five years, this is up

almost 40% from the time when floating interest rate loans were popular.

Home buyers in Japan are taking advantage of the current low interest rates

but anticipate rates will not drop further.

Construction industry shock

The Japanese real estate and construction sectors have been rocked by a

scandal surrounding structural flaws and falsified data for high rise

building across Japan.

The problem came to light when a condominium in Yokohama began to tilt,

apparently because foundation piles were inadequate. It was revealed that

the data supposed to confirm the piling work was falsified. Additional cases

of falsified piling data are coming to light.

There are now calls for independent third party checks to be made on

construction data submitted by contractors a move especially welcome in a

country that experiences frequent and occasionally massive earthquakes.

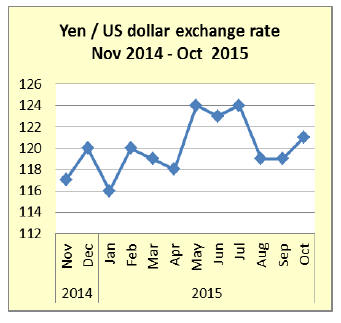

Yen/dollar rate hangs in neutral zone

The neutral stance adopted by the US Federal Reserve on interest rates

and the decision by the Bank of Japan to hold off on any further stimulus

measures has left the yen/dollar rate hanging in a 120/dollar range.

The yen received a boost in the second half of the month as nervous traders

shifted funds to yen as the US sailed a warship close to Subi Reef in the

Spratly Island chain where China claims sovereignty. In times of potential

crisis money flows into the yen as a ‘safe haven’ but this impact on

exchange rates was short lived.

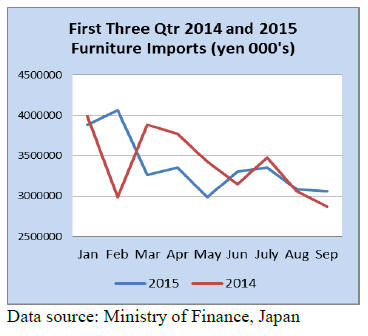

Japan’s first three quarter furniture imports

Japan’s imports of office, kitchen and bedroom furniture in the first three

quarters of 2014 and 2015 exhibit a similar trend except for the sharp rise

in February 2015 when imports rose spurred on by the decision of the

government to raise the consumption tax by 3%.

Consumer spending on a whole range of goods jumped in the months prior to

the 1 April tax hike.

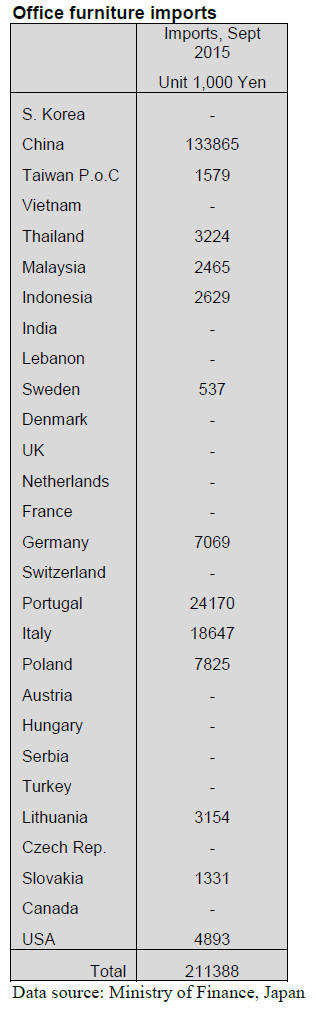

Office furniture imports (HS 940330)

Year on year September 2015 office furniture imports by Japan were down 11%

however, September 2015 imports were up 28% compared to August imports.

The top three suppliers in September were China, Portugal and Italy but

suppliers in Taiwan P.o.C slipped out of the top ranking in September.

Office furniture imports from China jumped a massive 60% in September

compared to a month earlier. Shippers in Portugal saw a modest increase but

imports from Italy remained at the same level as in August. The top three

supply countries accounted for 84% of all Japan’s office furniture imports

and if SE Asian supply countries are included then 90% of imports are

accounted for.

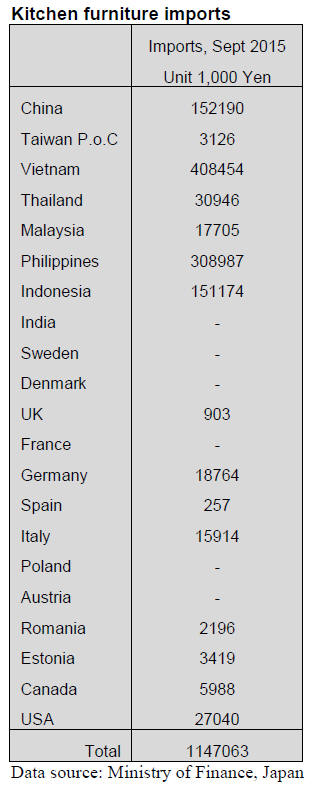

Kitchen furniture imports (HS 940340)

September 2015 imports of kitchen furniture remained steady at much the same

level as in August and were up 6.5% year on year.

The top three supply countries remain Vietnam, Philippines and China and

accounted for 75% of September kitchen furniture imports, down from the 85%

share in August. In September shipments from SE Asian supply countries

increased and captured a large share of total imports.

Kitchen furniture imports from EU suppliers remain small with only Germany

and Italy featuring in the import data.

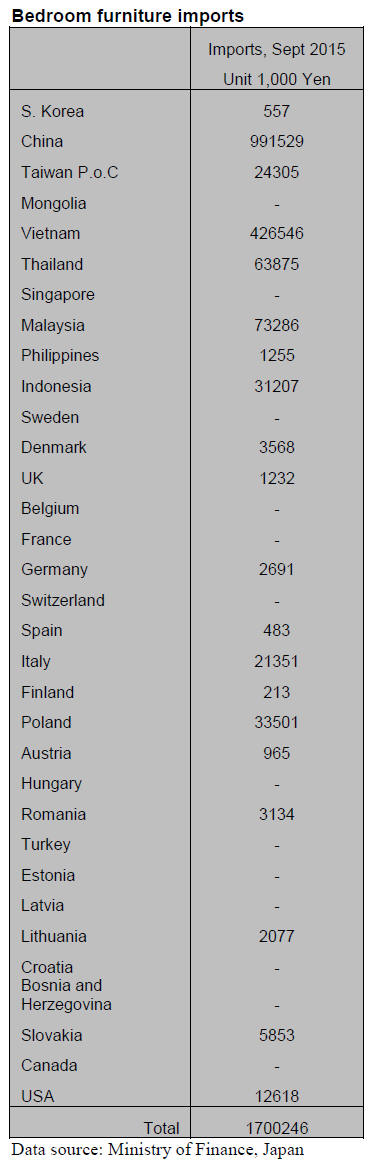

Bedroom furniture imports (HS 940350)

Despite the rather gloomy housing and consumer spending data September 2015

imports of bedroom furniture were up 9% year on year. This was despite the

6% downward correction in September imports compared to those a month

earlier.

As has been the case for most of the year China and Vietnam account for the

bulk of Japan’s bedroom furniture imports (83% in September). Shippers in

Malaysia saw September exports to Japan rise and other SE Asian suppliers

could only manage to maintain exports to Japan at around the same levels as

in August.

Trade news from the Japan Lumber Reports (JLR)

For the JLR report please see:

http://www.n-mokuzai.com/modules/general/index.php?id=7

South Sea (tropical) logs

Things changed after two big log buyers, India and China pulled back.

India made big purchase of about two months logs in last July then became

inactive since then. Move by India, which buys about 60% of Sarawak log,

gives large impact in Sarawak log market. China is quiet and stopped

energetic log purchase by general economic slowdown in China.

By absence of two giants, log market in Sarawak is changing slightly. Small

diameter log prices weakened some since last August but supply of quality

large size logs continues tight. Also supply of kapur and keruing for lumber

is getting tighter and tighter. The prices for such quality logs stay up

high but there is some sign that the prices get softer by weak trend of

small diameter logs.

Sarawak meranti regular log prices are about US$290 per cbm FOB, US$265 for

small meranti and US$250 for super small meranti. Sabah enjoys fair weather

and log production is steady and the log prices are weaker with stable

quality than Sarawak so that Japanese log importers send more ships to Sabah.

Log export volume from Malaysia for the first eight months was 127,264 cbms,

19.2% less than the same period of last year.

Weather in PNG and Solomon Islands has been fair for about two months so log

production is steady The largest buyer, China is absent now but supply of

quality logs Japan wants is low so that the prices remain high.

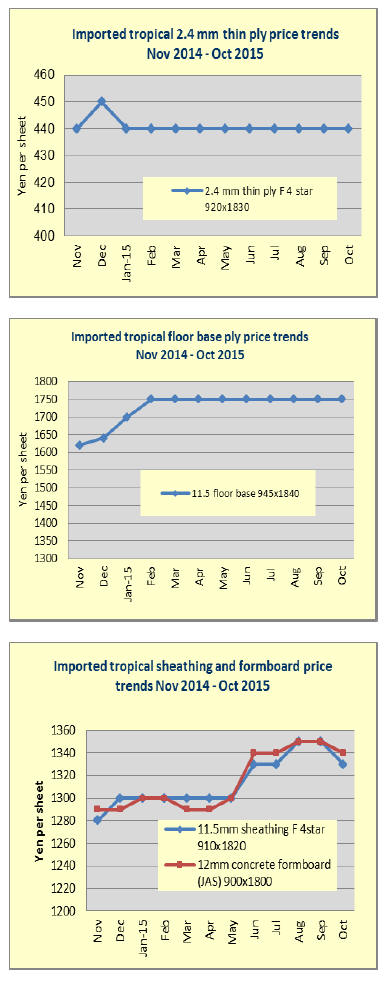

August plywood supply

Total plywood supply in August was 419,000 cbms, 9% less than August

last year and 6.5% less than July.

This is seven straight month with the volume less than 500,000 cbms. The

reasons are record low import plywood supply and production curtailment by

domestic plywood mills.

Drastic decline of Indonesian supply made share of domestic supply over 50%.

Softwood plywood inventories decreased under 160,000 cbms.

Total imported plywood supply in August was 205,200 cbms, 17% less than

August last year and 11.9% less than July. This is the lowest monthly supply

this year and the lowest in about four years since September 2011.

Since last May, record low monthly import has continued for four consecutive

months with average monthly arrivals of 217,500 cbms, 24% less than the same

period of last year. Assuming this low level continues, total year import

would be about 2,790 M cbms, which is lower than past record low import in

2009 of 2,840,000 cbms.

Indonesian supply sharply dropped in August. 44,600 cbms in August was 39.8%

less and 46.9% less.

Monthly average volume from Indonesia from May through August was 63,800

cbms and July arrivals were 84,100 cbms so August decline is conspicuous.

Malaysian supply continues less than 90,000 cbms for four consecutive

months. Eight month’s total supply is 20.8% less than the same period of

last year. Chinese supply remains unchanged.

Domestic production in August was 213,800 cbms, almost no change from July.

Softwood plywood production was 198,500 cbms. Eight months total is 4.6%

less than last year. The shipment was 222,400 cbms, 15.1% more than last

year and 11.9% less than July. Eight months total was 5.5% more.

August inventory was 159,600 cbms, about 23,000 cbms less than July.

PEFC promotes use of certified wood for the Olympic

PEFC (Programme for the endorsement of forest certification schemes) Asia

Promotions (Tokyo) emphasizes importance of using certified wood products

for the 2020 Olympic Games in Tokyo.

The Promotions commented that greening trend of the Olympic Games has

steadily been spreading and in 2012 London Olympics, percentage of certified

wood materials was almost 100% and policy to use certified materials is

clearly shown in other Olympics.

Use of certified materials has started in 2010 for the Winter Olympics at

Vancouver, Canada. At this time, percentage of certified materials reached

50-70% then in 2012 London Olympics, procurement of certified materials was

designated and percentage of PEFC and FSC certified materials was 95-100%

for 12,500 cubic meters of wood.

For 2016 Rio de Janeiro Olympic, by procurement policy with sustainability

management report, wood and pulp used for the Games are designated certified

products by FSC and PEFC.

For the Tokyo Olympics, PEFC, FSC and SGEC agreed to keep appealing use of

certified materials in 2013 and to continue appeals to necessary

organizations. For London Olympics, standard was set for public procurement

of wood products, which says only materials guaranteed sustainability can be

used and made examination and evaluation on forest certification system. The

London Olympic committee set standard on sustainability for the building and

printed materials then made timber supply panel.

The materials were supplied by ones which can perform, selected by auction.

There were twenty major projects in the Olympic Park only then certified

materials were used for other facilities like Olympic Village, cycle race

facility, swimming facility and stadium benches.

Old Wood plans marketing hardwood flooring in Japan

Old Wood (New Mexico, U.S.A.) flooring manufacturer plans to market the

products in Japan. Presently it is looking for marketing partner in Japan.

It has four plants in New Mexico and one in Mexico and markets the products

not only in the U.S.A. but also for Europe, Middle East and Asia.

It manufactures from hardwood logs in the areas such as mesquite, white oak,

black walnut and Douglas fir. It has its own timberland of about 2,400

acres. Logs are procured from New Mexico, Arizona, Colorado and Texas.

It respects sustained yield base harvest and buys logs from native American

land and also gives technical guidance to the native Americans.

|