Japan Wood Products

Prices

Dollar Exchange Rates of 10th

November 2015

Japan Yen 122.86

Reports From Japan

Lower petrol prices and employment

prospects lift

consumer confidence

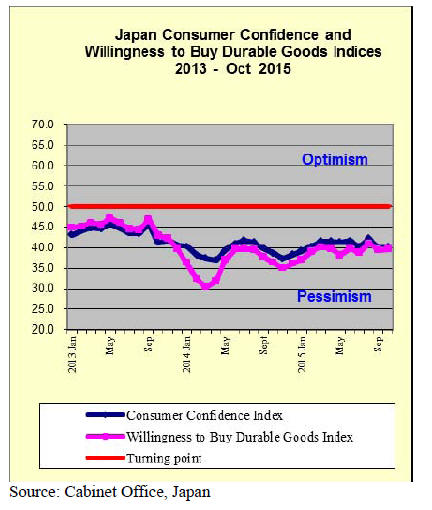

Japan’s Consumer confidence index rose in October

largely reflecting lower petrol prices and the employment

environment. Cabinet Office data shows the overall index

almost 1 point up from the previous month. This comes as

a welcome improvement after the decline in September.

The overall index is made up of four components of

consumer attitudes. Their view of income growth

prospects rose as did their attitude towards purchases of

durable goods. The Cabinet Office indices for October

were as follows

Overall livelihood: 39.6 (up 0.8 from

September) Overall livelihood: 39.6 (up 0.8 from

September)

Income growth: 40.0 (up 0.6 from

September) Income growth: 40.0 (up 0.6 from

September)

Employment:45.9 (up 1.0 from September) Employment:45.9 (up 1.0 from September)

Willingness to buy durable goods:40.3

(up 1.2 Willingness to buy durable goods:40.3

(up 1.2

from September)

Inflation target pushed forward

In an effort to explain why the 2% inflation target has been

pushed to the end of the next fiscal year the Bank of Japan

(BoJ) has cited falling oil prices but now cites falling

housing rent and public service fees.

Bank analysts point out that unchanged rents and

power,

water rates and public transport charges are tending to

undermine what they say are positive trends to higher

inflation. This scenario is explained in the BoJ semiannual

outlook report.

http://www.boj.or.jp/en/mopo/outline/qqe.htm/

The BoJ is facing mounting pressure to act as many

analysts feel the modest wages increases that have been

recorded are not enough to boost household spending

which is central to beating deflation.

September machinery orders beat expectations

The value of orders for new and replacement machinery

by private and public sector enterprises is a closely

watched indicator of manufacturing and market sentiment.

Because of the weak August numbers analysts did not

expect much cheer from the September figures but were

surprised.

The latest Cabinet Office data shows that in September the

value of orders for machinery received by major

manufacturers in Japan increased by 9.5% from August.

However, despite the positive news the July-September

orders fell 4% compared with the previous quarter.

In the October-December period total machinery orders

are forecast to rise modestly but private sector orders

could be maintained at around 3% says the Cabinet Office

report.

For more see:

http://www.esri.cao.go.jp/en/stat/juchu/1509juchu-e.html

Economists would like to see a more positive trend in

machinery orders as it is this that ultimately signals that

jobs are being created and economic growth is anticipated

by manufacturers. The forecast for weakening orders in

the third quarter of this fiscal year signals tough times

ahead for the BoJ and government.

Widening gap in regional land prices

Construction work for the 2020 Tokyo Olympics is

already having an impact on land prices in Tokyo and on

the availability and hence wages for construction workers.

As order books of construction companies fill new

customers are being asked to pay higher rates or are being

told start dates will be delayed.

The Land Ministry in Japan has shown that construction

prices topped yen 220,000 per square meter in April, a

price not seen since the bubble days.

Despite the rise in land prices in the urban areas nationwide

the average price of commercial land fell up to April

marking the eighth consecutive year-on-year fall. Prices

for residential land also declined, the 24th annual

decrease.

Analysts point to the widening gap between prices in the

main regional cities where prices are rising and prices in

those areas not getting a boost for government spending.

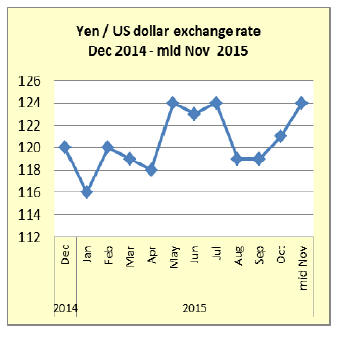

Yen slips as likelihood of US rate hike rise

Another round of quantitative easing by the Bank of Japan

(BoJ) had been anticipated but did not materialise. Had the

BoJ moved with more cash into the economy the yen

would have weakened to give a further boost to exports

which has been lackluster since the Chinese economy

slowed.

It was only the better than forecast jobs data for the US

that recently moved the yen lower. The improvement in

employment in the US is thought to have given the Federal

Reserve the confidence to come with an interest rate rise

before year end.

Import round up

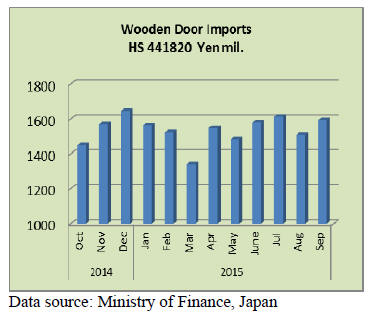

Doors

Year on year September 2015 door imports rose by around

10% and compared to August, September imports were up

just over 5.5%. Japan’s September door imports

wereamongst the highest for the year however average

monthly imports in the first three quarters of 2015 were

down 9.5% compared to the average monthly imports in

2014.

The top suppliers remain China and the Philippines

followed by Indonesia.

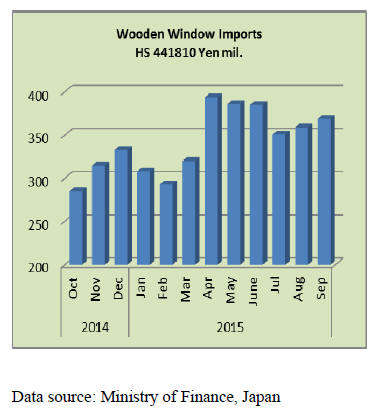

Windows

In the first three quarters of 2015 the average monthly

imports of wooden windows was down 23% compared to

the same period in 2014. However, September imports

were up 5.7% year on year and compared to a month

earlier September imports rose 3%.

China continues as the number one supplier followed by

the Philippines and the US. The top three supplires

accounted for over 80% of all wooden window imports in

September.

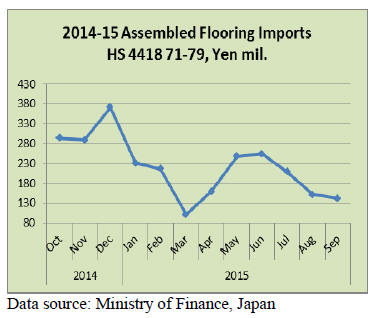

Assembled flooring

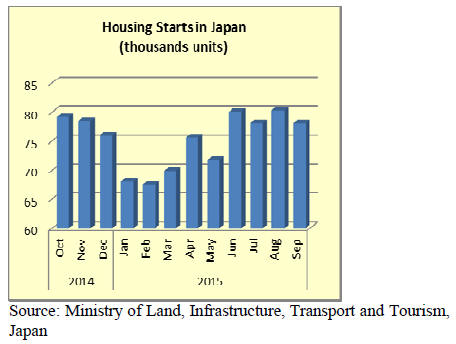

Year on year Japan’s imports of assembled flooring fell a

massive 56% and compared to levels in August this year

September imports were down 6.6%.

When comparing average monthly imports in 2014 with

the same period in 2015 the 23% decline gives an

indication of the weakness in the Japanese housing market.

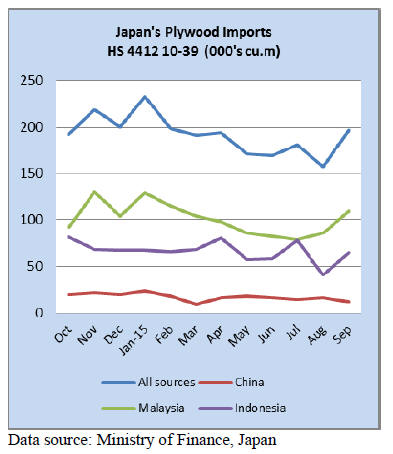

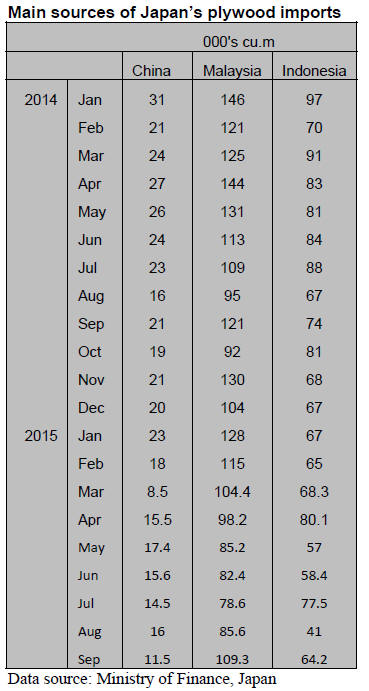

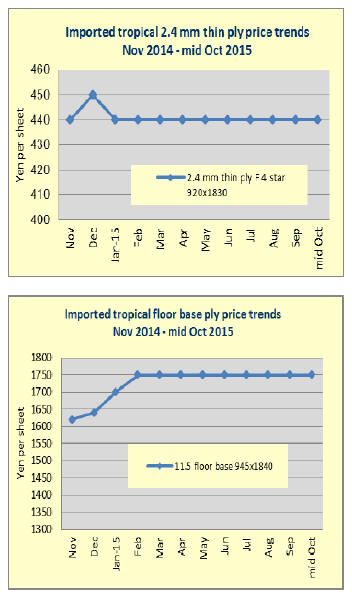

Plywood

Suppliers in three countries, China, Malaysia and

Indonesia account for almost all Japan’s plywood imports.

Plywood imports have steadily fallen since the beginning

of 2015 but September marked a turning point as import

volumes from Malaysia and Indonesia jumped. However,

overall imports of plywood remain very subdued.

Year on year September imports were down 11% but the

fall was not evenly spread across the three main suppliers.

Year on year imports from China crashed 45% while

imports from Malaysia dropped almost 20% and imports

from Indonesia fell 13.5%.

Average monthly plywood imports in the first three

quarters of 2015 were down 42% on the avaerage for the

same period in 2014.

Trade news from the Japan Lumber Reports (JLR)

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

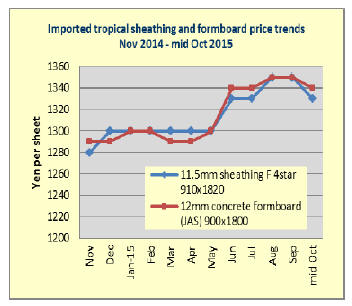

Change underway in Japan’s plywood industry

In last one year supply structure of plywood has drastically

changed and seems that transition is taken place in the

market. Rapid appreciation of yen since August 2014

pushed cost of imported plywood up and difficulty passing

hither cost on to the sales prices accelerate use of lower

cost domestic soft wood plywood.

Domestic plywood manufacture have been developing

non-structural plywood as future housing start are likely to

decline and production and shipment of such product have

been increasing.

In particular, softwood floorbase are expected to expand

and shipment of concrete forming panel for coating is

steadily increasing.

There is no statistic for softwood non-structural

plywood

so exact figure are not certain but according to the statistic

the Ministry of Agriculture, Forestry and Fishery monthly

average production of concrete forming plywood for the

first 8 months of this year is about 4,500 cu.m., 57.2%

more than the same period of the last year. Monthly

production of softwood concrete forming panel for coating

in 2015 is estimated about 4,000cu.m.

Monthly production of floorbase is estimated about

6000cu.m. but it appears to be about 10000 cu.m. by all

the plywood manufacturers as the Japan Forest Product

Journal made survey through major plywood manufactures

and volume was over 8000cu.m. by responders.

In short, domestic plywood is replacing imported hard

wood plywood on both floor base and concrete forming.

Plywood

Market of imported plywood is weak. There were some

low price spot offers in late September for book closing

purposes by the importers so market prices dropped by one

notch. The movement dwindle in September and October.

Despite record low level of import market does not react at

all. Then the arrivals increased. Malaysia supply in

September was 112,000cu.m. the highest since last

February after monthly arrivals had continues with 80,000

cu.m. level for four straight month from May through

August.

|