|

Report from

North America

National formaldehyde emission standards to be

issued early this year

In 2010 the US Environmental Protection Agency (EPA)

started developing national standards for formaldehyde

emissions from wood products based on the California

regulation, but the standards are still not in place. Industry

groups and others opposed some of the testing

requirements in the draft standard. The EPA expects to

issue the final regulation in spring of 2016.

Recently laminate flooring products sold by Ark Floors

showed in tests formaldehyde emissions well above those

allowed under California standards. Ark Floors is a

smaller importer of Chinese-made flooring.

The much larger company Lumber Liquidators had

previously been accused of selling flooring with high

formaldehyde emissions.

The Chinese company that supplied the flooring to Ark

Floors had products pulled from stores in China in 2012

over formaldehyde emissions, according to China¡¯s news

agency Xinhua.

According to the US flooring manufacturers the test

results for products sold by Lumber Liquidators and now

Ark Floors has created apprehension among Americans

about health impacts of wood flooring. Implementing a

national standard for formaldehyde emissions would

improve the market for producers and retailers.

Manufacturing industries report lower economic

activity

Economic activity in the manufacturing sector declined in

November for the first time in three years, according to the

Institute for Supply Management. Production and new

orders decreased based on the Institute¡¯s industry survey.

Furniture manufacturing companies reported lower output

in November, while production was unchanged in the

wood products sector.

Consumers confident in economy, plan purchases

Consumer confidence rose to its highest level in December

since July, according to the University of Michigan

consumer survey. It was also the highest December

confidence since 2004.

Consumers were positive about current economic

conditions and reported higher household incomes.

Many plan to buy durable household items, a positive sign

for furniture and wood product manufacturers. However,

heavy discounting on consumer products is widespread

due to the weak Chinese economy and the strong US

dollar. Consumers indicated they will base purchases on

low prices and discounts.

Housing starts near normal conditions

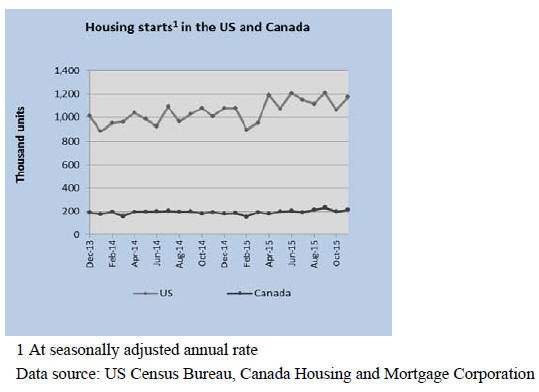

Housing starts in November were at a seasonally adjusted

annual rate of 1.2 million, up 10% from October. Starts

were 17% above the November 2014 rate of 1 million.

The strongest growth remained in multi-family

construction but single-family housing starts were also up

in November at 768,000. This is the highest level since the

financial crisis and indicates the US housing market is

back to near normal conditions.

The number of building permits was at a seasonally

adjusted rate of 1.3 million in November, up 11% from

October. Permits for multi-family construction accounted

for much of the increase in the number of permit.

The National Association of Home Builders expects a

modest growth in housing starts for 2016. Home builders

were positive in December about the market for newly

built, single-family homes, but confidence was unchanged

from November. The National Association of Home

Builders reports continuing concerns about high labour

and land costs.

¡¡

Drop in sales of existing homes

Sales of existing homes dropped considerably in

November, according to the National Association of

Realtors. All major regions in the US posted lower sales,

on average -11% across the country. Sales were 4% lower

than at the same time last year.

The sales drop is likely not due to low demand since

homes sold faster in November than in the previous

month.

The National Association of Realtors speculates that

depressed home sales may be related to affordability

issues and adapting to the new ¡®Know Before You Owe¡¯

rules (see http://www.consumerfinance.gov/know-beforeyou-

owe/). Almost half of realtors surveyed in November

reported that because of the new rules it is taking longer

to close deals with buyers.

Softening business conditions affects November nonresidential

construction

Spending in non-residential construction slowed from the

summer to November 2015 at a seasonally adjusted annual

rate, according to US Census Bureau data. Most building

construction declined, with the exception of office

buildings and public schools. The government revised

construction data from 2005 through October 2015 and

reported spending was lower than previously reported for

much of 2015.

The American Institute of Architects reported a softening

of business conditions in November, despite the generally

strong economy. Conditions in the Northeast were worse

than in the rest of the country. Most firms expect higher

revenues in 2016.

Canadian multi-family market remained strong

Canadian housing starts in November were up 7% from

the previous month at a seasonally adjusted annual rate.

The multi-family market in the major cities remained

strong, but single-family construction declined 4% from

October.

For 2016 the Canadian Housing and Mortgage

Corporation expects lower or unchanged construction

levels. Single-family starts will continue declining because

of high house prices in urban centres.

The economy in oil-producing regions will still suffer

from low oil prices in 2016. Housing demand has been

stronger in Ontario and British Columbia where

manufacturing benefited from the low Canadian dollar.

Housing starts are predicted to strengthen in2016 in

Quebec and Atlantic Canada.

Prices for Canadian crude oil reached a new record low in

early January. More production may be shut down and

new oil sands projects are being shelved. The OECD still

expects the Canadian economy to pick up in early 2016

led by growing exports of non-energy products.

US interest rate rise a risk to Canadian housing market

The long-anticipated raise in interest rates was announced

in mid-December by the US Federal Reserve. Rates were

raised by a quarter point, the first increase since 2006.

Unemployment is at its lowest in seven years and recent

economic growth surpassed expectations. November

unemployment was unchanged at 5%. Construction was

among the sectors with job gains. Real GDP increased

2.1% in the third quarter of 2015, according to the US

Department of Commerce estimates, down from 3.9% in

the second quarter.

If the US economy remains strong further gradual interest

rate increases are expected. This may be bad news for the

Canadian economy where household debt is at record

levels. Some analysts predict a housing market collapse in

Canadian cities if mortgage rates increase and housing

prices decline. The Canadian government tightened

mortgage down payment requirements.

October Import data

Keruing and sapelli sawnwood imports rise

US tropical sawnwood imports recovered in October 2015

from the decline in the previous month. 21,425 cu.m. of

tropical species were imported in October, up 11% from

September. Year-to-date imports were 14% higher than at

the same time in 2014.

The strongest month-over-month growth in imports was in

sapelli (3,245 cu.m.), keruing (2,169 cu.m.) and mahogany

(2,787 cu.m.).

Ipe sawnwood imports fell 60% to 1,370 cu.m. in October,

this was from exceptionally high imports in September. As

a result overall imports from Brazil decreased by almost

half in October.

Tropical hardwood imports from all other major suppliers

increased in October, in particular from Malaysia (+50%)

and Cameroon (+27%).

Hardwood plywood imports decline

October was the fourth consecutive month of decline in

imports of hardwood plywood. A total of 245,351 cu.m.

were imported, down 10% from September. Year-to-date

imports were 8% higher than in October 2014.

US imports from China decreased to 118,347 cu.m. Yearto-

date imports remain higher (+14%) than at the same

time last year. Plywood imports from Ecuador also

declined (10,572 cu.m.).

Indonesia¡¯s shipments to the US increased in October to

30,497 cu.m. but year-to-date imports were 5% lower than

at the same time in 2014.

Brazil and Malaysia lost moulding market share

Hardwood moulding imports were worth $16.5 million in

October, up 3% from the previous month. Year-to-date

imports were 5% lower than in October last year.

China and Canada significantly increased moulding

shipments to the US in October, while imports from Brazil

and Malaysia declined.

China was the only country with higher shipments year-todate

compared to 2014.

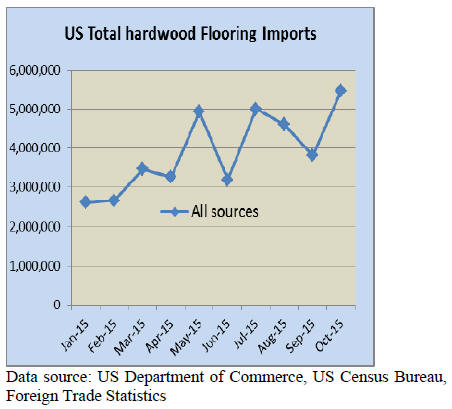

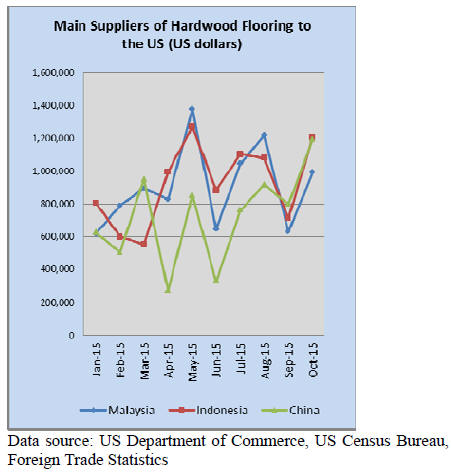

Strong growth in hardwood flooring imports

US flooring imports continue to outpace last year¡¯s level.

Hardwood flooring imports increased 44% in October to

$5.5 million, up 29% year-to-date from 2014. Imports

from all major supplier countries grew in October.

Indonesia and China were the leading suppliers at $1.2

million each in October, followed by Malaysia with just

under $1 million in shipments.

Imports of assembled flooring panels decreased from

September, but year-to-date imports were up 8% from the

same time last year. Total assembled flooring panel

imports were worth $11.4 million in October. China¡¯s

share declined to under half ($5.0 million) of total imports.

Year-to-date imports from Canada, Indonesia and Brazil

increased compared to October 2014. Canadian growth

was strongest, supported by the low Canadian dollar.

Year-to-October furniture imports 11% higher than a

year earlier

The value of wooden furniture imported in October was

almost unchanged from the previous month at $1.40

billion. Year-to-date imports were 11% higher than in

October 2014.

China¡¯s furniture shipments were stable in October at

$659.7 million (+10% year-to-date). Imports from

Vietnam declined by 3% to $267 million (+21% year-todate).

Most other countries increased shipments in October

with the exception of Malaysia. However, year-to-date

both Vietnam and

Malaysia saw the largest gains in the US market.

Furniture imports from India continued increasing in

October (+5% to $20 million). Imports from Europe

declined from the higher levels seen earlier this year.

Wooden office furniture imports grew by 8% in October,

followed by upholstered wooden seating at 3%. All other

types of wooden furniture declined from the previous

month.

|