Japan

Wood Products Prices

Dollar Exchange Rates of 25th

April 2016

Japan Yen 111.20

Reports From Japan

Massive rescue and recovery in progress

On Saturday 16 April a magnitude 7.3 earthquake was the

first of several severe quake to devastate parts of

Kumamoto Prefecture in Japan’s western island of

Kyushu.

The epicenters of the two most damaging earthquakes

were directly below a densely populated urban area. The

latest count puts the death toll at 50 with over 13,000

homes being completely destroyed and another 15,000

seriously damaged.

Experts point out that in contrast to the March 2011

magnitude 9 earthquake which struck in north east Japan,

the result of deep tectonic plate movements, the quakes

that are still battering Kumamoto have a shallow focus

which tends to concentrate the damage in a small area.

Japan is preparing an extra budget said to be over US$4

billion for relief and reconstruction in areas affected this

month's deadly earthquakes.

Delay in sales tax increase becomes more likely

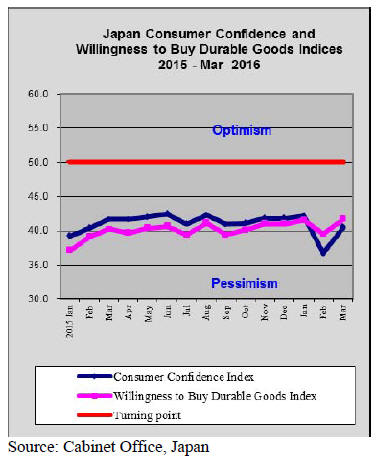

In its latest assessment of economic prospects the

government maintained an optimistic view but said it was

analysing what impact the recent disaster will have since

thousands of homes and businesses have been destroyed.

The government lowered its assessment of corporate

sentiment after the recent Tankan survey showed

companies were less optimistic about business conditions

in the first quarter of this year. A statement from the

Cabinet Office says “Japan's economy remains on track

for recovery, but more weak spots can be seen" .

Some analysts expect the economy to weather the impact

of the recent earthquakes but caution that the Prime

Minister may use the event as a reason to delay the rise in

sales tax early next year, particularly as consumer

sentiment is stalling.

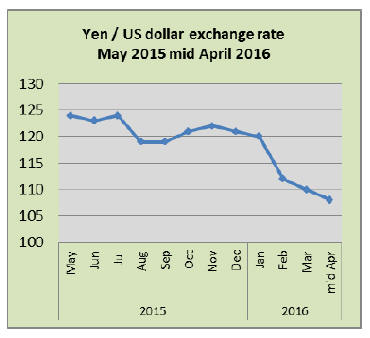

See-sawing yen/dollar exchange rate

The yen/dollar exchange rate see-sawed prior to, and then

after the monthly Bank of Japan (BoJ) Board meeting.

The financial markets had expected the BoJ to come with

further measures to weaken the yen which had gained

around 5% on the US dollar in the days running up to the

BoJ meeting.

To everyone’s surprise the BoJ maintained a neutral stance

which sent the yen soaring higher to an 18 month high

against the dollar.

A strong yen hurts Japanese exporters and puts downward

pressure on import prices, both effects the opposite of

what the BoJ and government are aiming for.

Quake resistant housing

Japan regularly experiences earthquakes being a very

seismically active country and as a result has, over the

years, developed rigorous earthquake building standards.

The current regulations date back to the 1981 Building

Standards Law and subsequent revisions. The evidence

from the Tohoku and Kobe quakes showed that the 1981

standards were sufficient as most of the damage occurred

to homes built prior 1950.

Further tightening of the building regulations was made in

2013 requiring owners of large public buildings to have

third party assessment of whether the properties meet the

1981 law.

The aim at the time was to increase to 90% public

properties that met the revised code. In some instances the

government provided support for improvements.

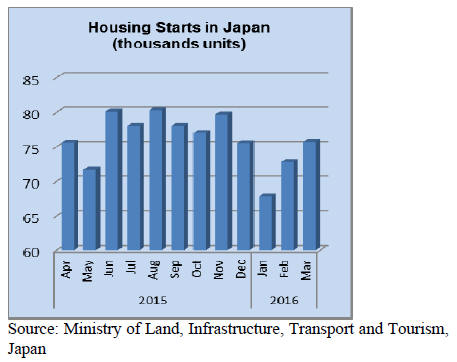

Fast pace housing starts

Data from the Ministry of Land, Infrastructure, Transport

and Tourism indicates that year on year March 2016

housing starts increased by just over 8%.

The expectation was for a slowing in the rate of starts from

the over 7% reported for February. March 2016 starts

marked the third consecutive rise and the fastest pace of

increase since August last year. The Ministry also reported

that orders at the biggest builders increased in March.

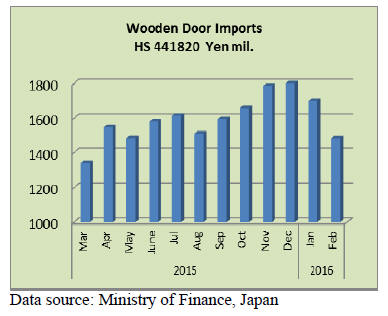

Doors

Year on year February 2016 imports of wooden doors fell

almost 3% after the 8% year on year rise in January. Since

December last year Japan’s imports of wooden doors have

been falling.

China remains the main supplier of wooden doors to Japan

followed by the Philippines and Indonesia. These three

suppliers dominate imports of wooden doors accounting

for over 84% of all imports of doors in February. Of note,

Brazil joined the list of countries shipping wooden doors

to Japan.

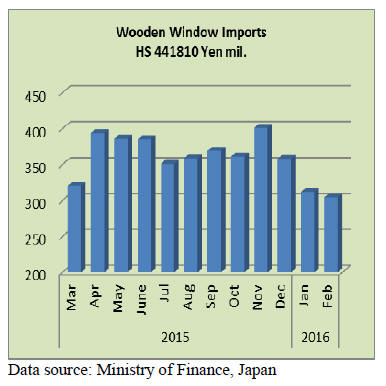

Windows

Year on year Japan’s February 2016 wooden window

imports were slightly up as they were in January but this

disguises the sharp deline in imports of windows since

November 2015. The level of wooden window imports in

February marked a new low.

The top three suppliers, China (29%), Philippines (24%)

and the US (24%) continue as the main suppliers

accounting for 85% of February 2016 imports.

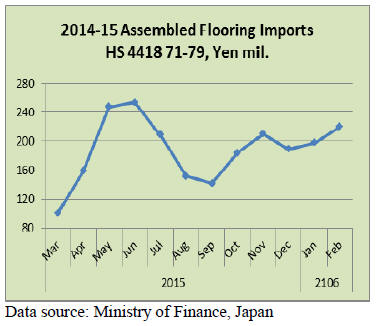

Assembled flooring

The data below shows imports of three categories of

assembled flooring, HS 441871,72 and 79. Most of

Japan’s imports are of HS441872 with China being the

main supplier followed by Indonesia and Malaysia which

accounted for over three quarters of February imports of

this category.

HS441879 flooring is supplier from Indonesia, China and

Vietnam in order of rank, the three accounted for 88% of

Japan’s imports of this category in February. Japan’s

imports of HS441871 are small with almost all coming

from Indonesia.

Plywood

February 2016 imports of plywood fell back after the

sharp rise reported in January. Year on year February

2016 plywood imports were down 12% and February

imports were down 15% from levels the previous month.

All three of the main suppliers saw February shipments to

Japan fall compared to levels in January; China (-38%),

Malaysia (-20%) and Indonesia (-5%). The top three

suppliers accounted for 93% of all Japan’s February 2016

plywood imports.

Trade news from the Japan Lumber Reports (JLR)

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

South Sea (tropical) logs

In Sarawak, Malaysia, rainy season was over but weather

is still unstable with occasional heavy rain in some area. In

the past, log production increases after rainy season is over

and the prices drop but this year log supply seems to be

tight as the suppliers are cautious in dealing with newly

control of illegal harvest so the log supply seems to stay

tight for some time.

The Japanese log importers have hard time to set up

shipping schedule due to very tight supply for quality logs.

Then Indian log buyers are now accepting higher offers by

the suppliers, which affects log prices for Japan.

Also after Malaysian currency ringgit rebounded and got

stronger so the log suppliers are asking higher log prices

but the Japanese are bearish as South Sea hardwood

plywood orders in Japan are weak.

In Sabah, weather is clear and fine so that log production

is steady but India has started buying Sabah logs for the

first time after they shifted to PNG and Solomon Islands to

shy away from spiraling high log prices in Sarawak.

Before India showed up in Sabah, log prices for Japan had

been stable but now it will be the same as Sarawak with

entry of India.

Present log prices in Sarawak for Japan are US$265-275

on meranti regular per cbm FOB, US$245 for small

meranti and US$230 for super small. These seem to be

bottom prices now and will go up.

Fire at Akita Plywood

Fire started at the second plant of Akita Plywood, one of

the largest plywood manufacturers in Japan in the evening

of April 6 then the fire extended to the first plant. The

second plant is totally destroyed by the fire. Fire obviously

started behind dryers then burnt roof and imported veneer

so the fire spread fast then the fire moved to the first plant

but the damage is minor.

Akita Plywood has three plants, the first, second and Oga,

which produce total of about 40,000 cubic meters of

plywood a month. The second plant specialises

manufacturing thick panel with monthly production of

10,000 cbms then the first plant makes 12 mm 3x6 and

floor base with monthly production of 15,000 cbms.

Since Akita Plywood is one of the group companies of

Seihoku group, the group is trying to cover and support

damage of Akita Plywood by increasing production of

other group plants.

The company plans to rebuild the second plant but it

would take about a year before the production resumes.

This gives shock to plywood market and there are some

speculative demand but other plywood mills are now

running in full and have no extra capacity to increase the

production.

Increasing supply of biomass fuel

Sharp increase of number of wood biomass power

generation plants all over Japan after FIT system has

started in July 2012 results in expansion of fuel supply by

large trading firms and subsidiary company of paper

manufacturing companies.

Companies, which have its own power generation plant in

the group or invested for biomass power plants,

aggressively participate in procurement of biomass fuel

which contributes increase of sales. Also wood fuel is used

by coal burning power plants to reduce carbon dioxide

emission.

Handling of wood fuel is one of substituting businesses to

supplement declining business of building materials sales

with decrease of housing starts in future.

Sumitomo Forestry’s fuel supply in 2015 (domestic wood

chip and imported PKS) was 1.2 million cubic meters,

5.3% more than 2014. With increasing number of biomass

power generation plants, supply of PKS sharply climbed

and was more than double of 2014 supply. Monbetsu

Biomass Power (power output of 50,000 kw), which is

jointly operated by Sumitomo Forestry and Sumitomo

Kyodo Electricity, will start up in late December this year

so Fuel supply will increase further more.

Sumitomo Trading’s fuel supply of imported wood pellet

in 2015 was 77,000 ton, 97.4% more than 2014. It had

been supplying for large power companies steadily then

additional supply for biomass power plant, which burns

coal and biomass fuel pushed the total volume up.

The largest wood biomass power plant Sumitomo Trading

owns, Handa Biomass Power (power output of 75,000 kw)

is under construction and will start up in May next year. It

will use coal as supplementary fuel at the beginning but it

will use 100% biomass fuel in future so its annual

necessary biomass fuel will be about 500,000 ton.

Hanwa Co., Ltd. imported about 160,000 ton of PKS in

2015. Oji Forest and Products Co., Ltd. covered decline of

sales of logs, lumber and plywood by increased sales of

paper manufacturing materials and wood biomass fuel in

2015. Nippon Paper Lumber Co., Ltd. increased supply of

fuel chip including PKS to 1,620,000 ton, 17% more than

2014.

It intends to strengthen business of this growing field,

which is not affected by declining housing starts.

|