2. GHANA

2015 export performance reported

Ghana¡¯s 2015 wood product exports totalled 367,061cu.m,

compared to the 356,036 cu.m recorded in 2014. The

corresponding export earnings for 2015 and 2014 were

Eur187.62 million and Eur138.22 million.

Compared to 2014, Ghana¡¯s 2015 volume of exports

grew

by 3% and by a significant 36% in terms of value.

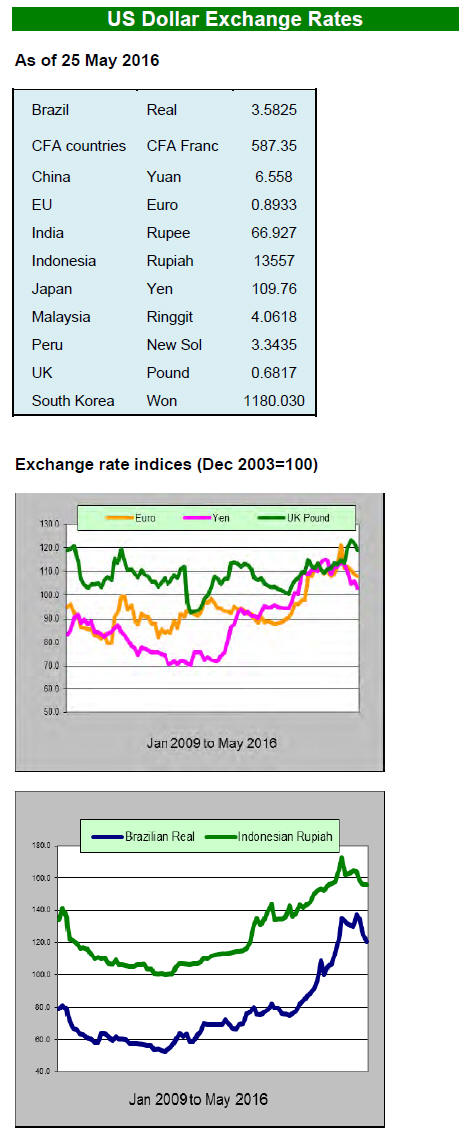

The major markets for Ghana¡¯s wood products in 2015

were Asia (59%), Africa (19%) and Europe (15%) as

illustrated above.

Wood product exports to Asia totalled 215,343 cu.m and

Asian markets continue to absorb a high proportion of

Ghana¡¯s wood products.

African markets accounted for 67,950 cu.m of all 2015

exports valued at Euro 26.93 million with the ECOWAS

market accounting for the largest share (82%) of the total

volume for sales to African countries.

Togo, Nigeria, Niger, Senegal, Burkina Faso and Benin

were the major ECOWAS countries that traded with

Ghana and 2015 imports by these countries increased

around 10% compared to 2014.

Previously Nigeria was a major importer of Ghana¡¯s wood

products, particularly plywood, but in 2015 Nigeria¡¯s

imports from Ghana dropped by 44% to 21,135 cu.m in

2015, from the 37,758 cu.m recorded in 2014. The decline

is attributed to Nigeria¡¯s regulations on the availability of

foreign exchange.

Exports to Senegal and Togo in 2015 also fell compared to

levels in 2014 declining 20% and 24% respectively. The

fall in exports to regional markets is attributed mainly to

supply problems in Ghana rather than any weakness in

demand.

The third major destination for Ghana¡¯s wood products in

2015 was Europe. The volume of wood products exported

to EU member states in 2015 totalled 54,734 cu.m, which

represented 15% rise year on year.

The major products exported in 2015; air and kiln dry

sawnwood, rotary veneers, dowels and flooring. The main

species in demand were wawa, asanfina, ceiba, sapele,

chenchen and koto, all of which posted year on year gains.

3. MALAYSIA

Leadership at MTCC changes hands

The Malaysian Timber Certification Council (MTCC) has

welcomed Himmat Singh as its newly appointed

Chairman. Dato¡¯ Dr. Freezailah Che Yeom was the

Chairman of MTCC since 1999and was the founding

Executive Director of ITTO.

The announcement from MTCC¡¯s CEO, Yong Teng Koon,

says ¡°Datuk Himmat¡¯s appointment marks another

milestone for MTCC as it continues to advance and

spearhead the sustainable forest management agenda in

Malaysia and in the Southeast Asian region.

We are indeed honoured to have Datuk Himmat Singh

lead MTCC as he brings with him a wealth of experience.

His distinguished career in the civil service spans over 35

years which includes serving as the Secretary General of

the Ministry of Plantation Industries and Commodities

covering forestry and timber trade before he retired in

December 2015.

We look forward to progressing to greater heights

under

his leadership as the Chairman of MTCC.¡±

In paying tribute to the outgoing Chairman, Yong said,

¡°MTCC¡¯s progress, thus far, is attributed to the astute

leadership of MTCC¡¯s outgoing Chairman, Dato' Dr.

Freezailah Che Yeom. We are truly grateful for his wise

counsel and invaluable contribution during his 17-year

tenure as a member of the MTCC Board of Trustees. We

wish him a very happy retirement."

See: http://www.mtcc.com.my/news-items/datuk-himmat-singhappointed-

as-mtcc-chairman

Prospects for 2016 good says MTIB

The export value of Malaysia's wood products is expected

to increase to RM24 billion (approx. US$5.9 billion) this

year from the RM22.14 billion achieved in 2015, despite

the current economic uncertainties.

Malaysian Timber Industry Board (MITB) Director-

General Dr. Jalaluddin Harun said higher international

sales will be driven by developments in Qatar and Iran and

the steady demand in the United States and the European

Union as well as India and Australia.

The total value of Malaysian wood product exports in

2015 expanded 6.4% year on year to RM22.14 billion,

with wooden furniture exports rising to RM7.3 billion

from RM6.4 billion in 2014.

Marketing mission to US delivers good results

The Malaysian Timber Council's marketing mission to the

United States in April generated just over RM9 million

(approx. US$2.2 million) in confirmed and potential sales.

This mission was launched to coincide with the

International Wood Products Association's 60th World of

Wood Convention in Texas.

The convention was attended by more than 250 importers,

service providers, government agencies and suppliers of

wood products from 25 countries. During the mission 11

of the 17 participating Malaysian companies secured sales.

Of the 11, six were first-time participants in such a

mission.

The US is proving to be a profitable market for Malaysian

flooring, dark red meranti and nemesu decking, meranti

sawnwood and finger-jointed and laminated timber. The

US is the largest market for Malaysian wooden furniture

accounting for 34% of total wooden furniture exports.

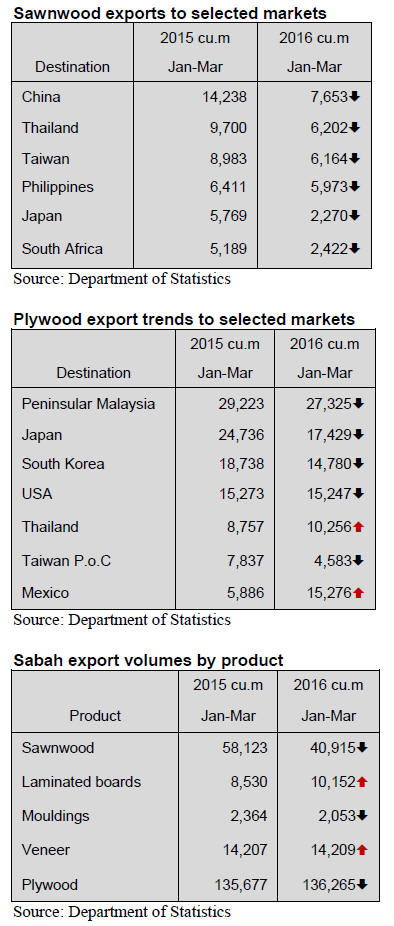

Discouraging first quarter results from Sabah

The Sabah Department of Statistics has just released data

on wood product for the first quarter 2016. Total exports

of sawnwood in this period were valued at RM80 million,

plywood exports totalled RM264 million and veneer

exports were worth RM25 million. The corresponding

value of exports in the first quarter in 2015 were:

RM74.53 million, RM238.78 million and RM19.89

million.

Sarawak exporters confident Japan¡¯s plywood

imports

will rise

Plywood exporters in Sarawak are confident that japan¡¯s

demand for plywood will rise in the months ahead from

the current low level. Executives at a major plywood

exporter said the recent decline in plywood prices seem to

have bottomed out and, as plywood stock levels are

falling, imports are expected to pick-up. In recent months

the yen has strengthened against major currencies which

make imports more appealing.

The other factor which should drive up imports is the

investment in infrastructure in connection with Japan¡¯s

hosting of the Olympics games in 2020. In reporting 2015

final quarter results Ta Ann said the average plywood

prices fell by 11% and log export prices were down

around 10%.

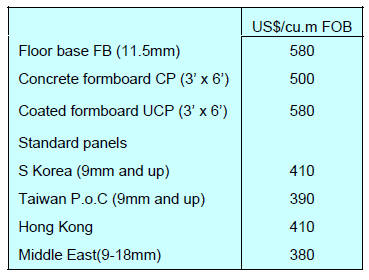

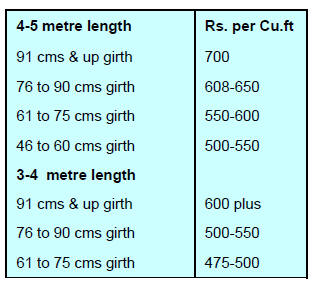

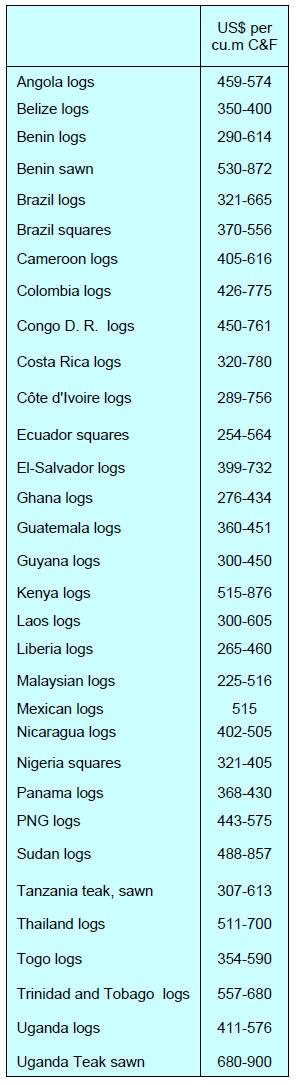

Plywood prices

Plywood Traders in Sarawak reported the following export

prices:

4. INDONESIA

High hopes for FLEGT exports

The government expects wood product exports to the

European Union to increase to around US$1.1 billion this

year as a result of the implementation of the FLEGT

timber legality certification process.

Nurlaila Nur Muhammad of the Ministry of Trade said

with the adoption of the FLEGT licensing system

Indonesia¡¯s exports to the EU will have a market

advantage. The benefits from Indonesia¡¯s VPA with the

EU was also highlighted by Foreign Minister Retno LP

Marsudi who said SVLK implementation would benefit

Indonesia, which currently has a 40 percent market share

in the EU tropical timber market.

Siti Nurbaya Bakar, Environment and Forestry Minister

said SVLK implementation would help the country

combat illegal logging and trade in illegally sourced

timber and would help improve governance in the forestry

sector.

According to government estimates 1,634 furniture

exporters and 70% of SME exporters have secured

domestic legality verification certification.

Villagers co-opted for fire prevention

Community-managed task forces are set to be created to

monitor forest fire hot spots in about 600 villages

throughout the country. Raffles Brotestes Panjaitan in the

Ministry of Environment and Forestry said his ministry

has been working with regional and local administrations

to prepare the launch of the new fire alert system which

will depend on village and community input.

Development of Patimban Port

The Japanese government has signalled to Indonesia that it

is eager to be involved in the development of the Patimban

deep seaport in West Java. Investment in infrasturure is

one of the pillars of the Indonesian government¡¯s plans for

reviving the economy.

Expansion of capacity at Port Patimban, some 70

kilometers from Jakarta, would vastly improve the

movement of goods into and out of industrial areas east of

Jakarta such as Karawang and Cikarang.

Japanese manufacturing firms, such as Toyota and Honda

would benefit from this development as they have

production facilities close by.

For more see: http://www.indonesiainvestments.

com/news/todays-headlines/japan-indonesia-topartner-

for-construction-of-patimban-seaport/item6864

5. MYANMAR

MTE off US sanctions list

It came as a welcome surprise in Myanmar when the

Office of Foreign Assets Control (OFAC) in the US

Treasury Department removed the Myanma Timber

Enterprise (MTE) from its Specially Designated

Nationals List (SDN). This list identifies foreign

individuals or enterties with whom US companies or

individuals are restricted from doing business with.

The Office of Foreign Assets Control (OFAC) a financial

intelligence and enforcement agency charged with

planning and execution of economic and trade sanctions in

support of US national security and foreign policy

objectives.

Efforts, which began in 2013, were made by MTE and the

International Wood Products Association (IWPA) in the

US to have MTE removed from the SDN list but the

OFAC only agreed to grant a General License which was a

year by year waiver. Through this mechanism only IWPA

members could benefit from the import license.

The most recent decision allows all USA companies to

trade with MTE but comes at a time when timber

production for export is set to fall as a logging restriction

is likely to come into effect in Myanmar.

New rubberwood processing joint venture

For the first time a Japanese company has entered into a

joint venture for the manufacture of rubberwood products

such as tables, chairs, cupboards, seats and wall cabinets.

The joint venture is between Myanmar¡¯s Moe Mya Chel

Company and Japan¡¯s Sumitomo and Oji Forest and

Products.

The factory, which has an annual production capacity of

around 8,000 cubic metres, will be located in in

Mawlamyaing, Mon State. There are some 200,000

hectares of rubberwood in Mon State alone with another

approx. 380,000 hectares across the country.

For more on this investment see page 15

Mixed signals on harvest levels

An official decision on a logging ban or logging restriction

has not been made known. The Deputy Director General

of Forest Department surprised everyone by telling

reporters from the Daily Eleven Newspaper that teak and

hardwood harvesting will continue for ten years.

He is reported to have said the teak harvest would be

19,200 and the hardwood harvest would be 592,330 but

did not mention the unit of quantity. Previously, the Forest

Department mentioned specific details of the harvest

levels which seem to contradict the latest statements to the

press.

Analysts and observers are waiting for the Forestry

Department to make an official announcement of planned

harvests to avoid confusion.

6.

INDIA

Inflation rate trends down

The Office of the Economic Adviser (OEA) to the Indian

government provides trends in the Wholesale Price Index

(WPI).

The official Wholesale Price Index for All Commodities

(Base: 2004-05 = 100) for April rose to 177.0 from 174.6

in March. The year on year annual rate of inflation, based

on monthly WPI, stood at 0.34% (provisional) in April

2016 compared to -0.85% in March.

Year to April inflation was 1,37%. For more see:

http://eaindustry.nic.in/cmonthly.pdf

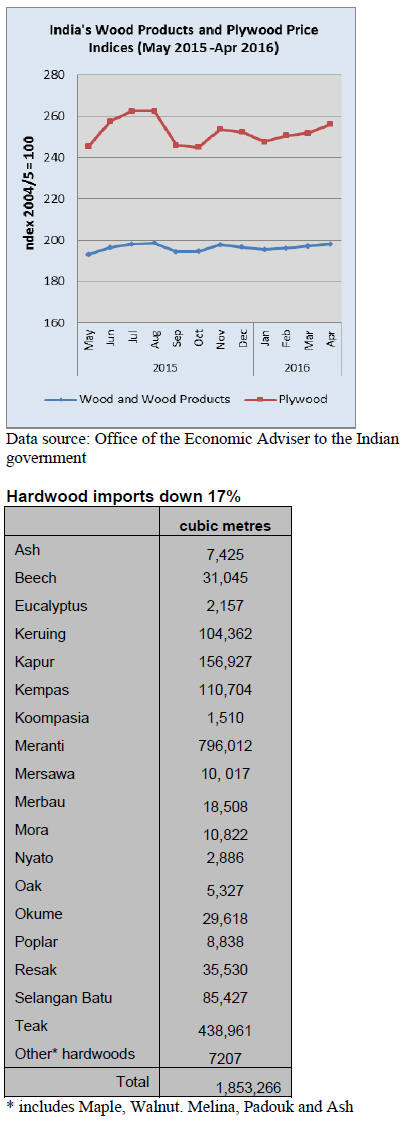

Timber and plywood price indices climb

The OEA also reports Wholesale Price Indices for a

variety of wood products. The Wholesale Price Indices for

Wood products and Plywood are shown below.

During fiscal 2014-15 timber imports via Kandla Port

totalled 3,952,130 cubic metres compared to 3,925,555

cu.m in fiscal 1013-14.

Against this backdrop, fiscal 2015-16 imports at 3,351,591

cum were some 11% lower than a year earlier. In

particular, 2015-16 imports of hardwoods fell almost 17%

year on year. The top three timbers imported in fiscal

2015-16 were meranti, teak and kapur.

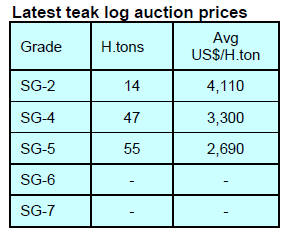

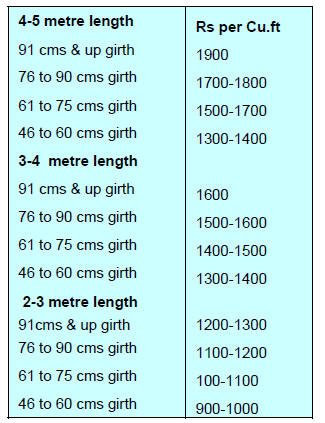

Fine quality teak offered at Madhya Pradesh auction

Analysts on the spot report arrivals of teak logs have been

good in all depots in Madhya Pradesh. Teak from this area

is sold in 2 to 5 metres lengths and mostly in the 120cm

and below girth classes.

Teak logs from this area are typically cylindrical and yield

a timber that is of golden colour with black stripes.

Auction prices for laurel (Terminalia tomentosa),

haldu

(Adina cordifolia ) bija (Pterocapus marsupium) and

sainwood (Chloroxylon swietenia ) are shown below.

Bidders at the latest auction were mostly buyers

from local

mills and merchants from Gujarat, Maharashtra, Rajasthan

and South India.

The latest auctions were held at depots in Harda,

Jabalpur,

Hoshangabad and Betul divisions. Over 25,000 cubic

metres of teak logs were sold and as additional logs are

arriving so an announcement on further auctions is

anticipated.

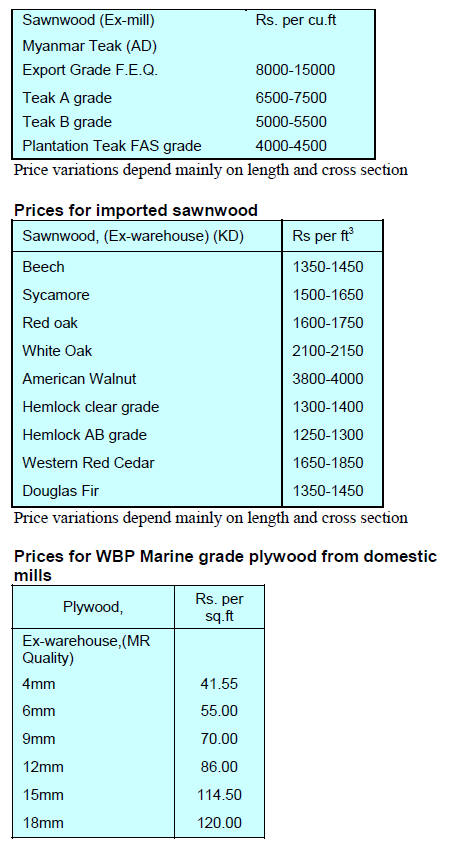

Plantation teak prices

The current pace of deliveries matches demand thus C&F

prices remain stable.

Prices for locally sawn hardwoods

The US dollar/Rupee exchange rate continues to trade in a

narrow band allowing importers to maintain recent price

levels.

Myanmar teak flitches resawn in India

Ex-mill prices for sawn teak remain unchanged.

7.

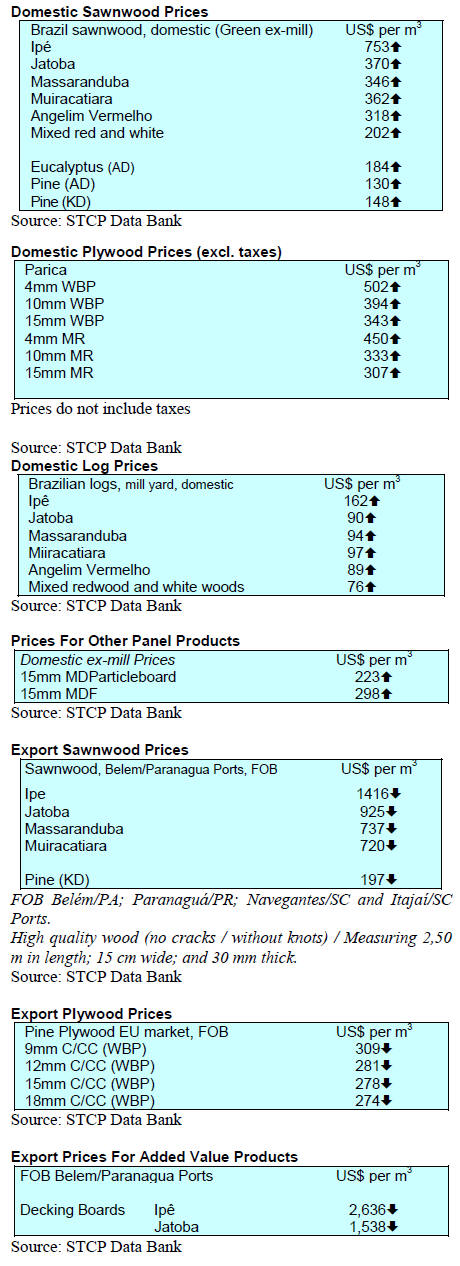

BRAZIL

Latest trends and innovations FEICON

BATIMAT

The 22nd FEICON BATIMAT exhibition showcasing

developments in construction, home furnishings and

textiles, architecture and designing and household services

industries was held in early April. This event is a reference

point for the construction sector in Latin America where

the latest trends and innovations can be shared.

According to the National Association of Construction

Material Retailers (ANAMACO), business to business

dealings were an important element in the event especially

for the building materials sector where in the region retail

sales continued to grow.

Representatives from the Brazilian Association of

Mechanically-Processed Timber Industry (ABIMCI) were

at the exhibition to investigate trends and innovations.

Brazilian manufacturers of wooden doors had a major

presence in the exhibition and were able to promote the

Brazilian Sectoral Quality Program for Wooden Doors

(PSQ-PME).

SEMA review of ABNT standards

The forestry sector is ranked fourth in the economy of

Mato Grosso but has failed to achieve its full potential in

international markets according to the State Secretariat of

the Environment (SEMA).

In an attempt to address this SEMA has established a

working group to review the impact of current standards

on the potential for wood product exports.

Brazil¡¯s standards determined by the Associação Brasileira

de Normas T¨¦cnicas (ABNT) will influence market

opportunities and need to reflect the latest requirements in

international markets. SEMA hopes to propose revisions

to ABNT standards.

In addition to SEMA the other institutions involved

included the Regional Council of Engineering,

Architecture and Agronomy of Mato Grosso state (CREAMT),

the Forest Engineers Association of Mato Grosso

state (AMEF), the Center for Timber Producers and

Exporters of the state of Mato Grosso (CIPEM), the

Brazilian Institute for Environment and Renewable

Natural Resources (IBAMA) and the Brazilian

Agricultural Research Corporation (EMBRAPA).

More on Red Cedar

As a follow-up to the recent news on red cedar in Brazil

Belevistaflorestal

(http://eng.belavistaflorestal.com.br/plus/), a pioneer in

development of red cedar in Brazil offered further

information on the development of red cedar in Brazil.

Belevistaflorestal writes ¡°We are a forestry company in

Brazil, Campo Belo, Minas Gerais. Since 2006, we have

developed a successful programme breeding Toona ciliata

(Australian red cedar). There are several lines of research

with participation of our federal universities and private

agencies.

Currently we a world reference point on this species and

have developed six high yield and adaptable geno-types.

We have developed our research based on the CSIRO

germplasm bank for conservation, from which we tested

101 families from 16 provenances along the east coast of

Australia, the natural distribution of the species.¡±

Recently the company conducted a market test on a pilot

scale to advance our understanding of the market and

present the timber to potential buyers in the domestic

market.¡±

For more see: https://globoplay.globo.com/v/4945198/

https://www.youtube.com/watch?v=CE53TC8Mh7Q

and

https://www.youtube.com/watch?v=2WkvFZHQOV0

Export round-up

In April 2016, the total value of Brazilian exports of

wood-based products (except pulp and paper) declined

8.7% compared to April 2015, from US$247.3 million to

US$225.7 million.

The value of pine sawnwood exports increased 29% from

April 2015 (US$ 21.7 million) and April 2016 (US$ 28

million). In terms of volume, exports increased over the

same period from 94,200 cu.m to 149,800 cu.m.

April tropical sawnwood exports increased 1.7% in

volume year on year from 34,400 cu.m in April 2015 to

35,000 cu.m in April 2016 however the value of exports

fell about 11% from US$17.9 million to US$16 million,

over the same period.

Pine plywood exports dropped 29.5% in value in April

2016 in comparison with April 2015, from US$47.4

million to US$33.4 million.

In terms of volume, however, exports fell by just 2.5%,

from 133,100 cu.m to 129,800 cu.m, over the same period.

Brazil¡¯s tropical plywood exports continue to rise and in

April were up 34% year on year from 9,400 cu.m in April

2015 to 12,600 cu.m in April 2016. Export values also

rose 4.3% from US$ 4.6 million to US$ 4.8milion, over

the same period.

As in previous months, exports of wooden furniture fell in

April US$ 37.1 million in April 2015 to US$ 35.2 million

in April 2016, a 5.1% drop.

Exports boost timber cluster in the Amazon region

The timber sector in Amazonas State has recorded

significant growth in revenues this year as exports have

pick-up.

According to the Superintendent of the Manaus Free Zone

(SUFRAMA) in the first two months of 2016, exports

were worth R$ 8.86 million compared to the R$ 4.47

million earned in the same period last year.

Although the figures presented by SUFRAMA are

encouraging the timber sector faces problems. According

to the Union of Plywood and Veneer Timber Industries in

Amazonas State, some 12 companies in the region ceased

operations mainly due to a lack of raw materials and

financing.

There is a strong demand for wood products in the region

from the construction sector and from furniture

manufacturers and this puts a strain on raw material

supplies.

It has been recognised that there is a need to promote

forest production if the industry is to meet domestic

demand and expand exports. The State Secretariat for

Planning, Development, Science, Technology and

Information (SEPLAN-CTI) has established a technical

group to look into opportunities for expanding raw

material supplies and an expansion of production.

ABIMCI participates in ASEAN meeting

The Brazilian Association of Mechanically-Processed

Timber Industry (ABIMCI) participated in the trade and

governmental meeting in Southeast Asia hosted by the

Association of Southeast Asian Nations (ASEAN) and the

Federation of Industries of Paran¨¢ State (FIEP).

Representatives of the embassies of Indonesia, Thailand,

Singapore, the Philippines and Vietnam along with

representatives of ASEAN member countries presented

details of business opportunities of interest to Brazilian

businesses.

ASEAN´s ten member countries represent a formidable

economic force and have an objective to become the

fourth largest economic grouping in the world within 20

years. Representatives from Brazil¡¯s consulate and from

the Brazilian-United States Chamber of Commerce also

attended the meetings along with representatives of the

National Service for Industrial Training (SENAI), the

Organization of Cooperatives of the State of Paran¨¢

(OCEPAR), the Trade Federation of São Paulo State

(FECOMÉRCIO) and the Paran¨¢ Institute of International

Relations (IPRI).

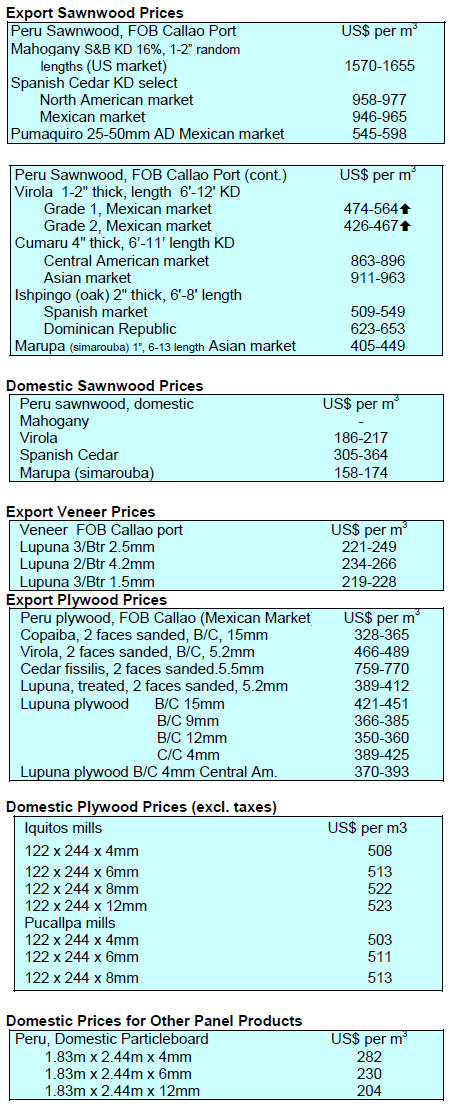

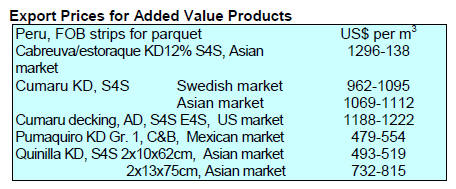

8. PERU

Particleboard imports falling

Peru¡¯s imports of particleboard were valued at US$43.7

million in the first four months of this year marking a

decline of almost 5% compared to the same period of

2015.

Novopan Peru continued as the main importer (US$9.5

million) but recorded an 8% drop compared to the same

period in 2015. However, Arauco Peru, the second largest

importer, saw its share of total import rise by 3%.

Masisa Peru, along with Arauco, was the only other

importer seeing a rise in January-April imports.

Somewhat of a surprise was the sharp drop in imports by

Interforest which reported imports in the first four months

were down over 50%.

Innovative financial products designed for timber

sector

Securing financing for forestry development, even

plantation establishment, is a major challenge for the

private sector. However, strides in improving financial

transparency on the part of the private sector and the

interest of the state in forestry development is opening the

way to development of innovative financial products

designed for the sector.

According to the National Forest and Wildlife Service

(SERFOR), financial institutions such as BBVA,

Scotiabank and BanBif have begun offering financial

products to forestry and timber companies.

For several years the government has been providing

financing through its Mipyme Fund. This is a small

business fund to promote innovation in micro and small

enterprises.

The stimulus to improved availability of financing for

forestry came in part from the loans provided by

Agrobanco and Cofide. These loans were effective

serviced which encouraged other financial institutions to

look opportunities in the timber sector. However, the

timber private sector recipients complain about the high

interest rates charged on commercial loans but a window

of opportunity is slowly opening.

In related news, the Agricultural Bank (Agrobanco) and

the French Development Agency (AFD) recently agreed a

deal which sees around US$57 million being made

available to support the Peruvian bank to become a¡¯ Green

Bank¡¯ through providing loans for environmentally

friendly projects.

One of the main conditions of the French support was the

implementation of an Environmental Management and

Social Risk Assessment system.

Agrobanco hopes that by 2119 it can triple its ¡®green¡¯

portfolio to project addressing climate change, improved

agricultural practices, energy from biomass, agro-forestry

and silvo-pastoral systems along with development of

sustainable forest plantations.

A

A