Japan

Wood Products Prices

Dollar Exchange Rates of 10th

June 2016

Japan Yen 109.76

Reports From Japan

Consumers are in no mood to spend

As was widely expected Japan’s Prime Minister has

announced that the scheduled April 2017 increase in

consumption tax will be postponed until October 2019.

This decision effectively postpones the government’s

focus on reducing the budget deficit.

The reason quoted for the postponement was that the

Japanese economy is not robust enough due to weak

demand for exports especially in China and Asian

emerging markets.

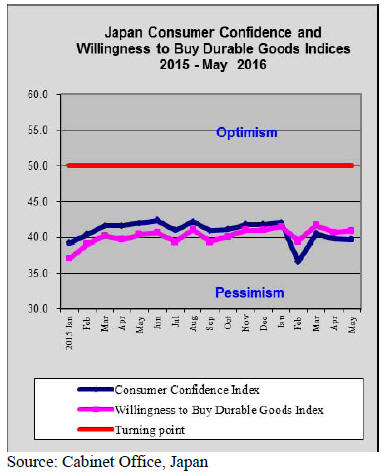

Analysts are of the opinion that Japanese consumers

would not be able to face a further tax rise under the

current economic conditions as suggested by the latest

consumer confidence data.

The survey indicates that, while there are positive views

on prospects for wages, consumers are in no mood to

spend and are tucking any gains into savings or paying off

debts. It is improving consumer spending that is key to

turning the Japanese economy around.

Yen hits a two-week high on sales tax delay

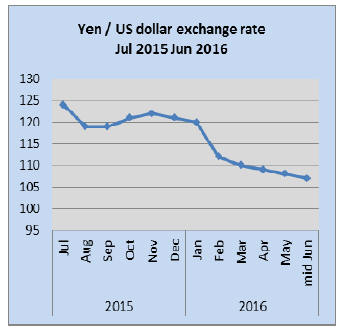

The strengthening of the yen against the dollar is

impacting profit expectations especially of exporters.

As prospects for a market driven fall in the yen/dollar rate

seems unlikely analysts now expect the Bank of Japan

will, after its next meeting, expand its asset purchases.

The yen continued to strengthen after the government

announced that the scheduled sales tax rise will be

postponed.

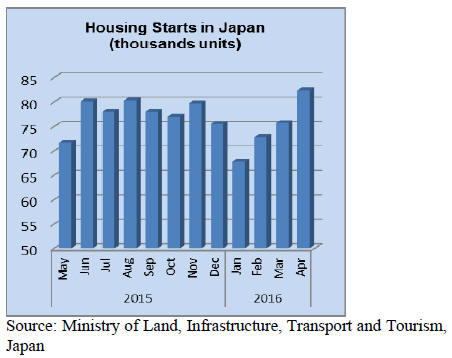

Onset of rains delays home repairs in quake area

The rain season has started in Japan and is set to continue

until late July. The onset of the rains was first reported for

Kyushu, the location of April’s devastating earthquake.

Thousands of homes were destroyed or damaged in

Kumumoto and construction companies have been flooded

with orders to undertake repairs, demolition and

rebuilding.

At present many damaged homes are relying on

waterproof sheets on the roof but with the rains becoming

heavier home owners are likely to face even more

problems.

Some people who had to abandon their homes after the

earthquakes are moving into temporary housing but there

are still around 7,000 people in evacuation centres.

The planned construction of 4,600 temporary housing

units in Kumumoto will be delayed because of the arrival

of the rains season and because the local government

cannot secure enough land.

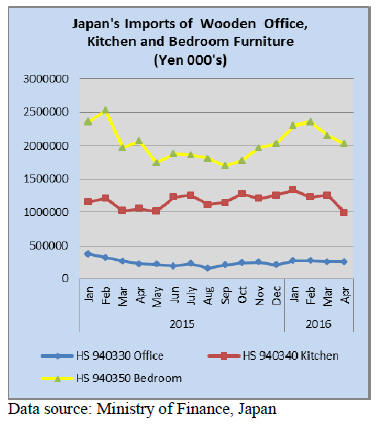

Japan’s furniture imports

The value of Japan’s imports of wooden bedroom

furniture fell almost 16% in the first quarter of 2016

compared to the first quarter in 2015 and April import

figures from Japan’s Ministry of Finance shows that the

downward trend continued especially for kitchen and bedroom

furniture.

Attitudes of Japanese companies operating

overseas

Much of the furniture shipped to Japan is manufactured in

Japanese overseas companies or from joint venture

operations. The Japan Bank for International Cooperation

(JIBC) conducts regular surveys of trends in overseas

investment and their 2015 survey offers a thoughtful

insight to current trends.

The full JIBC survey results can be found at:

https://www.jbic.go.jp/wpcontent/

uploads/press_en/2015/12/45909/English.pdf

The following extract from the report describes current

attitudes of Japanese companies with overseas operations.

Medium-Term stance Medium-Term stance

Given the state of the global economy companies

cautious but 80% of respondents were ready to

expand overseas operations.

Promising Countries Promising Countries

India was identified as the most as the promising

followed by Indonesia and China. Interest in

Brazil and Russia has fallen sharply and

companies considering investment in Mexico,

USA and the Philippines need to see an

improvement in those economies before

expanding operations.

Management Challenges Management Challenges

How to expand markets, Develop of competitive

products, finding individuals capable of

managing overseas operations and understanding

local demand drivers were the main challenges

identified.

Management through M&A Management through M&A

Mergers and acquisitions were stated as an

important means of securing effective

management.

Greater role of domestic business Greater role of domestic business

Many companies signaling expansion of overseas

plants identify that expand domestic business is a

significant driver. Some companies have

relocated from China back to Japan because of

falling domestic business.

Productivity in Japan and Overseas Productivity in Japan and Overseas

Survey respondents said while delivery times in

plants in Japan and overseas was at about the

same most said labour productivity in overseas

plants was lower than in Japanese plants.

Business Stance in China Business Stance in China

China is viewed as an attractive location for

overseas operations but respondents cited

concerns on the direction of the Chinese

economic and rising wage levels. Some

companies expressed concern on the political and

diplomatic situation between Japan and China.

Infrastructure challenges Infrastructure challenges

China and the developed ASEAN countries were

recognised as having good local infrastructure but

that there is room for improvement.

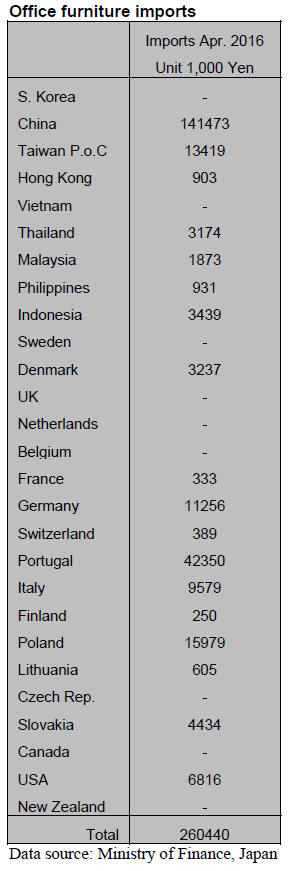

Office furniture imports (HS 940330)

Year on year, imports of office furniture in April 2016

were up 14.5% but compared to the previous month there

was a slight drop in the value of imports. China continues

as the major shipper of wooden office furniture to Japan.

The relative position of the second and third ranked

suppliers switches between Portugal, Poland and Italy

every month. In April 2016 Portugal was ranked second

followed by Poland.

In March this year Italy was ranked second followed by

Poland. Despite the good performance of Portugal, Italy

and Poland shippers in Asia account for the bulk of

shipments of office furniture to Japan (64% in April

2016).

The top three suppliers account for almost 80% of Japan’s

wooden office furniture imports but China saw its share of

imports drop 22% from a month earlier but there was a

spike in imports from Portugal. Portugal accounted for

16% of April imports.

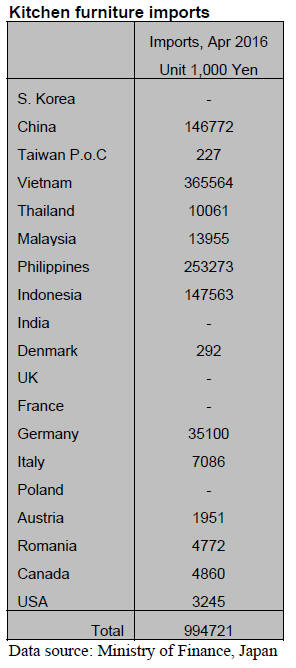

Kitchen furniture imports (HS 940340)

April saw a massive 21% fall in Japan’s imports of kitchen

furniture with shippers in the top three countries, Vietnam

(-24%), Philippines (-20%) and China (-21%) all feeling

the strain. Year on year wooden kitchen furniture imports

in April 2016 were down 6%.

At 37% of April imports Vietnam maintained its top

ranked position in terms of import sources. The

Philippines (25%) and China (15%) were close behind.

Asian suppliers of kitchen furniture accounted for 94% of

Japan’s April 2016 imports, a position held for many

years.

Germany is the only significant non-Asian shipper of

kitchen furniture but could only capture a 3.5% share of

April 2016 imports.

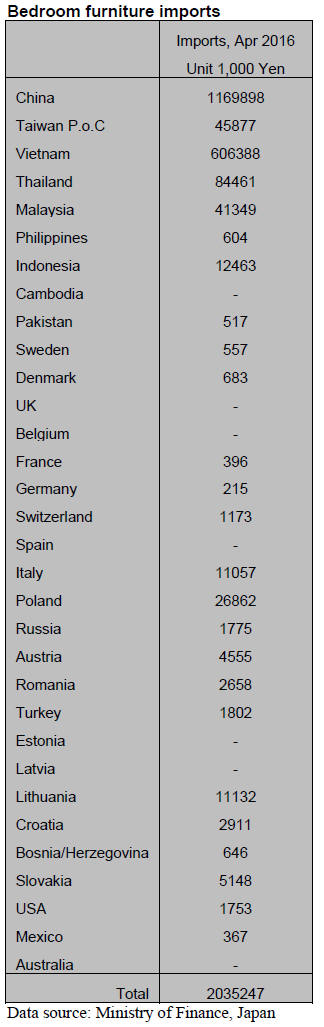

Bedroom furniture imports (HS 940350)

Year on year the value of Japan’s April 2016 imports of

bedroom furniture was largely unchanged but compared to

March imports there was a 5.5% decline.

As has been the case for months, the top three shippers of

bedroom furniture to Japan in April continue to be China

(57%), Vietnam (30%) followed by Thailand a distant 4%.

Asian exporters of bedroom furniture accounted for over

90% of Japan’s April 2016 imports.

Trade news from the Japan Lumber Reports (JLR)

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

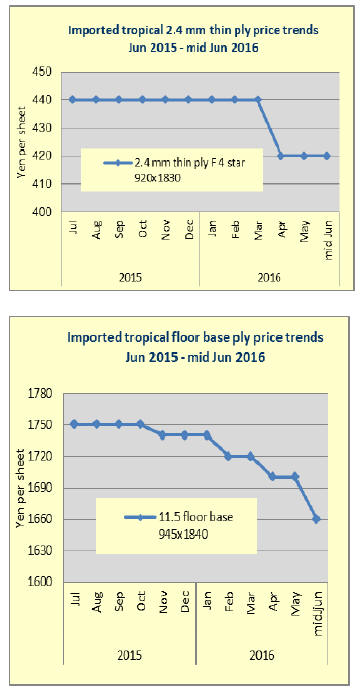

2015 Imported plywood market

Market of imported South Sea hardwood plywood suffered

prolonging supply and demand adjustment. The supply in

2015 was 2,885,800 cbms, 17% less than 2014, about

600,000 cbms decrease. Previous low was 2009 with

2,840,000 cbms. The supply in the first quarter of 2016

continues trending down by 12%.

The market has been in slump since August last year so

sluggishness has been more than seven months so that the

importing trading companies are seriously reviewing

import plywood business by steady loss.

The supply from two major sources, Malaysia and

Indonesia decreased considerably. Malaysian supply was

record low by 18% or about 260,000 cbms down.

Indonesian supply was also down by 16.5 % or about

170,000 cbms, next low behind 2009.

The supply decrease of 600,000 cbms in 2015 was

uniform from all the sources. Three major supply sources

of Malaysia, Indonesia and China all reduced about 17%

respectively.

However, difference is becoming obvious in 2016. For the

first quarter of 2016, Malaysian supply decreased by

22.6% compared to the same period of last year while

Indonesian supply increased by 3.4% (China decreased by

12.4%). Supplying items make this difference.

Trend of Malaysian supply is rather heavy in early period

of the year. In 2015, January arrivals were the highest in

2015 with over 130,000 cbms and three month average in

the first quarter 2015 was 120,000 cbms. Monthly average

supply in 2015 was 100,000 cbms.

The monthly supply declined down to 95,500 cbms during

September and December 2015 but the market continued

bleak so import curtailment still continues now. Actually

monthly import in the first quarter this year was down to

92,500 cbms, 22.6% less than the same quarter last year.

Meantime, Indonesia acted much sooner to reduce the

supply. The largest factor to influence the cost of imported

plywood is exchange rate. The yen started softening since

late August of 2014. Average rate of about 102 yen per

dollar during January and August 2014 moved to 107 yen

during September and October 2014 then reached 119 yen

by December.

Reflecting this change of yen rate, Indonesian monthly

average supply of about 99,000 cbms during January and

July 2014 dropped sharply down to 78,000 cbms during

August and December 2014. Monthly average of about

70,000 cbms in the second half of 2014 continued in 2015

so the monthly average in 2015 was 71,500 cbms

compared to 85,500 cbms in 2014.

The main item of Indonesian supply is floor base plywood

and as soon as the yen got weak, the floor manufacturers

in Japan reduced the purchase to the minimum. The supply

from Indonesia has been steady with about 70 M cbms a

month. Unlike commodity item of concrete forming panel,

distribution route of floor base is short to final user of

floor manufacturers.

With fierce competition of price war of floor products, the

manufacturers are very sensitive to the price of floor base

so higher cost automatically reflects import curtailment.

Roughly speaking, if the yen rate is between 100 yen to

110 yen, import of floor base is restricted to 70,000 cbms

and if the yen got stronger, the manufacturers speculate to

build up the inventory of import plywood. In short, the

supply depends on new housing starts and yen’s exchange

rate.

When the yen was weak like 121 yen per dollar in 2015,

the floor manufacturers seriously consider shifting to use

domestic softwood plywood but tide changed in 2016 to

strong yen.

The rate was 118 yen in January, 115 yen in February, 110

yen in March and April then in May, it shot up to 105 yen

momentarily. Looking at this trend, the floor

manufacturers stopped considering to switch to softwood

plywood because strong yen reduces import cost, which

narrows price difference between hardwood base and

softwood plywood so it is much easier for floor

manufacturers to use tropical hardwood plywood, which

they have been using for years.

The floor manufacturers have been testing domestic

softwood plywood to see if replacement is possible since

late 2014 with a lot of time and cost so they prepare for

any change of supply situation and change of exchange

rate.

Now market of Malaysian plywood is different from

Indonesian as supplying item from Malaysia is heavy to

concrete forming panel, which is commodity item and

wholesalers and distributors buy and sell sometimes in

speculation. Since there are many layers in distribution

channel and the demand is not steady. Therefore, slump

since last summer is simply caused by lack of demand.

Major wholesalers in Tokyo think that real recovery of the

demand will come in late 2016 or later with the reason that

the Olympic Games in 2020 would generate many

construction activities. Large construction works would

take two to three years to complete so start-up should be in

late 2016 or early 2017. Large construction companies are

not taking large orders before busy season arrives, which

maybe one of the reasons that demand for concrete

forming panel has been so slow since last summer.

If this forecast is right, concrete forming panel market

would stay depressed through 2016 with very low import

volume then the boom would come in late 2016 and on for

two to three years.

Now immediate problem is if the volume from Malaysia

continues as low as 90,000 cbms a month for a balance of

this year in depressed market, the importers may not be

able to justify such poor business. If such supply

curtailment continues all through the year, will it be

possible to increase the supply when the demand recovers.

Steering of the business is very difficult. The suppliers in

Malaysia may not be able to cope with such sudden

change of the market in terms of log supply with severe

control of illegal harvest in Sarawak, Malaysia.

Meantime domestic plywood manufacturers are making

softwood concrete forming panels to take over hardwood

panels.

South Sea (Tropical) logs

Log supply in Sarawak, Malaysia has been dropping

considerably without any sign of improvement.

In Sarawak, control on illegal harvest is severe, which

reduces total log supply. Since last March, India resumed

log purchase, which pushes log prices up and log prices

for Japan are up by about $5 per cbm.

Sarawak meranti regular log prices for Japan are US$273-

278 per cbm FOB. Meranti small are US$253 and meranti

super small are US$238. Price increase on logs in Japan is

difficult as plywood plants are curtailing the production

because of slump of plywood market. Log supply in PNG

and Solomon Islands is increasing.

Keytec markets scaffolding plywood

Keytec Co., Ltd. (Tokyo), started manufacturing and

marketing domestic larch scaffolding plywood on top of

South Sea hardwood scaffolding plywood.

There is demand for South Sea hardwood scaffolding

plywood with kapur, keruing and apiton but such species

are becoming hard to acquire and the prices have been

steadily climbing. Meantime, domestic larch is readily

available and the prices are not affected by fluctuation of

exchange rate so it started manufacturing larch plywood,

which prices are about 30% lower than South Sea

hardwood plywood.

It had inspection by the Plywood Scaffolding Safety

Technical Association to see if the product has satisfactory

standard the Association stipulates. By the test, bending

strength is 15.8 N/mm3, much harder than cedar. Also

even if it is left outdoor for three months, bending strength

is within stipulated standard the Association sets.

Traditional South Sea hardwood scaffolding plywood has

thickness of 28 mm, width of 240 mm with length of 2 and

4 meters but larch plywood has thickness of 35 mm with

the same width and length of hardwood. Weight of both is

22-24 kilogram. Because of lighter specific gravity,

thickness of larch is thicker.

Raw material of larch logs are supplied from Nagano,

Yamanashi and some from Gunma prefecture. It consumes

about 1,000 cbms of larch a month to make 15,000 sheets

of scaffolding plywood.

Key Tec newly introduced scarf jointer to make 4 meter

with 1.8 metre veneers and layup line, which makes

lamination with blue in order to manufacture domestic

larch plywood.

The president commented that this should promote using

domestic species and challenge is to acquire certificate by

the Green Purchase law.

PanaHome advances overseas

PanaHome Corporation (Osaka) has been advancing

overseas recently. PanaHome Asia Pacific (Singpore),

100% subsidiary of PanaHome established PanaHome

Gobel Indonesia (Jakarta,

Indonesia) with the purpose of housing development in

Indonesia.

This is a joint venture company with Gobel International

(Jakarta), which manufactures and markets electric

appliances and home appliances. PanaHome advanced to

Taiwan in 2010 and Malaysia in 2012.

It announced a plant that PanaHome MKH Malaysia,

consolidated subsidiary of PanaHome will put up and

market 490 units built for sale and 305 units of

condominium jointly with local developer, MKH.

It introduces W-PC method (Wall precast concrete

method), which speeds up construction time and shortens

by about three months compared to traditional brick pileup

method.

KND accepts trainees from Myanmar

KND Corporation (Tokyo), logistical dealer and

transporter of construction materials and also is engaged in

construction works, has started accepting trainees from

Myanmar for house building business.

Trainees are eight. At the beginning, five will start at

Chiba’s training center for basic study then three more will

come in September. After basic training on building

technique, they will engage in actual works.

The company says that text is written in Myanmar’s

language edited by the Japanese construction experts,

which has sophisticated content but is easy to learn by

concentration.

The president of the company says that the company

prepares educational system to learn Japanese construction

technique to give technical knowledge, which should

respond to various requirements house builders

requirement.

Trainees will be supplemental work force since shortage

of construction workers will be serious problem. At the

same time, the trainees will be able to use what they learn

in Japan in Myanmar, where the economy is expected to

expand rapidly.

The company is originally engaged in logistic works then

it expands the business of installation of system kitchen

and unit bath with renovation of houses. It does handle

installation of insulation and foundation sills with how to

put up building then applying metal fittings on precut

materials so it covers wide area of construction works.

Misawa Home considers overseas development

Regarding overseas business, Misawa Homes (Tokyo) has

been test marketing in Australia and plans to establish a

local corporation for market research then will build four

test units in Melbourne and five units in Brisbane to

examine local housing market. It will develop housing

business tied with local builder eventually.

The president says that it needs to examine local market

since Australia has different culture and housing demand

so it will prepare supply system as it continues examining

the market.

In Japan, it plans to increase percentage of value added

housing like smart house. It also plans to develop medium

high buildings in populated region since it uses property in

big cities much effectively so it tries to attract house

buyers to heavy steel framed fire proof five stories model

unit, which can be used for multi family dwelling together

with stores and rental units.

Also as new demand in future, compact condominiums for

single and aged dwellers and composite facilities then it

will actively develop non-residential units such as

renovation of large buildings.

Together with such future plans, it is promoting structural

change to improve profitability such as direct sales in large

cities and it is reviewing manufacturing and assembly

process. In Nagoya plant, it plans to expand panel

manufacturing lines.

|