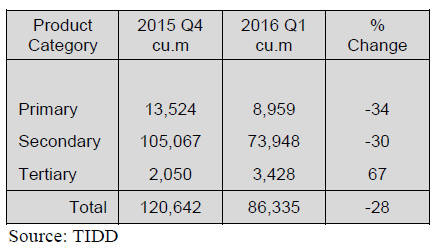

2. GHANA

First quarter export contract volumes drop

28%

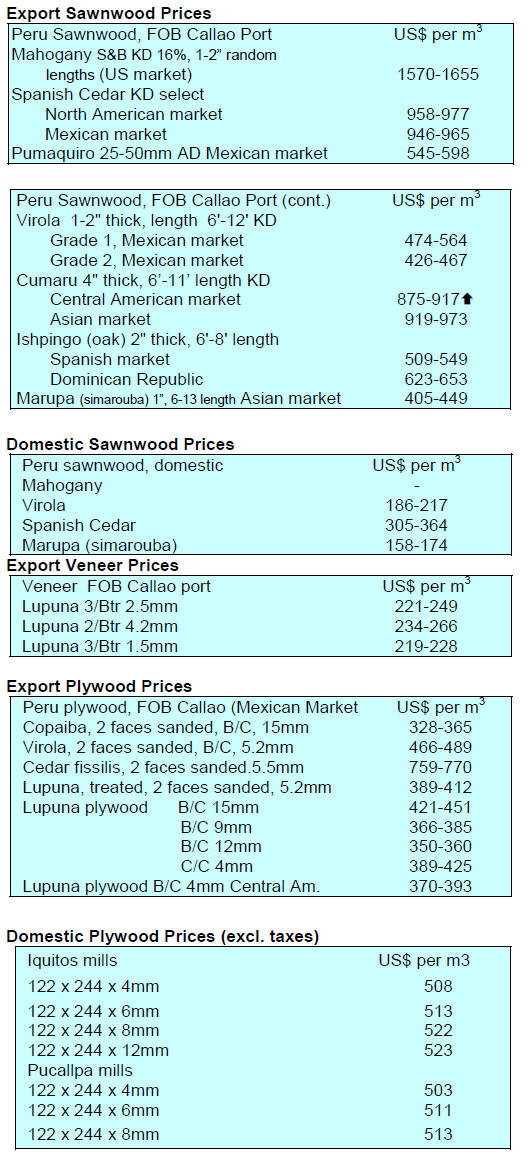

The total volume of Timber Industry Development

Division (TIDD) approved export contacts in the first

quarter 2016 was 86,335 cu.m, a drop of 28% when

compared to approvals in the final quarter of 2015.

The table below shows that there was a steep fall in

approvals for export of primary and secondary products,

with only the small volume of tertiary product exports

registering growth.

Exports of primary products in the first quarter

fell 33%

year on year due mainly to a decline in shipments of teak

logs/billets (-85%).

Secondary product exports also fell (-30%) to a low of

around 74,000 cu.m; while tertiary product exports

increased of 67% to 3,428 cu.m.

In the first quarter sawnwood accounted for 64% (55,409

cu.m) of the volume of all approved export contracts while

plywood accounted for a further 12% (10,292 cu.m).

Regional West African markets continued to be the major

market for plywood, while for tertiary products, such as

sliced veneer and kiln dried sawnwood, the main markets

were in Europe. Species such as rosewood (air-dried

sawnwood) and high lumber density species such as apa,

ekki and denya were mainly for the Chinese market.

Mahogany and cedrella sawnwood along with rotary

veneer found a ready market in the US. Middle East and

Egyptian markets emerged as a major destination for

backing grade veneer, with India the main market for teak

sawnwood and gmelina logs.

Ghana a PEFC member along with Cameroon and

Gabon

An early June press release from PEFC welcomed Ghana

as a National member. A spokesperson for PEFC said they

were delighted to welcome Ghana as our latest PEFC

National member, the third in Africa, alongside Cameroon

and Gabon.

Emmanuel Amoah Boakye at the Working Group on

Forest Certification said "Joining the PEFC Alliance is a

vital step towards gaining international recognition for our

Ghanaian National Forest Certification System."

When Ghana¡¯s scheme gains PEFC endorsement the

forestry and timber sectors will be able to demonstrate

their sustainable forest management practices and

confidently promote exports.

See:

http://www.pefc.org/news-a-media/general-sfm-news/2135-

Strategies for sustainable forest management

A workshop aimed at equipping forestry practitioners with

the requisite knowledge, tools and skills on certification

recently held in Accra. This brought together forestry

practitioners in government organisations, academic and

research institutions, civil society organisations and the

private sector from the region.

The workshop programme organised by the Africa Forest

Forum in collaboration with the Forestry Research

Institute of Ghana (FORIG) and the Economic Community

of West African States (ECOWAS), was expected to

enhance the understanding of participants on the

implementation strategies for sustainable forest

management.

The Director of FORIG, Dr. Daniel Ofori, said with

increasing demand in consumer countries for forest

products producers with certified forests operations would

find marketing so much easier and could enjoy price

premiums.

3. MALAYSIA

Look beyond traditional markets to

expand exports

The Malaysian International Furniture Fair (MIFF) has

become a major fixture for the international furniture trade

for many years. The 12th MIFF was held recently in Kuala

Lumpur and the organiser, UBM Malaysia, said visitors

from around 130 countries attended, a good measure of the

international appeal of MIFF.

Speaking at the opening, Minister of Plantation Industries

and Commodities, Douglas Uggah Embas, urged the

furniture industry to develop imaginative export strategies

and look beyond the traditional markets so as to whether

the current global financial turmoil. He said emerging

markets in ASEAN and Asia Pacific have high growth

potential.

Weak demand in major markets dampens Sarawak

export performance

The export performance of Sarawak wood products for the

first quarter of 2016 weakened by around 2% to RM1.62

billion compared to RM1.65 billion during the same

period in 2015. This said the Minister was mainly the

result of a slump in global demand.

The decline was most obvious in the main importing

countries such as Japan, Taiwan P.o.C, China, Thailand

and Middle East countries.

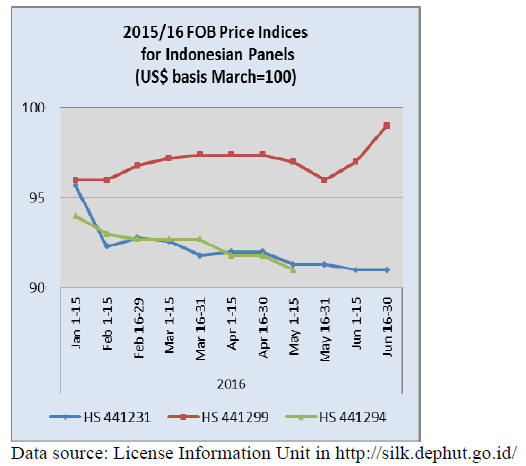

The value of first half 2016 plywood exports, the main

wood product exported from Sarawak, fell almost 14% to

RM791.5 million. In view of this, said the Minister, the

state government was considering measures to support

exporters such as strong promotion of the Sarawak Timber

Legality Verification System (STLVS) to drive

international recognition.

Sharp drop in Sabah sawnwood exports

The latest data from the Sabah Department of Statistics

showed exports of 56,885 cu m of sawnwood in the first

four months of the year valued at RM 109,192, 729. Over

the same period last year, Sabah exported 77,953 cu m of

sawnwood valued at RM 130,824,784.

In the period January to April 2016, Sabah exported

187,180 cu.m of plywood valued at RM 359,208,744

compared to the 192,690 cu.m valued at RM 336,442,072

exported in the same period in 2015.

Endorsement for Malaysia¡¯s latest MC&I for Forest

Plantations

A press release from PEFC has reported that the

Malaysian Criteria and Indicators (MC&I) for Forest

Plantations, as complementary to the Malaysian Timber

Certification Scheme (MTCS) which includes the MC&I

for Natural Forests has been endorsed.

The endorsement of this second edition of the MC&I for

Forest Plantations, which is designed to assess the

management practices for, and enable the certification of,

forest plantations, follows the re-endorsement of the

MTCS in 2014.

PEFC says ¡°These re-endorsements show both the

commitment of our members and underlines PEFC's

leadership in the continuous improvement of forest

certification, we appreciate Malaysia¡¯s continued

commitment, as well as the contributions of all the

stakeholders who have participated in the standards

revision and assessment processes.¡±

See:

http://www.pefc.org/news-a-media/general-sfm-news/2143-

german-system-and-malaysian-forest-plantation-standardachieve-

pefc-re-endorsement

4. INDONESIA

Indonesian FLEGT wood products possible

by year

end

Vincent Guerend, the EU Ambassador in Indonesia has

outlined the process through which the European

Parliament and the European Council will undertake a

process that will ultimately lead to confirmation that

Indonesian timber products satisfy the EU¡¯s legality

standards.

This process must be undertaken before any FLEGT

licensed shipments can be made to EU member states.

Guerend said the process started in the middle of June and

will continue for around two months. The process is

expected to run without problems and it is anticipated that

after 90 days of confirmation Indonesian FLEGT timber

shipments will begin.

Past mistakes in forest management costing millions

to correct says Vice President

Indonesia¡¯s Vice President, Jusuf Kalla, has had harsh

words on Indonesia¡¯s past forest management saying the

forests were exploited in the hope that poverty would be

eliminated but only a few prospered and the impact on the

environment was so severe that it is costing trillions for

forest rehabilitation.

This opinion was voiced during the launch of Environment

and Forestry Week in Jakarta. The Vice President said

despite there being appropriate regulations forests were

recklessly exploited.

The Vice President made the point that this mistake was as

much the responsibility of Indonesia as the importing

countries which paid scant regard to the impact of heavy

harvesting. Indonesia has launched several programmes to

restore Indonesian forests such as the 1-million hectare

movement, the 1-billion tree programme and efforts on

forest rehabilitation.

Tax amnesty bill adopted

After prolonged debate and consideration Indonesia has

adopted a tax amnesty bill that it anticipates could result in

billions of off-shore and untaxed dollars coming back to

the country.

Many wealthy Indonesians have kept money overseas but

now those willing to declare their untaxed savings would

be taxed at a rate of between 2-10%, far below the 30%

top income tax rate. The Minister of Finance, Bambang

Brodjonegoro, has said all money coming back home

would give a boost to economic growth and would be

channeled to infrastructure developments.

Indonesian cities growing faster than in neighbouring

countries

According to a recent study by the World Bank, Indonesia

is undergoing a transformation from a rural to an urban

economy. The country¡¯s cities are growing faster than in

other Asian countries at a rate of 4% per year. The impact

of this rapid rate of urbanisation will alter trade patterns

for wood products since domestic demand will expand.

The Bank report estimates that by 2025 Indonesia can

expect to have almost 70% of its population living in

cities. This, says the Bank, could lead to higher economic

growth through formal employment and from the better

labour productivity that generally results from

urbanisation.

The report notes that every 1% growth in urban population

correlated with a per capita GDP increase of 13% in India,

10% in China, and 7% in Thailand.

For more see:

http://pubdocs.worldbank.org/en/45281465807212968/IDNURBAN-

ENGLISH.pdf

5. MYANMAR

Protecting and rehabilitating remaining

natural forest

the biggest challenge

The Minister of Natural Resources and

Environmental Conservation (MONREC), Ohn Win, has

spoken in an interview with 7Day News of Myanmar on

the challenges for his administration. The first point made

was how to protect the remaining natural forests and

secondly, is it possible to rehabilitate degraded forests so

as to restore some lost forest cover?

These two challenges, said the Minister, are closely related

to ending the illegal timber trade. At the same time as

efforts are made on forest protection and restoration

parallel efforts must be made to repair and recovery

waterways and dams and improve watershed management.

One first step in controlling illegal felling will be

regulation of the import and sale of chainsaws. This is

intended to counter the growing illegal timber trade, which

say many experts, stems from poverty and weak law

enforcement.

MONREC plans to undertake a field resource inventory

and follow this up with satellite mapping to be repeated at

periodic intervals.

MTE to sell log stocks to sustain domestic production

During the one-year suspension of log extraction the

Myanma Timber Enterprise (MTE) is proposing to sell

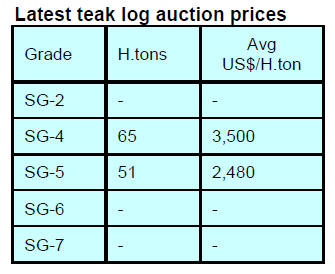

around 400,000 H.tons of logs.

Of the total, 30,000 H.tons of teak and over 300,000

H.tons of other hardwoods will be sold and priced in US

dollars while 9,000 H.tons of teak and around 60,000

H.tons of other hardwoods will be sold and priced in the

domestic currency.

Emphasis to be on raw material processing for export

Commerce Minister, U Than Myint, has said, while

foreign trade appears set to resume the generally upward

trend of the past five years, efforts will be made to change

in the range of imported goods.

Over recent years there has been a surge in imports of

construction materials driven by demand for buildings by

foreign investors. The Minister said he would now prefer

to see the country both producing and importing raw

materials to be processed for export.

The Minister said the aim of the government is to focus on

boosting agricultural exports and value-added

manufactured goods. To make this a reality, he said, it

may be necessary to amend some laws and regulations to

make exporting easier.

New FDI for plywood and veneer

The Myanmar Investment Commission at its first meeting

approved 8 investments. One of the successful applicants

in timber sector is CO2 Solution Company Limited which

proposes production of high quality veneer and plywood.

This approval comes at a time when logging has been

suspended across the country so analysts ask where the

company will secure raw material if it continues with the

investment.

Local investor face high interest rates

Domestic companies find it very hard to secure financing

and even if they do then interest rates are so much higher

than the rates that investors in Myanmar can obtain offshore.

Myanmar banks apply interest rates in the region of 12%

while overseas banks offer much lower rates. The

disparity in rates is a handicap for domestic companies.

6.

INDIA

Inflation rate trends down

The Office of the Economic Adviser (OEA) to the Indian

government provides trends in the Wholesale Price Index

(WPI).

The official Wholesale Price Index for All Commodities

(Base: 2004-05 = 100) for May rose to 179.4.0 from 177.0

in April. The year on year annual rate of inflation, based

on monthly WPI, stood at 0.79% (provisional) in May

2016 compared to 0.34% in April. Year to May inflation

was -2.2%.

For more see:

http://eaindustry.nic.in/cmonthly.pdf

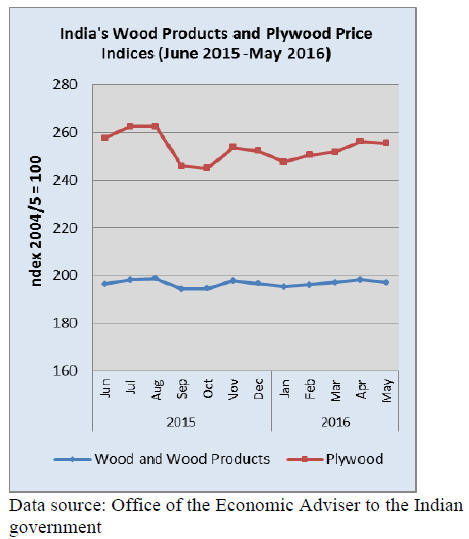

Timber and plywood price indices climb

The OEA also reports Wholesale Price Indices for a

variety of wood products. The Wholesale Price Indices for

Wood products and Plywood are shown below.

Commercial real estate offers opportunities

A new study from Cushman and Wakefield points out that

it is not only the family housing sector that offers

opportunities in India. Commercial real estate in India is

said to offer investment opportunities especially in the top

tier cities such as Mumbai, Delhi-National Capital Region,

Bengaluru and Pune. The study highlights Real Estate

Investment Trusts (REITs) as the recommended product.

A real estate investment trust (REIT) is commonly a

private sector vehicle attracting investment in incomeproducing

real estate such as office buildings, shopping

malls, apartments, hotels, resorts, and warehouses.

For more see:

http://realty.economictimes.indiatimes.com/news/commercial/rei

t-eligible-commercial-realty-market-in-india-estimated-at-43-54-

billion-rics-cushman-wakefield/52433726

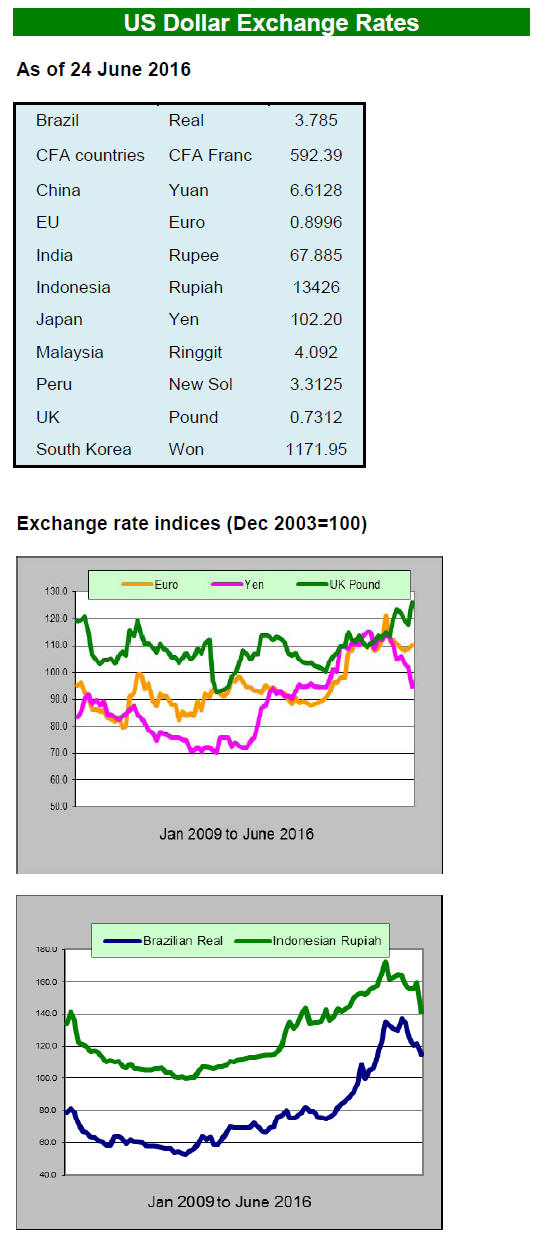

Currency markets un-nerved by RBI news

The Indian rupee began a downward slide against the US

dollar on news that Reserve Bank of India Governor,

Raghuram Rajan, will leave the post in September.

Markets had anticipated he would stay on for a second

term. The rupee seems set for a period of volatility until a

replacement is named. As of mid-June the rupee was down

around 0.75% against the dollar.

The Indian rupee was dealt a further blow on news that

Britain will leave the EU. The Rupee fell to 68 to the

dollar, its lowest level since February, but recovered

slightly.

Dangs division auction results

Log auctions at North and South Dangs Forest Depots

attracted brisk buying.

With Myanmar teak likely to become more difficult to

secure domestic mills are actively buying domestic teak.

The renewed interest in domestic teak lifted prices for both

teak and other hardwoods. Some 4,500 cubic metres of

teak and other hardwoods were auctioned.

Some ungraded logs were sold at Rs. 900-1,000 per

cubic

foot. Good quality non-teak hard wood logs, 3 to 4 metres

long having girths of 91cms or more of haldu (Adina

cordifolia), laurel (Terminalia tomentosa), kalam

(Mitragyna parviflora) and Pterocarpus marsupium

attracted prices in the range of Rs.800-1,000 per cubic foot

while medium quality logs sold for Rs.400-500 per cubic

foot.

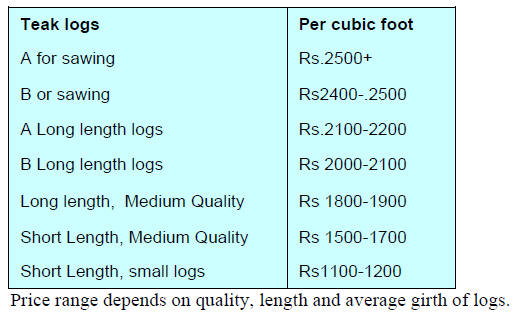

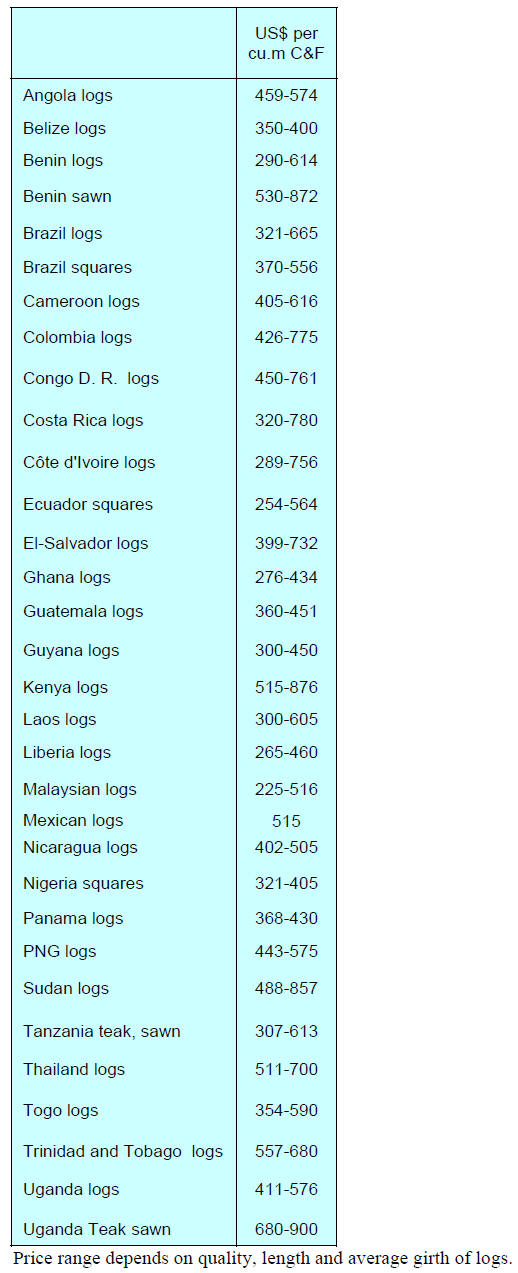

Plantation teak prices

The current pace of deliveries matches demand thus C&F

prices remain stable.

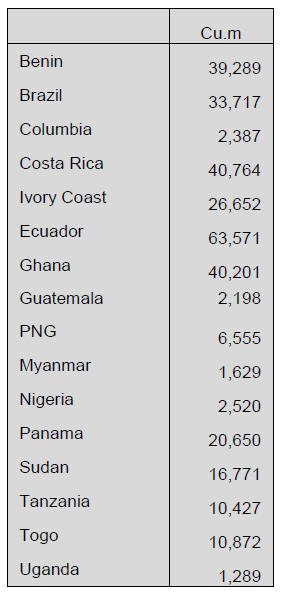

Plantation teak imports via Kandla Port during

fiscal

2015-16 are shown below.

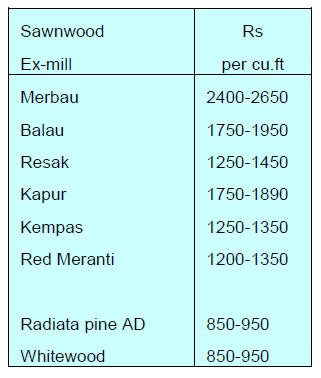

Prices for locally sawn hardwoods

The US dollar/Rupee exchange rate continues to trade in a

narrow band allowing importers to maintain past price

levels.

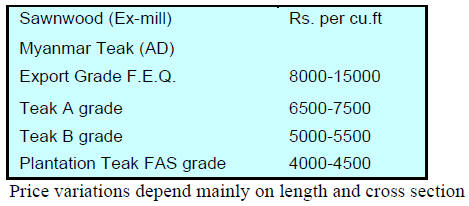

Myanmar teak flitches resawn in India

Ex-mill prices for sawn teak remain unchanged.

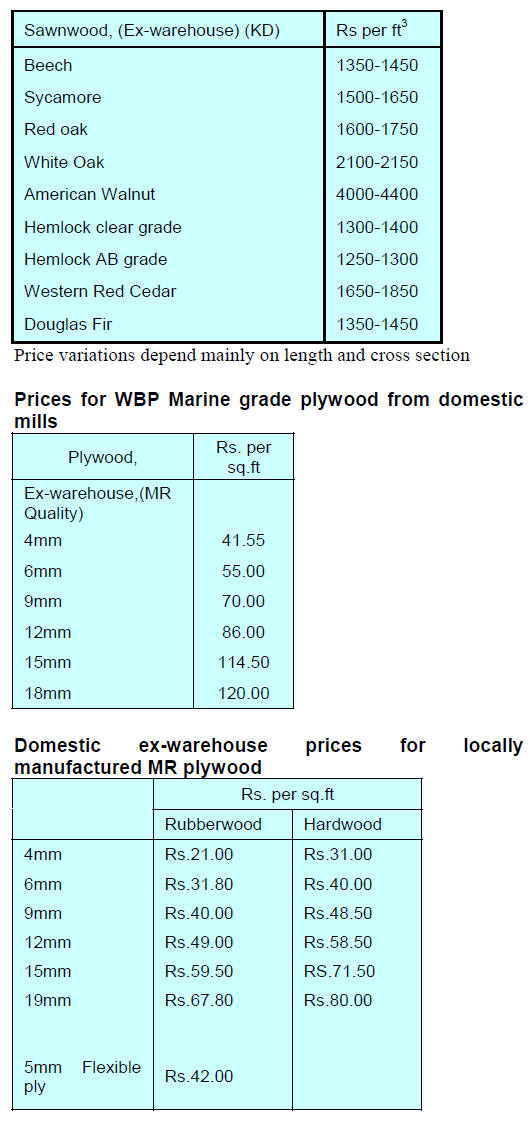

Prices for imported sawnwood

Overall, prices remain unchanged except for American

walnut for which firm demand resulted in an upward

pressure on prices.

7.

BRAZIL

IBA requests strengthening of export

policy

The Brazilian Tree Industry Association (Ind¨²stria

Brasileira de Árvores, IBA) has called for the urgent

development of new government initiatives to support

Brazilian manufacturers and exporters saying that

measures were needed to stimulate the economy and speed

the recovery of the forestry and wood processing sectors.

This call came at a meeting of private sector entrepreneurs

and the Federal Government.

According to IBA, the pulp, paper and wood-based

panels

sectors are making considerable efforts to increase exports

as domestic demand is weak. In addition to an overall

policy IBA called for measures making access to credit

easier and to speed up infrastructure improvements.

At the meeting with the government, the private sector

also stressed the need to stimulate domestic consumption

and reduce interest rates.

Association says Bolivia¡¯s new import regulations

disadvantage furniture exporters

The Bolivian government has introduced new procedures

for imports including wooden furniture. The new law,

Supreme Decree No. 2752, comes into force on 1 July

2016.

Bolivia is one of the main export markets for Brazil¡¯s

wooden furniture and in 2015 wooden furniture

manufacturers in Bento Gonçalves exported more than

US$1.5 million to Bolivia.

Export statistics for the five months to May 2016 indicate

that exports to Bolivia grew more than 30% compared to

the same period in 2015 lifting Bolivia into the top ten

export destinations for Bento Gonçalves manufacturers.

The Bento Gonçalves Furniture Industry Union

(SINDMOVEIS) has appealed to the Ministry of

Development, Industry and Foreign Trade (MDIC) saying

this action by Bolivia could seriously affect furniture

manufacturers in Bento Gonçalves and in the State of Rio

Grande do Sul.

The Bolivian decree imposes various administrative

procedures and the prior authorisation of furniture imports

which, says SINDMOVEIS is discriminatory.

SINDMOVEIS has suggested that the same rules as

applied for the Andean community should be extended to

the Southern Cone Common Market (MERCOSUR).

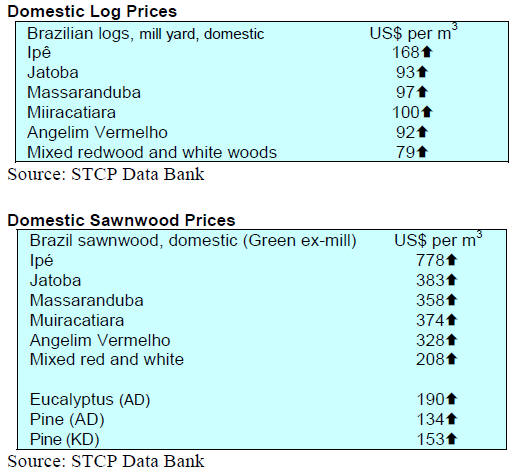

May export performance

In May 2016 the value of Brazil¡¯s wood product exports

(except pulp and paper) fell 1.6% in compared to May

2015, from US$231.7 million to US$228.1 million.

On the other hand, pine sawnwood export values rose just

over 10% between May 2015 (US$25.5 million) and May

2016 (US$28.1 million). In terms of volume, exports

increased 36% over the same period, from 111,900 cu.m

to 152,300 cu.m.

Tropical sawnwood exports also increased in May rising

11% in volume, from 29,200 cu.m in May 2015 to 32,500

cu.m in May 2016. But the value of exports increased by

just 4% from US$14.8 million to US$15.4 million, over

the same period.

The plywood export performance was mixed with pine

plywood exports falling 3% in value in May 2016 in

comparison with May 2015, from US$35.6 million to

US$34.5 million.

However, the volume of pine plywood exports increased

almost 33%, from 99,100 cu.m to 131,700 cu.m, during

the same period.

As for tropical plywood, export values and volumes both

increased. Export volumes rose 27% from 9,500 cu.m in

May 2015 to 12,100 cu.m in May 2016 while the value of

exports increased almost 9% from US$4.6 million to US$5

million, during the same period.

As has been the general trend over recnt months, wooden

furniture export values dropped from US$38.7 million in

May 2015 to US$36.2 million in May 2016, a 6.5%

decline.

Mobile application for timber tracking

The Brazilian Forest Service (SFB) has launched an

application for smartphones and tablets that allows timber

tracking and concession production. The application

utilises available information from Brazil¡¯s 2015 Chain of

Custody System (CCS).

The CCS captures information on standing trees in

approved logging concessions. When any tree is felled

within the sustainable forest management regime the forest

concessionaire is required to provide information to the

CCS.All transport of logs from forest to industry is also

registered in the system. At a sawmill sawn output is

bundled and each bundle is provided with an identity tag

(QR Code) generated by the CCS.

The CCS system can retrieve data on processed logs and

produces geographic coordinates for logs and sawnwood.

The SFB says the aim of this application is to provide

transparency on forest concessions activities to improve

the confidence of timber buyers that the material being

offered for sale can be tracked through the system to

demonstrate legality. This is important in the domestic and

international market where verified legal timber is now

demanded.

8. PERU

Minagri lists species for

commercialisation

The Ministry of Agriculture and Irrigation (Minagri) has,

through a resolution of the National Forest Service and

Wildlife (SERFOR), released an "Official List of Forest

Species for Exploitation for Commercial Purposes".

This is in support of improved management and

administration of forest resources at the national level and

to facilitate monitoring forest inventories and timber

movements along the supply chain.

The added advantage of the listing will be that more

reliable information will be available for the National

Forest Information System used to generate more reliable

and extensive data for planning.

Guidelines on processes for granting of forest

concessions

The Forestry and Wildlife National Service (Serfor), in

coordination with the Scientific University of Peru Iquitos,

the Regional Government of Loreto and the College of

Engineers of Peru recently concluded a training event

aimed at strengthening the capacity of professionals for

the development and implementation of forest

management plans to ensure the sustainable utilisation of

forest resources.

At this event framework guidelines were developed for the

processes of granting of forest concessions through the

public bidding processes conducted by The National

Forest and Wildlife Service (Serfor).

The Serfor Directorate said these guidelines will

contribute to the sustainable management of the country¡¯s

production forests.