Japan

Wood Products Prices

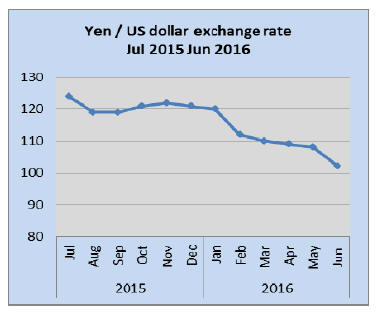

Dollar Exchange Rates of 24th

June 2016

Japan Yen 102.20

Reports From Japan

Brexit vote shatters economic gains of past

2 years

Two issues are dominating the news in Japan at the

moment, the national election scheduled for 10 July and

Britain’s decision to leave the European Union which,

since the referendum result was announced, has dominated

the news.

The UK decision to leave the 28 member EU has impacted

stock markets around the world but perhaps most hurt is

Japan because ‘Brexit’ has caused the yen to strengthen as

money poured into the safe-haven yen. A strong yen

undermines the competitiveness of Japanese exporters

upon which the economy relies heavily.

Unfortunately the Bank of Japan is not well position to

adopt traditional monetary support measures as these have

been exhausted already; only unconventional tools remain.

Yen volatility

In the days after the result of the UK referendum was

announced the yen soared in value against the US dollar

tipping almost 88 to the dollar at one point. Comments

from Japan’s Finance Minister and the Bank of Japan

Governor that this super strong yen would not be tolerated

had the desired effect.

Sensing government intervention money moved out of the

yen and the exchange rate settled at around 102 to the

dollar. However, even at this rate of exchange exporters

are feeling a pinch as most business plans anticipated an

average exchange rate for the year of around 105 to the

dollar.

The coming months of uncertainty will weigh heavily on

the Japanese economy with only importers enjoying a

buying spree for the time the yen remains strong.

Chilly election fever

In the face of the current economic crisis neither the ruling

LDP nor the opposition has been able to find a campaign

message to engergise voters and it is possible, say political

commentators, that the LDP could secure a majority in the

Upper House thus not having to rely on its current

coalition partner, New Komeito. If this is the case then the

LDP would secure its first overall Upper House majority

in almost 30 years.

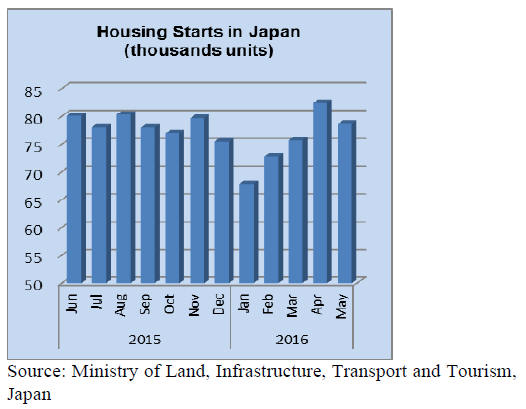

Housing starts unexpectedly high

May housing data released by the Ministry of Land,

Infrastructure, Transport and Tourism were unexpectedly robust

coming in at just over 78,000 units, well up on levels in May

2015. Month on month May starts were down but the April

figure was something of an anomaly.

The impact of the Bank of Japan’s negative interest rate

stance has meant that commercial banks are pushing home

loans at give-away interest rates. Apartment prices in the

main cities have risen sharply but the impact in the rural

communities has been more subdued.

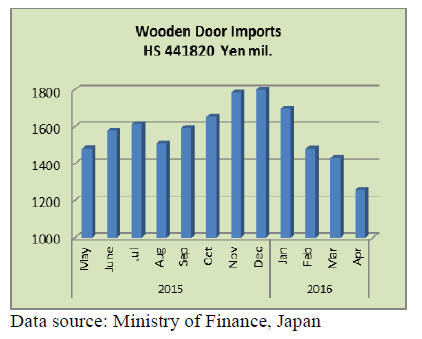

Import round up

Doors

Japan’s wooden door imports in April marked a new

record low and continued the downward trend that began

in January this year. Year on year wooden door imports

were down 18.5% in April and from a month earlier

imports dropped 12%.

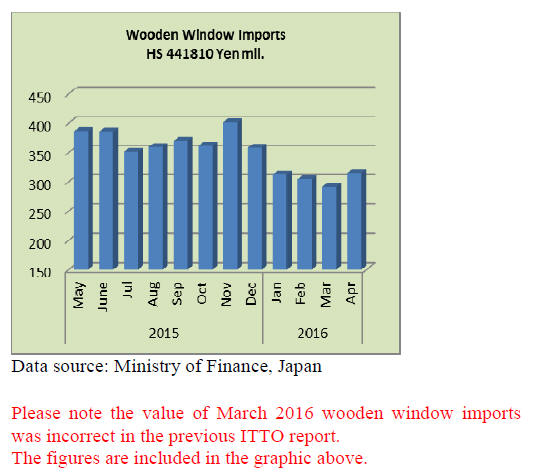

Windows

Japan’s wooden window imports rebounded in April rising

around 8% on levels in March. However, year on year

wooden window imports in April were down 20%.

The top three suppliers remain China, Philippines and the

US. Together these accounted for over 85% of April 2016

imports of wooden windows.

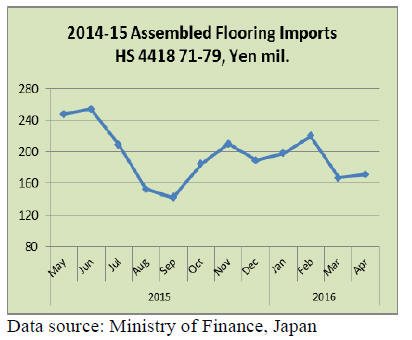

Assembled flooring

Assembled flooring imports have struggled to regain

levels in early 2015 and at current levels are about half of

the value recorded in the first half of 2015.

Year on year April 2016 imports were up around 12% but

compared to March there was only a 2% rise. In the

current market conditions in Japan any upward movement

is encouraging.

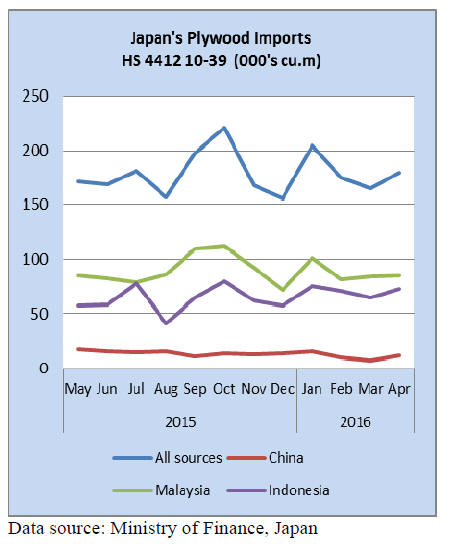

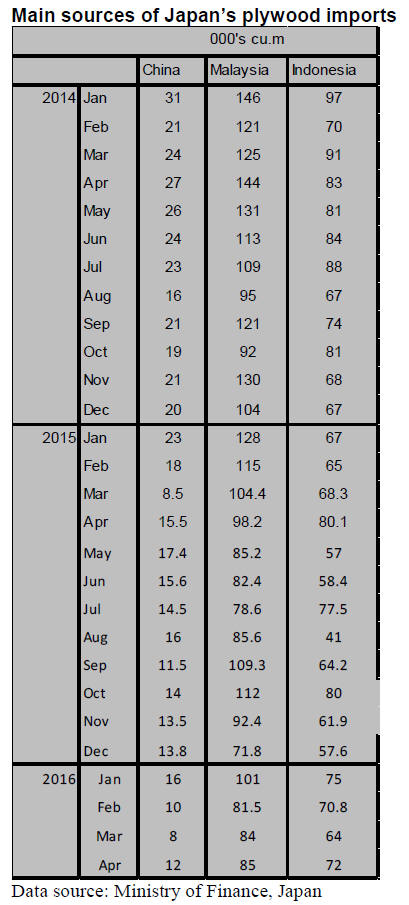

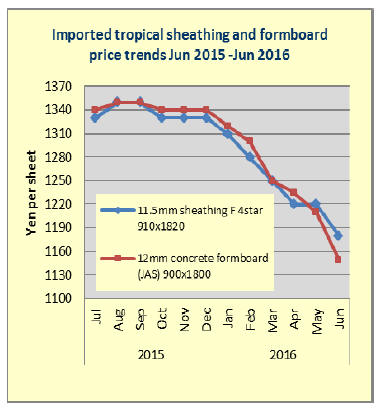

Plywood

Trends in total plywood imports into Japan over the past

12 months are illustrated below. The peaks and troughs in

total plywood imports refelct a variety of factors amognst

which currency movements loom large.

Malaysia and Indonesia were the main suppliers of

plywood to Japan with imports from China trailing at

around 25% of those from the top suppliers.

Imports of plywood from Indonesia in April picked up to

the second highest over the past 12 months but are stiil

some 10-15% below average monthly volumes from

Malaysia.

Trade news from the Japan Lumber Reports (JLR)

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

Forestry White Paper

The 2015 Forestry White Paper submitted to the Diet

describes the movement of Japanese forestry, forest

industry and wood industry in 2015 with the policy for

2016.

Topics are that degree of wood self-sufficiency was

31.2%, first recovery over 30% after 26 years, use of

domestic wood for facilities of the 2020 Tokyo Olympic

Games was officially decided Japanese cedar and larch

were used for the Japanese pavilion at Milano

International Fair in 2015. These indicate possibilities of

new wood utilization.

Another new move is that new techniques are adopted for

building of hotel with CLT and four stories wood building

with two hour fire proof materials.

Regarding wood biomass power generation facilities based

on FIT system, economic revitalization of local mountain

villages is expected but the issue is to secure stable

procurement of fuel. Use of forest residues and thinning in

2013 was 1,120,000 cbms then increased to 1,680,000

cbms in 2014.

Other topics in 2015 are that Japan indicated target of

reduction of global warming gas by 26% by 2030

compared to 2013 at COP 21of Paris agreement in 2015,

out of which 2.0% is covered by forest absorption.

Japan achieved target reduction of 3.8% by forest

absorption set at the Kyoto Protocol and now it is aiming

reduction of 2.7%. To realize such forest absorption,

subsidy for thinning harvest is important but Forest

Agency’s budget for such subsidy has been decreasing

year after year so to secure stable revenue, White Paper

suggests introduction of Forest Ecotax.

Revision of Forestry law

At the session of the Diet, law to revise a part of Forestry

law was approved on May 13 then on May 24, basic plan

of new Forest and Forestry was approved at the Cabinet

meeting. Basic plan shows direction of policies on forest

and forestry for next five years and a part of Forest Law is

revised to perform policies concretely and they will start in

April 2017.

By the new Forestry law, there is difference of degree of

wood self-sufficiency by 50% by 2020, which is

postponed by five years with new target of 51% by 2025.

To achieve the target, one of the issues is stable supply of

logs.

Preferable measure is that organizations of wood industry

collect logs or log markets collect logs from log suppliers

and steadily deliver logs to lumber and plywood mills.

Another system is that lumber and plywood mills

participate log harvest and supply logs by themselves.

In those, law to support mills’ subjective log procurement

is revision of part of special treatment law regarding stable

supply of wood.

Revision is that log supply plans beyond individual

prefecture can be approved by the Minister of Agriculture,

Fisheries and Forestry so that mills are able to collect logs

from much wider areas and that wood biomass users can

be added to business plan.

The plan says it is desirable that lumber and plywood mills

get into forest management and to promote this idea, forest

boundaries by each owner should be clearly clarified.

For this purpose, each local cities and villages maintain

account book of forest owners and publicize. This prevents

increasing forest properties, which are ownerless or

unknown who owns it.

Also the new plan states wood utilization is based

on

cascade use and unused wood and thinning should be used

for wood biomass power generation, which should prevent

using A class and B class logs suitable for lumber and

plywood manufacturing as fuel.

Mutual approval of SGEC and PEFC

SGEC, Japanese forest certification system run by the

Sustainable Green Ecosystem Council has been working to

reach mutual approval with the international authorization

system, PEFC then on June 3, official agreement is made.

Ones with either SGEC or PEFC certificate are allowed to

use both logo marks after necessary examination. From

now on, SGEC and PEFC activities in Japan are managed

by the SGEC and it will make contract to use logo marks

and public notice of COC certification.

The largest change for ones, which have SGEC certificate

is COC certificate fee. It has been only 10,000 yen a year

for SGEC members but now it will be the same as PEFC.

For ones, which sales are over 50 billion yen, annual fee

will be 400,000 yen, same as PEFC’s annual fee from

present 10,000 yen. Another change for ones with SGEC

certificate is it is necessary to have contract to use logo

marks.

SGEC’s logo marks can be used without any contract but

now contract needs to be made with SGEC to have license

number so that each logo has the number. Application of

the contract will start in July.

Also PEFC certified wood cannot have SGEC logo on

imported wood but ones with PEFC COC certificate,

which wish to handle domestic wood with SGEC logo

mark, contract to use logo can be made with SGEC’s

examination at the time of renewal. Ones, which wish to

use PEFC logo when domestic wood is exported, another

contract to use PEFC logo has to be made after regular

examination.

Wood biomass statistics start

The Forestry Agency will newly start wood biomass

energy utilization survey. This is to investigate actual

utilization of wood biomass through users of wood

biomass fuel like wood chip, wood pellet, sawdust and

firewood for power generation and boiler.

This will be official statistics of demand for wood biomass

fuel. Since there are increasing number of users of wood

biomass recently, this survey would tell actual demand of

wood biomass used for power generation, co-gen boiler

and combined use of biomass with coal for FIT and RPS

system.

This is the first official survey and will be used by the

Forestry Agency as a part of information the Forestry

Agency makes up every year of wood demand statistics

and forestry basic planning.

This is statistics based on the statistical law with the

Minister of Internal Affairs’ approval and the survey will

be made periodically and be publicized to grasp actual

condition of use of domestic wood biomass.

The first survey will be made through owners of power

generator and boiler as of December of 2015 to find out

operational condition, amount of fuel use by type of fuel

based on bone dry ton and whether it is co-gen or not.

The questionnaires are sent by mail or E-mail through

local government offices. Collected data will be disclosed

once in this summer then the final will be disclosed in

December 2016.

Wood and building materials manufacturers have been

tackling utilization of biomass such as waste wood for

power generation and heat for many years then biomass

power generation plants mushrooms after FIT system

started, which increases demand for biomass sharply.

This helps disposal of low grade logs and wood chip

manufacturers but meantime, existing industry like wood

fiberboard manufacturers suffer shortage of raw materials

with higher prices so there are strong demand to find out

actual demand of biomass fuel by the area. As to import

biomass fuel, it is revealed by the trade statistics made by

the Minister of Finance.

Ministry assists house builders for overseas

development

The Ministry of Land, Infrastructure and Transport starts

new business of supporting house builders’ overseas

development. It backs up introduction of Japanese house

building technique, equipment and materials and technical

proposals of housing projects.

It plans to give subsidy of one half of expenses the

Japanese house builders’ dealing on offers on building

technique, building materials and equipment. It has been

analyzing housing and construction condition in ASEAN

and Asian countries so it offers cooperation to prepare

building standard law in each country and helps supply

houses. It will invite house builders and contractors

publicly after it disclose the business plan.

Plywood

Domestic softwood plywood supply continues tight

particularly on thick panel. In late March, the movement

started weakening then in early April, Akita plywood had

fire and one plant burned down so that the supply got

tight. In middle of April, Kumamoto area had strong

earthquake and local plywood mills are busy to deal with

local demand. With all these factors, speculative

movement started all over Japan. Not only large precutting

plants but local small precutting plants got busy since last

May.

Rise of actual demand and speculative demand exceeded

the supply, which results in shortage of supply on some

items like thick panel.

Operation of precutting plants is expected to get

busier so

the demand seems to increase all over Japan. Thus, some

manufacturers are asking higher prices since June, 10 yen

per sheet up on 12 mm and 20 yen up on thick panel.

Softwood plywood production in April was 237,000 cbms,

6.5% less than March. Monthly average production during

January and April 2016 is 237,700 cbms as compared to

215,700 cbms for the same period of last year. Meantime,

April shipment was 247,000 cbms, 17.6% more than April

last year and 3.7% more than March. The inventories were

122,800 cbms, 10,000 cbms less than March.

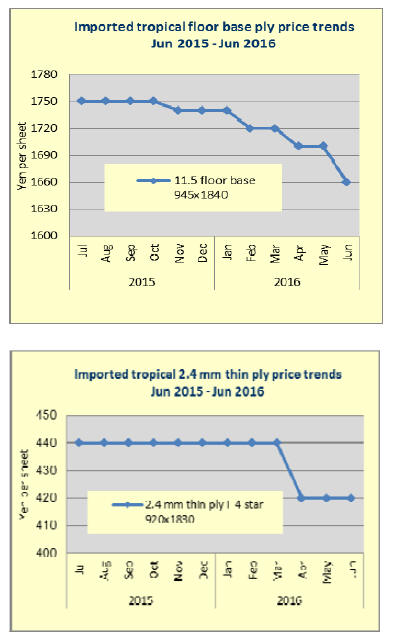

Imported plywood market has hit the bottom but there is

very little change in the movement. In Tokyo market,

some items are short in supply.

By March, the importers and wholesalers have disposed on

the inventories considerably so the overall inventories are

down now. The arrivals appear to stay low so once the

demand picks up, sharp rebound of prices is likely to

happen. The movement is expected to improve in June.

|