2. GHANA

Ghana signs controversial EPA with EU

Ghana is now preparing to bring into law the Interim

Economic Partnership Agreement (EPA) negotiated with

the European Union. The agreement is expected to ensure

that local businesses and industries can export more &Made

in Ghana* goods to the EU market quota and duty free.

However, manufacturers and service providers in the EU

ill enjoy the same benefits for their exports to Ghana. This

EPA was first mooted by Ghana*s former President J. A.

Kuffour back in 2007.

Countries which sign the EPA will benefit from a euro 6.5

million aid package over a five year period to help cushion

the impact of open markets to EU suppliers.

Other West African countries have until 1 October 2016 to

sign the EPA So far 13 of the 16 ECOWAS countries have

signed with the exception of Nigeria, the Gambia and

Mauritania.

In a related development, the Ministry of Trade and

Industry has initiated a four-phase strategy to support local

companies expand exports to the US. This strategy is part

of the US government*s trade initiative with sub-Saharan

African countries &African Growth and Opportunities Act

(AGOA)*.

Ghana Exim Bank open for business

The Ghana Exim (Export-Import) Bank began operations

last year after parliamentary approval of the Ghana

Export-Import Bank bill. The new export promotion bank

is the result of a merger of three agencies, the Export

Trade, Agricultural and Industrial Development Fund the

Exim-guaranty Company Ghana Limited and Export

Finance Company.

The main aims of the new agency are to support and

develop Ghana*s international trade capacity and to

strengthen the competitiveness of Ghanaian companies in

international markets.

In his mid-year review of the 2015 Budget the Finance

Minister said the bank is working to help address the

challenges faced by domestic companies, especially

SMEs, in securing credit.

Exports to regional markets fell in the first quarter

The top export destinations for Ghana*s wood products in

the first quarter of 2016 were China, India, Vietnam,

Germany and Italy which together accounted for just over

68,20,000 cu.m worth euro 38,7 million or 74% and 77%

of total first quarter volume and value exports.

In terms of volume China accounted for 33% while India

imported 32%. Despite the significant expansion of export

to Asian markets trade to regioal markets weakened.

3. MALAYSIA

India, Malaysia*s third largest timber

trading partner

The Malaysian Timber Council (MTC) arranged a

marketing mission to Chennai and Bangalore, India at the

end of August. The delegation was led by MTC Chief

Executive Officer, Datuk Dr Abdul Rahim Nik, and

included 19 Malaysian timber exporters to India.

India was Malaysia*s third largest timber trading partner

after Japan and the United States in 2015. The value of

wood products imported by India from Malaysia amounted

to almost RM1.9 billion in 2015, an increase of 6.3%

compared with 2014.

In the press release on the mission the MTC CEO said

※India holds huge promise as it is ranked as one of the top

three most attractive investment destinations in the world.

Its growing middle class and demand for timber as well as

timber-based products have prompted MTC to open a

regional office in India this year.§

When Myanmar introduced the log export ban in 2014

Indian importers began to import more logs and

sawnwood from Malaysia.

For more see: http://mtc.com.my/wpcontent/

uploads/2016/08/Mission-to-India.pdf

In related news, MTC plans to operationalise its office in

Bangalore in January next year to help strengthen

Malaysia*s marketing in India as well as neighbouring

countries. The MTC office in India is the fourth after those

in the United Kingdom, Dubai and China.

In announcing the new office Malaysia*s Plantation

Industries and Commodities Minister, Datuk Seri Mah

Siew Keong, reported that the MTC office in India will

also promote Malaysian wood products in Pakistan, Sri

Lanka and Bangladesh.

Boost for Johor furniture exporters

Wooden furniture exporters in Johor, a state in southern

Malaysia close to Singapore contributed around 60% to

Malaysia*s total wooden furniture exports in 2015. In

August a 5 year roadmap was launched for the

development of Johor's wood furniture industry.

This sets out ways to sustain the furniture manufacturing

sector given the challenges in international markets and in

addressing the domestic shortage of manpower in the

sector. The roadmap also addresses how to maintain and

improve the competitiveness of the state*s furniture

industry.

Deputy Plantation Industries and Commodities Minister,

Datuk Datu Nasrun Datu Mansur and Malaysian Timber

Industry Board Director-General, Datuk Dr Jalaluddin

Harun reported that land is being acquired in Muar for the

development of a Muar furniture hub and that nearby

Tangkak be developed as a centre for exhibiting wooden

furniture manufactured in the state.

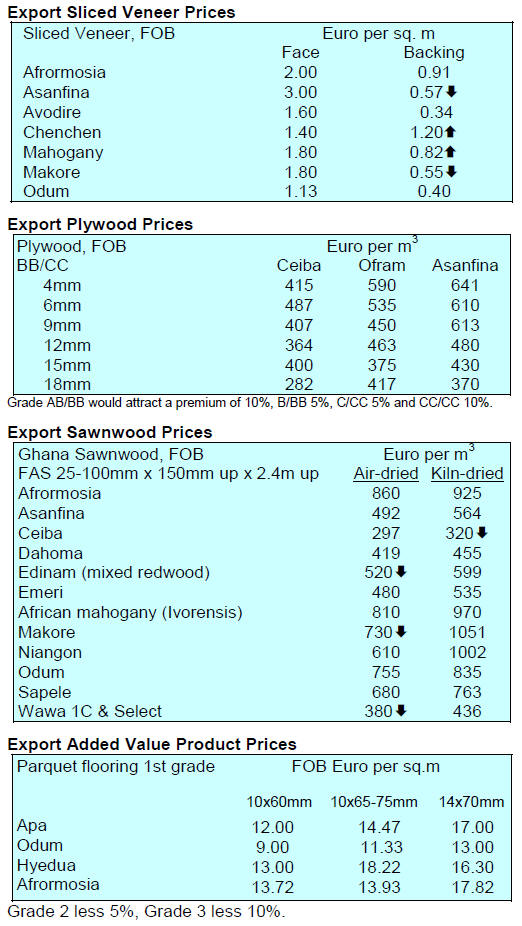

Plywood prices

Plywood Traders in Sarawak reported the following export

prices:

Floor base FB (11.5mm) US$560-570/cu.m FOB

Standard panels

S Korea (9mm and up) US$380/cu.m FOB

Taiwan P.o.C (9mm and up) US$400/cu.m FOB

Hong Kong US$400 FOB/cu.m

Middle East US$400/cu.m FOB

It has been reported in Japan that Sarawak plywood

manufacturers have come together to agree production

cuts in plywood specifications for the Japanese market due

to weak demand.

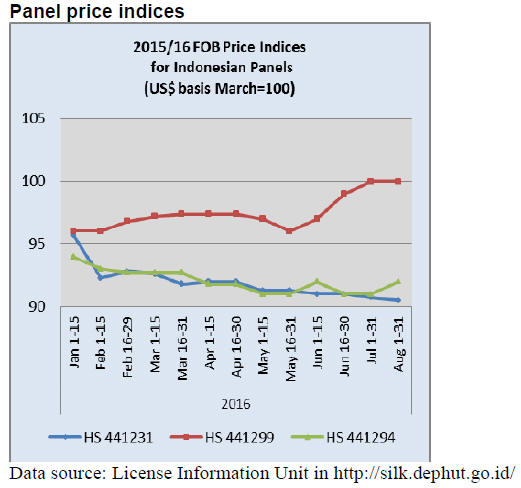

4. INDONESIA

Indonesia to ship first FLEGT licensed

wood products

in November

In a press release on 18 August the European Commission

announced it is ready to recognise Indonesia*s licensing

scheme for exports of verified legal timber.

The press release says ※One third (by value) of the EU's

tropical timber imports comes from Indonesia and the EU

buys 11% of timber products and paper exported from the

country.

The delegated regulation amends the FLEGT Regulation

to include Indonesia and its Licensing Information Unit

under the list of &Partner countries and their designated

licensing authorities*. It now also includes Indonesian

products covered by the FLEGT licensing scheme in the

list of &Timber products to which the FLEGT licensing

scheme applies only in relation to the corresponding

partner countries*.

The delegated regulation will enter into application on 15

November, making this the earliest date that Indonesia

could begin to issue FLEGT licenses. The EU-Indonesia

Joint Implementation Committee will announce the date

for FLEGT licensing to begin when it meets on 15

September§.

See: http://eur-lex.europa.eu/legalcontent/

EN/TXT/?uri=uriserv:OJ.L_.2016.223.01.0001.01.ENG

&toc=OJ:L:2016:223:TOC

Merger of main furniture and handicraft industry

associations

A new association, the Indonesian Furniture and

Handicraft Industries Affiliation (HIMKI) has been

inaugurated. HIMKI is a merger of the two associations,

AMKRI and Asmindo said HIMKI Chairman, Soenoto.

Since taking office the Indonesian President, who has a

background in the furniture sector, has been encouraging a

merger of the two associations in order to present a united

voice for the industry and to advance the competitiveness

of the sector.

Plan for all-out effort to encourage investment in wood

processing industries

Airlangga Hartanto, the Indonesian Minister of Industry

has said the government has set a target for wood product

exports at US$5 billion in five years. Statistics from the

Ministry of Industry show that the export value of wood

and rattan furniture was US$1.9 billion in 2014 and rose to

US$2 billion in 2015.

To help the private sector achieve the five year target he

indicated that an all-out effort to encourage investment in

the timber, furniture and national craft industries will be

made and that there will be a synergy of policies to realise

the US$5 billion export figure.

In related news Indonesia-investments.com has offered an

analysis of the manufacturing sector in Indonesia and says

if it is to contribute more than the current 20% to GDP it

needs a big boost. Indonesia*s dependence on commodity

exports heightens the risks to the economy.

Data from Indonesia's Industry Ministry reported in

the

analysis show that the domestic industry is growing at a

slower pace than Indonesia's overall economy.

Indonesia*s new Minister of Industry, Airlangga Hartanto,

sid his aim is to boost and strengthen the competitiveness

of Indonesia's small and medium-sized industries so that

they can compete with imported goods.

For more see: http://www.indonesiainvestments.

com/news/todays-headlines/manufacturing-industryindonesia-

in-need-of-development/item7070

New approach to monitoring SVLK

The Ministry of Environment and Forestry and the

National Accreditation Committee have agreed to jointly

monitor the Independent Assessment and Verification

Organisation which act as the watchdog for the country*s

timber legality assurance system (SLVK).

Ministry of Environment and Forestry Director General

for Sustainable Forest Management, Ida Bagus Putra

Prathama, said this will enhance the commitment and

credibility of the Indonesian timber legality verification

system.

World Islamic Economic Forum nets agreements worth

US$900 million

The recently concluded World Islamic Economic Forum

was a success as a range of agreements were reached for

investment in a wide range of service and industrial

sectors.

This forum brought together government officials,

company executives, academics innovators and investors

from over 70 countries to explore opportunities for

business partnerships in the Muslim World. The theme of

the forum was "Decentralising Growth and Empowering

Future Businesses"

Indonesia Finance Minister Sri Mulyani Indrawati said in

her closing remarks emphasized the crucial role of SMEs

in driving economic growth.

See: http://foundation.wief.org/

5. MYANMAR

Powerful quake strikes near Bagan

A powerful earthquake shook central Myanmar on 28

August. The quake struck near the town of Chauk, on the

Ayeyarwaddy River just south of Bagan.

The 6.8 magnitude quake killed three and damaged many

of the centuries-old Buddhist pagodas around the ancient

capital of Bagan and was felt across the country.

Our sympathy goes out to those affected.

Debate continues on harvesting ban

In a workshop held late July the former Director Genaral

of the Forestry Department, Dr. Kyaw Tint, explained his

latest research on how the Myanmar Selection System

(MSS) could be modified in the light of the decision to

restrict harvesting.

Dr. Kyaw*s conclusion was that a total harvesting ban

could create as many problems for the forestry sector as it

is intended to address and that sustainable harvesting

could be permitted in designated areas under close

monitoring.

In a related development U Myo Min, Director of the

Forestry Department has been quoted as saying the

harvesting contract between the Myanma Timber

Enterprise and private logging companies will be

cancelled.

It has been stated that MTE will undertake all logging with

its own resources when harvesting resumes after the 2016-

17 one year logging ban, However, the industry is asking

what volumes the MTE will be capable of delivering.

The debate on the proposed total harvesting ban rages on.

From the industry*s point of view a total ban will mean

they are starved of raw materials, may have to curtail

production and may have to reduce their workforce.

On the other hand there is an urgent need to get the

country back on the track of sustainable and legal

harvesting and to eliminate the illegal cross border trade.

Myanmar to encourage private plantations but

questions remain on tax relief

The new government in Myanmar is working its way

through the legislation and making changes that will

impact the timber sector.

In answer to a question in parliament Minister Own Win

indicated that in order to increase forest cover the

domestic and foreign private sector is being encouraged to

invest in plantations. It has been reported that 15 investors

have won approval for tree planation development and that

some 30,000 ha. have been established.

In related news, the government has indicated that

overseas investors will no longer automatically benefit

from tax exemption under the new Investment Law. The

previous administration allowed tax exemption for five

years for a wide variety of sectors. For priority sectors the

current law provides for discretion depending on the

industry and size of investment.

Duty free imported raw material 每 old legislation needs

to be addressed

With regard to the decision to allow duty free import of

timber raw materials an American delegation visited

Myanmar to discuss the investment policy and law. The

government decided to allow duty free import of raw

material which will be reprocessed for export.

The discussions revealed that the Union Taxation Law is

still operable and that this imposes a 25% tax on imported

logs and wood raw material. The domestic industry is

urging the government to address this through amending

the old legislation.

Economic policy 每 a focus on national reconciliation

In a statement explaining the government*s economic

policy the emphasis was on &greater fairness* in the

allocation of resources among regions and states that

would underpin the country*s pursuit of national

reconciliation. The aim is to achieve national

reconciliation through the establishment of a strong

market-oriented economic system.

Some of the states and regions that have been neglected in

the past such as Kachin and Shan State as well as the

Sagaing Region produce jade, gold and minerals while oil

and natural gas is found in Rakhine State. However, until

now income from these natural resources has been

accumulated by central government with just a fraction

being returned.

Kachin State Chief Minister U Khat Aung has pointed out

that for decades the returns from timber and jade

production have not benefitted the state. Natural resource

sharing was on the agenda at a recent summit of ethnic

organisations held in Kachin and the gathering called for

greater debate on resource sharing.

The policy statement also touched on foreign investment

reform of state enterprises and support for SMEs. The

government policy aims to encourage responsible

businesses and create an environment where companies

feel secure to invest.

At the same time state enterprises will be made more

accountable and transparent. On SMEs the policy

framework includes efforts aimed at increasing SME

access to financial services and developing a more skilled

workforce.

6.

INDIA

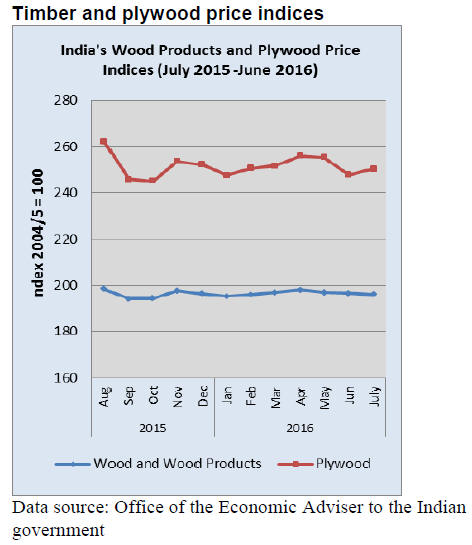

Inflation rate trends down

The Office of the Economic Adviser (OEA) to the Indian

government provides trends in the Wholesale Price Index

(WPI).

The official Wholesale Price Index for All Commodities

(Base: 2004-05 = 100) for July was 183.9 up 1% from 182

in June. The year on year annual rate of inflation, based on

monthly WPI, stood at 4.91% (provisional) in July 2016

compared to 1.62% in June.

For more see: http://eaindustry.nic.in/cmonthly.pdf

Launch of new ※Housing Data Project§ for the

Indian

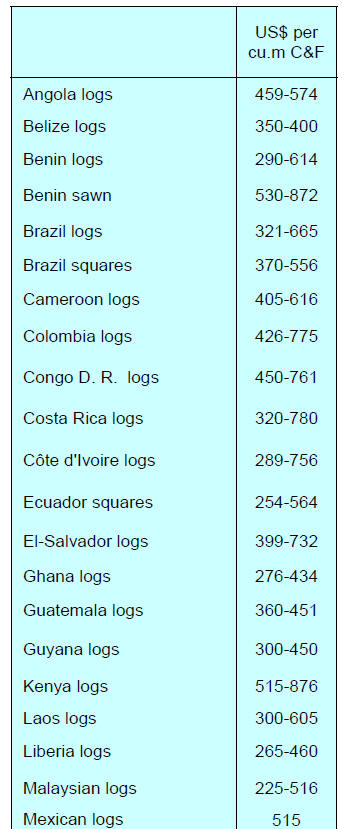

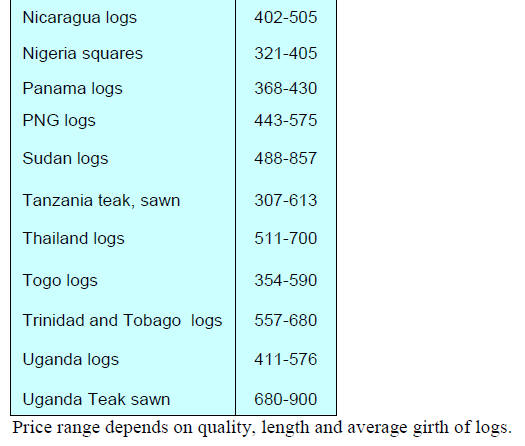

housing industry

The Confederation of Real Estate Developers* Association

of India, better known as CREDAI, recently concluded its

16th convention. This year the convention was held in

Shanghai under the theme 每 &Embracing Change*

The aim was to facilitate the exchange of knowledge and

experiences on the global best practices in the industry

against the backdrop of the Indian and Chinese economic

development prospects.

At the convention, CREDAI launched a new tool for

the

sector called the ※Housing Data Project§ this is a maiden

attempt at providing data from which to gain a good realtime

appreciation of India*s housing sector.

The project will provide details of housing stock, project

launches, absorption and the unsold inventory in 12

biggest urban areas in the country. CREDAI & Cushman

Wakefield also launched a joint report on *Embracing

Change: Exploring Growth Markets for Indian

Housing*. The report traces the major factors at work

which determine housing demand and supply in Tier II

and Tier III cities.

See: http://credai.org/press-releases/credai-16th-natcon--

embracing-change-held-in-shanghai-china

ODISHA 每 export promotion targets China

Odisha, (formerly Orissa) is one of India*s 29 states and is

located on the east coast on the Bay of Bengal. The state

has abundant natural resources and a large coastline. The

government of India has selected the coastal region of

Odisha to be developed into one of the Special Economic

Regions in the country.

Odisha is rich in forest resources and the state

administration is encouraging manufacturers of wood

products to export to China. A team from the Odisha

Forest Development Corporation (OFDC) plans to visit

China in September to promote the export of wood

products including sal and asana which is prized wood for

carving.

The OFDC launched an online forest products portal

which attracted buyers from all over India. OFDC, the

state government owned-corporation, earned a record

Rs6.85 billion revenue in 2015-16 and posted a net profit

of Rs 259.20 million.

New MDF plant for Southern India

Greenply Industries Ltd has announced plans to build a

new MDF plant in Chittoor, Andhra Pradesh. The plant

would have an annual production capacity of between

30,000 to 36,000 cubic metres and should be operational

in fiscal 2018-19.

Currently, Greenply has a MDF unit at Patangarh in

Uttarakhand and the company*s share of the domestic

market for MDF is said to be around 30%.

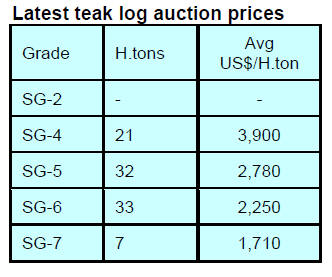

Western India actions of domestic teak

The last auctions of the season have been concluded in

South Dangs and Surat Forestry Division Depots with

considerable interest from buyers anxious to secure stocks

to last through the monsoon period.

The quality of logs offered for sale was good say

participants which helped drive up prices. Demand was so

active that much of the unsold stock from previous

auctions was sold. However, just around 7% of the fresh

log lots on offer remained unsold as buyers felt the reserve

price was too high. The auction in the new sale season is

to provide a large quantity of freshly felled teak and

hardwoods.

Good quality non-teak hard wood logs, 3 to 4 metres

long

logs having girths 91cms and up of haldu (Adina

cordifolia), laurel (Terminalia tomentosa), kalam

(Mitragyna parviflora) and Pterocarpus marsupium fetched

prices in the range of Rs.600-800 per c.ft and for medium

quality logs from Rs.500-550 per c.ft.

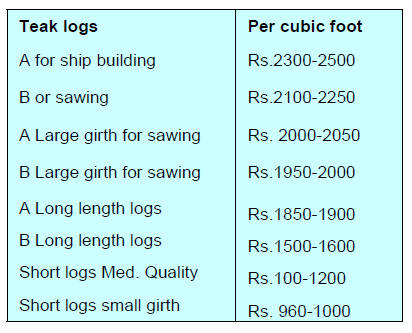

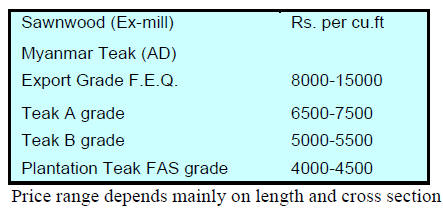

Plantation teak prices

The current pace of deliveries of imported plantation teak

match demand levels in the domestic markets and as such

there have been no reports of price changes.

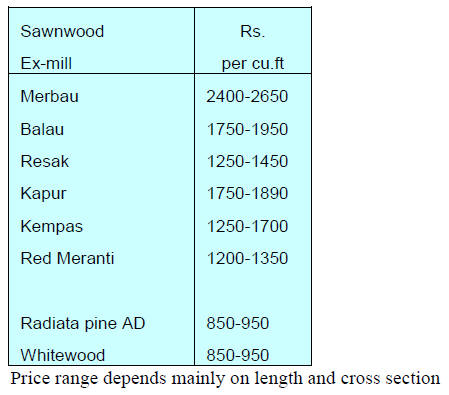

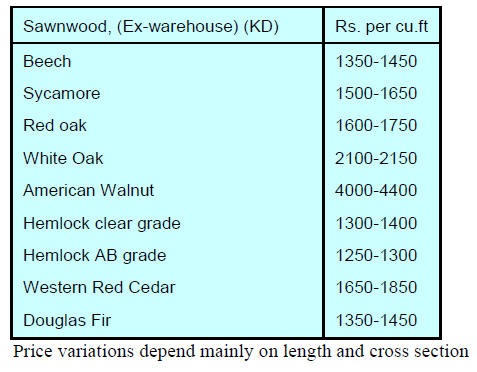

Prices for locally sawn hardwoods

As was the case in July the US dollar/rupee exchange rate

stability has allowed importers to maintain price levels.

Myanmar teak flitches resawn in India

Ex-mill prices for sawn teak remain unchanged.

Prices for imported sawnwood

Demand for imported sawnwood is reportedly flat which

is offering no opportunity expanding sales or for price

increases.

Prices for WBP Marine grade plywood from domestic

mills

Manufacturers report that domestic demand is sluggish

and that prices remain unchanged since last month.

7.

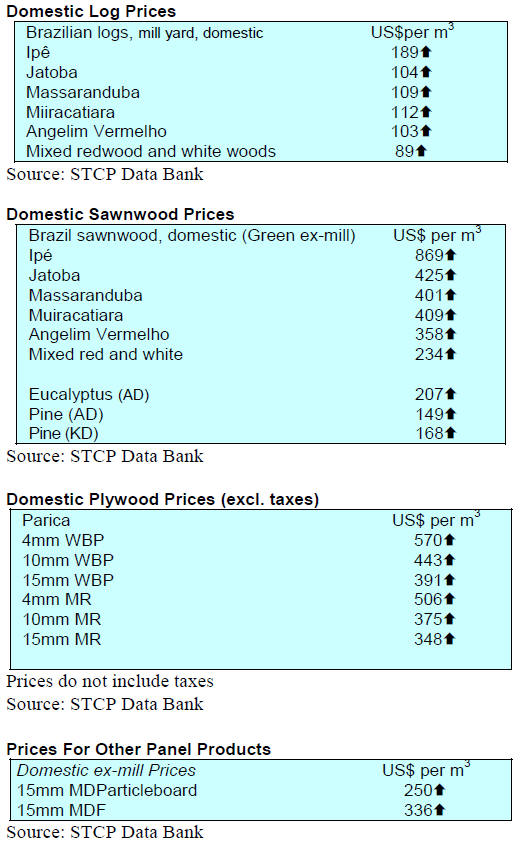

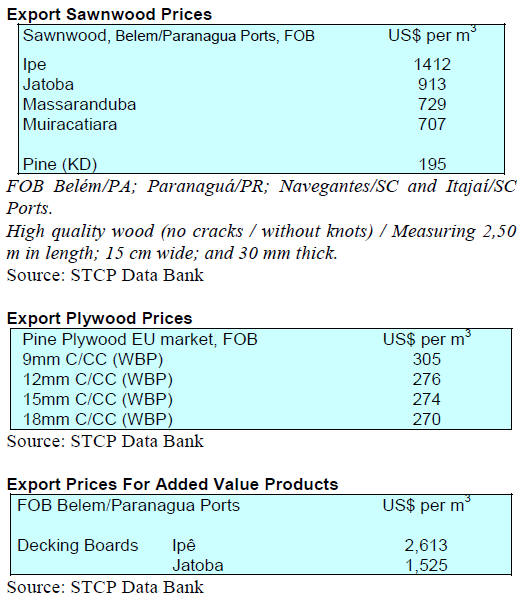

BRAZIL

Wood product trade surplus grows in first

half of 2016

Brazil*s wood product trade surplus totalled US$3.3

billion in the first half of 2016, an increase of 12% over

the same period of last year. Total revenue from exports of

sawnwood, panels, pulp and paper for the first half year

amounted to US$3.8 billion up slightly from the same

period in 2015.

Exports of wood-based panels in the first half were

443,000 cu.m, compared to 289,000 cu.m in the same

period in 2015, a 53% increase. Pulp exports grew to 6.4

million tonnes, a 16% increase over the same period in

2015. Paper exports increased just over 7% to top 1.1

milion tonnes between January and June 2016.

Exports of Brazilian pulp continue to grow, especially to

China, which was the main market in the first half of 2016.

A noticeable trend has been the effort of the pulp, paper

and wood based panel industries to focus on exports as the

strategy to partially offset the decline in domestic demand.

Domestic sales of wood-based panels totalled 3.2 million

cu.m in the first half, down 4.2% compared to the same

period last year. Domestic sales of paper totalled 2.6

million tonnes, being at about the same level as in the first

half of 2015.

July export performance

In July 2016, Brazilian exports of wood-based products

(except pulp and paper) fell marginally compared to levels

in July 2015, from US$237.4 million to US$ 237.0

million.

On the other hand, the value of pine sawnwood exports

increased 0.7% year on year from US$27.6 million in

2015 to US$27.8 million in the first half of this year. In

terms of volume, exports of pine sawnwood increased

18.5% over the same period, from 124,000 cu.m to 47,000

cu.m.

Similarly, tropical sawnwood exports increased 19.6% in

volume, from 27,100 cu.m in July 2015 to 32,400 cu.m in

July this year and but the value of exports rose just 9%

from US$13.6 million to US$14.8 million, over the same

period.

Brazil*s pine plywood exports declined in July 2016 (-1%)

in comparison with exports in July 2015, from US$34.2

million to US$33.9 million but the volumes shipped

jumped almost 27% from 102,900 cu.m to 130,300 cu.m,

during the same period.

As for tropical plywood, July 2016 exports increased 31%

in volume (from 9,700 cu.m to 12,700 cu.m) and export

revenues increased around 9% from US$4.6 million to

US$5.0 milion.

It came as a disappointment that July 2016 exports of

wooden furniture fell around 6.5% year on year.

Best practices in Brazilian plantation sector explained

The Brazilian Tree Industry (IBA) explained its &best

practices* used in the Brazilian plantation sector during the

23rd session of the FAO Committee on Forestry (COFO).

IBA explained that plantations are being established in

&mosaic* form interspersed between the natural forest so as

to create ecological corridors. IBA reported that the

adoption of innovative landscape management results in

multiple benefits in terms of biodiversity sustainability,

regulation of water resources and conservation of natural

forests.

IBA also highlighted that for each hectare of industrial tree

plantation around 0.7 hectare of natural forests was set

aside for conservation.

Satelite images and algorithms to detect deforestation

According to data from a Deforestation Alert System

(SAD) in June 2016 deforestation over the entire Amazon

exceeded 970 sq. km, a massive increase compared to the

same period in 2015. SAD projections are based on

analysis of satellite pictures and the use of algorithms to

estimate changes in forest cover, The states that the system

identified as most affected were Par芍, Amazonas and Mato

Grosso.

For more see: http://www.vizzuality.com/projects/imazon

8. PERU

ADEX calls for harnessing wood processing

sector to

spur economy

The timber sector is a vital part of the Peruvian economy

and the Association of Exporters (ADEX) has called on

the government to create the right conditions for increased

investment in the sector to reverse the decline in exports.

In the first half of this year wood product exports were

valued at US$62.3 million an almost 22% decline year on

year.

Exports of semi-manufactured products (US$35.6 million)

fell by 1%, sawnwood exports fell almost 50% in the first

half and veneer and plywood fell by 38% followed by a

drop in furniture exports of 44%.

Manufacturers in Peru are experiencing strong domestic

demand as the construction sector is booming and it is

partly the diversion of output to the domestic market that

has impacted exports.

The chairman of Wood and Wood Industry ADEX, Erik

Fischer, has said the country has a viable wood processing

sector and ample resources that should to be harnessed to

spur economic growth.

APEC discusses how best to combat illegal logging

At the 10th Meeting of the Expert Group of the APEC on

Illegal Logging and Associated Trade (EGILAT) that was

held in Lima from 17 to 18 August the focus was on

strengthening the means through which illegal harvesting

can be eliminated.

Participants were from Australia, Canada, Chile, South

Korea, Philippines, New Zealand, Malaysia, Papua New

Guinea, China, Russia, Taiwan P.o.C and the United

States. During the meeting Peru hosted a workshop with

the theme "Strengthening Forest Control and Marketing

Chains in APEC Economies" This addressed the

importance of traceability mechanisms and how

implementation can be managed as a tool for economic

development of SMEs and communities.

EGILAT aims to strengthen political dialogue and is

carried out within the framework of the preparatory

meetings of the Asia-Pacific Economic Cooperation

(APEC).