Japan

Wood Products Prices

Dollar Exchange Rates of 10th

October 2016

Japan Yen 103.61

Reports From Japan

Business sentiment stalls

The Bank of Japan's quarterly Tankan survey indicates

that, while large enterprises are still investing, they are

doing so at levels unchanged from June. The impact of

the strong yen and subdued consumer spending are the

main factors which have stalled business sentiment.

Analysts anticipate the current mood in companies will be

the pattern for the balance of the year, even though on the

domestic front the impact of the Kumamoto earhquake

was less devastating than first thought for manufacturers

with production plants in the area and even as concerns for

the direction of the global economy are easing.

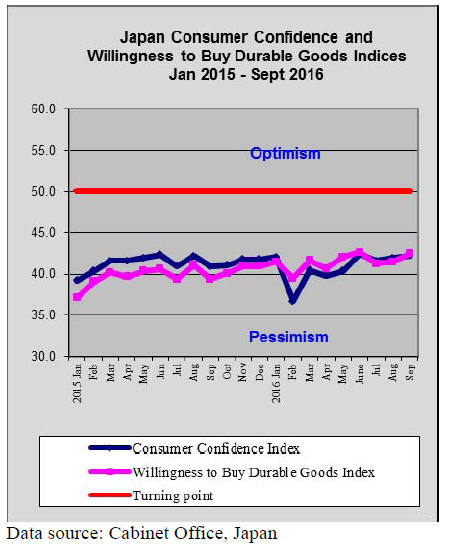

Consumer confidence rise beats expectations

The September consumer confidence survey conducted by

the Bank of Japan (BoJ) shows confidence continues to

improve in sharp contrast to the expected decline.

Among the various components, the index for overall

livelihood rose to 42.0 in September from 40.9 in August,

the income growth assessment was almost unchanged but

the index for employment prospects rose as did the index

for willingness to buy durable goods.

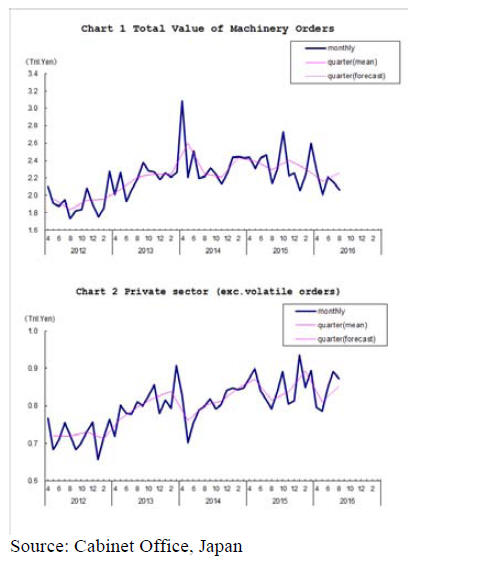

Machinery orders fall

The total value of machinery orders received by 280

manufacturers operating in Japan fell by 4% in August

from the previous month. Private-sector machinery orders,

excluding those for ships and for power company

machinery, declined by 2.2% in August.

The trend in core machinery orders, a highly volatile data

series, is regarded as an indicator of potential capital

expenditure over the next six to nine months.

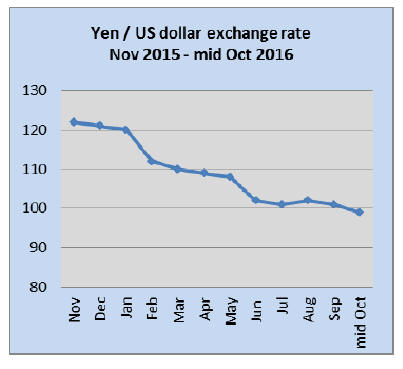

Only US interest rate decision can bring down yen

exchange rate

The yen continued to strengthen against the US dollar in

early October, a trend that has been apparent all year,

despite the decision of the BoJ to adopt negative rates in

an effort to stem the yen‘s rise. The yen has surged more

than 15% against the US dollar so far this year.

While the US continues with its loose monetary

policy

there is little to attract funds into the US dollar. In early

October the yen flirted with the 99/dollar level, the

strongest it has been all year.

It is widely anticipated that interest rates in the

US will

rise as early as December which may bring some relief for

the beleaguered BoJ.

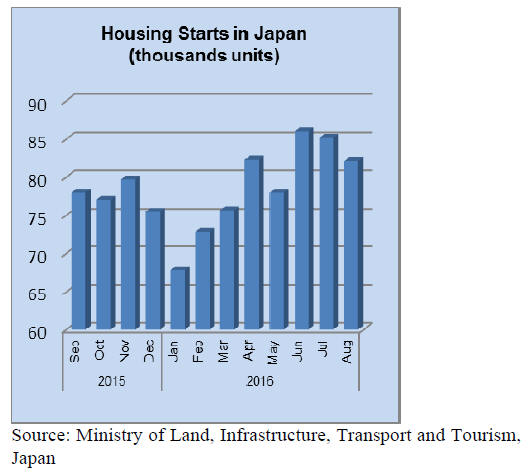

August housing starts up from a year earlier

Japan’s Ministry of Land, Infrastructure, Transport and

Tourism has reported that housing starts grew for the

second straight month in August, despite dropping

compared to levels in July, a fall reflecting the holidays

taken during the month. However, looking at the data it is

clear that the pace of acceleration seen over recent months

has slowed.

August 2016 starts were 2.5% higher than in August last

year but the performance in August was well below

analyst’s expectations.

Projecting forward to year end, housing starts could come

in at under 1 million. Despite the weak numbers for

August orders received by the top builders increased, the

first increase in three months.

See: http://www.estat.

go.jp/SG1/estat/ListE.do?lid=000001159965

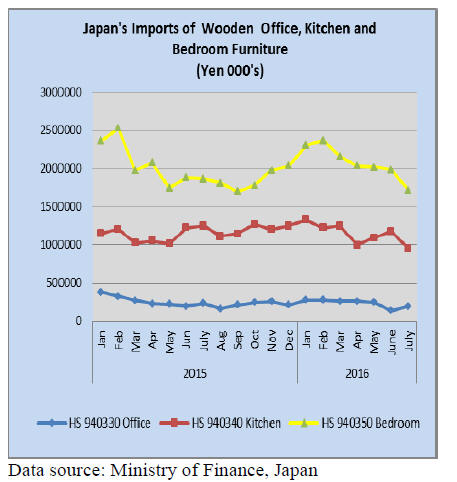

Japan’s furniture imports

After a very good start to the year the pace of growth in

wooden furniture imports has steadily slowed. From the

highs in January this year wooden office furniture imports

have fallen almost 7%, wooden kitchen furniture imports

are down 29% from January and wooden bedroom

furniture imports have dropped 25% from levels in

January.

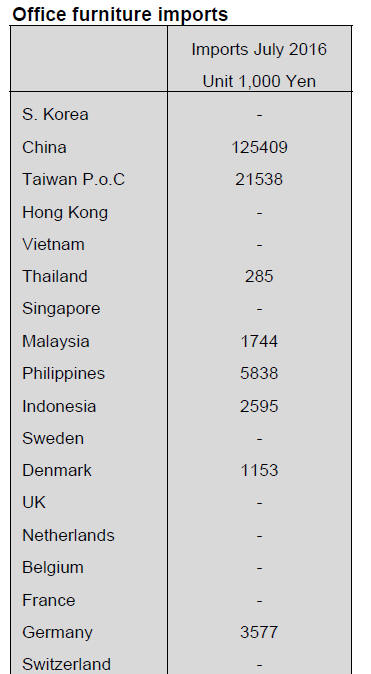

Office furniture imports (HS 940330)

Year on year, imports of wooden office furniture in July

were down 16% but compared to the previous month July

imports rose over 40%.

The top three suppliers, China, Italy and Poland all saw an

increase in sales to Japan in July. Shipments from China

were up 19%, those from Italy nearly doubled and

shipments from Poland rose 44% compared to a month

earlier.

China is the main wooden office furniture supplier to

Japan and in July accounted for over 60% of all imports.

Imports from Italy accounted for a further 6% and imports

from Poland came in at around 4.5%.

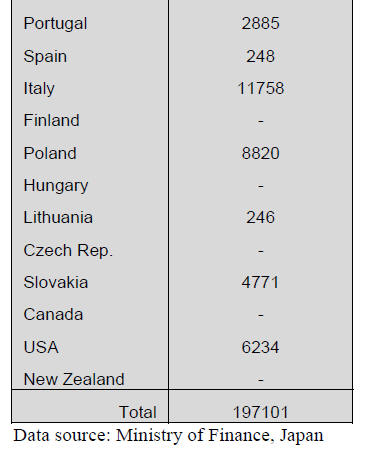

Kitchen furniture imports (HS 940340)

The increasing trend in wooden kitchen furniture imports

over the past two months came to an abrupt end in July as,

compared to a month earlier imports fell almost 20%.

Also, year on year July imports were down 6%.

Two suppliers Vietnam and Philippines dominate

Japan’s

imports of wooden kitchen furniture accounting for around

67% of all imports of this product and if imports from

China and Indonesia are included then over 90% of all

wooden kitchen furniture is accounted for.

The year on year downward trend in imports of wood

kitchen furniture spills over to month on month data also.

In July this year imports from the top supplier, Vietnam,

dropped 35% and imports from the Philippines fell 12%.

Amongst the other small suppliers of kitchen furniture to

Japan in July this year only Germany stands out having

supplied around 2% of Japan’s overall wooden kitchen

furniture imports.

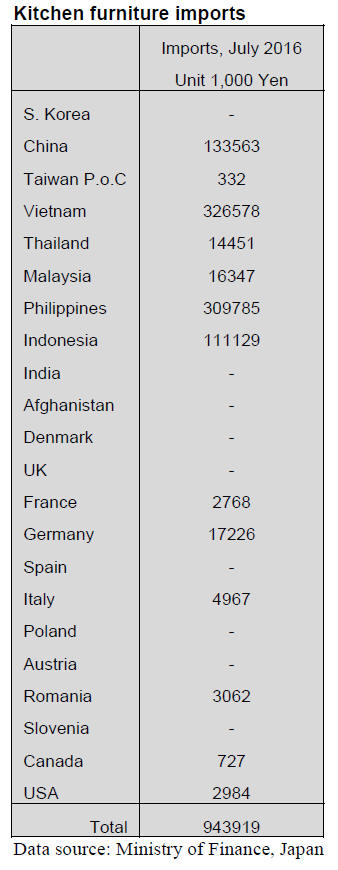

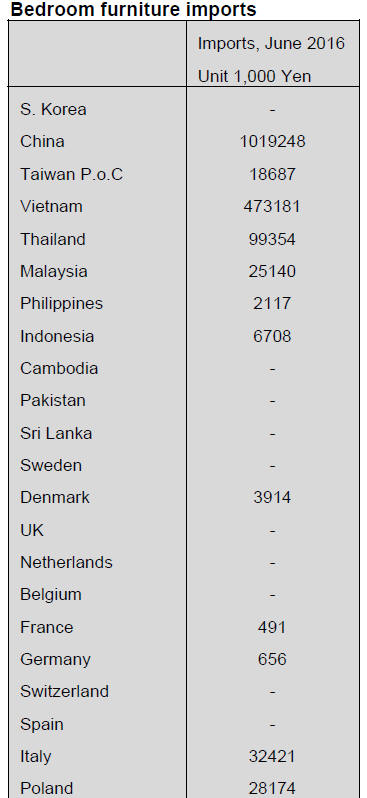

Bedroom furniture imports (HS 940350)

At 59% of all wooden bedroom furniture imports to Japan

in July, China stands out as the main supplier. The second

and third ranked suppliers in July were Vietnam (28%)

and Thailand (6%).

Year on year wooden bedroom furniture imports in July

were down 8% but there was an even sharper fall in month

on month imports (-13%).

Compared to June suppliers in Europe accounted a smaller

proportion of wooden bedroom furniture imports

accounting for 3.9% in July compared to 5% in June.

Trade news from the Japan Lumber Reports (JLR)

For the JLR report please see:

http://www.n-mokuzai.com/modules/general/index.php?id=7

South Sea (Tropical) logs

In Sarawak, India is reducing log purchase after FOB

prices increased as a result of reduction of log export

quota in July by 10%.Sarawak meranti regular prices are

US$275-278 per cbm FOB. If the prices go over US$280,

Japan is likely to stop buying.

Small meranti prices are US$255 and super small are

US$240. Production of kapur and keruing is extremely

limited so it is necessary to pay high prices to have the

supply.

PNG and Solomon Islands have fair weather and log

production is steady. Chinese purchase is slower now so

that Japan can buy easier but India is increasing log

purchase after reduced log production in Sarawak.

In Japan, softwood plywood demand is very active so that

mills are making softwood plywood so South Sea log

consumption is reduced.

Earthquake resistant standard remains unchanged

The Ministry of Land, Infrastructure and Transport and the

Building Research Institute disclosed direction that the

earthquake resistant standard should remain unchanged

after they investigated damages of recent Kumamoto

earthquake.

Since many buildings were built based on the former

standard of 1981 and new standard in 2000 collapsed so it

is necessary to reinforce quake resistant measures on

already built houses.

By the housing performance labelling system started in

2000, earthquake resistant class is established. Class 3

houses in Masuki town, where damages were heavy,

remain almost free of damage but seven houses built after

2000 collapsed but it was found that those had many

efficiency in design and execution of works so they did

not fully conformed to the standard so the committee feels

it is not necessary to revise the standard now.

The Building Standard Act is originally set back in 1950

then new standard is set in 1981 so the Ministry reviewed

and revised quake resistant standard every time strong

quake occurred. As a result of revision of standard, about

28% of building built by the former standard collapsed,

8.7% by the new standard then only 2.2% by 2000

standard so by tightening the standard, damage declined.

However, regardless of the rules, many wooden buildings

built in recent years have deficiency in structural design

and actual works, which led to extensive damages so there

are apparent reasons of collapse like braces and metal

fasteners were missing.

Forestry Agency’s budget request

The Forestry Agency’s supplementary budget for fiscal

year 2016 is 102.2 billion yen, 72.6% more than 2015 as a

result of addition of restoration budget for Kumamoto

earthquake and heavy rain.

Restoration budget for Kumamoto earthquake and

localized torrential downpours in Kyushu is 36,496

million yen to restore damaged forest and wood

processing facilities and other main budget is 31 billion

yen as compared to 22 billion yen in 2015, which is used

for subsidy for forest maintenance like thinning and road

system.

Budget of 33 billion yen is allocated for preparation of

large scale, high efficient wood processing facilities,

thinning to make stable supply of raw materials to such

facilities and maintenance of logging road system out of

which one billion yen is used for manufacturing of CLT

then another one billion yen is allocated for CLT related

subsidy.

Initial budget request for 2017 is 343.6 billion yen, 17.2%

more than 2016. 144.3 billion yen is allocated for thinning

and maintenance of road system, 71.7 billion yen for forest

conservation and 15 billion yen as subsidy to increase log

production and preparation of wood processing facilities.

Subsidy of 15 billion yen is used for introduction of high

efficient logging machineries, production facilities for

containerised seed bed, production facilities of CLT, wood

biomass related facilities like wood chip plant,

introduction of wood biomass boilers for which one third

or one half of expenses are subsidised.

For development of new demand for wood, 1.5 billion

yen is allocated. This is used for establishing application

method of CLT, development of fire proof materials,

wood use for non-residential buildings, value added

lumber products, wood use for engineering works, support

to obtain forest certificate.

In this 500 million yen is used for promotion of use of

cellulose nanofiber, heat utilization of biomass and stable

supply of fuel. 100 million yen is used for providing

information prior to start of clean wood law to control

illegal harvest coming in May 2017.

Certified wood biomass fuel from Thailand

Wood Pellet Siam Company limited (WPS) in Thailand,

which markets rubber wood pellet for fuel has acquired

certificate from JIA (Japan Gas Appliances Inspection

Association) as wood biomass fuel. There are more than

750 fuel suppliers with the certificate in Japan but this is

the first overseas supplier with the certificate.

This means that any wood biomass power generator uses

WPS pellet is qualified as recyclable energy in FIT system

and purchase price of electricity is 24 yen per 1kwh. WPS

is a subsidiary of Impact Electron Siam, which invests and

develops recyclable energy like solar power generation in

the Asia Pacific region.

Certified wood pellet is produced by waste of rubber wood

by some furniture manufacturing company. Monthly

production is 2,500 ton. WSP buys this and export for

Japan. Rubber wood tree is aged at about 25 years, which

is time to cut down and replant so the government is

promoting to replant rubber trees and gives subsidy to

farmers.

Harvested rubber trees are used for furniture

manufacturing but only half of fell trees are recovered for

furniture so waste is used as fuel.

WPS plans to build its own wood biomass fuel plant and

the first phase will complete in 2017 with the production

of 10,000 ton then it will keep expanding the facility in

three years and eventual target is 30,000 ton a month.

|