Japan

Wood Products Prices

Dollar Exchange Rates of 25th

October 2016

Japan Yen 104.23

Reports From Japan

IMF - 2% inflation target not achievable in

the medium

term

During the most recent meeting of the IMF and the

Institute of International Finance forecasts for the Japanese

economy were revised up. The Japanese economy is

expected to grow by 0.6% this year and in 2017. For 2017

the IMF forecast represents a major upgrade as the

organisation had expected growth to fall.

The annual meetings of the International Monetary Fund

and the Institute of International Finance are major global

financial and economic sector conferences drawing

participants from finance, politics and economics

including finance ministers and central bankers.

The IMF is now certain that the 2% inflation target that

had driven policy decisions by the Bank of Japan will not

be achievable in the medium term.

BoJ to consolidate more orthodox approach to fiscal

policy

Consumer prices in Japan continue unchanged which, say

analysts, strongly suggests the slowdown in inflation in the

country is more to do with weakness in the domestic

economy rather than falling commodity prices. If this is

the case then the 2% inflation target which had driven the

Bank of Japan’s (BoJ) policy until recently is unattainable

in the near future.

The consensus is that the BoJ, which has a two day policy

meeting in the first week on November, will consolidate

its new and more orthodox approach to fiscal policy and

will not announce any surprise moves.

In recent statements from a BoJ spokesperson it appears

the Bank is expecting commodity prices to begin to rise

next year and that this and a more stable yen/dollar

exchange rate will help lift prices.

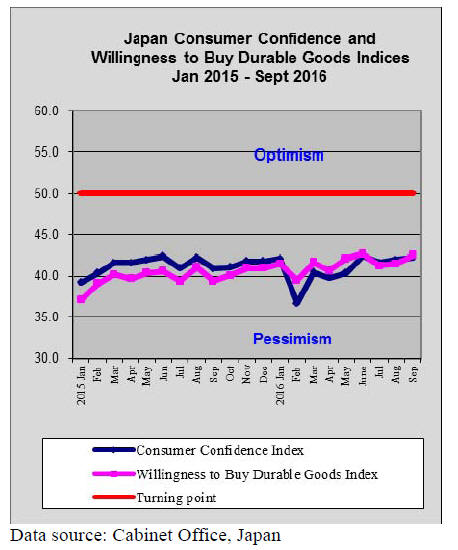

Household spending unmoved in September

September household spending data from the Ministry of

Internal Affairs confirmed what has been reported by

retailers, Japanese consumers are tightening their purse

strings and holding back on purchases of non-essential

items.

The weakening September figures for household

spending

cap the downward trend seen in the previous six months.

For more see:

http://www.stat.go.jp/english/data/sav/index.htm

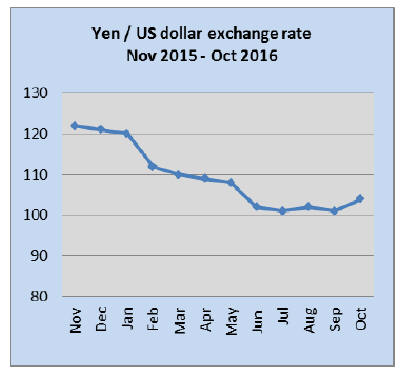

Yen changes course – drops 2.5% in a month

The yen has shifted direction once again and this time it is

weakening against the US dollar. In October the yen was

down 2.5% against the dollar, the steepest monthly drop

for several years.

The yen’s weakness is largely as the market is factoring in

an interest rate rise in the US in December. This and the

abrupt change of policy by the Bank of Japan, has meant

that money has been moved out of the yen.

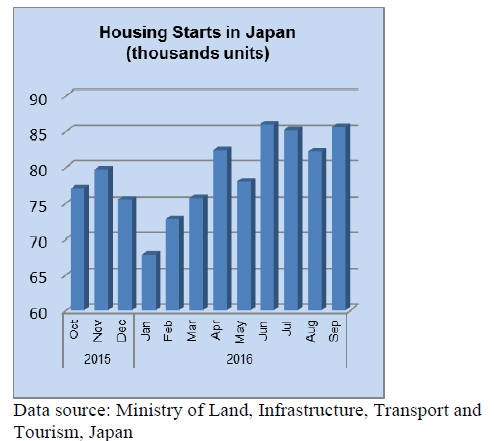

BoJ has watchful eye on credit growth

While the BoJ does not yet use the term housing bubble it

has said it is closely watching the rising trend in housing

loans being offered by the commercial banks. This is

presumably a warning that the Bank will act if it sees

credit growth moving too fast.

The current concern on the part of the BoJ stems

from the

rapid change in the ratio of real estate investment to GDP

which they find is becoming disproportionate.

Counting the cost of the Kumamoto earthquake

The prefectural authorities in Kumamoto, the site of the

most recent devastating earthquake in Japan, have

estimated the damage at close to yen 4 trillion. Private

homes were particularly badly damaged with around

170,000 affected including some 8,000 that were

completely destroyed. A magnitude 6.5 earthquake struck

April 14, followed by a 7.3 magnitude quake two days

later.

The damage was not confined to homes as factories and

hotels were also damaged as were many roads and bridges.

September 2016 housing starts were 13% up year on year

and a recovery in starts compared to August was achieved.

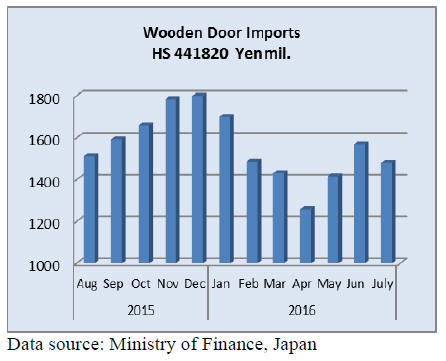

Import round up

Doors

Year on year July 2016 wooden door imports were down

8.5%. The top three suppliers in July were, in order of

rank, China (64%), the Philippines (18%) and Malaysia

(6%). The three together accounted for over 80% of all

Japan’s wooden door imports in July.

Japan’s wooden door imports rose steadily in the second

half of 2015 to peak in December of that year.

Subsequently, imports fell for most of the first half of this

year and on the basis of the July import figures, the

continued rise in imports in June seems something of an

anomaly.

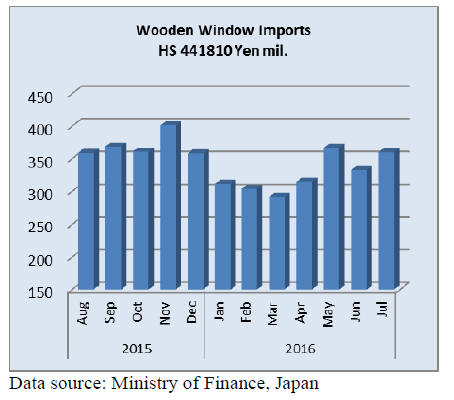

Windows

In contrast to the trends with wooden door imports a

different picture is presented in the data for wooden

window imports. Japan’s wooden window imports have

not exhibited the same volatility as seen with door

imports. Month on month wooden window imports rose

5% in July 2016 but year on year imports were down 17%

in July 2016.

Three suppliers account for the bulk of wooden window

supplies to Japan and each of the main suppliers has about

an equal share of the demand for imported windows:

China (34%), USA (29%) and the Philippines (26%).

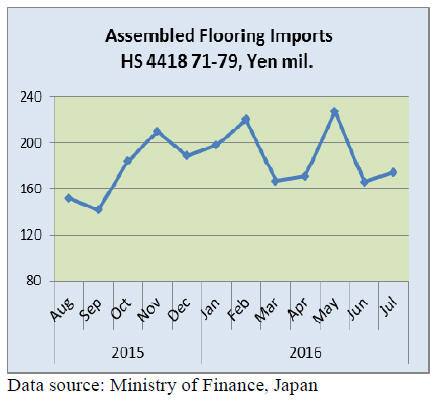

Assembled flooring

Three categories of assembled flooring are included in the data

presented below, HS 441871, 72 and 79. In July this year there

were no imports of HS 441871. For HS 441872 China, Malaysia

and Thailand were the main suppliers while for HS 441879 the

top ranked suppliers were Indonesia, China and Thailand.

Year on year Japan’s July imports of assembled flooring were

down almost 17% but month on month imports rose around 5%.

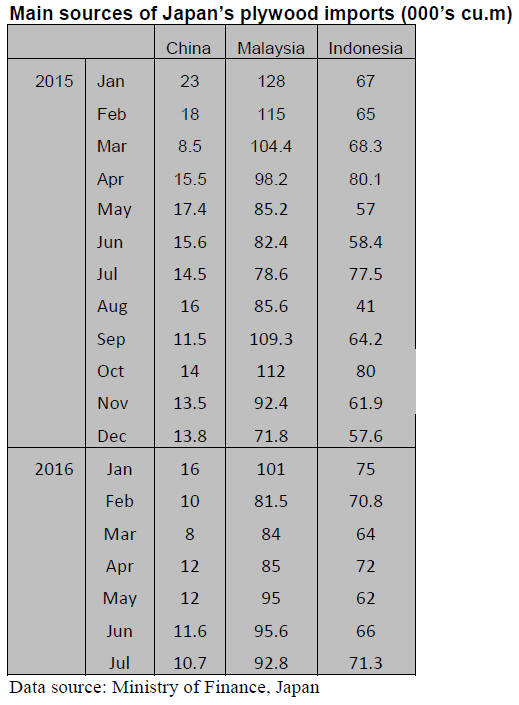

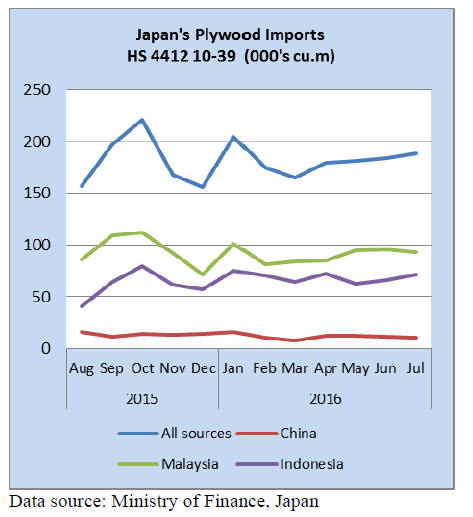

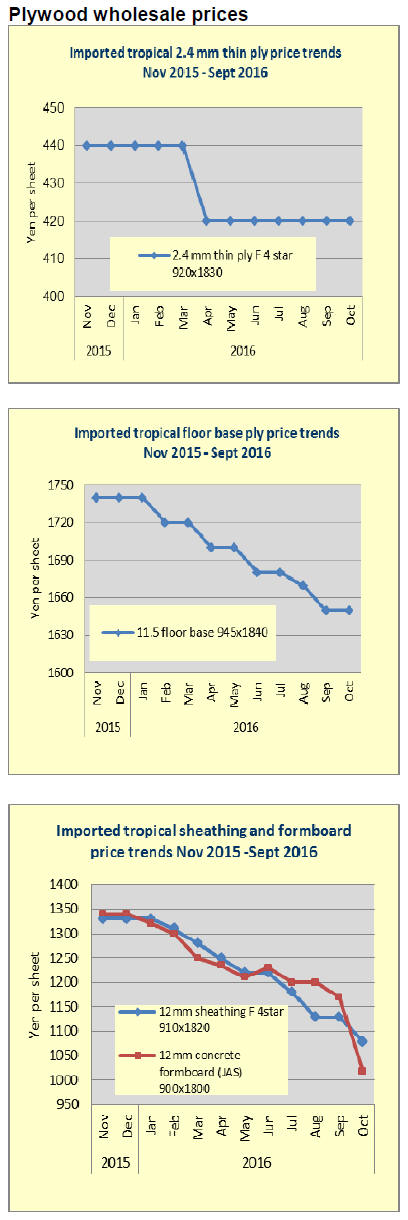

Plywood

In July this year, as has been the case for a number of

years, the main suppliers of plywood to Japan are

Malaysia, Indnonesia and China in this order of rank.

Year on year July plywood imports were up slightly but

month on month shipments from overseas were flat.

Malaysia’s July shipment of plywood to Japan were up

20% year on year but month on month July imports fell

3%. It was only Malaysia which recorded a year on year

rise in shipments to Japan in July with both Indonesia and

China seeing a ddecline (27% in the case of China and 8%

in the case of Indonesia).

Trade news from the Japan Lumber Reports (JLR)

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

Self-sufficiency of wood in 2015

The degree of self-sufficiency of wood in 2015 is 33.3%,

2.1 points up from 2014 and this is five straight years

improvement.

Total wood demand in 2015 is 75,300,000 cbm, 0.7% less

than 2014, out of which domestic wood is 25,060,000

cbm, 6.0 % up, which pushed the degree of selfsufficiency

up in 2015.

Total demand of industry use is 70,880,000 cbm, 2.3%

less. In this, domestic is 21,080,000 cbm, 1.4% more and

import is 49,090,000 cbm, 3.9% less so the degree of selfsufficiency

of wood of industry use is 30.8%.

In 2015, total housing starts are 910,000 units, 1.9% more

than 2014. In this, wood based units are 504,000, 3.0%

more but wood demand for housing starts decreased. In

particular, wood demand for lumber of both domestic and

import is lower than 2014. New demand of domestic wood

for laminated lumber and CLT has been developing and

construction of non-residential buildings like nursing

homes for aged people and kindergarten increased but this

is not reflected to the statistics.

Wood demand for plywood shows obvious trend of

shifting to domestic wood. Domestic wood increased by

5.5% while the imports are 18.1% less.

Because of significant drop of the imports, total

demand

decreased by 11.0% but the degree of self-sufficiency

moved up by 5.6 points.

Wood demand for fuel in 2015 increased by 39.5% out of

which domestic is 59.3% more. This pushed the degree of

self-sufficiency up significantly. Driving factor is

increasing use of unused wood for fuel after more wood

biomass power generation facilities increased by FIT

system. There were only 9 plants in 2014 then total

facilities in 2015 are 25 and more coming in 2016.

Wood demand by use

2015, it is necessary to add total demand of 3,700,000 cbm

and domestic supply of 14,940,000 cbm and degree of

self- sufficiency by 17.7 points.

July plywood supply

Total supply in July was 501,900 cbm, 11.9% more than

July last year and 1.2% more than June.

This is the first time that the supply reached 500,000 cbm

after six months. Production and shipment of domestic

plywood was over 260,000 cbm. Imported plywood

exceeded 230,000 cbm, first time in six months.

Domestic production in July was 267,000 cbm, 21.0%

more than July last year and 1.9% less than June.

In this, softwood plywood was 246,700 cbm, 23.6% more

and 1.8% less than June. Softwood structural panel was

238,800 cbm and non-structural panel was 7,900 cbm.

Shipment of softwood plywood was 250,000 cbm, 1.0%

less and 2.1% less. This is two straight months with

shipment of over 250,000 cbm. All the plywood mills

continue high production and shipment, supported by

active demand by major precutting plants. With busy

shipment, the inventories were 101,800 cbm, 3,000 cbm

less than June. The shipment exceeds the production.

Meantime, arrival volume of imported plywood in July

was 241,100 cbm, 3.6% more than July last year and 4.7%

more than June.

The arrivals for the second quarter were about 230 M cbm

a month then ordered volume has started coming in.

Malaysian volume was 95,700 cbm, 17.9% more and 2.9%

less. Indonesian volume was 78,300 cbm, 6.9% less and

6.8% more. Chinese volume was 51,800 cbm, 5.4% less

and 12.3% more.

Domestic demand for concrete forming panel is slow and

future outlook is bearish due to strong yen so the importers

are reducing future ordered volume so the arrivals for the

fourth quarter will be low.

Plywood

Both production and shipment of domestic softwood

plywood continue brisk pace. August production was

229,900 cbm, 15.8% more than August last year and 6.8%

less than July.

The shipment was 238,900 cbm, 7.4% more and 4.5%

less. Considering the fact that August is vacation month

with the Bon holiday, it is amazingly high shipment.

The inventories finally dropped less than 100 M cbm to

92,900 cbm. Large precutting plants have enough orders

for October and even small and middle precutting

companies are busy with orders from local contractors and

consigned orders from large precutting companies so they

also feel tight plywood supply. For them, regular orders

are filled by the suppliers but delivery of additional orders

is delayed so they feel uneasy if they should accept more

precutting orders.

In Hokkaido, where shortage is notable, to supplement

short supply, they use imported larch plywood and South

Sea(tropical)structural hardwood plywood.

Plywood conference by three countries

On September 19, plywood conference by three countries

was held at Sarawak, Malaysia. 46 people attended from

Indonesian Plywood Association (Apkindo), Malaysian

Timber Producers Association (STIA), Sarawak Timber

Association (STA) and the Japan Lumber Importers

Association, Japan Federation of Plywood Manufacturers

Association.

In the discussion, STA understand the situation of Japan

market. Despite announcement of STA’s production

curtailment announcement, price of concrete forming

panels in Japan weakened by advancing appreciation of

the yen but it expressed uneasy prospect to the future.

Despite steady new housing starts and very low

inventories of imported plywood in Japan, orders for

plywood mills have not increased and the prices remain

depressed.

Japan side asked if the production curtailment is really

performed. Malaysian side says this is gentlemen’s

agreement but export volume would tell the result. STA

commented that it would continue supply reduction until

there will be some change in Japan market.

Also supply side asked about the Japanese is aiming to

achieve degree of self-sufficiency of wood to 50%, which

would impact import products. For this, Japan side

explained that there are no other materials to replace

tropical hardwood plywood in quality. There are some

domestic products to replace South Sea plywood but

balance of 50% imports and 50% domestic will be kept

without any drastic change for a time being.

Japan side explained that domestic demand of plywood

will decline in a long run with decreasing population so it

is necessary to develop overseas market, which is the

common problem for plywood manufacturers in Malaysia

and Indonesia in future so three countries need to work

together to develop new markets.

|