2. GHANA

Wood tracking system field tested

The Forestry Commission has begun implementing a

wood tracking system. The system delivers all relevant

data on forest operations in order to track the timber

supply chain to the final point of sale.

The system will help curb illegal logging and the sale of

illegal timber and will eventually enable the country to

issue Forest Law Enforcement Governance and Trade

(FLEGT) licenses under the Voluntary Partnership

Agreement (VPA) between Ghana and the EU.

The system is currently being tested in selected forest

districts in Western, Brong Ahafo, Ashanti and Eastern

regions of the country.

President - businesses will be revived

The new government has been sworn in exactly one month

after Ghanaians gave the opposition the mandate to

manage the affairs of the country.

During his inaugural speech the new President said

Ghanaians should all recognise the danger from the

degradation of the environment and work to protect the

lakes and rivers, the forests, the lands and the oceans. He

said Ghanaians should learn and accept that they do not

own the land, but hold it in trust for generations yet

unborn and, therefore, have a responsibility to take good

care of it.

The full speech can be found at

https://www.youtube.com/watch?v=4n7ZZXcfpWE

New minister announced

Mr John Peter Amewu, the New Patriotic Party Volta

Regional Chairman has been nominated Minister for

Lands and Natural Resources.

Business leads express optimism

The President has assured the business community that

Ghana is open to business again and that businesses will

be revived under his administration. Some of the policy

changes planned include a cut in corporate and value

added taxes anda reduction in interest rates.

Many business leaders have been encouraged by the

expansionary policies of the new administration and are

calling on the new administration to implement businessfriendly

policies to revive the manufacturing sector in

Ghana.

3.

SOUTH AFRICA

Businesses back to work mid-January

The manufacturing and construction sectors in South

Africa stopped work for the Christmas and New Year

festivities in mid-December and only resumed business in

mid-January. Our analysis of the timber market trends in

South Africa will resume at month end.

Warning on structural timber usage

A recent press release from the Institute for Timber

Construction South Africa (ITC-SA) has warned South

African importers and endusers that timbers used in

structural applications must comply with South African

regulations.

Builders in South Africa are currently facing a shortage of

structural timber which has led to an increase in imports.

The ITC-SA says “National building regulations require

that all structural timber comply with SANS 1783, which

covers sawn softwood timber and both national and

international manufacturers of structural timber supplied

to the SA market are expected to be certified by a South

African-based ISO 17065-accredited certification body.”

Only the South African Technical Auditing Services

(SATAS) and the South African Bureau of Standards

(SABS) are accredited to certify manufacturers of products

in compliance with SANS 1783.

See:

http://itc-sa.org/category/press-releases/

Turbulent months ahead for the rand

Several analysts and the World Bank are warning of tough

times ahead for the rand exchange rate.

The consensus is that 2017 will be especially turbulent due

to internal political rivalry as presidential election loom

and due to uncertainty as to how US policies will change.

Nomura Market Research in a recent released suggested

that the rand could lose between 10-12% against the US

dollar in 2017. The World Bank has also issued a warning

that the South Africa currency could come under pressure

in 2017 but still expects the South African economy to

expand by 1.1% in 2017 due to better commodity prices.

Residential activity survey delivers hint of growth

The fourth quarter survey of real estate companies (estate

agents) by First National Bank (FNB) confirmed that

agents have noticed a slightly pick-up in the residential

property market.

FNB produces a residential sector index and in the fourth

quarter 2016 its ‘Residential Activity Indicator’ rose

slightly to 5.75, from the previous quarter’s 5.59. However

this modest rise is only a hint of improvement and a

significant further improvement in activity over the

coming quarters would be needed to be confident of an

improving trend.

http://www.fin24.com/Economy/slight-stir-in-sa-residentialproperty-

market-20170113

4.

MALAYSIA

US$100 billion Malaysia/China trade

target

China’s Ambassador to Malaysia Dr. Huang Huikang has

said he hopes the bilateral trade between Malaysia and

China could reach the target of US$100 billion this year.

Between January and November last year the bilateral

trade totalled almost US$85 billion.

China has been Malaysia’s largest trade partner for the

past seven years. Malaysia is China’s sixth largest trading

nation in the world. China is now the second largest

foreign investor in Malaysia.

Exports benefit from weakening currency

The Malaysian ringgit has been experiencing continued

weakness in international currency markets for some time

and observers fear further weakening due to both external

and internal issues. The ringgit was at 4.40 to the US

dollar in early January and has been testing the lows seen

during the 1998 Asian Financial Crisis.

Strong dollar boosts earnings in furniture sector

Malaysian furniture exporters have seen revenues and

profit rise over the past few months despite the ongoing

labour shortage due to restrictions on the hiring of foreign

workers. The strengthening of the US dollar has also given

a boost to exporters.

Over the eleven months to November 2016, Sarawak

produced 6,795,434 cu.m logs. Around 2.5% came from

swamp forests with the balance from hill forests. In the

same period in 2015, 7,575,387 cu.m of logs were

produced.

Production of hill logs in between January and November

last year was highest in Sibu (2,848,780 cu.m) with

Bintulu producing 1,828,637 cu.m and Miri 1,791,705

cu.m. Meranti was the predominant hill species produced

(2,309,561 cu.m), Kapur was second (221,742 cu.m) and

third was Keruing (170,810 cu.m).

New MTC Chairperson

In a press release the Malaysian Timber Council (MTC)

has announced the appointment of Dato’ Gooi Hoe Hin as

the new MTC Chairman effective January 1, 2017.

He takes over from Dato’ Sri Wee Jeck Seng. Dato’ Gooi,

who holds a Bachelor of Economics (Hons) from

University Malaya, served as the Private Secretary to the

former Chief Minister of Penang, the late Tun Dr. Lim

Chong Eu, before taking on various posts in the Ministry

of Primary Industries (now known as the Ministry of

Plantation Industries and Commodities).

During his 25 years of government service, Gooi worked

closely with the Ministry of Primary Industries and its

Ministers to develop various far reaching commodities

related policies which were instrumental in protecting the

commodities sectors, particularly palm oil, rubber, timber

and timber products and tin.

See:

http://www.mtc.com.my/images/media/359/PR_Appointment_of

_New_Chairman_for_MTC.pdf

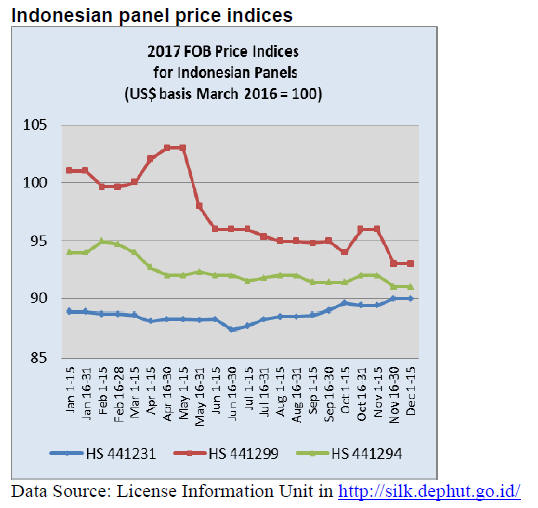

5. INDONESIA

Re-grouping Indonesian timbers

Work has been conducted at the Indonesian Forest

Products Research Center on the basic characteristics of

some readily available lesser used timbers which are

currently traded as Indonesian mixed tropical hardwoods.

It has been suggested that some of these timbers to be

deserve to be upgraded and traded individually.

The timbers of interest are mimba (Azadirachta indica

A.Juss), gopasa (VITEC cofassus Reinw. Ex Blume),

tembesu (Fagraea fragrans Roxb) and penggal buaya wood

(Zantoxylum rhetsum St. Lag). This research was

reported by Dr. Ratih Damayanti, M.Si, a researcher at the

Center.

Ratih explained that from a total of 1,060 timbers included

in the recent study, 40 could be classified in Class

Commercial I, 325 as Commercial II, 53 as Commercial

III, 212 as Commercial IV and 205 as Commercial Class

V. If this upgrading is adopted it will impact royalty

payments and improve government revenue.

For more see:

http://www.forda-mof.org/berita/post/3290

Furniture success in Saudi Arabian exhibition

Indonesian wood and acrylic furniture products made an

impact at the Jeddah International Trade Fair (JITF) 2016,

held 20-23 December at the Jeddah International Trade

and Exhibition Centre, Saudi Arabia.

Indonesian furniture exports to Saudi Arabia have been

increasing steadily and topped US$4.2 million in 2102

rising to US$4.3 million in 2013, US$4.5 million in 2014

and a whopping US$9.5 million in 2015!

New project to Protect Kalimantan Forests

A partnership programme between the US and Indonesian

governments, the Nature Conservancy and the World

Wildlife Fund for Nature, Indonesia has approved grants

worth US$3.3 million for local non-governmental

organizations to work with forest-dependent communities

to conserve tropical forests, protect natural resources and

wildlife and improve community livelihoods.

Extent of forest fires fell in 2016

According to Siti Nurbaya Bakar, Minister of

Environment and Forestry the number and extent of forest

and fires in 2016 fell. Satellite observations over 2016

show the number of ‘hot spots’ was down over 80% year

on year.

Improve infrastructure – the key to list investment

One issue that continues to hold back Indonesia's growth

prospects inadequate infrastructure. In the “World

Economic Forum Global Competitiveness Report”

Indonesia ranks 62nd out of 140 countries in terms of

infrastructure development. While the Indonesian

government is well aware of the need to improve this to

make the country more attractive to investors there are

serious challenges.

A recent article from Indonesia-Investments looks at this

issue and says “- developing Indonesia's infrastructure is

not an easy task. The Archipelago consists of about 17,000

islands which makes it more complex to enhance

connectivity and implies there exists a need to focus on

maritime infrastructure. Currently, sea transport is more

expensive than land transport as the country's sea transport

is yet to be developed substantially.”

The article continues “- decentralisation of power led to

the present situation in which local governments

sometimes fail to support the central government's

infrastructure plans.”

For the full article see: http://www.indonesiainvestments.

com/business/risks/infrastructure/item381

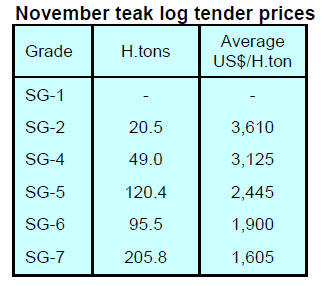

6. MYANMAR

Timber exports highest since log export

ban

Myanmar’s trade deficit reached to US$3.2 billion for the

9 month period April to December 2016, down slightly

from a year earlier.

Exports of wood products, at US$160 million, were the

highest since the log export ban in April 2014. Although

this is a small amount compared to exports from

Myanmar’s neighbours the growth since the log export

ban is significant. The major products exported are teak

sawnwod and ‘mini’ decking used for luxury boats.

Sawnwood export classification

The classification of sawnwood qualities and

specifications in Myanmar is rather unique. The most

common quality is the so-called FEQ (First European

Quality).

There are three major groups of sawn timber: Flitches

(with a cross-sectional area of 24 square inches and up,

excluding heartwood), boards (width 6 inches and wider),

scantlings (width 5 inch or below). In addition to

sawnwood there are two other main marketable items:

outdoor decking and ‘mini-decking’ for yachts. Because

there are restrictions on the maximum size of a flitch that

can be exported flitch production is limited.

Boards and scantling are regularly available and the EU

and US markets prefer long length boards. FOB prices for

these items depend not only quality but also the average

width and length.

The price of boards with an average width (8 inch) and

length (8 ft) can vary from US$ 4100 to 4500 /cu.m.

Export volumes may fall when new regulation

introduced

The MyanmarTimes has reported that a spokesperson from

the Ministry of Natural Resources and Environmental

Conservation, U Win Zaw, has said the volume of timber

that can be exported is likely to decline beginning May

this year.

The news item says “Only timber cut from logs sold by the

state-owned Myanmar Timber Enterprise (MTE) which

contracts out much of its cutting activity is eligible for

export. MTE sells timber monthly through a tender

system, with separate tenders in kyat and US dollars.”

U Win Zaw announced that beginning May 2017 only logs

purchased in US dollars can be processed for export.

http://www.mmtimes.com/index.php/business/24446-resourceministry-

plans-reduction-in-export-eligible-timber.html

7. INDIA

Growth set to slow even before impact of

demonetisation kicks-in

India’s Ministry of Statistics and Programme

Implementation has released economic forecasts for 2016-

17 suggesting the economy will expand at a slightly

slower rate (7.1%) than in the previous fiscal year.

Local analysts were quick to point out that the ministry

forecasts are based on data compiled prior to the decision

on demonetisation, the impact of this on growth prospects

remains very uncertain.

The ministry predicts the agriculture, forestry and fisheries

sectors will expand much more than in the previous period

but growth in mining is set to decline. Growth in

manufacturing and construction is also expected to slow.

See:

http://www.mospi.gov.in/sites/default/files/press_release/n

ad_prn_6jan17.pdf

Inflation rate trends

The Office of the Economic Adviser (OEA) to the Indian

government provides trends in the Wholesale Price Index

(WPI). The official Wholesale Price Index (WPI) for All

Commodities (Base: 2004-05=100) for November 2016

rose by 0.1% to 183.1 from 182.9 for October.

The annual rate of inflation, based on the monthly WPI,

stood at 3.15% (provisional) for the month of November

2016 compared to 3.39% for October.

See:

http://eaindustry.nic.in/cmonthly.pdf

Timber and plywood price indices climb

The OEA also reports Wholesale Price Indices for a

variety of wood products. The Wholesale Price Indices for

Wood products and Plywood are shown below.

Imported MDF gaining market share

India’s e-magazine Ply-Reporter has suggested that it is

over-capacity in international production of MDF that is

behind the continuing rise in India’s MDF imports.

Despite adequate domestic capacity and antidumping

protection measures low priced imported MDF is gaining

market share.

Data from the Directorate General of Commercial

Intelligence and Statistics, Ministry of Commerce and

Industry shows a 14% rise in 2015-16 MDF imports year

on year. The question that is being asked is that will

domestic manufacturers which have plans to expand MDF

capacity be able to compete with imports.

For the full story see:

http://emagazine.plyreporter.com/01112016/Home.aspx

Export of rosewood musical instrument parts on hold

With all Dalbergia being subject to CITES regulation

Indian manufacturers of rosewood products have had to

cease exports until the Forest Department and CITES

work out the formalities and procedures to be followed.

As was the case in November, prices from the new

plantation teak log suppliers remain unchanged at: Taiwan

P.o.C (US$,1036 to 2,126 per cu.m C&F) and Honduras

(US$471 to US$539 per cu.m C&F). Sawn teak from

China (US$855 to 1,118 per cu.m C&F) and from

Myanmar, (US$461-2,895 per cu.m C&F).

Indian importers still hostage to methyl bromide

treatment rules

Demand for imported plantation teak logs and sawnwood

continues to be good and suppliers have been able to ship

larger girth logs in recent months which has given a boost

to demand. Timber importers are still hostage to the

domestic requirement that shipments be treated with

methyl bromide.

Indian plant quarantine rules require that imported timbers

are fumigated with methyl bromide at the port of loading

and a certificate to that effect accompanies the imported

consignment.

However, many countries have banned the use of methyl

bromide so cannot comply with Indian phytosanitary

requirements. Indian authorities are well aware of the

problem but as yet have not suggested an alternative

internationally acceptable treatment. When this issue is

addressed Indian importers would have access to a wider

range of suppliers.

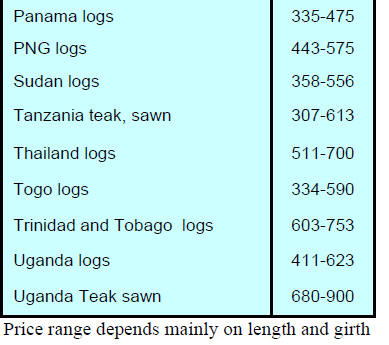

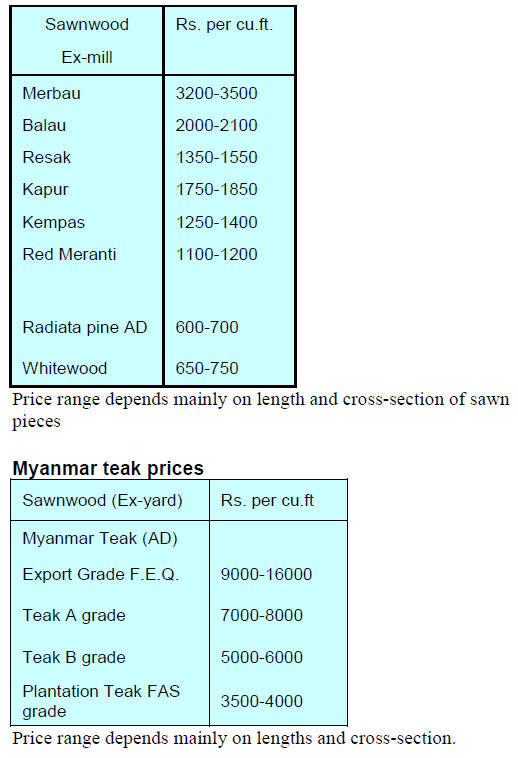

Prices for locally sawn imported timbers

Local analysts report a growing interest in sawn

hardwoods from Sarawak.

Rising international demand for India’s teak

products

drives up sawnwood imports

The steady supply of imported sawn teak from Myanmar

and China has held prices in check. Indian exporters of

teak products are experiencing increased sales and this has

lifted the volumes of sawn teak shipments.

Finally, plywood manufacturers secure price

increase

Plywood manufacturers in Indian have struggled to live

with rising production costs but no opportunity to raise

prices due to the subdued housing sector.

However, over the past months production costs have risen

even higher, mainly due to demonetization say analysts,

resulting in an urgent need to raise prices. The impact of

demonetisation and the slow introduction of the new

Goods and Services tax has created a tough trading

environment in the country.

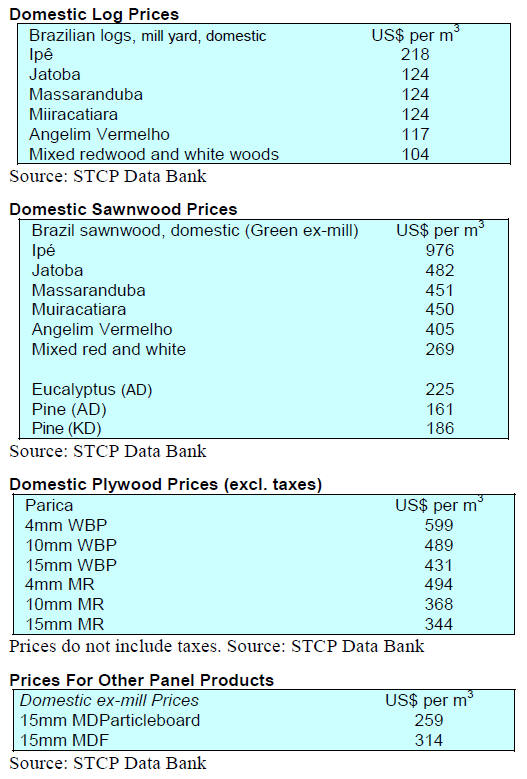

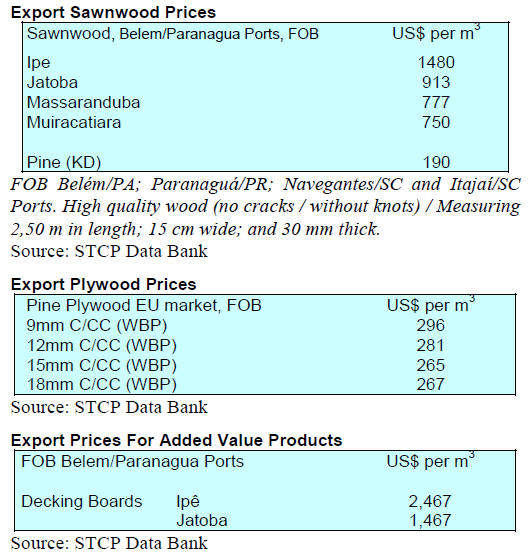

8. BRAZIL

Support for micro, small and medium companies

The Brazilian Development Bank (BNDES) has

announced measures to support micro, small and medium

size companies (M/SMEs). Among the measures that will

be offered beginning this month will be financial support

for investment projects and for the purchase of machinery

and equipment.

Offers of financing will range between R$90 million and

R$300 million and repayments can be spread over 5 to 10

years. Moreover, options for the refinancing of overdue

balances could be made available.

Other measures were also announced by BNDES such as

the launch of an exclusive portal for M and SMEs to

facilitate communication and consultation on product

development and speedier processing of applications.

ABIMCI has said these measures could benefit the wood

based industries.

Importance of the wood industry in the national

economy

The solid wood industry that includes sectors such as

plywood, sawnwood, flooring and other builders

woodwork is set to report a slight rise in 2016 employment

compared to levels in 2015 according to the General

Register of Employed and Unemployed Workers. These

sectors account for just under 60% (369,000) of jobs in the

Brazilian overall forest sector and, accounted for 9% of

the country's total formal employment in 2015.

Throughout 2015 the solid wood industry sectors shed

thousands of jobs but according to the 2016 Sectoral Study

by ABIMCI employment creation accelerated in 2016.

The survey showed that the solid wood sectors had

outperformed the national trend. Although the industry

had to deal with currency fluctuation, high inflation, high

interest rates, increased production and transaction costs

and slow investment the segment closed 2016 on a

positive note.

For 2017 the ABIMCI expects that the reforms and cuts in

public spending announced by the Federal government

could contribute to economic recovery and, consequently,

to improve sentiment and investment.

Furniture export figures from Rio Grande do Sul

The negative performance of the furniture industry in 2016

presented by the Furniture Industry Association of Rio

Grande do Sul (MOVERGS) was the result of weakness in

the domestic as well as international markets.

In September 2016, Brazilian furniture exports totalled

US$51.8 million and in October last year were US$ 53.5

million, both lower than that of August when the sector

registered a small increase, amounting to US$ 53.6

million.

A slight improvement was recorded in November 2016

when exports reached US$ 55.2 million. But overall, from

January to November 2016 exports totalled US$548.2

million, a decline of 0.6% compared to the same period of

2015.

Of total exports 23% went to the United States, 14% the

United Kingdom, 12% to Argentina, 7% to Uruguay and

6% Peru according to the IEMI - Market Intelligence

report based on data from the Ministry of Development,

Industry and Foreign Trade (MDIC).

In terms of ranking the main furniture exporting states in

Brazil in 2016 were Santa Catarina and Rio Grande do Sul

states (35% and 30%, respectively) followed by Paraná in

third place with 13.5%, São Paulo, 13%, and Minas

Gerais, 5%.

Earnings by furniture cluster fall

The Bento Gonçalves Furniture Industry Union

(Sindmóveis) ended 2016 showing major declines in

domestic sales, exports and job creation. The aim of the

Union, which represents about 300 companies, is to now

begin a recovery process through opening new markets in

Brazil and abroad.

A preliminary analysis indicates that, year on year, 2016

revenue earned by the Bento Gonçalves furniture cluster

fell around 18% between January and October.

Exports between January to October 2016 fell 4.6% year

on year and there was an almost 8% decline in the number

of employees in the cluster.

Sindmóveis says that among its members some are

investing in products for new export markets and looking

to modernise production, improve design and test

alternative distribution channels such as e-commerce in an

effort to resume growth.

9.

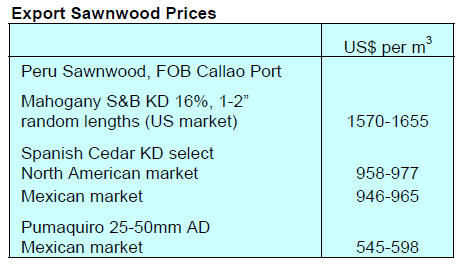

PERU

ADEX anticipates exports fell in 2016

According to Erik Fischer, Chairman of the Committee on

Wood and Wood Industry, ADEX, Peru’s wood product

exports continue to decline. Fischer has estimated that

wood product export shipments in 2016 are likely to be

around US$120 million. At this level they would represent

a 20% year on year decline (2015, US$151.7 million).

For 2017 Fischer anticipates a further 20-30% drop in

wood product export values. The highest value for wood

product exports was achieved in 2007 when they totaled

US$212 million.

Micro furniture enterprises provided with training

Within the framework of a project aimed at improvement

of the productive and commercial management capacities

of the micro-enterprises in the province of Coronel Portillo

and Padre Abad, Ucayali region, the Instituto Tecnológico

de la Producción-ITP (Technological Institute for

Production) in cooperation with CITEFORESTAL

Pucallpa had, by the end of 2016, trained more than 1,500

furniture makers from 182 companies.

The trainings programme focused on topics such as

identification of species, designing, production planning,

cost and quality control, wood drying and finishing.

Vast areas of inoperative forest concessions

According to Julio Ugarte, Director of Studies and

Research for Policy and Competitiveness at the National

Forestry and Wildlife Authority (Serfor), 6,254,183

hectares of forest are the subject of commercial concession

agreements. However, he points out that, to-date, some 5

million hectares of these allocated concessions are

considered inoperative.

According to Alfredo Biasevich, Director of the

Committee for the Timber Sector in the National Society

of Industries (SNI), between 2002 and 2004 concessions

were open to public tendering but many of those granted

concessions were small and medium producers which in

many cases did not have managerial or financial capacity

to operate a concession.

As of November 2016 there were 1,26 million ha. Of

forest designated as conservation, reforestation and

wildlife management areas.