2. GHANA

Private sector welcomes creation of

Business Ministry

The new government in Ghana has indicated it will create

a Ministry of Business Development to strengthen and

accelerate private sector growth.

In a press release the Association of Ghana Industries

(AGI) said this initiative is a positive move which the

AGI has advocated for many years. The AGI says “the

creation of an independent Ministry to lead and drive

private sector business in Ghana is timely”

The AGI press release says the success of this new

Ministry hinges largely on the role and contribution of the

private sector.

The private sector hopes that the new Ministry will

prioritise its interventions towards business growth with a

focus on the manufacturing sub-sector as the seed-bed of

industry and an engine of growth in the economy.

The AGI will meet with the Minister designate in the

coming days to contribute to the definition of its agenda

and roadmap for delivering on its objectives. The

Association of Ghana Industries (AGI) however cautions

government on the need to align and harmonise operations

of all institutions responsible for private sector growth in

order to avoid duplication of efforts and to ensure the

efficient use of resources.

The AGI emphasised that current private sector

institutions themselves have a wealth of information and

expertise and it is important for the new ministry to

coordinate all these resources.

See:

http://agighana.org/uploaded_files/document/2dae8ab5a0e5e918

bfea8d31d6b1ebd3.pdf

In a related development, the Minister designate for Trade

and Industry Alan Kyerematen, has said local

manufacturers could soon benefit from a government

stimulus package aimed at helping them become more

competitive. One focus of attention will be on access to

credit for SMEs.

3.

SOUTH AFRICA

Mills back to work

South African companies are all back at work after the

seasonal holidays and the market is slowly stirring. Some

mills only started work during the third week of January

which means there will be some delay until production

comes out of the kilns. However this is not an immediate

problem as there is no shortage of stock.

Even if stocks of some specifications fall there are readily

available products in Zimbabwe where millers are anxious

to find export markets as domestic consumption has

collapsed. In addition, there are sources in Swaziland that

can be tapped to fill stock shortages.

As usual after the year-end holidays, consumer

consumption dropped because consumers tended to take

on a lot of debt over Christmas and in the New Year they

direct what little is available to reducing debt and paying

for essentials such expenses associated with the beginning

of the school year.

Residential building expected to remain weak

Signals from the property market are not good with house

prices slipping, especially for top end properties.

An analyst at First National Bank has written

“residential

building growth is expected to remain weak this year,

aggravating the plight of the building sector. One of the

reasons for this, say local analysts, is that in recent years

building costs have been outpacing inflation.

Door makers use pine for core to cut costs

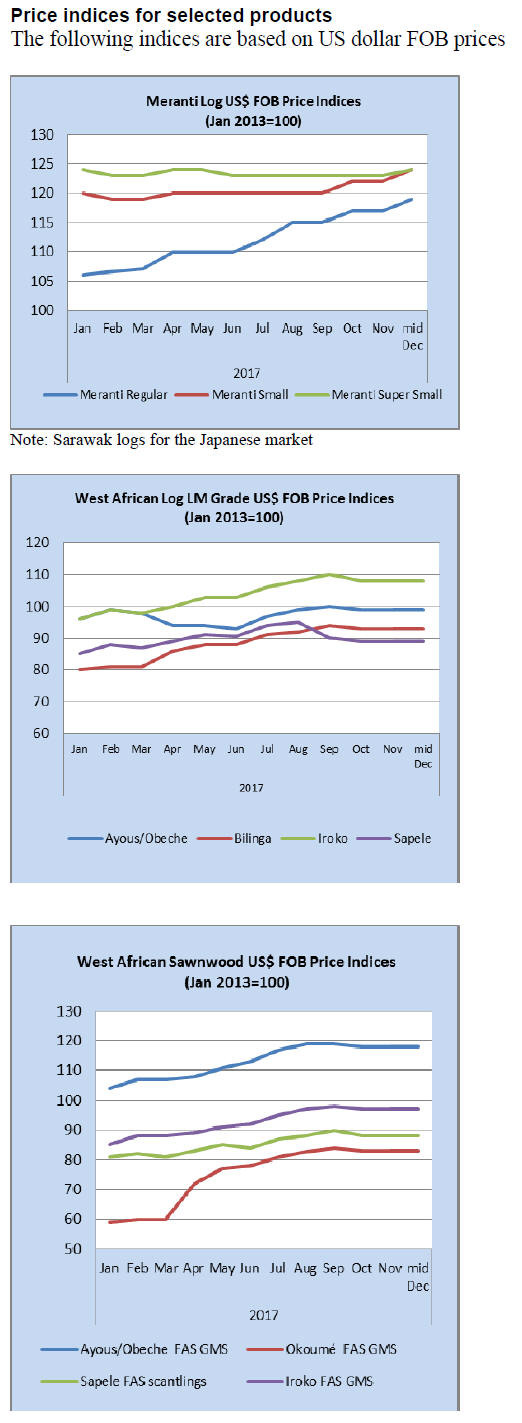

Local traders report meranti prices have fallen slightly and

that some shipments have been delayed due to the holiday

period. It is rumoured that some door manufacturers are

cutting production costs by using pine cores for door

manufacture and using meranti for the surface.

Prices for US hardwoods are reported as generally stable

except for white oak where US shippers are looking for

better prices due to rising demand in China.

African hardwoods have started to arrive after the holiday

and generally the prices are steady. Producers of okoume

and iroko have, so far, been unsuccessful in securing price

increases. Traders say the redwoods are selling quite well

with most of the market preferring edinam over the

mahoganies so prices for acajou are under pressure.

4.

MALAYSIA

2017 looking brighter for economy

The Malaysian Institute of Economic Research (MIER)

has forecast a Gross Domestic Product (GDP) growth of

4.5 per cent for Malaysia this year against an estimated

growth of 4.2 per cent projected for 2016.

The projection was based on the country’s healthy trade

balance in September, October and November last year,

which stood at RM6.6 billion, RM9.8 billion and RM9

billion, respectively.

MIER’s economic update anticipates the economy will

perform better in 2017 if the trade balance momentum

continues. GDP growth forecast for 2017 was revised

downwards to 4.5 per cent from its previous forecast of

between 4.5 and 5.5 per cent.

https://www.mier.org.my/presentations/archives/pdfrestore/

presentations/archives/pdf/MEO4Q2016.pdf

The positive views from MIER were supported by a report

from a Malaysian investment bank, Hong Leong, which

says “the outlook remains bright if not brighter in 2017 for

the wood-based manufacturers as earnings will be

underpinned mainly by continued weakness in the ringgit.

Foreign labour issue near resolution

Labour shortages which have held down growth in the

timber sector are set to ease as the government has

introduced a new policy, the Employer Mandatory

Commitment (EMC) which place more responsibility on

companies hiring foreign workers such as paying the

foreign worker levy.

The EMC will hold employers fully accountable for their

foreign workers on aspects such as job application,

rehiring and repatriation and the employers will no longer

be able to deduct the levy from the wages of their workers.

The new scheme was to be introduced at the beginning of

this year but has now been rescheduled for 2018 according

to media reports.

Certification in Sarawak

The State wants the main timber companies to have at

least one logging area certified by 2017. However, some

companies have expressed concern over the conditions set

by the Malaysian Timber Certification Scheme (MTCS).

They fear that endorsement by PEFC means that MTCS is

placed under the rules of this international certification

scheme which may be detrimental to the autonomy of the

timber industry in Sarawak.

The Borneo Post has two interesting stories on this

challenging domestic issue:

http://www.theborneopost.com/2017/01/11/grave-concernon-

timber-certification-linking-to-foreign-control-body/

and

http://www.theborneopost.com/2017/01/19/wan-junaidisheds-

light-on-mtcs-benefits/

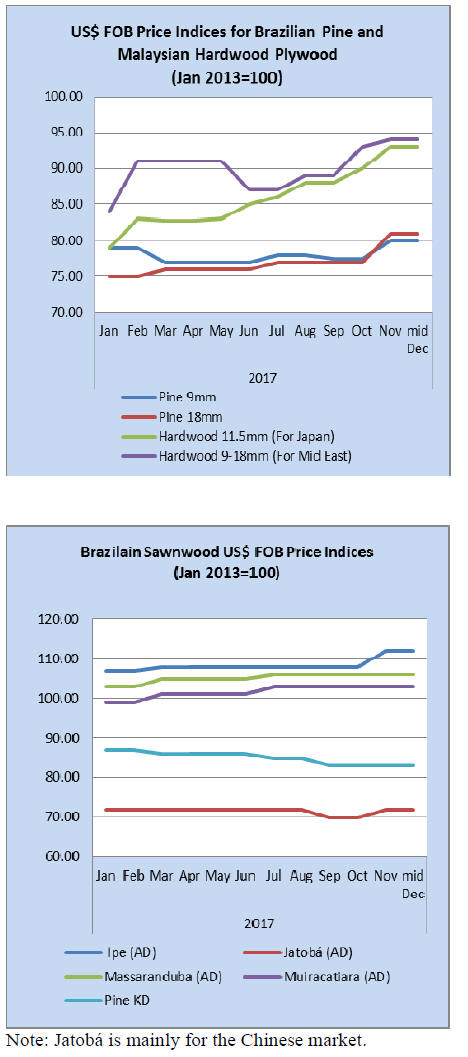

Plywood export prices

Plywood traders in Sarawak reported FOB export prices:

Floor base FB (11.5mm) US$540/cu.m

Concrete formboard panels CP (3’ x 6’) US$430/cu.m

Coated formboard panels UCP (3’ x 6’) US$500/cu.m

Standard panels (9mm and up)

S. Korea

US$395/cu.m

Taiwan P.o.C US$400/cu.m

Hong Kong

US$400/cu.m

Middle East

US$380/cu.m

5. INDONESIA

Indonesian FLEGT timber arrives in Europe

Indonesia's first verified legal timber shipment arrived in

Europe recently. On 16 January the first shipment arrived

at Tilbury Port in the UK where the Indonesian

Ambassador to London, Rizal Sukma, was on hand to

celebrate its arrival.

A few days later a further shipment arrived in Antwerp

and to celebrate its arrival the Indonesian Embassy in

Brussels and the Belgian importers organised a reception.

Easier to do business in Indonesia

Indonesia’s fiscal policy reforms and the improved

investment climate are expected to boost the economy

according to a press release from the World Bank

launching its latest report on Indonesia.

See: http://www.worldbank.org/en/news/pressrelease/

2017/01/17/world-bank-improved-effectiveness-ofspending-

in-indonesia-can-boost-growth-in-2017

The report says Indonesia has improved its fiscal

credibility but needs to accelerate tax administration and

policy reforms in order to increase tax revenue.

The report also highlights Indonesia’s recent improvement

in the World Bank’s Ease of Doing Business ranking to

91st in 2017 from 106th in 2016, making it among the top

10 improvers globally. This improvement is particularly

due to reforms that eased Starting a Business, Getting

Electricity, Paying Taxes, Registering Property, Getting

Credit, Enforcing Contracts and Trading Across Borders.

“The government’s investment climate reforms have made

it easier for businesses to open and operate, but boosting

private investment for economic growth will require

policymakers to move now on medium-term structural

reforms” said Hans Anand Beck, Acting Lead

Economist at the Bank.

The report, now in its sixth year of production, is produced

with support from the Australian government’s

Department of Foreign Affairs and Trade.

EU Trade Remedy Policy a challenge for exporters

The EU has revised its Trade Remedy Policy and the

Director General of Foreign Trade, Indonesian Ministry of

Trade, Dody Edward, said the implementation of this

policy could impact the flow of exports to the EU if the

EU determines products are being dumped or subsidised in

Indonesia.

Also voicing concern was the Director of Trade Security

Ministry of Trade, Pradnyawati who reported some

Indonesian products had been affected by anti-dumping

measures in the US. He said the EU is a strategic market

for Indonesian exporters of agricultural and fishery

products as well as wood products.

Restoration of peatland in 2017

The Indonesia government has announced plans to restore

400,000 hectares of peatland this year, a lower target

compared to 2016. Environment and Forestry Minister,

Siti Nurbaya Bakar, indicated that work will continue on

the construction of canals to provide the means to manage

water levels.

Nazir Foead, Head of the Peatland Restoration Agency

(BRG), said some companies with palm oil plantations

faced declining productivity due to higher water levels but

that the government would work with these companies to

minimise the impact of the peatland recover efforts.

6. MYANMAR

Customs statement questioned by timber

traders

According to a news release from the Myanmar Customs

Department, 202 companies have, so far, been permitted to

export 197,512 tons of timber in the current fiscal year (1

April 2016 to 30 April 2017.

Myanmar introduced a log export ban in April 2014 and

at the same time the Forest Department banned the export

of other type of products, baulks, boules and hand hewn

squared logs.

The news release from Customs did not specify the value

or species. Analysts point to the need for better

information since 197,512 tons, if all were teak, would

have generated some US$400 million! They comment that

timber exports have never achieved such a value

suggesting the figures from Customs need further

clarification.

MTE supplying mills from log stocks

The Myanma Timber Enterprise (MTE) has forecast that

the country could earn Myanmar Kyat 250 billion (around

US$185 million) from its sale of logs. Logging in

Myanmar has been suspended for one year but the MTE

had stocks of 15,000 tons of teak logs and 300,000 tons of

other hardwoods to offer to mills in the country.

The domestic media has quoted U Aye Cho Thaung of

MTE as saying they had recorded an income from sales

destined to international markets at US$299 million while

earnings from log sales for domestic consumption was

around 90 million Kyas (about US$67 million).

Shipment of teak and tamalan seized at port

Despite the efforts of the timber trade and government to

stamp out illegal practices and eventually negotiate a VPA

with the EU a shipment of around 500 tons of illegal teak

and padauk/tamalan were recently seized in Yangon Port.

The smugglers had tried to avoid the export restrictions

and many believe that for the shipment to have got as far

as the port suggests the smugglers had help from officials

along the supply chain.

U Barber Cho, Secretary of the Myanmar Forest

Certification Committee, said “that since this attempt at

smuggling was done outside of the formal supply chain

under which exporters comply with government

regulations this single incidence should not be considered

as reflecting a weakness in the control system”.

Cho praised the seizure of this illegal shipment and said “it

was mainly caused by weak law enforcement and possibly

corruption and that there will always be those who try to

find loopholes in the formal supply chain.”

7. INDIA

India's factory output unaffected by

‘demonetisation’

India’s industrial output rose in November despite the

chaos caused by the decision of the government to

withdraw large denomination notes from circulation.

November growth rose by 5.7% year on year beating the

1.5% growth forecast by analysts.

As inflation fell in December 2016 to 3.41%, the lowest

since late 2014 it is anticipated the Reserve Bank of India

may lower interest rates at its next meeting.

More interest in sawnwood than logs

In its November 2016 e-magazine ‘Ply Reporter’ provides

an analysis of India’s log and sawnwood imports pointing

out that, over the past five years, there has been a steady

decline in log imports but that, over the same period

sawnwood imports have grown almost 200%.

Imports of good quality sawnwood of appropriate

dimension leads to a reduction of residues which is a key

concern of door manufacturers, construction companies

and furniture makers.

Initially, sawnwood imports of decorative species were

imported from America, says Ply Reporter, but increasing

volumes now come from Malaysia, Indonesia and

Myanmar and this trade has been given a boost by the

reduction in import duties arising from agreements

between ASEAN countries and India.

For the full story see:

http://emagazine.plyreporter.com/01112016/Home.aspx

Coir panel an alternative to wood based panels

India accounts for more than two-thirds of world

production of coir and coir products. Kerala is the home of

Indian coir industry.

Efforts are under way to better utilise coir and one area of

focus that has been successful is the development of a

panel termed coirboard. Coirboard is a composite of the

needle felt coir fibre bound with phenol formaldehyde

resin.

The product is 100% wood free material made out of

natural coir fibre and is a substitute for wood composite

boards and even plywood in certain applications.

The Bureau of Indian Standards (BIS) has, in cooperation

with several companies, developed Standards for

coirboard. The BIS says : The coir fibres are used as raw

material with thermosetting adhesive as binder. Indian

standard for the product has been evolved and the

corresponding number is IS 15491 : 2004.

For more see: http://coirboard.gov.in/wpcontent/

uploads/2016/09/Executive-Summary-Survey-of-Coir-

Industries-in-India.pdf and

http://www.shriyaenterprises.com/

Plantation teak imports

Demand for imported plantation logs and sawnwood

continues to be good, but the problem of phytosanitary

regulations continue and suggestions for an alternate to

methyl bromide treatment are awaited. When this issue is

resolved Indian importers would have access to a wider

range of suppliers of raw materials.

Prices for locally sawn imported hardwoods

Prices remain unchanged from early January

Myanmar teak prices

The demand and supply of Myanmar teak sawnwood is

well balanced and the steady flow of imports from

Myanmar and China has kept prices stable and allowed

Indian manufacturers to maintain exports.

Prices for imported sawnwood

Sawnwood imports have been rising especially from

Sarawak. Local analysts say demand is steady and prices

are unchanged from a month ago.

Plywood manufactures pin hopes on interest rate

cut

to boost demand

Despite offers of discounts, plywood sales in the domestic

market remain dull. As interest rates are likely to fall

plywood manufacturers are pinning their hopes on this to

drive up consumption.

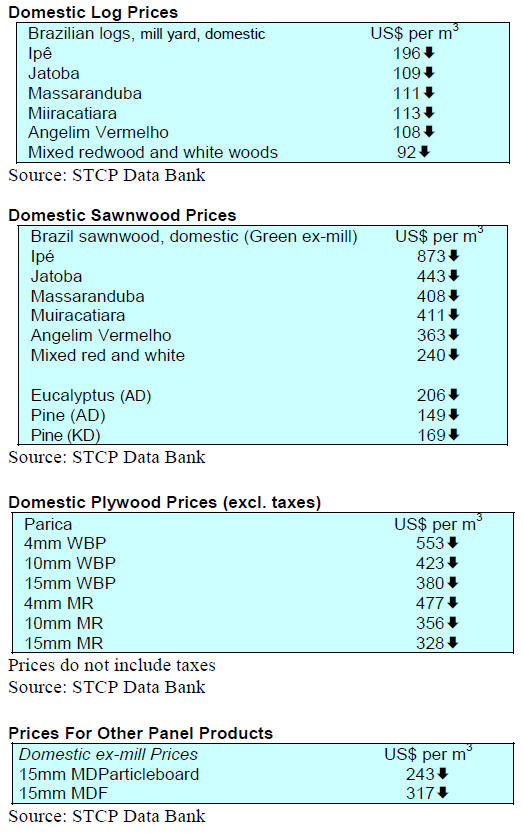

8. BRAZIL

Recovery of the furniture sector in 2017

According to the Bento Gonçalves Furniture Industry

Union (Sindmóveis), between January and November

2016 revenue earned by the Bento Gonçalves furniture

industry fell 17.4% compared to 2015 while the overall

decline in the state-wide furniture sector was 11.2%.

Despite these negative figures Sindmoveis is hopeful of a

recovery in the sector forecasting a slow start to the year

with a pick-up in the third quarter. According to

Sindmoveis, the lowering of interest rates will help

industry sentiment and consumer confidence.

SFB establishes incentive programme for

concessionaires

The Brazilian Forest Service (SFB) has established an

incentive programme for forest concessionaires (Procof)

setting out revised rules and payment schedules for forest

products harvested within national forests under forest

concession.

Under the new scheme companies can postpone payments

due to the Forest Service for up to 14 months without fines

and interest. The aim of this is to relieve the pressures on

company cash flows without compromising the financial

obligations to the federal government.

This scheme is apparently a temporary measure to take

account of the country's exceptional macroeconomic

environment and its impacts on the enterprises.

To-date, more than one million hectares of federal public

forests are under the forest concession regimes. Since

2010, when the first concessions were granted, some

500,000 cu.m of logs has been harvested generating about

R$ 45 million for the public coffers.

November and December export performance

In November 2016, the value of Brazilian exports of

wood-based products (except pulp and paper) increased

21.6% compared to November 2015, from US$205.5

million to US$249.9 million.

Pine sawnwood exports increased 42.5% in value in the 12

months to November 2016 . Over the same period the

volume of exports 46.9% from 112,600 cu.m to 165,400

cu.m.

Brazil’s tropical sawnwood exports rose 23.3% from

25,800 cu.m in November 2015 to 31,800 cu.m in

November 2016 and the value of exports increased 27%

from US$12.1 million to US$15.4 million over the same

period.

The value of pine plywood exports increased 17% year on

year in November 2016, from US$29.9 million to US$35.0

million. At the same time the volume of exports increased

17.6% from 112,600 cu.m to 132,400 cu.m.

As for tropical plywood, exports increased 22.5% in

volume, from 10,200 cu.m in November 2015 to 12,500

cu.m in November 2016. In terms of value tropical

plywood exports increased 33%, from US$3.9 million in

November 2015 to US$5.2 million in November 2016.

As for wooden furniture, exports rose from US$35.5

million in November 2015 to US$38.2 million in

November 2016, an almost 8% increase.

December trade figures have become available. Total

wood product exports (except pulp and paper) in

December 2016 increased 12.8% year on year to

US$260.2 million and the value of pine sawnwood exports

increased 29% year on year to US$ 35.1 million.

Year on year the volume of pine sawnwood exports

jumped 31.5% in December to 174,000 cu.m.

Tropical sawnwood exports also rose (46%) from 25,100

cu.m in December 2015 to 36,700 cu.m in December 2016

(from US$ 12.0 million to US$ 17.9 million over the same

period).

Both pine and tropical plywood exports increased in

December. Pine plywood exports rose 4.5% in value in

December 2016 (147,300 cu.m to 154,000 cu.m) while

tropical plywood, exports increased significantly in

volume and in value, from 8,800 cu.m (US$3.7 million) in

December 2015 to 17,900 cu.m (US$7.3 million) in

December 2016.

Exports of wooden furniture also performed well in

December rising from US$ 37.3 million in December 2015

to US$ 39.3 million in December 2016.

Product quality supports export success

The planted forests sector was able to survive the severe

downturn in consumption in the domestic market because

they were able to focus on exports.

Between January and November 2016, pulp, woodbased

panels and paper export volumes increase compared to a

year earlier, contributing to the positive result of the

sector's trade balance.

According to the Brazilian Tree Industry (Ibá), pulp

contributed US$4.8 billion (-0.1%), paper US$1.0 billion

(+ 9.7%) and woodbased panels US$220 million (+

29.4%).

In the domestic market paper sales fell slightly in the first

11 months of 2016 and sales of woodbased panels dropped

3.3% in the same period. For 2017, Ibá expects Brazil to

perform better than 2016 anticipating stronger domestic

demand.

Timber industry exported higher volumes, but earned

less

Due to a year marked by uncertainties in the domestic

economy, Brazil’s timber industry ended 2016 with lower

revenues despite an increase in export volumes.

Pine plywood export volumes in 2016 were 1,730,467

cu.m, the highest volume over the past 10 years and a 16%

increase compared to the volume shipped in 2015. The

monthly average plywood shipment was 144,206 cu.m,

24,000 cu.m more per month than in 2015.

Among the many destinations for Brazil’s pine plywood in

2016 were: the United States (28%), the United Kingdom

(16%), Belgium (11%), Germany (9.7%) and Mexico,

almost 5%.

The volume of pine sawnwood exported in 2016 totalled

2,166,555 cu.m.

A large volume of pine sawnwood is consumed

domestically mainly in civil construction. Among the

export buyers were the United States ( 42%), China, (13%)

and Saudi Arabia, almost 7%.

Pine veneer exports in 2016 were 30% up year on year

reaching 70,514 cu.m 2016. The main destinations were

Malaysia (40%), South Korea, (24%), and China, (11.5%).

In 2016, 62,803 cu.m of tropical plywood were exported

with the main markets being Argentina (26%), the United

States, (17%), the United Kingdom, (12%), Italy, (5%) and

the Dominican Republic a further 5%.

The volume of tropical sawnwood exported in 2016

reached 657,576 cu.m and the main markets were the

United States (21%), India (8.7%), Netherlands (8.4%),

China (8%) and Vietnam, 5.6%.

According to the Brazilian Association of Mechanically-

Processed Timber Industry (ABIMCI), one of the major

challenges that the industry will face in 2017 will be to

improve business strategies in order to protect themselves

against threats that may come from the domestic economy,

including rising costs of electricity, logistics and raw

material inputs.

Industry welcomes cut in interest rates

Inflation as measured by the Broad Consumer Price Index

(IPCA) ended 2016 with a rise of 6.29%, just below the

government’s target ceiling of 6.5%. Fortunately inflation

was below that of 2015 (+ 10.67%) and 2014 (+ 6.41%).

In January, during the first meeting of the year, the

Monetary Policy Committee (COPOM) of the Central

Bank lowered the basic interest rate for the third

consecutive time, from 13.75% to 13%. The Central Bank

affirmed that the decision was made based on indicators

that point to an economic activity below expectations.

9.

PERU

Imports of particleboard jumped in 2016

Ecuador and Chile were the two most important suppliers

of particleboard to Peru in 2016 with shipments of

US$32.8 million and US$25.9 million, respectively.

While shipments from Ecuador fell slightly in 2016 (-

0.8%), Chilean exports grew over 12%. Spain remained

the third ranked supplier despite a slight drop in shipments

in 2016 (-9%). Brazil, with exports to Peru worth US$8.1

million, was the fourth ranked supplier.

Among the main importing companies, Novopan and

Arauco returned to be the top importers with imports of

US$31.3 and US$15.1 million respectively. Novopan's

imports grew 1.4% and Arauco's increased 7.3% compared

to 2015. Masisa and Grupo Martín followed with imports

worth US$9.7 and US$8.9 million.

Roundtable on forestry development

The Ministry of Agriculture and Irrigation (MINAGRI)

officially approved a forestry board according to a

ministerial resolution published in the first half of January.

The technical secretariat to support this development will

be assumed by SERFOR. The forestry board will be

initiated quickly and those invited must present their ideas

and plans before 23 February.

The ministerial resolution stresses that the group will be

charged with identifying, promoting, and proposing action

on forestry matters "that will allow sustainable forest

development and the formalisation of its stakeholders".

The functions of the forestry board also include

identifying new opportunities in the forestry sector and

proposing and coordinating actions related to improving

the management and implementation of public policies.

Government support for wood products trade

The Executive Branch issued a Legislative Decree 1319

that will seek to promote trade in forest products and

wildlife of legal origin.

The measure will be supported by implementation of a

national forest and wildlife information system (SNFFS), a

tool of the National System of Forest and Wildlife

Management (Sinafor) and managed by the National

Forestry and Wildlife Service (Serfor).

The Decree also requires the registration of portable

sawmills, forest tractors and vehicles authorised for the

extraction and transport of timber products to primary

processing centers. In addition, the Decree authorises the

establishment of strategic control posts in the national

territory identified by Serfor.

Simplifications of Forestry Law will boost the sector

A Legislative Decree that simplifies administrative

procedures in the Forestry and Wildlife Law will help

develop the timber sector according to Erik Fischer, the

president of the Timber Committee of the Association of

Exporters (Adex).

He described as positive the measures defined in the

Legislative Decree No. 1283 as they could mean quicker

action to recover abandoned concessions. Fischer

emphasised the need to promote the production of raw

material for the forestry sector because of the 7.5 million

hectares that were tendered for concessions only around

25% are operational.

Serfor - National Forest Information System to be

tested

Local forest authorities are working to strengthen the

oversight of natural forest concessions and plantations in

the country. To aid this a National Forest and Wildlife

Information System (SNIFFS), a digital platform that will

allow greater control and monitoring of the timber

resource, is expected to be operational in the first quarter.

This was announced by Juan Carlos Guzmán Carlín,

Director General of Forestry and Wildlife Competitiveness

and Policy in Serfor. He said "this will help the exchange

of information between the regional and national

government and will allow better control and traceability”.

Jobs generated by the forestry sector

The forest sector generates vast numbers of jobs.

According to the Central Reserve Bank (BCR) for every

US$1 million in wood products exported, more than 300

Peruvians are employed. The timber sector is the third

highest agro-export activity that generates according to

ÁDEX.