2. GHANA

Rosewood trade ban lifted

The ban on trade in rosewood (Pterocarpus erinaceus) has

been lifted as mechanisms are in place to regulate

harvesting, processing and export according to the

Forestry Commission (GFC). At a recent press briefing,

the Deputy CEO of the GFC, John Allotey, said all

harvesting of rosewood would be based on quotas agreed

with CITES.

The felling of the species, commonly found in the three

northern regions of Ghana, started around 5 years ago

when the Forestry Commission allowed a few approved

companies to harvest and export rosewood. But, because

the timber is in such demand in international markets,

indiscriminate and illegal harvesting got out of hand such

that the species was under treat of extinction.

According to the minister’s statement, the lifting of the

ban is to enable companies to clear stocks already at the

ports and in depots across the country. Those companies

with stocks but whose harvesting was done without

approval will have to pay various penalties before they can

export rosewood stocks.

Development Bank for SMEs

The government has hinted of plans to set up a Business

Development Bank dedicated to meet the needs of SMEs

in the manufacturing sector. This was mentioned by the

Deputy Minister of Trade and Industries during the 2017

Ghana Manufacturing Award ceremony.

The expansion of domestic manufacturing has been

identified as a pillar of the government’s growth strategy

for the country.

In the past, wood product manufacturing was a

significant

contributor to Ghana’s GDP. Gold production and cocoa

exports were the main drivers of growth.

The contribution to growth of the wood products sector is

now a fraction of what it once was as the sector has been

hampered by raw material scarcity, power supply

problems, high interest rates and high production costs

which have undermined competiveness.

Support for natural resource management

The World Bank has offered Ghana funds to strengthen

local communities in the Western and Brong Ahafo

Regions of the country.

The funds will be used to strengthen community practices

towards reducing deforestation and improving sustainable

forest management. The project will contribute towards

helping the communities better understand REDD+

(Reducing Emissions from deforestation and Forest

degradation plus conservation of Forest, Sustainable

Forest management and Enhancement of Forest Carbon

Stocks).

3.

SOUTH AFRICA

Indicators suggest economy slowing

BankservAfrica’s Economic Transaction Index (BETI) for

April has been reported in the domestic press showing that

economic transactions conducted in April declined by

close to 2 percent.

This downturn reflects the impact of the April holidays but

may also signal a slowdown in the economy. The March

index suggested a strengthening domestic economy and

was the third consecutive month of positive growth.

See: www.bankservafrica.com/Press-Office/Month/4/Year/2017

Political uncertainty in the country is impacting both

consumer and business sentiment say analysts. Market

demand remains weak, contracts being placed are for

smaller volumes and for shorter durations and the pace of

enquiries has slipped. Part of the problem is that

government budgets for infrastructure are not being

offered.

On top of this, consumers show no interest in spending

and are holding onto their disposable incomes which have

taken a hit because of the recent fuel price increase due to

the weaker rand.

The private housing market is very quiet as the price

premium for a new home compared to a second hand

home is still over 30% and the prospect of higher interest

rates is of concern to prospective buyers.

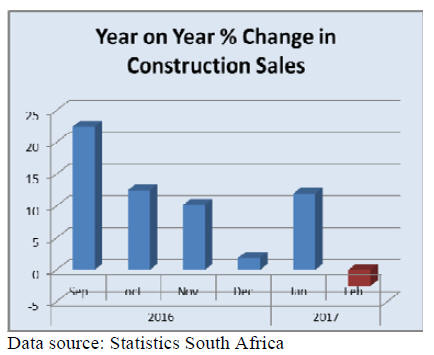

Slow construction spending undermines demand

Subdued demand in the construction sector is impacting

pricing. In the pine market there has been a bout of

aggressive discounting by mills as some roof truss plants

are standing idle.

American hardwoods are still moving but there has been

some discounting, especially of 25mm white oak, and the

volumes being purchased have fallen as some furniture

manufacturers are using more veneered boards.

Analysts report that stocks are building up at

panel

producers due to falling consumption.

The meranti market is also soft, driven down by the

weaker property market There has been some discounting

as traders reduce their stocks in line with market

requirements. The market for okoume faces the same

challenges.

Regional marketing a real challenge

When South African domestic markets are quiet eyes turn

to regional markets but there are few prospects it seems.

Analysts report that in Zimbabwe there is an acute

shortage of cash notes again.

There are reports of drivers being unable to get notes to

pay the road tolls - everyone is turning to credit cards.

More importantly importers are really struggling to have

access to funds.

Angola still faces a revenue crisis even though oil prices

have moved firmer recently. In Zambia the government is

insisting they use their own pine and eucalyptus resources

rather than imported wood.

Malawi has extensive plantations and is not a significant

market for South African producers. Malawi produces

wide range of products from its plantations and the

country has hardwoods such as panga panga (Millettia

stuhlmannii), ebony and kiaat (Pterocarpus angolensis). In

addition Malawi has some rubberwood plantations.

Also in the east, Tanzania is basically self-sufficient in

timber and they sell teak to India. What was once a

lucrative market, Mauritius, is now very quiet as the

property market has basically stalled.

4.

MALAYSIA

Cabotage policy revised

From 1 June this year companies shipping goods from

Peninsular Malaysia to Sabah, Sarawak and Labuan will

no longer be required by law to Trans-ship in Port Klang

and use Malaysian registered vessels to move goods

onward. The Malaysian Prime Minister announced the two

States and Labuan would be exempted from the cabotage

policy.

Under the earlier cabotage policy, goods destined for

Sabah, Sarawak and Labuan had to be trans-shipped at a

Peninsular Malaysia port (Port Klang) to a Malaysian

registered vessel.

The cabotage policy was introduced in the 1980s as a way

of promoting Port Klang as the country’s main transshipment

hub. The policy required goods from outside the

country to go first to Port Klang before being shipped to

Sabah, Sarawak and Labuan. This policy has been blamed

for the high costs of goods in Sabah, Sarawak and Labuan

compared to prices in Peninsular Malaysia.

Malaysia/EU FTA

Negotiations on a Free Trade Agreement (FTA) between

Malaysia and the EU have resumed. In September 2010

the EU member states approved the launch of negotiations

for a FTA with Malaysia. One month later, negotiations

were launched in Brussels but after seven rounds,

negotiations were put on hold in April 2012 at Malaysia's

request.

EU is the third largest trading partner for Malaysia and the

latest statistics from the Malaysian Timber Industry Board

(MTIB) show exports of wood products in January 2017

were worth RM 1,938 million accounting for just under

10% total wood product exports.

The FTA negotiations between Malaysia and the European

Union (EU) will include a discussion on the recent

resolution by the EU parliament to phase out the use of

certain vegetable oils, including palm oil, by 2020.

Massive increase in log cess in Sarawak

The Sarawak state government has announced an increase

in the log premium (cess) charge from RM0.80 to RM50

per cubic metre. The cess of RM0.80 was introduced in

1986 and was never reviewed.

This decision sent shock waves through the Sarawak

timber sector and companies are calling for the decision to

be reviewed as they fear it will undermine their

competitiveness because production costs will rise. A

response from CIMB Equities Research suggested that the

planned increase in cess could result in a 14% increase in

production costs.

See: http://www.theborneopost.com/2017/05/10/putting-footdown-

on-log-premiums/

Concessionaires in the Heart of Borneo area must

secure certification

The Heart of Borneo (HoB) initiative, a voluntary transboundary

cooperative project involving Malaysia,

Indonesia and Brunei, is an effort to conserve and protect

one of the most diverse natural ecosystems and the largest

contiguous tropical rainforests in Southeast Asia. The

Malaysian states involved are Sabah and Sarawak.

To ensure the forests in the HoB area are sustainably

managed, the Sarawak state government has directed

timber concession operators in the area to obtain forest

management certification by July this year.

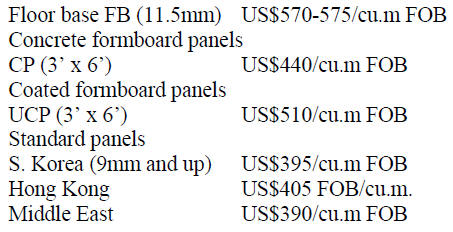

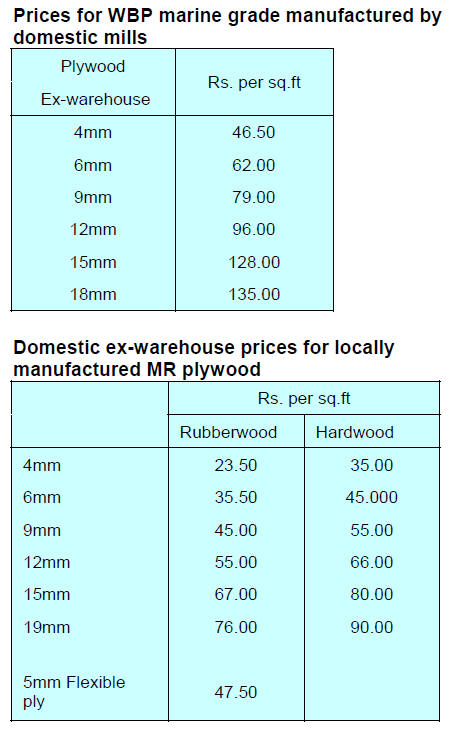

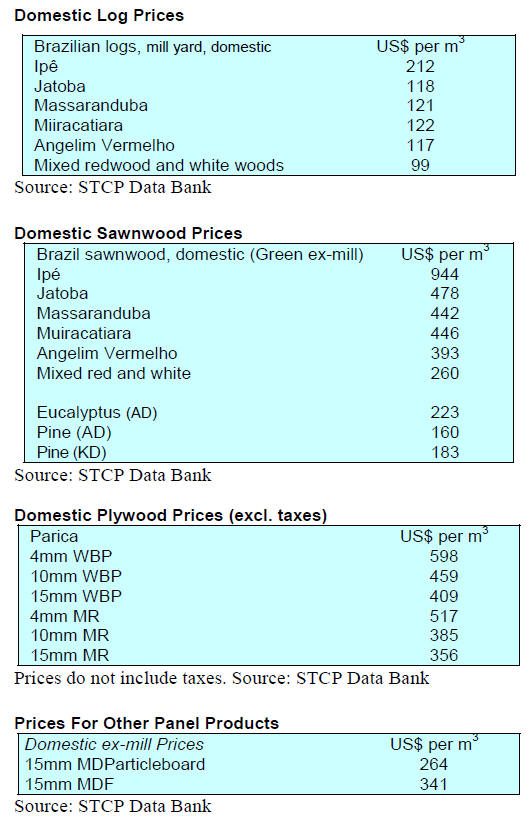

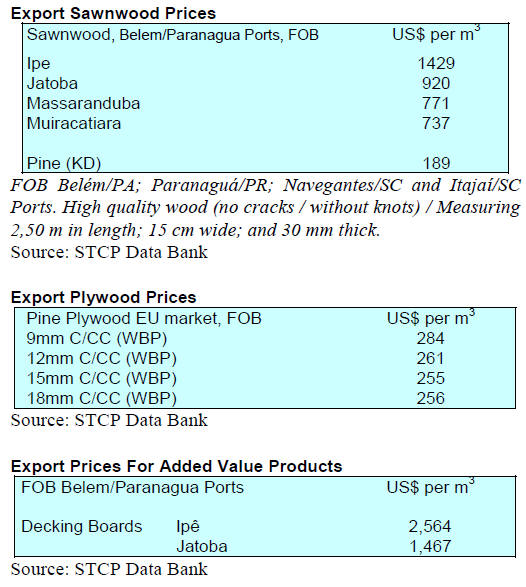

Plywood export prices

Plywood traders in Sarawak reported export prices:

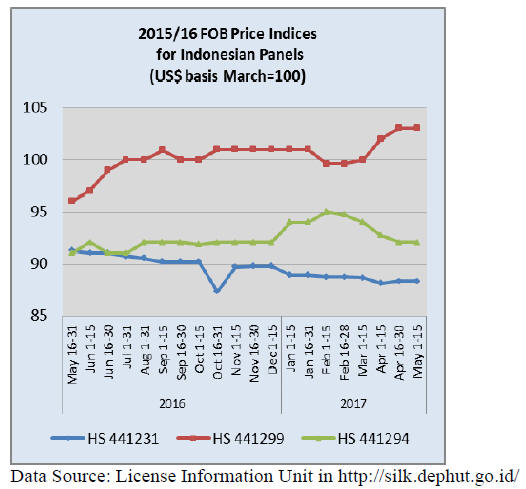

5. INDONESIA

Wood product manufactures must not relax

International Industry and Trade Advisor to the Minister

of Environment and Forestry, Laksmi Dewanthi, has said

while Indonesia was successful in becoming the first

country to earn the right to issue FLEGT licenses wood

product manufacturers cannot relax.

He said the forestry sector must carefully monitor progress

in other countries towards FLEGT licenses as competition

will mount which means industry must continually make

improvements to productivity and product lines.

In related news the Director of Forest Product Processing

and Marketing in the Ministry Environment and Forestry,

Rufi'ie, mentioned that since the launch of the FLEGT

licensing scheme Indonesia has issued 14,548 licenses for

the wood product exports to the European Union.

Rufi'ie reported that during 2016 the export value of wood

products to all countries reached US$9.26 billion and for

the first quarter 2017 the value of exports topped US$1.75

billion.

So far this year furniture exports have been very

successful. In 2016 exports to EU were worth US$800

million and in the first three months after FLEGT licenses

were issued exports were already US$300 million.

Indonesian crafts need marketing boost

Speaking at the 2017 International Handicraft Trade Fair

(Inacraft) in Jakarta, Indonesian President, Joko Widodo,

said the craft industry needs a marketing boost in order to

lure international buyers. He emphasised that Indonesia

has quality crafts but quality alone is not enough.

The President suggested that Indonesian craft makers

should pay attention to three aspects, product

specification, pricing and timely delivery. He also

emphasised that attractive and functional packaging was

an important element in attracting buyers.

Furniture from recycled wood an opportunity

The Indonesian Furniture and Handicraft Association is

encouraging its members to think about using local

recycled wood for export furniture as this type of furniture

is a niche market in Europe and the US.

Endro Wardoyo, a member of the Indonesian Furniture

and Crafts Industry Association (HIMKI), said she had

experienced buyers looking in Indonesia for such unique

furniture as they cannot find it in neighbouring countries.

According to Endro, recycled furniture of a rustic design is

popular in Europe and America.

Peatland restoration plan will impact viability of

plantation investment

Chairman of the Association of Indonesian Entrepreneurs

in Riau Province (Apindo), Riau Wijatmoko Rah Trisno,

has expressed the view that the Government Regulation

No. 57 of 2016 on Protection and Management of Peat

Ecosystems could undermine the competitiveness of

products derived from industrial plantation Forest (HTI).

His main concern seems to be that the land swap feature of

the Regulation may not be a viable solution in many cases.

Apindo, in Riau Province, is also concerned that some

20,000 workers in the industrial timber plantation (HTI)

sector could lose their jbs as a result of the new

Regulation.

According to Wijatmoko, there are 3,400 direct workers

and 17,000 indirect workers/sub-contractors in the HTI

sector that could be affected.

The new peatland regulation calls for HTI concessionaires

to allow the area to recover as peatland once the forest

plantation has been harvested. This, says Apindo, will

undermine the financial viability of the plantation

investment.

6. MYANMAR

Corruption and poverty driving illegal

activities

According to the Sagaing Region Forestry Department,

corruption, poverty, limited employment opportunities and

high market demand are the causes of illegal felling and

deforestation. Sagaing has 160 reserved forests and 87

protected forests which need constant guarding.

Sagaing Region and Shan State have experienced the

worst illegal felling and the authorities have reported the

seizure of around 50,000 tons of illegally harvested logs in

the border area.

The operations of the Forestry Department and police in

the two worst affected areas are not without risk.

According to the Minister, Forestry staff were recently

attacked while apprehending suspects. For fiscal 2016-17

8,321 suspected smugglers have been held.

MTE operations to be open and transparent

Ohn Win, Minister for Natural Resources and

Environmental Conservation, has said his ministry is

committed to provide complete transparency in the

operations of the Myanma Timber Enterprise (MTE).

He said members of parliament and civil-society

organisations will be invited to observe the entire process

under MTE management from felling, transport and sale.

He said an open system will begin in this fiscal year. This

move comes as the ministry attempts to reassure

international buyers that the origin of Myanmar’s wood

products can be tracked and verified legal.

Stiffer penalties for offenders

In another development, the Mandalay Regional

Government has said it intends to bring criminal charges

to those involved in illegal activities in the forest. This

would be over and above the actions taken under the

existing Forestry laws.

Analysts report that the Forestry Department is

disappointed with the lenient sentences handed down on

those guilty of illegal felling and smuggling. New penalty

structures have been decided.

For illegal teak harvesting if the quantity is less than one

ton the suspect will be charged under the Forestry Law, if

the quantity is between 1 to 3 tons then prosecution will be

governed by the Public Property Act and for over 3 tons

then the Protection of Public Property Act will be applied.

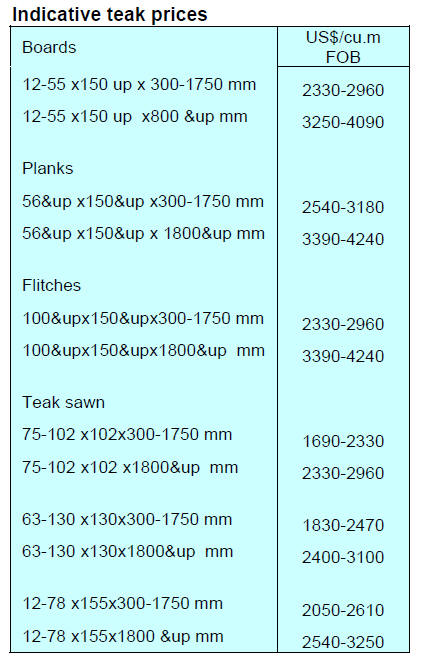

The FD has issued guidelines for pricing for export

according to the type of product; the price is set depending

on the market destination. It appears a two tier system will

be applied depending on the market.

7. INDIA

ESCAP survey optimistic on India

The ‘Economic and Social Survey of Asia and the Pacific

2017’ published by the UN Economic and Social

Commission for Asia and the Pacific (ESCAP) says

India’s economic growth is projected at 7.1% in 2017

rising to 7.5% in 2018 on the back of higher consumption

and increased infrastructure spending.

But ESCAP warns the concentration of bad loans in public

sector banks is a risk and there will be a need to

recapitalise the public sector banks.

See: http://www.unescap.org/publications/economic-and-socialsurvey-

asia-and-pacific-2017

Finance scheme for affordable homes agreed

The Confederation of Real Estate Developers’

Associations of India (CREDAI) and the State Bank of

India (SBI) have agreed to work together to make the

government’s ‘Housing for All’ plan a reality. The plan

calls for building affordable homes.

SBI is the largest bank and mortgage lender in India and

the agreement between SBI and CREADAI will deliver

construction finance at competitive rates to CREDAI

members for eligible affordable housing projects.

SBI and CREDAI had previously agreed to work together

on ‘Green Construction’ through which SBI will offer

concessionary rates on loans for the construction of green

projects.

See: http://credai.org/press-releases/sbi--credai-cometogether-

for-sustainable-development-and-affordablehousing

Calls to make selling logs from private land easier

The central government has proposed that states should

reconsider current regulations which severely limit the

felling and sale of timber from private land. This, says the

central government, would provide extra income to

farmers and help reduce dependence on imports of wood

products.

To begin effecting a change the Ministry of Environment,

Forest and Climate Change has written to states seeking

suggestions for expanding private agro-forestry investment

and on how to ease regulations on the sale and transport of

timber from private land.

For the full story see:

http://timesofindia.indiatimes.com/india/government-push-fortrade-

in-timber-on-private-land/articleshow/58542563.cms 2/4

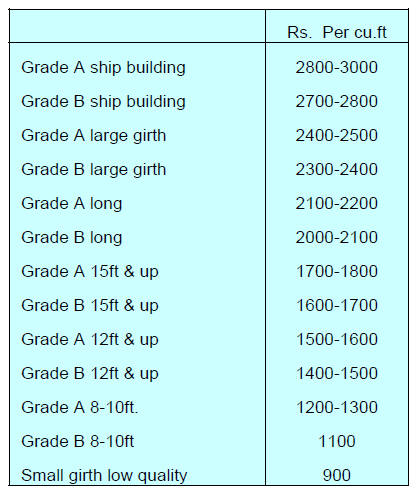

Western India auction prices down slightly

Between 4-11 April, auctions were conducted at various

forest depots of the North and South Dangs as well as the

Valsad Divisions.

Approximately 2,500 cubic metres of teak logs were

offered along with around 1,000 cubic metres of other

hardwood logs such as Adina cordifolia, Gmelina arborea,

Pterocarpus marsupium, Acacia catechu and Mitragyna

parviflora.

As imported plantation teak logs are mostly of small girth,

buyers were interested in the higher girth domestic teak

and these logs attracted good prices. However, analysts

report prices at the April auctions were lower than at the

most recent auctions in the same divisions.

Good quality non-teak hard wood logs attracted lower

prices than at the previous auction. Logs 3 to 4 m. long

with girths of 91 cms and up of Haldu (Adina cordifolia),

laurel (Terminalia tomentosa), kalam (Mitragyna

parviflora) and Pterocarpus marsupium, attracted bids of

around Rs.700 to 750 per c.ft. Second quality logs of the

same species attracted prices from Rs.350 to 500 per c.ft

while the lowest quality logs sold for from Rs.200 to 300

per .cft.

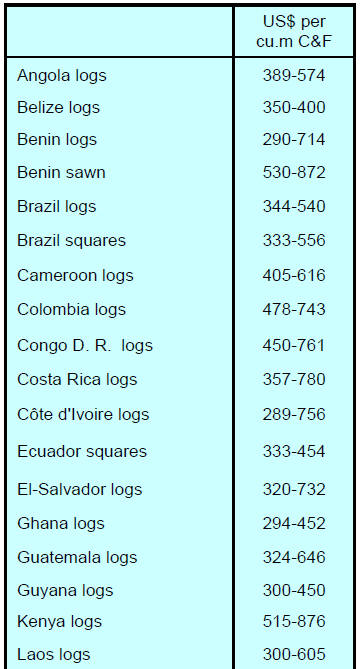

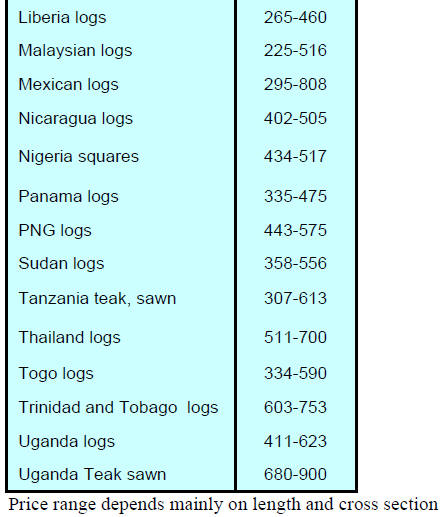

Imports of plantation teak

The supply of imported plantation teak remains steady and

the stronger rupee is helping importers hold down landed

costs.

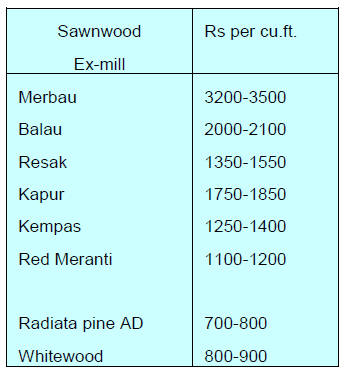

Imported sawn hardwood prices

Prices for domestically milled sawnwood have not

changed, except in the case of red meranti where ex-mill

prices have increased by about Rs.100 per c.ft. The price

rise for meranti, say analysts, is related to higher FOB

prices as well as firming domestic demand.

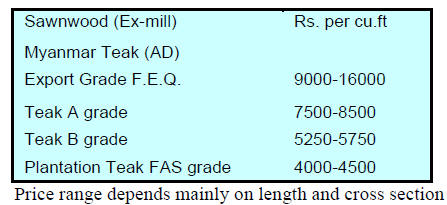

Stocks of Myanmar teak sustaining Indian mills

Indian millers are still able to secure Myanmar teak logs

from stockists in Taiwan P.o.C and other countries that

built up log stocks before the export ban in Myanmar.

However, as stock decline the firm demand is beginning to

drive prices higher.

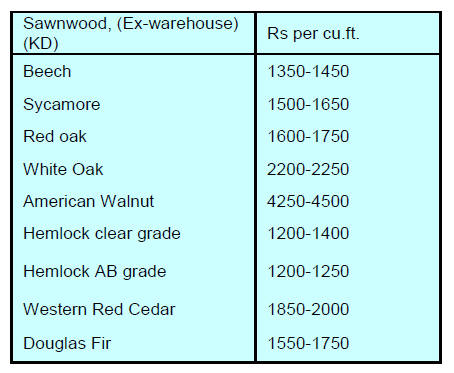

Prices for imported sawnwood

Demand for imported sawnwood is firm but importers

have been able to maintain prices as they have benefitted

from the stronger rupee.

Plywood prices increased to off-set higher

production

costs

Demand from plywood mills for logs has firmed as many

of the older mills are seeking additional supplies of logs

and veneer to feed recently installed extra processing

equipment. This, and steady demand, is driving up prices.

Since the end of April plywood prices have increased

between 5-6%, a significant and welcome rise for

manufacturers.

8. BRAZIL

Use timber to help to preserve forests –

WWF-Brazil

A recent story published by Agęncia Brasil (ABR), the

national public news agency, says WWF-Brazil has

declared deforestation in the Amazon is linked mostly to

cattle ranching and agriculture expansion and that

sustainable management for timber and environmental

services helps to preserve the forest. However, says

WWF-Brazil, it is necessary have robust systems for

tracking the source of timber and to consider certification.

WWF-Brazil is seeking to correct the impression that

wooden frame houses are inferior and wants to

demonstrate that technologies are available to process and

treat wood making it an excellent building material.

Standards association evaluates wood frame rules

In mid-April Brazilian Association of Technical Standards

(ABNT) committee responsible for developing the

technical standard for wood frame construction

(ABNT/CE-002: 126.011) met to evaluate progress in

implementation and to further refine the content of the

standard.

A decision was taken to extend the scope of the standard

to cover wooden buildings of up to two floors.

Issue of land ownership by foreign companies

addressed

In August 2010, a legal opinion from the Federal Attorney

General’s Office, indicated that legislation at that time

prohibited international groups from gaining control of

land in the country. This was rightly seen as a major

handicap to attracting foreign investment in forestry and

agriculture.

Recently, text for a new law that addresses land sale to

non-Brazilians (Law nš 4,059/2012), was submitted to the

Federal Government and Chamber of Deputies by a

commission called the Parliamentary Front for Forestry

(FPS). It is anticipated that the new text will be approved

within a few months.

The new draft bill removes the limit on the direct purchase

of land by international groups, except in the border areas,

legal reserve areas and areas in the Amazon biome.

However the new law will require that companies have a

Brazilian controlling shareholder. According to FPS, the

new draft bill does not allow the land to be bought by

sovereign wealth funds, state-owned enterprises and nongovernmental

organizations.

Raising competitiveness of the forest industries

The Brazilian Association of Mechanically-Processed

Timber Industry (ABIMCI) has promoted and participated

in several meetings with strategic institutions aimed at

identifying measures necessary to improve the

international competitiveness of the forestry sector.

Among the most recent meetings was one with the

Ministry of Development, Industry and Foreign Trade

(MDIC) at the preparatory meeting of the Brazil/United

States Business Council. The objectives of this meeting

were to discuss production in the sector and examine:

opportunities for partnerships in

foreign trade,

opportunities for partnerships in

foreign trade,

removal of technical and commercial

barriers to

removal of technical and commercial

barriers to

trade,

mutual recognition agreements,

mutual recognition agreements,

product standardisation,

product standardisation,

innovation

innovation

and

incentives to the creation of a single

export/trade

incentives to the creation of a single

export/trade

information portal and revision of the

Generalized System of Preferences (GSP).

ABIMCI has also conducted seminar on the foreign trade

and the forest products industry specifically addressing

topics such as exports as priority action for companies; the

economic perspective of foreign trade; evaluation of

Brazil-Argentina bilateral trade and the possibilities of

strengthening MERCOSUR for expanded trade relations.

9.

PERU

Use more wood for reconstruction in disaster

areas – ADEX

Since December last year Peru has been affected by

adverse weather blamed on the El Niņo effect. There has

been very heavy rainfall, floods, landslides, hail and

storms. The worst affected areas are in the northern coastal

regions but there are reports of damage in all 24 of the

country’s administrative departments. As of 21 April

reports indicate some 1.2 million people have been

affected.

The reconstruction of homes, a priority in the north of the

country, can be speeded up if locally available timber from

the Peruvian Amazon is used said Erik Fischer, Chairman

of the Committee of Wood and Wood Industry of the

Association of Exporters (ADEX).

He pointed out that in the US, Germany, Belgium,

Switzerland and Scandinavian countries wood is the

predominant material in housing construction. This, he

said, should encourage the government to place a priority

on the construction of wooden homes as this will boost the

local production of wood products and offer a quick

solution in the disaster hit areas.

Looking at the broader perspective, Fischer was of the

view that the country needs a housing policy that

emphasises the use of domestically available resources

such as timber.

He added that timber frame homes can be built more

cheaply than the traditional cement block or concrete

buildings.