2. GHANA

January exports – 6% year on year increase

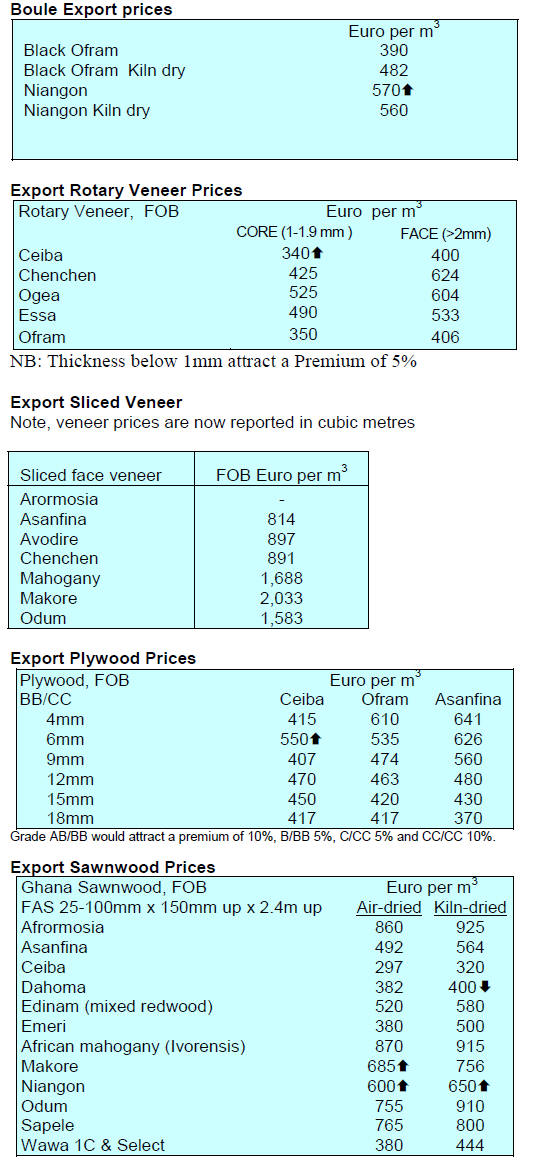

Ghana’s timber and wood product exports in January 2017

amounted to 30,758 cubic metres, a 5.76% year-on-year

increase when compared to the January 2016.

During the period under review, air dried sawnwood,

mouldings and peeled veneer exports grew sharply with

the value of exports increasing by 26%, 17% and 5%

respectively.

According to the Ghana Forestry Commission, Timber

Industry Development Division (TIDD) the leading export

products in January were air-dried sawnwood (22,346

cu.m), kiln dried sawnwood (3,334 cu.m), plywood for

regional markets (1,934 cu.m), roundwood billets (1,029

cu.m) and processed mouldings (717 cu.m).

Rosewood topped the list of wood species accounting for

44% of the total exported volume along with teak (18%),

wawa (9%), papao/apa (9%) and ceiba (6%).

Asian markets were the largest importer of Ghana’s wood

products in January 2017 accounting for 78% of all

exports (China; 54%, India; 21% and Vietnam; 3%).

The high volume of rosewood exports reflects the recent

lifting of the export ban by the Forestry Commission.

2016 export performance reported

The TIDD has released export data for 2016. The report

shows that for 2016 the country earned almost Euro 225

mil. from close to 397,000 cu.m of wood products, a

significant improvement on 2015 exports.

Sawnwood, plywood, veneer, boules and kindling

accounted for most of the 2016 exports earning close to

Euro 208 mil. from a volume of 353,000 cubic metres.

In terms of the direction of trade, Asian markets accounted

for around 73% of the volume of exports in 2016 with the

top markets being China and India. These two markets

favaoured rosewood, papao/apa, teak, wawa, koto/kyere,

potrodum and gmelina. European imports from Ghana

amounted to approx. Euro 26 million or 12% of all 2016

exports.

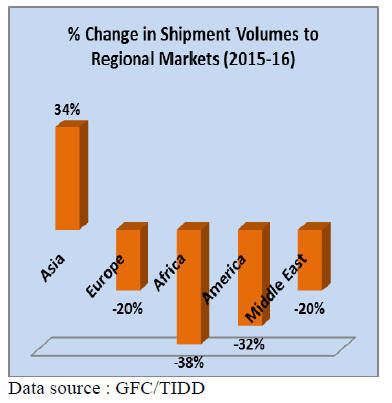

The growing importance of Asian markets can be judged

from the graphic below showing the percentage change in

the volume of shipments to various markets for 2015 and

2016 shipments.

Fuelwood harvesting adds to burden on forests

The GFC has revealed that fuelwood remains an important

source domestic cooking for around 70% of Ghana’s

population.

It is estimated that fuelwood consumption could be around

16 million cubic metres annually. Fuelwood harvesting is

a heavy burden on already over harvested forests.

Ghana has a National Forest Plantations Development

Programme, part of which aims at supporting the creation

of fuelwood woodlots.

3.

SOUTH AFRICA

Warning signs that investment in

plantations is not

keeping pace with demand

Roy Southey, the Executive Director of Sawmilling South

Africa, recently spoke on the prospects for the timber

industry. The main thrust of the speech was that prospects

for the next few years look positive for the timber industry

as demand is firm and the supply adequate.

However, there are warning signs for the medium term

because the area under plantations in South Africa is not

expanding in line with the demand for structural timber

and a timber shortage is likely in the next five to six years.

Southey commented that demand for structural timber was

particularly high in the Southern and Western Cape areas.

Also, demand for transmission line poles was good as the

government continues to finance its electrification

programme. As investment in plantations slows the supply

of timber will eventually become so bad that the country

may have to import structural timbers.

The sawmilling industry is in consultation with the

government seeking to address the looming shortage of

timber, reported Southey. One immediate solution would

be for the government to grant more licenses for

plantations.

About 20 years ago restrictions were introduced on

plantation development over fears of their impact on

ground water flows. Over the years the South African

economy has grown and demand for timber has expanded

but the creation of forest resources has lagged behind.

On its part, the sawmilling industry is seeking to increase

its efficiency to try and lift recovery from the average 49%

at present. To achieve this the industry will need to invest

in advanced technologies so the industry has approached

the Department of Trade and Industry to explore how the

government might aid such a shift in production.

For more see: http://www.timber.co.za/news/article/prognosisfor-

the-timber-industry

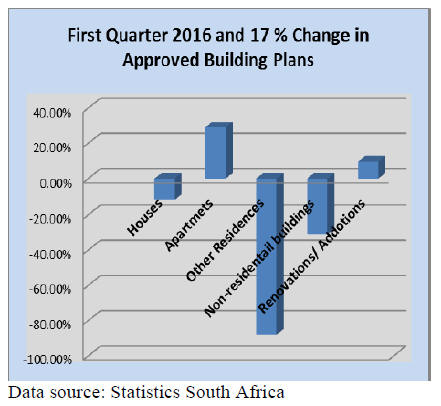

Value of approved residential building plans dips

The Bureau for Economic Research at the Stellenbosch

University (FNB/BER) tracks a range of economic

indicators and publishes the FNB/BER Building

Confidence Index.

The latest data is for the first quarter 2017 and FNB/BER

says its Building Confidence Index improved for the third

consecutive quarter in the first quarter of 2017. FNB/BER

writes “this marks the highest confidence in more than a

year. However, despite the higher confidence, building

activity was broadly lower, especially for main

contractors”.

The data available show that in the first quarter 2017 the

value of residential building plans passed fell by almost

8% compared to the same period in 2016.

Completions in the first quarter rose but with a decline in

housing starts activity in the overall construction sector

will slow in the second quarter and possibly beyond that.

See: https://www.ber.ac.za/BER%20Documents/BER-pressrelease/?

doctypeid=1068

4.

MALAYSIA

MTIB transfers local licensing

authority to Sabah

Beginning 1 June this year the authority to license the

export and import of wood products in Sabah will be

transferred from the Malaysian Timber Industry Board

(MTIB) to the Sabah Forestry Department. The decision to

transfer this authority is considered a ‘historical moment’

in Sabah reversing federal control which has been in place

for 25 years. The MTIB will now concentrate on

supporting the development of downstream activities in

the state.

Rubberwood – the raw material for added value

products

The Plantation Industries and Commodities Ministry said

last year the export of wood products from Malaysia stood

at RM22.1 billion, of which Sabah contributed about

RM1.75 billion or 7.9 per cent.

Although Peninsular Malaysia harvests from the natural

forests are small, manufacturers have built a vibrant

industry around the readily available rubberwood

resources and have developed an extensive international

market for rubberwood furniture.

More protected areas in Sabah

The Sabah Forestry Department has been systematically

reclassifying much of the natural forest in the state as

Total Protected Areas (TPAs). The forests in Sabah are

rich in commercial species but now greater emphasis is on

plantations.

The Chief Conservator of Forests in Sabah said although

plantation timbers are not of the same quality as timber

extracted from natural forests they could be turned into

high quality products, adding that the pattern of industry

development in Peninsula Malaysia is likely to be repeated

in Sabah as the local plantations become ready for harvest.

Sarawak – jobs security a priority as log harvests

reduced

Sarawak Urban Planning, Land Administration and

Environment Minister, Len Talif Salleh, in speaking to the

State Assembly, said there would be a gradual reduction

and phasing out of logging activities in the natural forest.

He continued saying, the state government needs to take a

holistic approach to the issue of natural forest logging in

order to avoid any negative impact on industrial

production and job security in the state. He said the timber

industry would be given time to adjust to the new

situation.

Last year timber exports from Sarawak amounted to

RM5.95 bil. and the industry has created employment for

over 100,000 people in the state. Also last year the state

government collected RM550 mil. in royalties, premium,

levies and fees from the industry which was used to

implement development projects.

The minister reiterated that the state government would

stop issuing timber licenses on state land except for

development purposes and would continue to strengthen

enforcement against illegal logging. He said the state’s

forestry policy also included making it compulsory for

timber license holders in the Heart of Borneo

Conservation Area to obtain internationally-accepted

forest management certification to ensure good practices

and sustainability.

In addition, he said the state government planned to

gazette up to one million hectares as totally protected areas

by 2020. At the same time, he said the government was

stepping up its planted forest programme with a target of

one million hectares to be planted by 2020.

On the issue of plantations, Sarawak Chief Minister Datuk

Amar Abang Johari Tun Openg, said he was disappointed

that the timber industry has not done more to help develop

a forest plantation industry in the state.

See:http://www.thestar.com.my/news/nation/2017/05/19/abangjo-

raps-timber-firms-over-lack-of-reforestationefforts/#

2mpXWAXoztxVMiiW.99

Malaysia Agarwood Fair 2017

The harvesting and trade of agarwood (also known as

gaharu or aquilaria) in Malaysia has progressed over the

years thanks to the MTIB which oversees and monitors

agarwood plantations.

The export value of gaharu products amounted to

RM15.16 million in 2016, up 15% from the year before.

Of this, RM10.3 million was derived from the export of

agarwood products comprising wood chips and wood

blocks, while RM3.74 million came from the export of

agarwood essential oils, and the remaining RM1.12

million from agarwood pieces.

Recently, MTIB hosted the Malaysia Agarwood Fair 2017,

the first for Malaysia. A total of 10 companies producing

agarwood products ranging from wood chips and blocks,

oudh perfume, tea and other products participated in the

fair.

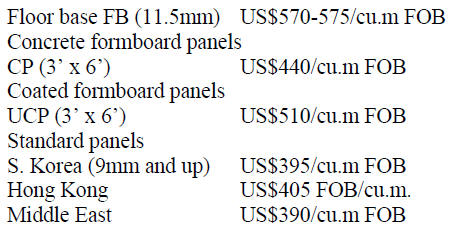

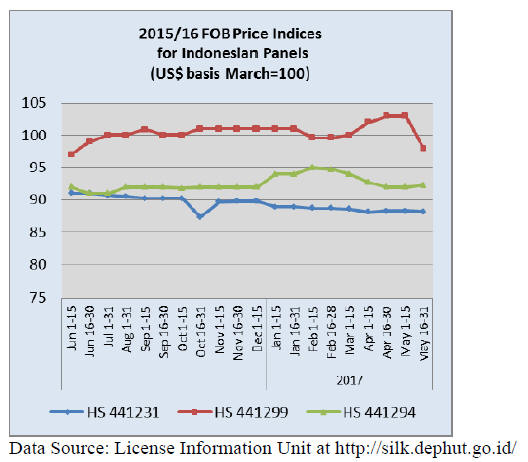

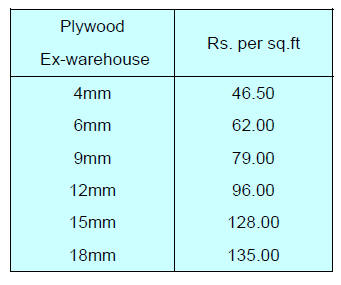

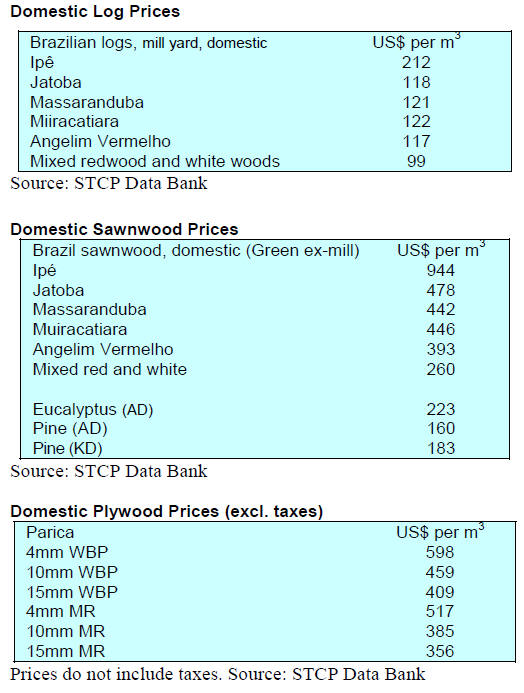

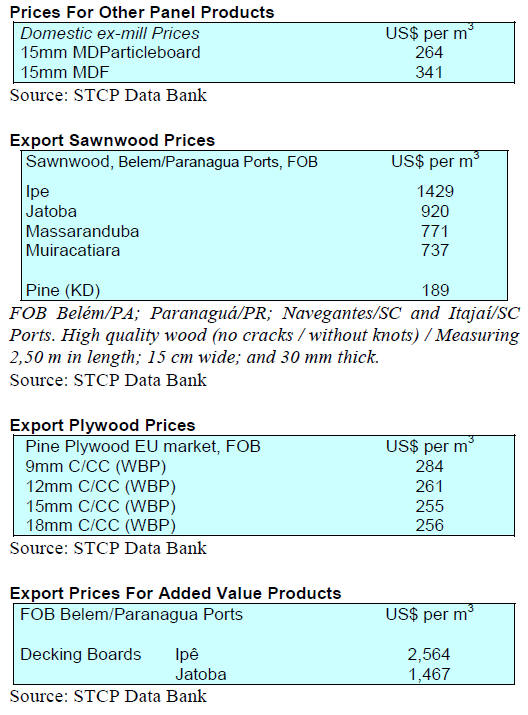

Plywood export prices

Plywood traders in Sarawak reported mid-May export

prices as follows:

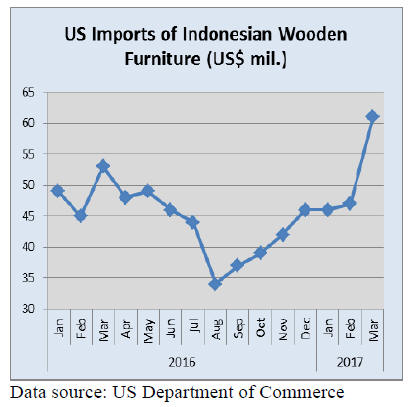

5. INDONESIA

Indonesian furniture warehouse in LA

At the opening in Los Angeles of a new warehouse by an

Indonesian furniture manufacturer, Umar Hadi, Consul

General of Indonesia, complemented the Indonesian

company saying demand for furniture products in the US

is expected to continue increasing around 3-4% per year.

Data from the US Department of Commerce for 2016

shows that on the west coast of the US Indonesia's

furniture exports enter through Los Angeles and San

Diego Ports.

Coordination of efforts to boost furniture and

handicraft sectors

The Director General of Agro Industry, Panggah Susanto,

said the government is determined to support development

of the furniture and handicraft industries and is working to

strengthen coordination between the various ministries

involved. Priority is being given to ensure raw materials

are available, promoting exports and encouraging

investment.

Panggah reported that his ministry had asked the

Minister

of Agriculture to exclude furniture samples from the

quarantine process.

In related news, the Ministry of Industry has adopted a

target for furniture exports of US$3.5 billion by 2019.

Currently, Indonesian furniture exports are around US$1.5

billion. According to the Director General of Small and

Medium Industries of Ministry of Industry, Gati

Wibawaningsih, the government’s efforts include support

to improve SME productivity, accessing raw material

needs and assistance in the import appropriate

technologies if not available locally.

Government/private sector effort needed in

conservation programmes

The Director General of Social Forestry and

Environmental Partnership, Hadi Daryanto, (Ministry of

Environment and Forestry) has said forest restoration

programmes would benefit from multi-stakeholder

approach.

He called for a new approach to implementing landscape

conservation and restoration programmes saying they

should be designed to involve government, the private

sector and civil society stakeholders.

Hadi emphasised that progress would be ensured if both

government and private sector could direct resources to

conservation and restoration efforts.

See: http://ekonomi.metrotvnews.com/mikro/gNQlld5Krestorasi-

hutan-butuh-kemitraan-multipihak

Pleas to revise peatland regulation

Businessmen and the Ministry of Industry have urged the

Indonesian President to revoke or revise regulation No.57

2016 on the Protection and Management of Peat

Ecosystems.

The Indonesian Forest Entrepreneurs Association (APHI)

of the Riau Regional Commissioners say the current

regulation threatens the viability of the industrial timber

plantation industry and has a negative impact on rural

economies.

The Ministry of Industry, in its approach to the President,

said the regulation as it now stands will negatively impact

the paper and palm oil industries because both industries

use timber raw materials from peatland areas.

Forest Moratorium extended

The Indonesian President has approved a two-year

extension to a moratorium on issuing new licenses over

land designated as primary forest and peatland.

This latest extension of the moratorium is the third

following the initial one in 2011 under the previous

administration of President Susilo Bambang Yudhoyono.

The decision to extend the moratorium is partly in an

effort to reduce emissions from fires during land clearing.

The government's forest moratorium covers an area of

around 65 million hectares.

6. MYANMAR

Third party verification for Myanmar MLAS

The Myanmar Forrest certification Committee MFCC) is

inviting agencies capable of providing third party

verification services in respect of the Myanmar timber

legality system. The credibility of the MFCC has been

called into question by civil society groups.

To reassure the international market the Forestry

department has banned the export of wood products made

from the confiscated logs, logs from conversion and logs

from conflict areas.

Barber Cho, Secretary of MFCC said that the creation of a

‘Focal Group’ and the setting up a system for third party

verification of the Myanmar Timber Legality Assurance

System (MTLAS)is a vital first step in regaining the

confidence of the international markets.

A recent review of the MTLAS determined that greater

public consultation was needed and that there was a need

for independent monitoring, both issues are being

addressed.

MTE sales in only US Dollars – no sales in Kyats

The Myanma Timber Enterprise (MTE) Export Marketing

and Milling Departments has concluded its recent sale at

which some 3,200 tons of teak logs, 366 tons of teak

sawnwood and 1,870 tons of other hardwood logs were on

offer.

At the same time they offered around 5,700 tons of teak

and other hardwoods logs under the tender system. Sales

through both systems had to be in US dollars.

Previously the Local Marketing and Milling of the MTE

conducted business in local currency but that is no longer

the case.

The Forestry Department has declared that all logs

to be

processed for export must be paid for in US Dollars not

Kyats.

Local conventions at odds with HS coding

Myanmar's Ministry of Natural Resources and

Environmental Conservation (MONREC) has issued an

order that all timber must be assigned a HS code within

HS 44.07 this code includes rough-sawn timber –under

domestic industry practice.

This, say local analysts, can include sawnwood (also

called conversion timber). It can also include squares,

posts, flitches, board, scantlings and flitches.

The domestic millers are not clear how this will mirror

items in the definition of ‘Special Commodity’ which will

attract an export tax.

Analysts point out that under the special commodity tax

sawn timber (either rough sawn or not) the tax is

structured to affect only large sawn baulks, i.e. if the

square section is 12 inches or more.

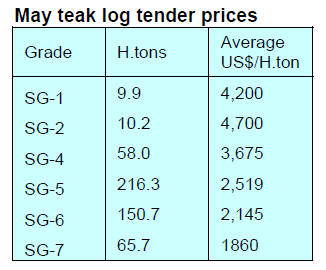

It will be seen that the average price of the

highest grade

of logs was below that of the second highest grade. This is

not the first time this has happened and reflects the

different assessment of the quality of the logs in the parcel

by the MTE and the commercial buyers.

7. INDIA

Businesses look for interest rate cut

The government has reported that inflation in April eased

to 3% and analysts say that as the monsoon is expected to

be normal and because grain production in 2016-17 was

satisfactory, inflation can be held in check this year. The

private sector is hoping that this will encourage the

Reserve Bank of India (RBI) to lower interest rates.

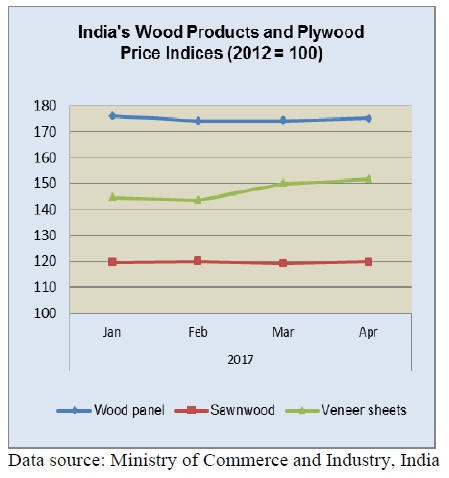

Wood product price indices

A press release from the Office of the Economic Adviser

to the Indian government has announced changes to the

Wholesale Price Indices report.

The Indian government periodically reviews and revises

the base year and range of products included to improve

the quality, coverage and representativeness of the indices.

As a result of the recent changes new indicative timber

sector indices will be reported to replace the previously

reported wood products and plywood indices.

The press release can be found at:

http://eaindustry.nic.in/uploaded_files/Press_Release.pdf

CITES and India’s Dalbergia sissoo

Export certification of India’s rosewood (Dalbergia

sissoo) is presently managed by CITES India which

operates within the Wildlife Section of Ministry of

Environment and Forests. Traders report that international

buyers are satisfied that certification is provided by CITES

through a department of government.

Fears had been expressed that India’s export of rosewood

musical instrument parts and handicrafts could be

disrupted but now business has returned to normal.

Notwithstanding this exporters contend that, given the

abundant and well managed sources of Indian Dalbergia, it

should not be included in the CITES listing.

Home building plan will require huge volumes of wood

products

The international brokerage firm CLSA

(https://www.clsa.com/), in a recent report, said the Indian

government’s plan to build homes for all Indians could

generate business worth over US$1 trillion.

The government’s plan calls for around 60 million homes

to be built between 2018 and 2024, most of which will be

included in the ‘affordable housing programme’ and will

require huge volumes of plywood and other wood

products.

An investment of this size, says the CLSA report, could

create over 2 million jobs annually and add nearly 1% to

GDP.

For more see: https://qz.com/979059/indias-economy-is-set-fora-

1-3-trillion-bonanza-from-60-million-new-homes/

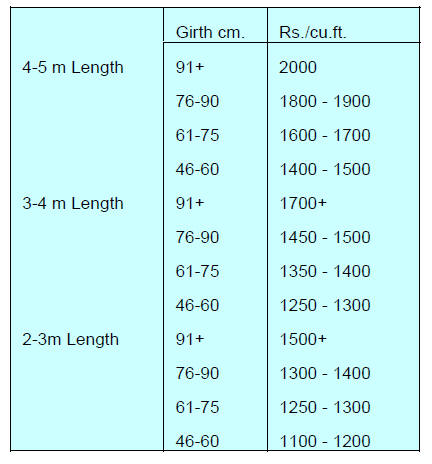

Madhya Pradesh teak and hardwood auctions

The teak logs auctioned in depots in Madhya Pradesh

come mainly in 2 to 5 metre lengths and mostly of girths

120 cms and below.

Madhya Pradesh teak logs have good form (cylindrical

like pencils) and the wood has a golden colour with black

stripes.

The latest Madhya Pradesh auctions were held at Harda,

Jabalpur, Hoshangabad and Betul division depots and over

10,000 cubic metres of teak logs and appoximately 7,000

cubic metres non-teak hardwoods were sold.

Buyers were mostly from local mills plus some merchants

from Gujarat, Maharashtra, Rajasthan and South India.

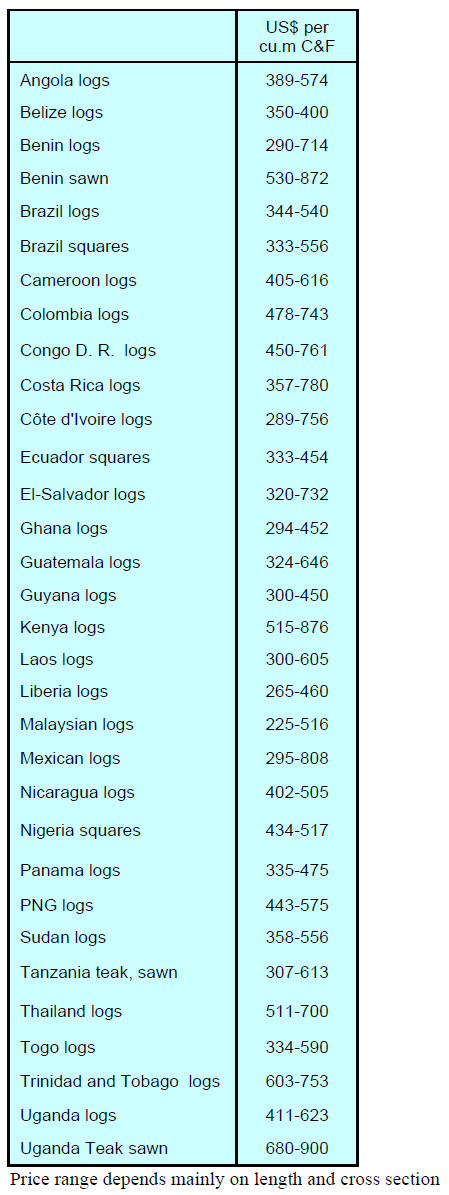

Price indications for the Madhya Pradesh auctions are

shown below.

Good quality non-teak hardwood logs attracted good

prices. Logs of 3 to 4m length having girths 91 cms & up

of haldu (Adina cordifolia), laurel (Terminalia tomentosa),

kalam (Mitragyna parviflora) and Pterocarpus marsupium,

fetched around Rs.700 to 750 per cu.ft . Second quality

log prices were in the region of Rs.350 to 500 per cu.ft

while the lowest quality logs attracted offers between

Rs.200 to 300 per cu.ft.

WPC production comes to India

The Indian press is reporting that Reliance Industries

(RIL) has concluded an agreement with Germany’s

Resysta International providing for the exclusive rights for

production and marketing in India of a wood polymer

composite (WPC) ‘RelWood’.

See:

http://www.business-standard.com/content/b2b-plasticspolymers/

reliance-partners-with-germany-s-resysta-for-woodcomposite-

technology-117042700253_1.html

and

http://www.thehindu.com/business/ril-partners-with-germanysresysta-

to-bring-innovative-wood-alternative-inindia/

article18226498.ece

Wood Plastic Composites (WPCs) are produced by

combining ground wood particles and

heated thermoplastic resin.

The Indian Business Standard article on the latest

development says around half of current demand for

WPCs in India is met by imports from China and the

market for WPC products has been growing at around

15% per year for the past 5 years.

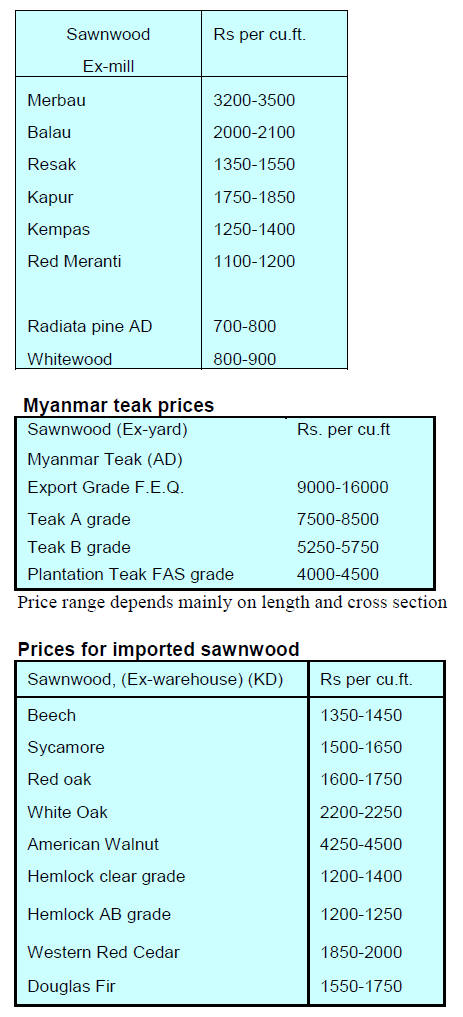

Imports of plantation teak

Prices for imported planation teak have not changed over

the past two weeks.

Imported sawn hardwood prices

Prices for sawnwood milled domestically remain

unchanged.

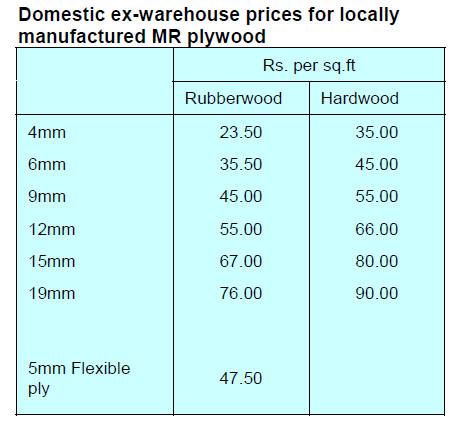

Prices for WBP marine grade manufactured by

domestic mills

Analysts expect plywood prices to rise further in the

coming months.

8. BRAZIL

Recession drives down inflation

The annualised inflation rate in Brazil dipped below 4% in

mid-May, the lowest for around 10 years. This is widely

expected to lead the Central Bank to cut interest rates.

Inflation has fallen from a high of almost 11% in January

last year to below the government's target. The sudden

turn-around is largely the result of the recession in Brazil

which has resulted in unprecedented unemployment and

weak consumer demand. If the low inflation holds the

Central Bank is expected to cut interest rates.

Amapá will have a system to control forest products

On May 16, the Forest Institute of Amapá State (IEF) met

to discuss the establishment of a Working Group that

would deal with forestry issues in the state of Amapá, in

the Amazon region.

One of the aims of the group is the improvement of the

timber tracking system in the state, part of the National

System for Control of Forest Products Origin

(SINAFLOR) that was developed by the Brazilian Institute

for Environment and Renewable Natural Resources

(IBAMA). Improvements planned will upgrade the system

to offer greater transparency.

The SINAFLOR system tracks the origin of timber,

charcoal and other forest products. Monitoring is done

from logging permits to transportation, storage, processing

and export. The improved system in Amapá State will be

phased in and should be fully operational by January 2018.

Export update

In April 2017 Brazilian exports of wood products (except

pulp and paper) increased 16% in value compared to April

2016, from US$190.5 million to US$221.0 million.

The value of pine sawnwood exports increased 37%

between April 2016 (US$28.0 million) and April 2017

(US$38.3 million). In volume terms, exports increased

25% over the same period, from 149,800 cu.m to 187,700

cu.m.

However, tropical sawnwood exports dropped just

over

11% from 35,000 cu.m in April 2016 to 31,000 cu.m in

April 2017. The value of exports also declined by the same

percentage from US$16.0 million to US$14.2 million,

over the same period.

Pine plywood exports increased almost 22% in value in

April 2017 compared to April 2016, from US$33.4 million

to US$40.6 million. It was encouraging to see that the

corresponding increase in export volumes was 13% over

the same period, from 129,800 cu.m to 146,800 cu.m.

There was positive news on tropical plywood exports

which increased significantly in volume and in value, from

12,600 cu.m (US$4.8 million) in April 2016 to 13,900

cu.m (US$5.4 million) in April 2017.

The good news continued with wooden furniture export

values rising from US$35.2 million in April 2016 to

US$38.2 million in April 2017 (+ 8.5%).

Chinese delegation announces interest in the timber

sector of the State of Amazonas

A delegation from the Chinese Forest Industry Association

comprising representatives of the government and the

business community visited the headquarters of the

Federation of Industries of the State of Amazonas

(FIEAM) to discuss opportunities for investment in

Brazil’s timber sector..

A spokesperson for the Chinese delegation said China has

extensive cooperation with other countries in forestry

research, industry, scientific innovation and technology

and see opportunities in the state of Amazonas, home to

the world's largest rainforest.

The delegation aimed to seeks cooperation in the forestry

sector and was hoping to facilitate communication to

promote business opportunities.

CIPEM searches for new markets and incentives to

export

The Center for Timber Producers and Exporters in Mato

Grosso State (CIPEM) has been exploring new market

opportunities in an effort to maintain sales in the light of

the weak domestic market due to the economic crisis in

the country.

According to CIPEM, Brazilian wood products are

internationally recognised for their quality but, in the case

of Mato Grosso State, most companies are not capable of

satisfying the requirements of international markets.

According to CIPEM the part of the solution depends upon

providing better information on the structure and

functioning of overseas markets so that entrepreneurs,

especially SMEs, have confidence to invest to lift

production and marketing skills to international levels.

CIPEM also highlighted the value to manufacturers from

participation in national and international fairs.

To provide a baseline for further development a survey of

manufacturers will be undertaken in cooperation with

companies affiliated with CIPEM in order to plan

international export promotion.

Study challenges government timber recovery

baseline

The Mato Grosso State University (UNEMAT) has

unveiled a study that challenges the Volumetric Yield

Coefficient (CRV) of 35% in Resolution No. 474/2016 of

the National Council on the Environment (CONAMA).

UNEMAT says some commercial species from the natural

forest yield a much higher conversion rate and that

adoption of a low 35% conversion rate is a mistake.

The university study shows, for example, recovery for

angelim-pedra (Hymenolobíum sp.) is around 52-55% and

for cedrinho (Cupressus Lusitanica) it is about 42%. In the

case of massaranduba (Manilkara spp), the study claims

the conversion rate can reach 54%.

The study authors say the CRV of 35% does not

correspond to the reality achieved by companies in Mato

Grosso and could have a negative impact. The University

plans a comprehensive study to create more data to

accurately reflect recovery and production.

The danger from adopting the low recovery figure is that

millers would be challenged when production is higher

than would be expected if the recovery rate was 35%.

9.

PERU

Peruvian entrepreneurs visit LIGNA 2017

For the first time Peruvian entrepreneurs from the timber

sector in Peru visited LIGNA 2017. This exhibition offers

an opportunity for visitors to update on forestry and

processing technologies, sawmill technology, solid wood

working, developments in the wood energy sector and

machinery and equipment.

One of the Peruvian group commented that it was

interesting to see firsthand progress in production

innovations and technologies.

Loreto Region initiates new process for allocating

concessions

The Forestry Development Executive Board has reported

that the Loreto Region has some 1.2 million ha. of forest

that could be made available to concessionaires and that a

new fast track allocation process will be available.

It was also reported that the regional government of

Ucayali is adjusting the way it manages concession

allocation based on guidelines provided by Serfor. They

are also providing technical advice to the regional

governments of Loreto, Ucayali, Madre de Dios, Huánuco

and San Martín on the guidelines and other technical

issues.

In related news, the Forestry Development Executive

Board presented a progress report on the National Protocol

to Standardise Criteria for Evaluation of Timber Forest

Resources. This was agreed by the forestry authority, the

Forest and Wildlife Resources Monitoring Agency

(Osinfor), regional forestry agencies and civil society.

Work begins on draft National Forestry Plan

The National Forestry and Wildlife Service has begun

drafting a National Forestry and Wildlife Plan (PLNFFS),

a guiding document for the next 10 years.

The development of the PLNFFS will focus on

“participation, commitment and a vision of the future for

the benefit of present and future generations”, said Vice

Minister Quijandría.

The development of the plan is seen as vital as the

contribution of the forestry sector to the Peruvian

economy as reflected in GDP barely achieves 0.9%.

The aim of the national plan is to increase this contribution

through competitive and sustainable activities which will

lead to greater and well distributed wealth as well as better

living conditions in the people.

The PLNFFS aims to provide a strategy for public and

private action in the forestry sector.