Japan

Wood Products Prices

Dollar Exchange Rates of 26th

June 2017

Japan Yen 112.00

Reports From Japan

BoJ Governor optimistic on prospects for

growth

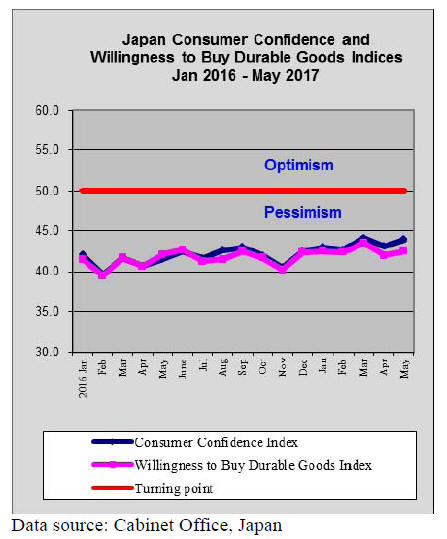

The Japanese government has upgraded its assessment of

the economy for the first time since December. In a press

release the Cabinet Office stated that the economy is

exhibiting a ¡°moderate recovery¡± due to a pick-up in

consumer spending and capital investment.

The sign of a strengthening economy was the theme of a

recent presentation by the Bank of Japan (BoJ) Governor

who emphasised that economic activity and growth

prospects for Japan have moved from a moderate recovery

trend toward a moderate expansion.

The prospects for the economy in fiscal 2017 and 2018

have improved and Japan's economy is likely to continue

expanding. In the first half of 2016, pessimistic views

about the global economy prevailed; concerns heightened

regarding the slowdown in emerging economies including

China and the global market volatility however, the global

economy is now showing positive momentum towards

growth which has lifted Japan's exports and production.

The BoJ Governor said ¡°against this background corporate

sector profits have been at record high levels, business

sentiment has been favorable and private sector fixed

investment has continued.

A feature of the current economic recovery phase is that

improvement in business sentiment has been seen, not

only for firms in metropolitan areas and large firms but

also for firms in the smaller towns.¡±

See:

https://www.boj.or.jp/en/announcements/press/koen_2017/

data/ko170622a1.pdf

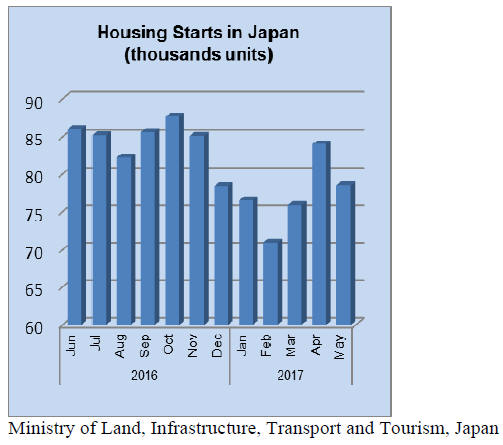

Housing starts reverse direction

Housing starts in Japan reported by the the Ministry of

Land, Infrastructure, Transport and Tourism declined in

May marking the first drop in three months. Year on year

starts were down just less than half a percent.

Data on orders received by the main construction

companies show that orders fell for the second straight

month in June.

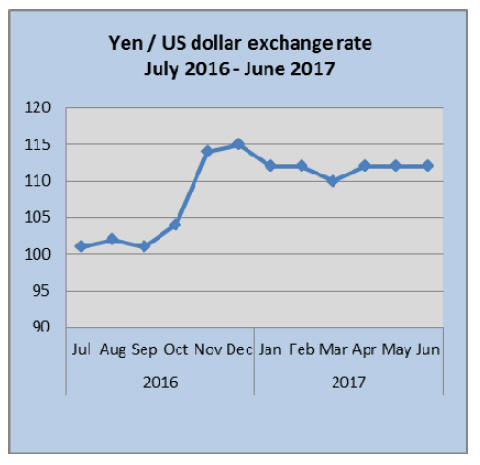

Yen hovers at 112 to the US dollar

In line with expectations the US Federal Reserve raised its

key interest rate by 25 points to 1.00 - 1.25% at the

conclusion of its June meeting. More significantly it

announced it will begin reducing its massive bond and

securities holdings. The impact of the interest rate on the

yen dollar exchange rate was muted as this had already

been factored in by traders.

Throughout the month the yen/dollar exchange rate varied

little, staying at around 112 yen to the dollar, a rate that

pleases exporters.

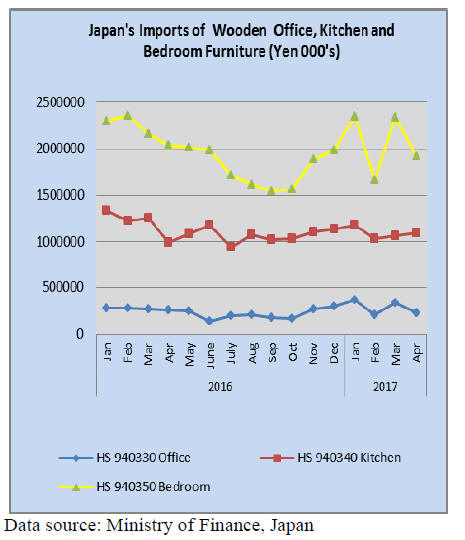

Japan¡¯s wooden furniture imports

The value of Japan¡¯s wooden bedroom furniture imports

has see-sawed for the past four months after a period of

steady increase that began in November last year. After

three consecutive months of increase imports in February

plummeted only to surge again in March. The same

pattern has been repeated in March and April.

Wooden office furniture imports in April dipped with a

noticeable reduction in imports from EU countries.

Given the volatility in imports of wooden bedroom and

office furniture it is not surprising that monthly imports of

wooden kitchen furniture have also exhibited more

volatility this year than seen throughout 2016.

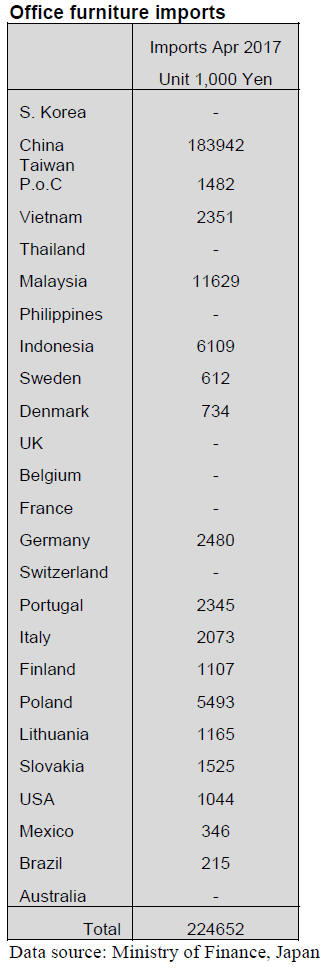

Office furniture imports (HS 940330)

April 2017 imports of wooden office furniture were down

around 7.5% compared to the same period in 2016 and

were down sharply (-32%) on levels in March.

Imports from China fell 13% in April and there was a

major decline in imports from EU suppliers. In March

imports of wooden office furniture from the main EU

suppliers accounted for 20% of total imports but this

dropped to just 6% in April.

April imports of wooden office furniture were dominated

by shipments from China which accounted for over 80%

of all imports of wooden office furniture for the month.

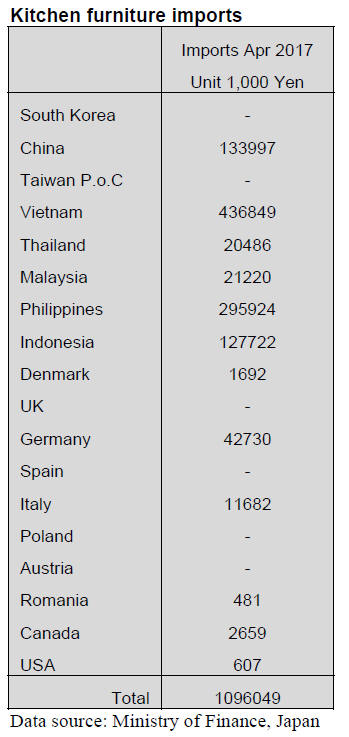

Kitchen furniture imports (HS 940340)

Year on year, April 2017 imports of wooden kitchen

furniture rose around 10% but there was little change in

the value of imports between March and April this year.

Vietnam maintained its position as the top supplier of

wooden kitchen furniture accounting for over 40% of all

imports of HS 940340.

In April, as was the situation in March, the Philippines

was the second largest supplier followed by China and

Indonesia. The top four shippers accounted for over 90%

of all arrivals of wooden kitchen furniture in April.

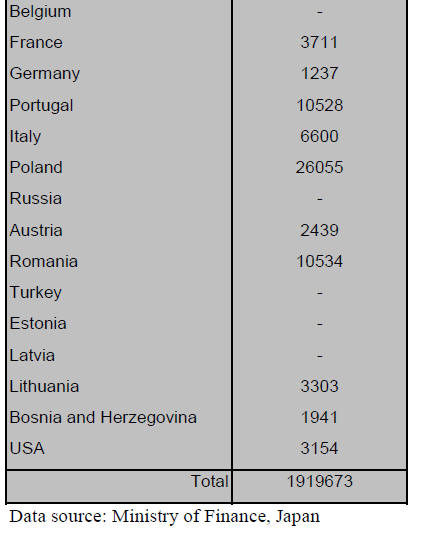

Bedroom furniture imports (HS 940350)

All the three top suppliers of wooden bedroom furniture(

China, Vietnam and Thailand ) saw a decline in the value

of shipments to Japan in April compared to levels in

March.

Shipments from the top supplier, China, fell almost 15%,

shipments from Vietnam were down 22% while shipments

from Thailand dropped just over 30%. The overall decline

for all wooden bedroom furniture from March to April was

18%.

However, overall year on year imports of wooden

bedroom furniture rose 6% from 2016.

Trade news from the Japan Lumber Reports (JLR)

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

Imports of legally verified wood

In 2016, percentage of legally certified imported wood in

sales was 41.2%, 5.6 points more than 2015 so certified

wood has steadily been increasing. However, distribution

volume of certified wood in the market was only 29.6%,

3.9 points up so the progress to handle certified wood

remains slow.

Apparently there is not strong demand for certified wood

in the market with little acknowledgement in the industry.

This is result of investigation of members of the Japan

Lumber Importers Association.

The Association disclosed result of follow-up survey

regarding legally certified imported wood products. Items

of survey are imported logs, lumber, laminated lumber,

plywood, particleboard and OSB from all the sources. In

total imported volume, about 72% is certified products out

of which less than 30% was sold in the market as certified

products.

By items of certified products sold in the market, logs are

59% and share of North American and South Sea

hardwood logs was high. Lumber is only 20% and

plywood is 13%. The Association will continue promoting

import and sales of legally certified products in relation to

the Clean Wood law.

Many more public wooden buildings

Since the ¡®Act for Promotion of Use of Wood in Public

Buildings¡¯ was implemented in 2010, the ratio of wooden

public buildings rose from 8.3% in 2010 to 11.7% in 2015.

During the same period, the ratio of wooden public

buildings of three-story or lower rose from 17.9% to

26.0% during the same period.

Background of the move is that domestic forest resources

planted after the World War II are now matured enough

for use as wood and wooden products in Japan and the

government of Japan has been making effort to promote

the use of wood through variety of policy tools, especially

wooden buildings but due to the policy of ¡®noncombustible

public buildings¡¯, wood use for public

buildings was very rare.

When such policy was made, people hoped to have fire

resistant communities with non-combustible buildings.

Since public buildings have strong potential for wood use,

the Diet introduced the Act, which requires the

government to take the lead in wood use in public

buildings.

The fundamental policy of the Act sets the target of the

government to construct all the public buildings of three

stories or lower with wood structure in principle. Further,

prefectures and municipalities are also required to develop

their own policy for the promotion of wood use and make

effort to promote practical wood use in public buildings.

Activities of CLT Association

The Japan CLT Association held the meeting on May 30

to report activities by the Association. CLT was officially

noticed publicly last year and movement to promote using

CLT has been accelerated by forming various unions and

association with head of local authorities. So far, 70

buildings with CLT panels are completed and 70 more are

planned.

Domestic production CLT in 2012 was 200 cbms then it

increased to 5,000 cbms in 2016 and it will be 20,000

cbms in 2017. There are eight JAS certified CLT

manufacturers as of April 2017 and there are nine CLT

processing plants so CLT supply system has been steadily

growing.

The Association has now 12 working groups (WG).

Standard specification WG is working to make up manual

of CLT construction and plans to hold lectures in this fall.

Sound proof WG plans to have floor and wall performance

tests. Fire proof structure WG passed two tests on ceramic

exterior siding and wood exterior wall. Manufacturing and

processing WG discussed requesting items for JAS

revision on CLT and accumulated data of warping by

dimensional stability performance tests.

Construction technical rationalization WG plans to request

adding CLT in standard wood building specifications by

the Ministry of Land, Infrastructure, Transport and

Tourism by showing method of construction procedure. It

is important to plan ahead where to place crane with

precise procedure otherwise efficiency would drop.

Insulation WG estimates thermal conductivity of CLT is

somewhere in between plywood and natural wood.

Parliamentary group aiming regional vitalization held the

meeting and the cabinet secretariat reported utilization of

wood including CLT by local governments. In this

meeting, each Ministry reported how they promote use of

CLT. The Forestry Agency explained the budget for CLT

and support to CLT related business.

The Ministry of Land, Infrastructure and Transport also

explained the 2017 budget to support CLT related

buildings and test of CLT buildings. The government is

seriously supporting for CLT promotion.

South Sea (tropical) logs

Export log prices continue rising as log production

stagnates even after rainy season was over. Sporadic

showers hamper logging activities. Japanese log importers

struggle to purchase enough logs to fill up ships even in

Sabah because of aggressive India¡¯s log purchase. In

Sarawak, local plywood mills have hard time to have

enough logs to run the mills.

Log suppliers remain bullish with busy purchase by India

and active purchase by local plywood mills. After new

restriction of log harvest of less than 50 cm of DBH in

Sarawak, log supply gets tighter and very few logs are

delivered to plywood mills. In this situation, Log prices

continue rising since last April.

Export log prices in Sarawak are US$280-290 per cbm

FOB on meranti regular, US$260 on meranti small and

US$240-245 on super small. These prices are too high for

depressed Japan market. Since timber premium duty will

be increased in Sarawak since July, log prices would

further climb.

In PNG and Solomon Islands, log harvest is hampered by

foul weather. Log prices are firming with active

purchase by main buyer, China and India, which try to buy

more to cover short supply of Sarawak. Particularly, prices

of highly demanded species by sawmills of keruing,

melapi and agathis continue climbing.

Expanding harvest of domestic wood and future

challenges

Total demand of wood in Japan in 2015 was 75,160,000

cbms, out of which domestic supply was 24,910,000 cbms

so the self-sufficiency rate rose to 33.2%.

In 2016, domestic wood supply was 20,660,000 cbms and

it continues climbing. Domestic wood demand has been

declining gradually but because the supply from foreign

countries is getting difficult by various reasons such as

decreasing resources, economic situation, environmental

protection and illegal harvest, so demand for domestic

wood keeps growing to supplement foreign supply.

Since the policy by the Japanese government has changed

from thinning to clear cutting and reforestation, log

harvesters are encouraged and activated with introduction

of high performance logging machines.

However, there is problem how to maintain sustainable

forest management by taking environmental protection in

consideration in major producing regions of Kyushu and

the North East where regional log production is more than

50 million cubic meters a year.

On demand side, there are two new major log users of

domestic wood. One is plywood manufacturers and

another is biomass power generation plants. Plywood mills

used to use imported logs but the supply is declining and

competition with other large market like China gets

severe, they shifted to use domestic wood.

Log demand for plywood in 2016 was 3,682,000 cbms

then this volume should increase to six million cbms by

the government basic forest plan. This means 15 to 16 new

plywood mills are needed to consume this much volume.

Plywood industry thinks it is possible to use that much

volume if half of the market of floor base and concrete

forming panels is switched to domestic products. These

two items have traditionally been supplied by Malaysian

and Indonesian plywood manufacturers.

There is one good example of tie-up case by the log

suppliers and users like plywood and lumber mills. The

North Japan Log Distribution Co-op. in Iwate prefecture

supplied total of 260,000 cbms for plywood and lumber

mills and 90,000 tonnes for biomass power generation

plants in 2016 and the target in 2017 is 300,000 cbms for

plywood and lumber mills and 100,000 tonnes to power

plants.

Biomass power generation plants are mushrooming all

over Japan and they are the major factor to activate

domestic log harvest.

By the Forestry Agency, estimated domestic wood fuel

volume for the power plants was 2,800,000 cbms in 2015,

1,000,000 cbms more than 2014 so the volume keeps

growing.

This market contributes stabilizing log harvesters¡¯

management as the market of low grade logs and unusable

wood. The price of fuel wood is low like 7,000 yen per ton

delivered to chip plant but power plants operate 24 hours a

day and they need consistent supply of fuel wood.

Another change in lumber industry is size of newly built

sawmills are much larger to consume larger volume of

wood. New trend is that sawmills buy all the products log

suppliers produce from top to bottom, which is called

cascade use of wood. Higher grade logs are used for

lumber manufacturing and low end is used as fuel. This

benefits log suppliers and sawmills need to tie-up with log

suppliers closely for large volume of wood they need.

Now, as log demand keeps growing, log suppliers are

facing various problems in future. Harvest areas are

getting into deep interior where there is no road system.

Traditionally, log harvest has been done in convenient

locations close to road. Introduction of tower yarder is the

best choice for efficient cable yarding. As the population

is aging in Japan, labor shortage will get serious problem.

Reforestation needs to review. After the War, softwood

trees were planted from valley bottom to top of ridges but

considering cost factor, softwood trees should be planted

in the areas close to road system.

Now problem is how to secure labor power for

replantation works. Log harvest business will use more

efficient, high performance machines, which attract young

people but reforestation is not attractive job and

mechanization is difficult.

Younger people shy away from hard and dirty work such

as undergrowth mowing. Introduction of robot is seriously

considered and also use of foreign labor is another choice.

|