|

Report from

North America

Continued growth in hardwood plywood imports from

China

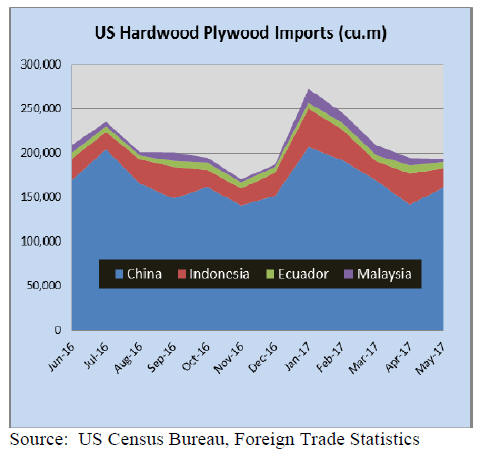

Hardwood plywood imports were almost unchanged from

March and April, at 287,156 cu.m. However, year-to-date

import volumes were up 22% from May 2016. The value

of hardwood plywood imports grew 4% from the previous

month to US$164 million in May.

Plywood imports from China increased 14% in May to

161,273 cu.m., while imports from most other countries,

except Canada and Russia, declined in May. Imports from

Indonesia fell 39% to 21,642 cu.m. (-7%). Vietnamese

plywood shipments to the US grew to 5,579 cu.m. in May.

Despite the month-over-month decrease in May imports

from Indonesia, Malaysia and Ecuador, year-to-date

imports from all three countries grew compared to the

same time last year. Year-to-date imports from Malaysia

doubled compared to May 2016.

More hardwood mouldings from Brazil

Hardwood moulding imports grew 14% in May to

US$17.6 million. Year-to-date imports were slightly

higher (1%) than in May 2016.

The largest jump was in imports from Brazil, which

increased 27% to US$3.6 million. Imports from China

grew to US$6.6 million in May, up 27% year-to-date from

May last year.

Indonesian moulding shipments to the US market grew

78% month-over-month to just under US$1 million in

May. Moulding imports from Malaysia were up in May,

but year-to-date imports decreased by nearly one third

from May 2016.

Hardwood flooring imports surge

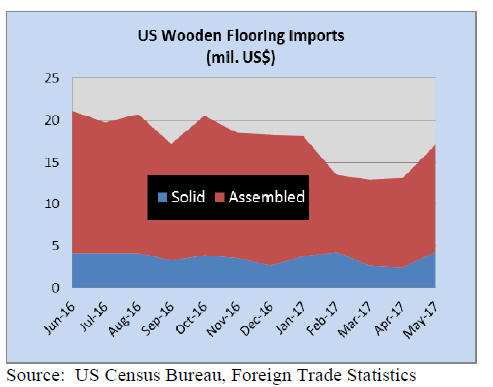

Imports of both hardwood flooring and assembled flooring

panels (engineered flooring) grew in May. Hardwood

flooring imports increased 72% from April to US$4.3

million and year-to-date imports were also up from May

2016. The strongest growth was in imports from Canada

and China, while imports from most tropical suppliers

grew at more moderate rates.

Brazil was an exception with US$407,757 worth of

hardwood flooring exports to the US in May, almost as

much as in the previous four months combined. Hardwood

flooring imports from Indonesia were worth US$630,984

in May, up 7% from April.

Assembled flooring panel imports were worth US$12.5

million in May, up 20% from April. Imports from Canada

and China decreased in May, while Indonesia significantly

increased its share in US imports. Imports of assembled

floor panels from Indonesia were worth US$1.6 million in

May, up 170% from the previous month. Year-to-date

imports from Indonesia were 71% higher than in May

2016.

Thailand and Indonesia shipped more assembled flooring

panels year-to-date than in May 2016. In hardwood

flooring China saw the largest gain, both month-overmonth

and year-to-date. In May imports from China were

worth US$904,146, followed by Indonesia (US$751,153)

and Malaysia (US$692,110).

Significant increase in wooden furniture imports

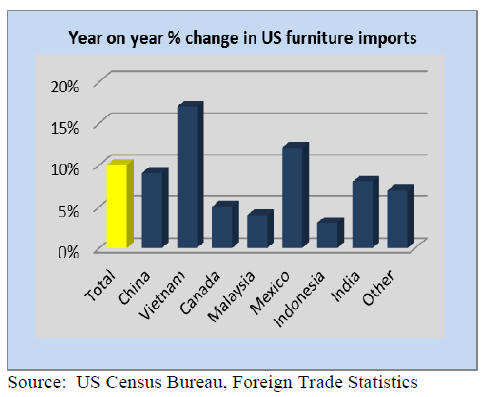

Wooden furniture imports grew 11% in May to US$1.63

billion. Year-to-date imports were up 10% from May

2016.

The strongest growth in imports was again from Vietnam

and China. Furniture imports from Vietnam grew 22% to

US$336.4 million. Imports from China were worth

US$662.1, up 16% from April.

Malaysia¡¯s exported US$51.2 million worth of wooden

furniture to the US in May, a 12% increase from the

previous month. Imports from Indonesia grew at the same

rate to US$51.7 million. Mexico and India also exported

more to the US in May.

Imports of all types of wooden furniture grew in May,

except office furniture. Imports of bedroom furniture

increased 17%, followed by seats (+13%) and wooden

furniture for other uses (+13%).

US furniture manufacturing up

The most recent estimate by the Bureau of Economic

Analysis revised GDP growth in the first quarter of 2017

up from previously 1.2% to 1.4%. In the fourth quarter,

real GDP increased 2.1%. The unemployment rate

remained almost unchanged at 4.4% in June. The rate has

declined 0.4 percentage points since January.

Economic activity in the manufacturing sector expanded in

June, according to the latest survey by the Institute for

Supply Management. Furniture manufacturing reported

the highest growth in June of all manufacturing industries.

Raw material prices increased in June for the furniture

industry. The wood products industry also grew and

reported strong growth in new orders.

Confidence in the economic outlook continued to decline

in early July, according to the University of Michigan¡¯s

survey of consumers. Hope for strong economic growth

after President Trump was elected appears to have largely

vanished. However, consumers¡¯ confidence in current

economic conditions was high. Based on the survey data

personal consumption will grow 2.4% in 2017.

IMF lowers growth forecast for US economy

The International Monetary Fund (IMF) has lowered its

economic growth forecasts for the US to 2.1% for 2017

and 2018, down from 2.3% and 2.5%, respectively. The

IMF cited as reasons uncertainty over the government¡¯s

fiscal policies and lower than expected growth in the first

quarter of this year.

The IMF headquarters themselves may move from

Washington DC to Beijing in about ten years, according to

IMF chief Christine Lagarde. The IMF¡¯s head office is

traditionally located in the country with the largest

economy which could be China in ten years.

Rising home prices and countervailing duties hit

housing market

Housing starts increased 8% in June to a seasonally

adjusted annual rate of 1,215,000, according to the US

Department of Housing and Urban Development and the

Commerce Department. Starts were 2% above the June

2016 rate. Single-family construction grew 13.5% in June.

The number of building permits issues, which indicates

future building activity, increased 7% in June from the

previous month at a seasonally adjusted annual rate. Multifamily

permits grew at a higher rate than single-family

authorizations.

Builders¡¯ confidence in the market for new single-family

homes slipped in July. It is at the lowest level since

November 2016, according to the National Association of

Home Builders/Wells Fargo Housing Market Index. High

sawn softwood prices are a particular concern to builders,

after the US imposed preliminary countervailing duties on

most Canadian softwood in April.

Sales of existing homes sales declined in June but

remained slightly higher than in June 2016, according to

the National Association of Realtors. Demand for homes

remains strong, but rising home prices and low inventory

dampened the sales pace.

The average sales price of new homes sold in the U.S. rose

by almost 12% during the year to February 2017, to

US$390,400, according to the U.S. Census

Bureau. Overseas buyers and recent immigrants purchased

almost 50% more residential property in the 2016-

17financial year compared to the same period earlier

according to the National Association of Realtors.

See: http://www.globalpropertyguide.com/news-

Foreign_investment_in_U_S_residential_real_estate_soars_despi

te_tight_inventory-3220

New Egger particleboard plant in North Carolina

Austrian based Egger Group plans to build its first

particleboard plant in the US in Lexington, North

Carolina. The company will invest approximately US$700

million to build the facility. North Carolina is the centre of

furniture manufacturing in the US, and the state has

offered economic development incentives of up to US$7.8

million to Egger if investment and job creation goals are

met.

See: https://www.egger.com/shop/en_JP/newspress/

news/item/23521_ex-en

|