|

Report from

Europe

Public comment invited on new FLEGT market report

Public comments are invited on a draft report by the

Independent Market Monitor (IMM), which is a multi-year

project implemented by ITTO and financed by the

European Union (EU) to support implementation of the

FLEGT Voluntary Partnership Agreements between the

EU and timber supplying countries.

The new IMM report reviews the latest data on forest

resources in VPA partner countries and on the timber trade

between partner countries and the EU during the 2014 to

2016 period. The report aims to establish the baseline

conditions for entry into the EU market of FLEGT

licensed timber.

Recognising that the first ever FLEGT licenses were

issued by Indonesia in November 2016, the report includes

additional commentary on the prospects for Indonesian

timber in the EU market.

The report also provides information on the status of

EUTR implementation and the market position of FLEGT

licensing in relation to private sector legality verification

and certification initiatives. The report concludes with

recommendations for future monitoring by IMM and

FLEGT-related communication.

The summary report is available at:

https://tinyurl.com/IMM-Summary

The main report is available at:

https://tinyurl.com/IMM-FLEGT-Main

Comments should be sent by email to:

technical@flegtimm.eu before 30 September 2017.

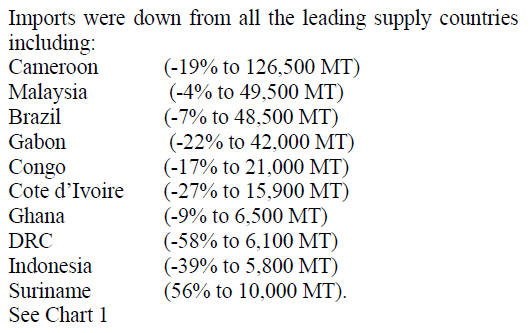

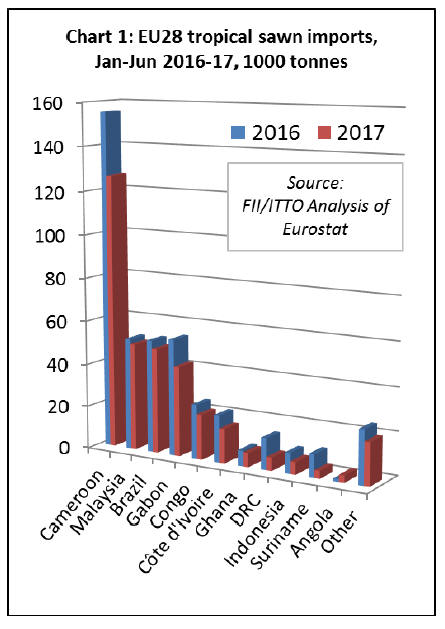

Tropical sawn wood imports decline in nearly all EU

countries

EU imports of tropical sawnwood in the first six months of

2017 were 348,600 metric tonnes (MT), 19% less than the

same period in 2016.

The decline was particularly pronounced for trade between

Cameroon and Belgium, following a surge last year, but

also affected nearly all exporting countries and EU

member states. The only minor exception was a slight

upturn in imports from Angola, mainly destined for

Portugal.

Imports in Portugal increased 20% to 15,500 MT during

the period (Chart 2).

Weak consumption in the EU remains a factor behind the

decline in EU imports of tropical sawn wood in some parts

of Europe, notably Italy where the economy continues to

struggle.

However, this factor alone cannot explain such a

widespread downturn across the whole of the EU,

particularly as economic activity in the region has been

showing signs of improvement this year.

Some supply side issues have contributed to the decline in

EU trade this year. European importers complained of

long delays in shipment from Douala port during the first

half of 2017, although this factor can only have had a

short-term effect.

There are also indications that tropical exporters were

concentrating on other more profitable and less demanding

markets for sawn wood during the period. Malaysia is

focusing less and less on the European sawnwood market

these days, despite the country¡¯s considerable efforts to

meet the EU¡¯s demanding green procurement

requirements.

Malaysia¡¯s exports of sawnwood have increased sharply to

the Indian sub-continent and China this year. Brazil is

exporting more to the US and India. Gabon¡¯s exports of

sawnwood to China increased 35% in the first 6 months of

2017. With good demand elsewhere, supplies restricted,

the EU market still slow and difficult to satisfy as the EU

Timber Regulation begins to bite, and with rising

competition from modified temperate hardwoods, it¡¯s

almost inevitable that tropical sawn wood imports into the

region will continue to fall.

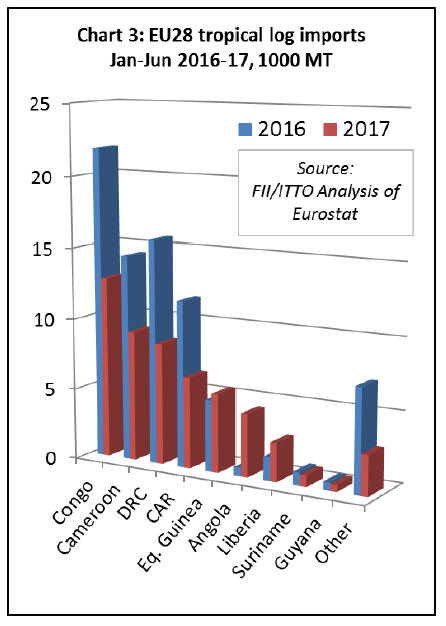

EU imports of tropical logs continue to slide

Tropical log imports into the EU fell in 2016 and this

decline continued in the first half of 2017. EU tropical log

imports declined 33% to 53,630 MT in the first half of

2017.

Imports declined from the four leading supply countries;

Congo (-42% to 12,760 MT), Cameroon (-37% to 9,150

MT), DRC (-46% to 8,530 MT), and the Central African

Republic (-45% to 6,400 MT).

These declines were partly offset by rising EU imports of

tropical logs from Equatorial Guinea (+10% to 5510 MT),

Angola (4420 MT from a negligible level in 2017), and

Liberia (+65% to 2730 MT). (Chart 3).

The EU trade in tropical logs is now concentrated in

France, Portugal and Belgium. Imports into all three

countries fell sharply in the first 6 months of 2017, down

62% to 18,700 MT in France, down 11% to 11,100 MT in

Portugal, and down 43% to 11,800 MT in Belgium.

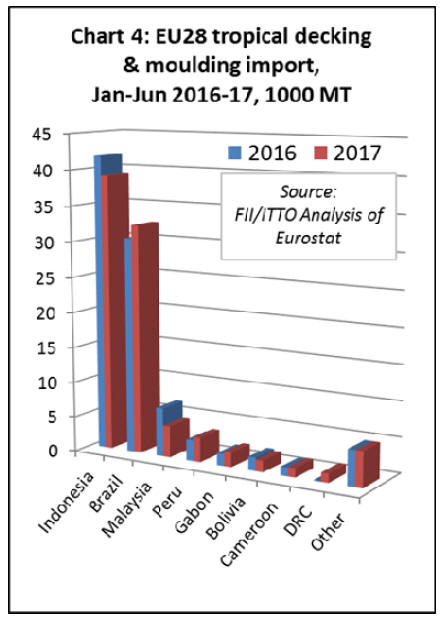

Slight fall in EU imports of tropical decking

EU imports of ¡°continuously shaped¡± wood (HS code

4409), which includes both decking products and interior

decorative products like moulded skirting and beading,

were 90,555 MT in the first half of 2017, down 2% on the

same period in 2016.

Imports fell 6% to 39,000 MT from Indonesia and were

down 36% to 4,400 MT from Malaysia. These losses were

partly offset by a 6% rise in imports from Brazil, to 32,400

MT. (Chart 4).

In the first half of 2017, imports of tropical decking and

mouldings increased 17% to 19,400 MT in France, but

declined into all other leading EU destinations including

Germany (-6% to 23,000 MT), Belgium (-10% to 15,800

MT), Netherlands (-16% to 15,400 MT), and the UK (-3%

to 5,600 MT).

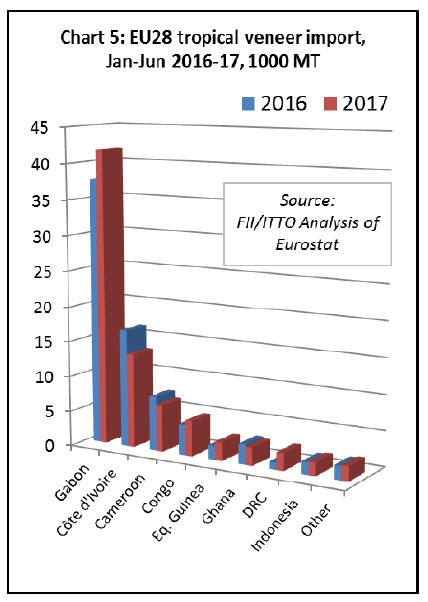

EU imports of tropical veneer recover some lost

ground

EU imports of tropical hardwood veneer increased 3% to

78,400 MT in the first 6 months of 2017 compared to the

same period in 2016. The rise was mainly due to an 11%

increase in imports from Gabon, to 41,800 MT, building

on gains made the previous year.

This is due both to better consumption in the EU and to

rising investment in veneer production capacity in Gabon

which has been on-going ever since the country banned

log exports in May 2010.

Strong growth in EU imports of Gabon veneer in the first

half of 2017 was sufficient to offset declining imports

from Cote d¡¯Ivoire (-20% to 13,300 MT) and Cameroon (-

14% to 6,600 MT). (Chart 5).

Imports of tropical veneer declined into the two largest EU

markets in the first half of 2017, falling 5% to 29,500 MT

in France and 7% to 17,000 MT in Italy. However, these

losses were offset by larger increases in imports in Spain

(+10% to 11,500 MT) and Greece (+40% to 7700 MT).

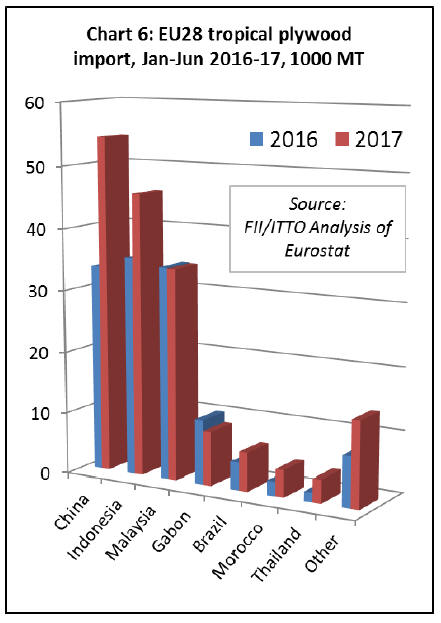

EU imports more tropical plywood, mainly from China

Plywood is one of the few sectors of the EU market where

tropical products have been performing reasonably well,

although much of the gain has been in indirect imports

from China rather than direct imports from tropical

countries. (Chart 6).

In the first six months of 2017, EU imports of products

faced with tropical hardwood manufactured in China

increased 62% to 54,300 MT, while direct imports from

tropical countries increased 21% to 171,100 MT.

Most of the gains in direct imports were from Indonesia,

rising 29% to 45,700 MT. Imports from Malaysia were

stable at 34,200 MT and imports from Gabon fell 16% to

8,700 MT in the first half of the year.

These are mixed results for those looking for evidence of

immediate market gains after issue of the first FLEGT

licenses in Indonesia at the end of last year. The 21% rise

in EU imports from Indonesia is encouraging and seems to

confirm early anecdotal reports that some EU importers

are favouring Indonesian product as it avoids the need for

time-consuming and expensive due diligence assessments.

On the other hand, plywood manufacturers in China, even

though using tropical hardwood veneers, appear to be

conforming to the EUTR due diligence requirements to the

satisfaction of many importers and regulators.

There are also reports that some plywood buyers in Europe

are still avoiding Indonesian plywood because of lack of

clear information on the exact species content when orders

are placed, usually a month or two before shipment.

Many Indonesian plywood mills do not know ahead of

time the exact mix of logs that will be available and

importers only have access to species information when

the order has been shipped and the FLEGT licence issued.

That conflicts with the internal procurement policies of

some large corporate buyers who now require, well in

advance, clear information on the exact species content of

all delivered timber products. Some of the larger Chinese

mills are better able to meet this requirement, while also

satisfying those buyers¡¯ needs for more regular large

shipments.

The rise in EU tropical plywood imports in the first half of

this year was mainly driven by the UK (+29% to 82,000

MT), Belgium (+52% to 30,300 MT), and Germany

(+24% to 11,000 MT). These gains offset a decline in

imports in the Netherlands (-29% to 16,400 MT) and

France (-20% to 10,300 MT).

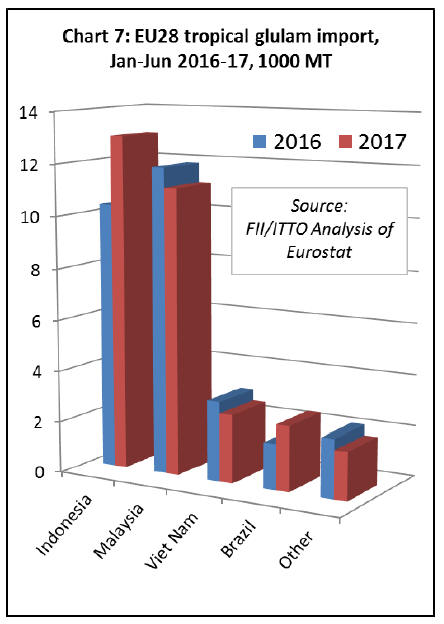

Tropical glulam

EU imports of glulam from tropical countries increased

6% to 31,200 MT in the first six months of 2017. ¡®Glulam¡¯

here refers to all those products listed in code 44189910 of

the EU Combined Nomenclature and, with respect to

imports from tropical countries, includes mainly laminated

window scantlings and kitchen tops.

In the first half of 2017, EU imports of glulam from

Indonesia increased 26% to 13,000 MT. There was also a

42% increase in imports from Brazil, to 2,500 MT. In

contrast, imports fell 6% to 11,100 MT from Malaysia,

and were down 14% to 2,700 MT from Vietnam. (Chart

7).

From a FLEGT licensing perspective, there was an

encouraging increase in Indonesia¡¯s share of the EU

market for tropical glulam, from 35% last year to 42% in

the first half of this year.

The quantity of glulam and other engineered wood

products supplied by tropical countries into the EU is still

very modest.

There are also significant challenges for tropical suppliers

in this market ¨C notably intense competition from

European manufacturers and the requirement for often

complex technical standards. This is particularly true of

structural glulam products, none of which are currently

imported from the tropics.

However, demand for glulam and other engineered wood

products is rising in the EU and there may be a larger role

for tropical countries in this sector in the future,

particularly as it provides opportunities to add value to

smaller and lower grade wood material.

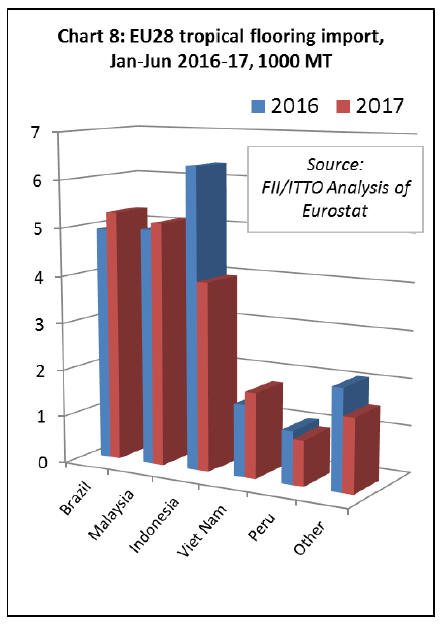

Another fall in EU imports of tropical hardwood

flooring

EU imports of tropical flooring products fell 11% to

18,700 MT in the first half of 2017, continuing a longterm

decline. Imports from Indonesia, the largest supplier

in 2016, declined 37% to 4,000 MT. This fall was only

partly offset by minor gains in imports from Brazil (+7%

to 5,300 MT), Malaysia (+3% to 5,100 MT), and Viet

Nam (+18% to 1,800 MT). (Chart 8).

Tropical wood flooring remains out of fashion in the EU

market which has become increasingly dominated by oak

and domestic European manufacturers. Share also

continues to be lost to a wide variety of non-wood

substitutes.

|