2. GHANA

Manufacturing sector – fastest growth in 5 years

Data released by the Ghana Statistical Service is showing

that the manufacturing sector in Ghana is beginning to

recover. An almost 7% increase in output was recorded for

the second quarter of this year, an improvement on the

5.9% growth in the first quarter and the highest quarterly

growth in 5 years.

As previously reported, the manufacturing sector has

suffered in recent years from the energy crisis, the high

cost of power and high taxes. The timber industry has an

additional worry in that log raw materials are in scarce

supply which the government is addressing with extensive

reforestation and afforestation efforts.

Recovering degradation in savannah forests

The Forestry Commission (FC) of Ghana is partnering

with the United Nations Development Programme

(UNDP), to develop the country’s second REDD+

programme, which is focused on reducing deforestation

and forest degradation in savannah forests.

Addressing the 2nd National REDD+ Forum under the

theme “Strengthening Law Enforcement for Effective

REDD+ Implementation”, and organised by the Ministry

of Lands and Natural Resources and the Forestry

Commission, the Ghana President, Nana Addo Dankwa

Akufo-Addo, said efforts to stop deforestation and forest

degradation in Ghana has his government’s full support.

The President tasked the FC with strengthening its law

enforcement measures to curb illegal logging, mining and

unsustainable harvesting of forest products. He also said

law enforcement agencies need to collaborate closely with

the FC and the Ministry of Lands and Natural Resources

to enforce the laws that govern the management of the

countries natural resources.

New tree seed centre

The Ghana media is reporting that, to support efforts in

reforestation and afforestation, a national tree seed centre

has been established through joint efforts of the Ministry

of Lands and Natural Resources and the Forestry Research

Institute of Ghana (FORIG).

The new Minister for Lands and Natural Resources, said

the Centre will be the cornerstone of efforts to revive the

health of Ghana’s forests. The Minister indicated that the

Forestry Commission required about 13 million seedlings

to meet its needs for the national plantation development

programme and it was to meet this demand that the Centre

was established.

For more see:

https://www.businessghana.com/site/news/general/154029/FORI

G-gets-national-tree-seed-centre

3.

SOUTH AFRICA

Evaporating confidence

Analysts write ‘the market is still weak and confidence,

what little remained, is evaporating fast”. On the political

front there is turmoil with the President having shuffled

the Cabinet. Despite the uncertainty the Rand has been

reasonably steady against major currencies which suggests

the uncertainty has already been factored in.

In addition to the political uncertainty, major storms have

lashed both Johannesburg and Durban, the latter being so

bad hit there was extensive damage to the port which had

cease operations for a few days. News reports say three

ships ran aground, equipment was lost and some piers are

still not accessible.

Despite the gloom, recent data from Statistics

South Africa

point to expanded GDP in the second quarter of this year,

which if confirmed, would mean the economy moved out

of recession. Analysts say the growth was driven higher

output from the agriculture sector.

While the overall economy showed signs of growth,

capital investment was reported as haven fallen.

Unsurprisingly, most indicators have been driven down by

the decline in residential construction.

No end of year boost to construction

The final quarter of the year is usually the busiest time of

the year in the building sector but pine mills continue to

build up stocks in the face of weak sales. The extent of

price discounting by pine mills is not yet undermining the

market but if the current market conditions continue into

the New Year competition for sales will become intense.

Many pine mills are feeling the strain of the last round of

log price increases set by the South African Forestry

Company (SAFCOL). In addition, there have been reports

of labour unrest affecting a few mills. Against this

backdrop some owners are talking of ceasing operations

until the market conditions improve.

The woodbased panel market is facing the same market

constraints as affecting pine sawmillers but panel

producers have benefitted from buyers switching from

solid wood to panels in an effort to cut costs.

Hardwood markets kept alive by demand for US timber

In contrast demand for American hardwoods remains are

steady driven by interest in white oak, ash and walnut.

High end furniture manufacturers seem to have enough

work for the time being.

Over the past few weeks traders report some improved

activity in the meranti market but this comes at a time

when consumption had fallen very low so all that can be

said is that there has been a modest recovery. A similar

change has been seen in the iroko market.

As buyers look to cut costs demand for Saligna

(eucalyptus) has also perked up especially as an alternative

to native hardwoods.

Wood in the home and everyday life – a call for

promotion

October saw the conclusion of the “Forestry

Industrialisation Conference” attended by the then Deputy

Minister of Agriculture, Forestry and Fisheries, Bheki

Cele, Mr Dikobe Martins, Deputy Minister of Public

Enterprises, Mr Bulelani Magwanishe, Deputy Minister of

Trade and Industry, as well as many captains of industry.

In an editorial in Sawmilling South Africa, Roy Southey

writes “A unanimous realisation coming out of the

conference was the need for the total South African

forestry sector to work together in promoting the virtues of

our sector, from the growing of trees to the use of timber

and timber derived products in the building of our homes

and everyday lives”.

WoodEX for Africa, July next year

WoodEX for Africa, the largest trade exhibition in Africa

dedicated exclusively to the timber trade, is scheduled for

July 2018. This event offers a unique business and

networking platform to connect, unify and grow the

African timber, tooling and machinery markets.

According to Stephan Jooste, WoodEX for Africa

Director, "The previous fourth edition of WoodEX for

Africa was very well supported by both local and

international exhibitors and visitors alike.

WoodEX for Africa 2018 will showcase innovative timber

and woodworking products and services, such as

woodworking machinery, fixtures and fittings, decking,

flooring, structural timber, timber preservatives and

treatment, sawmilling and logging, pulp and paper

manufacturing, and wood material and veneer production.

See:http://www.timber.co.za/news/article/dates-set-for-woodexfor-

africa-2018

4.

MALAYSIA

Revision of Malaysian timber

standard

Discussions are underway to revise the Malaysian Timber

Standard MS 1401, which describes the grading

requirements for dressed timber, door jambs and

mouldings manufactured from tropical hardwoods and

plantation timbers, MS 1401 was first published in 1996.

The Malaysian Timber Industry Board (MTIB) was

appointed the Standards Development Agency (SDA) for

timber in 2013. An SDA is responsible for the

management as well as the development of standards.

Part of the review process involves public comment, an

important stage in the Malaysian Standard (MS)

development process and a recent consultation was held

with the industry on the new draft MS 1401 “Specification

for Dressed Timber Door Jambs and General Mouldings”.

The purpose of the consultation was to update the timber

industry and stakeholders on the progress of the MS 1401

revision, to obtain feedback and comments on the

proposed changes made to MS 1401. The consultation

provided an opportunity for the industry to share views

related to the development of the standard.

Certified timber at the core of green cities

The Malaysian Timber Certification Council (MTCC)

took part in the recent International Greentech & Eco

Products Exhibition and Conference Malaysia (IGEM)

2017.

MTCC advocated the utilisation of timber certified under

the national certification scheme as a strategic move to

promote the building of greener cities in Malaysia.

MTCC CEO, Yong Teng Koon, said “The call for greener

cities is more than ever crucial with over half of the

world’s population living in cities today.

As we strive to transform our cities into modern,

sustainable living spaces, we must ensure that the

development process, among others, embraces the use of

sustainable materials at its core.

Green cities are about building and living in a sustainable

manner, which includes the use of sustainable material in

our everyday lives and the national certification scheme

empowers specifiers, companies and individuals to do

their part in achieving this. Yong also urged consumers to

join in this endeavour by consciously choosing certified

timber products”.

Firm demand for plywood

Recent reports say the supply of tropical plywood from

both Malaysia and Indonesia is tight in the Japanese

market. This is due mainly to the end of year wet season

when heavy rains cause delays in log supply.

Transportation of logs to the mills is a problem at present

so plywood mills are working with very low log

inventories. This situation will probably improve towards

year end.

According to Ta Ann, a leading Malaysian plywood

manufacturer and exporter based in Sarawak, the price of

its plywood products increased by about US$25 per cu. m

in first half-2017 and with improving demand further price

rises are anticipated.

Sarawak log production

Sarawak’s log production in first half-2017 was around

3.75 million cu.m, out of which 2.94 million cu.m was

from natural forests and 808,000 cu.m from plantations.

According to the Japan Lumber Reports, Sarawak’s

harvest of planted timber could be around 1.6 million cu.m

this year some 300,000 cu.m more than in 2016.

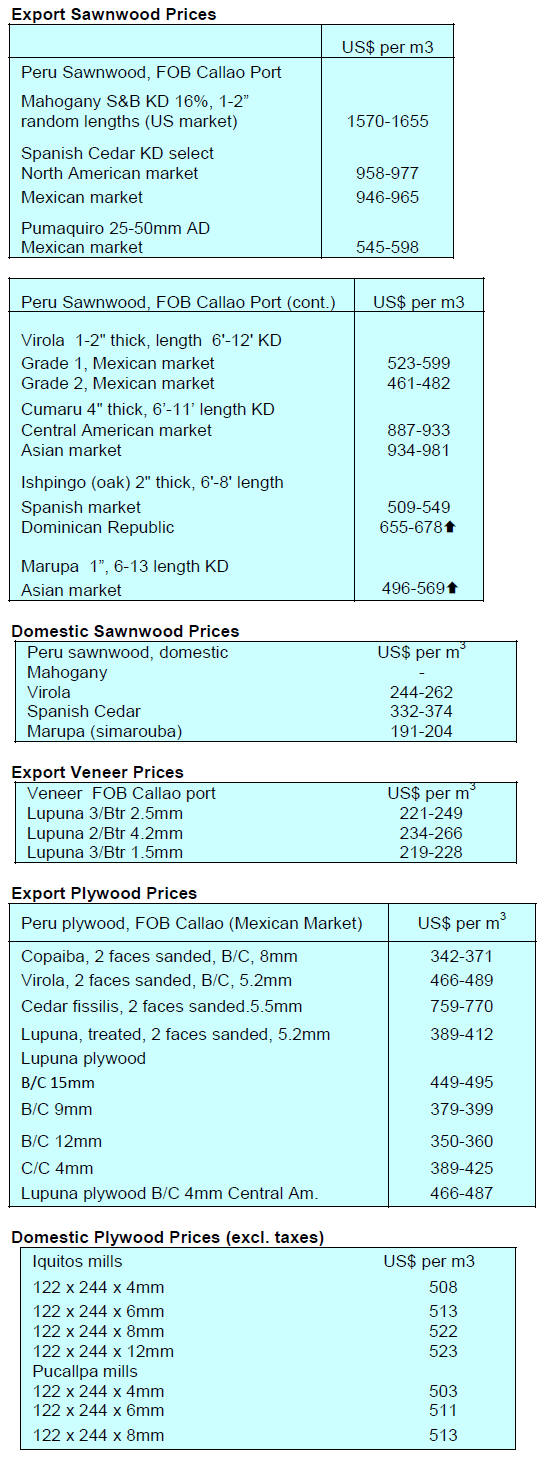

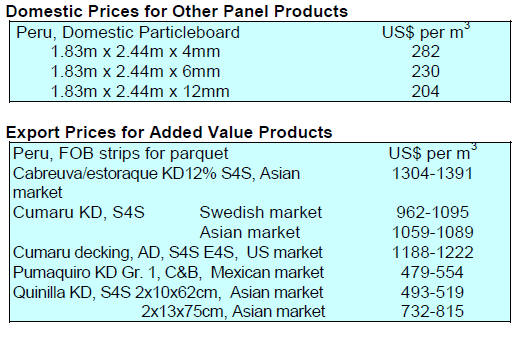

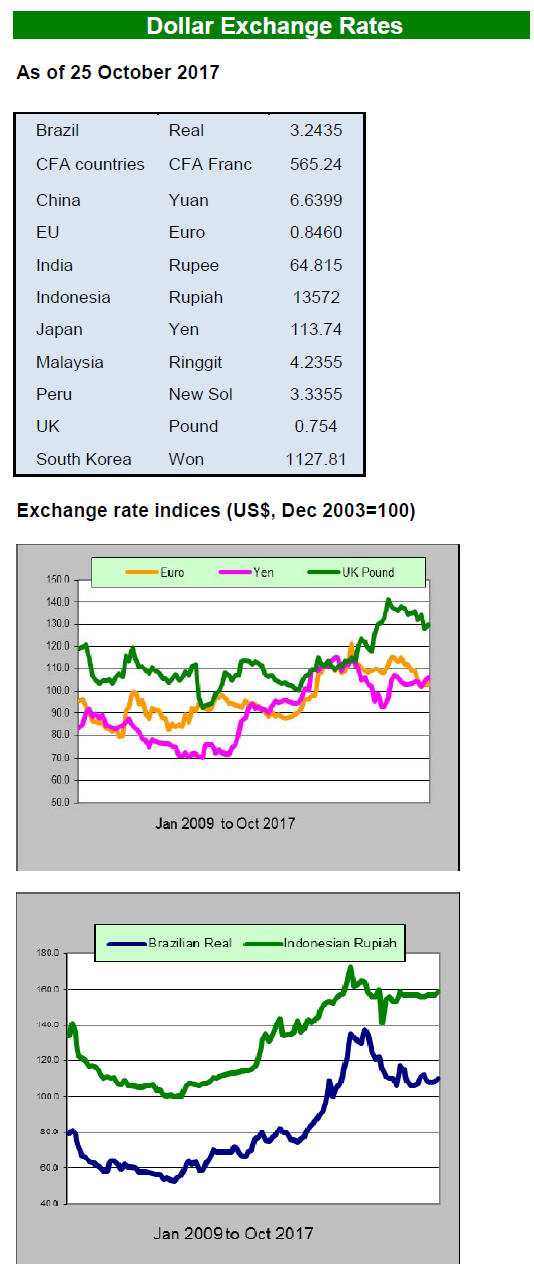

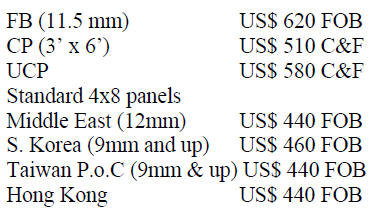

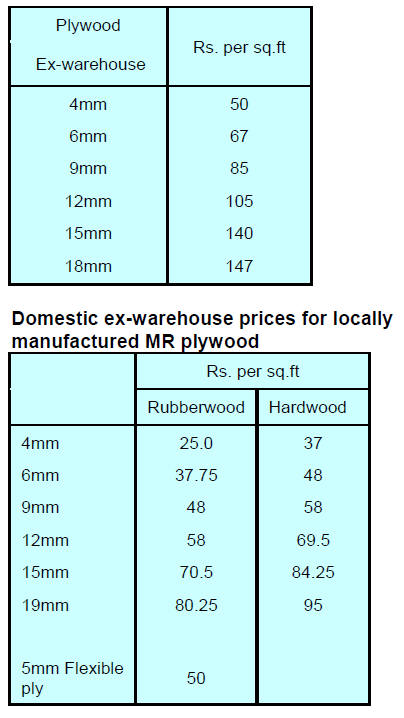

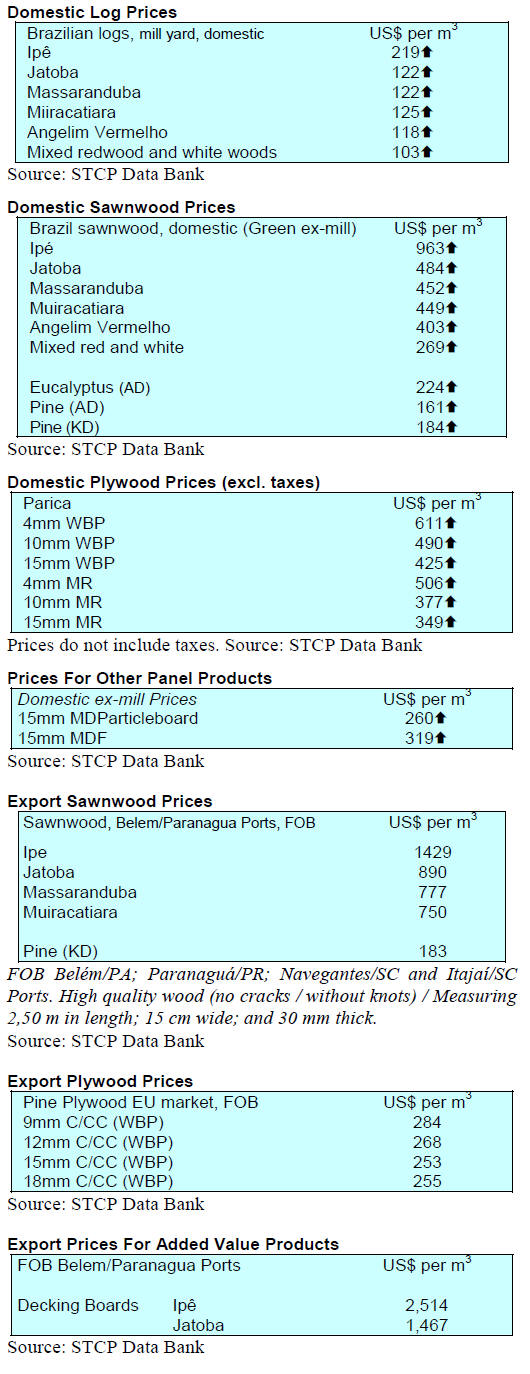

Plywood price update

Plywood traders based in Sarawak reported the following

export prices:

5. INDONESIA

Centre of excellence in wood processing

The Ministry of Industry is claiming some of the credit for

the establishment of a new training facility, the

Polytechnic for the Furniture and Wood Processing

Industries, built in an industrial estate in Kendal, Central

Java.

Analysts write this new development has been designed to

become a centre of excellence in technological innovation

and product development for the wooden furniture and

wood processing industry in the country.

In a press release the Secretary General in the Ministry of

Industry, Haris Munandar, said the Polytechnic will

deliver training on best practices for the sector through

high level vocational education that was initiated by the

Ministry and will create a link between academics and

industry.

Wood must have a great role in housing policy

An urban planning expert from Trisakti University, a

private university in Jakarta, Nirwono Joga, has called for

wood science and technology to be given a place in the

country’s housing policy.

The core of his argument was that wood has many

advantages over other building materials and home

construction costs are lower with wood components, many

of which can be fabricated off-site.

He called on the authorities to help develop the full

potential of wood in domestic housing, saying that a

review of some regulations may be necessary to encourage

more wood use in construction.

Chinese rattan furniture makers eye move to Indonesia

The future of the rattan craft industry in Cirebon, West

Java, is threatened according to Zaenal Arifin from the

Advisory Council of the Indonesian Furniture and Craft

Association (HIMKI).

It has been reported that a number of enterprises have had

to suspend production and decline orders from overseas

buyers because they were unable to secure raw rattan that

comes from Kalimantan, Sulawesi and Sumatra.

Rattan furniture is popular in China and with Indonesia

being the main source of raw rattan the restrictions on raw

rattan exports has worried Chinese rattan enterprises

prompting them to consider shifting production to

Indonesia.

The Indonesian and Chinese governments have been

exploring the feasibility inviting Chinese companies to

locate to Indonesia. Cirebon is known as the centre of the

rattan furniture industry in Indonesia and would be an

obvious place for foreign enterprises to establish

production capacity.

Major wood products producer to expand

A press release from Indonesia Investments has reported

that one of Indonesia's biggest vertically integrated

wooden product manufacturers, Integra Indocabinet, is

planning to expand production using some of the US$24

million derived from its recent initial public offering on

the Indonesia Stock Exchange.

Integra Indocabinet produces indoor and outdoor furniture

as well as wooden doors, wooden window frames and

other wooden and rattan-based products. During the first

half of 2017, around 80% of production was exported.

See: https://www.indonesia-investments.com/business/businesscolumns/

indonesian-wood-furniture-firms-in-focus-integraindocabinet/

item8303

6. MYANMAR

Calls for comprehensive assessment of

harvesting in

Myanmar

Analysts report that representatives of the Myanma

Timber Enterprise (MTE) recently held informal

discussions with representatives of its longtime critic the

Environmental Investigation Agency (EIA).

A report distributed by the EIA earlier this year led the

several authorities in EU responsible for enforcing the

EUTR to call for severe restrictions on timber imports

from Myanmar.

In Denmark action was taken against importers of teak and

in the Netherlands punitive measures were taken against

two companies which placed teak from Myanmar on the

European market.

In both cases it appears that the basis for action in

Denmark and the Netherlands was the EIA report on

Myanmar’s logging.

Barber Cho, Secretary of Myanmar Forest Certification

Committee has expressed disappointment that authorities

in the EU would base their decisions on just one

assessment and has called for more comprehensive and

realistic approach to assessing conditions in Myanmar.

He said “there are a lot of lessons we could take from EIA

reports which are professionally compiled but cannot be

regarded as the sole guide to judge the legality of

Myanmar Timber”.

Cho continued saying the timber industry in Myanmar is

striving to get all stakeholders in the forestry sector to act

responsibly and that such punitive measure as introduced

in some EU member states are uncalled for and

counterproductive as such action could undermine

ongoing efforts to negotiate a VPA with the EU. As yet

there has been no word on the outcome of the meeting

between the MTE and the EIA.

Property tax for investors in industrial zones

Foreign investors who use plots in industrial zones are

required to pay property tax according to Kyaw Zeya,

Secretary of the Yangon Regional Finance, Planning and

Economic Committee.

The issue of land is complicated in Myanmar. Six different

government authorities are tasked with handling land

management and there are many classification of land in

the country which complicates the issue of assigning

industrial plots.

Of concern to potential investors is that Myanmar’s land

rental price are the highest in ASEAN countries. Some

foreign investors attracted by the new investment law

hesitate because of the confusion over land issues even in

industrial zones. Nine MPs have debated a proposal for the

government to free-up idle state-owned lands and

buildings in Yangon region.

World Bank – Myanmar needs to better

communicate

progress with reforms

Despite some risks especially those related to the ongoing

conflict in Rakhine state, Myanmar’s economy is expected

to recover this year, with growth rising from 5.9% in 2016

to 6.4% this year.

Public and private investments in infrastructure such as

power and transportation are projected to pick up and

inflation is expected to ease according to a press release on

the October 2017 edition of the Myanmar Economic

Monitor.

This report says that despite notable reforms, strong

foreign investment a commitment to further reforms is

needed. The the report also suggests Myanmar build on

(and better communicate) important reforms already

underway. For instance the efforts to provide access to

finance, electricity and land, friendly business regulations

and labour force skills, all of which will boost investor

confidence should be promoted.

For more see

http://www.worldbank.org/en/news/pressrelease/

2017/10/04/myanmars-economy-is-projected-to-pick-upamid-

downside-risks

7. INDIA

Dip in inflation prompts calls for rate

cut

India’s official wholesale price index for all commodities

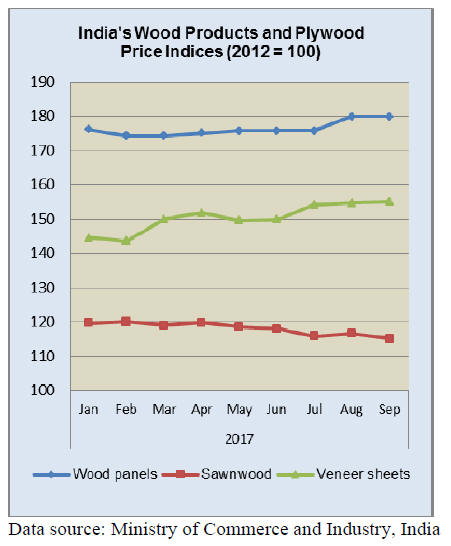

(Base: 2011-12=100) for September 2017 released by the

Office of the Economic Adviser to the government (OEA)

declined to 114.3 from 114.8 for the previous month rose

by 0.8% to 114.8 from 113.9 in July.

The annual rate of inflation, based on monthly WPI, stood

at 2.6% (provisional) for September 2017 compared to

3.24% for the previous month.

Inflation for this financial year so far was 0.97% compared

to a rate of 3.44% in the corresponding period last year.

The decline in food prices was the foundation for the

decline in inflation. The fall in annualised inflation has

prompted the Confederation of Indian Industry to seek an

interest rate cut.

The September wholesale price index for wood products

and plywood rose to 132.4 from 132.1 for the previous

month due to higher price of plywood and sawnwood.

The press release can be found at:

http://eaindustry.nic.in/cmonthly.pdf

Action to reverse economic slowdown

The Chairman of the Indian Prime Minister's Economic

Advisory Council (PMEAC) has acknowledged the

slowdown in economic activity and said his group will

develop plans that can accelerate growth and employment.

The PMEAC has urged the government to continue with

its policy of fiscal consolidation but avoid the temptation

of a fiscal stimulus package.

The PMEAC has identified priority areas for accelerating

growth including job creation, informal sector integration,

fiscal framework, monetary policy, public expenditure,

agriculture and animal husbandry.

For more see:;http://www.thehindu.com/news/national/pmsadvisory-

committee-acknowledgesslowdown/

article19840741.ece

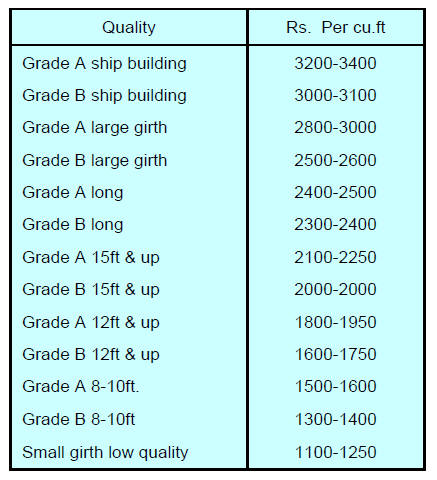

Auctions in Western Indian forest depots

Auctions at various forest depots in the Surat and Vyara

Division of the Dangs forests have just ended.

Approximately 6,000 cubic metres mainly teak was

offered for sale. Other timbers included Adina cordifolia,

Gmelina arborea, Pterocarpus marsupium, Acacia catechu

and Mitragyna parviflora.

At the Surat and Vyara Division auction good quality

nonteak

hardwood log prices remained firm.

First quality logs of 3 to 4m length with girths of 91 cm &

up of haldu (Adina cordifolia), laurel (Terminalia

tomentosa), kalam (Mitragyna parviflora) and Pterocarpus

marsupium attracted prices from Rs.800 to 900 per cu.ft.

Second quality logs were sold at between s.600 and 700

per cu.ft and the lowest quality logs went for between

Rs.250 to Rs.350 per cu.ft.

Century Ply continues to invest in processing capacity

The Indian construction sector WFM Construction

Industry Market Place website has reported that Century

Plyboards is planning to set up a door manufacturing unit

in collaboration with a Chinese Company.

Century Ply is also close to completing its MDF

plant in

Hoshiarpur in Punjab which will have the capacity to

produce almost 200,000 cubic metres annually making it

one of the largest MDF plants in the country.

For more see:

https://www.wfm.co.in/century-ply-setup-doorunit/

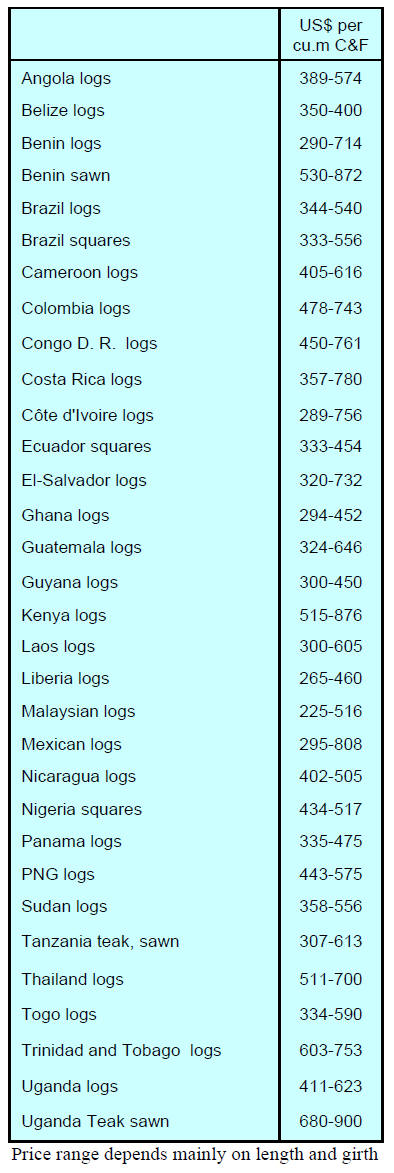

Imported plantation teak

Demand for imported logs remains steady and supplies are

reported as adequate say traders. In the absence of a

decision on the GST from the GST Council no prices

movements have been reported.

Locally sawn hardwood prices

Prices for imported hardwoods remain unchanged. Traders

report demand is slow which does not allow for any price

increases.

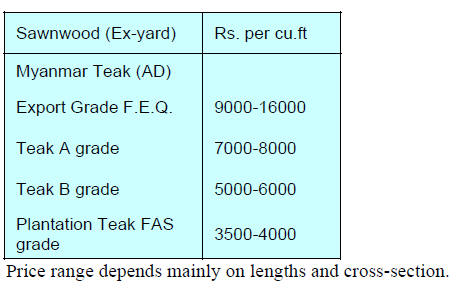

Myanmar teak prices

The arrivals of sawn Myanmar teak are adequate to meet

the slightly lower demand say traders. Due to weaker local

sales the price for some grades has been reduced to

stimulate sales.

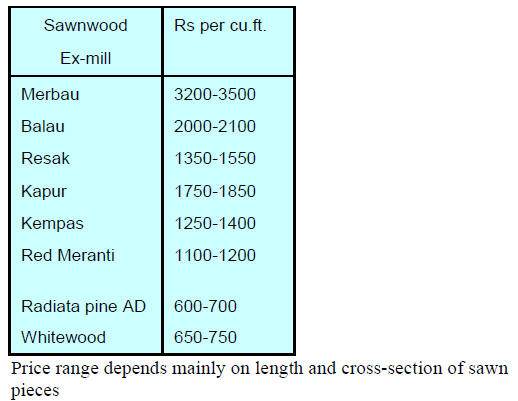

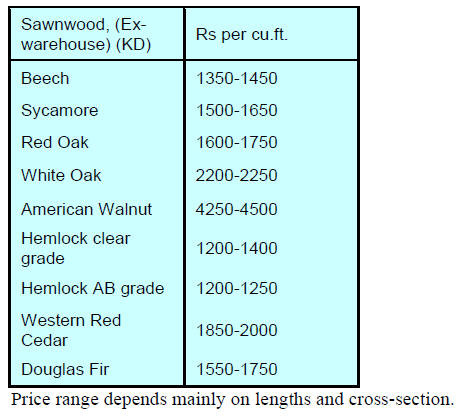

Prices for imported sawnwood

Prices for imported sawnwood (KD 12%) remain

unchanged.

Prices for WBP marine grade manufactured by

domestic mills

The slow housing market and the expansion of domestic

plywood production has put a downward pressure on

plywood prices.

8. BRAZIL

Impact of changing US tariffs discussed

During a recent joint-meeting of the Brazilian Association

of Mechanically-Processed Timber Industry (ABIMCI)

and the Paraná State Federation System of Industries

(FIEP) timber industry entrepreneurs discussed the

dynamics of the Brazilian timber sector.

The main issues discussed revolved around market

opportunities and hurdles created by exchange rate

fluctuations, logistics and tariffs on manufactured goods

especially those in the US market.

On exchange rates, specialists forecast that the BRL/US$

rate will remain around BRL 3.10/US$ this year with a

projected slight strengthening in 2018.

FIEP, with support of other institutions (including

ABIMCI), has been working on an investment plan for

logistics, infrastructure and new investments in ports and

railways that can improve the profile and performance of

enterprises in the southern state of Paraná.

The plan aims at reducing logistics costs and guaranteeing

energy supplies.

During the meeting the status of the US tariffs on Chinese

plywood exporters was discussed as was the likely

outcome of the negotiations on a revised North American

Free Trade Agreement.

It was noted that, at present, Canada supplies around 90%

of the sawnwood consumed in the US and that any change

to import tariff on Canadian sawnwood and plywood will

need to be carefully monitored.

Production of native timber declines

According to data from the Brazilian Institute of

Geography and Statistics (IBGE), production of native

timber fell almost 10% in 2016 compared to a year earlier.

The figure quoted by IBGE included production of

firewood for charcoal, fuelwood and industrial logs.

Extraction of hardwood logs from natural forests fell by

7% in 2016 compared to 2015 from 12.3 million cu.m to

11.5million cu.m. The northern Brazilian states of

Rondônia and Pará reported the most significant declines

in native timber production, dropping 23% and 21%

respectively.

On the other hand, production of native timber in the westcentral

state of Mato Grosso rose 8% last year to 3.3

million cu.m compared to 2015 when 3.1 million cu.m

were produced. However, despite the increased production

in Mato Grosso, national production declined.

Production of logs for charcoal from natural forests also

dropped 32% in the same period, from 797,000 cu.m

(2015) to 544,500 cu.m (2016). Extraction of native timber

fuelwood also fell 7%, from 27.0 million cu.m to 25.0

million cu.m.

Analysts comment that the decline in production from

natural forests is most likely the result of the recently

enacted environmental legislation and stronger

enforcement as well as the unavailability of labour in

remote areas.

Export roundup

In September 2017, Brazilian exports of wood-based

products (except pulp and paper) increased 25.0% in value

compared to September 2016, from US$201.2 million to

US$251.5 million.

Pine sawnwood exports in value increased 19% from

September 2016 (US$ 35.3 million) and September 2017

(US$ 41.9 million). In volume terms, exports rose 12%

over the same period from 181,100 cu.m to 202,500 cu.m.

Tropical sawnwood exports expanded 41% in September

2017 from 30,200 cu.m in September 2016 to 42,500 cu.m

this year. The value of September tropical sawnwood

exports jumped 38% from US$14.1 million to US$ 19.5

million this year. The good news continued with the value

of pine plywood exports which expanded 36% in

September 2017 from US$ 35.8 million a year earlier to

US$ 48.7 million this September. In volume terms

September 2017 exports were up 24%.

As for tropical plywood, Brazilian exports were 23.5%

higher in volume and 17% higher in value, from 13,200

cu.m (US$ 5.4 million) in September 2016 to 16,300 cu.m

(US$ 6.3 million) in September 2017.

Exports of wooden furniture from Brazil increased from

US$ 35.7 million in September 2016 to US$ 40.4 million

in September 2017, a 13% increase.

Strengthen forest industries to meet GGE goals

The Mato Grosso Timber Production and Export

Industries Center (Cipem), a union of eight forest-based

employers' unions, has said strengthening the Brazilian

forest-based industry will help the country to fulfill the

commitment made with the Paris Agreement.

Brazil committed to reduce its greenhouse gas emissions

(GGE) by 2025 and one measures proposed to achieve this

goal is the restoration and reforestation of 12 million

hectares by 2030.

For this to be achieved it will be necessary to enlist the full

support of private forestry sector.

A greater utilisation of wood in construction could

contribute to reducing GGE by the construction sector.

Some environmental agencies have been working in

partnership to show the benefits and opportunities from

using wood in architectural projects through adapting

technologies already used in other countries.

The Brazilian Tree Industry (IBÁ) has reported that forest

plantations in Brazil are able to store nearly 1.7 billion

ton/year of carbon dioxide.

Climate Fund - cash to reward declines in

deforestation

It has been reported that the Green Climate Fund (GFC)

approved a US$500 million package of support for

developing countries that prove reduction in deforestation

by 2022. Brazil is seeking around US$150 million for its

efforts in reducing deforestation in the Amazon and in the

Cerrado (Brazilian savannah) ecosystems between 2014

and 2018.

The GFC package offers US$5 per tonne of reduced

carbon which is a good opportunity for countries with

large forest areas and a high potential to reduce carbon

emissions through avoiding deforestation.

9.

PERU

SERFOR and Ucayali government

cooperation

In order to further develop strategies to strengthen forestry

and wildlife management the National Forestry and

Wildlife Service (Serfor) and the Regional Government of

Ucayali signed an inter-institutional support agreement.

The Executive Director of Serfor, John Leigh and the

General Manager of the Regional Government of Ucayali,

Luis Briceño, inked the agreement which consolidates

actions for the benefit of Amazon.

Leigh stressed that this was the first agreement by Serfor

with a regional government to whose authority for forest

and wildlife management has been expanded.

As part of the agreement Serfor will have a liaison office

in the headquarters of the regional government of Ucayali

and will be provided with basic services to facilitate

coordination and implementation of work. This agreement

runs for two years with the option for extension.

ITTC in the national interest say President

The President of the Republic, Pedro Pablo Kuczynski,

said that the upcoming international tropical timber event

to be held in Lima is of national interest.

Through Supreme Decree No. 012-2017 MINAGRI the

Peruvian State declared the Fifty-third Session of the

International Tropical Timber Council (ITTC) to be held

in in Lima is in the national interest. Peru will host the

ITTC in Lima from November 27 to December 2, 2017.

Regional forestry and wildlife monitoring board

In order to coordinate joint action a Regional Forestry and

Wildlife Control and Surveillance Bureau (MRCVFFS)

has been established in Ucayali. The new bureau brings

together participation of the Regional Government and ten

public institutions responsible for sector issues.

The Executive Director of Serfor said that this initiative

has the backing of the National Forest and Wildlife

Control and Surveillance System (SNCVFFS) as there will

be cooperation and joint work utilising up-to-date

technologies and surveillance methods to strengthen the

capacity to eliminate deforestation, illegal logging and

trafficking in wildlife and timber.

At next meeting is scheduled for the second half of

November when the Bureau will seek to identify

additional stakeholders from the public sector and civil

society that are allied to forest control and monitoring

activities.

The SNCVFFS, led by Serfor. works with the Satellite

Monitoring Unit in order to issue alerts on land use

change.