Japan

Wood Products Prices

Dollar Exchange Rates of 10th

November

2017

Japan Yen 113.54

Reports From Japan

Consumer confidence mirrors

Bank of Japan

assessment of prospects

The Bank of Japan (BoJ) monetary policy board meeting

in early November concluded that the economy continues

to proceed at an acceptable pace, but warned of downside

risks to growth from unpredictability in US economic

policies as well as uncertainty caused by the UK's

withdrawal from the EU.

The BoJ said inflation is expected to continue to rise

moderately adding that the Bank will continue its stimulus

as long as necessary. The BoJ board also decided to retain

the -0.1% interest rate on current accounts that financial

institutions maintain at the Bank.

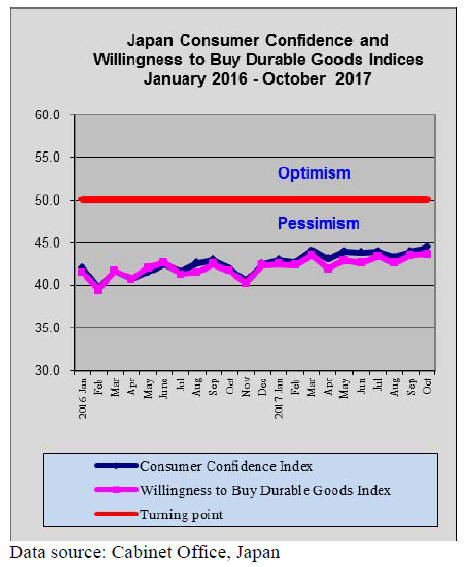

As if mirroring sentiment of the BoJ, Cabinet Office

data

shows that consumer confidence improved in October

rising to the highest level in four years. The index for

overall livelihood rose to 43.5 in October from 42.5 in

September while consumer views on likely income growth

also improved lifting the income growth index higher.

The assessment of willingness to buy durable goods

such

as wooden furniture and other household items rose

slightly.

BoJ and US Fed on a vastly different track

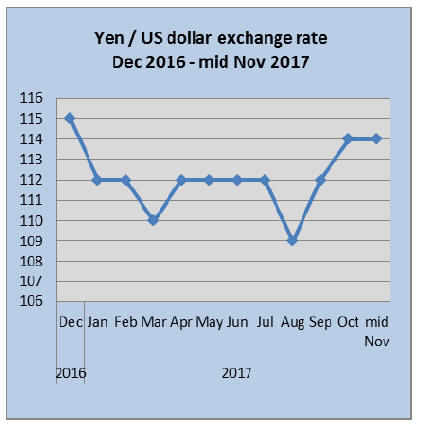

The Japanese Yen began November a little higher than

reported for October but weakened again against the US

dollar on news that the BoJ decided to maintain its current

monetary policy.

The US dollar was trading at 114.7 yen early in

November, its highest since January but soon eased back

to 114.0 to the US dollar. The US Federal Reserve and the

BoJ are on a very different track in terms of monetary

policy with the US likely to raise interest rates again in the

short term while the BoJ is sticking to its easy monetary

policy.

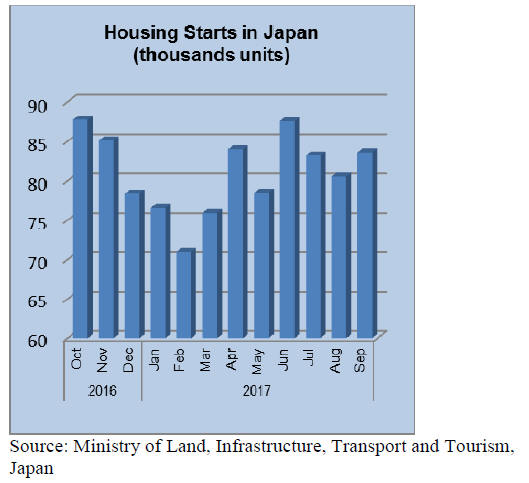

Banks pulling out of housing loan business

Year on year, September housing starts in Japan dropped

3% the third consecutive year on year fall. Data from the

Ministry of Land, Infrastructure, Transport and Tourism

shows that the decline was largely due to a drop in starts

of houses for rent, including apartments.

Early in the year cash flowed into the housing market in

response to changes in Japan¡¯s inheritance laws but that

now seems to have run its course. In September

construction orders received by the largest 50 builders fell

sharply.

The uncertain housing market and the BoJ stance on

interest rates has un-nerved two of Japan¡¯s biggest housing

loan providers.

Media report say Mitsubishi UFJ Trust and Banking will

stop offering housing loans next year as the declining

profitability of its housing loan business because of

Japan¡¯s negative interest rate policy.

Mizuho Financial Group is also reportedly ready to follow

suit and end its housing loan business in some regions next

year.

In an effort to sustain business some of the larger

builders

are looking beyond Japan. It has been reported that

Sumitomo is exploring opportunities to market family

homes in Indonesia where there is a rapidly growing

affluent middleclass.

Import round-up

Doors

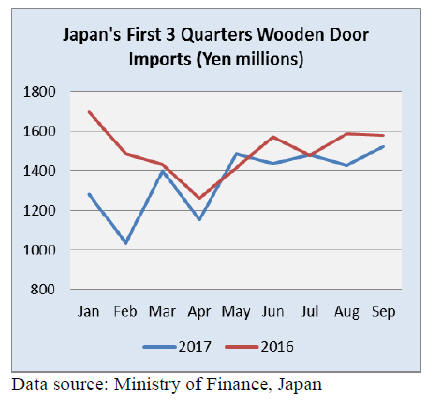

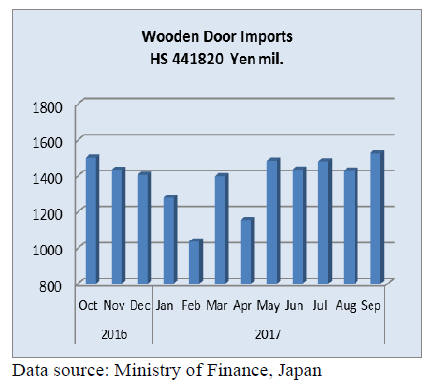

Japan¡¯s 2017 first three quarter imports of wooden doors

(HS441820) were down 9.5% year on year. First quarter

2017 imports crashed after the 2016 year end surge but

recovered steadily throughout 2017 apart from the dip in

the value of imports in April.

Year on year, September imports of wooden doors were

flat but compared to a month earlier there was a 6.5% rise

recorded in September.

Almost 90% of Japan¡¯s wooden door imports in

September 2017 were derived from three sources, China

(61%), the Philippines (18%) and Indonesia (9%).

Windows

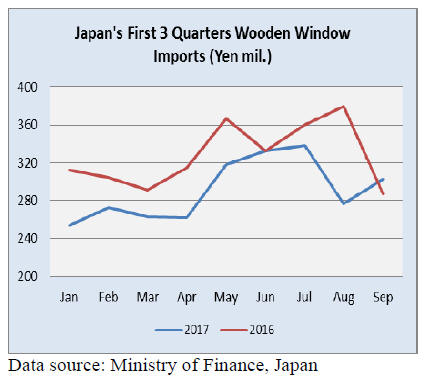

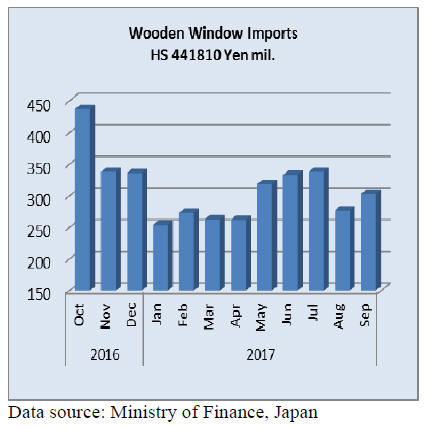

The trend in Japan¡¯s imports of wooden windows (HS

441810) in the first three quarters of 2016 and 2017 was

quite different and overall, the value of imports for the

first nine months of 2017 was down 11% from a year

earlier.

A rise in the value of wooden window imports in

September 2017 reversed the decline recorded in August.

Compared to a month earlier, September the value of

imports climbed 9% and year on year there was a slight

rise in the value of September imports.

Over 90% of Japan¡¯s September imports of wooden

windows were derived from three sources, China (31%),

The US (31%) and the Philippines (23%).

Assembled flooring

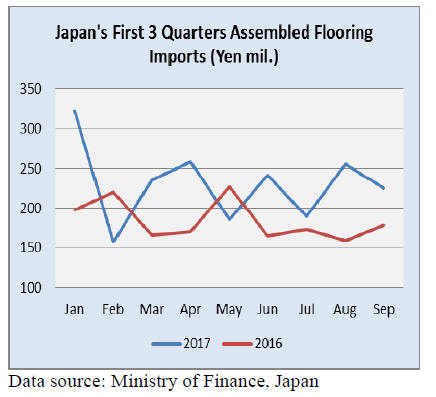

While February 2017 wooden flooring (HS 441871-79)

imports marked a low point in the first three quarters of

2017 there was a recovery such that for the three quarters

as a whole the value of imports increased almost 25%

compared to the same period in 2016.

In contrast to the monthly trend in imports in 2016 those

for the first three quarters of 2017 became much more

erratic with regular, periodic dips and peaks.

The value of September 2017 imports of wooden

flooring

wase up 26% from levels in September 2016 but dipped

when compared to a August imports(-12%).

For September 2107 HS 441875 accounted for 70% of

Japan¡¯s assembled flooring imports followed by HS

441879 at 25%. Shippers in China dominated September

imports of HS 441875 accounting for 63% of all imports

of this category followed by Indonesia (16%) and

Malaysia (4%).

For HS 441879, the top suppliers were China (34%),

Indonesia (32%) and Thailand (14%).

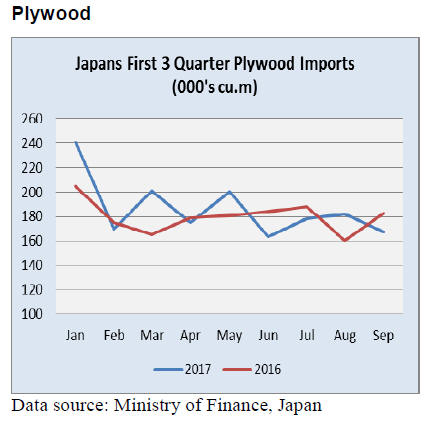

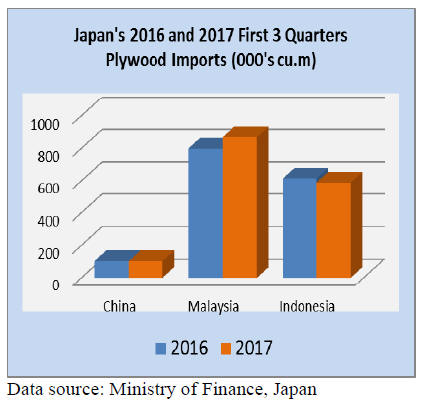

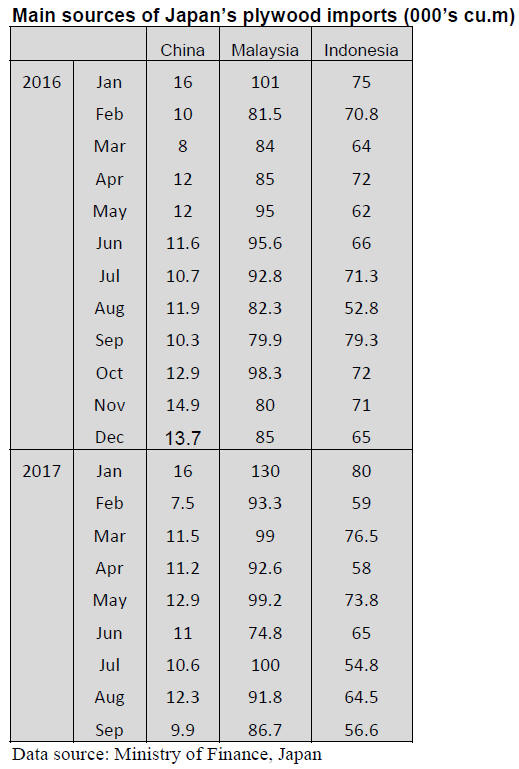

For both 2016 and 2017 the volume of plywood imports

dipped sharply early in the year but recovered slightly

from the end of the first quarter. Year on year, the volume

of plywood imports during the first nine months of 2017

were almost unchanged in comparison with 2016 despite

the rather steep peaks and dips in monthly trade.

In the first three quarters of 2017 imports from

China were

much the same as in 2016 however, imports from

Malaysia grew 9% year on year while imports from

Indonesia fell 4% year on year.

Trade news from the Japan Lumber Reports (JLR)

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

Wood products trade with EU

In last July, rough agreement was made by EPA trade

negotiation. On wood products, import duty will be

reduced step by step for next seven years and will be duty

free after eighth year on 10 items like SPF lumber,

structural laminated lumber and fiber board. Import duty

rate and imported value by items are shown in the chart. Import duty used to

be

high of 20% but now it is about 6%.

TPP (Trans Pacific Partnership) involves 12 countries

around the Pacific and it is basic rule to abolish all the

duties immediately but after the president Trump was

elected, U.S.A. decided to get out of TPP so this is deadrocked

now.

Meantime, it is significant that Japan and EU came up

with agreement since European wood products are now

major items for Japanese housing.

Demand on European lumber and laminated lumber has

been expanding largely in Japan as strength, quality and

supply capacity of European products cannot be replaced

by other sources so they surpassed share of North

American products.

It is certainly a good news that the duty will be abolished,

which reduces the cost of the products. However, it is hard

to predict how duty free will influence the market after

seven years, which is too far away to see.

European lamina is basic raw material for domestic

laminated lumber manufacturers but European suppliers

have other markets to play with while finished laminated

lumber like whitewood post and redwood beam are made

for Japan market so the suppliers have very little choice

and the prices are subject to Japanese market while lamina

has wider markets so actually the prices have kept

climbing despite considerable strong Euro.

Whitewood laminated post has competition of domestic

cedar laminated post and the same is on KD stud. Since

last summer, whitewood laminated post has not expanded

the share despite lower prices.

Redwood laminated beam has tight supply so despite

higher prices, it has been accepted in the market but the

demand for all the wood products will decrease in a long

run by decline of population in Japan so the demand for

European lumber will shrink.

Meantime, European market is active and other markets

like China continues growing so elimination of import

duty is easily wiped out by export price increase by the

suppliers and it does not help reduce the cost of import

products.

In board and plywood, OSB and particleboard are the most

influenced by the EPA.European OSB is the second

largest source of import. In 2016, total OSB import was

277,601 cbms, out of which European OSB was 90,442

cbms and Canadian OSB was 184,651 cbms, 66.5% share

in total import. Due to higher transportation cost from

Europe and strong Euro, European OSB is relatively

higher in prices compared to the Canadians.

In total import of particleboard in 2016, European PB was

168,792 cbms, 68.4% share. Majority is low melamine

decorative board.

Sawnwood exports up 60%

Export of lumber has been increasing rapidly in last two

years. For the first eight months of this year, the exported

volume is 84,370 cbms, 62.4% more than the same period

of last year. Total volume of the year will be 100,000

cbms.

This is quite progress since total lumber export volume is

about 40,000cbms in 2008 and 2009 and about

60,000cbms in 2010 and 2015. In 2016, Chinese economy

slowed down and log export slowed down but lumber

export has steadily growing.

China is the leading buyer of lumber, which is used as

lamina for laminated lumber and interior finishing then

sheathing of housing. Average unit prices are 34,000 yen

per cbm, which is not high but makes steady business.

Noticeable move is export of lumber to the U.S.A. This

year¡¯s export volume is 7,338 cbms, four times more than

the same period of last year. Average unit price is nearly

50,000 yen, much higher than the prices for China.

Lumber export for Taiwan P.o.C and Vietnam is also 30-

40% more than 2016. Lumber export to the Philippines

has been large but this is for some major Japanese house

builder¡¯s precutting business in the Philippines so that

processed lumber returns to Japan. Log export volume for

the first eight months is 677,582 cbms.

Plywood

The plywood market is generally firm. There is no tight

supply feeling but there are some delivery delays for small

precutting companies. Wholesalers, trading firms and

precutting plants are anxious to build up the inventories

toward the year end so that orders the manufacturers are

very active.

September softwood plywood production was 262,800

cbms, 4.1% more than September last year and 3.2% more

than August.

The shipment was 267,400 cbms, 4.9% more and 7.0%

more. This is the highest record of monthly shipment in

last five years.

The inventories were 105,300 cbms, 4,700 cbms less than

August. The market prices are firm and price hike by the

manufacturers are fully accepted now. The supply in the

Western Japan is much tighter in Kyushu and Osaka

region and there are delivery delays of about a month even

for direct delivery to precutting plants.

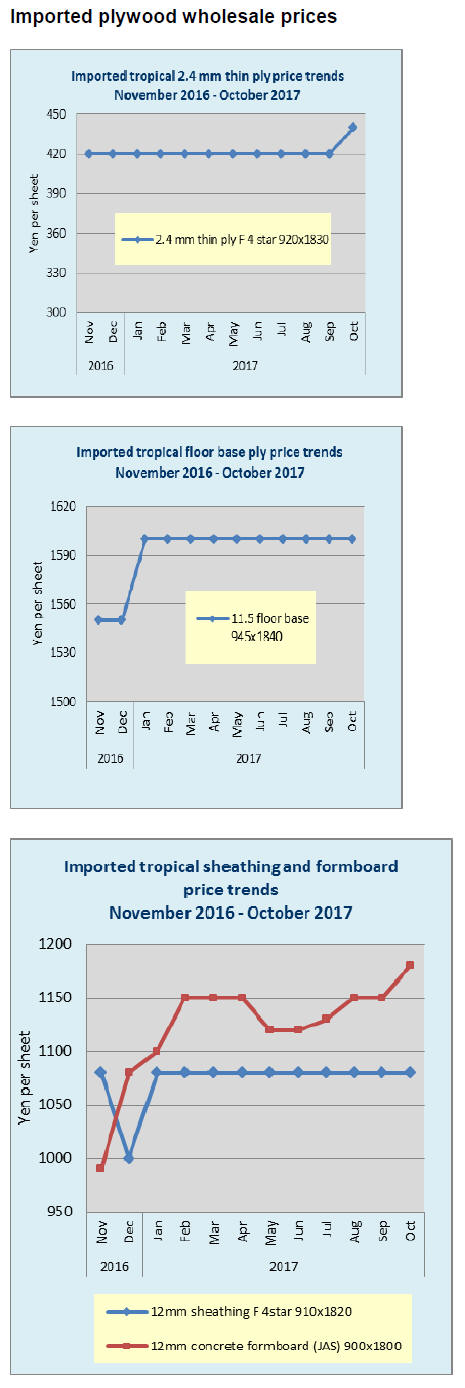

The market of imported plywood is getting firm on all the

products. Coated concrete forming panel prices have been

inching up but others like uncoated concrete forming panel

and structural panels had been without much price

increase but now that the suppliers are proposing higher

export prices on these items with softening yen, general

mood is price escalation.

As the importers have purchased high priced plywood,

they need to keep pushing the market prices further up.

With shipment delay, trading companies¡¯ inventories are

very little so they have no plywood to sell. The movement

of imported plywood continues inactive but the importers

try to buy back plywood from lower end of distribution

channels

Itochu Kenzai¡¯s business plan

Itochu Kenzai Corporation (Tokyo) held lecture meeting

in Osaka to review market trend and business plan of the

company.

It plans to increase supply of hybrid plywood made from

all planted trees to 1,200 cbms in 2017. It also plans to

expand supply of certified concrete forming panel and

structural panel. In this, sales expansion of structural panel

with selected cypress veneer is another target. Basic policy

is to increase handling of environmentally friendly wood

products.

Sales for the first half of 2017 would be 147.3 billion yen,

7% more than the same period of last year. In this, wooden

board sales of domestic and imported plywood and

fiberboard are 31.5 billion yen, 13% more.

Hybrid plywood of all planted trees means that it is not

traditional falcate plywood or meranti for face and back

but on top of falcate from agriculture forest, other planted

species grown in this forest is used.

To expand handling of forest certified plywood, it is

necessary to tie up plywood suppliers, which have limited

source of quality natural wood or have steady supply of

certified logs.

On domestic cypress plywood, it will tie up with domestic

manufacturers like Nisshin group and Noda. On wood

products, it is reviewing all the supply sources to make

sure supply of certified products.

|