2. GHANA

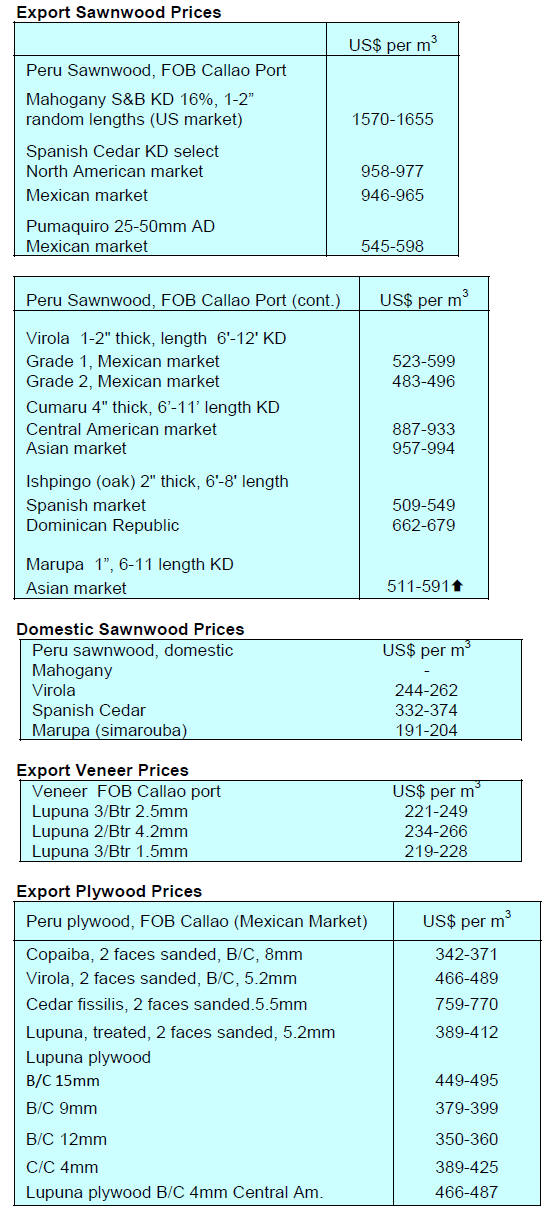

Fall in plywood exports drag down 2017 earnings

Data from the Research and Statistics Unit of the TIDD

shows Ghana’s cumulative exports of wood products in

2017 totalled 339,227 cu.m which earned the country a

total revenue of almost Euro190 million.

Compared to 2016 there was an almost 15% decline in

export volumes and a 16% drop in the value of exports.

In 2017 air-dried sawnwod accounted for 64% of export

volumes followed by kiln-dried sawnwood (11%) and

billets (9.5%). Another 10 products made up the balance.

In terms of trends, in 2017 exports of billets

(logs), boules

and curl veneers increased while exports of other products,

particularly sawnwood and plywood, declined.

Ghana’s overland plywood exports plummeted to just

15,549 cu.m in 2017 from a peak of 30,071 cu.m in 2016

and this resulted in the combined export earnings from

plywood and sawnwood to drop by around 48% (Euro

10.33 mil. in 2016 to Euro 5.32 mil. in 2017).

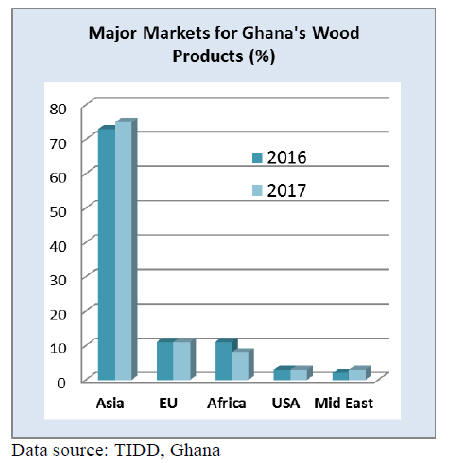

Asia, Ghana’s main export destination

Ghana’s export markets included Germany, Italy, France,

UK and Belgium in Europe, China, India, Vietnam in Asia

and South Africa, Morocco, Cape Verde.

In 2017 poles and billets accounted for 10% of exports

(34,170 cu.m), sawnwood, plywood, boules, veneers and

kindling accounted for 87% of exports while mouldings,

flooring, dowels and furniture accounted just over 3% of

exports. The leading species for these markets were wawa,

teak, ceiba, gmelina, and rosewood.

Asian and Middle East markets accounted for over 70%

of

export volumes in 2017 as well as in 2016. Demand from

Europe and America remained at the same level as in 2016

but sales to African countries fell accounting for just 8%

of exports in 2017 compared to 11% in 2016. The drop in

Africa’s share of Ghana’s exports is attributed to the

almost 50% decline in export volumes destined for

Nigeria.

Calls for tax overhaul

The Association of Ghana Industries (AGI) has called on

government to revise the tax exemption currently granted

to some companies. The AGI says exemptions are

discriminatory and companies benefitting tend to be

importing products that compete directly with locally

manufactured products which has slowed investment in

manufacturing.

Ghana Statistical Service data show that since 2010

growth of the manufacturing sector has been falling from a

high of 10% in 2010 to 4.6% in 2016 and now estimated at

3%, the lowest in more than a decade.

Correction

In the previous ITTO report it was stated that a furniture

test centre has been established by the Timber Inspection

Development Division of the Ghana Forestry Commission,

this was incorrect. The following correction has been

provided by the test centre team.

“To improve the quality and add more value to locally

made furniture a testing facility has been established at the

Forestry Research Institute of Ghana (FORIG) of the

Council for Scientific and Industrial Research (CSIR)

located at Fumesua near Kumasi.

The centre has modern equipment for testing furniture,

plywood and wood-based panels and was made possible

by technical support from UNIDO, with Bern University

of Applied Sciences (BFH) in Switzerland, as the

consultant.

Funding of the project was provided by the Government of

Switzerland under its Trade Capacity Building

Programme. The centre was built was renovated by CSIRFORIG.

This centre, say analysts, is the first of its kind in the West

Africa. The centre is expected to stimulate growth in

Ghana’s added value wood product sectors. The centre

was opened on 6 February 2018 at CSIR-FORIG campus.

Speaking at the function, the Minster for Trade and

Industry, Alan Kwadwo Kyeremanteng, who was

represented by the Director-General of Ghana Standards

Authority (GSA), said that the government will do all it

can to support growth in the wood products sector to lift

Ghana’s productivity and competitiveness locally and

internationally.

A representative of the Minister for Environment, Science,

Technology and Innovation stated that the Government

will ensure that Ghana wood and wood products and

related services are designed, manufactured and traded in a

sustainable manner to match the needs, expectations and

requirements of the consumers.

He added that the second and third wood processing levels

would be strengthened in order to generate more jobs and

to increase added-value production in Ghana.

He expressed concerned about the influx of low quality

and cheap foreign wood products (especially furniture)

onto the Ghanaian market, which according to him, could

be checked through the test centre to ensure that they meet

standards before they enter the local market”.

3.

MALAYSIA

Shortages of raw materials

and skilled workers could

hold back furniture export performance

Malaysia’s timber exports are expected to increase 5% this

year from the RM23.22 bil. in 2017, according to Dr.

Jalaluddin Harun, Director General of the Malaysian

Timber Industry Board (MTIB). His confidence stems

from the high demand for Malaysian timber in Japan, the

United States, member states of the European Union,

Australia and India.

Harun reported that Malaysia ships to more than 160

countries but marketing efforts will be focussed on those

countries with which Malaysia has trade agreements.

The main issues facing the timber sector, said Harun, are

shortages of both raw materials and skilled workers and

this must be addressed. Harun estimated that 80% of

Malaysian made furniture is of rubberwood and efforts

must be made to secure this resource for the domestic

industry.

‘Design Connects People’ – theme for Malaysian Fair

The Malaysian International Furniture Fair (MIFF) 2018 is

eyeing a 5% increase in sales this year despite the recent

rise in the ringgit against the US dollar. The annual event

recorded sales of US$940 mil last year.

As Malaysia prepares for the Malaysian International

Furniture Fair (MIFF) 2018, Tan Chin Huat, MIFF

founder and chairman, said the strengthening ringgit was

unlikely to affect exports as overseas buyers are more

concerned about design and quality.

This year the theme for MIFF is “Design Connects

People”, and the Fair will run between March 8-11. The

organisers say the Fair is expected to attract 600 exhibitors

from countries with 70% of the fair space being taken up

by Malaysian exhibitors.

For more see: http://2018.miff.com.my/

Revised fees in Sarawak to impact industry

The Sarawak Forest Department will introduce higher fees

for planted forest timber and also higher transportation

fees for hardwood timber with effect from 1 March this

year.

The fee for planted forest timber will be raised from

RM0.50 per cubic metre to RM1.50 per cubic metre and a

charge of RM1 per cubic metre will be introduced for

natural forest timber to pay for tracking the movement of

logs through the issuance of Shipping Pass or Land

Transport Pass.

4.

INDONESIA

Fiscal incentives to boost

investment

Sri Mulyani Indrawati, Indonesia’s Minister of Finance,

has said the government plans to introduce better tax

incentives to attract business investment.

The focus will be on four incentives namely tax

allowances, tax holidays, tax deductions for small and

medium enterprises and incentives for research and

development. The government is also considering

expanding the range of business sectors that can benefit

from these incentives.

Sustainability bond to finance rubber plantations

The UN Environment Programme has announced a

partnership with the World Agroforestry Centre, ADM

Capital and BNP Paribas for the issuance of a US$95

million Sustainability Bond to help finance sustainable

natural rubber plantations on heavily degraded land in two

provinces in Indonesia.

The UNEP web site says the project involves collaboration

with WWF, which has worked with Michelin and RLU to

set aside remaining High Carbon Stock (HCS) and High

Carbon Value (HCV) forest in the RLU concessions, as

well as conservation of wildlife and riparian areas. Out of

a concession area of 88,000 hectares, roughly 45,000

hectares will be set aside for community livelihoods and

conservation.

See: https://www.unenvironment.org/news-and-stories/pressrelease/

financing-natural-rubber-plantation-indonesia-promotingsustainable

Land allocation – a call for private sector participation

As part of its land reform programme, the Indonesian

government has plans to distribute land certificates over 5

million plots to Indonesian citizens and some 4.2 million

plots have already been designated. The Minister of

Environment and Forestry, Siti Nurbaya Bakar, has said

plots extending over about 2 million hectares of forest land

will be allocated this year.

In related news, the Minister has called upon the private

sector to participate in advancing social forestry.

According to Siti, a number of private parties have

announced their interest to work with communities in

social forestry areas. Several trials have been made and a

number of successful private partnerships have been set up

in the Pati forest area, said the Minister.

Satellite imagery to identify fire risk areas

The UK government, through the International Partnership

Programme (IPP) will provide grant support for efforts in

Indonesia and Malaysia to address the problem of forest

fires.

Sam Gymah, the UK’s Minister of State for Universities

and Science, said the project would be overseen by a

British company utilising satellite imagery to record water

levels on peat lands where forest fires often occur to

provide an early warning system of areas at risk.

5.

MYANMAR

Teak plantation harvests

planned

News is circulating that the Forest Department is planning

to allow harvesting of some mature (over 30-year-old)

commercial teak plantations to partially compensate for

the logging ban in the Bago Mountain Range.

Analysts write that the quality of plantation teak will not

satisfy quality requirements in international markets. As it

is not clear what natural teak harvest levels will be in

2018-19 it is difficult to assess how this will impact

industry.

Myanmar is said to have around 2.2 million acres of forest

plantations about half of which are of commercial value

according to the Ministry of Natural Resources and

Environmental Conservation.

There are approximately 1.2 million acres of forest

commercial plantations in Myanmar (approx. 50% of the

total) a further 30% are plantations in catchment areas and

around 16% are for other uses. In addition there are nearly

450,000 acres of firewood plantations and 6,480 acres of

mangrove plantations. However, the accuracy of these

figures cannot be confirmed as some plantations have been

badly managed or illegally cut.

In related news, the online ‘Irrawaddy Media’ is reporting

that Myanma Timber Enterprise (MTE) will harvest only

10,620 teak trees and 193,412 other timber trees in the

current fiscal year of 2018-19 although it has quota of

19,200 teak trees and 592,330 timber trees annually.

Export earnings well down on previous years

U Khin Maung Kyi, the Deputy Permanent Secretary of

Ministry of Natural Resources and Environmental

Conservation, has been quoted as saying income from

timber exports and domestic trade will exceed the US$90

mil. in fiscal 2017-18 target which ends 31 March 2018.

This represents a considerable decline from past years.

The value of wood product exports before the 2014 log

export ban averaged over US$500 million annually. In

fiscal 2013-14 exports were close to US$1 billion

according to Ministry of Commerce data. In the following

year exports declined to just US$93 million. Between

April and December 2017 timber export were said to be

around US$162 million.

In the latest projected export earnings from the Ministry it

is not clear whether US$90 million is MTE earnings from

log sales to the Industry or the export value since the

Ministry of Commerce has reported earnings of US$162

million for the first nine months of 2017.

EU paying special attention to teak imports

The domestic media (News Watch Weekly) has quoted an

Extractive Industries Transparency Initiative (EITI)

member, Aung Phyoe Kyaw, as saying that timber exports

to the EU have been temporarily suspended because of the

strict implementation of the FLEGT licensing system.

Analysts write that this is not correct and that timber

exports to the EU have not been suspended but that the

Competent Authorities of EU Member States which are

responsible to verify due diligence by importers are paying

special attention to imports of Myanmar teak.

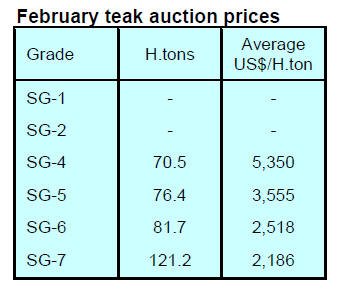

February teak auction prices sky-rocket

Prices at the February MTE teak log auction sky-rocketed

this month especially for the SG4 and SG5 grades.

One lot of SG4 teak logs attracted a price of US$6,099 per

H.ton, the highest ever recorded by MTE.

Analysts say most traders at the auction were caught by

surprise at the high prices and have put this down to a new

buyer for the Indian market entering the trade.

6. INDIA

Manufacturing output climbs and

business confidence

rises

The good news on December industrial production,

particularly manufacturing output and a dip in retail

inflation, has been interpreted as signaling that the

economy is stabilizing leading analysts to be optimistic on

third quarter 2017 GDP.

In another signal that economic sentiment may be

improving, the quarterly Business Confidence Index,

released separately on Monday by the Delhi-based

economic think tank National Council of Applied

Economic Research (NCAER), registered a growth of

9.1% in January, after declining for two consecutive

quarters.

Despite living longer with parents millennials aspire to

own a home

A recent survey, the results of which are presented in a

press release from CREDAI, has found that over 80%

Indian millennials still live with their parents but that a

majority aspire to own a quality home.

The survey for this report was conducted by the CREDAI

Youth Wing in association its partner the Los Angeles

based CBRE, one of the largest commercial real estate

services and investment company in the world.

The report highlights the major trends created and driven

by millennials, addresses issues such as why millennials

live with their parents longer and how millennial

consumers spend, save and play.

CREDAI says the report challenges common perceptions

and serves as one of the most authoritative studies ever

undertaken on such a demographic.

See: https://credai.org/press-releases/credai-youth-wing---cbrereport-

finds-millennials-and-youth-as-future-demand-drivers-foraffordable-

housing

Big plans to expand forest cover

At the opening of the Commonwealth Forestry Conference

in Dehradun, Ajay Narayan Jha, from the Ministry of

Environment and Forests, reported that India has a 24%

forest cover and that the government plans to increase this

to raise the carbon sink to 2.5 to 3 billion tonnes in 2030.

The focus will be on planting trees outside the forests and

in the agro-forestry sector according to the former Forestry

Director General S.S Negi, also present at the conference.

In related news, the government has announced its plans

for managing its compensatory afforestation fund created

from deposits by agencies when forest land was utilised

for non-forest purposes such as industrial development or

infrastructure.

For more see:

http://www.mahaforest.gov.in/fckimagefile/The%20Compensatt

ory%20Afforestation%20Fund%20Rule,%202016-

24_04_2017.pdf

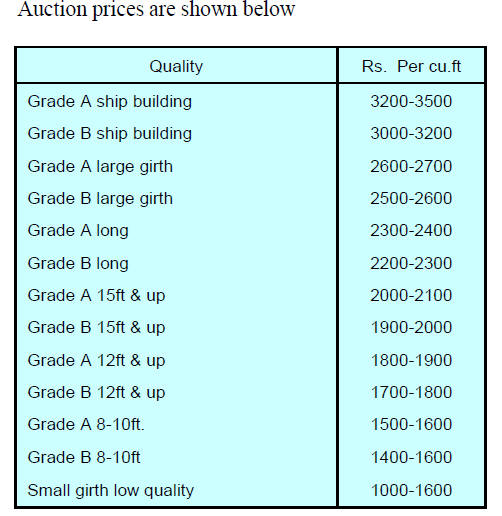

Teak and hardwood auction prices

Auctions at various forest depots in North and South

Dangs Divisions have been concluded. Some 5,000 cubic

metres, mostly teak logs were offered along with other

tropical hardwoods.

Analysts report one interesting development at the recent

auctions was the purchase of Laurel (Terminalia

tomentosa), by a musical instrument manufacturer. The

price offered was as high as Rs.1,300 per cu.ft.

This manufacturer is trying to promote laurel as an

alternative to rosewood in the production of musical

instruments for export as shipping rosewood, even locally

grown rosewood, is a major problem because of the

CITES regulations.

First quality non-teak hardwood logs 3-4m long

having

girths 91cms & up of haldu (Adina cordifolia), laurel

(Terminalia tomentosa), kalam (Mitragyna parviflora) and

Pterocarpus marsupium attracted prices in the range of

Rs.800-1300 per cu.ft. Second quality hardwood logs were

sold at between Rs.600-700 and low grade logs sold for

Rs.250-400 per cu.ft.

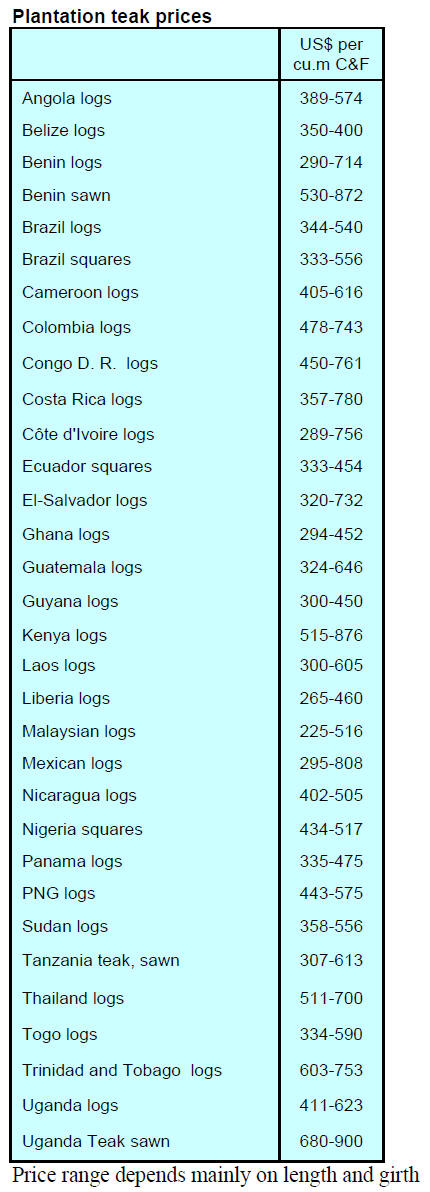

Imported plantation teak

Analysts report demand for imported teak logs remains

stable but there are growing concerns on the quality and

girths of imported plantation teak logs. The weaker US

dollar is an advantage for importers but Indian importers

are resisting supplier’s requests for better prices.

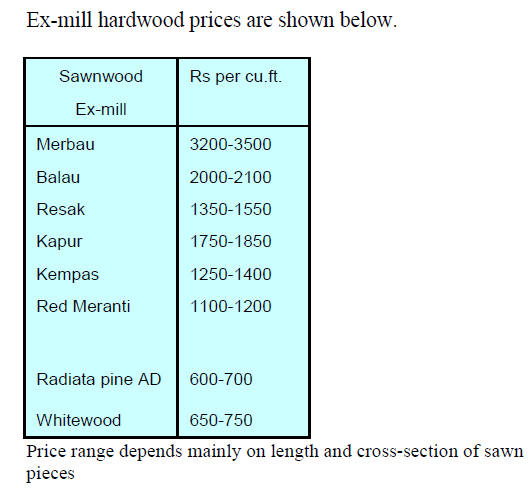

Locally sawn hardwood prices

Building work has picked up say analysts and demand for

hardwoods has been rising and this is expected to be

maintained for some time. In the face of rising

consumption, shippers are looking to raise prices but, say

analysts, competition in the retail sector is stiff such that

there is little room for price increases.

The functioning of the building sector has improved since

the government introduced the "Real Estate Regulatory

Act" which protects home buyers from builders who

unnecessarily delay completing construction work or are

slow in handing over homes to buyers.

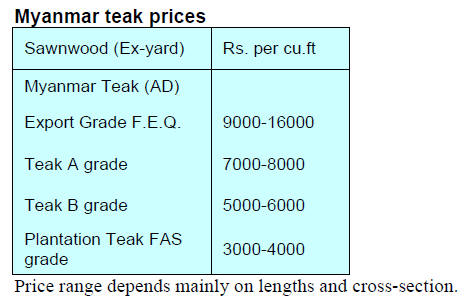

Imported sawn Myanmar teak

The level of imports of Myanmar teak are reported as

stable and the competition with alternative timbers is

becoming more intense.

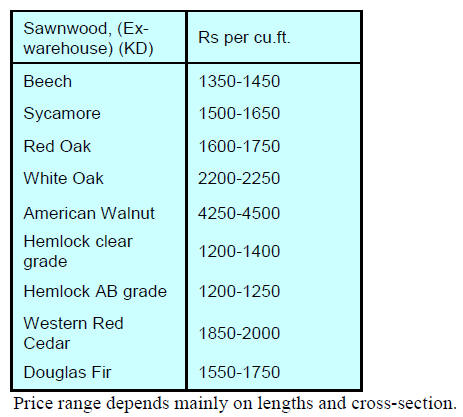

Prices for imported sawnwood

Prices for imported sawnwood (KD 12%) remain

unchanged.

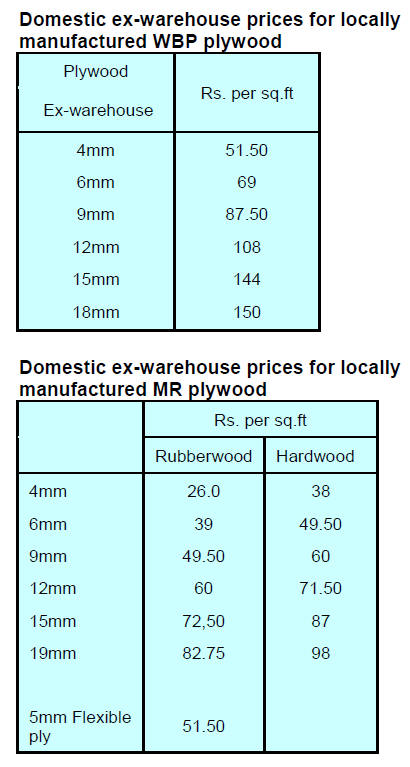

Domestic plywood prices

Analysts write that plywood prices are likely to rise in the

near future given the firm construction demand

additionally there are reports that demand for logs is rising

which will eventually lead to higher log prices which will

have to be passed on at some time.

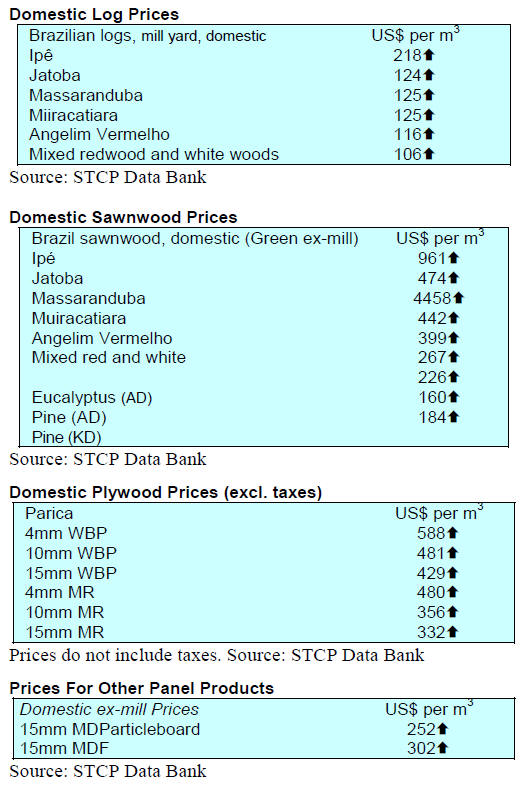

7. BRAZIL

Prospects for veneer production from

plantation

grown paricá

The Brazilian Agricultural Research Corporation

(EMBRAPA), in partnership with a timber company, is

exploring prospects for veneer production from plantation

grown paricá (Schizolobium amazonicum) which is

present in the lowland Amazon forest.

Trials have shown that out of 10,000 planted seeds about a

third germinated and grew to harvestable trees with a

diameter of around 25cm after 13 years and that an

average growth of three cubic metres per hectare/year was

achieved.

The volume of trees with a diameter of over 25 cm was

113 cu.m/ha in the plantation area compared to 95 cu.m/ha

in the non-planted area. When converted to veneer the

profit would be around R$16,863/ha for plantation grown

stock and R$12,381/ha in the non-planted area.

Researchers found that in paricás plantations on degraded

land other species began to propagate naturally and after

thirteen years the timber in the area had a commercial

value 36% higher than that of a degraded plot of the same

size where no remedial measures had been conducted.

According to EMBRAPA, there are more than 19 million

hectares of degraded forest that needs attention in Pará

state and that the use of paricá has great promise in Pará

and the wider Amazon. However, to be commercially

viable it would be necessary to make changes to

legislation that restricts natural forest species logging to

trees with a diameter of 50cm or more and of an age of at

least 50.

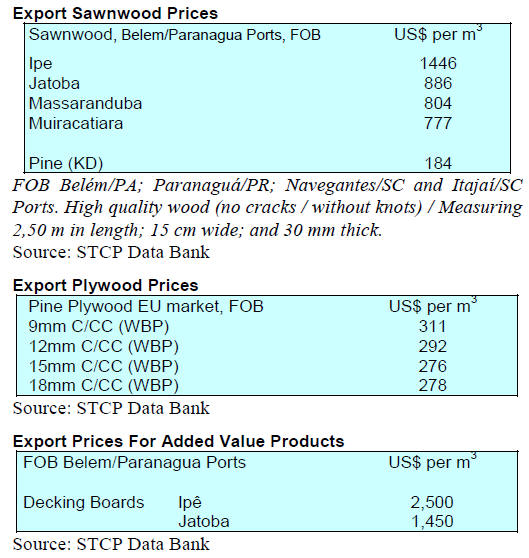

Export update

In January 2018, Brazilian exports of wood products

(except pulp and paper) increased 28.8% in value

compared to January 2017, from US$183.7 million to

US$236.6 million.

The value of pine sawnwood exports increased 23%

between January 2017 (US$33.6 million) and January

2018 (US$41.2 million). In terms of volume, exports

increased 18% over the same period, from 168,300 cu.m

to 198,900 cu.m.

In contrast tropical sawnwood exports fell around 12% in

volume, from 32,800 cu.m in January 2017 to 29,000 cu.m

in January 2018. But unit prices were higher such that

export values fell less than 1% over the same period.

Pine plywood export values increased a startling 55% in

January 2018 in comparison with a year earlier from

US$34.8 million to US$54.0 million. The volume of

plywood exports increased but by only 27% over the same

period, from 133,000 cu.m to 169,400 cu.m.

As for tropical plywood, exports increased in both volume

and value, from 10,600 cu.m (US$3.9 million) in January

2017 to 12,300 cu.m (US$ 5.1 million) in January 2018.

The good news on exports continued with for wooden

furniture where export values rose from US$26.6 million

in January 2017 to US$32.0 million in January 2018, a

20% rise.

Furniture exports begins favorably in 2018

2018 started well for furniture exports (all types), reaching

US$41.7 million compared tor US$37.5 million last year.

For the three main markets, the United States, the United

Kingdom and Argentina, the value of January 2018

exports topped US$20 million (US$18.5 mil. in 2017),

accounting for almost 48% of all furniture exports.

In terms of imports, in January imports rose 16% jumping

from US$45.1 million in January last year to US$51.6

million this January. Shippers in China increased their

share of the Brazilian market, from 31% of imports in

January last year to almost 38% in the first month of 2018.

Most Mato Grosso forests covered by management

plans

The forest-based sector in Mato Grosso state, a large

timber producing state, is committed to improving the

sustainability of forest activities, seeking new markets and

encouraging exports.

Data published by CIPEM (the Center for Timber

Producers and Exporters of Mato Grosso State) show that

93% (262,500 hectares) of the legally logged areas in the

state is covered by Sustainable Forest Management Plans

(PMFS) approved by the State Environmental Secretariat.

Additionally, it has been reported that there was a

significant drop in identified illegal forest activities.

The CIPEM report emphasises the contribution to the

State of the forest sector which is supporting around

90,000 direct and indirect jobs, represents the fourth

largest contributor to the state economy and produces

around 13 million cu.m for domestic production.

In addition, sustainable forest management provides

important environmental services, such as carbon

sequestration and sustainable harvesting of non-timber

products.

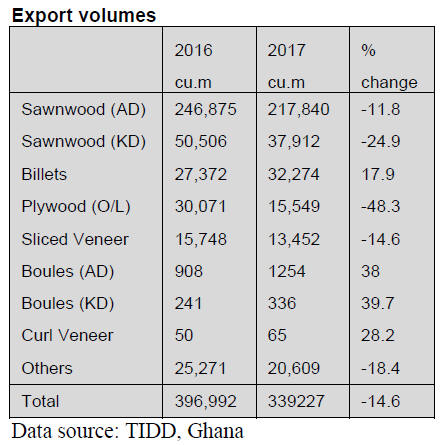

8. PERU

Timber companies at ‘BIG 5’

Dubai fair

A delegation of Peruvian timber entrepreneurs participated

in the ‘Big 5’ Dubai 2017 Fair considered one of the most

important construction and timber sector fairs in the

Middle East.

Companies participated in business meetings, visited

factories and exchanged information on markets in the

region, a major importer of tropical timber especially of

products for the construction sector.

The fair attracts the participation of large business groups

and buyers of wood products not only from the Middle

East but also from the USA, Europe and Asia.

Conserving and utilising Amazon forests – new

initiative to be launched

The Ministry of Agriculture and Irrigation (MINAGRI) is

planning to approve the implementation of numerous

projects worth around US$6.5 million for the recovery,

conservation and sustainable use of resources in Amazon

forests.

The projects were selected after a third call for competitive

bids for funds in the ‘SERFOR-CAF Sustainable,

Inclusive and Competitive Forestry Development

Program’ for the Peruvian Amazon.

The selected projects, to be implemented over a two year

period, reflect the need to recover and protect the Amazon

basins, recover the degraded ecosystems and promote

ecotourism. Projects will be implemented in the Amazon

regions of Junín, Madre de Dios, Amazonas, Huánuco,

San Martín, Pasco, Loreto and Ucayali. Nine of the

projects are dedicated to promoting the sustainable use of

forest products and protection of the ecosystem.

Mission to Dominican Republic

The consultancy company, Tropical Forest, is organising a

trade mission to the Dominican Republic for domestic

timber entrepreneurs from 8 -11 March.

The group of Peruvian business people will visit industrial

wood processing plants and conduct business meeting with

prospective buyers. Dominican importers have expressed

an interest in securing supplies of sawnwood, decking,

flooring and construction products.