2. GHANA

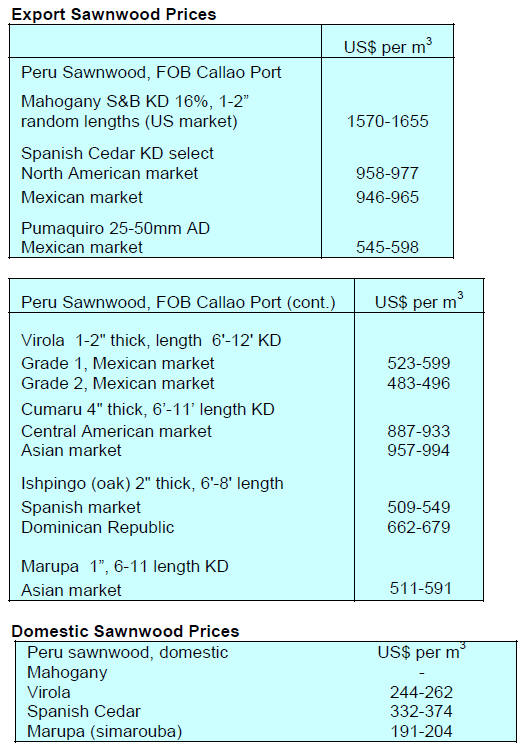

Approved contracts rose in Q4 2017

The Forestry Commission’s Timber Industry Development

Division (TIDD) has reported export contracts for a

volume of 164,759 cu.m were processed and approved

during the fourth of 2017.

This volume is close to 60% higher than in the final

quarter of 2016.

Table below shows the comparative breakdown of

approved export contracts for the 3rd and 4th quarters of

2017.

Export volumes of primary products (mainly

billets/logs)

fell 55% in the final quarter of 2017 compared to third

quarter. This decline was as a result of fewer shipments of

plantation teak logs/billets.

For the period under consideration the volume of

secondary products almost doubled compared to the

performance in the third quarter to a volume of 151,697

cu.m. Tertiary product exports also increased from 2,860

cu.m in the third quarter 2017 to 2,995 cu.m in the fourth.

The TIDD report said contracts for overland plywood

export rose 49% rise in volume. Shipments to

neighbouring West African countries. Sawnwood

accounted for 86% of overland shipments.In the final

quarter of 2017 exports of sawn rosewood increased by

160% to 86,300 cu.m.

Main markets unchanged

The West African market continued to be the lead market

for Ghana’s plywood. Of the total 2,850 cu.m exported,

2,293 cu.m was for the West African sub regional markets

notably Nigeria.

India continued to be the main destination for teak

(sawnwood and logs/billets) as well as gmelina logs while

the Middle East and Egyptian markets emerged as a major

destinations for backing grade veneer.

The markets for tertiary products such as sliced veneer and

kiln dried sawnwood were European member states while

air dried rosewod and other high density species such as

apa, ekki and denya found their way to the Chinese

market. China also emerged as a major destination for

sawn and kiln dried wawa.

Ghana firms up structures to weed out forest sector

illegalities

As part of government measures to control illegal

activities in the forest the Forestry Commission (FC)

organised a workshop to assist domestic timber companies

understand regulations for the forestry supply chain.

In a press statement, the FC said government is committed

to the implementation of a number of interventions to

address issues of deforestation, forest degradation and the

improvement of the contribution of forests to the country’s

economy.

The battle against illegal activities in the forestry sector

continues and the FC is doing every it can eliminate such

activities. But much more is needed, especially building

capacity of sector stakeholders.

3.

MALAYSIA

Researchers to benefit financially from

discoveries

A structure is being created that will allow researchers at

the Forest Research Institute Malaysia (FRIM) to benefit

financially from their discoveries. This was announced by

the Natural Resources and Environment Minister, Dr Wan

Junaidi Tuanku Jafafar.

The minister said the aim of the scheme is to provide

incentives to researchers working on practical issues. At

present only FRIM and the Government were entitled to

royalties from discoveries.

Raising awareness of importance of forest

conservation in Sabah

An Environmental Conservation initiative was recently

started in the Garinono Forest Reserve aimed at restoring

the diversity of the forest structure and at the same time

raising public awareness on the importance of forest

conservation. The event was jointly organised by the

Sabah Forestry Department and the Sandakan Polytechnic.

To launch the initiative some 400 tree seedlings, mainly

kapur merah (Borneo camphor) were planted. Forty–two

students were instructed on tree planting techniques.

Legality certification training for companies in

Sarawak

The state administration has targeted 2020 by which time

wood products from the state will all be certified under the

Sarawak Timber License Verification System (STLVS).

The state Forest Department is now preparing guidelines

and training for timber companies.

The Acting Director of the Forestry Department, Hamden

Mohammad, said companies would be given two years to

ready themselves for implementation. He stressed the

STLVS will project a positive image for the timber

industry as the auditing of the system would be undertaken

by a third party.

The STLVS was developed through consultation with

representatives of government and the timber industry.

To-date 16 timber companies have adopted the STLVS

since its introduction last year.

4.

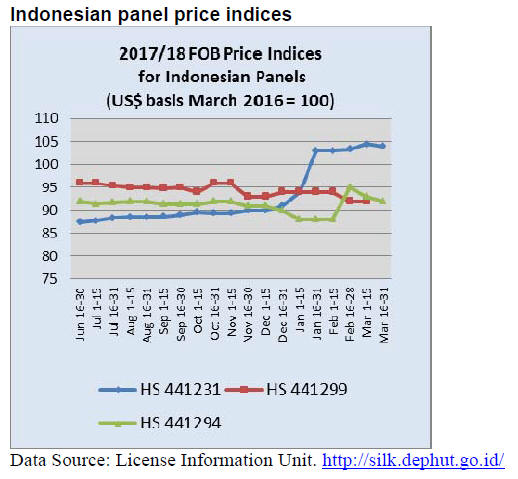

INDONESIA

Plans to protect unique

Indonesian craft designs

Haris Munandar, Secretary General in the Ministry of

Industry, has said Indonesia’s furniture industry is a

priority industry but that Indonesian furniture exports are

far below those of countries like Vietnam, Malaysia and

Singapore.

The minister reiterated that the furniture sector is

important for its capacity to absorb high levels of unskilled

and semi-skilled labour. In related news, the minister

spoke on efforts to protect the creative capacity of

Indonesian craftsmen and women.

The Ministry of Industry will facilitate Intellectual

Property Right (HAKI) registration for such the crafts

persons. Efforts are also underway to boost exports

through more effective promotion of the unique national

furniture and handicraft products.

The ministry has launched an e-Smart on-line programme

in cooperation with some domestic manufacturers.

Ministry of Industry rejects log export plan

In a surprise move, the Ministry of Industry has said it

rejects the plan to allow plantation log exports. The

Director of Forest Products and Plantation Industries in the

Ministry of Industry said that the focus of national

industrial development is to add value to natural resources.

See: http://industri.bisnis.com/read/20180312/257/748688/

kemenperin-tegaskan-tolak-wacana-ekspor-bahan-mentah

First e-commerce sale to the US

For the first time processed wood products offered through

the e-commerce scheme have been shipped to the United

States. Recently a shipment of processed merbau from CV

Indo Jati Utama, in Semarang, Central Java, was shipped.

The overseas order was through the online marketing

system launched by the Association of Indonesian Forest

Concessionaires (APHI). The system is called Indonesian

Timber Exchange E-Commerce. Director of CV Indo Jati

Utama, Gunawan Budikentjana, said the US market is

very demanding but selling SVLK certified wood products

on-line has great promise.

In related news, a spokesperson in the Ministry of

Environment and Forestry said the ministry expects the

use of online marketing of SVLK certified timber will

boost exports.

Correction

We wrong reported Ida Bagus Putera Parthama as APHI

Executive Director, when it is Indroyono Susilo. Our apologies

to both.

5.

MYANMAR

Foreign investment in-flow target achieved

Aung Naing Oo, Director General at the Directorate of

Investment and Company Administration (DICA) and

secretary of the Myanmar Investment Commission (MIC)

said Myanmar’s foreign investment inflows will exceed

the targeted for the 2017-18 financial year that ends 31

March, 2018.

For the year, the MIC has granted investment approvals

valued around US$ 6.11, which includes the value of

expansion and investment in the Thilawa Special

Economic Zone (SEZ). The total investment injected into

the Thilawa SEZ in the 2017-18 financial year is around

US$400 million.

Manufacturing, real estate and the services sectors are the

top three investment areas while mining, livestock and

fisheries saw limited inflow.

In the current fiscal year the oil and gas sector as well as

construction saw zero investment said Aung Naing Oo.

Myanmar enacted a new Myanmar Investment Law last

year to attract investment, stimulate the job market and

improve the Myanmar economy.

Doing business super challenging say new report

Recently the Yangon-based Myanmar Centre for

Responsible Business (MCRB) - an initiative funded by

the UK, Denmark, Norway, Switzerland, the Netherlands

and Ireland- announced its latest "Pwint Thit Sa"

("Blossoming") study which says a lack of transparency

and ’murky’ financial dealings continue to make doing

business in Myanmar "super challenging".

The study, the most ambitious of its kind, ranks

Myanmar’s public, private and listed companies on a

range of criteria covering everything from auditing

practices and ethics to whether the company has a website.

There are some companies that have attained standards

common to the region says the report but there is much

more to do according to the co-author and director of the

Myanmar Centre for Responsible Business, Vicky

Bowman.

See: http://www.myanmar-responsiblebusiness.org/index.php

6. INDIA

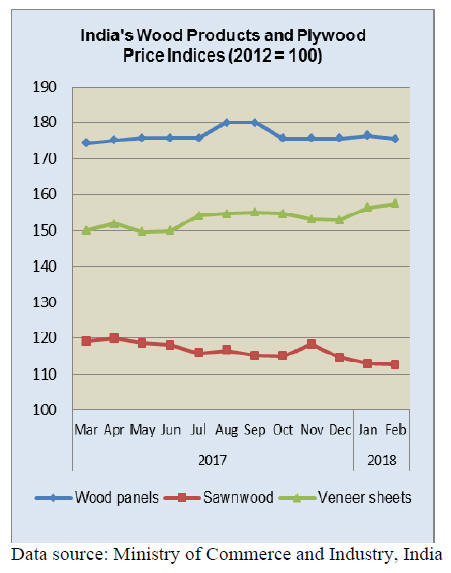

Unexpected drop in panel price index

India’s official wholesale price index for all commodities

(Base: 2011-12=100) for February 2018 released by the

Office of the Economic Adviser to the government (OEA)

remained unchanged from January at 115.8.

The annual rate of inflation, based on monthly WPI in

February 2018 was 2.48% up on February 2017 and was

also higher than in January. The overall index for the

wood products and cork group rose by 0.1% to 130.9 due

to the higher prices for wooden splint (+2%), veneer

sheets and wooden boxes/crates (1% each). However, the

index for plywood, blockboard and other woodbased

panels declined.

The press release from the Ministry of Commerce and Industry

can be found at: http://eaindustry.nic.in/cmonthly.pdf

Negative impact of GST and demonetisation

eases

India’s industrial output expanded faster than expected to

7.5% in January from 7.1% in December and inflation

figures showed a modest decline laying the foundation for

further growth. Analysts are interpreting the latest data as

suggesting the negative impact of de-monetisation and

initial turmoil from introduction of the standard Goods and

Services Tax has waned. The economy is forecast to grow

6.6% in the current financial year.

Double digit rise in Maharashtra’s forest cover

At an International Day of Forests 2018 event it was

announced that over the past 20 years the forest cover in

Maharashtra State increased by 6,839 sq. km or around

16%. In addition the area of mangrove forest had almost

doubled from 155 sq. km in 1995 to 304 sq. km in 2017.

Two main reasons were given for the success in

expanding

the forest cover, improved conservation efforts at the

district level and the active participation of local people in

forest management.

Small companies exiting real estate sector

The Indian housing market is undergoing significant

change in that there is an ongoing consolidation of house

builders in the so-called ‘unorganised’ sector which, until

recently, accounted for most almost 90% of house building

in the country.

These small and medium sized companies are struggling

to cope with stringent regulations in the Real Estate

Regulation and Development Act (RERA). This resulted

in many companies failing and having to put properties on

the market a reduced prices.

Analysts speculate that the number of SME builders could

drop to a tenth of the previous 45,000. Those companies

that are managing to continue in business say they are

being offered a large number of partially completed homes

by distressed companies. This is happening at a time when

the demand for houses is growing and news reports say the

top ‘formal’ sector builders are looking to expand land

purchases.

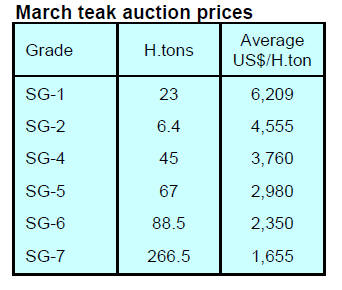

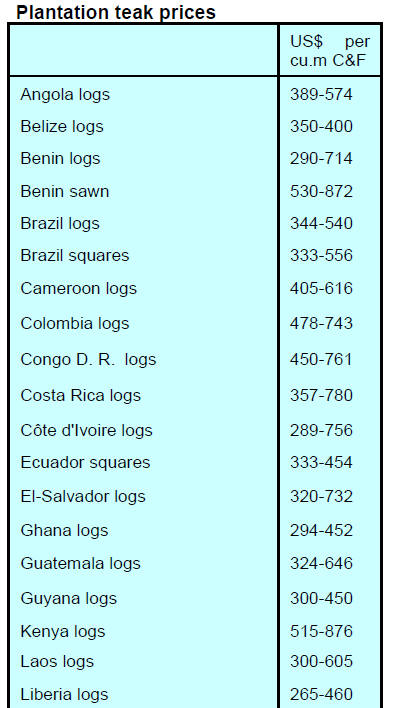

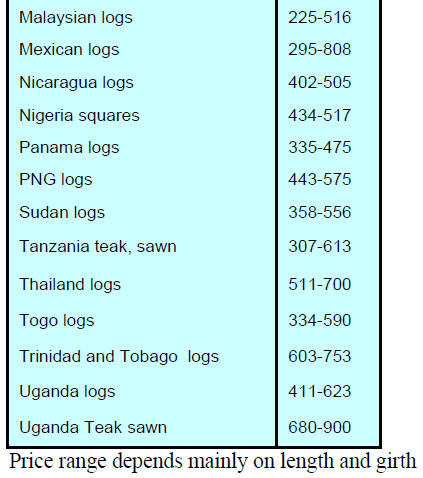

Imported plantation teak prices

Demand for imported plantation teak logs is reported as

steady and current levels of delivery are adequate to meet

market requirements. Analysts continue to complain that

average girths for log parcels are declining and that overall

quality is below that of recent years.

Locally sawn hardwood prices

Prices for locally sawn hardwoods remain unchanged.

Analysts write that, while importers are looking for better

domestic wholesale prices as log FOB prices climb the

level of competition in the local market is too strong for

this to be achieved.

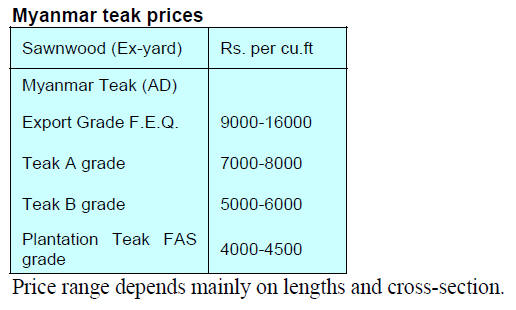

Imported sawn Myanmar teak

Prices for imported Myanmar teak remain unchanged.

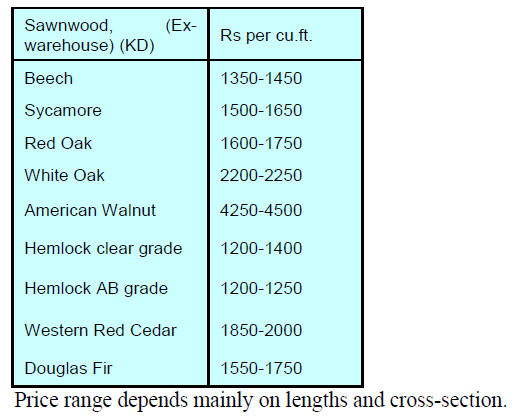

Prices for imported sawnwood

Prices for imported sawnwood (KD 12%) remain

unchanged.

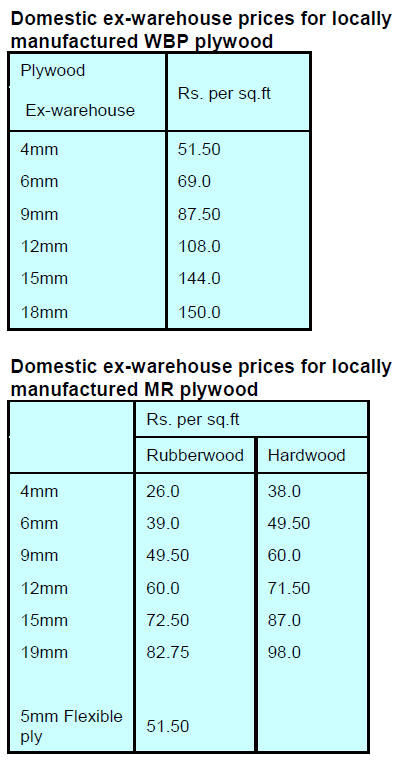

Plywood

Plywood manufacturers are facing growing competition

from wood/plastic composite boards as many new mills

are being established. The marketing of WPC panels

emphasies the waterproof and insect resistance properties

of these panels.

7. BRAZIL

Community forests can deliver

more timber

BVRio and Imaflora (Forestry and Agricultural

Management and Certification Institute) have published a

study "Commercialisation of wood products from

community forest management: diagnosis, options and

recommendations for the sector".

This study presents a survey of the current situation of

community forest management (CFM) in Brazil to identify

barriers and opportunities for improving growth in the

sector.

The report suggests CFM in Brazil has the potential to be

applied over 46 million hectares in the Amazon. The

national and state forests of the Amazon which total more

than 28 million hectares could, through sustainable

management, generate forest products worth between R$

1.2-R$ 2.2 billion per year the report says.

However, the current contribution of CFM to timber

production said to be well below its potential and there are

many hurdles to overcome to release the full potential says

the report.

See: http://www.bvrio.org/wpcontent/

uploads/2018/03/BVRio_Imaflora_Manejo-

Florestal_WEB_Low.pdf

Proposals to eliminate unnecessary timber seizures

A national forum on forest-based activities presented a

proposal to amend the Normative Instruction 21/2014 and

CONAMA Resolution 411/2009 and 474/2016, which

deals with the identification of forest products for the

purpose of inspection.

The aim of the new proposal is secure adoption by

inspection agencies of identification by species and

conversion rates in cubic metres. This proposal was

backed by the State administrations in Mato Grosso, Pará,

Rondônia, Acre, the major suppliers of forest products.

The current inspection procedure is a problem say

analysts. For example, fresh cut sawnwood measuring

40mm thick will be measured for volume but as the timber

dries there is shrinkage and the timber could become

38mm thick.

If the timber shipment is re-measured at 38mm thickness

the volume will differ from that of the volume for fresh cut

timber and this can be deemed mis-reporting and can lead

to seizure. The new proposal aims to provide suggestions

on shrinkage allowances to improve inspection processes

and avoid unnecessary seizures.

The proposal was well received by the environmental

agencies which control the origin, transportation and

commercialisation of forest products and analysts

anticipate a change to the system will be adopted in May

this year.

February export round-up

In February 2018, Brazilian exports of wood-based

products (except pulp and paper) increased 27% in value

compared to February 2017, from US$192.3 million to

US$244.0 million.

Over the same period the value of pine sawnwood exports

increased almost 26% from US$30.8 millionto US$38.7

million. In terms of volume exports increased 21% over

the same period from 152,700 cu.m to 185,600 cu.m.

On the other hand tropical sawnwood exports declined

slightly from 31,100 cu.m in February 2017 to 31,200

cu.m in February 2018 however, export values rose around

4% o US$ 14.3 million.

In February pine plywood exports increased sharply (56%)

in value in comparison with the figure of US$36.7 million

February 2017, from. The increase in the volumes of pine

plywood were more modest at 27%,from 138,100 cu.m to

175,200 cu.m.

As for tropical plywood, export volumes and value

increased from 9,800 cu.m (US$3.6 million) in February

2017 to 12,700 cu.m (US$5.2 million) in February 2018.

In addition, exports of wooden furniture also rose from

US$32.8 million in February 2017 to US$38.7 million in

February 2018, an 18% increase.

Monthly data released by the Ministry of Development,

Industry and Foreign Trade (MDIC) for February show a

significant increasing pace of all types of furniture exports.

Compared to February 2017 furniture export increased by

17% to US$51.6 million compared to US$44.1 million.

The positive result is mainly due to the expansion of sales

to the United States, which rose 27% in the first two

months of this year and to the United Kingdom (up 24%).

The top three importers (US, UK and Argentina) increased

their share of the total volume from 47% in the first two

months of 2017 to 49% this year.

8. PERU

Timber industry: barriers and

opportunities in internal

trade

The Technological Institute of Production (ITP) -

CITEmadera in cooperation with FAO has released a

report "The Timber Industry in Peru: Identification of

Barriers and Opportunities for the Internal Trade of

Responsible Wood Products", This warns that the timber

sector is characterised by a high level of business

informality.

See:

https://gestion.pe/economia/industria-maderera-barrerasoportunidades-

comercio-interno-229820

The report concludes that the domestic market absorbed

some 90% of all out put in 2015 up from just over 60% in

2007.

Analysis of domestic demand looking at domestic supply

and imports found that, on the basis of volume, the main

products and distribution were as follows sawnwood

(14.3% imported), agglomerated panels (78.3% imported),

industrial round wood (13.8% imported), sheets and

plywood (26.0% imported), wood charcoal (0.5%

imported) and sleepers (27.5% imported). Domestic

production did not satisfy demand in the domestic market

in 2015.

The report concludes that the main barrier to trade in wood

from sustainable and legal sources is the high rate of

‘informality’ in the sector. To address this it is necessary

to strengthen of business management, improve company

control procedures, strengthen concepts of quality and

sustainability and create a culture responsible business.

Tecno-mueble 2018 Fair

The aim of the Tecno-mueble 2018 Fair, a domestic event,

was to provide an opportunity for furniture manufacturers

in the country that could not afford to attend international

fairs to experience the latest technologies.

The Fair was opened as part of the Day of the Carpenter

celebrations in the Industrial Park of Villa El Salvador,

Lima and showcased, machinery and industrial equipment

for wood working.

This eighth Fair attracted more than 4,000 furniture

entrepreneurs from the interior of the country such as

Loreto, Ucayali, Pasco, Madre de Dios, Tacna, Cajamarca,

Piura, Ica, Moquegua, Ayacucho, Arequipa.

APEC adopts new suggestions on combatting illegal

logging

A proposal from Peru on approaches to combating illegal

logging was incorporated into the 13th meeting of the

APEC Expert Group on Illegal Logging and its Associated

Trade (EGILAT) which took place in Port Moresby, Papua

New Guinea.

The Executive Director (e) of the National Forestry and

Wildlife Service (SERFOR), John Leigh Vetter, who was

at the meeting reported that APEC member countries

agreed to organise a workshop in 2019 in Chile, the

purpose of which would be increasing knowledge of the

tools and methods available to prevent and combat illegal

logging.

In a presentation, the Executive Director of SERFOR

made known the ongoing activities in sustainable

management and the building cooperation between

institutions and authorities to prevent and confront illegal

logging.

Peru major buyer of Ecuador’s particleboard

Ecuador’s exports of particleboard amounted to US$97.3

million in 2017, an increase of 8.5% compared to 2016.

Colombia and Peru were once again the main export

markets for Ecuador’s particleboard. Exports to these two

markets accounted for 94% of total exports in 2017.

Exports to Colombia amounted to US$57.3 million (2016:

US$50.9 million) a significant rise of around 12%.

Exports to Peru amounted to US$34.1 million, a 4.6% rise

compared to US$ 32.6 million in 2016. Exports to

Panama, the third most important market, recorded a slight

drop US$2.71 million in 2016 to US$2.66 million in 2017.

Bolivia, the fourth largest market, posted a sharp drop

(-18%) to US$1.31 in 2017.