Japan

Wood Products Prices

Dollar Exchange Rates of 10th

April

2018

Japan Yen 107.20

Reports From Japan

Business sentiment close to 10

year high despite short

term risks to growth

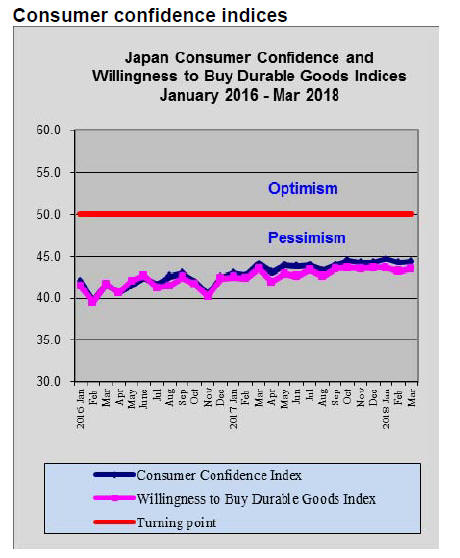

The Bank of Japan¡¯s (BoJ) quarterly ¡®Tankan¡¯ survey

points to declining confidence on the part of major

companies, a reversal of the trend in the previous survey.

For small and medium sized companies which account for

considerable employment in manufacturing, their

assessment of prospects in the medium turn have become

more pessimistic.

Amongst the major companies sentiment worsened for the

first time in two years in just over two years and analysts

put most of the damage on the strengthening yen and fears

of a trade war between the US and China.

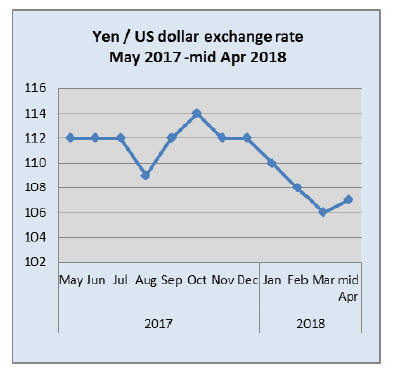

The Japanese government is concerned that a

strengthening yen and global trade friction could

undermine the economic progress that has been achieved

through its export led growth strategy which has benefitted

from improved global growth.

A strong yen drives down the competitiveness of Japanese

exports and also undermines overseas profits in terms of

yen.

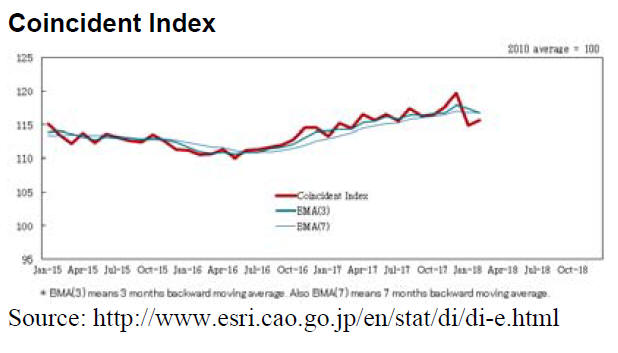

However, the latest survey from the BoJ should be viewed

in the context of improvements that have been achieved in

economic growth in Japan The prime index for business

sentiment is still close to the highest in over a decade. In

Japan, the coincident index, which reflects the current

economic activity, rose confounding forecasters.

Weak yen policy likely face criticism from

US

The Japanese government is preparing for tough

negotiations with the US government which is determined

to redress trade imbalances.

In particular, Japanese officials are worried that the US

will target the country¡¯s weak-yen policy which is helping

exporters and supporting economic improvement. If the

recent trade deal with South Korea is any guide, currency

devaluation will be on the negotiating table. Last month in

talks between the US and South Korea currency policies

were discussed.

If Japan¡¯s Prime Minister is faced with questions on the

yen weakness he will have great difficulty in convincing

the US that a weak yen is good for both countries and not

a source of the US deficit.

Analysts write that Japan accounts for less than 10% of the

US trade deficit but even the idea that the currency will be

a topic of discussion is driving the yen up. The strongest

argument for Japan is that over the past 20 years there has

been a marked change in the Japan/US economic

relationship from Japanese companies exporting to the US

to being major investors in the US to market directly to US

consumers.

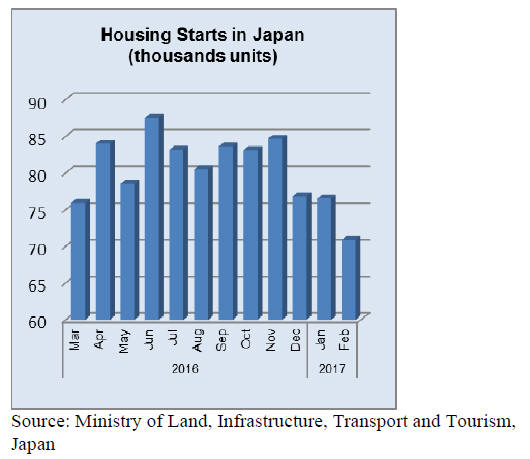

Affordable homes in Tokyo

Surprisingly, rents for homes in Tokyo are well below that

of other major cities around the world and rents have

remained at much the same level over the past 10 years. If

anything, there has been a downward pressure on rents.

Behind the ¡®affordable home¡¯ scenario, the envy of

urbanites in London, New York and Paris, is the continued

pace of new home starts. Tokyo adds around 100,000 new

homes annually which exceeds demand even given the

pace of migration from rural areas.

These new homes are mainly high rise, there is nowhere in

Japan to build dormitory cites, a common approach in

other parts of the world. This means that home size has not

been affected; in fact data show that the average home size

in Tokyo is increasing despite increased housing density.

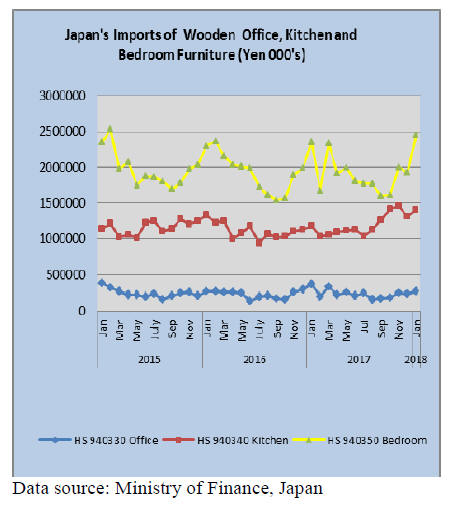

Furniture imports

The value of Japan¡¯s January 2018 wooden furniture

imports all trended higher. A sharp increase in month on

month imports of kitchen furniture was particularly

noticeable. Imports on wooden office and bedroom

furniture also trended higher in January compared to levels

recorded for the previous month.

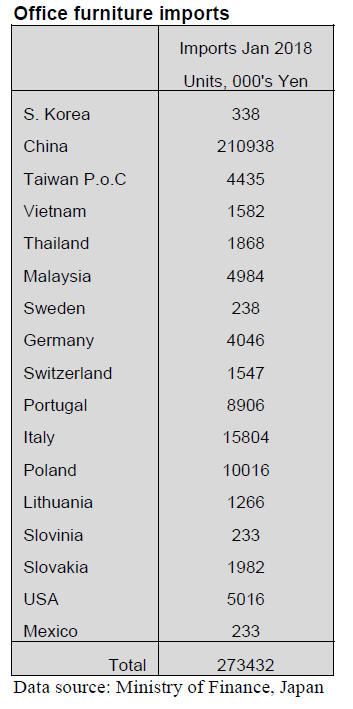

Office furniture imports (HS 940330)

Since the low reported for August 2017 Japan¡¯s imports of

wooden office furniture have risen for 5 consecutive

months. January 2018 imports were up 11% compared to a

month earlier but January imports were down 27%

compared to levels in January 2017.

The top four shippers of wooden office furniture (HS

940330) to Japan in January 2018 accounted for almost

90% of all imports of this category of furniture. China was

the largest supplier at 77% of the total in January followed

by Italy, Poland and Portugal.

Of the top 4 shippers only Italy saw a drop in sales

to

Japan in January. Shippers in the EU accounted for around

16% of Japan¡¯s wooden office furniture imports in

January.

Kitchen furniture imports (HS 940340)

There was a sharp rise in Japan¡¯s imports of wooden

kitchen furniture in January 2018. Month on month,

import values rose 7% and year on year January 2018

imports were 19% higher. The Philippines is emerging as

the major supplier of wooden bedroom furniture to Japan.

Shippers in the Philippines have consistently shipped to

japan but the 45% share of January imports of wooden

kitchen furniture is significant. Vietnam is the other main

supplier and in January its share of imports of this

category of furniture was 36%. China is the third ranked

shipper.

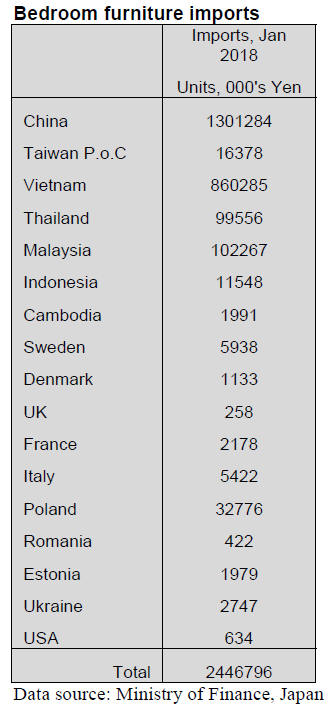

Bedroom furniture imports (HS 940350)

While January 2018 imports of wooden bedroom furniture

were only 4% higher than in the same month in 2017 there

was a 27% increase on month on month imports.

Japan¡¯s imports of wooden bedroom furniture dipped in

the second quarter of 2017following the trend observed for

both 2017 and 2016 but since the low in September 2017

import values for wooden bedroom furniture have been

rising. In January this year there was a 13% increase in

shipments from China, the number one supplier, a 45%

increase in shipments from Vietnam, the number two

supplier and a threefold increase in shipments from

Malaysia.

Trade news from the Japan Lumber Reports (JLR)

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

Challenge of (domestic) afforestation

The Forestry Agency has stopped the policy of long range

harvest with thinning and changed to clear cutting and

afforestation since 2013 and speeds up this policy.

However, problems arose main harvest and ensuing

reforestation.

In last several years, replanted area is only 20,000 hectares

for the area of 50,000 hectares of main harvest. Main

reasons of difficulty of reforestation are labor shortage,

shortage of nursery stock, lack of subsidy and damages by

deer but the largest reason is unwillingness by forest

owners.

There is no solution to this problem. There is subsidy of

68% of reforestation cost yet owners need to spend

300,000-500,000 yen per hectare. It is owners¡¯ decision if

they are willing to reinvest for reforestation but it is not

attractive investment after log prices dropped. For owners,

there are plenty of other investments as compared to long

range investment of 50 years until trees grow and harvest.

Another problem is secret felling. After log prices

increased in Miyazaki prefecture, there are many robbing

of trees which owner is not aware so such forestland is left

without reforestation.

The new forest management law requires timber owners to

reforest after harvest as obligation with penalty but there is

no case of penalty so far.

Whenever timber is harvested, the owner needs to file

harvest plan to the government and it is required to

describe how the owner plans to do of harvested area.

Other than reforestation plan, natural regeneration is

another choice for the owner. If trees grow in certain

density and height after five years, it is acknowledged as

natural regeneration but there are many hectares of

unmanaged land covered with nothing but bushes.

Newly introduced forest management system is supposed

to put main harvest and replantation as one unit. Local

government is assigned management right from unwilling

timberland owners and ask highly motivated neighboring

owners to manage and replantation is obligation but for

owners, cost of replantation is deducted from revenue of

sales of timber.

After all, there is no incentive for the owners to invest for

replantation. This is serious issue for future of forest

management in Japan.

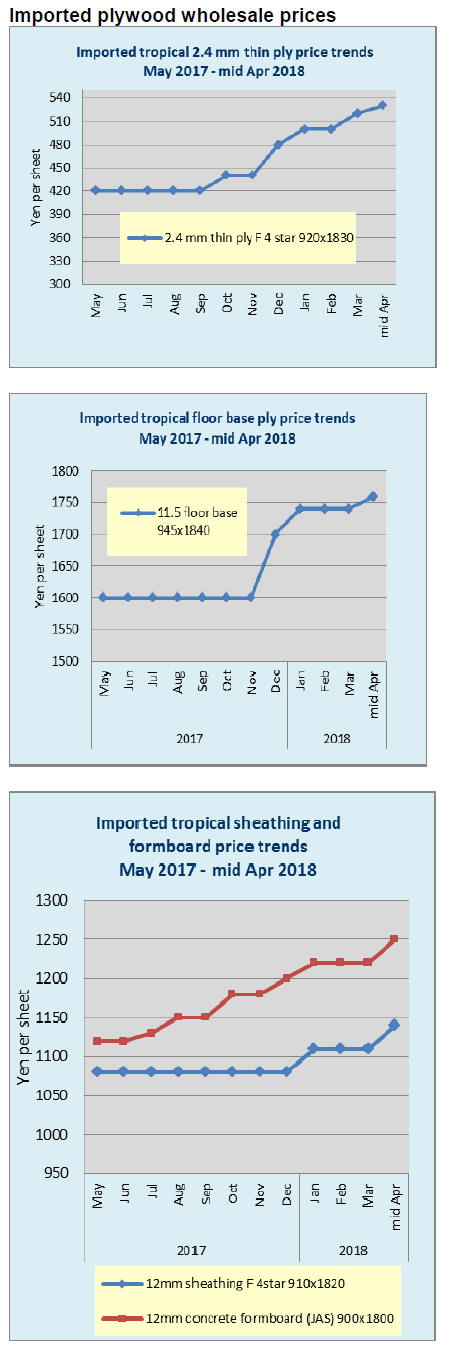

South Sea (Tropical) lumber and logs

Plywood mills South Sea hardwood log inventories

continue scarce. The mills are willing to pay higher prices

if quality logs are available but it is hard to see any

recovery of log supply so mills are looking for other

species but meranti.

Market prices of Sarawak meranti regular log C&F are

12,000 yen per koku or higher and Sabah kapur log prices

are 16,000 yen or higher.

Demand for concrete forming panel made by South Sea

logs is not so active but because of tight supply of

imported panels, certain amount of orders continue

coming in for domestic plywood mills.

Logs from PNG and Solomon Islands are heavily bought

by Chinese so Japan has very little chance to buy.

Demand for imported laminated free board is slow but the

supply from producing regions is declining because of

tight log supply. The market prices are holding steady.

North American log import in 2017

Total volume of logs imported from the North America in

2017 was 2,604,825 cbms, 6.7% less than 2016.

Decrease by species is 133,000 cbms of Douglas fir, 5.2%

less but in percentage, hemlock was the largest by 25.7%.

Also decrease of Sitka spruce by 19.0% and yellow cedar

(cypress) by 16.2% is large.

Decline is not only by demand decrease but by climate

factor in the North America and also by hot North

American lumber market, which pushed the prices sharply

in the second half of the year.

Despite starts of wood based units in 2017 increased by

8.1%, log import decreased, which means the market relies

less on the North American logs. Lumber demand declined

as structural laminated lumber with European lamina and

domestic logs took larger share in lumber market.

Douglas fir supply from the U.S.A. was 1,589,015 cbms,

8.3% less than 2016 and from Canada was 820,203 cbms,

1.4% more. This is two straight years¡¯ increase from

Canada. Compared to 2015, it is 31.7% increase.

With countervailing duty and anti-dumping duty imposed

on Canadian softwood lumber, robust lumber market in

the U.S.A and resultant higher log prices were expected

from the beginning of the year so that the Japanese

Douglas fir cutting sawmills increased purchase of

Canadian Douglas fir logs together with softwood

plywood mills in Japan but unexpected severe winter

weather and the worst forest fires reduced log production

and the prices soared.

IS sort FAS prices in July 2017 were $860 per M Scribner

then it shot up to $1,040 in January 2018.

Hemlock and yellow cedar grow in high elevation so

heavy snow delayed start of logging.

North American lumber import in 2017

Import volume of North American lumber in 2017 was

2,199,239 cbms, 1.6% less than 2016. This is four

consecutive years¡¯ decline. SPF lumber increased by 1.8%

but Douglas fir volume remained the same as 2016 then

volume of hemlock, spruce and yellow cedar (cypress)

decreased considerably.

Reasons of decline are hot North American lumber market

and higher prices for China then progress of demand

decline for traditional lumber use in Japan.

Import of SPF lumber was the highest since 2013 but it is

13.7% less than 2013 and compared to the peak of 2008, it

is 16.5% less. 2x4 housing starts continues high but the

main type is apartment so that use of 2x4 lumber per unit

is much less than detached unit. SPF lumber had been

superior in cost performance but now supply stability is

shaky with higher prices, the users are looking for

substitutions.

Hemlock declined largely by 15.0%. Compared to 2013,

decline is 37%. Hemlock lumber has competitive edge to

Douglas fir lumber but number of suppliers is limited so

the supply stability is not as good as Douglas fir. Hemlock

lumber took share of Douglas fir lumber but severe winter

weather and forest fires reduced the supply volume so

attempt to grab larger share of Douglas fir lumber market

failed. Yellow cedar lumber supply dropped much more

than hemlock by 20.5%.

|