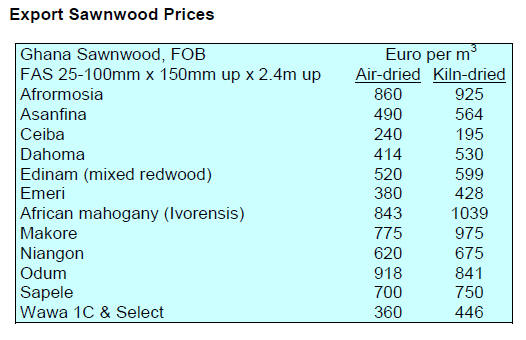

2. GHANA

Timber Validation Committee inaugurated

A Timber Validation Committee has been inaugurated by

the Ministry of Lands and Natural Resources (MLNR) to

oversee validation of licenses and other processes in the

forestry sector. The Deputy Minister, Benito Owusu-Bio,

instructed members of the committee to uphold the

principle of good governance as enshrined in the Forest

and Wildlife Policy.

The committee was tasked with enforcing regulations and

ensuring transparency in the implementation of the Timber

Resources Management and Legality Licensing

Regulations through safeguarding the principles of

transparency, credibility and independence in the

operation of the country’s Legality Assurance System.

The Deputy Minister was emphatic that the root cause of

illegal logging in the country could be traced to weak law

enforcement, inadequate monitoring and coordination. It

was for this reason that the committee was established to

address the existing inadequacies and enforce the legal and

policy framework to deal with illegality in the forestry

sector.

Ghana endorses the Africa Free Trade Agreement

Ghana has endorsed the African Continental Free Trade

Agreement (ACTFA). The aims of the agreement are to:

• Create a single continental market for goods and

services, with free movement of business persons and

investments and thus pave the way for accelerating the

establishment of the Continental Customs Union and the

African customs union.

• Expand intra African trade through better harmoniszation

and coordination of trade liberalisation and facilitation

regimes and instruments.

• Resolve the challenges of multiple and overlapping

memberships and expedite the regional and continental

integration processes.

• Enhance competitiveness at the industry and enterprise

level through exploiting opportunities for scale production,

continental market access and better allocation of

resources.

See: https://au.int/en/ti/cfta/abou

and

https://au.int/en/pressreleases/20180321/list-african-countriessigned-

establishment-african-continental-free-trade

Many in the private sector in Ghana have expressed

concern that the increased competition from FTA

participants could undermine local manufacturing but the

Minister of Trade and Industry, Allan Keremanten, is

optimistic that a zero tariff market beyond ECOWAS will

be an advantage. Ghana is considering hosting the ACTFA

Secretariat.

3.

MALAYSIA

Furniture exports to 180 countries

2017 was a tough year for the Malaysian furniture

manufacturers and exporters with persistent issues and

challenges relating to production, material supply, red tape

and soft global demand for furniture. However, the

Malaysian furniture industry persevered and furniture

exports in 2017 exceeded RM10 billion.

According to the official trade statistics from the Ministry

of International Trade and Industry, Malaysian furniture

exports grew by 6.4% last year, a stronger pace compared

to the 4.2% in 2016, to record RM10.1 billion of furniture

exports to over 180 countries.

As a net exporter of furniture, Malaysia remains in the list

of top 10 furniture exporters in the world according to the

CSIL Centre for Industrial Studies.

However, the Malaysia Furniture Council (MFC) has

pointed out the challenges to sector growth which include:

the availability of sawn rubberwood

the availability of sawn rubberwood

the Malaysian Timber Export Board (MTIB)

the Malaysian Timber Export Board (MTIB)

export license requirement on furniture exports,

the continued export of rubberwood veneer and

the continued export of rubberwood veneer and

finger-jointed sawnwood

the availability of foreign labour

the availability of foreign labour

The Ministry of Plantation Industries and Commodities

recently announced the following to support furniture

manufacturers:

a moratorium on sawn rubberwood exports

a moratorium on sawn rubberwood exports

continued deferment of the MTIB export license

continued deferment of the MTIB export license

requirement for furniture

review of levy on veneer and finger jointed

review of levy on veneer and finger jointed

sawwood

review of the foreign worker levy and minimum

review of the foreign worker levy and minimum

wage rates

The MFC has confidence that the RM10 billion furniture

export target as determined in the National Timber

Industry Policy can be achieved.

5 year contract for container flooring

The domestic media in Malaysia has reported that Sabah

based Sinora has secured a five year contract to supply

container flooring to a Chinese enterprise, Foshan

Zhengsen. To meet this contract Sinora will expand its

container flooring production line.

Ramin and Gharu quota

For 2018, the export quota for Ramin products

(Gonystylus spp.) which includes parts and derivatives has

been fixed at 10,000 cubic metres. The export quota for

Karas/Gaharu (Aquilaria spp.) products which includes

wood chips, wood blocks and essential oils is fixed at

150,000 kg for 2018. All exporters of Ramin and

Karas/Gaharu products must secure export permits from

MTIB.

‘High income’ status by 2020

The World Bank has said Malaysia’s export growth is

likely to be sustained in the first half of this year in line

with the rise in global trade and that 2018 economic

growth could top 5.4%, dipping to around 5% in 2019

because of the high level of household and public debt.

The Bank anticipates that Malaysia could achieve ‘highincome’

status between 2020 and 2024 but to achieve this

there is a need to address structural reforms. A highincome

economy is defined by the World Bank as one

where income per citizen is US$12,476 a year or more.

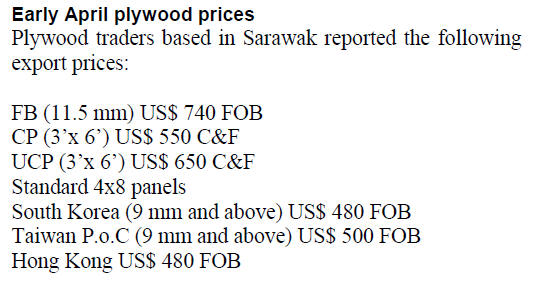

Early April plywood prices

Plywood traders based in Sarawak reported the following

export prices:

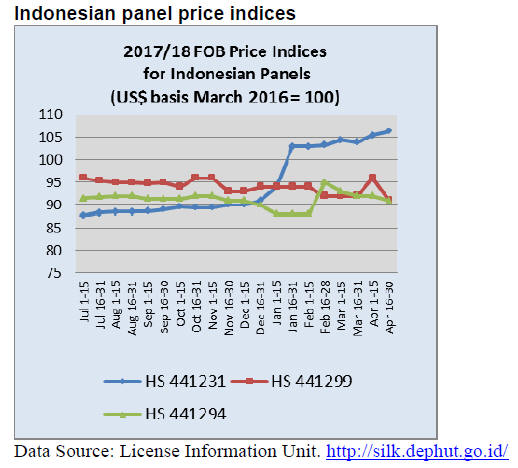

4.

INDONESIA

Furniture makers consider

increasing timber imports

The Association of Indonesian Furniture and Handicraft

Industry (HIMKI) has raised questions on the management

of the timber trading system. Abdul Sobur, Secretary

General of HIMKI said that the availability of domestic

timber is declining and that prices are rising as a result.

Sobur commented that furniture makers are now

considering increasing raw material imports which

currently run to around 25% of sector consumption.

Furniture exports could benefit from US/China trade

dispute

The trade dispute between the US and China is providing

business opportunities for furniture producers according to

Wang Sutrisno, Director of the Indonesian company,

WOOD.

Wang commented that China accounts for almost 50% of

US wooden furniture imports while Indonesia, until

recently, could only secure a 3% share. Indonesia’s share

of US imports is set to rise, said Wang, as buyers in the

US look for alternative suppliers.

10 million Indonesians depend on the forest

The Ministry of Environment and Forestry has reported

that around 70% of rural inhabitants still depend to some

extent on the natural resources in forests. The Ministry

estimates that some 35,000 villages are impacted and that

some 10 million people in the country are assessed as poor

and have no legal rights to resources from the forest.

Siti Nurbaya, Minister for Environment and Forestry, said

in an official statement that data from the Ministry

indicates that the past policy of forest management permits

is oriented to the timber private sector.

Data shows that 42 mil. ha. of state forest are subject to

management permits but that only 4% of these are for

community utilisation. To correct this the Ministry has

established a social forestry programme through which

permits are granted directly to communities. This

programme involving communities has become one of the

Presidents priorities.

Indonesian furniture gaining recognition in

international markets

Twenty-seven Indonesian designers attended the furniture

and interior design exhibition ‘Salone Internazionale del

Mobile’ in Milan between 17-22 April. The conclusion

drawn from the event was that Indonesian furniture

products and designs are increasingly gaining recognition

in international markets and have a firm standing in Italy

where there are several Indonesian furniture showrooms as

well as online furniture sales businesses managed by

Italian companies.

Aries Asriadi, from the Indonesian Embassy in Rome,

commented that Indonesia furniture makers need to

continue to promote products with high added value attract

Italian buyers.

5.

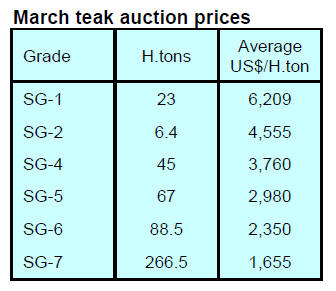

MYANMAR

Regional forestry training centre for

Myanmar

The Asian Forest Cooperation Organization has been

officially launched. This is an intergovernmental regional

organization with the aim of strengthening regional forest

cooperation to address the impact of climate change. The

member nations are Korea, Bhutan, Brunei, Cambodia,

Indonesia, Kazakhstan, Laos, Mongolia, Myanmar,

Philippines, Singapore, Thailand, Timor-Leste and

Vietnam.

The Organization has been promised almost US$24

million for projects to 2023. A sum of US$16.6 million is

earmarked for programmes that include a regional

education and training centre in Myanmar, development of

education and training programmes, establishment of a

forest genetics research centre for restoration of major

timber species in Cambodia, rehabilitation and

development of the mangrove forest ecosystem in the Binh

Province, Vietnam and village-based forest rehabilitation

in Laos.

See:

http://www.koreaherald.com/view.php?ud=20180423000430

Logs seized in Bago Mountains

The domestic press has quoted the Ministry of Natural

Resources and Environmental Conservation as saying over

5,000 tons of illegally harvested timber had been seized

and suspects held in Bago Region in the southern central

part of the country. There has been a total logging ban in

the Bago Mountain Range since 2016. Of the total seized,

2,266 tons was teak.

The State Minister for Forestry in the Bago Region has

been relieved of duty but the information from the

Ministry does not link the illegal felling and the removal

from office of the official.

The authorities in Myanmar have cracked down on illegal

logging and in his mid-April New Year (Thingyan)

address, Minister Ohn Win mentioned that the Community

Monitoring and Reporting System ( CMRS) will be used

to assist combating forest crime.

No to foreign investments utilising natural forest logs

Last year the Myanmar Investment Commission (MIC)

suspended approvals of foreign investment in the forestry

sector if the business plan involved utilisation of logs from

the country’s natural forest.

Last year investment approvals fell for the second

consecutive year, underscoring the challenges the

government faces in keeping up the momentum of capital

inflows. Despite the decline in international investment

domestic investments topped US$12 billion in 2017

according to the MIC.

The Thilawa Special Economic Zone attracted

around US$400 million last fiscal year. The zone on the

outskirts of Yangon is being developed jointly by Japan

and Myanmar.

No log sales in April

Due to the Thingyan celebrations there were no log tender

sales in April.

6. INDIA

Surge in veneer prices lifts wood

products index

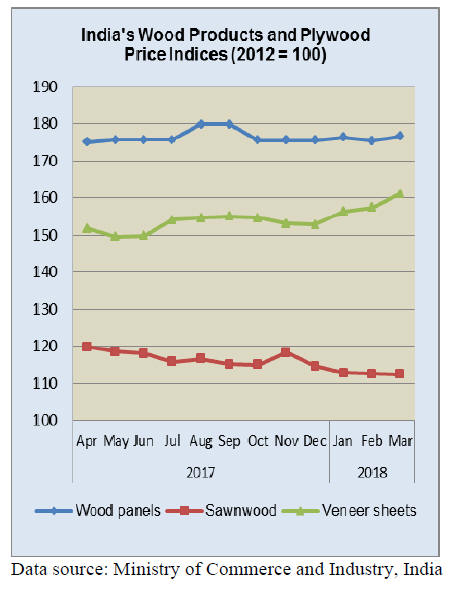

India’s official wholesale price index for all commodities

(Base: 2011-12=100) for March 2018 released by the

Office of the Economic Adviser to the government (OEA)

rose by 0.2 percent to 116.0 (provisional) from 115.8

(provisional) for the previous month.

The annual rate of inflation, based on monthly WPI in

March 2018 was 2.47% compared to 2.48% (provisional)

for the previous month. The overall index for wood

products and cork group rose by 0.6% to 131.7 due to the

higher prices for laminated wood, veneer sheets and wood

panels. However, the price of wooden boxes/crates

declined.

The press release from the Ministry of Commerce and Industry

can be found at: http://eaindustry.nic.in/cmonthly.pdf

Firm expansion of industrial production

Industrial production in India expanded almost 2% in

February on the back of robust manufacturing and good

sales of consumer durables. The other positive news is that

retail inflation slowed for the fourth consecutive month in

March supporting the view that the Indian economy may

be on a sustained recovery path.

The Reserve Bank of India has lowered its inflation

forecast for 2018-19 to 4.7%-5.1% in the first half and

4.4% in the second half.

Discussions continue on forest policy revision

Discussions on the draft revision of the national forest

policy continue. The draft proposes a ‘green’ cess to

promote “ecologically responsible behavior” and says

greater use of wood products has the potential to create

employment opportunities by boosting indigenous

manufacturing using domestic resources.

The draft policy is open for public comments until the

June 30 and the Ministry is emphasising that the country

needs to change its mind set from forests to landscapes,

from canopy cover to healthy ecosystems, from

substituting wood to promoting sustainable wood use,

from participatory approaches to empowerment and to

greater community participation.

India has set an ambitious target of bringing 30% of its

geographical area under forest cover within a decade

(from the current 25%) and recommends that this be

achieved by rehabilitating degraded land with native

species.

Traders still cannot get adequate bank credit to

sustain imports

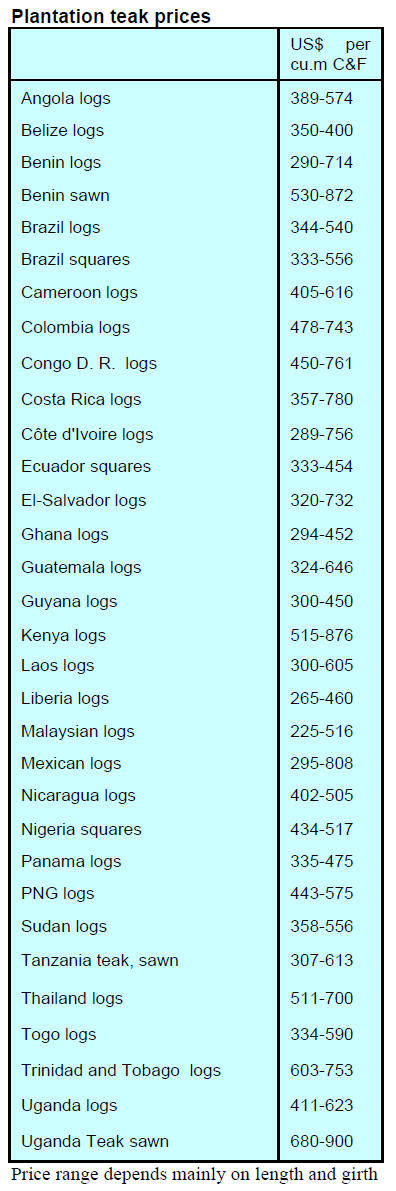

Demand for imported logs is stable and there are no

reports of changes in C&F prices. The pace of plantation

teak imports continues to be impacted by the withdrawal

of credit facilities offered to importers due to the recent

financial scams at Indian Banks. With limited working

capital importers have had to cut back on purchases.

Analysts write “efforts to return to normal practices

continue but it seems this will take some longer time to

settle”.

From recent import data it appears that shippers in Brazil

and Ghana are offering larger volumes than was common.

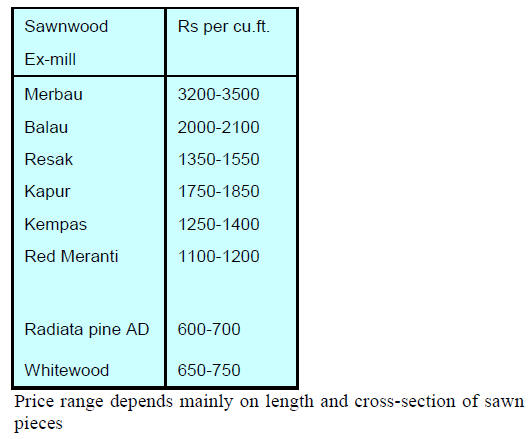

Locally sawn hardwood prices

Prices for domestically milled imported hardwoods

continue unchanged.

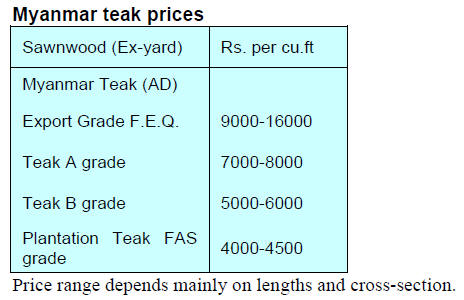

Imported sawn Myanmar teak

Prices for imported Myanmar teak remain unchanged.

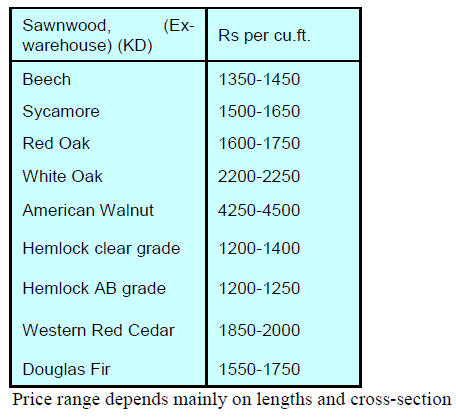

Prices for imported sawnwood

Prices for imported sawnwood (KD 12%) ex-warehouse

remain unchanged.

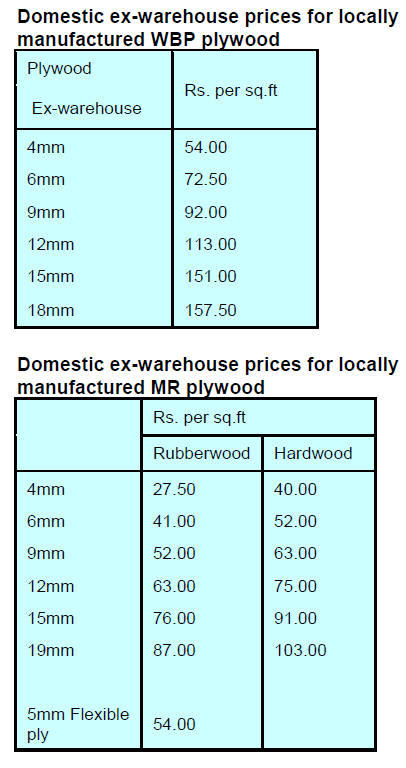

Structure of plywood sector changing

Competition from composite panels is increasing as new

mills come on line. Plywood manufacturers complain that

the GST (sales tax) for composite panels is 18% as against

28% for plywood panels.

Adding to the problems for plywood manufacturers is the

rising price for peeler logs, this, and the expected increase

in resin and other chemical costs, signals a further

plywood price increase may be imminent.

The application of a national Goods and Services tax

(GST) is impacting the structure of plywood

manufacturing in India with the share of production

between the ‘organised’ and ‘unorganised’ sectors

narrowing from 25:75 to around 50:50 at present.

Current domestic plywood prices are shown below.

7. BRAZIL

Improved domestic furniture

sales

February domestic furniture sales expanded almost 2% in

comparison with February 2017 building on the modest

growth recorded in January.

The best performance came from traders in Espírito Santo

(42.7%), Pernambuco (26.4%), Distrito Federal (19.0%),

and Goiás (17.5%). In contrast, of the 12 states surveyed,

five reported negative results: São Paulo (-9.2%), Ceará

(-2.7%), Bahia (-2.6%), Paraná (-2.0%) and Minas Gerais

(-.9%).

Amazon Fund promotes recovery in the Amazon

The Amazon Fund will make available around R$200

million for projects focused on increasing the forest cover

in the Amazon.

With the support of the Ministry of the Environment

(MMA) and the Brazilian Forest Service (SFB) the Fund

has started a series of workshops on forest recovery. The

first workshop took place on 10 April in Porto Velho,

Rondônia. The objective was to guide participants on

preparing project proposals in support of the National Plan

for Native Vegetation Recovery (PLANAVEG).

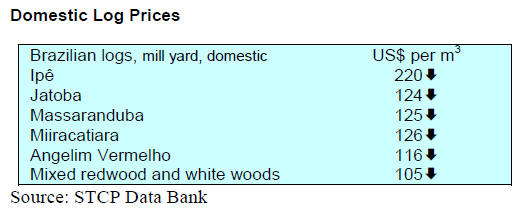

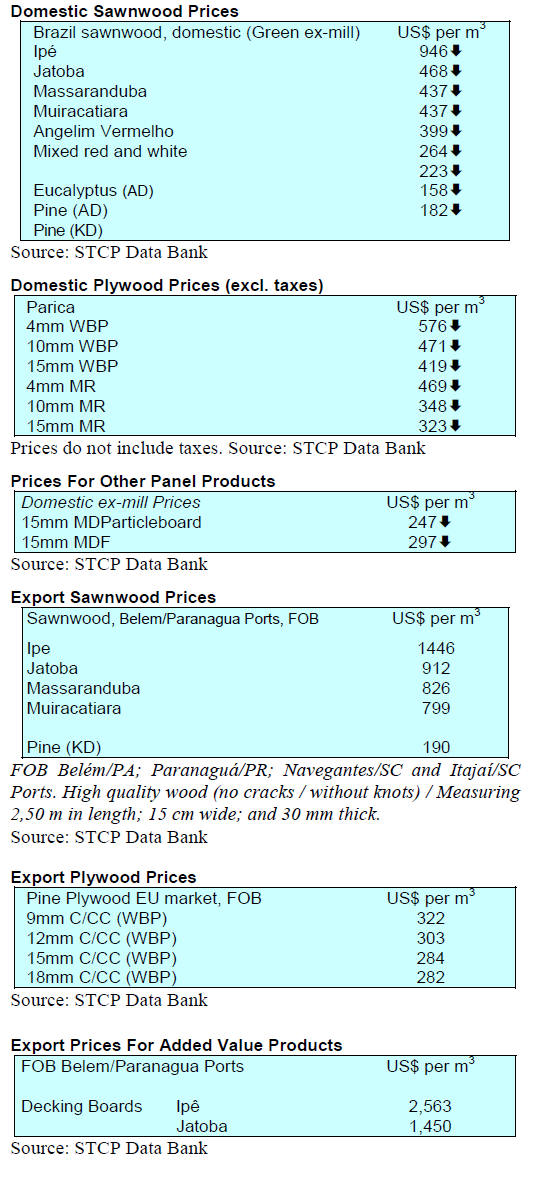

Export update

In March 2018, Brazilian exports of wood-based products

(except pulp and paper) increased 19% in value compared

to March 2017, from US$226.6 million to US$270.4

million.

The value of pine sawnwood exports increased 13%

between March 2017 (US$39.2 million) and March 2018

(US$44.3 million) while in terms of volume there was an

almost 9% increase from 193,400 cu.m to 210,600 cu.m.

Tropical sawnwood exports also increased in March rising

10% from 34,600 cu.m in March 2017 to 38,100 cu.m in

March 2018. The value of March tropical sawnwood

exports increased 14% from US$15.3 million to US$17.5

million year on year.

There was a sharp rise in the value of year on year pine

plywood exports in March (+49%) in value in March.

Exports increased from US$43 million to US$64 million

year on year. The 22% increase in the volume of pine

plywood exports underlines the steady rise in prices.

Exports increased from 159,300 cu.m to 194,600 cu.m

year on year.

Brazil’s tropical plywood, exports are modest but in

March export volumes and values rose; from 13,900 cu.m

(US$5.4 million) in March 2017 to 16,600 cu.m (US$7.1

million) in March 2018.

An almost 6% increase in the value of wooden furniture

exports was recorded in March this year. Exports rose

from US$42 million in March 2017 to US$ 44 million in

March this year.

Export of panels grows

According to Indústria Brasileira de Árvores (Ibá), wood

panel exports in the first two months of 2018 totalled

192,000 cu.m, an almost 10% increase compared to the

same period last year,.

Markets in Latin America accounted for more than half of

the volume exported in January and February, up 14%

over the first two months of 2017. The second largest

market for Brazilian wood panels was the US at US$11

million (up 38%).

In the first two months of this year the domestic market for

wood panels expanded over 6% to 1.1 million cubic

metres.

New IBAMA control system

Last year the Brazilian Institute of Environment and

Renewable Natural Resources (IBAMA) launched the

National Forest Products Control System (SINAFLOR),

SINAFLOR is a system that integrates existing platforms

used by IBAMA for forest control, such as the Document

of Forest Origin (DOF), the Annual Operational Plan

(POA) and the National Rural Environmental Registry

System (SICAR).

The objective is to improve the level of control of the

origin of forest products from logging permits to

transportation, storage, processing and export. The system

aims to increase the degree of reliability to meet

international demands regarding the origin of legal timber.

All states in the country have until May this year to issue

logging permits and document commercialisation of forest

products.

IBAMA says the SINAFLOR system will significantly

reduce the possibility of fraud by bringing more

operational security to the issuance of logging permits, key

elements in achieving two objectives of the Brazilian

Coalition, to curb illegality in the timber sector and to

increase the area of sustainable forest management and

tracked area in the country to 25 million hectares by 2030.

8. PERU

Osinfor aims for ISO standard

The Forestry and Wildlife Resources Oversight Agency

(Osinfor) has initiated a process for adopting international

management standards with the support of the German

development cooperation agency, GIZ.

If this is successful then Osinfor could become accredited

under the international management standard ISO 9001

and ISO 27001. This would mean Osinfor would become

the first public institution in the forestry sector in Peru to

acquire ISO accreditation.

ISO accreditation will help boost confidence in the

information that the Osinfor makes available through its

General Information System and its Geographical

Information System both of which contribute to addressing

illegal logging.

Conclusion of mission to Milan Fair

A group of forestry entrepreneurs, together with the

company specializing in commercial and technology

missions, ‘Tropical Forest’, visited the Milan Furniture

Fair from April 17 to 22.

The group was made up of diverse timber exporters from

around the country. Dialogue was conducted with

European importers and suppliers of technology.

Other mission planned for this year include Technological

Mission to Xylexpo of Milan - May 8-12, Technological

Mission to IWF USA fair - August 22-25, Business

Mission to Furniture China fair - September 11-14 and

Technological Mission to Exposicam Italy - October 16-

19.

Ministers gather for 2020 Initiative

Agriculture and Forestry Minister from Argentina,

Colombia, Belize, El Salvador, Nicaragua, Honduras and

Peru recently gathered for the Fourth Annual Meeting of

the ‘2020 Initiative’. The aim of this initiative is to control

deforestation and further develop the forestry and wood

processing sectors.

Peru’s Minister of Agriculture said "In order not to

continue degrading the lands and deforesting them, we

propose alternatives to cocoa or coffee crops in

ecologically sustainable and profitable mixed activities,

rather than subsistence agriculture”, This was supported

by the Ministry of the Environment whose intention is to

fight deforestation.

The ‘2020 Initiative’ was conceived at the Lima Climate

Change conference and is in support of the goals of the

Bonn Challenge and the New York Declaration on Forests.