Japan

Wood Products Prices

Dollar Exchange Rates of 10th

August 2018

Japan Yen 110.90

Reports From Japan

¡¡

Labour

shortage now a major problem

Japan¡¯s economy is beginning to feel the effects of the

volatility in global markets, the result of US trade policies,

as well as from the rising costs of imported raw materials

and the domestic labor shortages.

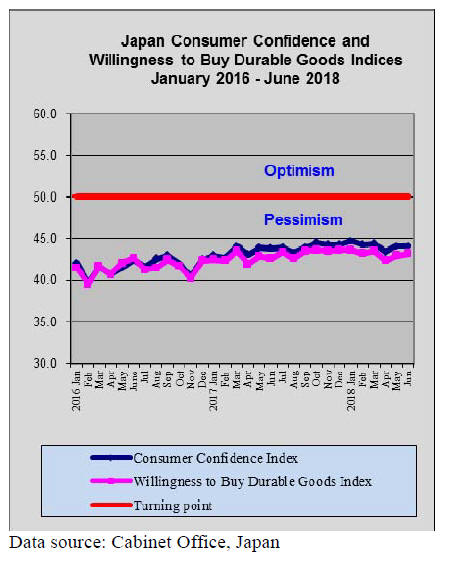

The latest Tankan quarterly survey for June released by

the Bank of Japan (BoJ) showed business confidence, even

amongst the large manufacturers, was declining. June

figures marked the second monthly fall in confidence.

Revised GDP indicated that the economy shrank at an

annualised rate of 0.6 percent in January-March period but

initial figures for the second suggest GDP improved which

if the figures are not revised down would lift annualised

GDP to 1.9%

Economic uncertainties did not drive the (BoJ) to

change

policy direction and at its latest policy board meeting the

BoJ maintained its positive assessment of economic

prospects and even revised upwards its assessment for

private sector capital investment in three of the nine

regions of Japan.

The labour shortage in Japan is now a major problem

especially in the construction and manufacturing sectors

and the latest population data indicate that there is no easy

fix as Japan¡¯s population is falling at its fastest pace yet

recorded.

Bank of Japan aims to keep yen competitive

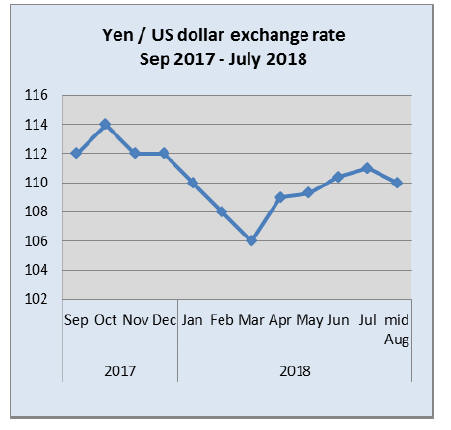

After the BoJ decided to maintain its current monetary

policy the yen fell against the US dollar. There was

speculation that the BoJ would end to years of policy

stimulus but this was put to rest with the BoJ Governor

saying the Bank has no intention to raise interest rates and

that the current policy will be maintained until the

inflation target has been achieved.

Some analysts say the decision to maintain the current

policy is partly driven by the BoJ¡¯s interest in keeping the

yen competitive, especially against the Chinese yuan

which has fallen sharply against the US dollar.

Japanese homes boil because of Inadequate

insulation

Temperatures across Japan have soared this summer, with

a record high of 41 degrees Celsius recorded in late July

prompting the Japan Meteorological Agency to declare the

high temperatures, combined with elevated humidity, a

natural disaster.

Between the end of April and the end of the first week in

August, at least 138 people have died from heat-related

complaints and over 70,000 have been admitted to

hospitals for heatstroke or heat exhaustion according to the

Fire and Disaster Management Agency.

The searing temperatures are especially affecting the

elderly who prefer not to use air conditioners or simply

cannot afford to have them running. The impact of the

summer heat has be aggravated by inadequate insulation in

most Japanese homes.

Houses more than 25 years old rarely have roof insulation

and wall insulation at about 5cm is wholly inadequate to

prevent the inside wall becoming hot in direct sunlight.

Calls have been made for the authorities to help those at

the greatest risk. In South Korea, which has also been

affected by very high temperatures, the government has

said it will reduce the price of electricity supplied to

households for the months of July and August and that

additional help would be provided to low-income families.

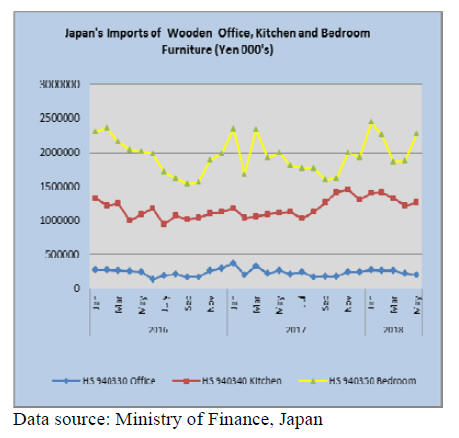

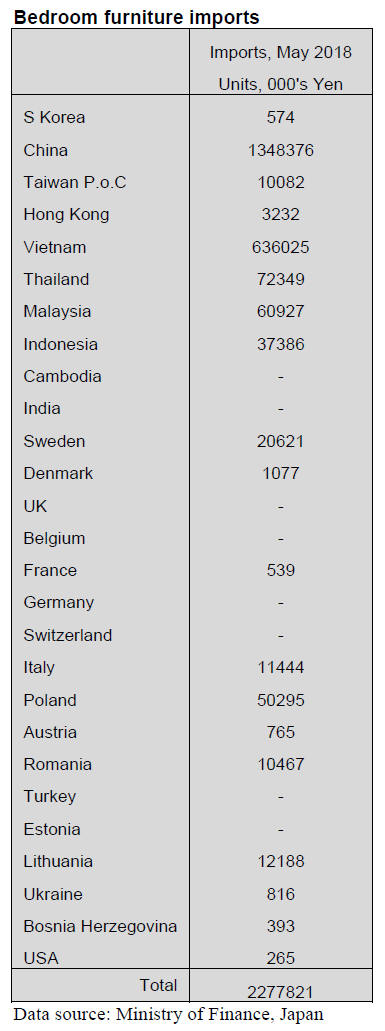

Furniture imports

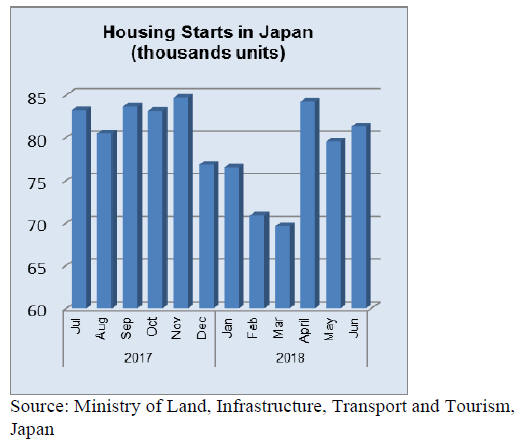

May saw a reversal of the April decline in the value of

both wooden bedroom and kitchen furniture imports. May

bedroom furniture imports were significantly higher than a

month earlier and kitchen furniture imports rose

moderately.

The month by month trends in imports of bedroom and

kitchen furniture are quite different. Wooden bedroom

furniture imports show consistent peaks and dips mirroring

the cyclical trend in housing starts. On the other hand

imports of wooden kitchen furniture, which could be

expected to also mirror housing starts, show no regular

pattern seemingly more closely related to consumer

confidence.

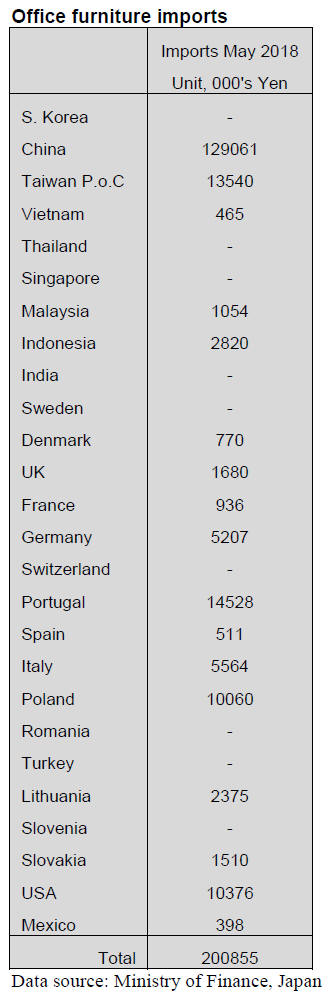

Office furniture imports (HS 940330)

The value of May imports of wooden office furniture was

down on levels in the previous month and marked the third

monthly decline after the peaks seen in January and

February.

Year on year the value of May wooden office furniture

imports was down 24% and there was a 10% decline in

May imports compared to a month earlier.

The top three shippers of wooden office furniture to Japan

remain China, accounting for 64% of total May wooden

office furniture imports, followed by Portugal (7%) and

Taiwan P.o.C also 7%.

In May, the value of imports from China was largely flat

but, while small compared to China, imports from

Portugal expanded by six times the level in April and

shippers in Taiwan P.o.C saw a tripling of shipments of

office furniture to Japan

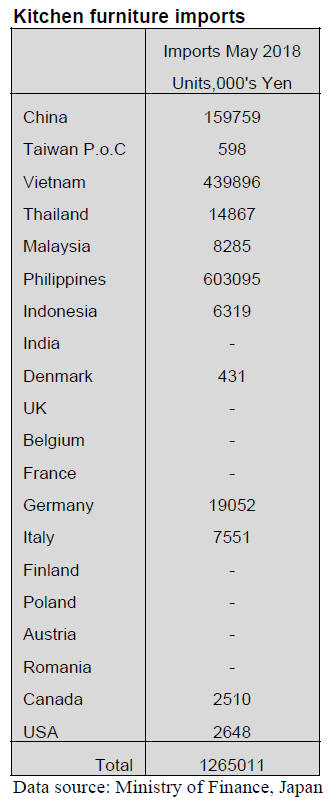

Kitchen furniture imports (HS 940340)

In contrast to the downward trend in office furniture, May

imports of wooden kitchen furniture were up 13% year on

year and up almost 4% compared to a month earlier.

Three suppliers account for the bulk of Japan¡¯s wooden

kitchen furniture imports, the Philippines, (48%), Vietnam

(35%) and China (13%).

The big winners in May were both the Philippines and

China both of which saw shipments rise on the other hand

shippers in Malaysia, Indonesia and Thailand saw sales

fall in May compared to a month earlier. The only non-

Asian shippers of wooden kitchen furniture in May were

Germany and Italy.

Bedroom furniture imports (HS 940350)

Unexpectedly, Japan¡¯s imports of wooden bedroom

furniture surged in May reversing two months of declines.

The value of May imports of wooden bedroom furniture

was up 21% compared to April and year on year May

2018 imports were 14% higher.

The top three shippers of wooden bedroom furniture to

Japan in May were, in order of value, China, Vietnam and

Thailand. Exporters in these three countries accounted for

90% of Japan¡¯s wooden bedroom furniture imports in

May. Shippers in China accounted for 59% of May

imports followed by Vietnam (28%) and Thailand.

Trade news from the Japan Lumber Reports (JLR)

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

Unprecedented heavy rain hit Western Japan

Record breaking heavy rain hit Kyushu, Shikoku and

Western Japan for four days since July 4, which caused

inundations and landslides. Bursting dikes flooded many

houses and landslides engulfed many houses. Death toll

reached 200 with heavy tolls in Hiroshima and Okayama

prefecture. Road system is heavily damaged and rail

system is disrupted.

Chugoku Lumber in Kure, Hiroshima prefecture suffered

little damages at the sawmills but supply of electricity and

industrial water is stopped so mills operations are stopped.

It has some inventories so lumber supply is possible but

deliveries take time because of damaged road system.

Many other building materials manufacturing facilities in

the area are damaged by muddy flood water. Heavy rain

also damaged logging road system so log supply in the

area is definitely affected.

Many houses are destroyed and people evacuated to

temporary shelters as water and electricity supply is

stopped. Hundreds of volunteers from all over Japan rush

to the area to help clean up works in hot weather over 35

degreed after weather changed to scorching sunny day for

more than ten straight days and many suffers heat stroke.

Log exports continue increasing

For the first four months of this year, log export was

347,476 cbms, 23.5% more than the same period of last

year.

Lumber export also increased to 45,656 cbms, 14.8%

more. 285,195 cbms or 82.1% of export logs went to

China. By species, cedar is 290,175 cbms, 83.5% in total

log export. Cypress is 44,421 cbms, 12.8%.

In lumber export, China is top buyer with 19,372 cbms,

42.4% then about 9,000 cbms for the U.S.A. and the

Philippines. By value of lumber export, 680 million yen

for China then 436 million yen for the U.S.A. 380 million

yen for the Philippines so the U.S.A. becomes the second

in value.

Cedar fence board for the U.S. market continues to be

steady but growth is slowing. Lumber export by species is

24,032 cbms of cedar, 52.6% then cypress is 11,043 cbms,

24.2%. Pace of log export for 2018 seems to be over one

million cbms but heavy rain in the Western Japan is likely

to hamper log harvest and may influence export volume.

Besides logs and lumber, export of plywood for the first

four months is 40,142 cbms, 9.6% more.

Wood supply and demand projection for 2018

The Forestry Agency held the first wood demand

projection meeting on June 26. The supply for 2018 seems

to be the same as 2017 in general. Trend is increase of

domestic wood and decrease of imports. Supply of

structural laminated lumber would decline for

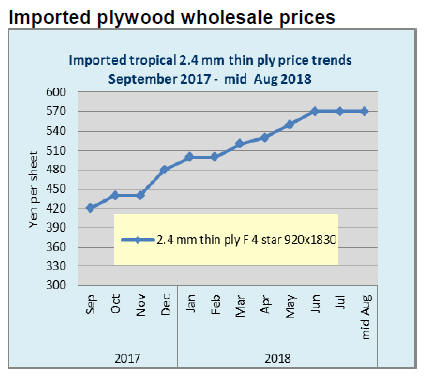

bothdomestic production and imports. Domestic plywood

production would increase some while imported plywood

would decrease some.

Domestic log supply increased in 2017 and the supply

would be the same as 2017. There is some comment that

domestic wood supply replaces inflated imported wood

products but in a long run, it would cause declining

demand for wood.

Domestic log demand would increase as the new softwood

plywood mill in Miye prefecture by Nisshin started and in

the second half of the year, it would be in full production.

By record breaking heavy rains in early July in Western

Japan hit major log producing prefectures like Hiroshima,

Okayama, Ehime and Kohchi and it would take some time

to restore logging road systems so log production would

drop in these regions so some areas may suffer log

shortage.

High prices of North American wood products would

continue for the second half of the year and the supply

would continue tight but the demand is also stagnating so

both supply and demand would keep shrinking.

European wood supply would increase more than last year

in the second half but structural laminated lumber would

decline.

Radiata pine logs and lumber are only items to be more

than last year. Increase of logs would be in the fourth

quarter this year and lumber from Chile would increase

during July and September.

Log supply from both Russia and South Sea countries

would decrease considerably by supply side problems.

Log export ban by Sabah of Malaysia would impact log

supply. Log import from Far East Russia would drop by

log export duty so the demand in Japan would shift to

veneer for plywood mills in Japan, which have been using

Russian larch logs.

Projection of new housing starts for 2018 by 12 private

think tanks is 930,000 units, which is revised downward

by 23,000 units from previous projection in last March.

Negative factors are inflating building materials cost and

labor.

South Sea (tropical) logs and lumber

At the recent Forestry Agency¡¯s demand and supply

projection meeting, log supply from South Sea for the

fourth quarter and first quarter next year is reduced by half

of initial projection after Sabah, Malaysia bans log export.

Plywood mills peeling Malaysian logs are now seeking log

supply from other regions like PNG and Solomon Islands,

Africa, South America then veneer supply from Russia

and Indonesia.

Movement of merkusii pine laminated free board from

Indonesia is recovering with start of more public facilities.

Distributors carry ample inventories so they are not ready

to place new orders yet.

Review of domestic logs

Share of domestic logs in total logs used for

manufacturing lumber and plywood has been climbing.

While import of logs continues to decline, domestic log

production continues increasing. For domestic wood

products manufacturers, domestic logs are now

indispensable.

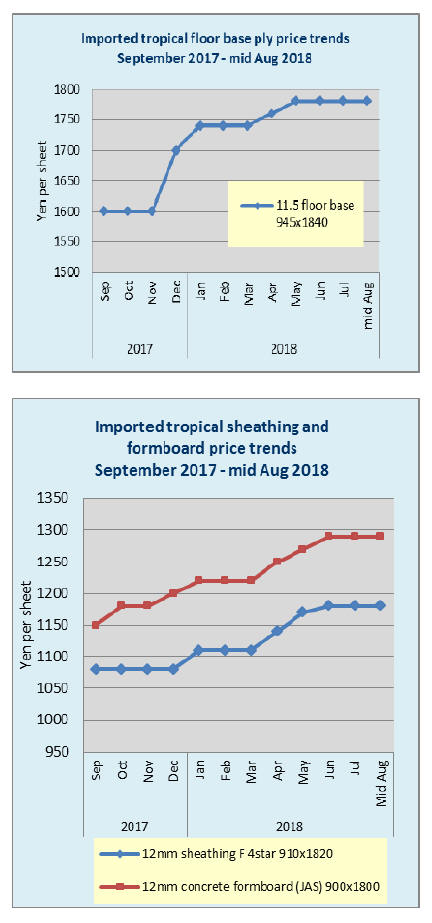

Supply side price escalation of all the imported wood

products is remarkable since second half of 2017.Facing

such steep price inflation, it is challenge how much

domestic wood can replace imported items such as SPF

2x4 lumber, green hemlock square for sill, KD Douglas fir

square for girder and purlin, European laminated post and

stud and floor base of South Sea hardwood plywood. Also

another challenge is if stable log supply is achieved to

satisfy growing demand.

In 2017, domestic log supply for industrial use expanded

to 21,279,000 cbms when new housing starts did not

increase. This proves that share of domestic logs in total

log consumption increased.

Meantime percentage of kiln dried products in total

lumber shipments exceeded 40% for the first time. This

means increase of new domestic log cutting sawmills with

kiln dry facilities so domestic KD lumber production

increased, not imported species like Douglas fir.

Also, domestic log consumption for plywood

manufacturing is now nearly four million cbms. Now a

new softwood plywood mill in Miye prefecture by Nisshin

has started running and Yamanashi plant by Keytec and

Ohita plant by Shin-Ei will start up next year. These plants

consume about 100,000 cbms a year so the volume will

keep increasing for plywood manufacturing to over 4

million cbms next year.

New housing starts in 2017 are 964,641 units, 3,064 units

less than 2016 but domestic log supply increased to 21,279

M cbms, 619 M cbms more than 2016. While housing

starts decreased, domestic log demand increased.

By species, supply of all the softwood species increased

over 2016. Cedar took 63.5% in total softwood then

cypress increased to 12.2%. Larch production was less

than the demand. Larch is used for laminated lumber and

plywood so the demand is growing.

In the wood statistics made by the Ministry of Agriculture,

Forestry and Fisheries, it is the first time since 1997 that

the demand for domestic logs hit over 21,000,000 cbms

but contents have changed a lot in last 20 years. Compared

to 1997, logs for lumber decreased by 2,804,000 cbms

while logsfor plywood increased by 3,792,000 cbms.

Hardwood log demand dropped by half while cedar

increased.

Share of domestic logs in 1997 was 46.0% then it climbed

to 80.8% in 2017 and 80% of logs consumed by sawmills

is domestic.

Log demand has shrunk by about 40% in last 20 years.

Demand for imported logs shrunk by one fifth so share of

domestic logs almost doubled. Declining trend of log

demand had been before 1997.

Demand decline for both imported and domestic logs had

been lasting and in 2012, both were almost even with

15,000 M cbms each. Since then share of domestic has

kept growing while that of imported has kept dropping.

As to imported logs, logs from all the sources have

decreased. Sharp decline of Russian logs (7% of 1997) and

South Sea logs (4% of 1997) is conspicuous. Some of log

demand is replaced by finished products but shifting to

domestic logs of plywood manufacturing is notable

change.

Cedar logs replaced imported logs. Cedar log demand in

20117 was12,147,000 cbms while that in 2002 was

6,860,000 cbms so it is1.8 times increase in fifteen years.

Domestic log production by the region is changing.

Kyushu has been the top producer but it is now peaking

off while the North East is growing. Log production by

seven prefectures in Kyushu was 5,078,000 cbms while

that by six prefectures in the North East was 5,201 M

cbms and they have more room to grow. Log producers in

these regions are seriously tackling replantation to make

sustainable forest management to insure future log supply.

In 2017, log demand for lumber increased by 1.3% from

2016. Domestic log demand increased by 3.7% while

demand for imported logs decreased by 5.4% so share of

domestic climbed to 75.2%. Shifting from high cost North

American logs to domestic logs progressed in 2017.

The most symbolic move is Cypress Sunadaya in Ehime

prefecture, which had been cutting North American yellow

cedar for years then by skyrocketing prices and tough

availability, it gave up to cut North American cypress and

changed to domestic cypress. By species of logs for

lumber manufacturing in 2017, cedar was 8,200,000 cbms,

1.3% more than 2016 then cypress was 2,180,000 cbms,

9.9% more.

|