|

Report from

North America

Tropical plywood suppliers gain market share

Hardwood plywood imports were slightly down in June

from the previous month, but overall the monthly import

volume is not much lower than in previous years, before

the US anti-dumping and countervailing duties were put in

place for plywood from China.

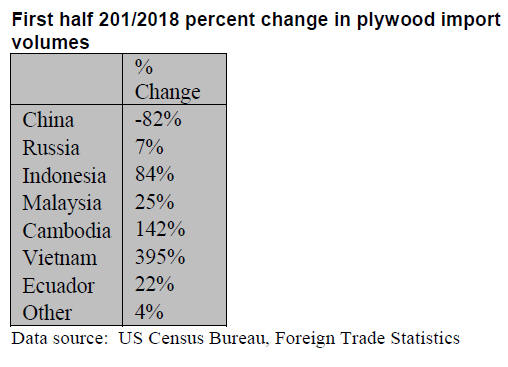

Higher imports from all tropical suppliers made up in part

for lower imports from China. Year-to-date plywood

imports from Indonesia were up 84% compared to June

2017.

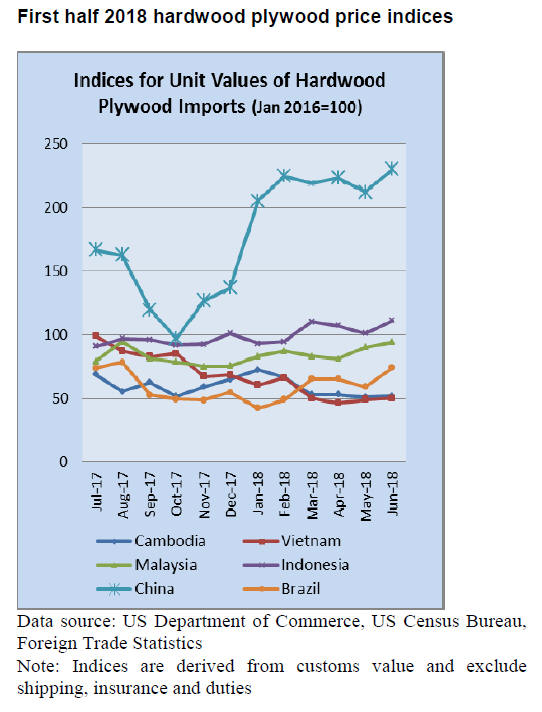

The value of plywood imports was almost unchanged from

May because of higher prices of plywood from China

(excluding duties), Indonesia and Malaysia.

Higher moulding and flooring imports

Hardwood flooring imports were worth over US$6 million

in June, up 40% year-to-date compared to June 2017.

China remains the largest source of imports, but imports

from Malaysia and Brazil doubled year-to-date.

Imports for assembled flooring panels (laminate,

engineered) declined in June. While China and Canada

dominate U.S. imports, Thailand and Vietnam have

become significant new sources of assembled flooring. In

the first half of 2018 Thailand and Vietnam each

accounted for 4% of total U.S. imports of assembled

flooring.

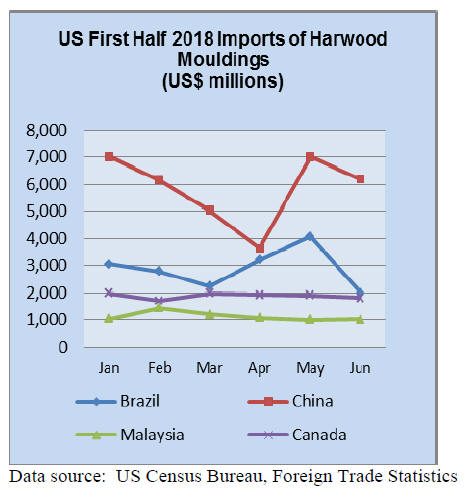

Hardwood moulding imports were down in June from the

previous month, with the exception of imports from

Malaysia. Imports from Malaysia grew 24% year-to-date

compared to June 2017.

Higher US furniture imports from China

Wooden furniture imports grew 2% in June to US$1.71

billion. Imports in the first half of 2018 were 6% higher

than during the same time period in 2017.

The month-over-month growth was entirely in furniture

imports from China, while imports from most other

countries fell. The increase in furniture imports from

China could be in response to potential tariffs. While

tariffs specifically on furniture had not been announced at

that time, by end of July the Trump Administration

confirmed it would raise tariffs from 10% to 25% on

US$200 billion worth of products from China.

Imports of upholstered, kitchen and office furniture grew

in June, while wooden seating and bedroom furniture

declined.

US wood product manufacturing slows

Retail sales at furniture and home furnishing stores grew

5% year-to-date in July, compared to July 2017 (U.S.

Census Bureau, Advance Monthly Retail Trade Survey).

Retail sales did not change much in July from sales in June

and May.

The Kitchen Cabinet Manufacturers Association reported

a 1% growth in year-to-date cabinet sales in June

compared to last year.

The wood products and furniture industries reported

growth in July, but at a lower rate than most other

manufacturing industries, according to the Institute for

Supply Management¡¯s Manufacturing (ISM) Business

Survey. One of the survey¡¯s respondents in the wood

products sector commented that the trade war and lower

demand from export markets like China has affected

business.

GDP growth estimated at 4.1% in Q2

GDP growth increased to 4.1% in the second quarter based

on the advance estimate by the Bureau of Economic

Analysis. In the first quarter of 2018 GDP grew 2.2%.

Increased personal spending, exports and government

spending contributed to GDP growth in the second quarter.

The unemployment rate edged down to 3.9% in July,

according to the U.S. Bureau of Labor Statistics.

Modest growth in home construction

Low unemployment and a strong economy support

demand for housing, but housing starts grew only 0.9% in

July at a seasonally adjusted annual rate, according to the

U.S. Department of Housing and Urban Development and

the Commerce Department. Building permits were slightly

up from June.

The high cost of building materials and labour contribute

to the slow growth in the housing market, along with

worsening affordability. Housing affordability in the

second quarter of 2018 was the lowest in ten years,

according to the National Association of Home Builders

(NAHB)/Wells Fargo Housing Opportunity Index, due to

rising construction costs and interest rates.

|