Japan

Wood Products Prices

Dollar Exchange Rates of 10th

October

2018

Japan Yen 112.16

Reports From Japan

¡¡

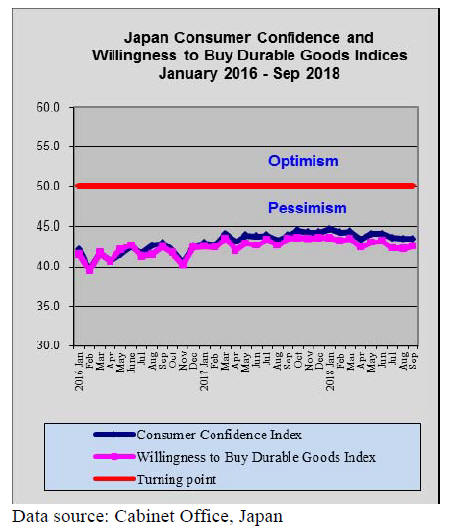

Optimism detected in consumer

sentiment survey

Japan's September consumer confidence index was

slightly up from a month earlier according to the Cabinet

Office in Japan.

Of the individual components used to compile to overall

index that for income growth prospects rose, not surprising

given the tight labour market in Japan. The slightly more

optimistic tone of the survey results was also reflected in a

rise in the index on prospects for expenditure on durable

goods.

IMF calls for fresh look at economic

challenges in

Japan

Christine Lagarde, Head of the IMF, was recently in Japan

where she called for an overhaul of Japan's economic

policy (so-called ¡®Abenomics¡¯) to tackle stubbornly low

inflation and sluggish growth.

She warned that ¡°the economic challenges facing Japan

will only grow as Japan's population continues to age and

shrink," noting that both the size of the economy and the

population would contract by a quarter over the next 40

years.

The report from the IMF says ¡°Six years into

¡®Abenomics¡¯, notwithstanding considerable

accomplishments, a fresh look at remaining challenges is

warranted. On the positive side, unemployment rate is at a

25 year low and the fiscal deficit has been halved,

employment and female labor force participation have

increased substantially, deflationary risks have been

reduced and corporate cash reserves are at all-time highs.

However, inflation remains well below BoJ¡¯s target, fiscal

policies have yet to put public debt on a sustainable path,

and household incomes remain stagnant.

Demographic change will depress growth and productivity

due to a shrinking and ageing labor force and a shift

toward consumption, while fiscal challenges will magnify

with rising age-related government spending and a

shrinking tax base.

Additionally, labor market rigidities limit productivity

growth and hamper the pass-through of demand stimulus

to real wages and prices¡ªeffectively undercutting

monetary transmission and blunting the impact of fiscal

support.¡±

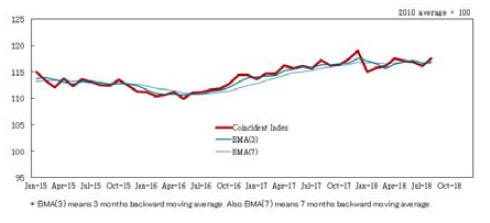

Multiple natural disasters drive down business

sentiment

A string of natural disasters seriously disrupted industrial

production and drove down business confidence among

Japan¡¯s big manufacturers as reflected in the latest Bank of

Japan (BoJ) quarterly review. In fact, business confidence

dropped to its lowest in more than a year.

The prospect of escalations in the trade friction between

the US and China dampened businesses capital

expenditure plans.

The overall impression from the latest business survey is

at odds with the rosy picture of economic prospects from

the BoJ.

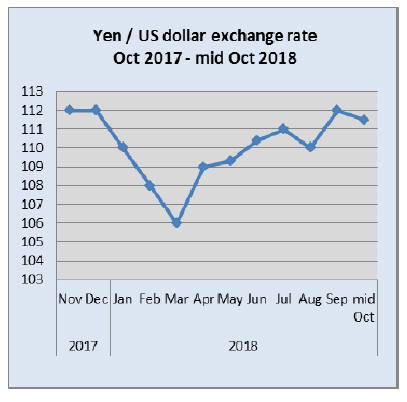

Stock market dip drives down dollar ¨C yen

gains

The US dollar struggled to maintain its recent gains as a

result of the mid-month decline in US and global stock

values. Looking forward, weaker than expected US

consumer price movement in September has driven fears

that the Federal Reserve may skip an interest rate hike at

its next review which would further dampen interest in US

dollar holdings.

In the face of uncertainty the yen once again became the

favorite and over the past two weeks has been showing

some gains against the US dollar.

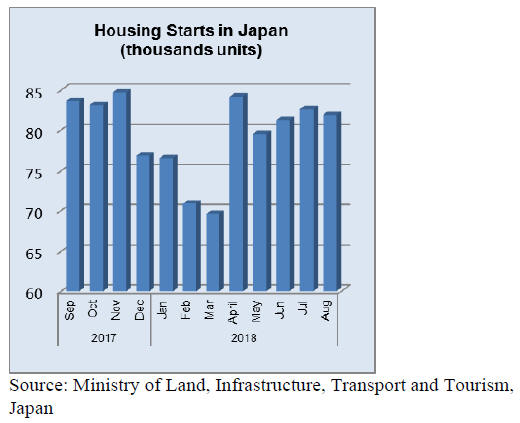

Prefab home production represents new market

opportunity

In Japan, around 15%, approx. 10,000 units of new homes

are prefabricated by the top three house builders which

specialise in producing factory-perfect home components.

The prefabricated housing technology developed in Japan

is opening up new opportunities for house builders in

export markets.

A recent article Preparing for our prefab future: A

burgeoning US prefab market has much to learn from

Japan¡± highlights the advances of Japanese factory-built

houses.

See: https://www.curbed.com/2017/10/25/16534122/prefabhomes-

manufacturing-japan-vs-us

Wooden furniture imports

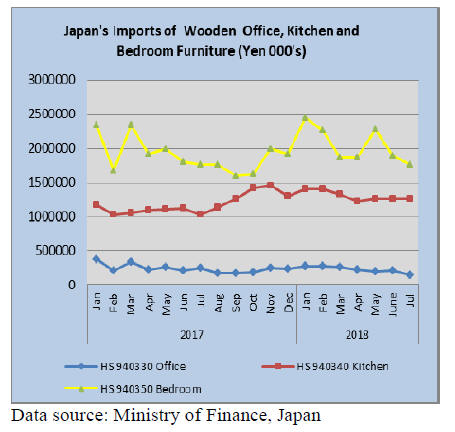

The combined value of Japan¡¯s wooden office, kitchen and

bedroom furniture imports between January and July this

year was the lowest for the year mirroring the pattern seen

in 2017. This largely reflects importers adjustment of

shipments to take account of the holiday period when

furniture sales are traditionally quiet.

Compared to the month earlier, July imports of wooden

office, kitchen and bedroom furniture were down around

6%. If imports follow the pattern in previous years there

should be a pick-up in the value of furniture imports

beginning in September.

Of the three categories of wooden furniture tracked the

sharpest decline in July was in office furniture, there was a

slight drop in the value of wooden bedroom furniture but

imports of kitchen furniture held up well.

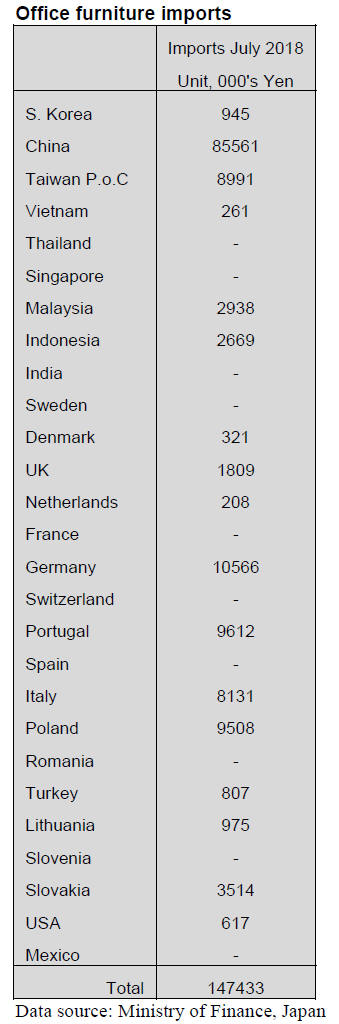

Office furniture imports (HS 940330)

Year on year, the value of Japan¡¯s July 2018 imports of

wooden office furniture (HS940330) fell over 40%, the

lowest level for the year to July.

In contrast, month on month imports were down just 28%.

Shippers in China and Portugal saw a 30% decline in

orders from Japan in July.

The top three shippers of wooden office furniture to Japan

in July were China, Germany and Portugal. These three

accounted for over 70% of all Japan¡¯s imports of wooden

office furniture.

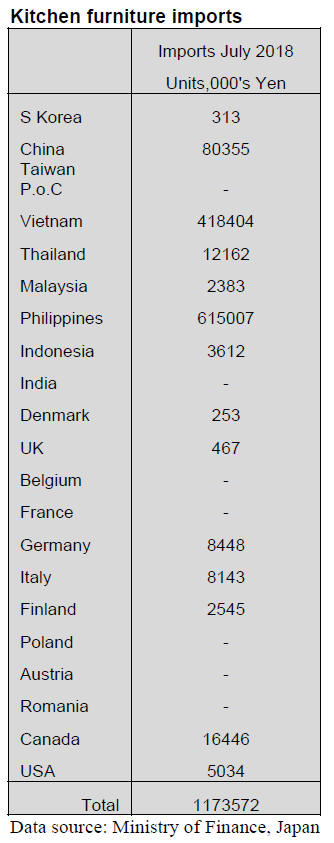

Kitchen furniture imports (HS 940340)

The value of Japan¡¯s kitchen furniture imports have

moved up and down in a very narrow range this year. Year

on year imports of wooden kitchen furniture were 23%

higher in July 2018 but month on month they dropped 7%

with most of this decline being borne by shippers in China.

As has been the case since the beginning of 2018, three

suppliers accounted for most of Japan¡¯s wooden kitchen

furniture imports; the Philippines, (52% up slightly month

on month), Vietnam (36%, unchanged month on month)

and China (7% down slightly month on month).

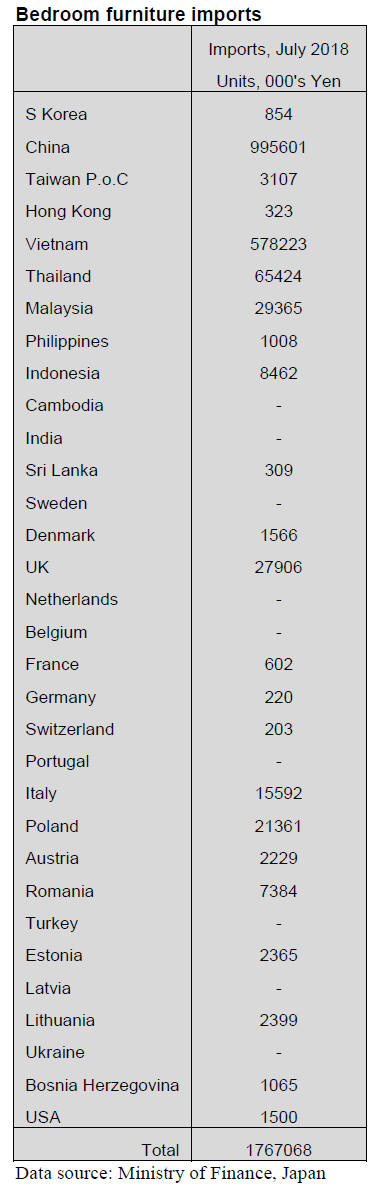

Bedroom furniture imports (HS 940350)

July marked the second consecutive month on month

decline in the value of Japan¡¯s wooden bedroom furniture

imports. However, year on year the value of imports was

largely unchanged.

China retained its position as the number one shipper of

wooden bedroom furniture to Japan, accounting for over

half of all imports of this category of furniture.

Vietnam also retained its second ranked position

accounting for an additional 30% of all of Japan¡¯s wooden

bedroom furniture imports. Interestingly, July shipments

from Vietnam were up 12% as it seems shippers in

Vietnam are capturing market share from exporters in

Thailand.

Trade news from the Japan Lumber Reports (JLR)

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

South Sea (tropical) log imports for the first half 2018

Total South Sea log import for the first half of this year

was 80,657 cbms, 31.1% more than 2017.

Since Sabah, Malaysia stopped log export, log import for

the second half would decrease considerably.

In 2017, Sarawak, Malaysia tightened log harvest and

timber premium was raised the India purchased large

volume before GTS tax was raised so log FOB prices

soared then India¡¯s purchase slowed down in fall 2017 at

which time, Japan purchased larger volume, which arrived

Japan in early 2018. This pushed the volume for the first

half.

Sabah¡¯s log export ban started in May this year. Japan

relied on Sabah logs recently.

Actually over 10,000 cbms of Sabah logs were imported in

January, February and May and total of Sabah logs were

30% more than 2017. The importers are looking for

substituting sources and only source seems to be PNG.

Without Sabah logs, log buyers go to Sarawak.

Meranti regular log prices in Sarawak had been about

US$300 per cbm FOB but now the prices climbed to

US$320. Log prices in PNG are leveling off after China,

the main PNG log buyer, slowed down after general

economy peaked off.

Japanese plywood mills carry ample log inventories now

with large arrivals in the first half. In any case, price hike

of wood products of South Sea logs.

South Sea (tropical) logs and lumber

After Sabah, Malaysia banned log export in last May, log

purchase shifted to PNG. There have been no logs from

Sabah since June.

Logs from Sarawak, Malaysia continue coming in but the

volume is limited by harvest restriction by environmental

reasons and increased duty. Meranti regular log prices in

Sarawak are minimum of US$320 per cbm FOB, sizable

increase after Sabah logs became unavailable. Some

buyers procure small MLH in Sarawak.

Prices of mersawa from PNG shot up temporarily but

leveled off after China slowed down the purchase. The

prices are higher than meranti but the Japanese plywood

mills intend to continue buying mersawa steadily.

Keruing for lumber is short with very little log supply. The

buyers in Japan keep buying lumber from South East

Asian countries but the supply is unstable.

Price of Vietnamese eucalyptus plywood for crating is

edging up by higher production cost and increasing

plywood production facilities by China.

Plywood conference by three countries

Plywood conference by three countries of Indonesia,

Malaysia and Japan was held in Tokyo in September.

At the meeting, each country explained situation of

plywood industry, raw material problem and trend of

trade.

Japan explained that majority of raw material of plywood

is now domestic wood and 52 % of plywood supply is

domestic but 48% is imports, which is indispensable

materials for such items like floor base and concrete

forming panel.

Domestic manufacturers mainly produce structural panel

but they are now trying to produce non-structural products

like floor base and concrete forming panel with softwood

but the volume is limited and it is far from replacing

imports.

Both in Indonesia and Malaysia, use of planted trees has

been increasing. In Sarawak, Malaysia forecast of natural

grown timber harvest is 4.4-4.5 million cbms, 1.0 million

cbms less than 2017 while plantation wood will be 1.6-1.8

million cbms, 200,000 cbms more than 2017. Therefore,

manufacturing of plantation wood is key to the future.

In Indonesia, it is suffering duty sanction by the U.S.A. for

plywood export. U.S.A. is the second largest market next

to Japan but the future is unpredictable. China is the

biggest target of U.S.A. trade sanctions so exporting

plywood from China to U.S.A is becoming difficult so

China is now shifting producing facilities to Indonesia and

export plywood to the U.S.A through third country like

Vietnam.

Wood pellet supply

The Forestry Agency announced wood pellet supply in

2017. Domestic production was 126,532 tonne, 5.3% more

than 2016.

Import of wood pellet increased considerably to 506,353

tonne, 46% more. Domestic share is now down to 20%

while imports is up to 80%.

Reason of supply increase is demand of fuel increased.

Total wood pellet supply in 2017 was 632,885 tonne,

35.5% more than 2016. In 2013, total was about 190,000

tonne and share of imports was 43% then the imports

exceeded in 2015 and the share rose to 80% in 2017.

Sources of imports are mainly Canada and Vietnam.

Others like Southern U.S.A., Malaysia, Thailand and

Russia will increase the supply for Japan.

Domestic supply has increased for three straight years.

Fuel use was 122,047 tonne, 7.4% more than 2016. Use

for heating like wood stove was not main reason of

increase. Combination use with coal for power generation

increased, which uses mainly imported wood pellet.

Number of wood pellet manufacturers in Japan is 147, one

less than 2016. Raw materials are 45% of sawmills¡¯

residue of 56,920 tonne then 45,926 ton of logs and

leftover fiber in the woods and 21,657 tonne of building

scraps.

Import wood pellet prices

Wood pellet prices in Vietnam, one of main wood pellet

supplying countries, soared since September last year by

bullish purchase by Korea and the prices in this summer

are US$145-148 per tonne FOB, US$40 up from

September last year then Korean purchase slowed down

by excessive inventories and the prices turned softer and

the prices in early this month are down to less than

US$140. Present market continues weak with the prices

being US$135 and forecast is the prices would soon drop

less than $130.

PKS prices are holding at about US$80 per tonne FOB.

Indonesian PKS prices are US$108 per ton C&F. The

prices vary by degree of removal of debris. Then there is

difference of ocean freight by loading location.

PKS supply is ample and buyers¡¯ market pushed the

export prices down but now the supply and demand are

balancing so the export prices should be bottoming.

Wood biomass used for energy

The Forestry Agency disclosed wood biomass used for

energy. In 2017, wood chip used for energy such as

biomass power generation was about 8,370,080 BD tonne,

12.8% more than 2016. It has been increasing steadily for

last three years.

This proves that there are increasing numbers of biomass

power generation facilities under FIT system. This

investigation is based on owners of boiler or power

generation, which use biomass fuel such as biomass power

generation facilities, power generation facilities, which use

biomass fuel combined with coal, boiler to generate heat.

The Agency investigated amount of biomass. In total of

1,447, 1,398 companies responded.

Wood chip made from thinning and leftover fiber in the

woods increased by about 40%. Imported wood chip

increased by 15 times although absolute volume is small

yet.

Wood chip derived from sawmill residue decreased to

1,500,000 BD tonne, about 150,000 tonne less than 2016

while wood chip from building scrap increased by about

150,000 BD ton. Low price of wood chip made from

building scrap replaced wood chip by sawmill residue.

Total wood chip volume was 12.8% more than 2016 or

one million BD ton. Main reason is increased number of

FIT biomass power generation facilities and increased use

of wood chip by coal burning power generation facilities.

By statistics the Agency for natural resources and energy

made, new FIT power generation stations, which use

biomass fuel and started the operation in 2017 was 25 with

total output of 329,368 kw. Not only large power stations,

there are increasing number of small biomass power

stations and localized heat stations.

|