|

Report from

Europe

EU internal wood furniture trade rises but external

trade is flat

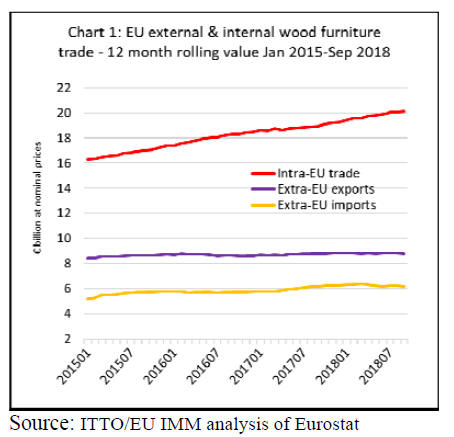

The latest Eurostat trade data for EU wood furniture trade

indicates that the trends as reported by ITTO MIS in

September 2018 (Volume 22, Number 18) have continued;

internal EU trade is rising, whereas external trade is

broadly flat, both on the import and export side (Chart 1).

Internal EU trade in wood furniture, which increased 4%

to €19.3 billion in 2017, increased a further 6% in the first

nine months of 2018. The rise in internal EU trade is

driven mainly by exports from Poland, particularly to

Germany, and from the Netherlands to several

neighbouring countries including Germany, France and

Belgium.

Wood furniture production is rising in Poland, while more

imports into the EU from outside the region are now being

funnelled via the Netherlands.

Meanwhile the pace of EU wood furniture exports to non-

EU countries, which were flat at €8.7 billion in 2016 and

2017, continued at the same rate in the first nine months of

2018. EU exports to the USA, China and Russia have

increased slightly this year but these gains have been

offset by declining exports to Switzerland, Norway,

Canada and UAE.

Wood furniture imports into the EU from outside the

region increased 9% to €6.3 billion in 2017. Import value

in the first nine months of 2018 was €4.7 billion, 1.6% less

than the same period in 2017. After a strong start last year,

imports slowed a little from May 2018 onwards.

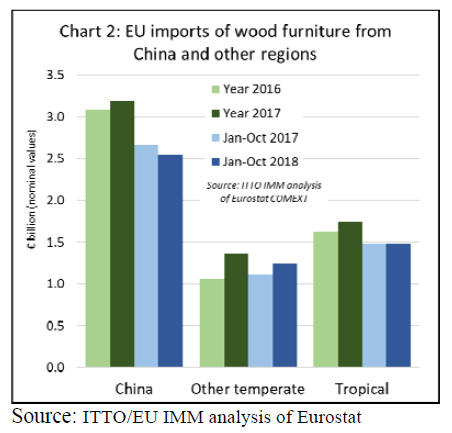

Fall in EU wood furniture imports from China and the

tropics in 2018

After making gains in 2017, EU wood furniture imports

from China, by far the largest external supplier, fell 5% to

€2.55 billion in the first 10 months of 2018.

During the same period, EU imports of wood furniture

continued to rise from other temperate countries, mainly

those bordering the EU. EU imports from these countries

increased 11% to €1.25 billion in the first 10 months of

2018, building on a 28% gain recorded the previous year.

The biggest gains in 2018 were made by Ukraine, Belarus,

Russia, USA, Bosnia, and Turkey.

After a slow start to the year, EU imports of wood

furniture from tropical countries picked up pace in the

second half of 2018, and totalled €1.49 billion between

January and October 2018, slightly exceeding the 2017

level (Chart 2).

In recent years China¡¯s competitiveness in the EU wood

furniture market has been impeded as prices have risen on

the back of growing Chinese domestic demand and new

laws for pollution control pollution in China.

EU furniture importers also continue to question the

variable quality of product imported from China and some

have struggled to obtain the legality assurances required

for EUTR conformance when dealing with complex wood

supply chains in China.

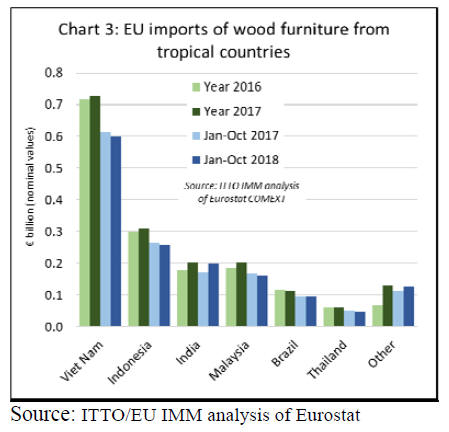

The main South East Asian supply countries have all

followed a similar trajectory in the EU wood furniture

market in the last two years. A rise in EU imports in 2017

was followed by a decline in 2018.

After increasing 1% to €730 million in 2017, EU imports

from Viet Nam fell 3% to €599 million in the first ten

months of 2018. Imports from Indonesia increased 4% to

€311 million in 2017 but fell back 4% to €257 million in

the first ten months of 2018. Imports from Malaysia

increased 10% to €203 million in 2017 and were 4% down

at €163 million in the first ten months of 2018.

In contrast, EU wood furniture imports from India have

continued to rise, up 15% to €199 million in the first ten

months of 2018 after a 12% increase to €202 million for

the whole of 2017. Imports from Brazil were €57 million

in the first ten months of 2018, matching the 2017 level

(Chart 3).

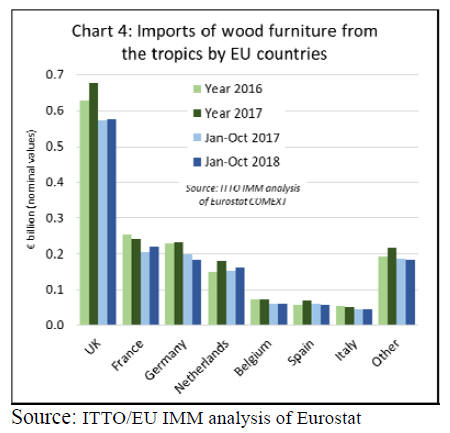

There were also shifts in the destinations for wood

furniture imported into the EU from tropical countries in

the first ten months of 2018. Imports in the UK, the largest

market, were €577 million between January and October

2018, 1% more than the same period in 2017. There were

also rising imports in France (+8% to €219 million) and

Netherlands (+6% to €163 million).

However, in the first ten months of 2018 these gains were

offset by falling imports of tropical wood furniture in

Germany (-9% to €182 million), Belgium (-3% to €61

million), Spain (-7% to €57 million), and Italy (-2% to €44

million) (Chart 4).

IMM report examines impact of FLEGT licensing in

furniture sector

With further support, development and communication of

FLEGT and FLEGT licensing can play a role to underpin

tropical timber product market share in the highly

competitive European furniture sector.

This is according to the latest survey by the Independent

Market Monitor (IMM), an ITTO project funded by the

EU (see www.flegtimm.eu).

The core aim of the IMM scoping study of procurement in

the EU furniture industry is to gauge the sector¡¯s

perceptions of the value, impacts and process of sourcing

products from supplier countries engaged in the FLEGT

VPA process.

The latest report is based on individual country surveys

undertaken by the IMM¡¯s network of correspondents in

seven lead importing countries. These were the

Netherlands, UK, Germany, France, Italy, Spain and

Belgium, which between them account for 83% of all

furniture imported into the EU from VPA partner

countries.

The key rationale of the survey is that assembled wood

furniture consistently comprises 40% of the value of EU

timber and wood products sourced from FLEGT VPA

partner countries. So, canvassing furniture sector opinions

of the VPA initiative and FLEGT licensing offers valuable

lessons for the development of EU market awareness and

penetration of VPA-sourced and licensed.

¡°[The aim is] to provide a preliminary assessment of the

current and potential role of FLEGT licensing to improve

market access for wood furniture from VPA countries in

the EU, and to recommend a strategy to optimise the

benefits of FLEGT licensing [in this respect],¡± states the

report.

The study was also designed to provide a comprehensive

baseline of perceptions and impacts of the FLEGT VPA

initiative in the wood furniture sector in order to generate

recommendations for IMM¡¯s long term monitoring of the

industry.

The report recognises that VPA country furniture and

furniture product suppliers face a ¡®crowded and fiercely

competitive market¡¯ in the €36 billion EU furniture arena.

The EU furniture industry comprises an estimated 130,000

companies. 87% of wood furniture sold in the EU market

is also made in Europe.

The basis of the survey comprised semi-structured

interviews with 47 European companies, representing the

spectrum of business type, from very large furniture

retailers, to medium-sized manufacturers and distributors.

Between them these imported indoor and outdoor

furniture, plus wood furniture components and raw

materials. They had sourced from a combined total of nine

of the 15 VPA-engaged countries and altogether dealt with

over 850 individual foreign suppliers.

The companies were asked about their perceptions of

quality, price, lead times from order to delivery, logistics

(the ease of moving products) and the range of products

available from various countries and regions.

When asked to compare these variables on a country-bycountry

basis, it was clear that both western and eastern

European EU countries were perceived as most

competitive across the range of factors considered. The

third-most competitive region identified was that of non-

EU countries in Eastern Europe. Viet Nam, Indonesia and

China were perceived to be the next-most competitive.

The survey included questions on purchasing policies.

Around one-quarter (11 of 47) of the companies

interviewed did not have written environmental

purchasing policies.

For those that did have policies, the dominant feature was

a requirement for ¡°legality¡± or legal compliance regarding

wood origin or trading (20 companies); the remainder (16

companies) were pro-certification, with a preference for

the Programme for the Endorsement of Forest

Certification and/or the Forest Stewardship Council.

Products licensed under the EU FLEGT initiative were

valued by 45% of those interviewed (typically those

sourcing from Indonesia). An additional 19% of those

interviewed stated that FLEGT licensing could play a role

in their purchasing decisions if it were available in other

countries.

Overall, the companies interviewed were positive towards

the FLEGT process, although the lack of availability of

licensed products from countries other than Indonesia was

a common concern. Some respondents expressed doubt

that the FLEGT process had led to on-the-ground

improvements in forest governance.

The chief benefit identified for those favourably disposed

towards FLEGT licensing centred on the linkage with the

EU Timber Regulation and the simplified due-diligence

process.

Outlook for tropical timber in the European furniture

trade

The study asked interviewees for their views on the

outlook for tropical timber in the European furniture trade.

Forty-three percent considered that the market for tropical

wood furniture would grow or stabilise in the next decade

and 32% thought demand and volume would shrink (25%

expressed no opinion).

The wide range of alternative materials and consumer and

specifier attitudes towards tropical timber were seen as the

main negative drivers.

Fashion largely drives the style and design of wood

furniture, with end consumers destined to buy 80% of

production. A complex web of interconnected drivers

determines the choice of wood and accompanying colours

and features. Consumers, retailers and manufacturers have

a huge range of options for materials and the choice of

wood in furniture per se is no longer guaranteed.

The report concludes that ¡®licensed timber alone will not

reverse the trends that are [negatively] impacting on

tropical wood in Europe¡¯. However, it does have value

and a role to play here, ¡®as a tool to be utilised to form

part of the process of building confidence in tropical

timber in a wider [strategy] that might help maintain

market share¡¯.

This strategy, the report notes, would also require a wider

range of players¡¯ involvement, including ¡®major retailers,

trade associations, national governments, NGOs,

architects, and other opinion formers¡¯.

Wood furniture market perceptions of FLEGT licensing,

the report concludes, are that it ¡°lacks the glamour of third

party SFM certification where sustainability is the main

focus¡± which currently limits its consumer-facing role. At

the same time, the report suggests FLEGT licensing can

offer ¡°assurance to business-to-business buyers operating

at the base level of responsible purchasing¡±.

Report recommendations

Minimise the bureaucracy involved in the

process Minimise the bureaucracy involved in the

process

of importing FLEGT-licensed timber to maximise

the business benefits for operators.

Encourage those companies not yet using Encourage those companies not yet using

FLEGT-licensed timber to do so.

Demonstrate the benefits of the

FLEGT-licensing Demonstrate the benefits of the

FLEGT-licensing

scheme in Indonesia to build trust.

Clarify within the trade the impacts and Clarify within the trade the impacts and

achievements of FLEGT-licensed timber and

timber legality assurance schemes.

Speed up the introduction of

FLEGT-licensed Speed up the introduction of

FLEGT-licensed

timber supplies from other VPA countries

For more details, including full report download:

http://www.flegtimm.eu/index.php/reports/76-imm-eu-furnituresector-

scoping-study-flegt-can-impact-european-furnituremarket-

2

ETTF Secretariat shifts from Netherlands to Germany

The secretariat of the European Timber Trade Federation

(ETTF) is moving from the Netherlands to Berlin. The

move follows the announcement that Andr¨¦ de Boer is

stepping down as ETTF Secretary General in 2019,

handing over the reins to Thomas Goebel, Chief Executive

of German Timber Trade Federation GD Holz.

The first quarter of 2019 will see a transition process, with

Mr Goebel officially taking on the role by April 1,

combining it with his position at GD Holz.

Mr de Boer, who is a commercial lawyer by profession, is

a regular ITTC delegate and member of ITTO¡¯s Trade

Advisory Group, and has often chaired the ITTO Market

Discussion. He took over at the helm at the ETTF ten

years ago after its formation from an amalgamation of

European timber trade bodies prior to that he was

Managing Director of the Netherlands Timber Trade

Federation (VVNH) for 20 years. His time at the ETTF, he

said, has been both challenging and exciting.

¡°The European timber importing sector in this period has

had to adapt to major changes; concentration of the

industry and a decline in tropical timber trade, as well as

the implementation of the EU Timber Regulation,¡± he

said. ¡°But the trade has evolved and moved with the times,

and at the same time the ETTF has gained relevance

throughout the international market as advocate of a legal

and sustainable, but also a commercially significant and

dynamic industry.

¡°We are now an integral part of the conversation on

climate change and the development of a low carbon

bioeconomy. There¡¯s also recognition at government level

that a commercially viable forestry and timber industry is

integral to maintenance of the forest resource; it¡¯s widely

accepted that it¡¯s a case of use it or lose it.¡±

Mr. de Boer said now was the time to hand over to a new

team to take the organisation forward and exploit the

opportunities to grow the European timber market.

Mr. Goebel said he looked forward to his new role. ¡°The

ETTF has equipped itself well to master the challenges

and realize the opportunities to come for the timber trade

and is well placed to further strengthen representation of

its members interests,¡± he said.

In another strategic move for the future of the ETTF, its

annual general meeting in 2018 decided that it should join

the European Confederation of Woodworking Industries,

Brussels-based CEI-Bois, where a key focus will be

helping develop a new timber trade segment.

¡°CEI Bois, with its close connection to the EU in

Brussels, will further serve the interests of the trade

through this separate trade pillar, in which the ETTF will

play a leading role,¡± said Mr. Goebel. ¡°It¡¯s decisive that

we develop this facility.¡±

At present the ETTF has 18 member associations in 16

countries.

ISO publishes chain of custody standard for wood

products

ISO (the International Organization for Standardization)

has published a new, voluntary standard for chain of

custody (CoC) of wood and wood-based products

(together with cork and lignified materials other than

wood, such as bamboo, and their products).

While the standard does not cover forest management, it

can be used to transfer information about the source of the

wood-based product.

According to ISO, the standard is intended to enable

tracking of material from different categories of source to

finished products and has several purposes. It can facilitate

business-to-business communications by providing a

common framework that allows businesses to ¡°speak the

same language¡± when describing their chain of custody

system.

Purchasers can use the standard document to evaluate the

information they receive from suppliers to help identify

suitable input material.

This information can then be used together with a set of

specified criteria to determine whether a product/input

material fulfils the conditions for the intended use.

Other standards and certification schemes can use the

standard as a reference regarding chain of custody

systems.

More details see:

https://www.iso.org/obp/ui/#iso:std:iso:38200:ed-1:v1:en

|