3.

MALAYSIA

Agencies harmonise support for

industry

The three timber agencies within the Ministry of Primary

Industries; the Malaysia Timber Industry Board (MTIB);

the Malaysia Timber Council (MTC) and the Malaysian

Timber Certification Council (MTCC) recently held a joint

meeting to harmonise ongoing and proposed programmes

for the timber sector and formulate effective strategies to

achieve the national wood product export target of RM25

billion by 2020.

The focus of attention was on the sustainable supply of

raw materials, raising productivity and improving the

marketability of Malaysian wood products.

On raw material supply the group determined that success

in improving availability depended very much on land

being available for plantations, collaboration between

agencies and undiminished maintenance of forest

certification.

The importance of developing high valued-added products

and increasing productivity through the development of

automation and mechanisation was also addressed. It was

determined that a holistic approach throughout the supply

chain, from raw material supply, availability of skilled

workers, automation and mechanisation, product designs,

engineered timber products would be required.

Critical to success in improving the marketability of wood

products was ability of exporters to comply with market

regulations and certification. The report of this joint

review will be presented to the Minister of Primary

Industries.

Ethnic groups confront workers clearing forest

The Sarawak Forestry Department has been told to

suspend a permit issued to an oil-palm company to clear

forest on the fringes of Mulu National Park.

It has been reported that this instruction came from Mulu

State Assemblyman, Gerawat Gala, because of a

confrontation between groups of Penan, Berawan and

Tering with plantation company workers. Felling has

stopped according to the Sarawak media and the land is

being guarded by the ethnic groups.

For more see: https://www.thestar.com.my/metro/metronews/

2019/03/22/logging-activity-suspended/

Sabah Chief Conservator defends log export ban

Chief Conservator of Forests, Mashor Mohd Jaini, said the

State Government’s log export ban should spur the

development of the wood-based industry in the State. He

said the aim of the State government was to see the

production of a wide range of high value wood products to

support economic development and the creation

employment opportunities.

Mashor said harvesting in the natural forests contributed

around 50% of State revenue in past years but this is not

the case now as production from the natural forest has

fallen sharply.

The Sabah media has reported the Conservator as saying

“To ensure the forestry sector remains relevant as one of

the main sources of revenue for socio-economic

development, the State Government has committed to

manage the State’s forest resources in line with the

principles of sustainable forest management in accordance

with international standards.”

See: http://www.dailyexpress.com.my/news/132786/log-exportban-

empowers-the-wood-based-industry/

In 2018, Sabah exported 151,553 cu.m of sawntimber

worth RM289 million; 491,207 cu.m of plywood worth

RM1,048 million and 63,947 cu.m of veneer worth

RM105 million.

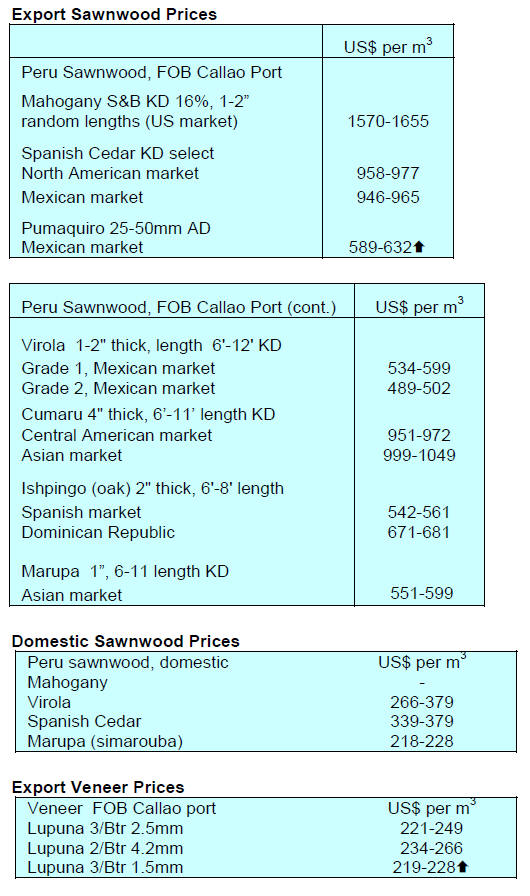

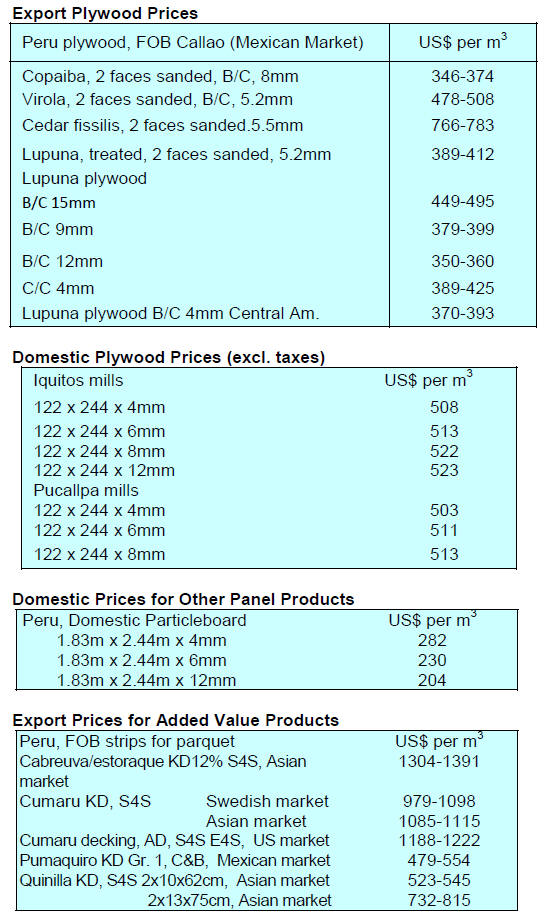

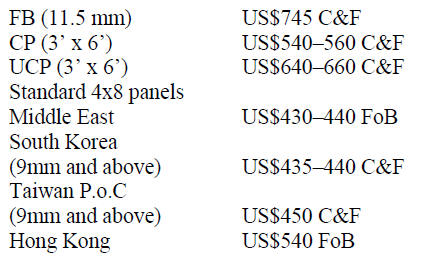

Plywood prices

Traders based in Sarawak reported the following export

prices in mid-March:

4.

INDONESIA

President declares SVLK

legality verification only

necessary for upstream sectors

The Indonesian President, Joko Widodo, responded

positively to complaints from furniture entrepreneurs

about the national timber legality verification system

(SVLK) and promised to simplify this system.

This was in response to statements from the Chairman of

the Indonesian Furniture and Handicraft Industry

Association (HIMKI), Soenoto, who pointed out that it is

enough that SVLK verification is conducted for upstream

raw material sourcing. If downstream enterprises also have

to secure SVLK certification this is a duplication, it

increases costs and undermines competiveness of

downstream companies.

The media in Indonesia have reported that the President

reaffirmed that this will be dealt with and that SVLK

certification for upstream processes will be all that is

required. It is reported that he called on his administration

to simplify SVLK legality verification to encourage local

businesses to invest and increase exports.

https://www.medcom.id/ekonomi/mikro/VNxqyrJb-presidensederhanakan-

sistem-verifikasi-legalitas-kayu

https://news.okezone.com/read/2019/03/13/337/2029583/turutipengusaha-

mebel-jokowi-pangkas-regulasi-sistem-verifikasilegalitas-

kayu

In other news, President Joko Widodo, in answer to

questions after reviewing the International Furniture Expo

(IFEX) 2019, heaped praise on the county’s furniture

producers saying he was impressed with progress made in

terms of design and quality pledging to support R&D in

technology, design and also on raw material issues.

He acknowledged that there remain many issues to be

addressed such as the supply of raw materials at

competitive prices as well as the sustained availability of

raw materials.

Furniture and craft entrepreneurs should diversify

export markets

Furniture and craft entrepreneurs who are members of the

Indonesian Furniture and Craft Entrepreneurs Association

(Asmindo) hosted the Jogja International Furniture and

Craft Fair (JIFFINA) in March.

Speaking at the opening the Chairman of JIFFINA 2019,

Endro Wardoyo, said that entreprenuers need to be

developing markets outside their traditional US market.

He continued by pointing out that there is huge potential in

new markets in the EU such as the Netherland, Germany,

France, Britain and Italy. In addition markets in Japan and

South Korea should be examined.

At JIFFINA 2018 the target for sales was US$64 million

but at the recent show it was announced that annual sales

of US$80 million was the target.

The Director General of Small and Medium Industries,

Gati Wibawaningsih, said that the Ministry of Industry

will continue to encourage expansion of the small and

medium industries nationally as they play a vital role in

employment generation.

In related news, Airlangga Hartarto, Minister of Industry,

said the government continues to support the performance

of labor-intensive and export-oriented manufacturers in

order to strengthen the structure of the national economy.

According to Airlangga, the development of the domestic

furniture industry has great prospects as it has available

abundant wood and rattan raw materials.

“Lightwood’ export promotion in Vietnam

The Ministry of Trade will seek ways to help

manufacturers boost exports of processed ‘lightwood’ to

Vietnam. The first step was made when a Business-to-

Business event was held in Ho Chi Minh City. The aim of

this was to increase the interest of importers in processed

Albizia falcataria and Jabon wood (collectively traded as

lightwood).

The Director, Export Development in the Ministry of

Trade, Arlinda, said that demand for wood products in

Vietnam is surging and this is a good opportunity for

Indonesain exporters of ‘lightwood’ products.

Arlinda reported that Indonesia's ‘lightwood’ exports to

Vietnam in 2017 were valued at just US$10.48 million but

this could be increased substantially.

The promotional effort in Vietnam resulted in a

memorandum of understanding between Indonesian

companies with members of the association of Vietnamese

Handicraft and Wood Industry Association (HAWA) and

the Binh Duong Furniture Association (BIFA) aimed at

furthering business ties.

5.

MYANMAR

MTE responds to EIA report

The Frontier Myanmar, an English-language weekly

magazine, recently interviewed U Khin Maung Kyi,

Deputy General Manager at the Myanma Timber

Entreprise (MTE) on the EIA allegations of corruption in

the timber sector.

The text of the interview can be found at:

https://frontiermyanmar.net/en/myanma-timber-enterprise-notworried-

about-eia-corruption-report

EUTR Competent Authority briefing by MTCC

During a recent meeting in Europe representatives from

the Myanmar Forest Certification Committee (MTCC)

provided some background information to several EUTR

Competent Authorities on the Myanmar timber sector.

(EUTR Competent Authorities are the authorities in EU Member

States responsible for implementation of the EU Timber

Regulation).

The following is an extract from a Hand-out distributed by

Myanmar. The document will be available on the MTTC

website http://www.mfcc.org.mm/.

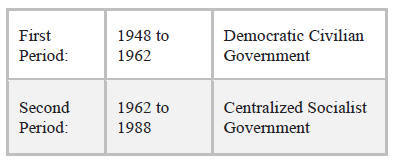

“When we examine developments in Myanmar, we should

think in terms of six main periods since we became an

independent state in 1948.

The majority of deforestation is believed to have

happened

during the fourth period as a result of the isolation of

Myanmar due the political situation.

During the fifth period we witnessed the start of

remarkable changes in the forestry sector, and at the close

of that period on April 1 2014 Myanmar introduced the

Export Logging Ban.

Changes have continued into the sixth period, under the

current NLD-led government, and one-year moratorium in

the whole country 2016-17 (ten-year moratorium in Bago

Mountain Range where the environmental impact would

be severe) In addition, the Myanmar Government has

significantly determined not to depend on the income of

natural resources and placed a priority on forest

conservation.

Such positive developments are due to many facts – open

and closed critics in both soft and hard approaches from

both outside and inside the country.

At this juncture there is one extremely important fact –

there are many professional people in the Myanmar’s

forestry sector. They have not been happy and have been

deeply upset about the negative impact on the production

forestry by the people in power.

Such professional people and non-professionals who love

the forest have tried in every possible ways to stop the

drivers of the negative impacts and to move towards the

right direction. They have been applying a soft power

approach and considering broad issues within forestry

such as economic and livelihoods development, while a

few INGOs, who value only the environment, have been

applying hard power approach.

Role of MFCC

A Timber Certification Committee-Myanmar (TCC-M)

was formed in 1998. It was reformed the Myanmar Forest

Certification Committee (MFCC) in 2013, with a new

Committee assigned in 2018.

MFCC formulated MTLAS based on ASEAN and ITTO

and MFCC is fully convinced that MTLAS is required and

is the foundational solution to strengthen Myanmar timber

legality and to meet the international bench mark.

MFCC conducted the MTLAS Gap Assessment Project

with the assistance of EU-FLEGT-FAO Programmed

carried out by an independent international assessor. The

Gap Assessment Project recommended four key areas to

be strengthened to support the credibility of timber

traceability and legality:

Since the GAP report was released in 2017 MFCC and

others in the forestry sector have been working hard to

close the gaps.”

6. INDIA

India’s SFM certification recognised

The Indian media has reported that the Programme for

Endorsement of Forest Certification (PEFC) Council has

endorsed the Certification Standard for Sustainable Forest

Management developed by the Network for Certification

and Conservation of Forests (NCCF), an Indian non-profit

organisation.

The NCCF was established by the private sector, the

government and non-profit organisations with the aim of

setting standards for certifying sustainable management in

India’s forests.

Vijai Sharma, NCFF chairman, said India’s forest deliver

essential ecological, economic and social services and

provide direct livelihood for around 275 million forest

dependent people in the country.

https://www.downtoearth.org.in/news/forests/india-s-first-forestcertification-

scheme-gets-global-recognition-63678

Woodworking, one of the fastest growing sectors in

the economy

The organisers of DelhiWood 2019 have reported that

over 500 exhibitors from 35 countries exhibited at the

latest fair held 13-16 March at the Expo Centre and Mart

in Greater Noida making it the biggest woodworking

industry show in India.

The woodworking industry is one of the fastest growing

sectors of the Indian economy and the World Bank has

said output from India's organised furniture industry is

expected to grow 20% annually for the next few years.

The aim of DelhiWood 2019 is to provide the

technological support to spur this growth.

https://www.business-standard.com/article/news-ani/india-sorganised-

woodworking-industry-projected-to-cross-usd-32-

billion-in-2019-119031400678_1.html

Multiple media sources in India are quoting a World Bank

study which says India’s ‘organised‘ furniture sector could

be worth US$32 billion in 2019 boosted by online sales.

The government’s ‘Housing-for-All‘ initiative, the

development of smart cities and growth in the tourism and

hospitality sectors will also drive furniture demand.

However, when assuming power five years ago, the new

government promised that every Indian will have a home

to live in by 2022 but, while millions of new homes have

been planned and approved to deal with India's

homelessness problem, many remain to be built. This

issue, amongst others, is at the core of campaigning for the

upcoming election.

http://www.indiawood.com/indiawood-2018-marketscenario.

php

https://www.f9furnichair.in/blog-info-furniture-industry-in-indiathe-

rising-dawn-settling-dusk

Growth depends on increasing skilled labour force

India is the world’s fastest growing economy and the

government of India has been working to transform the

country into a competitive, high-growth, high productivity

middle-income country.

A decade ago the Indian economy was largely agro-based

but there has been a marked shift as manufacturing and

services have expanded. To progress their aim the

government recognises that a lack of skilled workers could

undermine further diversification of the econmy.

More than 12 million youth between 15 and 29 years of

age are expected to enter India’s labor force every year for

the next two decades.

The government’s recent skill gap analysis concludes that

by 2022, another 109 million skilled workers will be

needed in the 24 keys sectors of the economy. According

to a National Skill Development Council (NSDC) report,

India’s furniture and furnishings industry will need 11.3

million skilled workers by the year 2022.

https://nsdcindia.org/sites/default/files/Furniture-Furnishing.pdf

and

http://www.worldbank.org/en/news/feature/2017/06/23/skillingindia

At the recent ‘Construction Technology India 2019’

conference innovative construction technologies in the real

estate and construction sectors were discussed with the

aim of supporting the vision of the government to provide

homes for all Indians by 2022. This presents a major

challenge and will require a movement towards new

construction technologies.

To achieve this vision, the Ministry of Housing and Urban

Affairs founded the “Global Housing Technology

Challenge-India (GHTC-India) which is charged with

identifying appropriate construction technologies applied

around the world that are environmentally sound,

economic and disaster-resilient.

The 2-day long Expo cum Conference provided a unique

opportunity for B2B interactions with global as well as

Indian industry partners and explore further areas of

collaboration, signing of MoUs and work in India on

housing construction sector. CREDAI is the Knowledge

Partner at Global Housing Technology Challenge India.

See CREDAI press release at:

https://credai.org/press-releases/credai---knowledge-partner-atglobal-

housing-technology-challenge-india-ghtc-india-ministryof-

housing-and-urban-affairs

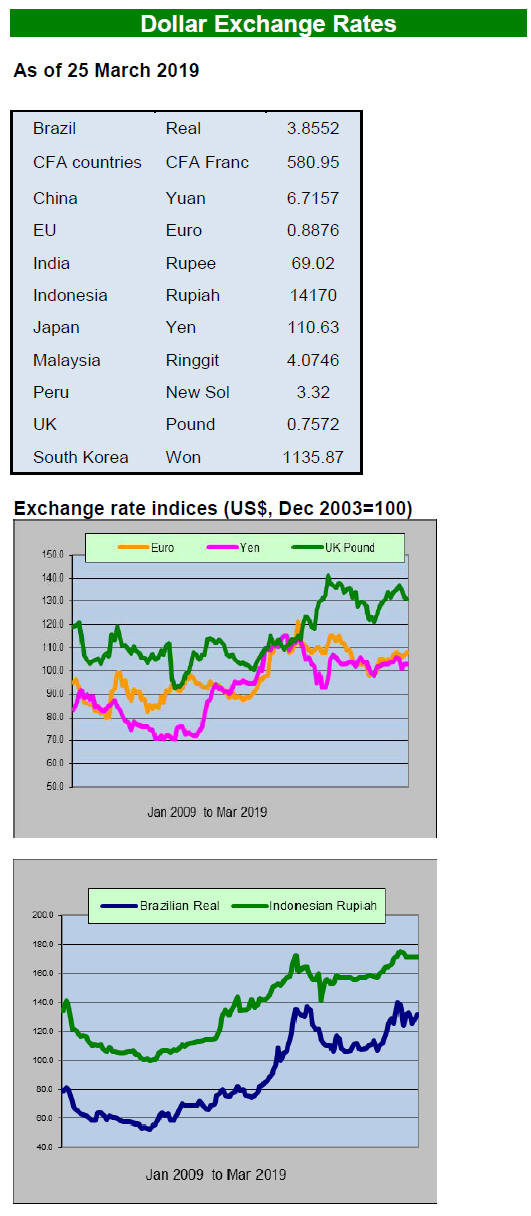

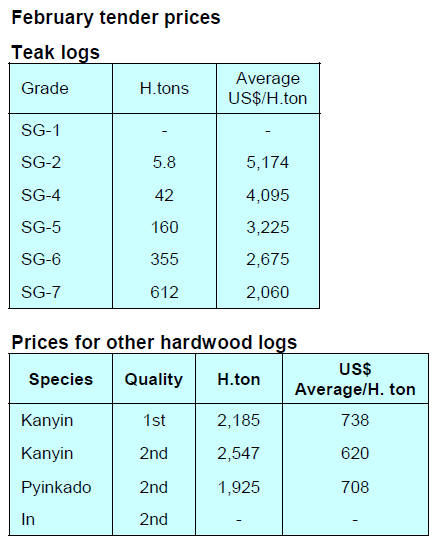

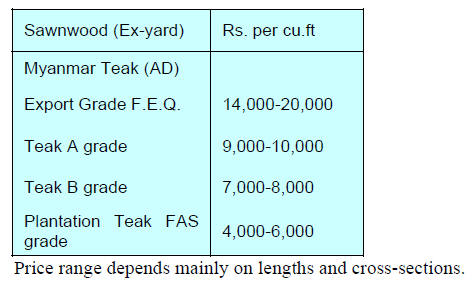

Plantation teak prices

The Rupee continues to strengthen against the US dollar.

The US dollar is the currency used in supply countries to

price export teak such that the firmer Rupee is good news

for importers. However, with the general consensus

amongst importers that further strengthening is likely they

are biding their time hoping to conclude contracts at an

even better exchange rate than the current Rp69 to the US

dollar.

C&F prices for plantation teak landed at Indian ports are

within the same range as shown in the previous report.

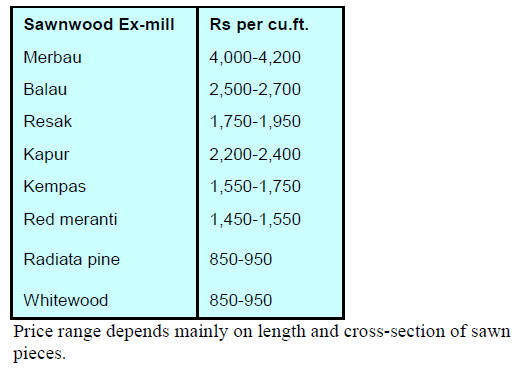

Locally sawn hardwood prices

Prices for imported sawn hardwoods remain unchanged.

Myanmar teak prices

Analysts report that traders continue to complain they

cannot secure adequate supplies of Myanmar teak.

Prices for Myanmar teak continue as previously reported.

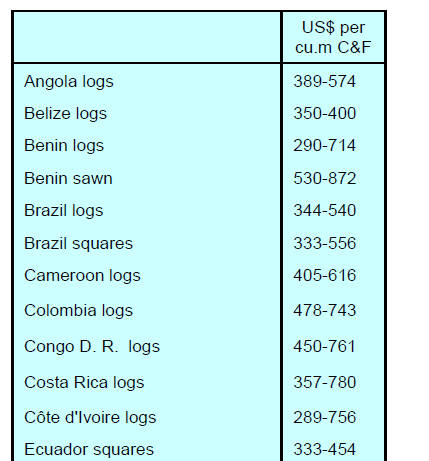

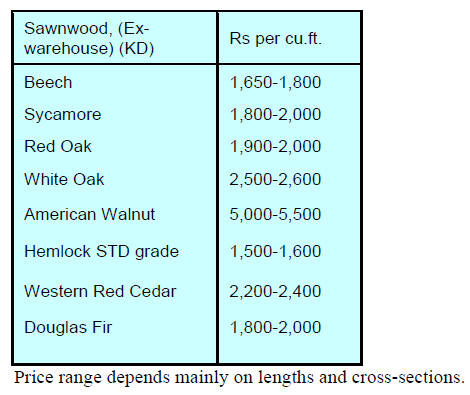

Sawn hardwood prices

In addition to efforts by US shippers those in Canada and

in some European countries such as Finland have

increased promotional efforts and this is delivering in

terms of rising sales. The diversification of sources has

helped keep prices stable.

Indicative prices for some imported timbers are shown

below.

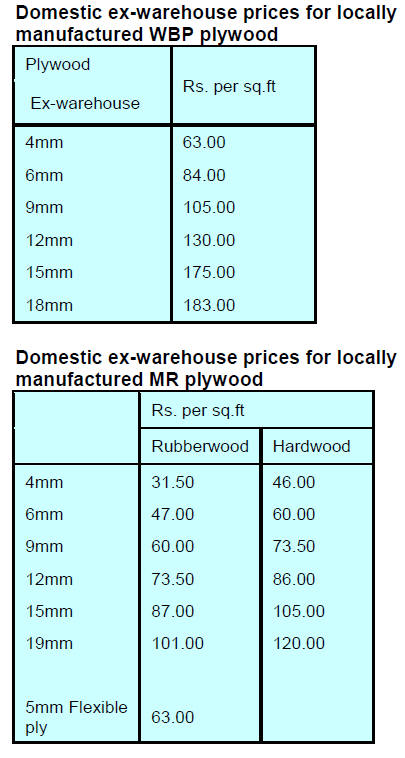

Plywood

The importance of Gabon as a major supplier of veneer

and plywood is growing as production from new Indian

investment comes on-stream. The same applies to

shipmnets of sawnwood from Gabon to India.

Domestic plywood prices ontinue as previously reported.

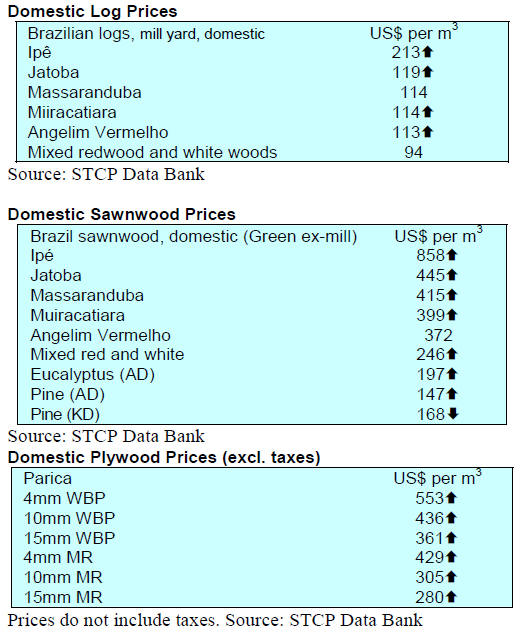

7. BRAZIL

SINAFLOR extensively used

across the country

The National System for Control of Origin of Forest

Product (SINAFLOR - Sistema Nacional de Controle de

Origem de Produtos Florestais) has been extensively used

across the country to verify permits for forest

management, land use change and production.

SINAFLOR data indicates that 5,244 approvals have been

issued since the system became mandatory in May 2018.

A further 2,500 applications are being processed.

The Brazilian Institute for Environment and Renewable

Natural Resources (IBAMA) conducts training courses to

support SINAFLOR and over 400 entrepreneurs,

consultants and public servants have been trained in the

states of Rondônia, Paraná, Paraíba, Alagoas and Roraima.

In February this year IBAMA inaugurated a distancelearning

training platform.

The need for an integrated national system for forest

control in the country was recognized in the 2012 Forest

Code. SINAFLOR controls the origin of timber, charcoal

and other forest products and by-products, tracking

permits for logging, transportation, storage, processing and

export.

More credit lines for forestry sector

In March this year the Timber Industry Union of Northern

Mato Grosso State (Sindusmad) hosted an event

"Financing the Production Chain for Sustainable Timber

Forest Management". Representatives of Banco do Brasil

were present and announced the bank would offer new

lines of credit specifically for the forestry sector.

This Sindusmad initiative builds on a partnership between

Banco do Brasil, the World Wide Fund for Nature

(WWF), Sindusmad and the Center for Timber Producers

and Exporters of Mato Grosso State (CIPEM). The aim is

to assist financing those committed to sustainable

utilisation of forests.

A spokesperson from Sindusmad pointed out that the

forestry sector has long sought credit lines for the

development of production. The forestry sector will now

have available credit lines for the entire production chain

including forest management, renovation of production

technologies, and working capital according to CIPEM.

International funds for Floresta-plus

Brazil will benefit from funding from the Green Climate

Fund (GCF) for successfully reducing greenhouse gas

emissions from deforestation. A GCF payment of US$96.5

million is based on the results achieved by Brazil in the

Amazon biome between 2014 and 2015, which were

endorsed by experts from the United Nations Framework

Convention on Climate Change (UNFCCC).

These funds are ear-marked for a pilot programme to

‘Incentivise Environmental Services for the Conservation

and Recovery of Native Vegetation’, or Floresta + to be

implemented by the Brazilian government with support

from the United Nations Development Program (UNDP).

Brazil has achieved significant emission reductions from

deforestation in the Amazon biome.

Export update

In February 2019, the Brazilian exports of wood-based

products (except pulp and paper) increased 3.2% in value

compared to February 2018, from US$244.2 million to

US$252.1 million.

The value of pine sawnwood exports increased just over

14% between February 2018 (US$38.8 million) and

February 2019 (US$44.3 million). At the same time export

volumes rose by almost 15% over the same period, from

186,200 cu.m to 213,700 cu.m.

Brazil’s tropical sawnwood exports rose almost 28% from

31,100 cu.m in February 2018 to 39,700 cu.m in February

2019 but the value of exports only rose 13% from

US$14.2 million to US$16.1 million, over the same

period.

In contrast, pine plywood exports declined 6.3% in value

in February 2019 compared to February 2018, from

US$57.1 million to US$53.5 million but there was an

increase in export volumes from 175,200 cu.m to 195,600

cu.m in the same period.

Brazil’s exports of tropical plywood remain small and in

February export volumes dropped from 12,700 cu.m

(US$5.2 million) in February 2018 to 10,800 cu.m

(US$4.0 million) in February 2019.

On a brighter note, exports of wooden furniture in

February increased from US$38.8 million in February

2018 to US$40.4 million in February 2019.

Furniture exports rise in Rio Grande do Sul

The decline in domestic demand for furniture during the

recent economic crisis in the country which saw the US

dollar appreciate strongly against the Brazilian currency

resulted in many manufacturers in Bento Gonçalves to

turn their attention to international market.

In 2018, furniture manufacturers in Bento Gonçalves, Rio

Grande do Sul, earned US$42.6 million from exports a

12.5% increase over 2017 according to Bento Gonçalves

Furniture Industry Union (Sindmóveis).

In the first two months of 2019 companies in the region

sealed export contracts worth US$61 million an increase

of 34.4% over the same period of the previous year.

Sindmóveis estimates that international sales for 2019 are

expected to grow by 14% to about US$50 million.

The Latin American countries are the main destinations

for furniture produced in Bento Gonçalves. Uruguay was

the biggest buyer last year, followed by Peru and Chile.

Latin American markets are attractive to companies in

Bento Gonçalves because the competition is lower than in

Europe.

However, countries like Saudi Arabia and the United

States are good markets and in the first two months of

2019 the main export markets were in North America.

8. PERU

Industrialisation could help

eliminate illegal

logging

When meeting the media the Vice President of the

Association of Exporters (ADEX), Erik Fischer, said the

country suffers the loss of thousands of hectares of forest

annually as a result of unsustainable activities and called

for a new approach to the fight against illegal logging.

He suggested that prioritising domestic manufacturing

could be part of the solution as job security would be a

driving force behind sustainable harvesting.

He added that in 2018 manufacturers in the sector added

almost 30,000 direct and indirect jobs, around 3% more

than in 2017. This number could increase significantly if

forestry concessions are managed sustainably. He pointed

out that Peru has 17 million hectares of forests earmarked

for production but 3 million hectares are currently being

harvested.

Sernanp and Osinfor cooperation agreement

The National Service for Natural Protected Areas in the

State (Sernanp) and the Wildlife Resources and Wildlife

Oversight Agency (Osinfor) signed an inter-institutional

cooperation agreement that will promote joint action for

the conservation of forests nationwide.

Through this strategic alliance between both agencies in

the Ministry of the Environment the conservation and

sustainable use of forest resources will be promoted

through the exchange of experiences and information to

optimise the efficiency and effectiveness of each entity

objectives.

Loreto export potential boosted through updated

export plan

Edgar Vásquez, Minister of Foreign Trade and Tourism,

handed the Regional Governor of Loreto the Loreto

Regional Export Plan (PERX Loreto), a document that

will serve to boost exports from this important region to

the northeast of the country.

The Loreto Region has great export potential especially

for wood products, cocoa and camu camu said the

minister.