Japan

Wood Products Prices

Dollar Exchange Rates of 10th

May

2019

Japan Yen 109.34

Reports From Japan

¡¡

Survey ¨C economy worsening for the

first time in six

years

A government survey during the first quarter 2019 shows

the Japanese economy ¡°worsening¡± for the first time in

more than six years reinforcing the view that Japan may

have entered a recession in the first quarter 2019. This

calls into question the wisdom of raising the consumption

tax in October.

The main economic indicators indicate that risks to

exports due to the US/China trade war and weak domestic

demand undermined business confidence and investment

plans. Exports are estimated to have declined by 1.5% and

capital spending by 1.8%.

Private consumption, which was supporting the economy,

also fell. Worries are also mounting that the US/China

trade war will further affect the Japanese economy and

that the US may take a tough stance on its trade talks with

Japan.

Private consumption falls and risks to economy grow

Following the disappointing economic performance in the

third and final quarters last year, it appears that private

consumption weakened in the first quarter of 2019.

The second half 2018 decline was put down to the

combined impact of a series of natural disasters and a drop

in exports especially to China but the overall decline was

tempered as private consumption held up. This changed in

the first quarter when private consumption fell and this

was felt by importers.

It remains to be seen if the increased government spending

and the up-beat mood of consumers as they welcomed the

new Reiwa Era has boosted spending. But the consensus

amongst analyst is that the far greater risk for the Japanese

economy is the escalating trade friction between the US

and China.

When global tensions rise there is the usual flight of

foreign currency to the Yen and already the Yen has

appreciated against the US dollar, bad news for Japan¡¯s

exporters.

If predictions of a contraction in growth in the first quarter

2019 are proven correct it is likely there will be calls for a

delay in the consumption tax hike scheduled for later this

year.

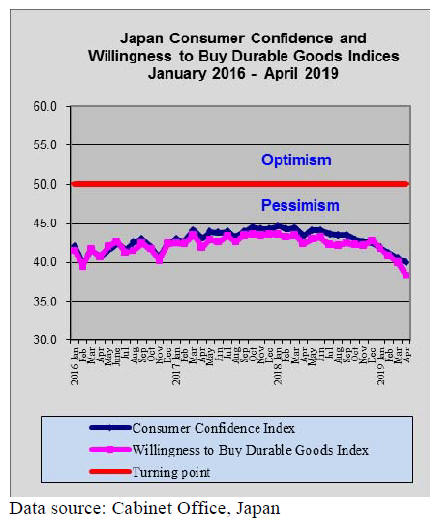

3 year low for consumer confidence

The April Consumer Confidence Survey conducted by the

Cabinet Office shows consumer confidence declined to the

lowest level in more than three years. The overall index

fell to 40.4 in April from 40.5 in March. This put the April

index at the lowest since February 2016.

Among the other indices, the index reflecting households¡¯

inclination to buy durable consumer goods declined in

April along with those measuring expectations on

employment, livelihood and income growth.

See: https://www.esri.cao.go.jp/en/stat/shouhi/shouhi-e.html

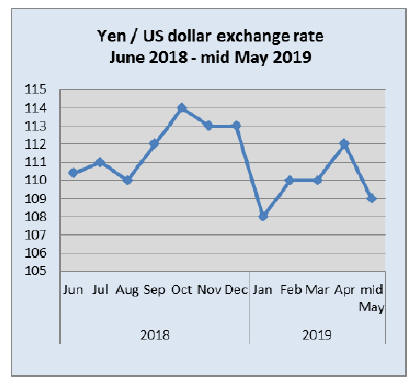

Global uncertainty - a rush to Yen

Amid escalating trade tensions between the US and China

the Japanese currency appreciated against the US dollar

with the US$/Yen falling to around 109 on 10 May.

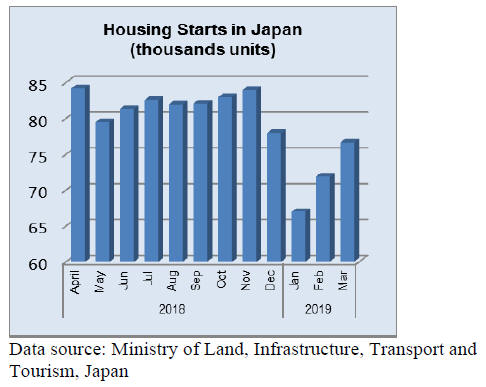

Millions discovered as old homes demolished

The latest housing survey from the Ministry of Internal

Affairs and Communications says that in 2018 the number

of homes in Japan increased by 1.8 million to 62.4 million

of which 53.7 million or about 86% were occupied at the

time of the survey. Of the remaining 14% a large

proportion of these were classified as abandoned.

The owners of abandoned and dangerous old houses are

required to demolish these structures and when owners

cannot be located the authorities will undertake the work.

The domestic press reports that it is not uncommon, during

the demolition, for hidden cash to be found. Apparently,

around Yen 600 million of hidden cash was found and

handed to the Tokyo Metropolitan Government last year.

https://www.stuff.co.nz/life-style/homed/latest/112493313/whyare-

so-many-houses-sitting-empty-in-japan

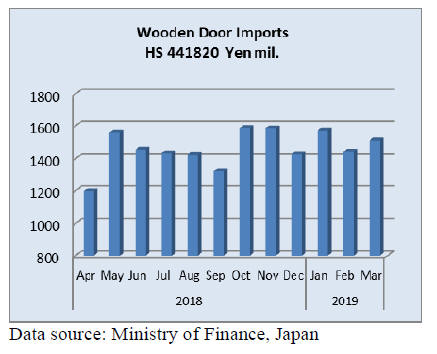

Import update

Wooden door imports

Year on year, the value of Japan¡¯s March wooden door

imports rose 26% and compared to the value of imports in

February there was a 5% jump in March. First quarter

2019 imports of wooden doors were 6% higher than in the

same period in 2018.

In March the top shippers of wooden doors to Japan were

China, the Philippines and Indonesia. China accounted for

60% of March imports of wooden doors followed by the

Philippines (22%) and Indonesia.

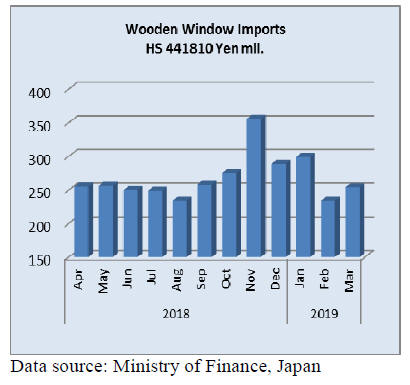

Wooden window imports

Following the year on year decline in the value of wooden

window imports in February, March year on year imports

continued down, falling 11%. However there was a slight

up-tick in the month on month imports (+8%). First

quarter 2019 imports of wooden windows were little

changed from a year earlier.

Some 70% of Japan¡¯s March imports of wooden windows

were supplied by China (41%) and the US (33%).

Shipments from Sweden contributed another 2-3% with

the balance being shipped from mainly manufacturers in

the EU.

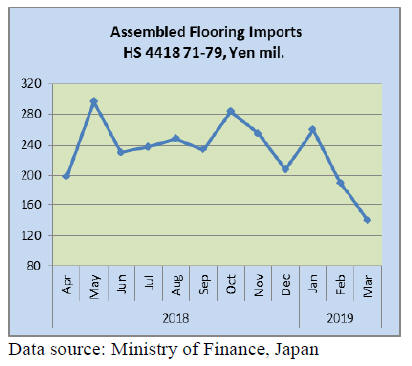

Assembled wooden flooring imports

The value of assembled flooring imports nosedived in

February and the downward trend extended into March

with year on year imports dropping a further 26%. The

month on month trend was no better with an over 25%

decline recorded.

March imports of wooden flooring were predominately of

HS441875 which was 97% of all categories of wooden

flooring imports. March imports were dominated by

shippers in two countries, Indonesia and China.

Shipments from Indonesia accounted for 46% of all March

imports of wooden flooring and shipments from China

added a further 44%. In previous months shipments from

Thailand were significant but this was not so in March.

First quarter 2019 imports of assembled flooring were

15% below that in the first quarter 2018.

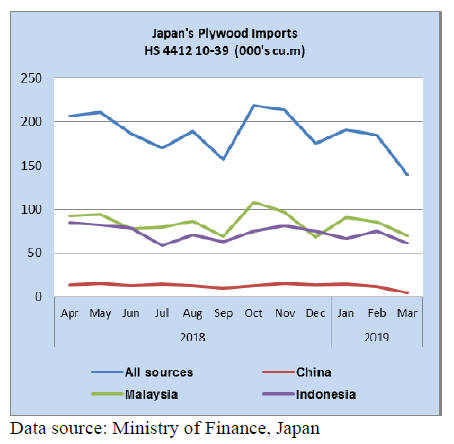

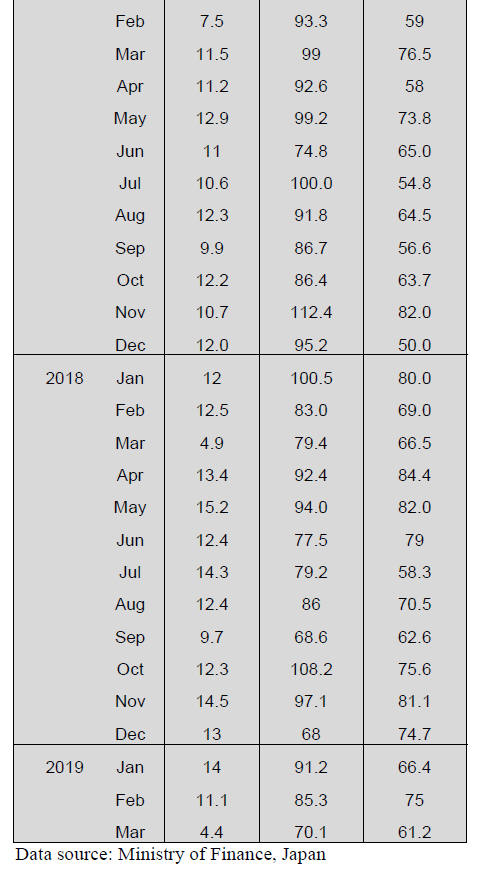

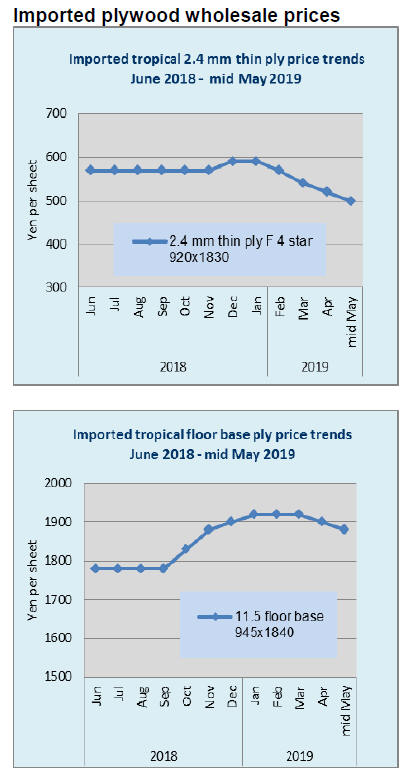

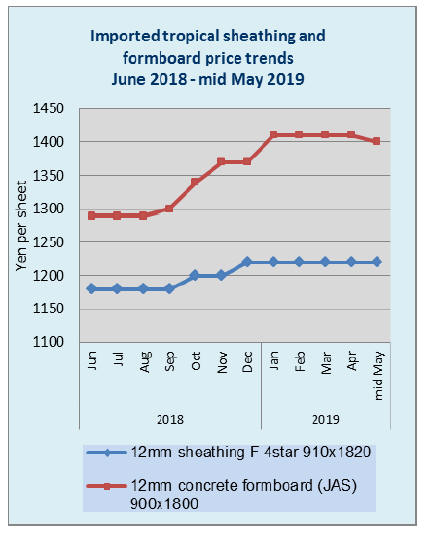

Plywood imports

Japan¡¯s March 2019 plywood imports dropped below

150,000 cubic metres, a record low. Plywood demand

remains firm and more of the domestic demand is being

met from domestic production from domestic raw

materials as well as imported veneer. Year on year March

import volumes were 13% down and month on month

March imports fell a massive 24%.

Compared to the first quarter of 2018 plywood imports fell

6% in the first quarter of 2019.

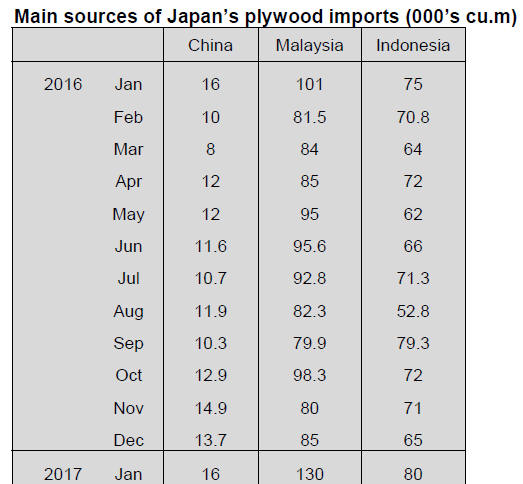

As usual, the top three suppliers Malaysia, Indonesia and

China continued to dominate plywood imports but all

three saw March shipments drop.

Shipments from Malaysia and Indonesia, the two biggest

suppliers, fell 26% year on year in March 2019 and

shipments from China were also down 10% year on year.

More startling was the month on month shipments from all

three main suppliers with China witnessing a 60% decline

only just beating the 64% decline in shipments from

Vietnam which was beginning to gain market share.

Trade news from the Japan Lumber Reports

(JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

Increasing imports of veneer

Import of South Sea hardwood veneer for manufacturing

plywood has been increasing since second half of 2018.

Import of veneer from Malaysia and Indonesia in

November 2018 was over 2 million square metres and the

import in February 2019 was almost the same.

After Sabah, Malaysia banned log export since May 2018,

log supply shifted to PNG and at the same time, import of

veneer from Malaysia and Indonesia increased to

supplement short supply of tropical hardwood logs.

Tropical hardwood log import in 2018 was 153,407 cbms,

4.5% more than 2017 out of which logs from PNG were

76,394 cbms, 164.5% more.

This is about a half of total log import. Logs from Sabah

dropped by about 50% with about 37,000 cbms. Logs from

Sarawak were about 40,000 cbms, slight drop from 2017.

After Sabah¡¯s log export ban, log import was expected to

drop sharply but PNG increased to fill the gap.

Japanese hardwood plywood manufacturers have been

testing many species from various sources and at the same

time, they increase using hardwood veneer from Malaysia

and Indonesia. Some trading firm has established

supplying 10 containers of veneer a month (about 800

cbms in log base).

Total veneer import in 2017 was 11,000,000 square metres

then that in 2018 was 13,000,000 square metres. The

import for January and February in 2019 was 3,520,000

square metres, which is more than one fourth of total

import of 2018.

South Sea (tropical) logs

Log market prices in Japan on both Malaysian and PNG

are firm. Log importers are asking Malaysian log suppliers

not to increase log prices any more as further increase lose

log market in Japan.

Malaysian log suppliers are facing increase of minimum

wage and harvest tax Log import this year has been stable

mainly from PNG but future is uncertain as there are

rumors that Sarawak, Malaysia may reduce log export

quota from present 20% in summer and may stop export

eventually. With Sabah continuing log export ban and if

Sarawak stops log export, PNG is the only source left.

Japanese plywood mills increase import of hardwood

veneer to supplement log shortage.

Wood demand projection by Forestry Agency

The Forestry Agency held demand projection meeting in

March 22. There are different opinions for rush-in demand

before the consumption tax hike in October by source and

item.

With such expectation, there may be oversupply by startup

of new plywood plants and import products.

Projection of new housing starts by 12 private think tanks

is 920,000 units in 2019 and 880,000 units in 2020.

Domestic log demand for lumber manufacturing for the

second quarter would decline but increase for third

quarter.

Log demand for plywood will increase with three new

plants including LVL starting up. Domestic log export in

January decreased for three major markets of China, Korea

and Taiwan. Particularly export for China dropped by

34.8% from January 2018.

North American log demand may decrease after the

second largest Douglas fir cutting sawmill, Toa quit last

year and competition with others like European laminated

lumber gets severe.

Demand for North American lumber for the second and

third quarter decreases compared to 2018.

For European lumber for the second and third quarter,

depressed redwood laminated lumber may recover some

but inventory adjustment is priority matter. Import of

redwood lumber keeps declining while domestic laminated

lumber mills will increase production toward fall demand.

Plywood demand now is pausing but is expected to

recover after holidays in early May while the supply of

softwood plywood will increase by start-up of new plants.

Imported plywood orders will decline for the second

quarter with ample inventories but will increase in the

third quarter after the inventories decline. Radiata pine

logs and lumber import will decrease after April due to

demand slow period of crating lumber.

Tropical hardwood lumber import in 2018

Import of laminated free board in 2018 was about 10%

less than 2017 because the demand in Japan stagnated and

the inventories stayed high and the prices were down.

Meantime, on the supply side, the cost increased by higher

planted species and investment to deal with environmental

problems so the orders from Japan dwindled. Meantime,

lumber for DIY stores like falcate had steady import.

Chinese red pine and Indonesian mercusii pine lumber

decreased. Laminated free board from Thai increased. The

volume is small yet but it has high standard so the demand

should increase little by little.

Hardwood lumber¡¯s problem is inflating prices due to

shortage of quality logs in producing regions like Malaysia

and Indonesia.

Processed lumber mainly for interior use also decreased

except for Vietnam. In China, by environmental

restrictions, many manufacturing plants were either

intensified or shutdown so the supply decreased by about

12%.

Forestry Agency subsidizes wood fence

The Forestry Agency has started subsidizing wood fence

and wood decking of residential and non-residential

buildings by allocating supplementary budget of 2019.

Amount of budget is 1,509,970,000 yen.

Maximum amount of subsidizing of wood fence is five

million yen and of decking and door is ten million yen.

Wood used for this purpose is either domestic or imports.

Appropriate treatment for durability is required by part

where wood is used.

Conditions for subsidy is 0.05 cubic metres per part or

0.02 cubic metres per one metre of wood is used in case

wooden fence or other exterior facility.In case of other

facilities like decking, post, gate door, board walk and car

port, more than 0.2 cubic metres of wood must be used.

Used wood must be legally proven wood based on the

Clean Wood law.

Once legality is proved, subsidised amount for wood fence

is 30,000 yen per one metre and 300,000 yen per cubic

metre for wood decking.

Furthermore, in case legally proven wood supplier is

registered dealer based on Clean Wood law, subsidized

amount for wood fence is 40,000 yen per one metre and

for wood decking is 40,000 yen per one cubic metre.

In case all related dealers from log supplier, lumber mill,

processed facility, distributor and contractor are registered

based on Clean Wood law, preferential deal is applied as

50,000 yen per one metre of wood fence and 500,000 yen

per one cubic metre of wood decking. Maximum amount

of subsidy is five million yen for wood fence and ten

million yen for wood decking.

|