|

Report from

North America

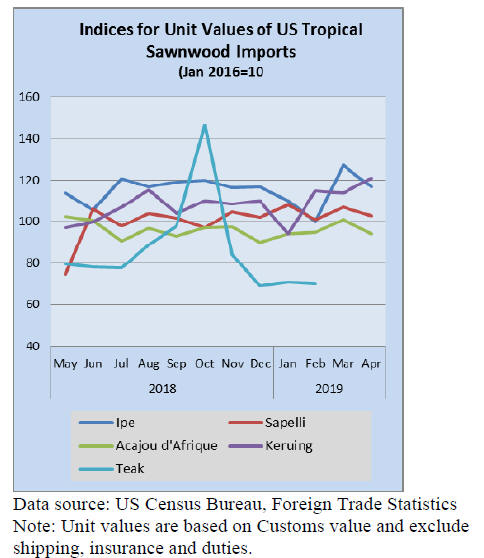

Sawn tropical hardwood imports rebound in April

US imports of sawn tropical hardwood rose by 22% in

April, returning to the strong import volume seen in the

first two months 0f the year. April volumes of 22,960

cubic metres were the second highest in more than two

years, with only this January being higher.

Import volumes are ahead of 2018 by 23% year to date.

Imports from Brazil, Cameroon, Congo (Brazzaville), and

Malaysia all gained in April and are well ahead of 2018

year to date.

Imports from Ecuador, which had been outpacing last

year¡¯s volume, fell by 26% in April to now lag behind

2018 by 4% year to date. Imports of Acajou d¡¯Afrique

were up 61% in April and are more than doubling 2018

volume year to date.

Sapelli, teak, ipe, keruing, and virola imports all improved

in April and are outpacing 2018 totals year to date.

Imports of Balsa fell by 27% in April and are now 4%

behind 2018 year to date.

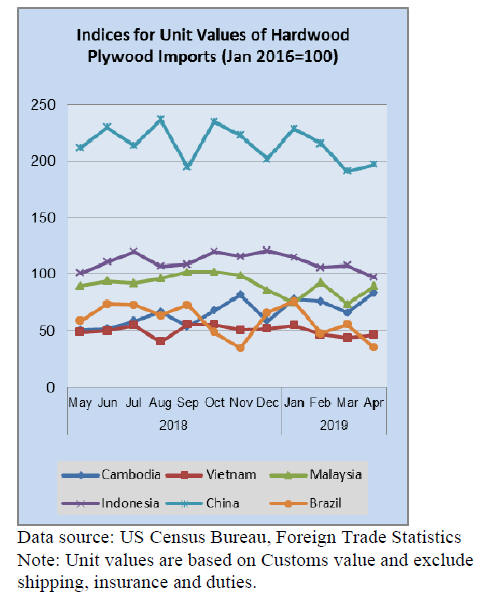

Hardwood plywood imports fall 5%

US imports of hardwood fell by 5% in April. Total import

volume is now down by 4% year to date. Volume from

most major trade partners fell in April with imports from

Russia, Indonesia and Cambodia all not meeting March

levels and lagging behind 2018 year to date.

Imports from China, which have been steadily declining

for the past several months, rebounded somewhat (32%)

from a historically bad March, but are still one-tenth of the

volume we saw two or three years ago. Imports from

Vietnam, which had been strong in the first quarter,

declined by more than one third in April, but are still

strongly outpacing last year¡¯s totals.

Tropical veneer imports remain weak

Despite a 12% rise in US imports of tropical hardwood

veneer in April, sales for the month were only two-thirds

that of April 2018.

Year-to-date total imports are down 19% with Chinese

imports at less than half the level of 2018 year to date after

declining by 48% in April.

Imports from India fell by 30%, but remain up 81% year

to date after a strong 1st quarter. Imports from Italy and

Ghana both saw encouraging gains in April but still are

not up to their 2018 pace year to date

Flooring imports show steady improvement

US imports of hardwood flooring improved for the third

straight month, rising by 14% in April. Despite a

prolonged slide in imports from China, overall imports are

up 12% year to date with Malaysia, Brazil and Indonesia

all gaining from China¡¯s loss. Imports from China fell by

25% in April and are down 44% year to date.

Imports of assembled flooring panels also continued their

steady rise, improving by 7% in April. Imports from China

more than doubled in April to rebound from a dismal

March but are still 33% behind 2018 year-to-date. Imports

from Brazil and Thailand, which have been gaining

strongly from declining US/China trade, both fell sharply

in April.

Moulding imports continue to fall

US imports of hardwood moulding fell by 8% in April

following an already weak first quarter of the year.

Imports are down 28% year to date from last year with

imports from China and Brazil both 49% behind 2018 year

to date. Imports from Brazil did pick up strongly in April

(36%), as did imports from Malaysia.

The 41% rise in imports from Malaysia in April nearly

brought numbers even with 2018 year to date after a very

weak March.

Furniture orders flat in first quarter

The results of the Smith Leonard survey of residential

furniture manufacturers and distributors for March showed

new orders in March 2019 down 3% from March 2018

following a 5% decline in February. This decline in orders

brought the year-to-date results to a flat order rate for the

full quarter. Only 42% of the participants posted increased

orders year to date.

Shipments were 1% lower than March 2018 following a

3% decrease reported last month. So, after a fast start in

January, year-to-date shipments only increased 3% for the

quarter. Backlogs remained steady from February as the

dollar amount of orders was about the same as the dollar

amounts shipped. Backlogs remained 4% ahead of March

2018.

Wooden furniture imports rose in April

US Imports of wooden furniture grew by 11% in April,

bringing sales roughly in line with 2018 levels for the year

so far. Imports from Vietnam were up 14% in April and

are up 27% above 2018 year to date. Imports from China

rebounded somewhat in April, rising 29%, yet remain

down 15% year to date from 2018.

Consumer confidence gains despite trade war

US consumer sentiment remained at very favorable levels

but eroded somewhat in the last two weeks of May due to

fears about tariffs. The University of Michigan¡¯s sentiment

index rose to 100 in May from the prior month¡¯s 97.2.

While that is an eight-month high, escalation of the trade

war with China weighed on the outlook for the overall

economy, paring gains that previously showed a 15-year

high.

Unfavorable references to tariffs more than doubled in late

May from the first half of the month, with 35% of

consumers spontaneously mentioning the levies. That

matched a peak recorded in July 2018 when the US began

its initial round of duties on Chinese goods. Consumer

sentiment remains high due to unexpectedly strong

economic growth and the lowest US unemployment in 49

years.

Unit values: Please note the unit values in the tables on

last report 16-31 May 2019 TTMR are US Dollars

except for plywood which is cubic metres.

|