Japan

Wood Products Prices

Dollar Exchange Rates of 25th

June

2019

Japan Yen 107.18

Reports From Japan

¡¡

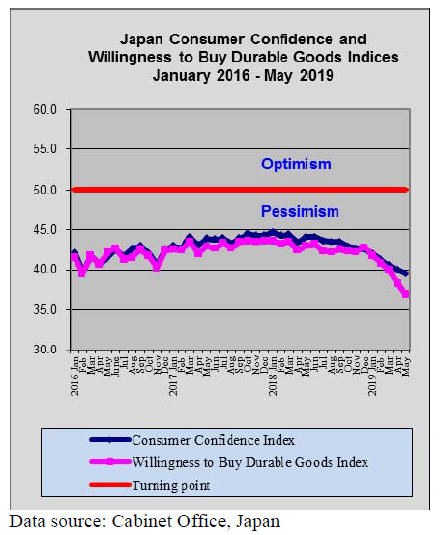

Business confidence deteriorating

A June 2019 survey to assess business sentiment

conducted by the Asahi Shimbun has shown that showing

Japanese business confidence is deteriorating rapidly.

Behind the falling confidence, said respondents, was

uncertain prospects in overseas economies and stagnation

of Japanese consumer spending. The survey of 100 major

Japanese companies has been conducted in the Spring and

Autumn annually for several years.

In the Spring 2019 survey only 32% of firms said business

conditions are expanding gradually, a sharp drop from the

66% of firms reporting expansion in the 2018 Autumn

survey. The number of companies saying business

conditions are weakening jumped to 10% in the Spring

2019 survey from around 1% in the 2018 Autumn survey.

http://www.asahi.com/ajw/articles/AJ201906180049.html

In related news, the Reuters poll has reported that

manufacturers¡¯ business confidence dropped to a 2½-year

low in June. Subdued business confidence, along with

slowing exports and domestic spending, has clouded the

outlook for the Japanese economy.

Will the Japanese pension be enough?

In mid-June, Japan¡¯s Financial Services Agency published

a report on the financial security of future retirees

suggesting that they would be wise to save more to make

up for expected shortfalls in the public pension system.

This sparked a major controversy in the government and

was immediately reported as likely to have a very negative

impact on consumer confidence and spending, core drivers

of the economy.

The report said, in the worst case, people should aim to

have yen 20 million savings to top up the ¡®average¡¯

pension for a retired couple in their 60s. The report

shocked many of the younger generation, few of whom

could ever save so much given the employment situation

in the country. Analysts are anticipating a further drop in

the consumer confidence index for June.

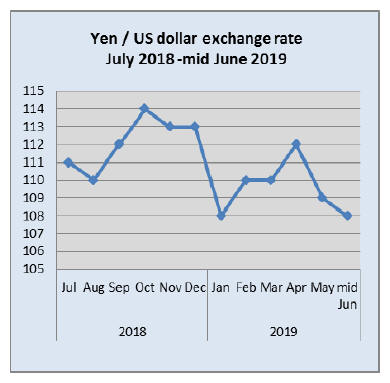

US dollar at new low against the yen

The US dollar weakened further in the second week of

June in anticipation of a July cut in interest rates by the US

Federal Reserve.

In June the yen fell to a low of 107 against the US dollar

on ¡®safe-haven¡¯ yen purchases as the Iran/US war of words

escalated however, the yen firmed after Japanese

government officials expressed concerns on recent yen

strength. It is widely anticipated that the Bank of Japan

(BoJ) would move quickly to stem any sharp rise in the

strength of the yen against the US dollar.

At the latest BoJ monetary policy meeting it was decided

to hold rates steady but Governor Kuroda made it clear

that the Bank is ready to add more stimulus if the risks to

the Japanese economy rise.

Kuroda said the Bank could combine interest rate cuts

with further asset buying if needed to keep the economy

on track to achieve its inflation target.

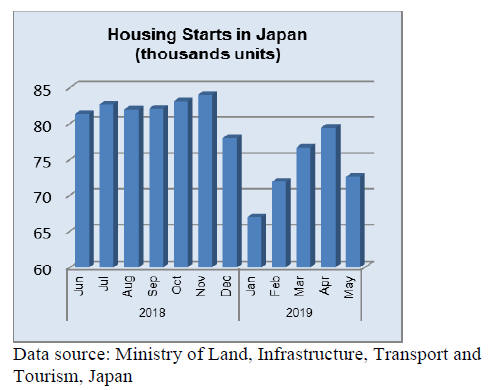

Second year on year decline in housing

starts

Japan¡¯s housing starts declined year on year for the second

month in May dropping by around 7%, worse than the 5%

drop in April. On an annual basis housing starts would

come in at 900,000 based on data up to May. The forecast

for 2019 starts was 948,000 down from the 988,000 in

2018.

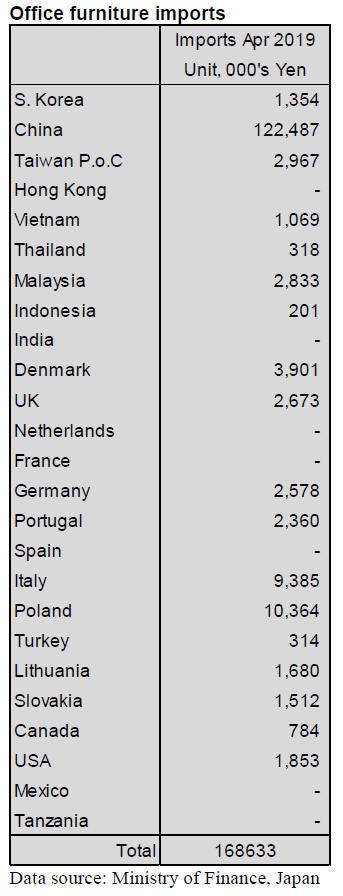

Office furniture imports (HS 940330)

Japanese importers of wooden office furniture tap into a

more diverse supply network than observed with imports

of either wooden kitchen or bedroom furniture.

March imports were mainly from China (49%) and

Germany which contributed a further 27%. If shipments

from Poland were added then over 80% of March imports

were from just these three countries.

A look at April wooden office furniture import sources

reveals a different picture as shippers in Poland, Italy and

Denmark took a good share of imports but were well

behind the 72% supplied from manufacturers in China.

Year on year, the value of April imports of wooden office

furniture fell 25% and there was a sharp 33% drop in

month on month imports. The value of April shipments

from China were at about the same level as in March,

shipments from Poland dropped 40% compared to March

but Italy surged back with an almost 70% rise in the value

of shipments compared to March.

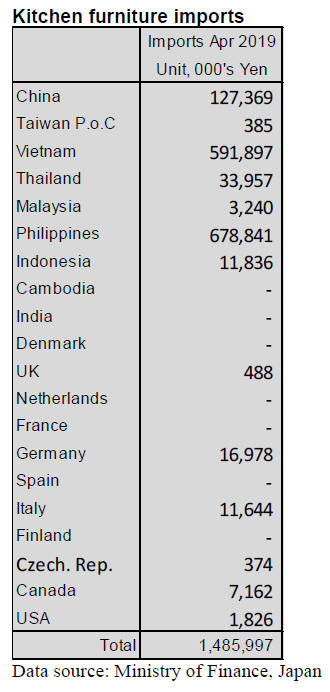

Kitchen furniture imports (HS 940340)

As has been the case for the past 12 months, the top

shippers of wooden kitchen furniture to Japan in April

were the Philippines (46% of all wooden kitchen furniture

imports) and Vietnam (40%). China is the third largest

shipper of wooden kitchen furniture to Japan and

contributed around 9% to the total value of imports in

April.

Year on year the value of April imports of wooden kitchen

furniture rose 21% but there was a 3% decline compared

to levels in March. April shipments from the Philippines

fell 10% month on month but Vietnam and China both

saw shipments rise in April (12% and 34% respectively).

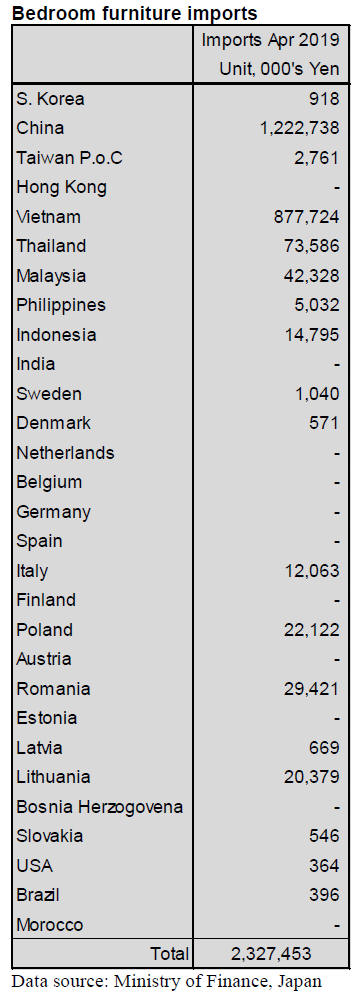

Bedroom furniture imports (HS 940350)

The decline in Japan¡¯s imports of wooden bedroom

furniture first noted in February continued into March but

April imports reversed the decline push the value of

imports the highest for 2019.

As in previous months, the combined value of imports of

wooden bedroom furniture from the top two shippers,

China and Vietnam, accounted for 90% of the value of

April 2019 imports. The third largest shipper was

Thailand, followed by Malaysia but their combined

imports only accounted for about 5% of all April imports.

Year on year the value of April imports of wooden

bedroom furniture was up 24% and there was a 27% rise

in the value of imports compared to March. The big

winners in April were China (39% rise m.o.m) and

Vietnam (21% rise m.o.m.). Thailand and Malaysia saw a

fall in shipments to Japan.

Trade news from the Japan Lumber Reports

(JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

http://www.n-mokuzai.com/modules/general/index.php?id=7

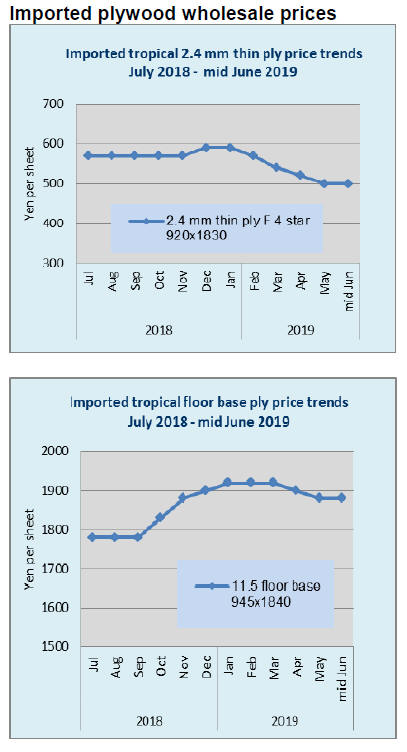

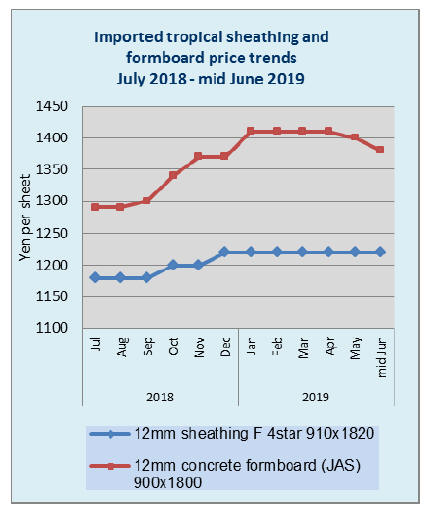

Agonizing South Sea (tropical) plywood manufacturers

Plywood manufacturers in Malaysia and Indonesia are in

tough spot with declining orders from overseas markets

and spiraling cost of logs.

Since spring of 2017, plywood prices in Malaysia and

Indonesia soared to record high level by log shortage

while the market in Japan continued sluggish log supply in

Indonesia started recovering gradually since fall of 2018

and plywood export prices weakened but the demand in

other markets like Korea dropped by trade conflict

between China and the U.S.A.

Some plants in Indonesia restarted manufacturing concrete

forming panels for Japan since last February and March

after the supply of concrete forming panels from Malaysia

in last two years decreased by log shortage in Sarawak.

Malaysian plywood manufacturers continued bullish

despite softening trend of Indonesia plywood prices but in

last two to three months, export prices of some items are

adjusted downward after log prices weakened after the

rainy season was over. Log prices of about 850 ringgit per

ton for last two years are now down to about 750 ringgit.

Production of plywood mills dropped by lack of orders so

mills profitability has not improved despite lower log cost.

Mills continue asking to reduce log prices to log suppliers

but log production cost remains high so further reduction

is unlikely.

Mills accept low priced orders from the Middle East

market to maintain production but low operation

continues.

Logs, plywood and palm oil are three major items for

wood industry in Sarawak, Malaysia but export of logs

and palm oil continues slow. Market of palm oil is soft

worldwide and log export shifted to PNG.

Import plywood market in Tokyo continues weak and

warehouses in Tokyo Bay ports are plugged with plywood.

Increasing container cargoes results in congestion as unstuffing

takes longer. This also influences unloading

works of bulk carriers.

Shipping companies bear demurrage and they are reluctant

to carry plywood now. They are collecting surcharge from

plywood manufacturers as they sell C&F base. Japanese

importers face difficult decision to purchase future

cargoes since it takes more time from placing orders to

delivery to the customers by port congestion.

Plywood

Movement of both domestic and imported plywood is

stagnant while the manufacturers¡¯ stance has no change.

Domestic manufacturers are now determined to correct

sales prices to their initial proposed prices because there

are variety of prices with precutting plants, which deal

direct with manufacturers.

South Sea hardwood plywood manufacturers show no sign

of reducing export prices so there is a gap between

suppliers¡¯ prices and market prices in Japan.

Demand of softwood plywood is getting active by orders

from precutting plants and trading firms¡¯ sales continue

busy so overall circumstances are favorable but due to

shortage of truck drivers and construction workers,

deliveries are delayed and construction works are delayed

so boom feeling is not really there. Also, market prices are

confused with some dumping sales.

Actually dealers are holding back new purchase as the

prices may weaken after new plywood mill started

running.

Softwood plywood manufacturing cost has been climbing

recently by higher log prices and transportation

prices so it is urgent issue for the manufacturers to bring

the sales prices up to cover higher cost.

The inventories by the manufacturers are not high and

some mills in Western Japan ran extra three days during

early May holidays to accumulate the inventory. April

production and shipment are almost even so that May

inventories should drop again.

Movement of imported hardwood plywood continues dull

even after lengthy holidays in early May. Dealers tried to

reduce the inventories after warehouse companies

increased storage charges so the market prices continue to

be weak. Thus, price hike is difficult when low priced

offers are in the market.

Performance of major house builders

Total housing starts in 2018 are 952,936 units, 0.7% more

than 2017. Owner occupied units are 287,710, 2.0% more.

Rental units are 390,093, 4.9% less. Units built for sale are

267,175, 7.5% more out of which condominiums are

119,683, 10.5% more and detached units are 144,905,

5.1% more.

Performance of major house builders in 2018 was almost

flat with 2017. Units built were almost same as 2017.

Business of no-residential units by major builders was

good. Orders of detached units are recovering but rental

unit boom was over and financial institutes tighten loans

for rental units as they are obviously over built and land

owners¡¯ mind is shrinking to build apartments.

Actually rental units start has been dropping month after

month for last two years. Meantime demand for detached

units built for sale continues active but the demand is

saturated so the largest builder feels alarming signal.

Since around 2015, rental unit building accelerated so that

not only rental units builders but other major house

builders had increasing orders. Compared to single

detached houses, apartment sales are larger and more

efficient to increase sales so house build ers shifted more

sales workers from detached unit to apartment and came

up with new apartment models to cover slow sales of

detached units.

Now after the boom of rental unit sales was over, house

builders need to find other means to cover drop of rental

unit sales so tide reversed from rental units to detached

units sales.

Fortunately rush-in demand before consumption tax

increase in October turned up so major house builders

shifted sales force from rental units to detached owner

occupied units and also put more effort to develop nonresidential

building sales.

Sumitomo Forestry and Misawa Homes, which specialize

detached owner occupied units, moved sooner to recover

orders and targets are younger first time buyers of urban

dwellers. Number of two income family increase and

buyers of major house builders increased.

Rental unit builders like Leo Palace 21 registered large

loss after many cases of corner-cutting construction was

found in their concrete condos and major executives

resigned. The largest rental units builder, Daito Trust

suffers declining orders.

Domestic logs and lumber

Log production through early June was steady so that log

supply is a bit too much and the log prices are on weak

side. Now that rainy season arrived, log production should

slow down and the forecast says this year¡¯s rainy

season is long so the log market should tighten in July.

Weak log market has been lasting for last four months. In

particular, down trend of cypress is conspicuous in last

two months. 4 meter sill cutting cypress log prices are

down to 16,500-17,000 yen in early June from over 20,000

yen up until last December and some low prices of less

than 16,000 yen are seen in some areas.

3 meter post cutting cedar log prices are held at 12,000-

13,000 yen in major supply areas but there are low offers

like 10,000 yen so the future is uncertain. 4 meter purlin

cutting cedar log prices are about 10,000 yen.

Lumber movement is steady mainly for large precutting

plants and the prices of KD 3 meter 105 mm cedar post are

50,000-52,000 yen and of KD 4 meter 105 mm cypress sill

are 64,000-65,000 yen. Lumber buyers demand further

reduction because log prices are down but lumber prices

have not gone down as much as logs.

Compared to 105 mm lumber, 120 mm lumber market is

weak with slow demand on both green and KD lumber.

Prices of low priced common cedar lumber shot up to

32,000 yen since last summer through early this year by

supply shortage are now back down to30,000 yen as the

demand is simmering down.

New plywood mill completed

Ohita plant of Shin-ei Plywood, one of Seihoku group

companies, completed building plywood manufacturing

plant. The plant uses 100% domestic species to

manufacture structural softwood plywood.

The annual production is 68,000 cbms (monthly

production of 280,000 sheet of 12 mm 3x6) It uses

cypress for face and back with cedar core but it also plans

to make 100% cedar panel. The market is Northern

Kyushu. This is the second plant for Shin-ei.

Annual log consumption would be about 110,000 cbms

(70% cedar and 30% cypress). Shin-ei is the only plywood

mill in Kyushu with the first plant in Minamata, which

produces softwood structural plywood and coated concrete

forming panel.

Annual log consumption of this plant is 300,000 cbms out

of which 270-280,000 cbms are domestic species plus

some imported logs but in two to three months, all the logs

it uses will be domestic species. It uses logs from three

neighboring prefectures of Kumamoto, Kagoshima and

Miyazaki.

By completion of Ohita plant, log procurement is more

stable by dividing territories and Minamata plant will

produce more coated concrete forming panel after Ohita

plant produces enough structural panels. Sin-ei

experienced hard time to satisfy customer¡¯ orders after

Kumamoto earthquake when demand for structural panels

increased for restoration of damaged areas and it felt

necessity to have another plant in Kyushu.

|