|

Report from

North America

Sawn tropical hardwood imports from Brazil jumped

25% in June

US imports of sawn tropical hardwood were down by 25%

in June following a strong May, but still greatly outpaced

volume from one year ago. Imports fell to 18,193 cubic

meters, in June, which is 17% higher than that of June

2018. After the first half of the year, import volume is

ahead of 2018 by 25% year to date.

Imports from most trading partners fell in June, while

imports from Brazil jumped by 25%. Imports from Brazil

are up 35% year to date as the country has separated itself

from Ecuador as the top supplier to the US Imports from

Ecuador rose by 7% in June but remain down 12% year to

date.

The decline in volume was chiefly due to drops of more

than 50% in both jatoba and keruing imports. Even with

the June decline, US imports of Jatoba are still impressive.

Through the second quarter, imports of Jatoba are up

117% and jatoba has surpassed balsa as the top tropical

hardwood imported to the US by volume.

Vietnam replaces China as top supplier of hardwood

plywood to the US

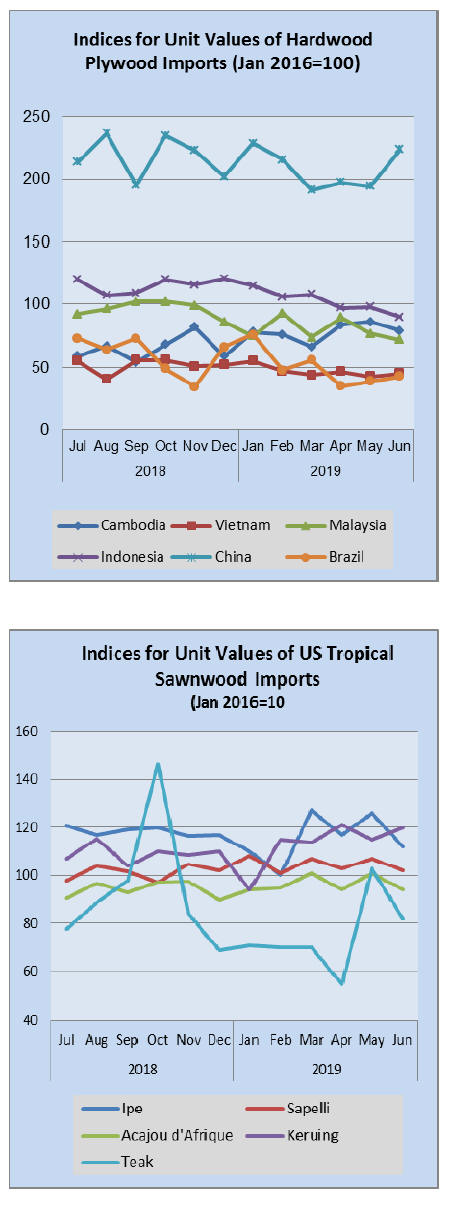

US imports of hardwood plywood were down 5% in June,

with decreases in volume from nearly all trading partners.

Imports from China were down 21% in June and are

behind last year¡¯s volume by just under 90,000 cubic

meters (51%) year to date.

Through the first half of the year, US imports are down

26% and, with the exception of Vietnam, imports from all

major trading countries are down more than 10% year to

date.

While down slightly in June, imports from Vietnam have

increased more than 112,000 cubic meters year to date, up

109%, as the country has supplanted China to become the

new top supplier of hardwood plywood to the U.S.

Imports of Chinese tropical veneers fall further

US imports of tropical hardwood veneer rose by 5% in

June but remain at a level 30% below that of June 2018.

Year to date imports are down 21% as imports from China

and Cameroon continue to plummet. Imports from China

were down 32% in June and trail 2018 by 61% year to

date. Imports from Cameroon were down 22% in June and

are 65% behind 2019 year to date. Imports from India

were up 31% in June and are ahead by 27% year to date.

US importers turn to Brazil for hardwood flooring

US imports of hardwood flooring fell by 18% in June,

ending an extended stretch of growth. Despite the tumble,

imports for June were nearly even with that of June 2018

and remain 15% ahead year to date. Imports from China

continue to dwindle, down 47% in June and 48% year to

date. Importers turned again to Brazil to make up the loss.

Imports from Brazil rose 33% in June and are up 123%

year to date.

The story is much the same regarding Imports of

assembled flooring panels. Imports were also down 18%

in June but remain 11% ahead year to date. Imports from

China were down 28% in June and are 23% behind year to

date. But it is Vietnam that is gaining from China¡¯s fall

here. While down 30% in June, US imports from Vietnam

are up by 179% year to date.

Moulding imports regress

After falling by 16% in June, imports of hardwood

mouldings ended the first half of 2019 down more than

25% year to date. Imports from Brazil and China were

down by more than 20% for the month and are both at

nearly half of 2018 totals year to date. Imports from

Canada were up 6% in June and are 10% ahead through

the first half of the year.

GDP grows by 2.1% in 2nd quarter

The US economy grew at an annual rate of 2.1% in the

second quarter, a rate better than economists had expected,

but slower than the 3.1% pace of the first quarter.

The middling result was propelled by a strong increase in

consumer spending and government spending, which

rebounded after the government shutdown in January. But

it was dragged down by a large decrease in business

investment, particularly in real estate, which had been

much stronger in 2018.

Residential investment fell for the sixth straight quarter.

However, consumer spending was very strong, growing at

a 4.3% annualised rate in the second quarter, up from only

1.1% in the prior quarter. Spending on durable goods,

which includes long-lasting items like cars and furniture,

was particularly strong, growing at a 12.9% annualised

rate.

|