3.

MALAYSIA

Increased exports of plantation logs

from Sarawak

Logs from industrial plantations are fast becoming a major

export for Sarawak as production from the natural forest

has been reduced drastically. According to Sarawak

Timber Industry Development Corporation (STIDC), in

the first half of 2019 Sarawak exported over 399,000 cu m

of plantation logs, mainly acacia mangium, most of which

was shipped to Indonesia.

Of the total log export volume of 731,758 cu.m in the first

six months of 2019, plantation logs accounted for about

half. Acacia mangium exports have expanded rapidly

since 2013 when some 147,100 cu.m was exported.

Records show there are 43 licensed forest plantation

owners in Sarawak with around 420,000 ha. However,

expansion of the planted area has fallen far short of the

State target of one million ha. for 2020. A new target data

2025 has been adopted.

Trade analysts report that some Japanese companies have

been testing acacia mangium and falcata as alternative raw

material sources.

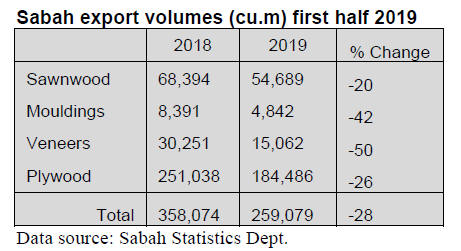

Sabah export earnings plummet

Data released by the Sabah Statistics Department for the

first half of the year showed Sabah’s wood product exports

were worth RM540,331,476, a decline of 23% from the

corresponding period last year. In 2018 first half exports

were RM705,887,110.

The national tree - Merbau

The Prime Minister, Dr. Mahathir Mohamad, has

confirmed Malaysia will maintain at least a 50% forest

cover in accordance the commitment made at the Rio

Earth Summit in 1992. Speaking at a recent exhibition the

Prime Minister announced that merbau Intsia bijuga is

now the national tree of Malaysia. Intsia bijuga, locally

known as ifit, is also the official tree of Guam.

See:

https://www.nst.com.my/news/nation/2019/08/515369/merbaunow-

malaysias-national-tree

Non-timber forest products

Urban Planning, Land Administration and Environment

Assistant Minister, Len Talif Salleh, has reported that the

Sarawak Forest Department was collaborating with

various national and international agencies on research and

development of species such as gaharu (agarwood).

Through a project in Ulu Menyang in Batang Ai the local

community plants gaharu to produce gaharu tea. The

Department and NGOs assist in supplying seedlings,

technical advice, monitoring and maintenance.

In related news there is a proposal to plant bamboo in

Undop, near Sri Aman. There is already a pilot project

where 25 hectares have been planted with 13 species of

bamboo.

Sabah mangrove project with support from Japan

private sector

The Sabah Forestry Department (SFD) has signed a MoU

with the International Society for Mangrove Ecosystems

(ISME) for a mangrove rehabilitation project funded by

Tokio Marine & Nichido Fire Insurance Co Ltd (TMN),

Japan.

Plywood prices

Plywood traders based in Sarawak reported the following

July export prices.

4.

INDONESIA

Investment in furniture

manufacturing slows - export

target slips

The Secretary General of the Association of Indonesian

Furniture and Crafts Industry (HIMKI), Abdul Sobur, said

while initially entrepreneurs predicted that furniture

production could grow 8% this year, conditions in the

domestic and export markets are seriously challenging

which has impacted investment and competiveness. As a

result industry growth is now estimated only 5% - 6%.

He said if Indonesia wants a furniture sector like

Vietnam’s which continues to expand conditions must be

created that stimulate domestic investment as well as

foreign investment.

Sobur said he is convinced Indonesia has the potential to

attract the relocation of manufacturers from China but the

investment climate in the country must be improved.

See:

https://surabaya.bisnis.com/read/20190820/532/1138814/tanpainvestasi-

masuk-industri-mebel-cuma-tumbuh-5-persen

Las Vegas furniture show a success for Indonesian

producers

In a press release the Ministry of Trade reported the

success of Indonesian companies at the recent Las Vegas

Market Exhibition.

Indonesia's participation in show was encouraged by the

Indonesian Trade Promotion Center (ITPC) for the

Chicago and Los Angeles areas and 3 Indonesian

exporters exhibited their products at the Indonesian

Pavilion.

The Head of ITPC (Chicago), Billy Anugrah, said the

Indonesian Pavilion received a lot of attention and

business enquiries were worth around US$500,000.

See: https://pressrelease.kontan.co.id/release/furnitur-danproduk-

dekorasi-rumah-indonesia-memikat-di-las-vegas-market-

2019

Authorities step up efforts to fight forest fires

The authorities have stepped up efforts to control forest

fires because the number of ’hot spots’ has risen in recent

week causing smoke to blanket large parts of the country

and neighbouring countries. The media report more than

600 fires were detected between 31 July and 6 August and

there were another 150 outbreaks in a few days after 6

August.

An emergency response team has deployed extra

helicopters for water bombing bringing the total to 36

according to the National Disaster Management Agency.

Indonesia- South Korea trade deal to be signed

After a meeting with the South Korean Minister of Trade,

Industry and Energy, Myung Hee Yoo, Enggartiasto

Lukita, Indonesia’ Minister of Trade, said Indonesia and

South Korea are set to finalise a Comprehensive Economic

Partnership Agreement (IK-CEPA) during the November

ASEAN-Korea Summit to be held in South Korea.

Central Statistics Agency (BPS) data shows total trade

between the two countries was US$18.6 billion in 2018

with Indonesia enjoying a surplus of US$443.6 million.

South Korea is the seventh largest destination for

Indonesia's exports which include mineral, natural rubber,

plywood and manufactured goods.

5.

MYANMAR

MEITI report praised for

boosting transparency

Art Blundell and Khin Saw Htay, writing for the online

media ‘moderndiplomacy’ a platform for assessing and

evaluating complex international issues that are often

outside the boundaries of mainstream Western media and

academia, acknowledge the improved transparency in

Myanmar specifically mentioning the latest

Myanmar Extractive Industries Transparency Initiative

(MEITI) report as an important contribution to improved

transparency and accountability in Myanmar’s forest

sector.

See: https://moderndiplomacy.eu/2019/08/20/in-myanmar-betteroversight-

of-forests-a-vital-step-in-transition-to-rule-of-law/ )

Analysts in Myanmar write “the recent launching

ceremony of the MEITI report on the forestry sector is a

really significant development in the transparency history

of forestry sector of Myanmar”.

Myanmar-Japan-US investment forum

A Myanmar/Japan/US Forum on ‘Fostering Responsible

Investment’ was held recently in Yangon.

The Forum was organised by the Ministry of Investment

and Foreign Economic Relations in collaboration with the

US Embassy, the Embassy of Japan, the American

Chamber of Commerce, the Japan Chamber of Commerce

and Industry, the Myanmar Federation of Chambers of

Commerce and Industry, the Japan International

Cooperation Agency, the Japan External Trade

Organization and US Commercial Services. The aim was

to highlight Myanmar’s investment potential against a

background of Asian growth potential.

The Directorate of Investment and Company

Administration (DICA) has reported that investment flows

into the country from Japan and the US totaled US$1.6

billion as of the end of June 2019.

New voice for entrepreneurs

With the creation of the Myanmar Entrepreneurs

Association (MEA) entrepreneurs in the country can more

effectively voice their concerns and share knowledge and

experience among members. The MEA was inaugurated

on 22 August with U Ko Ko Htwe as the chair of the

association.

It is understood MEA will seek to be a platform for

entrepreneurs to share their knowledge and experience in

areas such as human resource management, technology

and financing.

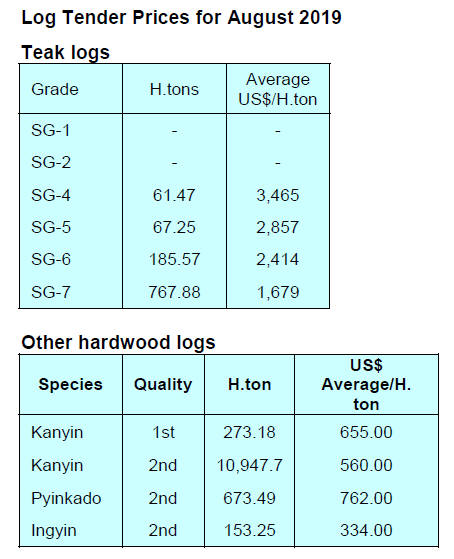

Log tender schedule announced

The Myanma Timber Enterprise (MTE) has announced the

tender schedule for 2019-20. MTE says 8,000 tons of teak

logs and 150,000 tons of hardwood logs will be auctioned.

The harvesting season usually begins in

October/November.

6. INDIA

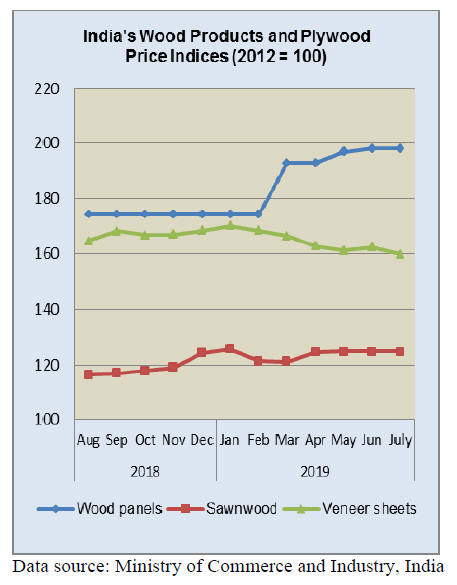

Only plywood prices on the rise

The official Wholesale Price Index for ‘All Commodities’

(Base: 2011-12=100) for July 2019 declined to 121.2 from

121.5 in June. The index for the group 'Manufactures of

Wood and of Products of Wood and Cork ' declined to

134.2 from 134.6 for the previous month due to lower

prices for wooden splints and veneer sheets. However,

prices for plywood were higher.

The annual rate of inflation based on monthly WPI in July

stood at 1.08% compared to 5.27% in July in the previous

year.

The press release from the Ministry of Commerce and Industry

can be found at: http://eaindustry.nic.in/cmonthly.pdf

Plantation teak imports

Serious efforts are being made by importers’ to get the

government to ease the advance payment conditions for

GST. The timber sector is not the only one affected

adversely by the GST implementation and in some other

sector industrial action has been taken to draw attention to

the issue.

The rupee is slipping against the US dollar and dropped to

Rs.71, per US dollar, the year’s lowest. A firm dollar,

weak domestic equity markets and asset outflows from

India as the super-rich move money to avoid the recent tax

hike weakened the rupee.

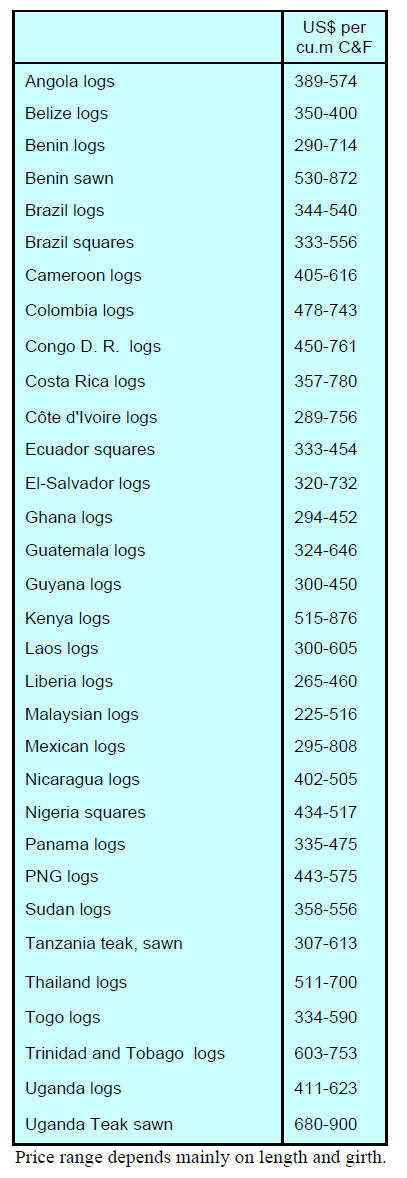

C&F prices for teak imports continue within the same

range as reported previously.

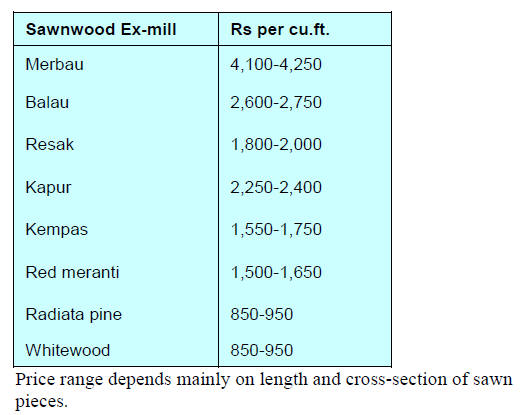

Locally sawn hardwood prices

Ex-mill prices for sawnwood milled from imported logs

remain unchanged in what analysts write is a stable

market.

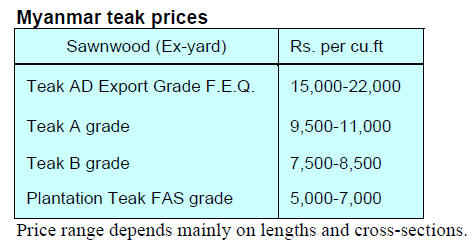

Importers cut back on Myanmar teak

Due to weakening demand for Myanmar teak, importers

have started to reduce the volumes being imported. The

main reason for the slowing demand is the dull housing

market and consumer concerns on the economy and

current political issues.

The government is actively promoting construction of

affordable housing but real estate observers report home

sales and starts have declined. In fact, according to a

report from PropTiger.com, affordable housing accounts

for half of the unsold housing stock in key cities.

PropTiger says” while home sales in the affordable

category fell 7% during the quarter ending June, new

launches declined by 56% compared to the same quarter of

2018”.

For more see: https://housing.com/news/proptiger-com-realinsightreport/?

utm_source=internal&utm_medium=email&utm_campai

gn=subscribersDigest

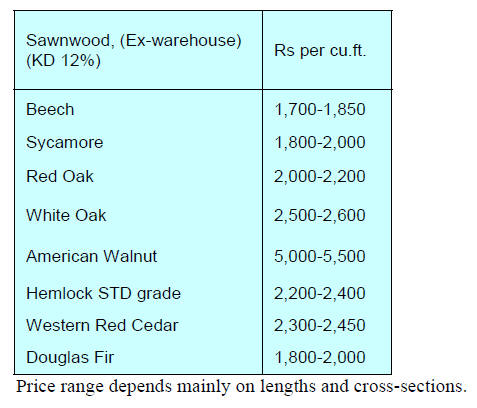

Sawn hardwood prices

Prices for imported European and US hardwoods remain

unchanged at the moment as importers are absorbing the

higher costs due to exchange rate changes.

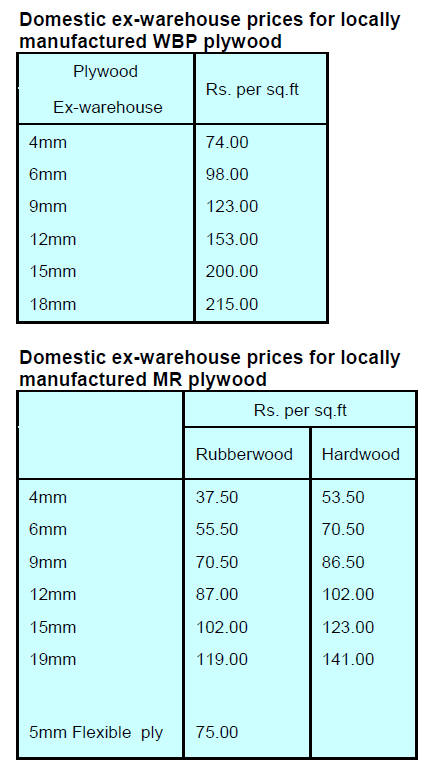

Plywood

Traders report that the price increases introduced earlier in

the month have been accepted in the market but the dull

housing market has impacted sales.

Local manufacturers have noted an increase in

imports of

birch plywood from Russia which has gained market

acceptance and the volume of imports from Russia is

expected to increase.

Production of hardwood plywood in Russia and the EU

has increased to such an extent that these countries are

having to diversify markets. (See EU report )

The market for face veneers is undergoing change say

analysts. Suppliers in SE Asia are facing growing

competition from shippers, many of which are SE Asian

companies, operating in Gabon. This is benefitting Indian

mills as face veneer prices have fallen.

Forest Rights Act – government pledges to protect

forest dwellers rights

On a purely domestic issue, ‘Down-to-Earth‘, an Asian

think tank on politics, the environment and development

supported by the Indian Centre for Science and

Environment recently focused on a decision from the

Indian Supreme Court ordering the authorities in 21 states

to explain why evictions, under the Scheduled Tribes and

Other Traditional Forest Dwellers (Recognition of Forest

Rights) Act (FRA) 2006, had not been implemented. The

government acted immediately a secured a stay-order

promising to protect the rights of forest dwellers.

This issue has become a major test for the government

which in it election campaigning promised to protect the

rights of forest communities.

‘Down-to-Earth’ says “Several empirical studies including

works of the Tata Institute of Social Sciences, Centre for

Science and Environment and Indian School of Business

show that wherever properly implemented, community

forest rights have improved conservation”.

For the full story see:

https://www.downtoearth.org.in/blog/forests/forest-rights-act-alitmus-

test-for-govt-to-protect-forest-dwellers-65816

7.

VIETNAM

Not all plain sailing for companies

relocating to

Vietnam

The prospect of a long drawn out US/China trade conflict

is seen as an opportunity for Vietnam to capture more of

the US market share and this has been happening but it is

not plain sailing. Many Chinese manufacturers have

relocated to Vietnam but face problems.

One Chinese manufacturer in Vietnam pointed out that in

China the company could get all the goods and services

necessary to keep the factory running but in Vietnam the

engineering service sector, for example, is not well

developed and does not have the latest technology.

There are also problems, for example, with securing

educated and skilled workers and the infrastructure is not

well developed.

However, despite the problems many big corportations

have relocated creating a golden time for Vietnam to

develop the domestic industrial service sector and for the

Vietnamese companies to improve their positions in the

global supply chains.

See: https://nhipcaudautu.vn/thuong-truong/wsj-viet-nam-se-canthem-

nhieu-nam-nua-de-tro-thanh-cong-xuong-cua-the-gioi-

3330083/

Walmart wants to widen range of Vietnamese goods in

its stores

Vietnamese products continue to attract foreign retailers

and recently representatives of Walmart were in Vietnam

to explore opportunities to expand its network of

Vietnamese suppliers.

Walmat executives participated in a workshop “Enhancing

participation of Vietnamese enterprises in global

distribution networks” chaired by the Minister of Industry

and Trade.

The workshop was informed that Walmart now has stores

in 28 countries with total turnover of over US$500 billion

2018 and the stores are visited by an average of nearly 270

million people per week.

To meet consumer demands Walmart reported that it

wants to widen the range of Vietnamese goods in its stores

and is willing to provide technical assistance, capacity

building, productivity improvement and advice on legal

compliance for the various markets.

Cambodia and Vietnam discuss cooperation to halt

cross-border illegal timber trade

During a recent visit to Vietnam, Cambodia’s National

Assembly Foreign Affairs Commission Chairman,

Chheang Vun, discussed with his hosts how the two

countries could cooperate to curb the trade in illegal

timber from Cambodia.

Cambodia’s National Committee for Forest Crime

Prevention recently seized nine trucks as they made their

way toward the Trapaing Sre checkpoint in Kratie

Province apparently on their way to Vietnam.

See: https://www.khmertimeskh.com/50635603/kingdom-seeksvietnams-

help-to-curb-timber-trade/

EU/Vietnam trade deal may boost opportunities in

German furniture market

Trade between Vietnam and Germany should expand due

to the recently agreed EU-Vietnam Free Trade Agreement

(EVFTA) and the EU-Vietnam Investment Protection

Agreement (EVIPA).

Vietnamese furniture is popular in the EU but Vietnamese

firms say their market share in Germany is small. In the

first quarter of 2019, Vietnam’s furniture exports to

Germany were only US$80.8 million, a fraction of

Germany’s furniture imports.

8. BRAZIL

Forest concessions effective tool for

sustainable use

of public forests

The Brazilian Forest Service (SFB) and Madeflona

Industrial Madeireira Ltda. recently signed a forest

concession agreement for the Forest Management Unit IV

in the Jamari National Forest in Rondônia State. Officials

stressed that such partnerships are one of the most

effective tools for the preservation and sustainable use of

public forests as they prevent encroachment and help

combat illegal activities.

The total forest area granted was 32,294 hectares. The

company, which won a competitive bidding process in

2018, will be able to exploit the area for 40 years. Harvests

will be limited to trees over 50cm diameter and the

company plans to develop non-wood forest product

harvesting and ecotourism. The company estimates annual

revenue could reach R$2.2 million.

Currently, around one million hectares of forest

concessions have been granted to ten companies for 40

years. According to the SFB the goal is to allocate 4

million hectares as forest concession by 2022 in the states

of Amazonas, Amapá and Pará and it is estimated that

about 25,000 direct and indirect jobs would be generated.

The forest concession agreement authorises logging and

controlled use of wood and other forest products but does

not allow access to genetic resources, use of water

resources, exploration of mineral resources, fisheries or

wildlife or commercialisation of carbon credits.

The land title remains with the government for the

concession period as the concessionaire is only entitled to

forest management. In addition, the local community is

assured of access to the concession area.

Madeira /Wood 4.0 Program promotes improvement of

production and managerial performance

The so-called ‘Madeira/Wood 4.0 Program’ developed by

the Brazilian Support Service to Micro and Small

Businesses (Sebrae-MT) and the Center for Timber

Producers and Exporters of Mato Grosso State (CIPEM),

will soon begin studies on stock/inventory and process

management and energy efficiency in collaboration with

companies associated with CIPEM.

A forest stock management study will focus on control,

traceability, material flow, consumption and purchasing

strategies. The purpose is to provide technical

recommendations for the improvement of production and

managerial performance of the participating companies.

The study on energy efficiency aims to increase the energy

efficiency of production systems through an analysis of

processes and will develop solutions based on ISO 50001.

The ‘Madeira/Wood 4.0 Program’ will also offer

workshops on financial management, commercial

management, diagnosis of competitiveness and

technological assessment of the productive area for

entrepreneurs associated with the forest trade unions of the

Alta Floresta, Guarantã do Norte, Juína and Sinop regions,

major timber producing clusters.

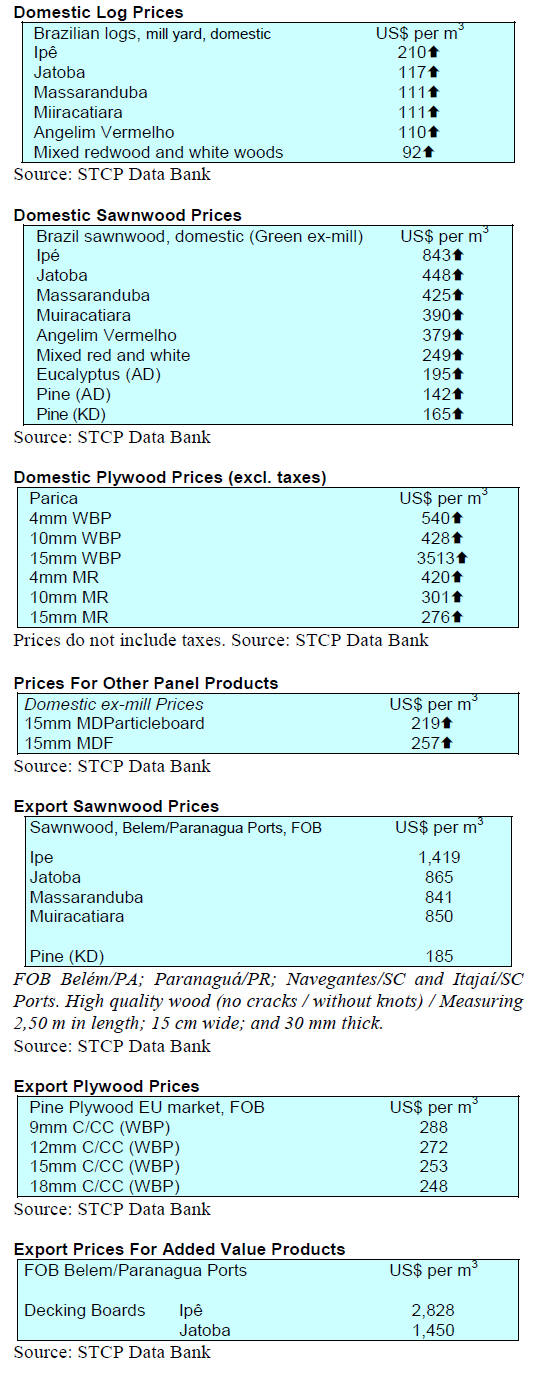

Export update

In July 2019, the value of Brazilian exports of wood-based

products (except pulp and paper) increased 4.4%

compared to July 2018, from US$213.9 million to

US$223.3 million.

The value of pine sawnwood exports declined 9.4% in

July this year compared to a year earlier (July 2018,

US$41.7 million and July 2019, US$37.8 million).

However, in terms of volume exports increased 17% over

the same period, from 163,400 cu.m to 190,900 cu.m.

In contrast, the volume of tropical sawnwood exports

increased almost 50% from 0,800 cu.m in July 2018 to

46,100 cu.m in July 2019. In value, exports increased 27%

from US$13.7 million to US$17.4 million over the same

period.

The value of pine plywood exports fell 35% in July 2019

in comparison with July 2018, from US$47.7 million to

US$30.8 million and export volumes also fell from

136,200 cu.m in July 2018 to 129,000 cu.m in July 2019.

Tropical plywood exports declined in volume (-29%) and

in value (-37%), from 11,600 cu.m (US$5.1 million) in

July 2018 to 8,200 cu.m (US$3.2 million) in July 2019.

The same negative result was seen for wooden furniture

exports which fell from US$48.3 million in July 2018 to

US$45.5 million in July 2019,an almost 6% drop.

Exports of panels to Asian markets dip

There was a drop in first half 2019 woodbased panel

exports from Brazil. According to the Brazilian Tree

Industry (IBA), in the period January to June 2019,

598,000 cubic metres of panels were exported, a drop of

3.5% compared to the volume exported in the same period

of 2018.

While there was a rise in panel exports to China, exports

to Asian markets and Oceania dropped sharply (-72%).

Exports to Europe also fell by 71% in the first half of

2019.

In contrast, domestic sales of panels rose over 3% year on

year in the first half of 2019. According to IBÁ, apparent

consumption of wood panels was at its highest this year.

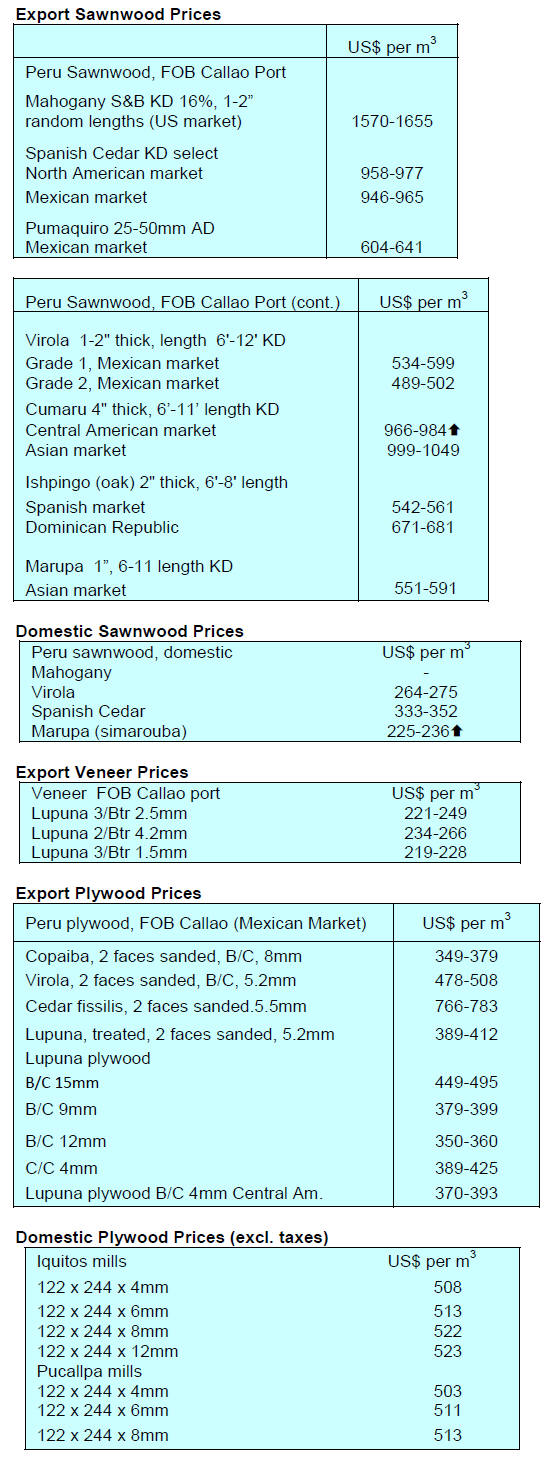

9. PERU

Sharp drop in sawnwood

exports to China

According to the Association of Exporters (ADEX), first

half 2019 timber exports were worth US$60.9 million

FOB, just over half a percent higher than in the first

quarter of 2018. Sawnwood exports in the first half

dropped by almost 14% to US$9.8 million, FOB.

China continues to be the main export destination market

for Peruvian exporters accounting for around 11% of all

exports in the first half, a rise of over 15% year on year. In

the first half 2019 France was the second highest export

destination and there was a significant year on year rise in

exports to France.

The Dominican Republic remained the main export market

for Peru’s sawnwood accounting for almost 40% of all

sawnwood exports. Mexico is the second ranked market

followed by China. In the first half 2019 sawnwood

exports to China dropped over 60%.

Extra cash to check forest management plans

The Ministry of Economy and Finance (MEF)has

transferred around US$1.4 million to the Forest and

Wildlife Resources Supervision Agency (OSINFOR) so it

can boost monitoring of forest management plan

implementation in areas most affected by illegal logging.

Slight drop in imports of wooden furniture

In the first six months of 2019, Peruvian imports of

wooden furniture totalled US$25.67 million, a slight year

on year decline to US$25.94 million.

Brazil remained the main supplier of wooden furniture

shipping almost US$17 million in the first quarter 2019.

China was the second largest supplier at US$3.69 million

followed by Malaysia with US$1.1 million.

The main Peruvian importers of wooden furniture in the

first half of 2019 were Sodimac (ACE Peru SAC), the

Falabella Group, Saga Falabella and Homecenters

Peruanos.

July a bad month for forest fires

The National Institute of Civil Defence reported that the

142 forest fires reported across the country up in July

alone were caused mainly by farmers. In late August only

one fire was reported and this was in the district of

Tamburco in Apurimac.

The largest number of forest fires were reported in the

Department of Cusco, with a total of 32; followed by

Ayacucho, with 14 events; Huánuco and Puno, with 12

each and Ancash 10. In the Amazon, six fires were

reported while in Madre de Dios there were three. Loreto

and Ucayali reported only one fire.