Japan

Wood Products Prices

Dollar Exchange Rates of 25th

October

2019

Japan Yen 108.88

Reports From Japan

¡¡

Impact of typhoon damage on economy

clouds other

issues such as tax increase

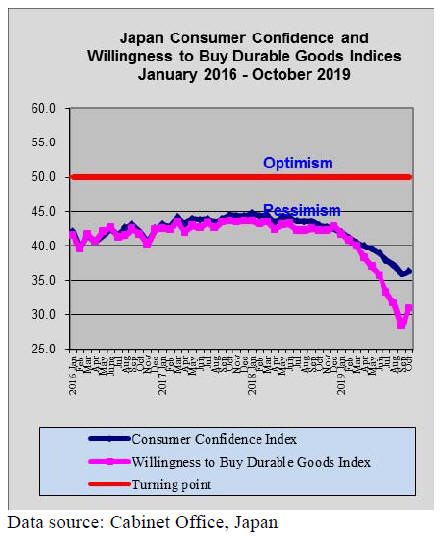

A press release from Markit Economics says the Japanese

economy is at risk of contracting as business activity

slumped in October following the 1 October sales tax

increase. However, analysts at Makit say the extent to

which the tax change has pulled down economic activity

has been clouded as a result of the recent typhoon related

disasters which has impacted the economy.

The latest Markit survey indicates October business

activity declined for the first time in three years and

prospects for the year ahead are not bright.

In the October issue of its World Economic Outlook, the

International Monetary Fund kept its forecast for Japan's

economic growth at 0.9 percent this year and predicted

that it will slow to 0.5 percent next year.

Japan¡¯s Cabinet Office downgraded its assessment of

economic fundamentals to "deteriorating" after data

showed that exports and production were faltering as a

result of an economic slowdown in major overseas

markets.

See:

https://www.markiteconomics.com/Public/Home/PressRelease/ddfd100b9b404ca994338a9d25cf0280

Bank of Japan ready to counter risks to growth

prospects

While there is some hope that the US and China will move

their ¡®first stage¡¯ trade deal further and news that UK will

not crash out of the European Union the continued level of

uncertainty in global demand suggests the US may move

to cut interest rates for a third time.

In Japan the governor of the Bank of Japan (BoJ) has said

the Bank will not hesitate to lower interest rates further if

it needed to ease monetary policy to counter the growing

risks to Japan¡¯s growth prospects.

The stance of the BoJ governor underlines concerns on

global demand prospects due to the US/China trade war.

The pronouncements from the BoJ governor are clear

signals that the Bank is ready to act pushing short term

interest rates even lower. What the Bank fears is a

strengthening of the yen against the dollar which would be

bad news for exporters and the economy.

Retail sales surge - furniture and home furnishing

snapped up before tax hike

Department store sales in Japan soared 23% in September

from a year earlier as consumers were out in force for lastminute

shopping before the consumption tax was raised

and this pushed up retails sales for the second consecutive

month according to the Japan Department Stores

Association.

High priced items were in demand and there was a

doubling of monthly sales of art, jewelry and precious

metals and furniture and home furnishing also sold well.

While the sales tax was one issue driving September sales,

the huge year on year rise in September sales was partly

because 2018 September sales were depressed due to the

effect of a series of natural disasters according to the

Association.

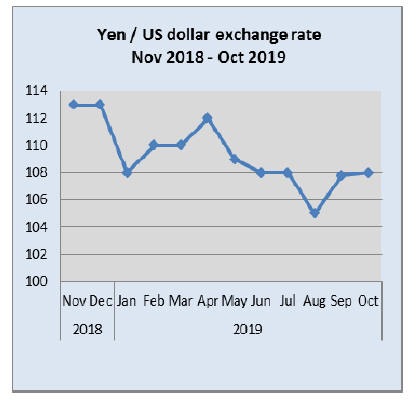

Exchange rate remarkably stable

The Japanese yen exchange rate against the US dollar has

been remarkably stable for the year to date and analysts

anticipate that the yen/dollar exchange rate will be

between yen 105-110 for the balance of the year. As

optimism for a lowering of tensions between the US and

China grow and as the UK will no longer crash out of the

EU this stability should be reinforced. The current

exchange rate of around 108 to the US dollar is supporting

exporters who suffer when the yen strengthens.

Another catastrophic typhoon ¨C extensive

damage to

homes reported

The 21st typhoon of 2019 thunder across Japan in Octber

adding to the damage left by typhoon number 19 and

inflicting damage on new areas across the country, areas

that are unaccustomed to severe typhoons.

Japan¡¯s Fire and Disaster Management Agency reported

on 20 October that 56,753 homes were damaged by

Typhoon Hagibis (the 21st of this year) exceeding the

51,110 houses that were damaged by flooding in Western

Japan in July last year.

The number of houses submerged above floor level in the

21st typhoon of the year is over four times that in July

2018 when around 7,000 houses suffered similar damage.

Typhoon Hagibis was one of the severest natural disasters

in recent years.

The Ministry of Agriculture has estimated the damage to

the farming, forestry and fishery industries at US$1.5

billion.

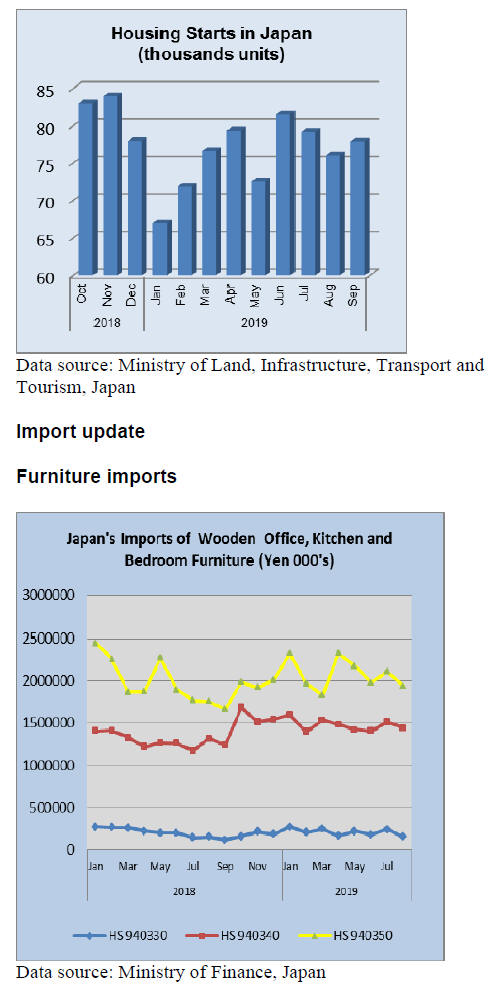

Japan¡¯s housing starts fell again year on year in September

despite a slight month on month uptick.

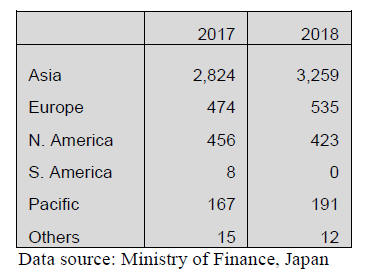

Japan is a major importer of wooden furniture and

parts

but what is often overlooked is that the country is also a

significant exporter of wooden furniture shipping around

US$3.2 bil. in 2018. The table below shows exports to

major regions of the world.

Shipments to Asian markets account for over 70% of

all

shipments of wooden furniture from Japan. China

represents the largest Asian market taking a quarter of all

shipments to Asian countries followed by South Korea

(16%), Hong Kong (14%) and Taiwan P.o.C (13%). The

second main market region is Europe where shipments

enter via Denmark, Holland and Belgium.

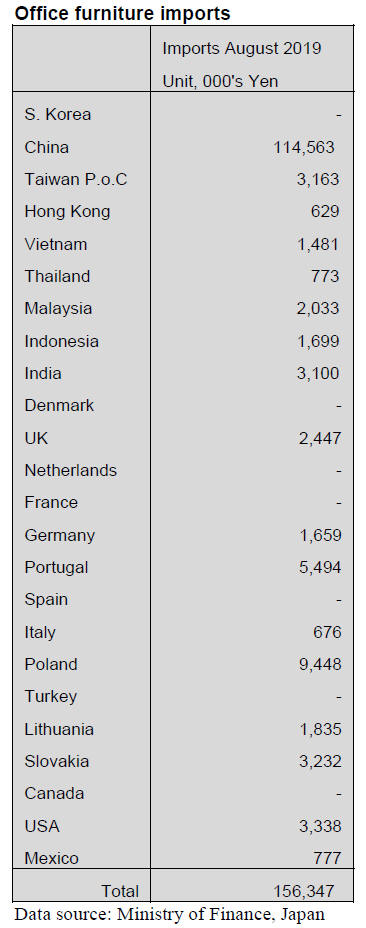

Office furniture imports (HS 940330)

After the sharp year on year rise in the value of imports of

wooden office furniture (HS 940330) in July, August year

on year imports were flat but month on month they rose

just over 35%.

Shipments of office furniture from China surged in

August

and accounted for almost 75% of all wooden furniture

imports. The other two significant shippers were Poland

(6% of import values) and Portugal (4% of import values).

Shipments of wooden office furniture from shippers

outside of Asia accounted for just 28% of August arrivals.

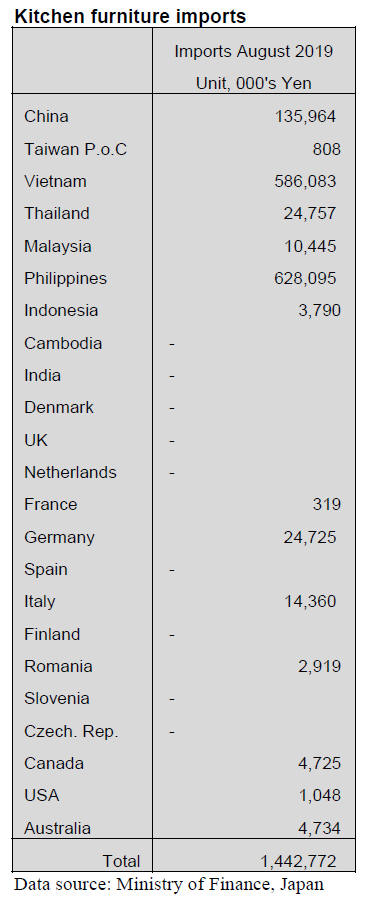

Kitchen furniture imports (HS 940340)

Exporters of wooden kitchen furniture to Japan have great

difficulty capturing market share from the top two

suppliers, the Philippines and Vietnam which accounted

for 44% and 41% respectively of all August arrivals of

wooden kitchen furniture.

Year on year August import values were up 9% but month

on month August imports dropped 5%. As in previous

months China is not a major supplier of wooden kitchen

furniture for the Japanese market neither are shippers in

Europe or North America.

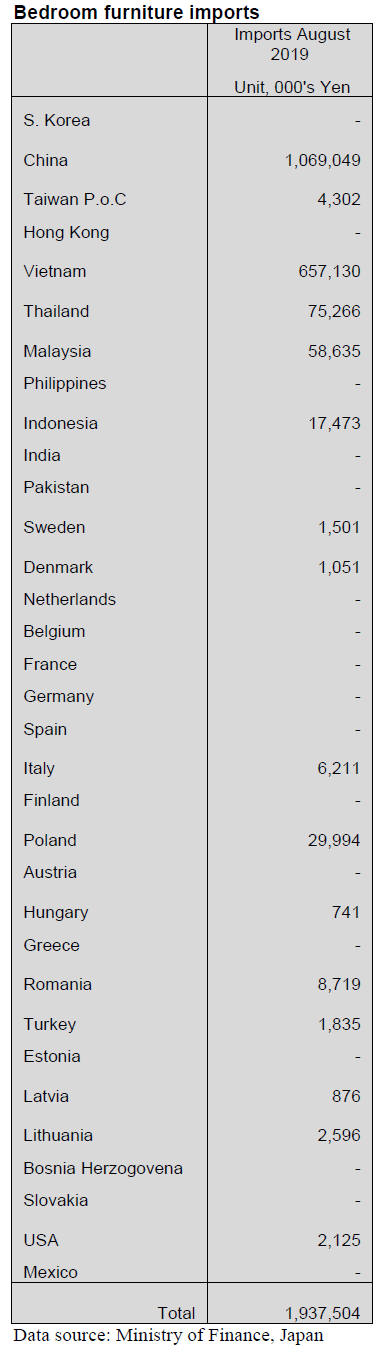

Bedroom furniture imports (HS 940350)

China¡¯s dominance of Japan¡¯s imports of wooden

bedroom furniture (HS 940350) extended into August as

around 55% of all arrivals of wooden bedroom furniture in

the month were from China.

August shipments of bedroom furniture from China

were

about 5% up on the value of July shipments. Exporters in

Vietnam held onto their second rank in term of the value

of shipments to Japan and in August accounted for 34% of

all wooden bedroom furniture imports into Japan.

Year on year value of shipments of wooden bedroom

furniture to Japan in August were up 10% but there was an

8% decline month on month.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

http://www.n-mokuzai.com/modules/general/index.php?id=7

Inflating ocean freight

New rule to use low sulphur oil regulated by the

International Maritime Organization will be applied since

January 1, 2020. This is for marine and air pollution

prevention and the rule is applied worldwide.

Some shipping companies have started switching to low

sulphur content fuel. The new rule regulates present

sulphur content of fuel oil from present 3.5% or less to

0.5% or less. Price difference between present oil and new

regulated oil is almost US$200 per tonne so this extra cost

will be added on ocean freight.

Changing to low sulphur content oil is the most convenient

measure for shipping companies. Another option is to

install exhaust gas purification equipment named scrubber

on a ship, which is costly and takes time about a month for

installation or switching fuel from oil to LNG, which

means to build a new ship.

Oil prices fluctuate daily but as of October 16, price of oil

of sulphur content of 3.5% or less is $355 per ton but of

oil of sulphur content of 0.5% or less is $533 so difference

is US$180 per tonne.

For instance, in case of hauling Canadian wood pellet

(loading of 25,000 tonne) with oil consumption of 700

tonne, additional cost would be about US$5 per tonne,

about more than 10% higher than present freight.

However, ocean freight fluctuate not only by oil cost but

other factors like demand and supply of cargo ships and

availability of return cargoes so freight is decided by

individual negotiations but shipping companies are

determined to pass additional oil cost onto freight.

In case of North American wood pellet, long term contract

of more than ten years is normal and this additional freight

factor is counted in but imported biomass fuel like wood

pellet and PKS from South East Asia is largely affected by

this change. Indonesian PKS freight is now US$24-30 per

tonne (full load with one port loading and one port

discharging) then after fuel change, additional cost would

be about US$3-6 per tonne.

On other cargoes, shipping companies and charterers set

freight once a year and to cover fluctuation of oil market,

they use bunker adjustment factor (BAF) like fuel

surcharge airlines use for jet fuel.

All the charterers agreed to accept BAF for cargoes like

coal and iron ore for which long term contract for several

years. Container ships are normally set the rate once a year

in spring time.

Liaison meeting for CLT use promotion

Relative government offices held liaison meeting to

discuss promotion of CLT use on September 30. Domestic

CLT production increased to 80,000 cbms but the demand

is about 18,000 cbms with very little growth. Buildings

which use CLT were 18 in 2014, 25 in 2015, 47 in 2016,

89 in 2017, 113 in 2018 and 116 in 2019.

Number of building has been increasing steadily but

amount of use of CLT is limited so total number of

building does not necessarily mean increase use of CLT.

Target of CLT production is 500,000 cbms by 2025 so the

production continues to grow. Challenge is how to

increase the demand.

Immediate issue is to reduce the cost of CLT down to yen

70,000-80,000 cbms, which is about half of present cost,

which is competitive with other structures. The Forestry

Agency, the Ministry of Land, Infrastructure and

Transport, the Ministry of Environment continue to give

subsidy to the building with CLT.

In 2019, buildings with CLT will be total of 116. By the

area, Kochi prefecture has 13, Okayama prefecture has 11,

Tokyo 8, Hokkaido 7, Kagoshima 6, three prefecture of

Aichi, Fukushima and Ehime has 5 each. Type of building

with CLT is office, multi family unit, public housing, store

and warehouse. Public hall and assembly hall have been

increasing since 2017. As of last July, there are confirmed

52 buildings with CLT after 2020.

South Sea (tropical) logs

With steady supply from PNG, the Japanese plywood

mills carry ample log inventories as the demand for South

Sea hardwood plywood does not grow. However, the log

supply from South Sea countries always has uncertain

factors so the plywood mills and South Sea hardwood log

users always look for substituting supply of different

species.

Market of free board is pausing now but demand for shop

interior finishing should show up in later this year so it

should get busy again. The market of imported LVL for

crating and condominium stud is slow. Chinese LVL for

building materials is relatively busy.

Decreasing Russian log import

Russian softwood log import for the first eight months of

this year was 77,894 cbms, 15.8% less than the same

period of last year. Decrease of Far Eastern larch logs is

the largest after log export duty increased to 40%.

Red pine logs from Siberia were 25,808 cbms, 51.3%

more and whitewood from Far East was 4,268 cbms,

26.5% more. Larch logs from the Russian Far East was

45,962 cbms, 36.2% less.

Reason of red pine log import increase is that sawmills in

Japan bought more logs because of quality and shipment

time of genban is uneven and soaring prices. Red pine log

import in May was 6,633 cbms and 7,956 cbms in June,

which were more than larch logs.

On Far East larch logs, preferred log export quota is

allocated to forest products companies, which satisfy

certain amount of wood processing but log suppliers

which have no such processing are imposed 40% export

duty.

The duty rate would be raised by 20 points more in 2020

so availability of Far East larch logs will be much tighter.

Import of larch logs was almost 100,000 cbms in 2018 but

it will be far less this year. The export prices have not

changed much at about US$190 per cbm CIF on red pine

and US$190-200 on larch.

Meanwhile, lumber import for the first eight months was

446,597 cbms, 0.4% more but low grade lumber is getting

larger in volume so the market is divided into two of high

to medium grade and low grade. Low grade market is

weak with heavy inventory.

Import of European lumber through polar route

Tomakomai wharf and port management union in

Hokkaido has done trial shipment of European lumber

through polar route. Chinese shipping company, Cosco

group¡¯s ship sailed Helsinki, Finland on September 13 and

arrived Tomakomai¡¯s container terminal on October 9

through Arctic Ocean and unloaded 20 40 feet containers

of European lumber.

Voyage through Arctic Ocean from Europe is more than

10 days shorter than the route through Suez Canal but the

Arctic Ocean in not navigable in winter time with solid ice

so the navigable season is limited from July through

October.

Cosco makes about 50-60 times of the trip a year by this

route from Europe to China and Tomakomai Port

considers to use this route not only import but also export

business. This is newly developed route after ice is

reduced by global warming and advanced ice breaking

ship.

|