|

Report from

North America

US, Mexico and Canada agree to trade deal changes

On 10 December negotiators from the US, Mexico, and

Canada met in Mexico City to sign an agreement making

changes to the so-called US-Mexico-Canada Agreement

(USMCA) to update the North American Free Trade

Agreement. The changes were the result of negotiations in

the US between the Trump Administration and key

Democrats in the House of Representatives and were seen

as necessary to win approval from the House Democratic

Caucus.

While the text of the changes is not yet available a Fact

Sheet from the US House of Representatives Committee

on Ways and Means outlined changes to the

environmental provisions in the agreement. These include

a new commitment that all parties adopt, implement, and

maintain seven multilateral environment agreements, new

mechanisms to monitor whether environmental protections

are being applied, and enhancements to mechanisms that

ensure only legally harvested and taken flora and fauna are

traded through Mexico.

See:

https://waysandmeans.house.gov/sites/democrats.waysandmeans.house.gov/files/documents/USMCA%20win%20factsheet%20.pdf

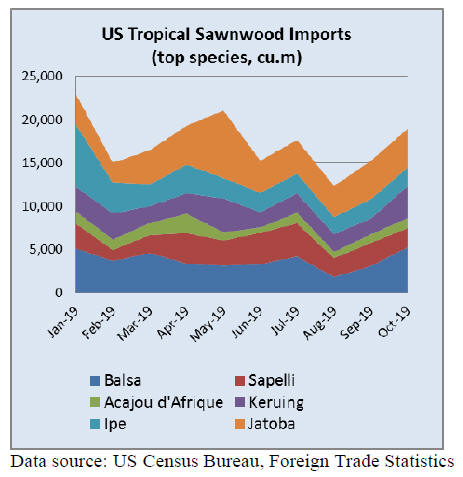

Sawn tropical hardwood imports continue upswing

US imports of sawn tropical hardwood expanded 18% in

October, rising to 22,080 cubic metres for the month.

Imports were 10% higher than October of last year. For

the year to October imports are up on 2018 by 17%.

Imports from Ecuador continue to grow, rising by 74%

month on month in October but are still at a level slightly

below that of October 2018. Total imports from Ecuador

for the year to October are down 8%.

Sawnwood imports from Brazil and Cameroon both fell by

more than 20% in October but remain well ahead of 2018.

Jatoba imports remained steady at a level well above

previous years. Jatoba imports are more than double that

of 2018 and are the highest volume tropical hardwood

imported by the US year to date.

Balsa, the traditional import leader, saw a 71% increase in

volume in October to a level roughly even with October

2018 and is now down 8% from last year to date.

Keruing imports more than doubled in October and are

now up 37% year to date. Teak and padauk also saw

stronger imports in October and are well ahead of last

year¡¯s volume to date.

Canadian imports of sawn tropical hardwood grew by 30%

in October. The month saw the highest dollar value of

imports since May 2017. The strong monthly performance

boosted year to date imports to 5% ahead of last year¡¯s

totals, with imports of sapelli up 39% and iroko up 67%

year to date.

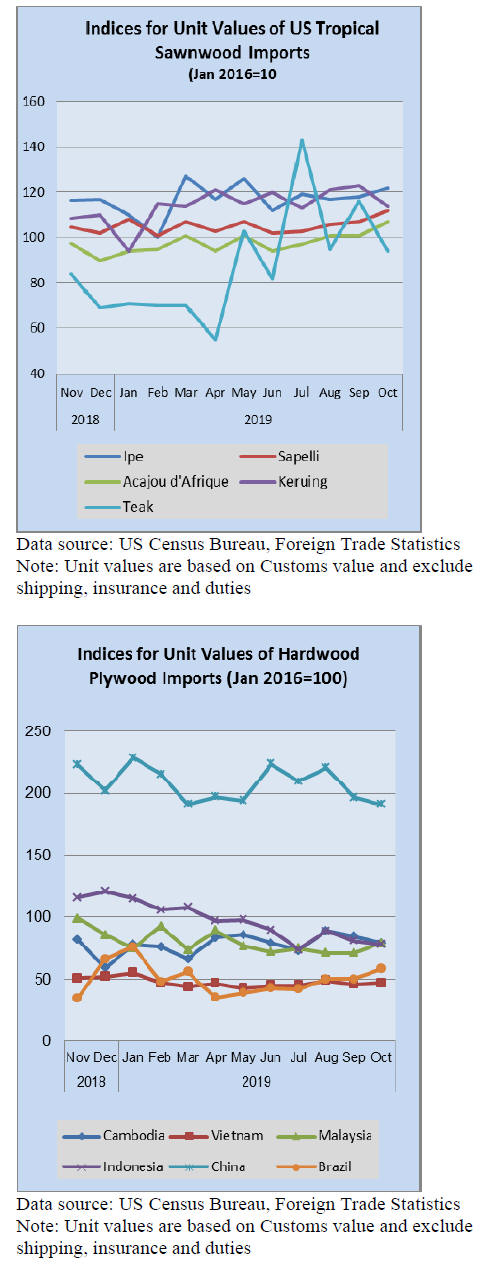

Hardwood plywood imports climbing

US imports of hardwood plywood rose by 18% in October

to reach one of its highest levels of the year. The more

than 246,000 cubic metres of plywood imported was 16%

higher than that of October 2018 and now year to date

totals are just 7% below those of the same period last year.

Imports from Russia saw its strongest month since 2012

after increasing by 39% in October. Imports from China

and Indonesia both fell in October and are down 52% and

29% respectively year to date.

Imports from Vietnam continue to grow; they were up

18% in October and are up 83% year to date.

Rebound in Tropical veneer imports

US imports of tropical hardwood veneer rebounded

sharply from a dismal September, rising 58% in October

to a level 16% better than that of October 2018. However,

2019 imports still trail last year by 18% year to date.

Imports from Italy came back strong in October after

suffering its slowest month in three years to now outpace

2018 year to date by 4%. The Italian imports offset

monthly declines of more than 10% from all other major

supplying countries.

Imports from China and Cameroon were both down by

nearly half in October and are behind 2018 year to date

totals by more than 50%.

China and Indonesia only winners as flooring imports

drop

US imports of hardwood flooring fell by 12% in October

to a level more than 25% below that of October 2018. The

decline leaves overall imports only slightly ahead of last

year, up 3% year to date. Imports from China and

Indonesia held steady in October, while imports from all

other major trading countries fell by at least 10% for the

month.

Imports of assembled flooring panels fell by 3% in

October and are within 1% of 2018 year to date. Imports

from China were down 4% in October and are off by 41%

year to date. Imports from Vietnam and Thailand were

both down in October, but still greatly exceed numbers

from October 2018. Year to date imports from Vietnam

are up 114% and imports from Thailand are up 38%.

Sharp decline in moulding imports from Malaysia and

China

US Imports of hardwood moulding fell by 14% in

October, led by sharp declines in imports from China and

Malaysia. Malaysian imports declined by 34% and

Chinese imports fell by 25%. Year to date imports are

down 24% overall with imports from China and Brazil

both at around half of last year¡¯s totals.

US Wooden furniture imports, China down others up

US imports of wooden furniture grew by 9% in October

but were still 10% less than that of the previous October.

Slowing imports from China was the main reason for the

decline. Imports from China were down by 3% in October

and are lagging 2018 by 27% year to date.

Imports from are other leading trading partners were up in

October and are ahead of last year¡¯s year to date totals.

US unemployment matches half-century low

US job gains roared back in November as unemployment

matched a half-century low and wages topped estimates.

This provides the Federal Reserve with more reason to

hold interest rates steady after three straight cuts.

Payrolls jumped 266,000, the most since January, after an

upwardly revised 156,000 advance the prior month,

according to a US Department of Labor release.

That topped all estimates in a Bloomberg survey calling

for 180,000 jobs. It was the first full month that General

Motors Co. workers returned to work after a 40-day strike,

adding 41,300 to automaker payrolls following a similar

drop the prior month.

The jobless rate dipped to 3.5%, matching the lowest since

1969. Average hourly earnings climbed 3.1% from a year

earlier, exceeding projections, and the prior month was

revised higher. Private employment jumped by 254,000.

|