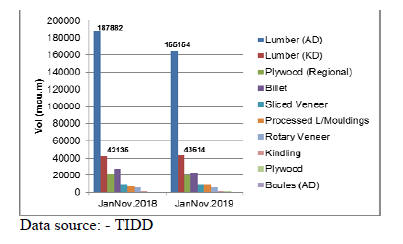

In both 2018 and 2019 the top export product was airdried

sawnwood followed by kiln-dried sawnwood.

However, while the volume of the former dipped from

2018 (187,882 cu.m) to 2019 (165,154 cu.m) the latter

increased from 2018 (42,1135 cu.m) to 2019 (43,614

cu.m).

Ghana’s wood product exports up to November 2019 went

to the traditional market destinations of Asia (69%),

Europe (16%), Africa (10%), America (4%) and Middle

East (2%), with teak, wawa, ceiba, mahogany and niangon

as the leading species.

Local timber dealers cannot secure raw materials

Some domestic timber traders have appealed to the

government to review the emphasis on wood product

exports saying the domestic mills and traders cannot

secure sufficient raw materials to profitably continue in

business.

Traders obtain timber from local sawmills but these mills

are also facing problems in securing raw material

according to the local media. Analysts write, “in light of

this it is vital that the FC continues its crack-down on

illegal logging and mining”. The current ban on chainsaw

milling was a bold step by the FC.

For more see:

https://thebftonline.com/2020/economy/timber-export-collapsing-woodwork-industry/

Loan facility secured for ‘One District One Factory’initiative

Exim Bank in Ghana has secured a major source of

funding from Credit Swiss to finance more factories under

the ‘One District One Factory’ (1D1F) initiative. The

agreement was signed in London at a Ghana Investment

and Opportunities Summit. Investors in the 1D1F scheme

benefit from incentives for machinery and equipment and

corporate tax exemptions.

3.

MALAYSIA

Lunar New Year Holidays – logging suspended

Timber businesses, like other businesses across Malaysia,

took a break during the lunar New Year. Logging camps

emptied as workers travelled home and mills closed, many

for as much as two weeks. With logging suspended for the

holidays there is concern in Sarawak that this will result in

delayed deliveries of logs to the mills. Analysts say the

recent period of bad weather has driven down mill log

stocks.

Central Bank rate cut reminiscent of cut during the

2003 SARS outbreak.

The Malaysian central bank, Bank Negara Malaysia, has

lowered interest rates by 25 points to 2.75%. While this

came as a surprise to many it is considered a wise move in

view of the increasing global headwinds, not least of

which is the recent coronavirus outbreak which could

impact the global economy.

The Bank has said that 2020 growth is expected to

gradually improve on the back of steady household

spending and an anticipated improvement in export

performance. Kenanga Research, which monitors growth

trends, said the move by the Bank is reminiscent of

decisions taken during the SARS outbreak in 2003 when

the bank cut interest rates.

Plywood makers see signs of growth in Japanese

demand

The Star newspaper in Malaysia has run a story saying,

while Malaysian plywood manufacturers have been badly

affected by the sudden drop in exports to Japan, its main

market, there could be a turnaround this year supported by

reconstruction in Japan after the severe damage to

infrastructure and homes from typhoons and flooding.

The Japanese government announced an extra budget for

fiscal. In this supplementary budget the government has

allocated around yen 2.31 trillion for reconstruction from

the 9th typhoon of the year (typhoon Hagibis) and other

recent disasters as well as to rebuild infrastructure.

Japan’s plywood imports from Malaysia averaged 63,000

cubic metres in the first 9 months of last year but in the

final 3 months of 2019 there was a rise in imports to an

average of around 70,000 cubic metres per month.

For more see:

https://www.thestar.com.my/business/businessnews/2020/01/06/plywood-makers-may-see-rebound-in-exportsto-japan

5 year strategy to expand certification

In Malaysia there are 4.37 million hectares of PEFC

Certified Forests (as of 31 Dec. 2019) in 16 FMUs and 7

FPMUs. There are 378 PEFC Certificates for Chain of

Custody issued (as of 30 Nov. 2019). The Malaysian

Timber Certification Council has the ambition to expand

certification and has developed a 5 year strategy to

increase the number of certified FMU to 40 and the

number of timber companies certified under CoC to 600.

The MTCC strategy calls for expansion of the scope of

certification under the MTCS, greater acceptance and

recognition of MTCS-certified products both domestically

and internationally, closer collaboration with stakeholders

and increased efforts on communication, education and

public awareness and on embracing innovation and

technological advances.

4.

INDONESIA

New SMEs business development centre

in Jepara

Gati Wibawaningsih, Director General of Small, Medium

Industries in the Ministry of Industry has announced that

the ministry will open a material centre to support growth

of furniture SMEs so they can become more competitive

in international markets.

Gati said, the new centre will focus on capacity building in

production planning and inventory control, raw material

management and managing logistical activities. The

centre will also develop a machinery rental service

business.

See:

https://www.validnews.id/Material-Center-IKM-Furnitur-Dibangun-di-Jepara-Qom

Need to upgrade rattan furniture to become

internationally competitive

At a National Workshop in Cirebon, West Java the

Indonesian Furniture and Crafts Industry Association

(HIMKI) agreed that the Indonesian rattan furniture sector

must be upgraded to become competitive internationally in

terms of design and cost.

HIMKI Chairman, Soenoto, said that Indonesia’s rattan

furniture should have a more prominent place in

international markets as there are abundant rattan

resources in the country. The HIMKI agreed to prioritise

rattan furniture but also to continue to encourage nonrattan

furniture to compete in the world.

Trade deficit Narrowed in 2019

Indonesia's trade deficit narrowed last year as consumers

tightening their wallets which meant less imports.

According to the Central Statistics Agency (CSA) the

2019 deficit was around one-third of that recorded in

2018. Indonesia’s exports fell around 7% in 2019 but

imports dropped even more sharply by almost 10%.

According to the CSA, agricultural exports were the only

sector that grew although this contribution to overall

exports was still small at 2%. Indonesia posted trade

surpluses with the United States, India and the

Netherlands. But the biggest trade deficits were with

China, Thailand and Australia. While the figures may

seem encouraging most of the declines in imports were of

raw materials which could signal slowing industrial

output.

See:

https://jakartaglobe.id/business/indonesias-trade-deficitnarrows-by-third-in-2019

Ministry ends the collaboration with WWF

In a ministerial decree (No. 32 of 2020) the Ministry of

Environment and Forestry (KLHK) ended its collaboration

with the WWF Indonesia Foundation. All collaboration

agreements between the KLHK and regional governments

with WWF Indonesia have been terminated.

The decision to terminate the collaboration was based on

the results of an evaluation conducted by KLHK which

concluded that conservation and forestry based

cooperation had been unilaterally expanded in scope by

WWF Indonesia. In addition, WWF violated the substance

of the cooperation agreement including through a series of

social media campaigns and publication of reports that

were not factual.

See:

https://nasional.kontan.co.id/news/kementerian-lingkunganhidup-akhiri-kerjasama-dengan-wwf-ndonesia-ini-alasannya

and

https://ekonomi.bisnis.com/read/20200124/99/1193668/klhkputus-kerja-sama-dengan-wwf-indonesia

UK Minister - Brexit will bring opportunities for more

trade and investment

During a visit to Indonesia in mid-January this year British

Asia and Pacific Minister, Heather Wheeler, said Brexit

will offer opportunities for Indonesia and the UK to

negotiate a trade deal to bring down tariffs and drive trade

and investment. She highlighted the opportunities for

expanding wood product exports to the UK.

See:

https://www.liputan6.com/global/read/4155830/menteri-inggrissebut-dampak-brexit-ke-indonesia-sangat-bagus

5.

Myanmar

Preparatory VPA negotiations suspended

In November last year a delegation from the EU visited

Myanmar and met with members of the Multi

Stakeholders Group (MSG) formed specifically to

negotiate a VPA with the EU. The EU delegation also met

with representatives of the Forest Department and

Myanmar Forest Certification Committee (MFCC).

According to those participating in the meetings their

understanding was that the EU has suspended the

preparatory phase of VPA negotiations with Myanmar.

The result of this is that the MSG has to act unaided to

formulate a roadmap to strengthen forest governance and

law enforcement. This, says an analyst, can be interpreted

as the immediate prospects for FLEGT licensed timber

from Myanmar are dim.

In the absence of FLEGT licensing the alternative course

is to build another mechanism to satisfy the due diligence

requirements of the EUTR so as to maintain the market for

Myanmar timbers in the EU.

It is understood that work on a mechanism to meet legality

verification requirements in the EU will be supported by

FAO through a two year project. However, analysts write

“there is no official announcement, from either Myanmar

or the EU to confirm suspension of support for VPA

negotiations”.

Cross border teak exports to Thailand

In November last year Myanmar exported some 100 tons

of teak sawnwood to Thailand via a cross border trade

arrangement being the first of around 1,100 tons set to be

shipped. The export process was witnessed by Minister

Ohn Win and supervised by the Forest Department, the

General Administration Department, the Custom

Department, the Immigration Department and the

Myanmar Police.

Statistics released by Ministry of Commerce show that

between April 2011 and November 2019 about 70 tons of

forest products have been exported through the cross

border trade arrangement. There are no official records for

the cross border trade with China most of which was

deemed illegal by the Myanmar government.

In a revision of its forestry laws China has included a

prohibition on enterprises in China buying illegally

sourced timber. Analysts comment that how the law will

be enforced is not yet clear. The local media in Myanmar

have welcomed the change but say the provincial

authorities in China may not strictly enforce the new law.

Positive growth prospects says World Bank

Growth in Myanmar is expected to pick up to 6.4 percent

in fiscal 2019-20 from 6.3pc in 2018-19 and 6.2 pc in

2017-18 as a result of the increasing government spending

and private investments on infrastructure, transportation

and communication, according to the World Bank.

According to the World Bank Myanmar Economic

Monitor report – ‘Resilience Amidst Risk’ economic

growth in Myanmar in the coming fiscal year will be

supported by a higher expenditure by the government on

infrastructure projects and communication. A forecast

increase in foreign investments in construction is also

expected to boost growth.

Other growth sectors identified by the Bank include

tourism and the services sector. The agriculture sector,

says the report, should receive a boost from higher export

demand.

6. INDIA

Home sales fall 30% in one quarter

Indian Housing.com recently highlighted a report from

PropTiger.com that shows housing sales and new starts

fell during the third quarter of the financial year 2019-

2020.

The report on the third quarter fiscal 2019 indicates that

sales in India’s nine main markets fell by 30% year-onyear

which drove developers to delay new building

projects which are over 40% down from the previous

quarter.

PropTiger says the high level of unsold residential housing

inventory is serious with stocks in the main markets

exceeding three quarters of a million.

For more see:

https://www.proptiger.com/guide/post/real-estatereport-q4-2019-proptiger-datalabs-report

Satish Magar, president of CREDAI, has reminded policy

makers that the Indian real estate sector is the top nonfarm

employer and the sector makes a significant

contribution to the country’s GDP. He says that sector

stakeholders are looking to the government to address the

downturn in the real estate sector in the 2020 budget due

to be announced in February.

The problem of falling home sales is particularly acute in

the ‘affordable and mid-segment’ home market where

some 40% of completed homes in the top eight cities

remain unsold.

More particleboard mills for Gujarat

In its recent magazine Plyreporter has news of prospects

for two new particleboard plants set to come online in

Morbi and Rajkot Gujarat, India's westernmost state.

Gujarat has been pioneer in the manufacture of woodbased

panels with more than 20 particleboard lines in operation

but panel makers say the supply of raw materials has

become a problem and that many mills are operating

below capacity.

The attraction of Gujarat for composite panel production,

says Plyreporter, is the availability of raw materials

especially residues from the large number of sawmills.

For the full story see:

https://www.plyreporter.com/article/61294/gujarat-to-have-moreparticle-board-plants-in-2020

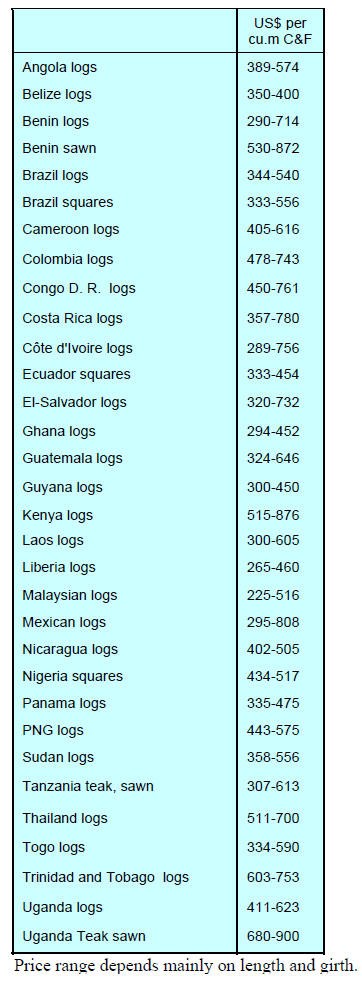

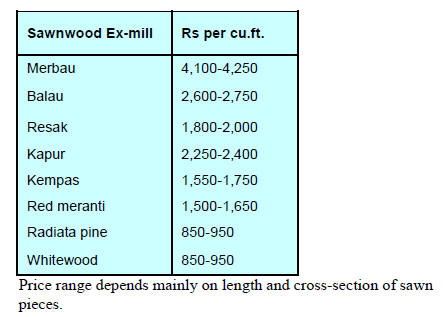

Plantation teak prices

C&F prices remain steady within the same range as

reported in early January being largely influenced by the

stable rupee/US dollar exchange rate which is at around

Rs.71 to the dollar.

Ever the optimists, importers are still hopeful the GST

Council will consider a reduction to the 18% GST which,

they say, is a heavy burden. The Council is continuing its

review and there are hopes that some relief will be

announced in the 2020 budget due in February.

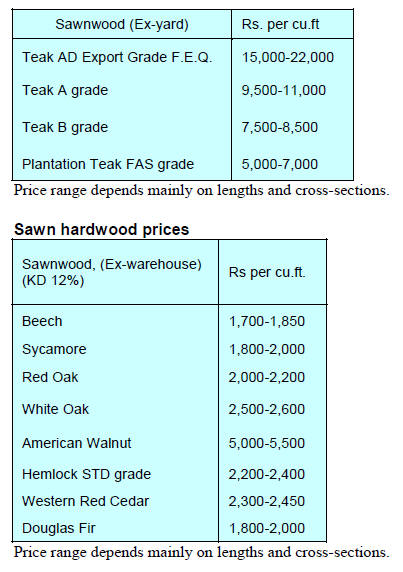

Locally sawn hardwood prices

Despite the slow housing market traders report domestic

market demand and import volumes remain balanced.

Myanmar teak prices

Despite the weak housing sector and tough trading

environment prices for Myanmar teak remain resilient, a

feature of products with high end market demand.

All eyes will be on the 2020 budget due next month for

stimulus to provide incentives for home buyers and thus

lift demand for housing.

Plywood

Prices for plywood in the domestic market remain

unchanged from early January. Plywood manufacturers are

currently benefitting from a slight easing of prices for face

veneer from both SE Asian shippers and from companies

peeling veneers in Gabon.

Analysts write that MDF and particleboard are gaining

market share and with new production due to come online

competition will increase.

7.

VIETNAM

Exports by Vietnamese-owned and FDI

enterprises

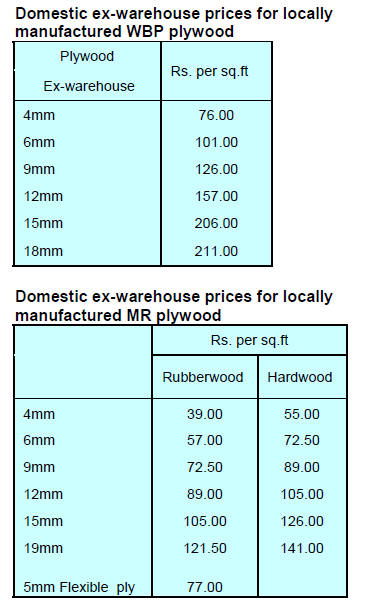

According to Vietnam’s Customs, in 2019 the total value

of wood and wood product exports from 2,392 enterprises

(Vietnamese-owned and FDI enterprises) amounted to

US$10.647 billion (19.5% higher than what was achieved

in 2018) lifting the wood and wood product export rank to

6th amongst Vietnamese export commodities.

(Wood defined as HS4401 – 4418. Wood Products defined

as HS9401 – 9421).

Of the total, wood product exports accounted for

US$7.783 billion (23.5% higher than 2018) and

contributed a 74% share of the total value of wood and

wood product exports. With the current trend, wood and

wood product exports are expected to grow at between 17–

20% in 2020.

Wood and wood product exports by FDI

enterprises

In 2019 the value of wood and wood products exported by

612 FDI enterprises amounted to US$4.71 billion, a 42%

of the total value wood and wood product exports from

Vietnam (up 20% on 2018). Wood product exports by FDI

enterprises were reported at US$4.34 billion or over 90%

of the total value of wood and wood product exports by

FDI enterprises.

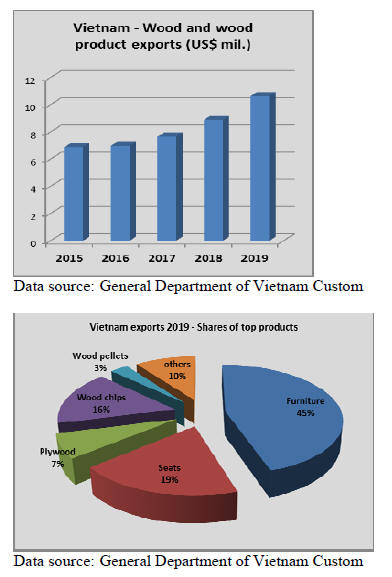

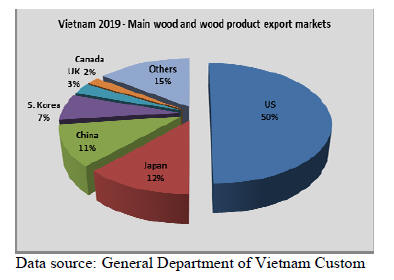

Export destinations

In 2019, the US continued as the top market for Vietnam’s

wood and wood product exports at US$5.33 billion, a

share of around 50% of all wood and wood product

exports. The growth in the market year on year was over

37%.

Japan was the second largest market accounting for 12%

of 2019 exports followed by China 11% and S. Korea 7%.

In contrast to the growth in the markets mentioned above

there were declines in exports to South Korea, Australia

and Malaysia dropped.

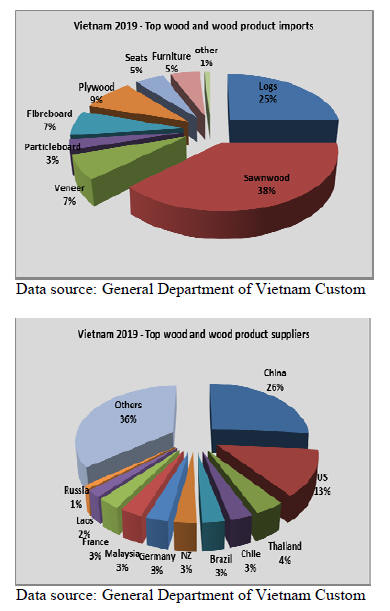

Wood and wood product imports and exports

Wood and wood product imports by Vietnamese-owned

and FDI enterprises in 2019 were valued at US$2.542

billion (10% up on 2018). In 2019 the value of wood and

wood products imported by FDI enterprises was reported

at US$775 million equivalent to 31% of total wood and

wood product imports and 16% up on 2018).

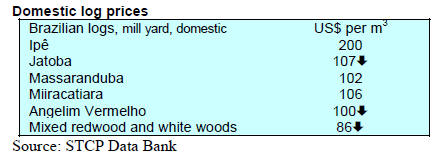

In 2019 China continued as the leading wood and wood

product supplier to Vietnam with shipments being worth

US$656 million (equivalent 26% of all wood and wood

product imports into Vietnam in 2019 followed by the US

at 13%. Wood and wood product imports to Vietnam from

Malaysia and Laos dropped sharply in 2019 (-69%

Malaysia and -27% Laos compared to 2018).

See:

http://goviet.org.vn/bai-viet/tinh-hinh-xuat-nhap-khau-gova-san-pham-go-cua-viet-nam-nam-2019-9093

National certification standard announced

On 7 January 2020, the FSC national standard for Vietnam

was announced in Hanoi. This national standard is being

promoted as a tool for Vietnam to manage its forests

sustainably and at the same time promote responsible

wood processing and trade.

According to VNFOREST, Vietnam currently has over

around 200,000 ha. of FSC certified forests. The national

standard for Vietnam was developed in accordance with

FSC's system for the development and maintenance of

Forest Stewardship Standards.

This defines certification requirements for all forest

operations in Vietnam, including for Small and Low

Intensity Managed Forests.

A review of Forest Stewardship Standards is ongoing and

revised Principles & Criteria version 5-2 will be applied.

Current standards are valid until replaced by a new Forest

Stewardship Standard. According to Vu Thi Que Anh,

Country Director, FSC Vietnam, The national standard

will be effective from 1 May 2020.

See

https://fsc.org/en/document-centre/documents/resource/426

and

https://vietnamnews.vn/environment/571329/vns-national-foreststewardship-standard-effective-from-may.html

8. BRAZIL

Brazilian economy set for major

change

At the 2020 World Economic Forum held in Davos the

President of Brazil outlined the reforms his administration

is planning. These, he said, include reducing the size of the

state, lowering taxes, improving social safety nets and

fostering greater business opportunities.

Brazil is the eighth-largest economy in the world and has

the sixth-largest population. The President said the new

reforms are “aimed at building a new Brazil – a safe,

secure, open, trusted and fully integrated member of the

global community”.

He said the focus of the Brazilian administration will be

on balancing environmental sustainability with economic

growth. At the same Forum, the Brazilian Minster of the

Economy, a newly-established super-ministry, told

delegates that Brazil’s economy is on course to grow by

2.5% this year, slightly higher than the government’s

earlier forecast of 2.4%.

The new economy ministry has seven special secretariats –

finance; federal revenue; foreign trade and international

affairs; privatisation and disinvestment; productivity,

employment and competitiveness; bureaucracy reduction,

management and digital government; and social security

and work.

Furniture cluster in Amazonas faces difficulties

Transport and logistics issues as a result of the remote

location are hampering development of furniture

production in the state of Amazonas. Producers point to

competition with furniture clusters in the southern states of

Brazil and a lack of government investment in the

Amazonas clusters as the main issues needing to be

addressed.

In 2009, for example, the government announced that the

municipality of Tabatinga in the Três Fronteiras area of

Western Amazonas would receive R$6000,000

investments for development of the wooden furniture

production sector but, as of the end of 2019, there has been

no progress on this, say analysts.

Currently, the government's main support for the furniture

sector is through the Sustainable Development Agency of

Amazonas (ADS) and the Amazonas School Furniture

Regionalization Programme (Programa de Regionalização

do Mobiliário Escolar - PROMOVE) which provides

furniture to public schools through a partnership with 42

Amazonian furniture manufacturers.

However, furniture produced by PROMOVE uses both

hardwood and MDF and local SME furniture makers

complain it is difficult for them to also supply school

furniture as their source of raw material is mainly native

timber species and the availability of certified legal timber

is a problem.

Observers write “The challenge in the state of Amazonas

is to consolidate a furniture industrial cluster using only

certified timber and wood from forest plantation obtained

in a sustainable manner. “

Illegal logging crack-down in Mato Grosso

An operation called ‘Pinga Fogo’ was launched in the first

week of January to investigate illegal activities in Mato

Grosso. The operation was carried out by the State

Secretariat for the Environment (SEMA), inspectors of the

Mato Grosso Agriculture and Livestock Defense (INDEA)

and the Military Police Tactical Force.

During the operation inspectors seized a total of 1,340

cu.m of timber of which 470 cu.m was of Brazil nut

(Bertholletia excelsa), a species protected by law. In

addition 870 cu.m of other species was siezed. SEMA

estimates that this is the largest seizure of protected

species ever carried out in Mato Grosso. Four people were

arrested, three timber companies were penalised and

equipment seized because of non-compliance with the

legislation.

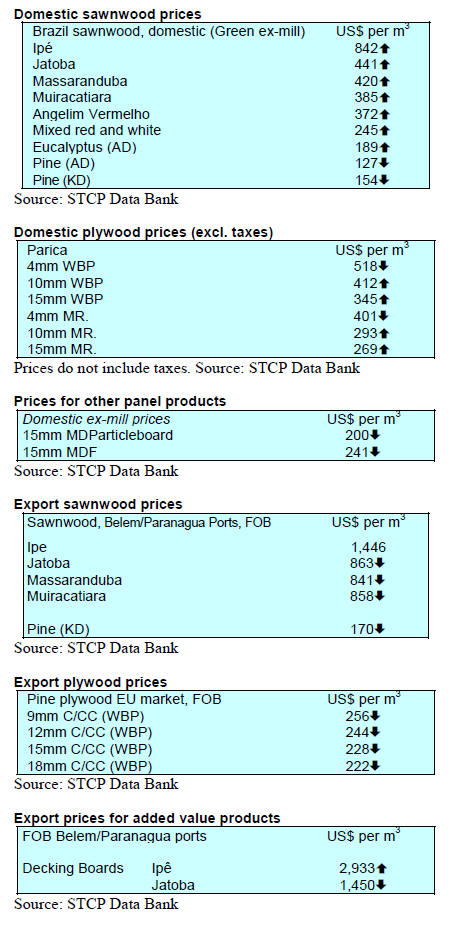

Export update

November

In November 2019, the Brazilian exports of wood-based

products (except pulp and paper) declined almost 19% in

value compared to November 2018, from US$301.0

million to US$244.9 million.

The value of pine sawnwood exports in November fell 3%

year on year from US$56.4 million in 2018 to US$ 39.0

million in November 2019. In terms of volume, exports

fell 23% over the same period, from 266,700 cu.m to

206,200 cu.m.

The volume of tropical sawnwood exports also fell

dropping 26%, from 55,800 cu.m in November 2018 to

41,400 cu.m in November 2019. The value of these

exports also dropped 17% from US$23.0 million to

US$19.2 million, over the same period.

In November 2019 pine plywood exports declined 39% in

value in comparison with November 2018, from US$59.1

million to US$35.9 million. In volume, exports fell 15%

over the same period, from 188,800 cu.m to 160,800 cu.m.

A similar drop was recorded for exports of tropical

plywood which fell 26% in volume and 33% in value,

from 11,400 cu.m (US$ 4.8 million) in November 2018 to

8,400 cu.m (US$ 3.2 million) in November 2019.

Wooden furniture export values also fell but only

modestly from US$48.9 million in November 2018 to

US$47.5 million in November 2019.

December

In the final month of 2019 the decline in exports

continued. The total value of Brazilian exports of woodbased

products (except pulp and paper) dropped 23% in

value compared to December 2018, from US$291.9

million to US$224.6 million.

Pine sawnwood export values declined 27% between

December 2018 (US$46.5 million) and December 2019

(US$34.0 million) and this decline extend to export

volumes which declined 18% in volume over the same

period, from 220,600 cu.m to 181,900 cu.m.

The volume of tropical sawnwood exports dropped 36%

from 52,400 cu.m in December 2018 to 33,400 cu.m in

December 2019. In terms of value exports decreased 30%

from US$22.1 million to US$15.4 million over the same

period.

The value of pine plywood exports declined 37% in

December 2019 in comparison with December 2018, from

US$57.3 million to US$35.9 million. In volume term

exports decreased 12.4% over the same period, from

192,300 cu.m to 168,400 cu.m.

As for tropical plywood, exports fell a massive 45% in

volume and 51% in value from 13,800 cu.m (US$5.5

million) in December 2018 to 7,600 cu.m (US$2.7

million) in December 2019.

The decline in wooden furniture export earning was

steeper in December than in November. The exported

value decreased from US$50.5 million in December 2018

to US$43.9 million in December 2019, 13% down.

2019 plywood export performance

Brazil’s pine plywood exports in 2019 totalled 2,062,508

cu.m a decline of 9% year-on-year. Exports have

exceeded 2 million cubic metres annually for the past few

years having risen from 1.2 million cubic metres in 2014.

The main markets in 2019 were the US, UK, Belgium,

Mexico and Germany.

Export volumes of other products such as pine veneer

declined but exports of mouldings and engineered wood

flooring, which have remained stable in recent years, saw

a 16% decline in export volumes in 2019.

For the year in total tropical plywood exports were higher

than in 2018 but still well below levels in past decades.

The monthly average plywood export volume was 7,427

cu.m.

Bento Gonçalves furniture exports increased in 2019

The Bento Gonçalves furniture cluster, a major cluster in

Rio Grande do Sul State increased exports by over 10%

2019 compared to the previous year outperforming the

furniture industry in Rio Grande do Sul State and Brazil as

a whole.

The international market represents approximately 5% of

the total revenue of the cluster, which comprises 300

companies including those in the municipalities of Bento

Gonçalves, Monte Belo do Sul, Pinto Bandeira and Santa

Tereza.

Exports from the Bento Gonçalves furniture cluster have

been growing for the past four years rising from US$34

million in 2016 to over US$40 million annually.

The top 10 markets in 2019 were Uruguay, the US, Chile,

Colombia, Peru, Saudi Arabia, the UK, Mexico, Paraguay

and Panama.

There was a steep rise in exports of furniture to the UK

(+113% y-o-y) and the US (+135% y-o-y). There were

successes in reaching out to new markets such as Saudi

Arabia which now represents the sixth largest market for

furniture exported by the Bento Gonçalves cluster.

Uruguay remained the main destination for exports.

The main native timber species used for export production

in Brazil are cedar (Cedrela spp) and mahogany

(Swietenia macrophylla) used mainly for for sawnwood,

interior finishing and furniture along with ipe (Tabebuia

spp.) and freijó/brazilian-walnut (Cordia goeldiana) for

sawnwood, flooring, decks and furniture.

The expectation is that 2020 will be the best year for the

furniture industry since 2013. Strong domestic demand is

forecast for 2020 in addition to continuing increases in

exports.

An important event for the furniture sector this year will

be ‘Movelsul Brasil’ its 22nd edition and this should boost

demand in the domestic and international markets.

9. PERU

2019 export performance reverses

declines in earnings

The Association of Exporters (ADEX) has reported that

Peru’s sawnwood exports between January and October

earned US$19. 4 million, an almost 3% increase over the

same period last year thanks to a greater demand from

countries such as the Dominican Republic and Mexico.

Sawnwood accounted for 19% of the value of all wood

exported between January and October. being well below

the value of added value products, mainly flooring.

Sawnwood shipments to the Dominican Republic grew

over 20% to US$6.8 million and the country topped the

list of importers of Peru’s sawnwood.

The second largest market was Mexico where shipments

earned US$6.1 million, some 36% up year on year. China

ranked third at US$2.8 million but there was a 33%

decline in shipments to this market. Peru also exported

sawnwood worth US$0.9 million to Cuba, US$0.7 to

Vietnam, US$0.6 to the US, US$0.5 to South Korea and

US$0.3 to New Zealand.

However, the 2019 export performance was disappointing

when it is recalled that in 2016 China imported sawnwood

valued at around US$10 million FoB.

According to the ADEX the modest rise in export earnings

in between January to October would suggest that total

2019 will exceed those of 2018. 2018 marked the fourth

consecutive decline in export earnings.

Advisory commission on forest and wildlife policy

installed

The National Forestry and Wildlife Commission

(Conafor), an advisory body for the National Forest and

Wildlife Service (Serfor), was installed on 21 January after

four years of delay.

The commission is an advisory which will advise the

Serfor Board of Directors and maintain coordination with

the institutions that are members of the National

Management System Forest and Wildlife (Sinafor). Seven

specialists from different disciplines will contribute to the

activities of Conafor.

The installation of this Commission is an advance in the

management of the sector and will strengthen the

institutional capacity and authority to implement the

forestry and wildlife laws and regulations, say analysts.

Training for native communities in use of Operations

Manual

Officials of regional governments and native communities

in Madre de Dios, Loreto, Ucayali and Selva Central will

receive training from Serfor on the application of guidance

in the recently released Operations Manual for reporting

information on timber harvests and processing.

The objective of the training is to improve the capacity on

following the Operations Manual which contains guidance

on how to record activities such as harvesting and

transporting timber from the forest. As of 2 March this

year the use of the Operations Manual will be mandatory.

The documents that will be generated by the Manual will

be vital in allowing for the verification of the legal origin

of wood products.

The training and technical assistance is being provided

through the USAID Forest programme and the US Forest

Service, the USAID Pro-forestry project, Forest Crime

projects of the United Nations Office on Drugs and Crime

(UNDOC), the Global Fund for Nature (WWF) and GIZ

Proambiente II.

Peruvian imports composite boards

Between January and November 2019 Peruvian imports of

composite boards were valued at US$92.9 million, a slight

decline compared to 2018.

Ecuador stood out as the main supplier in the first eleven

months of 2019 with a solid performance seeing a growth

of 15% in shipments to Peru which were worth US$42

million (2018: US$35 million).

Shipments from Chile dropped in the first eleven months

of 2019 (-28%) but Chile remained the number two

supplier. Other shippers were Spain and Brazil.